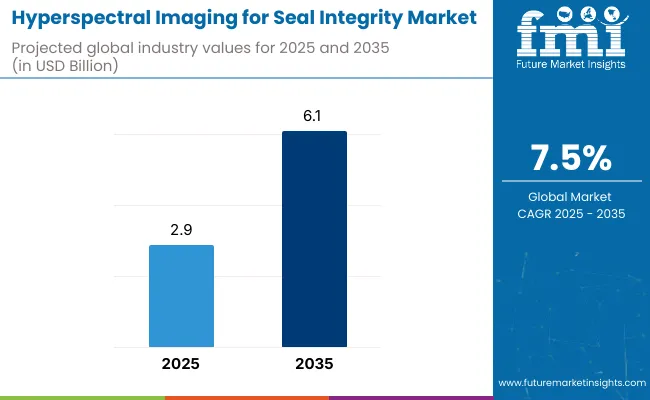

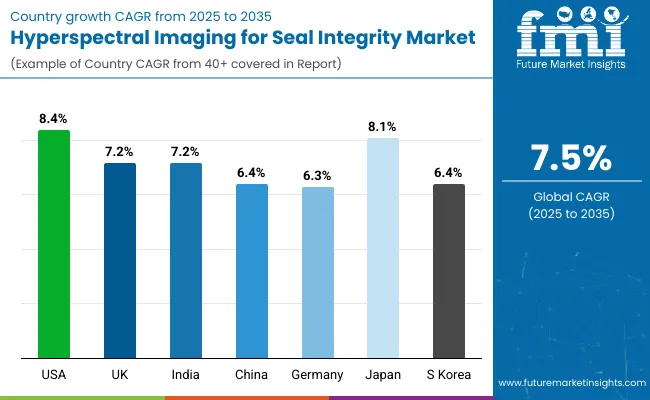

The hyperspectral imaging for seal integrity market is anticipated to grow from USD 2.9 billion in 2025 to USD 6.1 billion by 2035, registering a total increase of USD 3.1 billion over the decade. This marks a 106.9% overall expansion, with the market projected to grow at a compound annual growth rate (CAGR) of 7.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.9 billion |

| Industry Value (2035F) | USD 6.1 billion |

| CAGR (2025 to 2035) | 7.5% |

By the end of the forecast period, the market is expected to more than double, with a 2.1 increase in size. In the first five-year period (2025-2030), the market increases from USD 2.9 billion to USD 4.1 billion, contributing USD 1.1 billion, or 35.5% of the total decade growth. Adoption is driven by the food & beverage and pharmaceutical sectors, where real-time, non-destructive inspection of flexible and rigid packaging becomes a regulatory and operational priority. Short-wave infrared (SWIR) systems dominate during this phase, supported by heightened need for high-resolution defect detection in MAP (modified atmosphere packaging) applications.

In the second half (2030-2035), the market advances from USD 4.1 billion to USD 6.1 billion, contributing USD 2.0 billion, or 64.5% of total growth. Accelerated deployment of AI-powered hyperspectral platforms, integration with inline quality control systems, and edge-processing capabilities make the technology accessible for medium-sized enterprises. Growth is further bolstered by sustainability mandates, which demand reliable seal validation in recyclable and bio-based materials, where micro-defects compromise shelf life and safety.

From 2020 to 2024, the hyperspectral imaging for seal integrity market grew from USD 2.2 billion to USD 2.7 billion, driven by hardware-centric adoption across food, pharma, and medical device packaging lines that require non-destructive, high-speed inspection systems. During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of revenue, with leaders such as Engilico, Specim, Headwall Group, and Cubert GmbH focusing on hyperspectral vision systems tailored to detect seal contamination, wrinkles, and product-in-seal anomalies.

Competitive differentiation relied on wavelength precision, inspection speed, and inline automation compatibility, while AI-based analytics software was typically bundled with equipment rather than positioned as a standalone revenue stream. Service-based models including calibration support and vision system upgrades contributed less than 10% of the total market value.

Demand for hyperspectral imaging in seal inspection will expand to USD 6.1 billion in 2035, and the revenue mix will shift as AI analytics, remote diagnostics, and subscription-based software layers grow to over 40% share. Traditional hardware vendors face growing competition from machine vision startups and automation providers offering cloud-integrated platforms, edge-AI algorithms, and real-time QC dashboards.

Major imaging system providers are pivoting to hybrid models, embedding adaptive machine learning, multi-material inspection capabilities, and predictive maintenance modules to preserve market relevance. Emerging players continue to gain share by offering open-architecture systems, sustainability-linked rejection algorithms, and format-flexible deployments. The competitive advantage is moving away from hardware precision alone to intelligent inspection ecosystems, workflow scalability, and recurring software-driven revenue streams.

Increasing demand for advanced quality assurance systems in food, pharmaceuticals, and high-value packaging applications is driving the growth of the hyperspectral imaging (HSI) for seal integrity market. Hyperspectral cameras provide non-invasive, real-time inspection of sealed packages by capturing hundreds of spectral bands, enabling the detection of defects such as leaks, incomplete seals, contamination, and delamination without damaging the product. This technology ensures compliance with stringent safety regulations and enhances consumer trust.

Short-wave infrared (SWIR) and visible-near-infrared (VNIR) imaging systems have gained popularity due to their ability to analyze materials at the molecular level and detect subtle irregularities invisible to the human eye or standard machine vision systems. These hyperspectral setups offer high accuracy, rapid inspection speeds, and are capable of integration into inline production environments with minimal disruption.

Industries such as ready-to-eat meals, modified atmosphere packaging (MAP), pharmaceuticals, and baby food are driving demand for non-destructive seal verification to reduce recalls, ensure safety, and maintain product integrity. HSI systems enhance process control, reduce packaging waste, and improve efficiency across sterile or sensitive packaging lines.

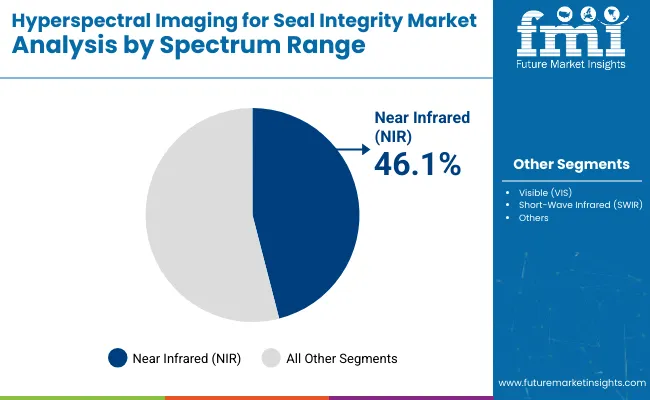

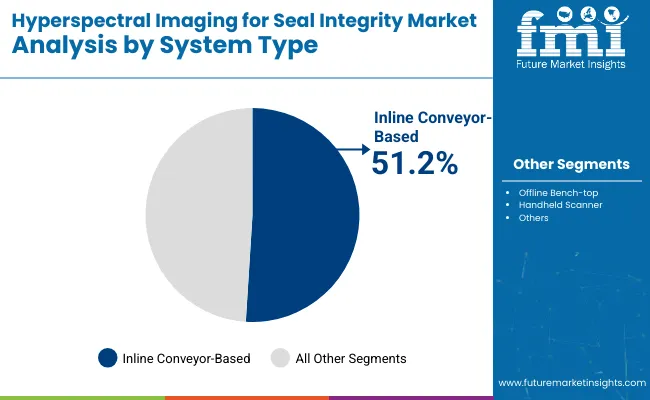

The market is segmented by spectrum range, system type, application, industry compliance, end-use industry, and region. Spectrum range includes visible (VIS), near infrared (NIR), and short-wave infrared (SWIR), offering distinct detection capabilities for surface and subsurface seal analysis. System type segmentation comprises inline conveyor-based systems, offline bench-top units, and handheld scanners, enabling real-time, lab-based, and portable inspection flexibility. Application areas include seal defect detection, contaminant detection, and film thickness verification, supporting comprehensive quality assurance in critical packaging operations.

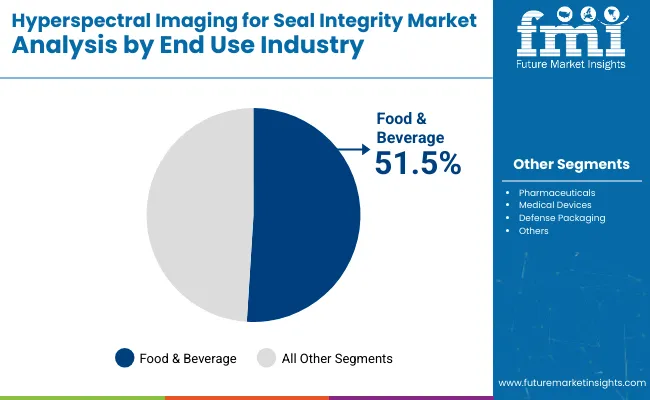

Industry compliance covers food safety (FSMA), pharma (GMP), and medical device packaging standards, ensuring hyperspectral systems align with regulatory mandates and audit requirements. End-use industries include food & beverage, pharmaceuticals, medical devices, and defense packaging, all of which demand high-integrity seals for safety, sterility, and shelf stability. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The near infrared (NIR) segment is projected to command the highest share of 46.1% in 2025 in the hyperspectral imaging (HSI) market for seal integrity applications. This dominance is attributed to the NIR wavelength’s ability to penetrate deeper into packaging materials and accurately detect contaminants or seal voids invisible to standard visual inspection systems. NIR’s ability to capture detailed spectral fingerprints of organic and polymeric materials makes it especially valuable in food and pharmaceutical packaging environments where micro-defects can compromise safety or shelf life.

The technology’s high sensitivity enables early defect detection, reducing product recalls and improving batch consistency. NIR sensors can operate under varying light conditions and integrate with AI-based vision systems for real-time decision-making. Regulatory bodies like the FDA and EFSA recognize NIR-based hyperspectral systems as valid compliance tools for high-risk packaging, particularly in perishables. As demand for hygienic and tamper-evident packaging intensifies, the NIR-based HSI system is expected to gain sustained market preference.

The food & beverage sector is anticipated to hold the largest share of 51.5% in 2025 within the hyperspectral imaging for seal integrity market. This growth stems from rising scrutiny under the Food Safety Modernization Act (FSMA) and equivalent global standards, which require validated inspection protocols for primary and secondary packaging. Food processors are adopting hyperspectral solutions to ensure integrity in thermoformed trays, sealed pouches, and vacuum packs where oxygen or moisture ingress can rapidly degrade product quality.

From ready-to-eat meals to dairy and protein-based products, seal assurance has become a critical control point. HSI systems help detect under-seals, foreign particles, or inconsistencies caused by filling errors. Inline deployment of hyperspectral cameras enables non-contact, high-speed inspection without interrupting flow. With growing consumer demand for transparency and extended freshness, the food and beverage industry is expected to remain the largest and fastest-growing user segment for seal integrity validation technologies.

The inline conveyor-based segment is projected to lead the hyperspectral imaging market with a 51.2% share in 2025. These systems are increasingly favored by packaging facilities for their ability to conduct seamless, non-destructive inspection of seals without disrupting production speed. Installed over conveyor belts, inline HSI setups analyze spectral data in real time, flagging anomalies such as incomplete seals, air gaps, or contaminant entrapments before the next processing step.

Their integration with PLCs, robotics, and smart production dashboards supports predictive maintenance and ensures compliance with Good Manufacturing Practices (GMP). Inline systems also minimize human error associated with manual sampling. Industries like pharmaceuticals, dairy, and ready meals rely on this technology to maintain high throughput while meeting strict seal validation protocols. As Industry 4.0 adoption accelerates, inline hyperspectral solutions are expected to dominate for their real-time intelligence and automation compatibility.

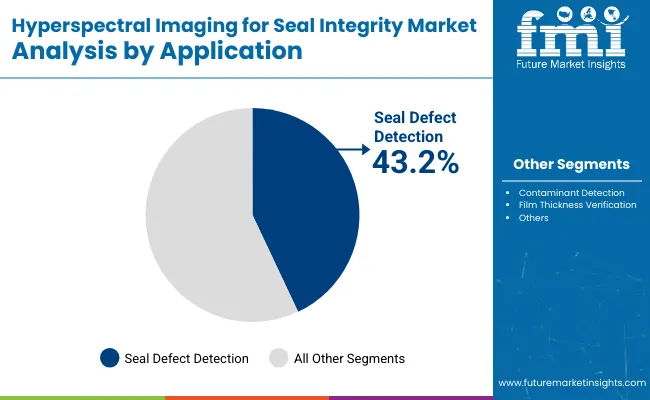

Seal defect detection is projected to emerge as the leading application segment with a 43.2% share in 2025, highlighting its central role in packaging quality control. As packaging evolves to include sustainable, multilayered, or recyclable materials, ensuring seal integrity becomes more complex. Hyperspectral imaging helps overcome this challenge by identifying micro-defects like leaks, delamination, seal creases, or contamination without physically altering the package.

Advanced imaging algorithms analyze spectral deviations along the seal area, enabling the differentiation between good and faulty seals with high precision. This capability significantly reduces the rate of false rejects and improves inspection reliability. Manufacturers in both food and pharma are deploying these systems to comply with increasingly stringent regulatory norms. With growing reliance on automated packaging systems, seal defect detection via HSI is set to remain the cornerstone application, supporting product safety and brand reputation.

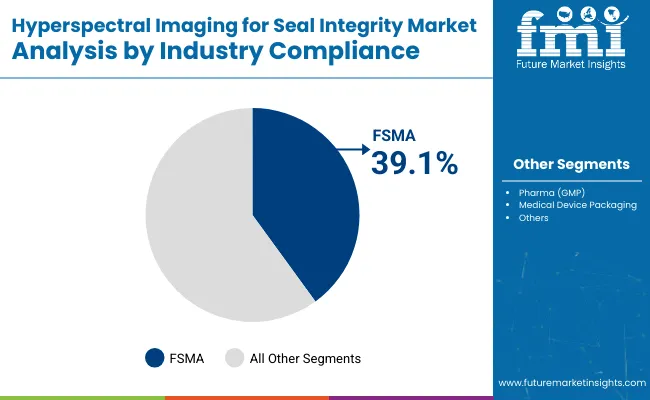

The FSMA compliance segment is expected to hold a 39.1% share in 2025, as hyperspectral imaging increasingly aligns with regulatory expectations for food safety. The USA Food Safety Modernization Act mandates proactive risk prevention, including the detection of packaging defects that can compromise food integrity. HSI systems equipped with FSMA-compliant validation protocols are gaining traction in facilities processing dairy, meats, and ready-to-eat meals.

These systems help demonstrate due diligence during audits by producing image logs, spectral maps, and automated reports for traceability. Their deployment reduces dependency on manual inspection while enhancing repeatability and documentation accuracy. Compliance with FSMA has now become a strong purchasing driver for hyperspectral systems, especially among USA-based and export-oriented processors. As regulators globally adopt similar standards, FSMA-compliant seal integrity technologies are likely to experience robust adoption across food and pharma value chains.

System complexity and calibration challenges limit broader implementation, even as demand rises across pharmaceuticals, food packaging, and medical devices for non-invasive, high-resolution inspection technologies that verify seal quality and detect micro-defects in real time.

Non-destructive Quality Assurance in Regulated Packaging Environments

Hyperspectral imaging (HSI) is gaining strong traction in industries such as pharmaceuticals, food & beverage, and sterile medical packaging due to its ability to detect invisible or sub-surface seal defects. Unlike traditional visual inspection or X-ray, HSI provides pixel-level chemical and structural analysis, enabling early detection of channel leaks, voids, delamination, and particulate contamination. It supports compliance with stringent quality standards such as FDA CFR 21, EU MDR, and ISO 11607 for sterile packaging validation.

In aseptic environments and vacuum-sealed product lines, hyperspectral imaging ensures 100% in-line seal integrity without damaging the packaging. As product safety becomes non-negotiable, manufacturers are increasingly integrating HSI into automated inspection frameworks for sterile barrier systems and modified atmosphere packaging (MAP).

High Capital Costs and Data Interpretation Complexity

Despite its technical superiority, adoption of hyperspectral imaging for seal inspection is hindered by high capital expenditure and system sophistication. Equipment typically involves costly cameras, tunable filters, and hyperspectral lighting setups, which require specialized calibration to match packaging substrates and product contents. The vast data output generated per inspection demands robust computing infrastructure and skilled data analysts to interpret wavelength signatures and material spectra.

False positives or interpretation errors can disrupt production or cause unnecessary product rejection. These barriers can be significant for small or medium enterprises without in-house optical engineering or machine vision expertise, limiting adoption in cost-sensitive or decentralized packaging operations.

AI-powered Defect Classification and Inline System Integration

A key trend driving the hyperspectral imaging market for seal inspection is the convergence with AI and real-time automation. Machine learning algorithms are now being trained to differentiate acceptable variability from actual defects, reducing false alarms and improving classification accuracy. HSI systems are also being miniaturized and integrated directly into packaging lines using compact sensors and real-time analytics software. These inline configurations eliminate the need for offline quality checks and enhance line efficiency without compromising resolution.

modular setups with remote calibration and adaptive lighting are supporting multi-material packaging ranging from clear films to foil laminates. As regulatory oversight strengthens and zero-defect goals intensify, hyperspectral imaging is rapidly transitioning from a lab-grade solution to an industrial packaging standard.

The global hyperspectral imaging (HSI) market for seal integrity verification is entering a high-growth phase, fueled by demand for non-destructive, real-time, and high-precision inspection in food, pharmaceuticals, and sterile medical packaging. HSI enables spectral-level analysis of seal defects, contamination, and barrier breaches that are otherwise invisible to RGB or thermal cameras.

The USA and Japan are leading adoption due to stringent quality regulations in pharma and medical device packaging. Emerging economies such as India and the UK are scaling investment in AI-powered inline inspection systems. Germany and South Korea are deploying HSI within smart factory initiatives, while China is integrating hyperspectral sensors in high-speed blister, pouch, and tray-sealing lines.

The hyperspectral imaging market for seal integrity in the United States is projected to grow at a CAGR of 8.4%, driven by regulatory pressure from the FDA, ASTM standards, and consumer safety mandates. USA pharmaceutical and food packaging facilities are replacing traditional vision systems with HSI-enabled cameras capable of detecting foreign particles, incomplete seals, and delamination in real-time.

The UK hyperspectral imaging market for seal inspection is forecast to grow at a CAGR of 7.2%, driven by compliance with MHRA, FSA, and ISO packaging integrity standards. British pharma and dairy industries are deploying HSI for contamination detection and seal uniformity across high-speed FFS lines. Startups and automation integrators are introducing compact, AI-driven HSI modules tailored for SMEs.

India’s hyperspectral imaging market for seal integrity is projected to grow at a CAGR of 7.2%, supported by expanding pharmaceutical exports, medical device production, and automation of food safety inspections. Indian firms are adopting HSI-enabled modules for real-time pouch and strip seal checks. Government compliance audits and WHO-GMP requirements for export packaging are also accelerating investment.

The hyperspectral imaging market in China for seal integrity is expected to grow at a CAGR of 6.4%, driven by domestic food safety campaigns, e-pharma packaging, and advanced inspection in electronics and medical devices. Chinese packaging facilities are embedding HSI sensors in pouch and tray-sealing lines for real-time validation without halting production. AI-based interpretation and multi-band visualization are enabling early detection of seal anomalies.

Germany’s hyperspectral imaging market for seal integrity is forecast to grow at a CAGR of 6.3%, driven by pharma-grade compliance standards, cleanroom packaging, and traceability automation. German manufacturers are using HSI not just for seal presence, but also to assess surface chemistry, contamination, and seal integrity under varying material combinations.

The hyperspectral imaging market for seal inspection in Japan is expected to grow at a CAGR of 8.1%, backed by advanced pharmaceutical manufacturing, robotics-integrated packaging lines, and premium hygiene standards in functional food packaging. Japanese companies are using HSI for spectral signature-based anomaly detection in laminate seals and multilayer sachets.

South Korea’s hyperspectral imaging market for seal integrity is projected to grow at a CAGR of 6.4%, driven by growth in export-ready K-food, OTC pharma, and clinical nutrition products. The focus is on integrating HSI with existing high-speed packaging lines without increasing reject rates or process time. Korean firms are embedding compact HSI heads in rotary blister and sachet sealing equipment to comply with FDA, EU, and ASEAN regulations.

The hyperspectral imaging for seal integrity market is moderately fragmented, with optical technology leaders, packaging quality assurance innovators, and precision sensor specialists competing across food, pharmaceutical, and medical device packaging lines.

Global leaders such as Headwall Group and Specim hold significant market share, driven by their advanced hyperspectral cameras, real-time data processing capabilities, and seamless integration with high-speed packaging systems. Their strategies increasingly emphasize AI-enabled defect recognition, spectral range customization, and non-destructive seal analysis for thermoformed trays, pouches, and flow packs.

Established mid-sized players including Cubert GmbH and Engilico focus on inline and offline hyperspectral solutions tailored for seal quality inspection. These companies are enhancing adoption through robust spectral calibration, intuitive interface software, and compatibility with vacuum-formed, lidding film, and flexible packaging materials. Their systems are especially relevant for high-risk, high-value segments such as ready-to-eat meals, sterile medical goods, and pharmaceutical blister packs.

Key Development Hyperspectral Imaging in Seal Integrity

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| By Spectrum Range | Visible (VIS), Near Infrared (NIR), and Short-Wave Infrared (SWIR) |

| By System Type | Inline Conveyor-based, Offline Bench-top, and Handheld Scanner |

| By Application | Seal Defect Detection, Contaminant Detection, and Film Thickness Verification |

| By Industry Compliance | Food Safety (FSMA), Pharma (GMP), and Medical Device Packaging |

| By End-Use Industry | Food & Beverage, Pharmaceuticals, Medical Devices, and Defense Packaging |

| Key Companies Profiled | Engilico Engineering Solutions NV, Specim, Spectral Imaging Ltd, Headwall Group, Middleton Spectral Visualization (MSV), and Cubert GmbH |

| Additional Attributes | Non-destructive and real-time seal inspection technology, increasing demand in FSMA- and GMP-compliant packaging lines, use of SWIR imaging for multilayer seal layer detection, integration of AI/ML for defect classification, growing adoption in pharmaceutical and medical device packaging, improved food safety compliance via inline conveyor-based systems, rise in deployment of handheld scanners in QA labs, advances in spectral mapping for thin film validation, enhanced quality assurance in aseptic environments, and rapid technology expansion in North America, Germany, Japan, and South Korea |

The global hyperspectral imaging for seal integrity market is estimated to be valued at USD 2.9 billion in 2025

The market size for the hyperspectral imaging for seal integrity market is projected to reach USD 6.1 billion by 2035.

The hyperspectral imaging for seal integrity market is expected to grow at a CAGR of 7.5% between 2025 and 2035.

The key spectral technology types in this market include near infrared (NIR), short-wave infrared (SWIR), visible spectrum (VIS), and extended IR imaging systems.

In terms of spectral technology, the near infrared (NIR) segment is expected to account for the highest share of 46.1% in the hyperspectral imaging for seal integrity market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA