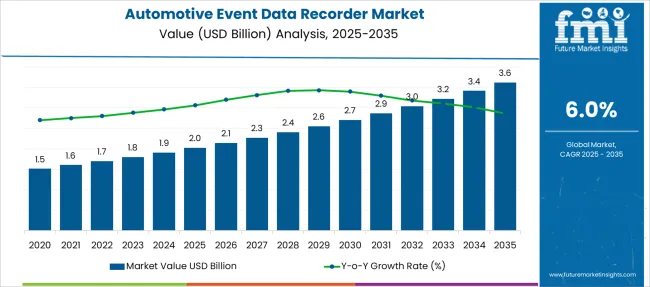

The Automotive Event Data Recorder Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Event Data Recorder Market Estimated Value in (2025 E) | USD 2.0 billion |

| Automotive Event Data Recorder Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The automotive event data recorder market is experiencing significant momentum as vehicle safety regulations and demand for forensic crash data continue to rise across global markets. Event data recorders have become increasingly critical in modern automotive ecosystems as they assist in capturing pre- and post-collision metrics that are vital for insurance claims, legal proceedings, and regulatory compliance.

Growing awareness among consumers, insurers, and vehicle manufacturers about the importance of data transparency and liability management is further contributing to adoption. Additionally, the rise in autonomous and semi-autonomous driving technologies has intensified the need for robust, real-time vehicle data capture systems.

With regulatory bodies in both developed and emerging economies focusing on road safety and accident analysis, the integration of event data recorders is being actively encouraged, especially in new vehicle models. Over the forecast period, technological advancements such as cloud-based telematics and vehicle-to-everything communication are expected to further integrate event data recorders into connected vehicle frameworks, shaping the future trajectory of this market..

The market is segmented by Component, Vehicle, and Sales Channel and region. By Component, the market is divided into Hardware, Event data recorder units, Sensors, Accelerometers, Gyroscopes, Speed sensors, Brake sensors, Airbag deployment sensors, Storage devices, Power supply units, Software, Data analysis software, Data retrieval software, and Cloud-Based platforms. In terms of vehicles, the market is classified into Passenger vehicles, Commercial vehicles, Electric vehicles, and Others. Based on Sales Channel, the market is segmented into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

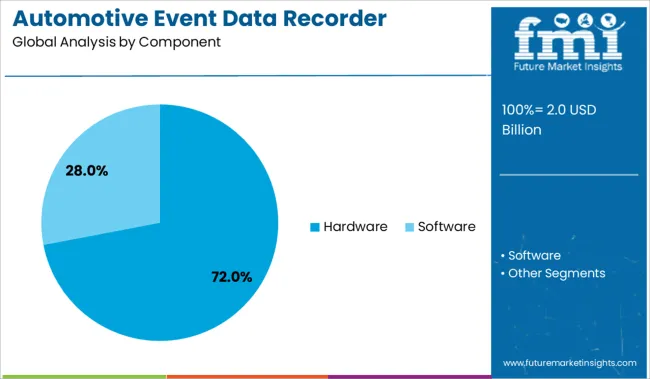

The hardware segment is expected to contribute 72% of the Automotive Event Data Recorder market revenue share in 2025, positioning it as the leading component type. This dominance is attributed to the critical role hardware plays in capturing and storing event-related data in real time. Physical modules equipped with sensors, accelerometers, and memory storage units have been essential for accurately logging data before, during, and after collision events.

As reliability and data fidelity are paramount in accident investigations, original equipment manufacturers have prioritized robust hardware integration within vehicle architectures. This segment has also been reinforced by its compatibility with evolving sensor technologies and in-vehicle networks.

Additionally, hardware components serve as the primary foundation upon which advanced analytics and telematics solutions operate, further underscoring their importance in safety and compliance-driven markets. As vehicle safety regulations tighten globally, manufacturers have increasingly focused on embedding durable and standards-compliant hardware solutions, leading to sustained growth within this segment..

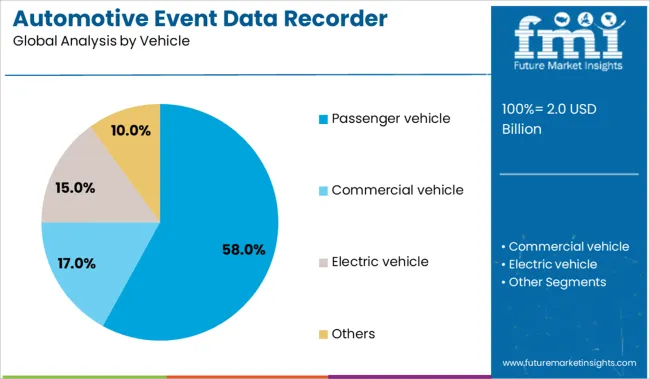

The passenger vehicle segment is projected to account for 58% of the Automotive Event Data Recorder market revenue share in 2025, making it the dominant vehicle category. The high volume of passenger vehicle production globally, coupled with increasing consumer demand for advanced safety features, has been instrumental in driving this segment's expansion. Passenger vehicles are more frequently involved in urban traffic scenarios, which has raised the demand for data recorders that support accident analysis and driver behavior monitoring.

In response to evolving road safety policies, regulatory bodies have increasingly mandated the integration of event data recorders in passenger vehicles, further accelerating market adoption. Manufacturers have incorporated these systems to enhance transparency, reduce liability risks, and improve post-collision diagnostics.

Moreover, rising consumer awareness and interest in vehicle safety have made event data recorders a valued addition in both entry-level and premium models. As connected vehicle technologies evolve, the role of data recorders in passenger vehicles is expected to expand further, reinforcing the leadership of this segment..

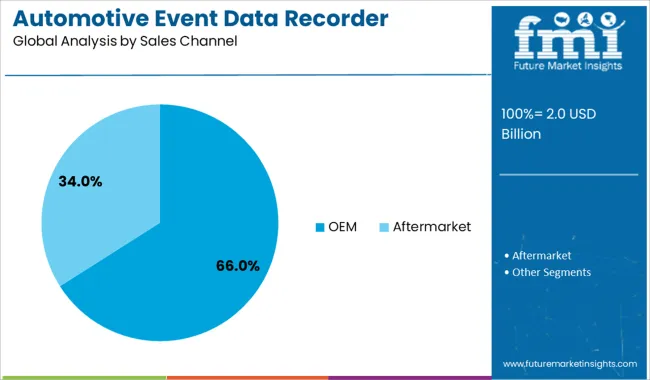

The OEM segment is forecasted to capture 66% of the Automotive Event Data Recorder market revenue share in 2025, establishing it as the leading sales channel. This growth has been driven by the increasing integration of event data recorders as standard safety equipment in new vehicle models. Automakers have been aligning with regulatory requirements and consumer expectations by embedding data recording functionalities directly into vehicle electronic systems.

The ability to deliver factory-fitted, tamper-proof devices that meet compliance standards has made OEMs the preferred channel for deployment. Additionally, the growing prevalence of connected and autonomous driving features has required seamless integration of event data recorders within vehicle control systems, which is more efficiently achieved at the manufacturing level.

OEM-installed recorders offer higher reliability, better warranty coverage, and streamlined system compatibility, which has increased their adoption across vehicle categories. With more markets introducing legislation mandating event data recorder installations, OEMs are expected to remain the dominant channel for product distribution and long-term market growth..

The automotive event data recorder market has found strong opportunity through integration with insurance telematics platforms. From 2023 to 2025, EDRs were increasingly used to support claims automation, driver scoring, and premium adjustments in both personal and fleet policies.

This evolution has positioned recorders as proactive risk tools, enabling insurers to streamline operations while incentivizing safer driving behavior. Providers offering secure, insurer-compatible solutions are poised to lead this data-driven segment.

A surge in regulation requiring event data capture in accidents has been recognized as a primary catalyst for growth in the automotive event data recorder market. In 2023, national safety agencies mandated that EDRs record pre-impact braking and steering input to aid collision investigations.

By 2024, commercial fleets were being equipped with upgraded recorders capturing higher-resolution telematics and impact metrics to support liability determination. In 2025, insurance use of recorded event data was being expanded to automate claim adjudication and fraud detection workflows.

These trends demonstrate that regulatory and insurer-driven demand is compelling manufacturers to standardize advanced recorder systems-shifting EDRs from optional safety features into essential vehicle components.

By 2023, partnerships between insurers and vehicle manufacturers had begun to pilot event data recorder integration into usage-based insurance models, offering policyholders reduced premiums for safe driving behaviors. In 2024, insurer-platform compatibility was being scaled, allowing crash and near-miss data captured by EDRs to support claims triage and automated fault determination.

Moving into 2025, this model was being expanded to fleet programs, where real-time event logging enabled dynamic risk scoring and on-demand premium adjustments. These developments demonstrate that connecting recorders directly to insurance ecosystems transforms them from passive post-incident tools into proactive risk management devices. Vendors positioned to offer seamless, secure data sharing with insurers are likely to dominate this emerging market segment.

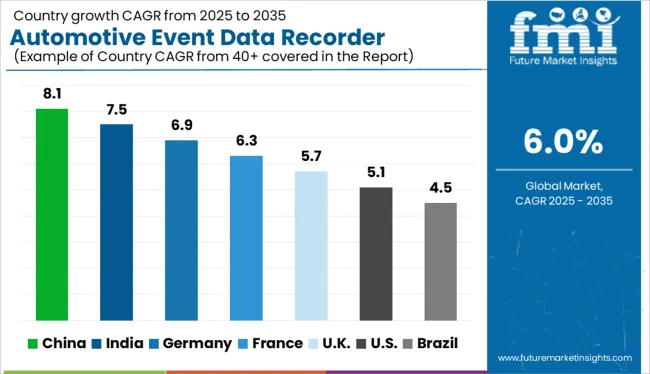

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

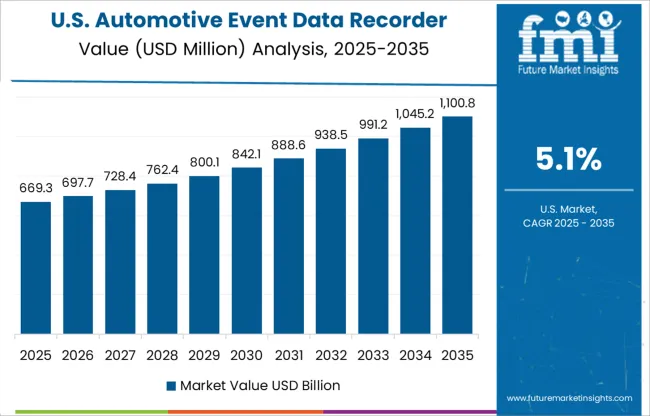

| USA | 5.1% |

| Brazil | 4.5% |

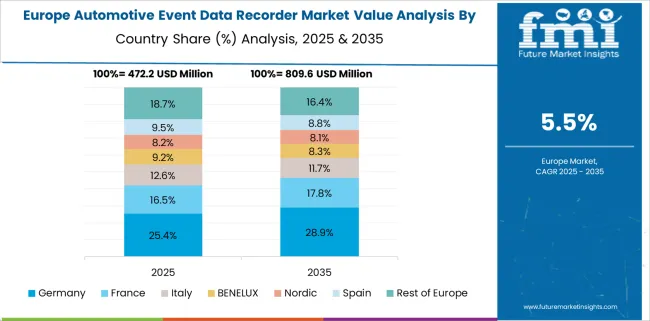

The automotive event data recorder (EDR) market is projected to grow globally at a CAGR of 6% from 2025 to 2035. China leads at 8.1%, followed by India at 7.5% and Germany at 6.9%. France aligns with the global average at 6.3%, while the United Kingdom lags slightly at 5.7%.

China and India are witnessing a surge in demand due to regulatory safety frameworks and insurance-linked telematics. Germany’s growth is supported by Euro NCAP mandates and OEM-fitted EDR systems. France advances with public fleet digitization and crash analytics integration, while the UK shows cautious progress through voluntary adoption and insurer-driven deployments.

China is projected to lead the global EDR market with an 8.1% CAGR, fueled by new vehicle safety mandates and integration into intelligent transportation systems. Government regulations are pushing commercial vehicles and EVs to install tamper-proof recorders for post-incident analytics. OEMs are embedding EDR systems into ADAS-enabled models to support compliance and liability management. Domestic players are offering dual-channel devices with 4G connectivity and cloud sync features.

India is expected to grow its EDR market at a 7.5% CAGR, driven by rising road fatality rates and draft proposals under Bharat NCAP. Government push for safer roads is prompting transport operators and car manufacturers to include black-box style devices in buses, trucks, and premium cars. Local firms are producing compact, low-cost recorders compatible with retrofit kits. Insurers are also piloting usage-based policies tied to event data.

Germany is forecast to grow at a 6.9% CAGR in the EDR market, driven by Euro NCAP requirements and industry-led vehicle safety innovation. German automakers are embedding EDRs in electric and autonomous models for post-crash analysis and compliance. Data encryption, crash sensor integration, and multi-event memory support are standard. Regulatory push for data standardization is increasing collaboration between auto OEMs and diagnostics software providers.

France is projected to grow at a 6.3% CAGR in the EDR market, led by digital mobility policies and adoption across commercial vehicle segments. Public and municipal fleet operators are installing EDRs for safety tracking and accident resolution. EDRs are now linked with national traffic enforcement databases to streamline claims and investigations. French OEMs are exploring EDR-in-ADAS convergence for driver behavior analysis and fleet training.

The United Kingdom is forecast to grow its EDR market at a 5.7% CAGR, shaped by voluntary commercial adoption and slow regulatory progression. While not mandated yet, insurers and fleet operators are increasingly adopting EDRs for claims validation and liability assessment. Usage is concentrated in courier fleets, logistics providers, and private hire vehicles. However, broader passenger car uptake is limited by data protection uncertainty and cost concerns.

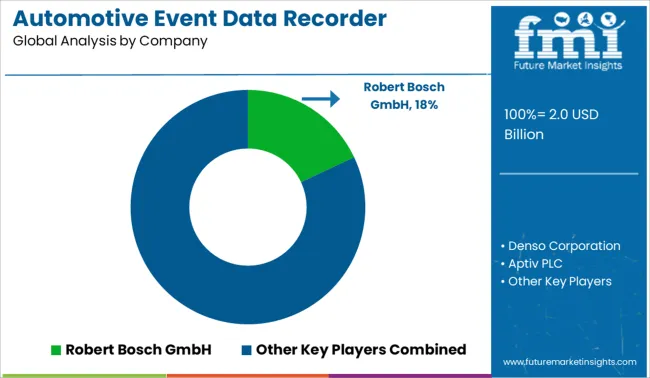

The automotive event data recorder market is moderately consolidated, led by Robert Bosch GmbH with an 18% market share. The company holds a dominant position through its advanced crash detection systems, integration with OEM safety platforms, and compliance with international regulatory standards for accident data recording.

Dominant player status is held exclusively by Robert Bosch GmbH. Key players include Denso Corporation, Aptiv PLC, Continental AG, and Autoliv Inc. - each offering embedded EDR modules within broader vehicle safety architectures, enabling post-crash diagnostics, data recovery, and telematics services.

Emerging players are currently limited in this segment due to stringent regulatory requirements and the need for deep integration within established automotive safety systems. Market demand is driven by government regulations mandating EDR deployment, rising vehicle safety expectations, and the expansion of connected vehicle infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Component | Hardware, Event data recorder unit, Sensors, Accelerometers, Gyroscopes, Speed sensors, Brake sensors, Airbag deployment sensors, Storage devices, Power supply units, Software, Data analysis software, Data retrieval software, and Cloud-Based platform |

| Vehicle | Passenger vehicle, Commercial vehicle, Electric vehicle, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Denso Corporation, Aptiv PLC, Continental AG, and Autoliv Inc. |

| Additional Attributes | Dollar sales by EDR type (built-in vs aftermarket), regional demand trends, competitive landscape, buyer preferences for data analytics & privacy, integration with telematics, innovations in AI-enhanced crash prediction and real-time monitoring. |

The global automotive event data recorder market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the automotive event data recorder market is projected to reach USD 3.6 billion by 2035.

The automotive event data recorder market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in automotive event data recorder market are hardware, event data recorder unit, sensors, accelerometers, gyroscopes, speed sensors, brake sensors, airbag deployment sensors, storage devices, power supply units, software, data analysis software, data retrieval software and cloud-based platform.

In terms of vehicle, passenger vehicle segment to command 58.0% share in the automotive event data recorder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA