The blinds and shades market is expanding steadily due to increasing demand for energy-efficient, aesthetic, and smart window treatment solutions. Rising urbanization, improved living standards, and rapid adoption of home automation systems are enhancing product penetration across residential and commercial sectors. The market is being supported by innovation in fabric materials, motorization technology, and design customization, which are improving user convenience and interior appeal.

Growing awareness regarding solar protection, light control, and thermal insulation has driven sustained adoption across climate-sensitive regions. The future outlook indicates continued growth as consumers shift toward automated and sustainable alternatives, supported by the integration of IoT-enabled systems and energy-saving designs.

Manufacturers are emphasizing eco-friendly materials and enhanced functionality to align with green building trends Consistent technological progress, coupled with rising smart home investments, is expected to reinforce the market’s profitability and ensure its stable expansion through the forecast period.

| Metric | Value |

|---|---|

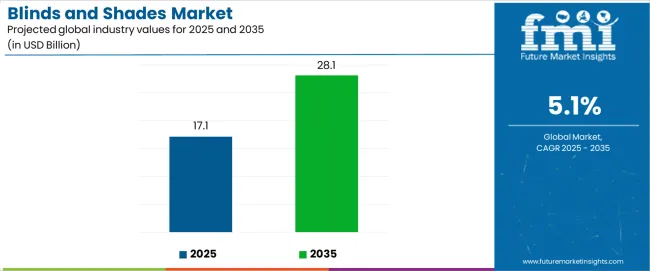

| Blinds and Shades Market Estimated Value in (2025 E) | USD 17.1 billion |

| Blinds and Shades Market Forecast Value in (2035 F) | USD 28.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

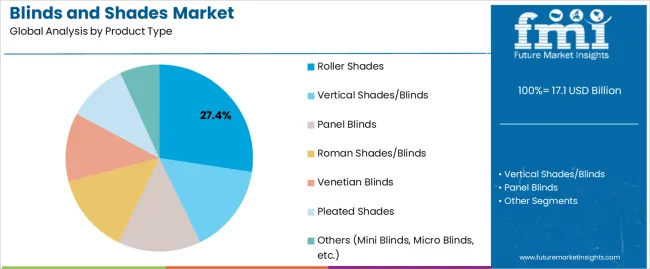

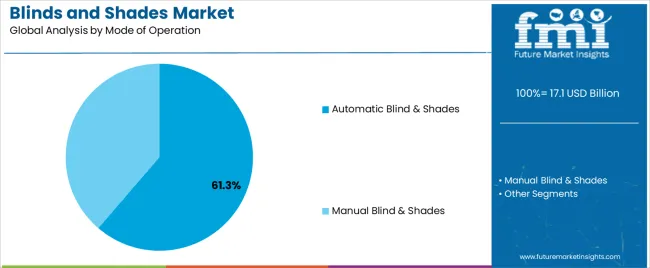

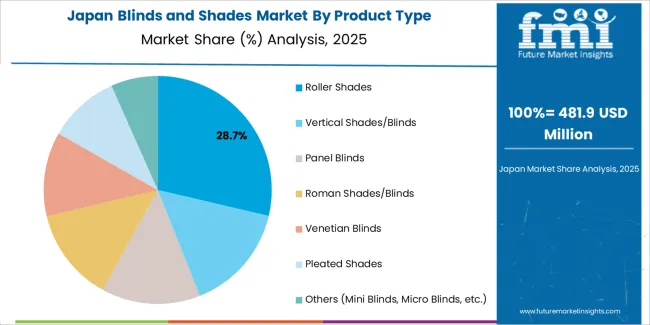

The market is segmented by Product Type, Fabric, Mode of Operation, Application, and Distribution Channel and region. By Product Type, the market is divided into Roller Shades, Vertical Shades/Blinds, Panel Blinds, Roman Shades/Blinds, Venetian Blinds, Pleated Shades, and Others (Mini Blinds, Micro Blinds, etc.). In terms of Fabric, the market is classified into Synthetic Blinds & Shades and Natural Blinds & Shades. Based on Mode of Operation, the market is segmented into Automatic Blind & Shades and Manual Blind & Shades. By Mode of Operation, the market is divided into Automatic Blind & Shades and Manual Blind & Shades. By Application, the market is segmented into Residential and Commercial. By Distribution Channel, the market is segmented into Offline, Others, and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The roller shades segment, accounting for 27.40% of the product type category, has emerged as the leading product due to its versatility, minimalistic design, and efficient light control properties. Market dominance has been reinforced by the segment’s adaptability across residential, corporate, and hospitality applications.

The compact structure and easy installation of roller shades have made them a preferred choice among modern consumers. Advancements in material coatings and automated lifting systems have enhanced performance and durability, supporting wider adoption.

Manufacturers are focusing on expanding customization options, including patterns, opacity levels, and colors, to align with evolving interior design trends The segment’s sustained growth is further supported by demand for cost-effective and space-efficient window coverings, ensuring its continued leadership within the blinds and shades market.

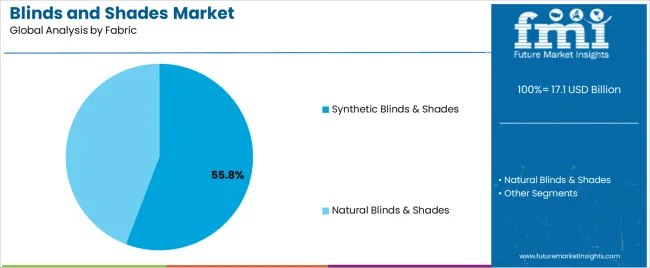

The synthetic blinds and shades segment, representing 55.80% of the fabric category, has maintained its leadership owing to superior durability, moisture resistance, and affordability compared to natural alternatives. The segment’s dominance has been supported by advancements in polymer-based fabrics that enhance UV resistance and color retention.

Widespread acceptance across residential and commercial installations has been attributed to easy maintenance and extended service life. Manufacturers are increasingly incorporating recyclable synthetic fibers to address environmental concerns and regulatory compliance.

The availability of lightweight, flexible materials with enhanced aesthetic appeal has further driven preference for synthetic options Continued innovation in material engineering and production efficiency is expected to sustain this segment’s leading share and strengthen its competitive advantage across diverse end-user markets.

The automatic blinds and shades segment, holding 61.30% of the mode of operation category, has achieved a leading position due to the rapid proliferation of smart home technologies and growing consumer inclination toward convenience and energy efficiency. Integration with voice assistants, mobile apps, and sensor-based systems has enhanced operational ease and improved energy management in modern households.

The segment’s dominance has been reinforced by technological innovation in motorized mechanisms, battery efficiency, and remote accessibility. Commercial spaces have increasingly adopted automated shading systems to optimize natural lighting and reduce energy consumption.

Rising affordability of automation components and wider availability through online and retail channels are further supporting adoption The continued advancement of connected home ecosystems and demand for personalized comfort solutions are expected to sustain the growth momentum of this segment across global markets.

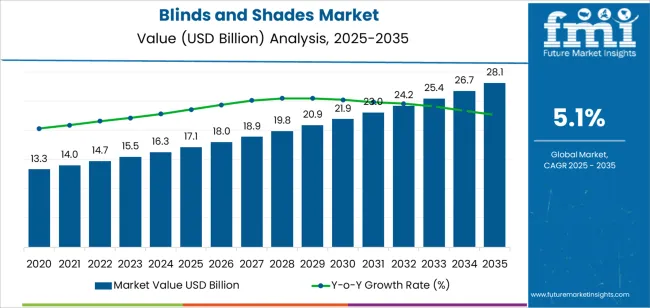

From 2020 to 2025, the blinds and shades market experienced a CAGR of 4.4%. Blinds and shade have emerged as go-to choices for window coverings, valued for their ability to effectively block sunlight. With a plethora of styles and colors available, they cater to diverse preferences.

The market has seen a surge in demand for exterior shade designed to withstand harsh weather conditions, providing homeowners with effective protection against precipitation

The blinds and shade market has seen a notable shift towards energy-efficient features, including innovations like smart solar shade and automated honeycomb shades. These advancements are driving their adoption in green building initiatives, aligning well with the trend towards smart buildings and distributed energy systems.

There's a rising preference among consumers for eco-friendly options such as blinds made from natural fibers. This growing awareness of sustainability is expected to further bolster consumer interest and drive growth in the blinds and shade market. Projections indicate that the global blinds and shades market is expected to experience a CAGR of 5.1% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 4.4% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.1% |

The provided table highlights the top five countries in terms of revenue, with China and India leading the list.

The trend toward urbanization in India is fueling a rising demand for contemporary and visually appealing interior solutions, such as blinds and shades.

China's rapidly expanding real estate sector, driven by urbanization and infrastructure development, fuels demand for blinds and shades.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 1.9% |

| Australia | 4.6% |

| China | 5.6% |

| Japan | 5.2% |

| India | 6.4% |

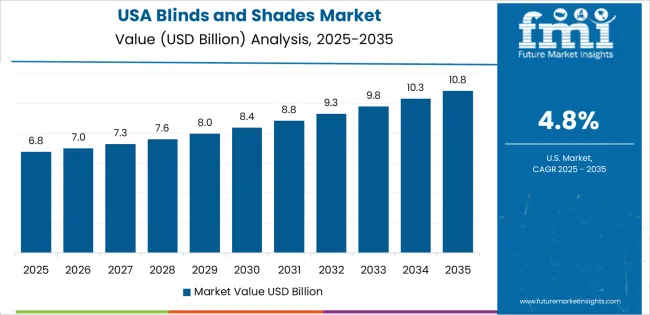

The blinds and shades market in the United States is expected to expand with a CAGR of 1.9% from 2025 to 2035. The blinds and shade market in the United States is driven, growing emphasis on energy efficiency and sustainability, prompting consumers to invest in window coverings that offer insulation and light control benefits. This trend is further fueled by rising awareness of environmental issues and the desire to reduce energy consumption.

Technological advancements in the industry, such as smart blinds and automated shades, are appealing to tech-savvy consumers looking to enhance convenience and control over their home environments. The integration of these features into smart home systems is also contributing to market growth.

The blinds and shades market in China is expected to expand with a CAGR of 5.6% from 2025 to 2035. The blinds and shade market in China is experiencing significant growth propelled by rapid urbanization and the construction of new residential and commercial buildings are driving demand for window coverings to enhance privacy, control light, and improve energy efficiency. As more people move to urban areas, there is a growing need for blinds and shade to outfit homes, offices, and public spaces.

Increasing disposable income and changing lifestyles have led to a rising demand for high-quality interior décor products, including blinds and shades. Consumers are increasingly seeking products that offer both functionality and aesthetic appeal, driving manufacturers to innovate and offer a wide range of designs, materials, and customization options.

The growing awareness of environmental issues and the importance of energy conservation are driving demand for energy-efficient window coverings in China. This has led to a shift towards products such as solar shade and insulated blinds, which help regulate indoor temperatures and reduce energy consumption.

The blinds and shades market in India is experiencing rapid growth driven by several factors. Firstly, urbanization and the expansion of residential and commercial infrastructure are creating a burgeoning demand for window coverings. The blinds and shades market in India is expected to expand with a CAGR of 6.4% from 2025 to 2035.

As more people move to urban areas and new buildings are constructed, there is a growing need for blinds and shade to provide privacy, light control, and aesthetic appeal.

Consumers are increasingly seeking stylish and functional window coverings to enhance the ambiance of their living spaces. This has led to a surge in demand for a variety of designs, materials, and customization options in the Indian market.

The blinds and shades market in Japan is expected to expand with a CAGR of 5.2% from 2025 to 2035. There is a growing emphasis on energy efficiency and sustainability, prompting consumers to invest in window coverings that offer insulation and light control benefits.

This trend is particularly pronounced in Japan, where energy conservation is a significant concern due to the country's limited natural resources and commitment to environmental sustainability.

Australia's climate, characterized by hot summers and cold winters, further fuels the demand for window coverings that can help regulate indoor temperatures and reduce energy consumption.

This has led to a rise in the popularity of blinds and shade that provide both thermal insulation and UV protection. The blinds and shades market in Australia is expected to expand with a CAGR of 4.6% from 2025 to 2035.

The trend towards urbanization and the construction of new residential and commercial properties in Australia is contributing to the growth of the blinds and shade market. As more people move to urban areas and new buildings are constructed, there is a growing need for window coverings to provide privacy, security, and aesthetic appeal.

The below section shows the leading segment. The roman shades/blinds segment is to account for a market share of 23.3% in 2025. Based on application, residential segment is expected to have a share of 66.7%.

| Category | Market Share |

|---|---|

| Roman Shades/Blinds | 23.3% |

| Residential | 66.70% |

Roman Shades/Blinds Segment to account for a market share of 23.3% in 2025. Roman shade consist of a continuous piece of fabric spanning the window's length, characterized by horizontal folds. Upon being raised, the fabric elegantly gathers into a decorative pelmet.

These shade are increasingly popular in contemporary home designs, offering versatility in fabric choices and materials. They can be operated using either a standard cord or chain drive mechanism, providing both functionality and style to modern interiors.

The residential segment emerged as the dominant force in the blinds and shades market, commanding 66.7% of the total market share in 2025. Blinds and shade play a crucial role in enhancing energy efficiency and security in homes.

With ongoing advancements in insulation technology, especially vital in extreme weather conditions, the blinds and shade market is witnessing a significant uptick in consumer interest.

This surge is further fueled by a boom in construction activities across both residential and non-residential sectors. There has been a notable rise in home renovation projects as individuals seek to elevate their living standards and enhance their lifestyles.

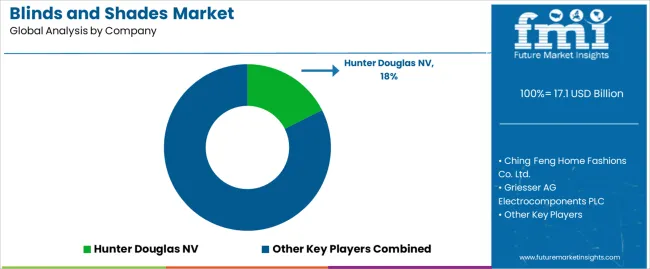

Key global players in the blinds and shades market are concentrating on expanding their businesses, advancing their product development, and introducing new products to broaden their global presence.

Market players expand their product portfolios to cater to diverse customer preferences and market segments. This may include offering a wide range of materials, colors, patterns, and styles to appeal to different tastes and budgets.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 17.1 Billion |

| Projected Market Valuation in 2035 | USD 28.1 billion |

| Value-based CAGR 2025 to 2035 | 5.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Product Type, Fabric, Mode of Operation, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Ching Feng Home Fashions Co. Ltd.; Griesser AG Electrocomponents PLC; Hunter Douglas NV; Lafayette Venetian Blind Inc.; Legrand; Lutron Electronics Company; Mechoshade Systems LLC; Nien Made Enterprise Co. Ltd.; Persianas Canet S.A; Qmotion Shades; Schenker Storen AG |

The global blinds and shades market is estimated to be valued at USD 17.1 billion in 2025.

The market size for the blinds and shades market is projected to reach USD 28.1 billion by 2035.

The blinds and shades market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in blinds and shades market are roller shades, vertical shades/blinds, panel blinds, roman shades/blinds, venetian blinds, pleated shades and others (mini blinds, micro blinds, etc.).

In terms of fabric, synthetic blinds & shades segment to command 55.8% share in the blinds and shades market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

External Blinds Market Size and Share Forecast Outlook 2025 to 2035

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA