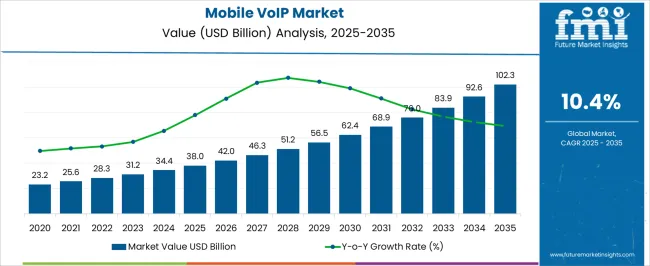

The Mobile VoIP Market is estimated to be valued at USD 38.0 billion in 2025 and is projected to reach USD 102.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period. From 2020 to 2024, the market expanded from USD 23.2 billion to USD 34.4 billion, with annual growth rates ranging between 9.0% and 10.2%. Early adoption was driven by increasing demand for cost-effective voice communication and enterprise connectivity solutions. Year-on-year growth during this phase reflects steady uptake among early users, incremental integration into mobile and enterprise networks, and the gradual expansion of service availability across regions, establishing a solid base for wider adoption.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 38.0 billion to USD 62.4 billion, with YoY growth averaging 10–10.5%. Adoption expands across corporate and consumer segments, supported by improved network penetration and growing reliance on mobile communication. From 2030 to 2035, growth continues steadily to USD 102.3 billion, with annual increases around 10–11%. The YoY analysis highlights consistent expansion, with recurring subscriptions, broader enterprise adoption, and rising consumer usage driving predictable market growth. Demand stabilizes across regions, reflecting a transition toward a mature and widely adopted mobile VoIP market.

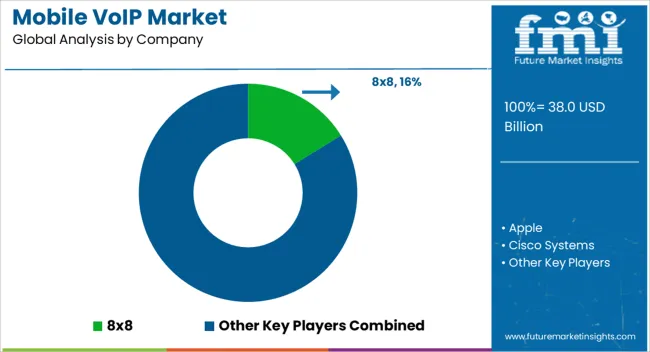

8x8, Apple, Cisco Systems, Facebook (Meta), Google, GoTo Connect, Microsoft, Nextiva, Twilio, Zoom Video Communications

| Metric | Value |

|---|---|

| Mobile VoIP Market Estimated Value in (2025 E) | USD 38.0 billion |

| Mobile VoIP Market Forecast Value in (2035 F) | USD 102.3 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The mobile VoIP market is experiencing significant expansion, supported by the rapid growth of high-speed mobile internet connectivity, increasing smartphone penetration, and the shift toward cost-efficient communication solutions. Demand is being driven by consumers and enterprises seeking flexible, feature-rich platforms that provide high-quality voice and video communications over data networks. Advancements in mobile application development, audio-video compression technologies, and integration with unified communication systems are enhancing service reliability and user experience.

The market is also benefiting from the rise of remote work, online collaboration, and cross-border communications, which have increased the need for affordable international calling and conferencing solutions. Telecom operators and VoIP service providers are focusing on improving encryption, reducing latency, and integrating AI-based enhancements to strengthen competitiveness.

As 5G networks continue to roll out globally, latency reduction and bandwidth improvements are expected to further elevate mobile VoIP quality and adoption The combination of evolving communication needs, infrastructure upgrades, and competitive service offerings is positioning the market for sustained long-term growth across multiple regions.

The mobile VoIP market is segmented by platform, service, pricing model, application, end user, and geographic regions. By platform, mobile VoIP market is divided into Android OS, iOS, Windows OS, and Others. In terms of service, mobile VoIP market is classified into Video and voice call, Messaging, and File sharing. Based on pricing model, mobile VoIP market is segmented into Subscription-based, Pay-as-you-go, and Hybrid. By application, mobile VoIP market is segmented into Social networking apps, Gaming applications, and Enterprise communication.

By end user, mobile VoIP market is segmented into Individual consumers and Corporate. Regionally, the mobile VoIP industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Android OS platform segment is projected to account for 26.8% of the mobile VoIP market revenue share in 2025, making it the leading platform category. This leadership is supported by Android’s dominant global smartphone market share and its widespread adoption across both developed and emerging markets. The open-source nature of Android OS enables VoIP application developers to customize features, optimize performance, and integrate advanced functionalities without restrictive licensing constraints.

The segment is benefiting from the affordability and availability of Android-powered devices, which expand accessibility for users in price-sensitive markets. Additionally, Android’s compatibility with a wide range of hardware specifications ensures that VoIP services can be delivered efficiently across multiple device tiers.

The increasing integration of VoIP features into Android-native dialers and messaging platforms is further accelerating adoption. As 5G coverage expands and mobile internet quality improves, the Android platform is expected to maintain its leadership in the VoIP space, supported by continuous innovation and large-scale developer ecosystem contributions.

The video and voice call service segment is anticipated to represent 42.1% of the mobile VoIP market revenue share in 2025, establishing itself as the dominant service type. Its leadership is being driven by the growing preference for real-time, high-quality communication solutions that combine both voice and video capabilities in a single platform.

Improvements in mobile internet speeds, particularly with the rollout of 4G LTE and 5G networks, are enhancing call clarity, reducing latency, and supporting seamless video streaming. The segment’s growth is further supported by the integration of additional features such as screen sharing, background noise reduction, and multi-party conferencing, which are expanding its appeal for both personal and professional use.

The rising adoption of video-enabled collaboration tools in remote work and online education is also contributing to the strong demand for these services. As service providers continue to optimize compression algorithms and network efficiency, the combined video and voice call offering is expected to remain the preferred choice for mobile VoIP users globally.

The subscription-based pricing model segment is expected to hold 54.6% of the mobile VoIP market revenue share in 2025, making it the dominant pricing approach. This dominance is being driven by the value and predictability it offers to both consumers and service providers. Subscribers benefit from fixed monthly or annual fees that allow unlimited or bundled usage, eliminating the uncertainty of pay-per-use billing.

Service providers favor this model for its ability to deliver stable and recurring revenue streams while encouraging customer loyalty through ongoing service improvements. The segment is also benefiting from the increasing availability of bundled plans that integrate voice, video, and messaging services across multiple devices under a single subscription.

Enhanced customer retention strategies, including premium features and personalized offerings, are further reinforcing adoption. As competition in the mobile VoIP space intensifies, subscription-based models are expected to remain a central pricing strategy, enabling providers to differentiate themselves through added value and consistent service quality while maintaining profitability.

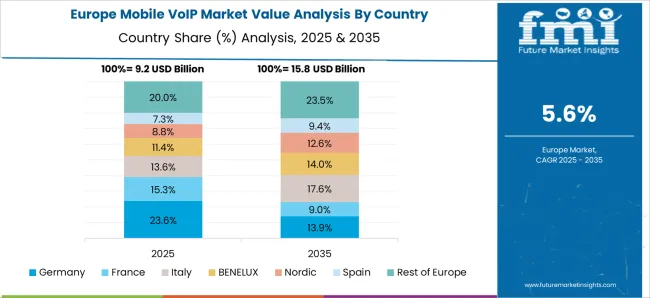

The mobile VoIP market is expanding due to rising smartphone penetration, growing demand for low-cost communication, and improved mobile network infrastructure. Mobile VoIP enables voice calls, messaging, and conferencing over data networks, reducing reliance on traditional telephony. North America and Europe focus on enterprise adoption, while Asia-Pacific and Latin America show rapid consumer growth. Providers emphasize call quality, app security, seamless integration with existing telecom services, and compatibility across platforms to enhance adoption across both consumer and business segments.

Mobile VoIP adoption is closely tied to the proliferation of smartphones and expanding mobile broadband coverage. Affordable smartphones and increasing 4G and 5G penetration enable consumers and businesses to access VoIP services seamlessly. Users benefit from lower communication costs compared to traditional voice networks, particularly for international calls. App-based VoIP solutions integrate with contacts and messaging apps, providing convenience and ease of use. Until alternative communication platforms offer similar global reach and low-cost functionality, mobile VoIP remains a preferred choice for cost-conscious users and businesses seeking reliable, mobile communication solutions.

The rise of remote work, virtual teams, and cloud-based collaboration has driven enterprises to adopt mobile VoIP for unified communications. Businesses leverage VoIP for video conferencing, voice calls, and messaging, reducing operational costs while maintaining connectivity. Features like call forwarding, virtual numbers, and integration with CRM systems enhance productivity. Security, encryption, and quality of service are critical for enterprise adoption. Providers offering secure, scalable, and customizable VoIP platforms gain competitive advantage. Until alternative solutions can match mobile VoIP’s cost-effectiveness, flexibility, and integration with business workflows, enterprises will continue to prioritize VoIP for mobile communication and remote collaboration.

The quality of mobile VoIP calls depends on network stability, bandwidth, and latency. Providers focus on optimizing data transmission, employing codecs, and implementing adaptive jitter buffering to maintain call clarity. Poor network conditions can cause dropped calls, echo, or delays, impacting user experience. Telecom operators and app developers are working to enhance performance over variable mobile networks, particularly in areas with fluctuating connectivity. Until alternative mobile communication technologies provide consistent quality at similar cost, mobile VoIP will remain preferred for users seeking reliable and efficient voice and video communication over data networks.

As mobile VoIP transmits voice and data over the internet, security and privacy are key concerns. Encryption, secure authentication, and compliance with data protection regulations influence adoption. Enterprises and consumers prioritize providers that safeguard against hacking, eavesdropping, and call interception. Regional regulations regarding VoIP usage, taxation, and licensing impact market penetration, especially in countries with restricted VoIP policies. Providers ensuring secure, regulatory-compliant services gain consumer and enterprise trust. Until alternative communication channels offer similar security and regulatory adherence, mobile VoIP remains a trusted solution for private and business communications globally.

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

The global Mobile VoIP Market is projected to grow at a CAGR of 10.4% through 2035, supported by increasing demand across telecommunications, enterprise communication, and mobile networking applications. Among BRICS nations, China has been recorded with 14.0% growth, driven by large-scale deployment and adoption in mobile and enterprise networks, while India has been observed at 13.0%, supported by rising utilization in telecommunications and business communication systems. In the OECD region, Germany has been measured at 12.0%, where production and adoption for mobile and enterprise communication solutions have been steadily maintained. The United Kingdom has been noted at 9.9%, reflecting consistent use in mobile and business communication applications, while the USA has been recorded at 8.8%, with deployment and utilization across telecommunications, enterprise, and mobile networking sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The mobile VoIP market in China is growing at a CAGR of 14.0%, fueled by the rapid adoption of smartphones, high-speed internet connectivity, and increasing demand for cost-effective communication solutions. Enterprises and individual users are leveraging mobile VoIP services to reduce telecommunication costs, enhance flexibility, and support remote communication. Rising smartphone penetration and 4G/5G network expansion are key factors driving market growth. Technology advancements, such as HD voice quality, multi-platform compatibility, and seamless integration with messaging apps, are increasing user adoption. Businesses are also using mobile VoIP for customer support, virtual meetings, and global collaboration. Regulatory support for digital communication infrastructure and investment in telecom networks further boost market expansion. The market benefits from urbanization, remote work trends, and the growing need for scalable communication platforms, making mobile VoIP a vital tool for personal and professional communication in China.

The mobile VoIP market in India is expanding at a CAGR of 13.0%, supported by increasing smartphone usage, affordable data plans, and rising internet penetration. Both individuals and enterprises are adopting mobile VoIP services to reduce communication costs and improve flexibility. Integration with messaging platforms, social media apps, and business collaboration tools enhances market adoption. Growing digitalization across sectors, remote work trends, and online education programs further drive demand for mobile VoIP. Telecom operators and service providers are investing in network upgrades and enhanced security measures to support reliable VoIP communication. The market also benefits from government initiatives promoting digital infrastructure and connectivity across urban and rural regions. Rising awareness of mobile VoIP features, such as high-quality voice calls, video calling, and conferencing, ensures continued adoption and steady market growth in India.

The mobile VoIP market in Germany is growing at a CAGR of 12.0%, driven by enterprise adoption, high smartphone penetration, and advanced telecommunication networks. Companies are increasingly using mobile VoIP for business communication, remote meetings, and customer support to reduce costs and improve efficiency. Individuals benefit from high-quality voice and video calling services integrated with mobile apps. Germany’s mature telecom infrastructure, availability of high-speed internet, and emphasis on secure communication protocols support market growth. Market players are introducing innovative features such as multi-device support, cloud integration, and AI-powered call management systems. Growing urbanization, digital workplace adoption, and a focus on seamless communication experiences further fuel demand. Regulatory frameworks ensuring privacy, security, and data protection enhance market reliability. The mobile VoIP market in Germany is expected to maintain steady growth driven by technology adoption and enterprise usage.

The mobile VoIP market in the United Kingdom is expanding at a CAGR of 9.9%, supported by widespread smartphone usage, affordable mobile data, and increasing demand for flexible communication solutions. Enterprises rely on mobile VoIP for virtual meetings, remote collaboration, and customer service. Individuals use VoIP for high-quality voice and video calls, messaging, and integration with social platforms. Telecom operators are investing in infrastructure upgrades, 5G rollout, and network reliability to meet growing demand. Technological advancements such as cloud-based VoIP, AI-enabled call routing, and multi-platform integration enhance user experience. Government initiatives promoting digital connectivity, smart cities, and remote work trends further support market growth. With increasing awareness of cost-effective communication solutions and continuous technological innovation, mobile VoIP adoption in the UK is expected to grow steadily in both personal and enterprise segments.

The mobile VoIP market in the United States is growing at a CAGR of 8.8%, driven by the need for cost-effective communication, enterprise collaboration, and remote work solutions. Individuals increasingly use mobile VoIP for video and voice calls, messaging, and integration with social and productivity apps. High-speed internet, 5G networks, and smartphone penetration enable seamless VoIP experiences. Enterprises are adopting cloud-based VoIP systems, AI-powered call management, and multi-platform integration for efficient business operations. Regulatory compliance and data security measures ensure reliability and user trust. Demand is also fueled by online education, telehealth services, and remote workforce communication needs. Continuous technological innovations, cost reduction benefits, and the increasing importance of flexible communication solutions ensure steady adoption and growth of the mobile VoIP market in the United States.

The mobile VoIP (Voice over Internet Protocol) market has become a cornerstone of modern communication, enabling voice and multimedia calls over internet networks rather than traditional telephone lines. This technology offers cost efficiency, global connectivity, and seamless integration with mobile and desktop platforms, making it indispensable for both businesses and individual users. The growing adoption of smartphones, expansion of high-speed internet networks, and demand for unified communication solutions are driving the growth of the mobile VoIP market worldwide.

Key players in this market include 8x8, which provides enterprise-grade cloud communication platforms with integrated VoIP, video, and collaboration tools. Apple leverages its ecosystem with FaceTime and iMessage, offering VoIP services to millions of iOS users globally. Cisco Systems delivers robust VoIP solutions for enterprises, ensuring secure and high-quality communication. Facebook (Meta) facilitates VoIP services through Messenger and WhatsApp, connecting users across platforms. Google offers solutions such as Google Voice and Google Meet, enabling flexible VoIP communication for both personal and professional use.

Other notable suppliers include GoTo Connect, Microsoft, Nextiva, Twilio, and Zoom Video Communications, all offering feature-rich VoIP services with advanced integration capabilities, cloud-based functionality, and high scalability. These companies focus on enhancing user experience, ensuring reliable call quality, and integrating artificial intelligence, analytics, and security features. Collectively, these industry leaders are shaping the mobile VoIP market, driving innovation, and enabling seamless global communication in an increasingly digital world.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.0 Billion |

| Platform | Android OS, iOS, Windows OS, and Others |

| Service | Video and voice call, Messaging, and File sharing |

| Pricing Model | Subscription-based, Pay-as-you-go, and Hybrid |

| Application | Social networking apps, Gaming applications, and Enterprise communication |

| End User | Individual consumers and Corporate |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 8x8, Apple, Cisco Systems, Facebook (Meta), Google, GoTo Connect, Microsoft, Nextiva, Twilio, and Zoom Video Communications |

| Additional Attributes | Dollar sales vary by service type, including VoIP apps, SIP services, and enterprise solutions; by device type, spanning smartphones, tablets, and IoT devices; by application, such as personal communication, business collaboration, and customer support; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising mobile internet penetration, demand for cost-efficient communication, and adoption of unified communication platforms. |

The global mobile VoIP market is estimated to be valued at USD 38.0 billion in 2025.

The market size for the mobile VoIP market is projected to reach USD 102.3 billion by 2035.

The mobile VoIP market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in mobile VoIP market are android os, ios, windows os and others.

In terms of service, video and voice call segment to command 42.1% share in the mobile VoIP market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Mobile Messaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA