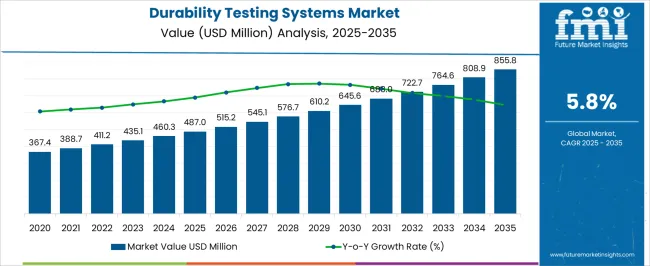

The Durability Testing Systems Market is estimated to be valued at USD 487.0 million in 2025 and is projected to reach USD 855.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Durability Testing Systems Market Estimated Value in (2025 E) | USD 487.0 million |

| Durability Testing Systems Market Forecast Value in (2035 F) | USD 855.8 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Durability Testing Systems market is experiencing robust growth, driven by increasing demand for high-performance and reliable products across automotive, aerospace, and industrial sectors. The adoption of durability testing systems is being fueled by the need to evaluate product performance under simulated operational and environmental conditions to ensure safety, reliability, and compliance with industry standards. Technological advancements, including multi-axis testing, automated data acquisition, and real-time monitoring, are enhancing the accuracy and efficiency of durability evaluations.

Rising investments in research and development by automotive manufacturers, suppliers, and testing laboratories are further propelling market expansion. The growing focus on product lifecycle management, cost reduction through early failure detection, and compliance with stringent regulatory standards is reinforcing adoption.

Additionally, increasing implementation of smart manufacturing and Industry 4.0 initiatives is driving demand for advanced testing systems As companies prioritize product quality, safety, and innovation, the market is expected to maintain steady growth, supported by continuous enhancements in testing methodologies, instrumentation, and data analytics capabilities.

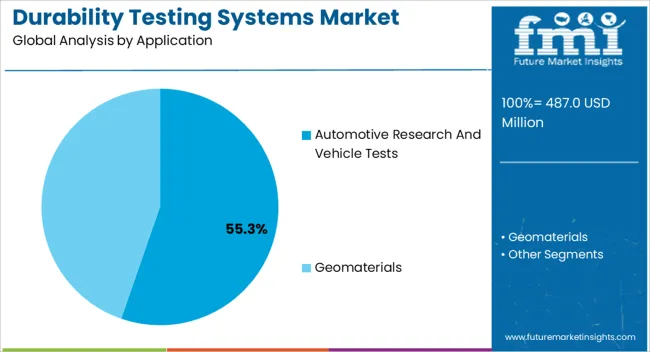

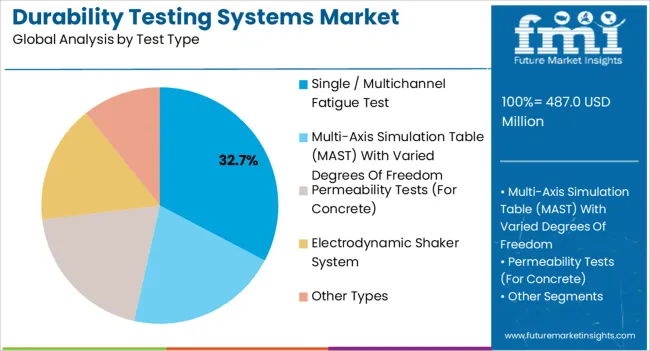

The durability testing systems market is segmented by application, test type, and geographic regions. By application, durability testing systems market is divided into Automotive Research And Vehicle Tests and Geomaterials. In terms of test type, durability testing systems market is classified into Single / Multichannel Fatigue Test, Multi-Axis Simulation Table (MAST) With Varied Degrees Of Freedom, Permeability Tests (For Concrete), Electrodynamic Shaker System, and Other Types. Regionally, the durability testing systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automotive research and vehicle tests segment is projected to hold 55.3% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the rising need for reliable evaluation of vehicle components, systems, and overall performance to ensure safety and compliance with regulatory standards.

Durability testing enables manufacturers to simulate real-world driving conditions, assess wear and fatigue, and predict lifecycle performance, thereby reducing the risk of failures and recalls. Increasing investments in electric and autonomous vehicles have further intensified the need for advanced testing protocols that account for novel components and materials.

The integration of automated measurement systems, real-time monitoring, and data analytics provides actionable insights that inform design improvements and quality assurance As the automotive industry continues to focus on enhancing safety, performance, and durability, the automotive research and vehicle tests segment is expected to maintain its leadership, driven by technological innovation and stringent regulatory compliance.

The single / multichannel fatigue test type segment is anticipated to account for 32.7% of the market revenue in 2025, making it the leading test type category. Its growth is being supported by the increasing requirement to evaluate material and component behavior under cyclic loading conditions, which are critical for predicting product lifespan and performance reliability.

Single-channel tests are used for focused analysis of individual components, while multichannel systems enable simultaneous testing of multiple parts or assemblies, improving efficiency and reducing testing timelines. The adoption of advanced fatigue testing systems with real-time monitoring, automated control, and integrated data acquisition has enhanced testing precision and repeatability.

Manufacturers across automotive, aerospace, and industrial sectors are leveraging these systems to optimize design, reduce warranty claims, and ensure compliance with performance and safety standards As industries continue to prioritize durability, reliability, and operational efficiency, the single / multichannel fatigue test type segment is expected to retain its leading position, driven by technological advancement and growing demand for predictive maintenance and lifecycle assessment solutions.

Durability Testing systems are used to assess a machine or a material’s performance when subjected to adverse environments such as mechanical trauma, extreme pressure and temperature etc. The process differs from Reliability Tests where a pre-qualified sample is tested in a simulated environment.

This process is undertaken as a measure of quality control to guarantee a machine/ material’s performance within its average shelf life before its roll-out, thereby eliminating any related defects or exceptions. These tests also determine the degree of fatigue experienced by machine/ material’s creating space for design improvements to minimize this effect by OEMs. The durability testing systems market has evolved over 5 decades since the inception of automotive and industrial automation equipment to ensure product longevity as well as safety in terms of human interface and use.

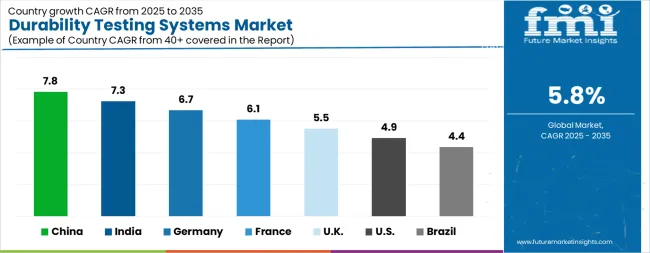

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Durability Testing Systems Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Durability Testing Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Durability Testing Systems Market is estimated to be valued at USD 166.2 million in 2025 and is anticipated to reach a valuation of USD 268.9 million by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 22.7 million and USD 16.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 487.0 Million |

| Application | Automotive Research And Vehicle Tests and Geomaterials |

| Test Type | Single / Multichannel Fatigue Test, Multi-Axis Simulation Table (MAST) With Varied Degrees Of Freedom, Permeability Tests (For Concrete), Electrodynamic Shaker System, and Other Types |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

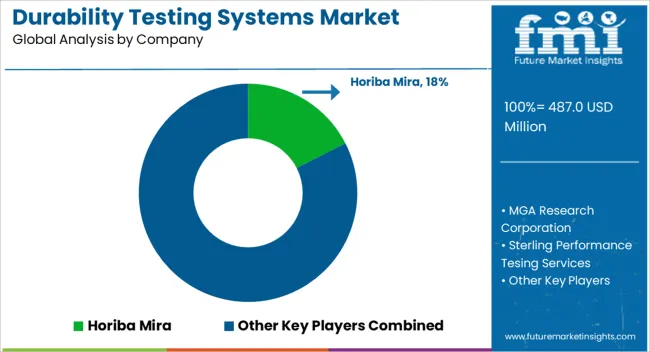

| Key Companies Profiled | Horiba Mira, MGA Research Corporation, Sterling Performance Tesing Services, MTS Systems Corporation, Intertek Group Plc, Kistler Holding AG, Schleibinger Testing Systems, Aimil, Advanced Test & Automation, and Campbell Scientific |

The global durability testing systems market is estimated to be valued at USD 487.0 million in 2025.

The market size for the durability testing systems market is projected to reach USD 855.8 million by 2035.

The durability testing systems market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in durability testing systems market are automotive research and vehicle tests and geomaterials.

In terms of test type, single / multichannel fatigue test segment to command 32.7% share in the durability testing systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Market Share Distribution Among Leak Testing Machine Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA