The pharma and healthcare social media marketing market is expanding steadily. Growth is being driven by increasing digital engagement across healthcare organizations, the rising importance of patient-centric communication, and the widespread adoption of social media for brand awareness and outreach. Market dynamics are shaped by regulatory compliance requirements, data privacy concerns, and the need for evidence-based promotional strategies.

Companies are leveraging data analytics, automation tools, and influencer collaborations to enhance audience targeting and engagement efficiency. The future outlook remains positive as digital transformation continues to reshape healthcare marketing strategies.

Advancements in content personalization, artificial intelligence-driven campaign management, and cross-platform integration are expected to optimize marketing effectiveness Growth rationale is centered on the necessity for transparent and compliant communication, the ability to deliver educational health content, and the strategic use of digital tools to foster trust and engagement, ensuring sustained expansion and modernization of marketing operations across the global pharmaceutical and healthcare landscape.

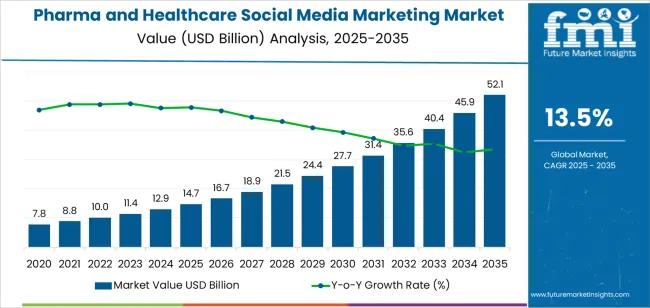

| Metric | Value |

|---|---|

| Pharma and Healthcare Social Media Marketing Market Estimated Value in (2025 E) | USD 14.7 billion |

| Pharma and Healthcare Social Media Marketing Market Forecast Value in (2035 F) | USD 52.1 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

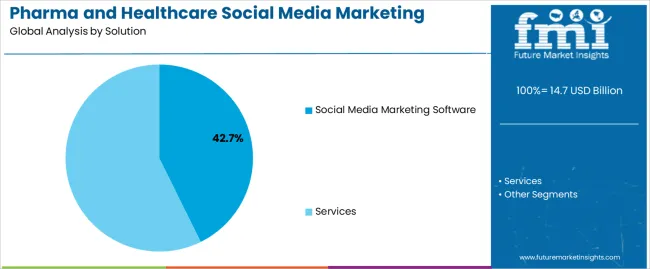

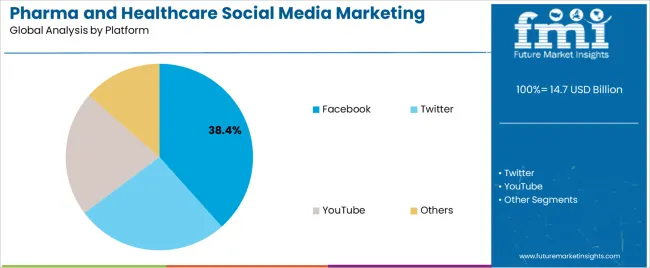

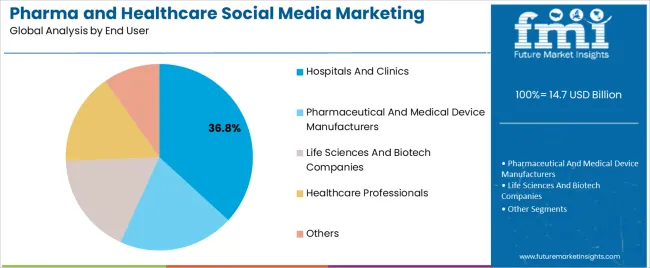

The market is segmented by Solution, Platform, and End User and region. By Solution, the market is divided into Social Media Marketing Software and Services. In terms of Platform, the market is classified into Facebook, Twitter, YouTube, and Others. Based on End User, the market is segmented into Hospitals And Clinics, Pharmaceutical And Medical Device Manufacturers, Life Sciences And Biotech Companies, Healthcare Professionals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The social media marketing software segment, accounting for 42.70% of the solution category, has been leading the market due to its ability to streamline campaign management, monitor engagement metrics, and ensure regulatory adherence across digital platforms. Adoption has been accelerated by the need for scalable, data-driven tools that support real-time analytics and audience segmentation.

Integration with customer relationship management systems and compliance modules has strengthened market confidence. Demand has been reinforced by healthcare organizations focusing on consistent branding, targeted communication, and patient outreach.

Continuous upgrades in automation, content scheduling, and data visualization features are enhancing operational efficiency Over the forecast period, increasing demand for integrated and AI-enabled marketing solutions is expected to sustain segment dominance and drive innovation in performance measurement and compliance tracking within the healthcare digital marketing ecosystem.

The Facebook platform segment, representing 38.40% of the platform category, has maintained leadership owing to its extensive user base, cost-effective advertising capabilities, and precise audience targeting tools. Its wide reach and flexibility in campaign design have made it a preferred choice for healthcare marketers aiming to connect with diverse demographics.

The segment’s share has been strengthened by Facebook’s enhanced analytics, ad optimization, and content delivery systems. Healthcare providers and pharmaceutical companies are leveraging the platform for patient education, awareness campaigns, and product updates.

Regulatory-compliant communication frameworks have improved brand credibility and patient trust Continued innovation in engagement tools, combined with expanding integration with healthcare-specific marketing software, is expected to reinforce Facebook’s role as a primary channel for social media-driven healthcare outreach.

The hospitals and clinics segment, holding 36.80% of the end user category, has emerged as the leading adopter due to growing emphasis on digital patient engagement and reputation management. Healthcare facilities are increasingly using social media platforms to share educational content, promote preventive care initiatives, and enhance visibility among target audiences.

The adoption of structured marketing strategies has enabled improved patient communication and brand differentiation. Data-driven insights from social media analytics are being utilized to refine content strategies and monitor patient sentiment.

Hospitals and clinics are also investing in professional social media management tools to ensure compliance and optimize return on investment Expanding healthcare infrastructure and rising competition among providers are expected to sustain growth momentum for this segment, solidifying its position as a key driver in the pharma and healthcare social media marketing market.

The swift digitization of healthcare has revolutionized the methods of accessing and exchanging information. Social media platforms have evolved into essential communication pathways between healthcare and pharmaceutical companies, their patients, and medical experts. The pharmaceutical sector understands the significance of having a digital presence to interact with its target market as more people look to Internet platforms for health-related information.

By utilizing social media, businesses create communities around certain health conditions, offer assistance, and distribute instructional information. Digitalization has reduced processes, making collaboration and communication within the healthcare ecosystem more effective.

As healthcare becomes more digitally connected, social media marketing methods are growing in prominence as businesses try to adapt to their customers' changing demands and tastes in the digital era. This escalates the pharma and healthcare social media marketing market growth.

Social media platforms are crucial for shaping opinions and promoting discussion among key opinion leaders (KOLs), who comprise healthcare professionals, patient advocates, and influencers. Pharmaceutical firms harness the credibility of trustworthy voices in the healthcare sector, expand their audience, and amplify their messaging by working with KOLs.

The pharma social media marketing vendors increase the success rate of their social media marketing strategies by interacting with KOLs and taking advantage of their knowledge, perspectives, and networks. KOLs are also significant ambassadors and promoters for healthcare programs and pharmaceutical goods, raising awareness and influencing behavior.

Using KOLs' influence to promote their brands and products on social media allows pharma and healthcare social media marketing providers to connect with target audiences, and reach a wider audience. This factor strengthens the pharma and healthcare social media marketing market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 7,099.40 million |

| Market Value for 2025 | USD 11,471.10 million |

| Market CAGR from 2020 to 2025 | 12.7% |

The segmented healthcare social media marketing industry analysis is included in the following subsection. Based on comprehensive studies, the social media marketing software sector is leading the solution category, and the Facebook segment is commanding the platform category. Followed by, hospitals and clinics sector commanding the end user category.

| Segment | Social Media Marketing Software |

|---|---|

| Share (2025) | 53.60% |

Social media marketing software's user-friendly interfaces make it easy for providers to plan and carry out extensive marketing campaigns, giving them a competitive advantage. Social media marketing software's scalability allows for expansion and flexibility to shift market conditions by meeting the changing requirements of the pharmaceutical and healthcare industries.

Social media marketing software integrates with current systems, improving overall operational cohesiveness and making it easier to implement cross-channel marketing campaigns.

| Segment | |

|---|---|

| Share (2025) | 35.40% |

Facebook offers a range of aad types, such as video, carousel, and sponsored posts that provide flexible storytelling options for audiences to successfully receive healthcare and pharmaceutical messaging. Facebook also provides healthcare influencer advertising providers with reliable campaign success measurement tools and powerful analytics, enabling data-driven optimizations for increased return on investment.

| Segment | Hospitals and Clinics |

|---|---|

| Share (2025) | 32.60% |

As a result of the growing trend of digital health initiatives, hospitals, and clinics are engaging in social media marketing to improve their online presence and attract patients. The hospitals and clinic segment's perceived trustworthiness affects other vendors, making them significant forces behind the pharmaceutical social media advertising market expansion.

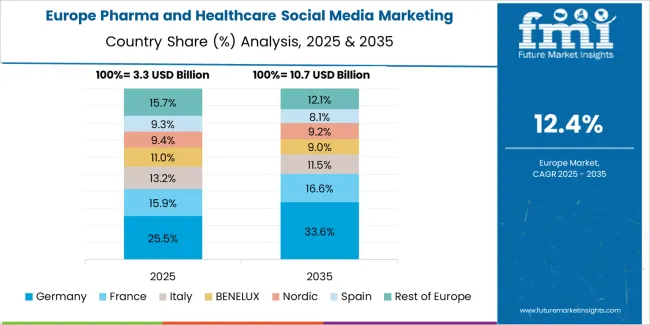

The pharma and healthcare social media marketing market can be observed in the subsequent tables, which focus on the leading economies in Australia and New Zealand, China, the United States, Germany, and Japan. A comprehensive evaluation demonstrates that Australia and New Zealand has enormous opportunities for growth of pharmaceutical social media marketing market.

| Countries | Australia and New Zealand |

|---|---|

| CAGR (2025 to 2035) | 15.0% |

Australia and New Zealand’s regulatory landscape focuses on ethical practices in pharma and healthcare social media marketing strategies. User generated content and influencer collaboration play a significant role in impacting the perception of healthcare and pharma brands among Australia and New Zealand consumers. Social media platforms are progressively a growing trend among consumers in Australia and New Zealand seeking community-driven health advice.

| Nation | China |

|---|---|

| CAGR (2025 to 2035) | 13.8% |

Localization and culturally relevant content are noteworthy for pharmaceutical and healthcare companies to establish relationships with Chinese consumers on social media platforms. A significant trend in China is the integration of social commerce with healthcare social media marketing methods, which makes it easier for consumers to find and buy products.

The adoption of social media platforms for healthcare information-seeking and interaction is driven by China's large population and rising internet penetration.

| Nation | United States |

|---|---|

| CAGR (2025 to 2035) | 10.4% |

Pharmaceutical and healthcare companies leverage personalized and targeted advertising as crucial tactics to connect with various demographic groups in the United States market. Influencer collaborations seem to be a growing hit in these industries, making influencer marketing an established trend in social media marketing.

| Nation | Germany |

|---|---|

| CAGR (2025 to 2035) | 5.0% |

Telemedicine and digital health solutions integrated with social media platforms offer pharmaceutical and healthcare companies in Germany new ways to improve patient accessibility and engagement. German customers in healthcare social media marketing prefer educational and fact-based material, underscoring the significance of authority and reliability.

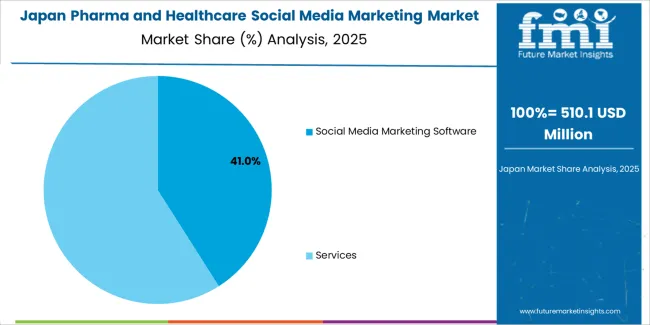

| Nation | Japan |

|---|---|

| CAGR (2025 to 2035) | 4.3% |

Given Japan's aging population, there is an increasing demand for healthcare services and information on social media, which presents an opportunity for pharmaceutical and healthcare businesses to interact with senior citizens. Government rules prioritize customer safety and privacy in social media marketing campaigns for pharmaceutical and healthcare companies, stressing openness and adherence to industry norms.

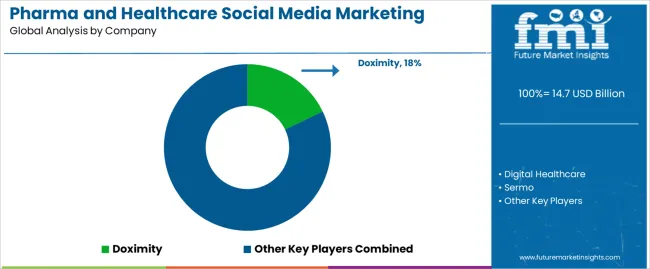

The market's competitive environment is defined by a wide range of pharma and healthcare social media marketing providers meeting the sector's demands. Significant pharmaceutical social media marketing vendors supply a range of platforms and services catered to distinct healthcare industry groups.

Digital Healthcare and Sermo are notable pharma social media marketing providers that provide all-inclusive solutions for interacting with patients and healthcare providers. To promote cooperation and knowledge-sharing among medical professionals, MomMD and Student Doctors Network concentrate on building communities tailored to their needs. Doctors interact and remain informed about business developments and medical breakthroughs on platforms offered by QuantiaMD and Doximity.

Orthomind and WeMedUp are two modern healthcare digital marketing vendors that provide patient data management and workflow simplification. Medical applications that address the requirements of particular healthcare workers, such as DoctorsHangout, Nurse Zone, and All Nurses, offer tools and chances for networking.

A platform for doctors called Ozmosis completes the scenario by providing a forum for communication among medical professionals. The healthcare digital marketing market is distinguished by an extensive array of healthcare social media advertising providers providing distinctive solutions to satisfy the changing demands.

Notable Breakthroughs

| Company | Details |

|---|---|

| DocStokes | A leader in digital marketing for the healthcare industry, DocStokes continued to promote and encourage the sector's digital transformation in January 2025. It bridged the void between doctors needing marketing assistance and IT and marketing experts' solutions. |

| DocStokes | With a strong marketing plan, DocStokes made an important transition in 2024 to help doctors in Delhi, Mumbai, and Surat while preserving its reputation as a brand. With significant growth, DocStokes expanded to Delhi NCR, Pune, and Gurgaon. |

| QuantiaMD | QuantiaMD raised a funding of USD 12 million from an existing investor Fuse Capital. With this funding QuantiaMD aims at expanding its sales, marketing and client services in health plans, health systems along with the pharmaceutical industry. |

| QuantiaMD | A partnership between CareCloud and QuantiaMD was announced to help medical practices become profitable and efficient. To support medical groups in staying more engaged with peers on best practices, the collaboration allowed more than 160,000 QuantiaMD physician members to discuss topics ranging from cutting-edge procedures and technologies to navigating new government reimbursement mandates. |

The global pharma and healthcare social media marketing market is estimated to be valued at USD 14.7 billion in 2025.

The market size for the pharma and healthcare social media marketing market is projected to reach USD 52.1 billion by 2035.

The pharma and healthcare social media marketing market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in pharma and healthcare social media marketing market are social media marketing software, _cloud-based, _on-premises, services, _social media strategy and consulting, _campaign and brand management, _seo services and _support services.

In terms of platform, facebook segment to command 38.4% share in the pharma and healthcare social media marketing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharma Sampling Valve Market Size and Share Forecast Outlook 2025 to 2035

Pharma Peeler Centrifuge Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA