The continuously increasing number of terrorist organizations is giving rise to defense security systems across the world. In India, for security purposes, the Defense Research and Development Organization (DRDO) initiated a project named Airborne Surveillance Platform (ASP) to develop an airborne early warning system. This airborne early warning system is designed to detect threats from aircraft, ships, or any other vehicles at long ranges across the border.

Airborne surveillance can give a bird’s-eye view, which is possible from aircraft, and provides quicker footage, a more extended line of sight, and a more extensive area of an observation than on the ground, though usually with less resolution. Nowadays, airborne surveillance can be done by manned aircraft, hot-air balloons, lower orbit satellites, helicopter-based surveillance systems, and unmanned drones.

The design of airborne surveillance systems consists of an antenna and rotodome, airborne data processor, and integrated navigation system. For airborne surveillance, a synthetic aperture radar (SAR) and night camera are used to provide situational awareness. Airborne surveillance can capture data and images in any environment, and can also offer live videos of any particular area. The market for airborne surveillance is increasing, as many influential countries are looking forward to becoming secured from enemies.

On the other hand, humans can control manned airborne surveillance, but unmanned airborne surveillance is uncontrollable when any computer malfunction occurs. Drone warfare can cause collateral damages on civilian lives and property. Airborne surveillance devices are costly to produce and manufacture. Battery or energy limitation is another challenge in airborne surveillance. The capacity of drones to support cameras and motors is not sufficient. However, commercial drones can typically fly continuously for only around 25 minutes, which increases costs. Companies are manufacturing hydrogen fuel cells, which are lighter and more efficient than electric and lithium batteries. Nowadays, many countries are adopting airborne surveillance to provide aerial overview, security guard tours, thermal imaging, short- and long-range tracking, and crowd control, most importantly for defense purposes. The commercial drone market is rapidly growing in several industries such as transport, infrastructure, agriculture, telecom, security, media & entertainment, insurance, and mining.

Several developments are waving up unceasingly in the airborne surveillance industry, with reference to cyber-security and imaging, along with the proliferating growth rate of the market has drawn Future Market Insights’ interest in studying and analyzing the market, so that we can offer our clients with a solution which is a blend of quantitative and qualitative analysis of the airborne surveillance market, along with recent developments and innovations.

The airborne surveillance system market, at the moment, is experiencing noteworthy developments, driven by various vendors in the air, land, and naval industries. Vendors such as Saab, along with BAE Systems, are currently working on developing drones and radar technologies, wherein Saab is providing its GlobalEye AEW&C solution.

The companies are focusing on developing and manufacturing innovative products and radar technologies to enhance airborne, maritime and land surveillance. With multiple technologies being developed continuously, their integration and application with any system from any manufacturer has become very cumbersome.

GlobalEye AEW&C provides air, maritime, and ground surveillance to produce maximum operational performance in terms of detection capabilities and mission continuity. With extended range and enhanced performance, GlobalEye AEW&C is perfectly positioned to provide the most demanding operational requirements. GlobalEye AWE&C has the ability to detect and focus on low-observable air targets in heavy clutter and jamming conditions, and can also detect maritime targets, including small jet-skis. GlobalEye AEW&C also detects moving objects through long-range wide areas and provides radar images. GlobalEye AEW&C can fly up to an altitude of 6,500 ft with 11 hours of endurance. It consists of a self-protection system, voice communication, satcom, EO/IR sensor, datalinks, and AIS.

BAE Systems offers radar technologies to provide better and enhanced video surveillance systems. BAE systems offer a product named Sampson, which provides situational awareness and targeting solutions. The radar Samson is used by air defense systems to combine the role of surveillance and tracking. Sampson provides search and precision tracking of multiple targets with weapon control systems. Sampson offers various features, such as stealth target detection, ECM immunity, and variable data rate for threat tracking. In operational capabilities, Sampson supports both, point and area defense against future air threats in heavy jamming.

The system is reconcilable with active and semi-active homing missile systems, which makes operational availability high. However, multiple parallel paths are used in the design to maintain several sub-systems when the operation fails. To maintain servicing of the system, there are no high voltage or high power microwave parts used. The operating costs of Sampson are economical, since highly reliable transmitters are used.

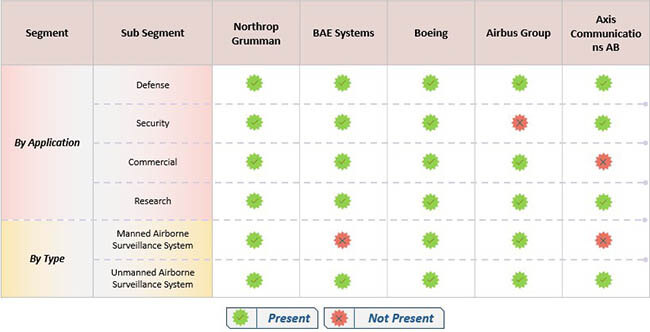

The market, currently, is considerably competitive, with continuous product and technology developments by established as well as new players. Some of the key players in the airborne surveillance system market are Axis Communications AB, BAE Systems, L-3 Communications, Northrop Grumman, UTC aerospace systems, Boeing, Raytheon, Rockwell Collins, Thales, Saab AB, Lockheed Martin Corporation, Textron Inc., Leidos, Airbus Group, Elbit Systems Ltd., Hikvision, Dahua Technology , Panasonic, Honeywell Security, Hanwha, United Technologies, Tyco, Bosch Security Systems, Pelco, Huawei Technologies, Siemens AG, Avigilon Corporation, Uniview, Flir Systems, Inc, and Williams Advanced Engineering, among others.

These companies are continually evolving their portfolios with newer technological developments and upgrades. For instance, in December 2017, Airbus and Williams Advanced Engineering collaborated to explore potential areas in innovative technologies.

Both the companies are focusing on manufacturing and developing lightweight unmanned aerial systems (UAS) and batteries. Airbus’ Zephyr is a solar-powered unmanned aerial system or drone with communication and surveillance capabilities. Williams Advanced Engineering intends to manufacture lightweight batteries for Airbus’ Zephyr for better lifespan of the unmanned aerial system.

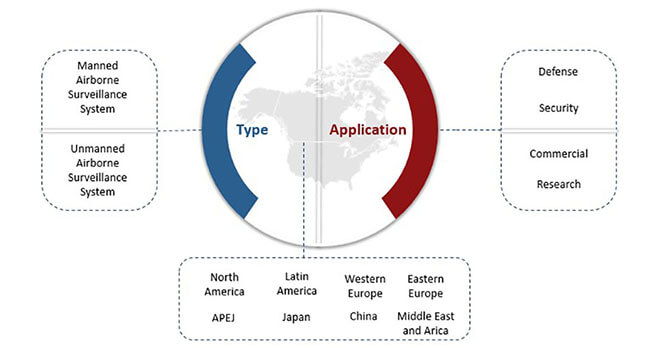

The global airborne surveillance systems market can be segmented on the basis of airborne surveillance type, application, and region. On the basis of airborne surveillance type, the market can be segmented into manned airborne surveillance system and unmanned airborne surveillance system.The unmanned airborne surveillance system segment is expected to hold a majority of the airborne surveillance systems market’s share, and is furthermore expected to grow at a faster rate in comparison to the manned airborne surveillance system segment.On the basis of application, the market can be segmented into defense, security, commercial, and research.

With respect to geographical segmentation, the airborne surveillance systems market can be segmented across North America, Latin America, Western Europe, Eastern Europe, APEJ, Japan, China, and the Middle East & Africa. Among the various regions, North America is expected to dominate the global airborne surveillance systems market during the forecast period, owing to the high sales of manned airborne surveillance systems and high implementation of security radar units in the region.

The U.S. is expected to hold a major share in the global airborne surveillance systems market because of the high demand from end users and technological advancements in the country. Asia Pacific and Europe are expected to follow North America, and Asia Pacific is expected to grow at a considerably faster rate during the forecast period, owing to increasing sales in the region.

The methodology utilized to asses and forecast this market involves both, vendors and consumers. The financial data (revenues) of key vendors is apprehended through secondary research sources, such as companies annual reports and investors’ presentations; industry association publications; paid data bases including Factiva, Avention, Orbis, and others; industry journals & magazines; research papers; and other relevant data available on the public domain.

Estimated market revenue is cross-validated by conducting primary interviews with various participants, majorly C-level executives or senior sales personnel of market players in the ecosystem. Stakeholders, including component providers, device manufacturers, technology providers, software providers, distributors and resellers, and system integrators, as well as service providers are interviewed to fetch the most relevant industry data. On the consumer side, end-user surveys across different industries and regions are performed to gather and analyze qualitative information of the market, from a consumer’s perspective.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Airborne SATCOM Equipment Market

Trade Surveillance Market Size and Share Forecast Outlook 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Coastal Surveillance Systems Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Surveillance Market Report – Growth & Forecast 2025 to 2035

AI in Video Surveillance Market Size and Share Forecast Outlook 2025 to 2035

5G-Enhanced Surveillance Market

Intelligence Surveillance Reconnaissance (ISR) Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Mobile Video Surveillance Market

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft Video Surveillance Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA