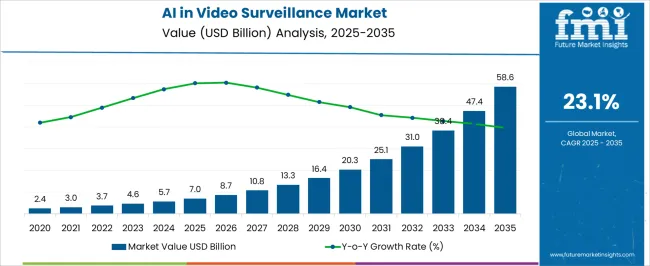

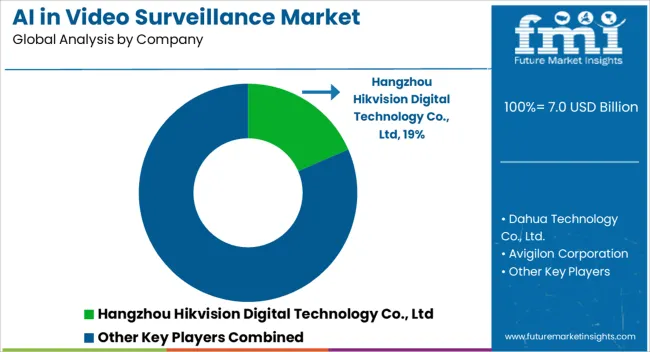

The AI in Video Surveillance Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 58.6 billion by 2035, registering a compound annual growth rate (CAGR) of 23.1% over the forecast period.

| Metric | Value |

|---|---|

| AI in Video Surveillance Market Estimated Value in (2025 E) | USD 7.0 billion |

| AI in Video Surveillance Market Forecast Value in (2035 F) | USD 58.6 billion |

| Forecast CAGR (2025 to 2035) | 23.1% |

The AI in video surveillance market is expanding significantly, driven by the rising demand for intelligent monitoring solutions across urban security, critical infrastructure, and enterprise environments. AI integration enhances surveillance capabilities by enabling real-time analytics, anomaly detection, and predictive insights, thereby reducing manual intervention. The market’s current trajectory is supported by government investments in smart city initiatives, increasing concerns over public safety, and the adoption of AI-powered analytics in private sector applications.

Cloud connectivity, edge computing, and advancements in deep learning algorithms are improving the scalability and accuracy of video surveillance systems. Cost efficiencies in storage and data management are also influencing adoption trends.

Looking forward, the market is expected to benefit from wider integration with IoT ecosystems, regulatory mandates for safety compliance, and continuous innovation in hardware and software. These factors collectively establish AI-enabled video surveillance as a cornerstone technology for next-generation security infrastructure.

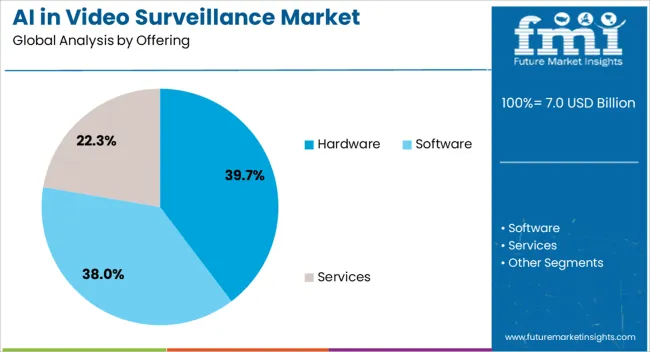

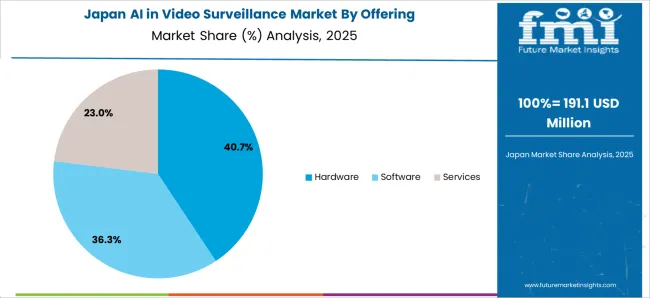

The hardware segment accounts for approximately 39.70% of the AI in video surveillance market, reflecting its critical role in enabling system performance and functionality. Cameras, sensors, and processing units form the backbone of AI surveillance, ensuring seamless integration of advanced analytics.

Demand is being driven by increasing deployment of high-resolution IP cameras capable of real-time video processing, supported by powerful GPUs and edge devices. The segment’s growth is reinforced by the need for reliable infrastructure capable of handling vast volumes of video data.

With ongoing improvements in imaging quality, storage efficiency, and hardware miniaturization, adoption rates are expected to increase further. Hardware investments also remain essential in large-scale deployments across smart cities, transportation hubs, and industrial facilities, ensuring the segment’s continued relevance.

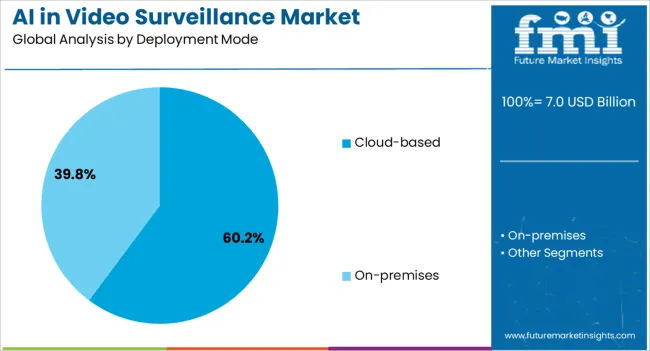

The cloud-based segment leads the deployment mode category with approximately 60.20% share, owing to its scalability, cost-effectiveness, and ability to enable centralized surveillance management. Cloud deployment supports real-time analytics, remote access, and flexible storage options, making it highly attractive for both enterprises and government agencies.

The adoption of subscription-based models and integration with AI-driven video analytics platforms further strengthens its position. Enhanced cybersecurity protocols and growing confidence in data privacy frameworks have also facilitated wider adoption.

Cloud-based systems are increasingly preferred for multi-site operations, where centralized monitoring improves efficiency. With expanding IoT integration and 5G connectivity, cloud deployment is expected to remain dominant, enabling broader accessibility and reduced infrastructure costs.

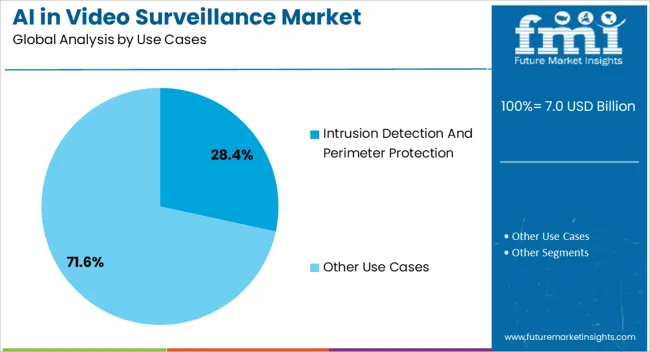

The intrusion detection and perimeter protection segment holds approximately 28.40% share of the use case category, underscoring its importance in security-critical environments. AI-powered video analytics enhance detection accuracy by minimizing false alarms and enabling proactive threat identification.

The segment benefits from increasing demand in sectors such as transportation, defense, energy, and commercial real estate, where perimeter security is paramount. AI integration enables real-time monitoring of restricted zones, anomaly detection, and automated alerts, improving response times.

Growing investment in smart city surveillance and infrastructure protection has further fueled adoption. With rising global security concerns and continuous refinement of AI algorithms, intrusion detection and perimeter protection are expected to sustain a leading role in the market.

The market is experiencing growth, though several restraining factors can adversely affect its development and expansion.

| Attributes | Details |

|---|---|

| Offerings | Hardware |

| CAGR (2025 to 2035) | 23.4% |

The hardware segment dominates the AI in the video surveillance market, growing at a CAGR of 23.4% through 2035. This rising popularity is attributed to:

| Attributes | Details |

|---|---|

| Deployment Mode | On-premises |

| CAGR (2025 to 2035) | 23.1% |

Based on the deployment mode, On-premises dominates the global AI in video surveillance market with an annual growth of 23.1% CAGR. This rising popularity is attributed to:

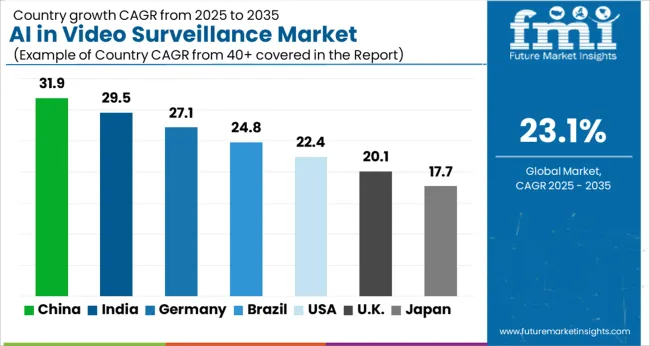

The section analyzes the AI in video surveillance market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table presents the CAGRs for each country through 2035.

South Korea is the leading Asian country in the market. The Korean AI in video surveillance market is expected to register an annual growth rate of 24.8% until 2035.

Japan is another Asian country leading in the AI in video surveillance market. The Japanese market is anticipated to register a CAGR of 25.0% through 2035.

China is another Asian country in the global AI in video surveillance market, which is anticipated to register a CAGR of 24.4% through 2035.

The United Kingdom is a European country leading the AI in video surveillance market. Its market is predicted to register an annual growth rate of 24.1%.

The United States dominates the AI in video surveillance market in the North American region. It is expected to exhibit an annual growth rate of 23.8% until 2035.

The global AI in video surveillance market is highly fragmented, with key players such as Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Avigilon Corporation (Canada), Milestone Systems A/S (Denmark), YITU Tech (China), SenseTime (China), Agent Video Intelligence Ltd. (United States), etc.

Hikvision, a Chinese company, has become a global video surveillance and AI technologies leader. Its expertise lies in developing AI-powered cameras, video analytics software, and integrated solutions that offer real-time threat detection, facial recognition, and behavior analysis.

NVIDIA Corporation, a leading American technology company, has contributed to the market's growth through its graphics processing units (GPUs) and AI hardware solutions. The company's platforms, such as NVIDIA Metropolis, provide a foundation for building AI-powered video analytics applications that enable efficient processing and analysis of vast amounts of video data.

Recent Developments

The global AI in video surveillance market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the AI in video surveillance market is projected to reach USD 58.6 billion by 2035.

The AI in video surveillance market is expected to grow at a 23.1% CAGR between 2025 and 2035.

The key product types in AI in video surveillance market are hardware, software and services.

In terms of deployment mode, cloud-based segment to command 60.2% share in the AI in video surveillance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Aircraft Video Surveillance Systems Market Growth - Trends & Forecast 2025 to 2035

Video Surveillance Storage Market Report - Growth & Demand 2025 to 2035

Video Surveillance Market Growth - Trends & Industry Forecast 2025 to 2035

Airborne Surveillance Market

Mobile Video Surveillance Market

Intelligence Surveillance Reconnaissance (ISR) Market Size and Share Forecast Outlook 2025 to 2035

Connected Enterprise Video Surveillance Solutions Market

AI-Powered Embryo Selection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA