The ASEAN Frozen Food market is set to grow from an estimated USD 11,679.1 million in 2025 to USD 27,421.2 million by 2035, with a compound annual growth rate (CAGR) of 8.9% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 11,679.1 million |

| Projected ASEAN Value (2035F) | USD 27,421.2 million |

| Value-based CAGR (2025 to 2035) | 8.9% |

Market growth has also been supported by the greater recognition of the nutritional advantages of frozen food as well as the technological improvements witnessed in the freezing procedure. Frozen foods, which are like a time capsule of nutritional value and flavor, are the most preferable choice for consumers who are constantly watching their weight. Moreover, the success of e-commerce and the introduction of online grocery shopping have made frozen food products easily available, and now consumers can order the items they like most from their houses without any effort.

The frozen food state in the ASEAN region is marked by the presence of various products such as frozen vegetables, ready-to-eat meals, and frozen desserts. Along with the growing trend of international cuisines and the craving for handy, high-quality food items, innovation in the product line is on the uprise. As the market progresses, production companies are looking into creating novel tastes, healthier variants, and environmentally friendly packaging to align with consumer demands. On the whole, the ASEAN frozen food market has huge potential for expansion, thanks to the mix of simple solutions, plus health, and innovation.

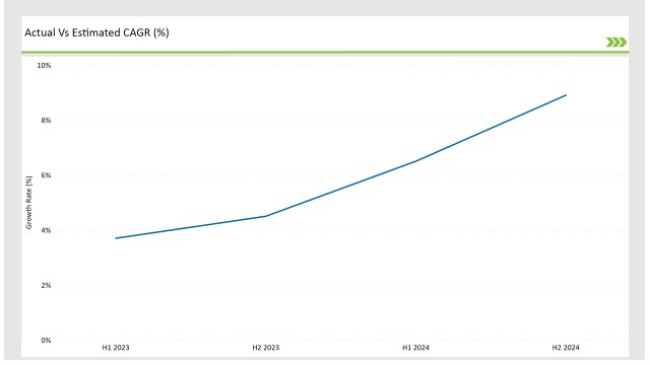

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Frozen Food market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Frozen Food market, the sector is predicted to grow at a CAGR of 3.7% during the first half of 2024, with an increase to 4.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.5% in H1 but is expected to rise to 8.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of organic frozen vegetables by a leading food manufacturer targeting health-conscious consumers. |

| 2024 | The partnership between a major frozen food brand and a popular meal kit service to offer frozen meal options. |

| 2024 | Introduction of a new range of frozen plant-based meat alternatives by a prominent food company catering to the growing demand for vegan options. |

| 2024 | Expansion of a frozen seafood processing facility in Malaysia to increase production capacity and meet rising demand for seafood products. |

Rising Demand for Convenience Foods

The convenience food demand significantly influences the ASEAN frozen food market. In light of urbanization, the rise in the number of lifestyle changes of consumers of having less time is now impacting the consumption of fast food. These kinds of foods are apposite, because, they need no preparation or very little time and also they have a long storage time without the risk of changing the food quality.

The increase in this demand is noted especially with the working-class people and families who for the most part are too busy to prepare healthy meals from scratch. Frozen food products, including ready meals, frozen vegetables, and pre-marinated meats, solve the problem quite differently by helping customers enjoy healthy meals without the problem of long cooking. The other reason that explains the increasing number of food products is the broadcasting rise of meal kits and frozen food subscriptions.

Rise of Health and Wellness Focus

Consumers are paying attention to natural and organic foods, indicating the general impetus towards the clean eating movement and the transparency of the people who make the products. Manufacturers address this problem by making changes to the formulations of products already on the market and as a result, they develop new healthier product lines. For example, they are developing frozen foods with an emphasis on whole grains lean proteins, and a variety of vegetables.

What is more, the plant-based diet's popularity continues its good job of helping people find new plant-based frozen items such as plant-based products, including meat substitutes, and dairy-free desserts. The ongoing focus on health, and wellness that continues to reflect consumer choices will no doubt positively affect the frozen food market which is going to change through the introduction of more nutritious and wholefood products.

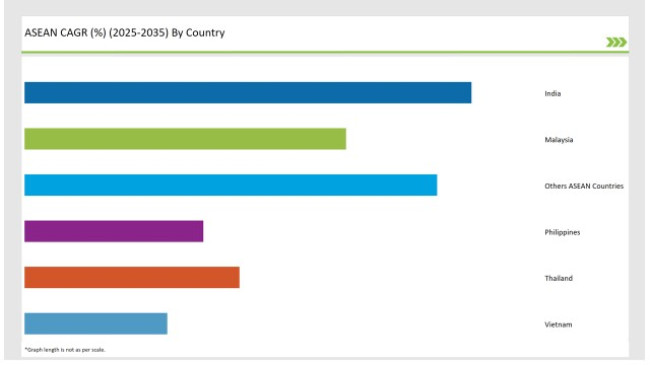

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India's frozen food industry is rising quickly under the impact of the transformation of the lifestyle of the consumer and the phenomenon of urbanization. When an increasing number of individuals shift to urban places and follow hectic daily schedules, the need for simple-to-prepare, instant meals stands sky-high.

Frozen foods are an efficient alternative for consumers because they get both quick and simple meal planning, as well as high quality and nutrition without any compromise. The measures taken by the Indian government to inspire food processing and the development of cold chain facilities have also played a part in the growth of the frozen food market.

Better logistics and distribution channels have facilitated manufacturers in supplying goods to consumers all over the country and as well to rural areas. Furthermore, the rise in the number of frozen food goods in supermarkets and hypermarkets has made it much easier for customers to find these products.

The Thai frozen food sector is also registering notable expansion, as a result of prioritizing both quality and convenience. With the people being more health-conscious and the people looking for easy meal options, the utilization of frozen food has been simply going up. Frozen seafood and meat products are especially common and, of course, they are a must to prepare many Thai dishes.

The government of Thailand has undertaken several initiatives to support the food manufacturing sector, including funding for cold chain logistics and infrastructure. This has consequently enhanced the distribution of frozen food which is now more available to the customers in different parts of the country. The rise of modern trade channels, such as supermarkets and hypermarkets, has also been a great factor that has helped the distribution of frozen food products.

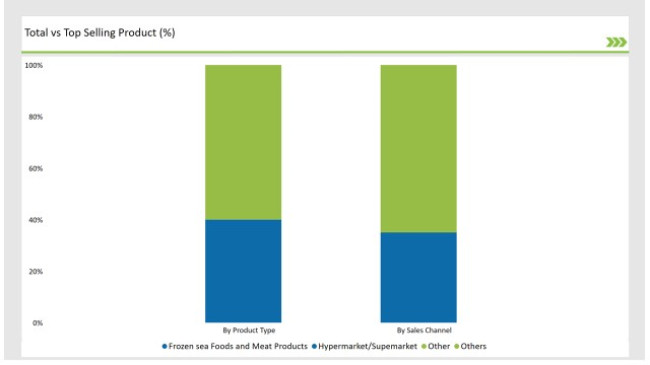

In the segment of the ASEAN frozen food market, frozen seafood and meat products constitute the largest part with a market share of 40% in 2025, thus being the leading segment. The basis of this segment growth is an the ever-rising demand of high-quality protein sources, as well as the significant use of seafood in different foods throughout the region.

Among frozen seafood products, shrimp, fish, and squid, are highly-valued mainly because these are easy to cook and can be used in a wide range of dishes. The segment of frozen seafood and meat continues to develop along with the innovations in freezing technology that are effective in keeping these products fresh and maintaining their nutrition

The hypermarket and supermarket segment is a crucial sales channel in the ASEAN frozen food market, accounting for 35% of the market share in 2025. This channel plays a significant role in the distribution of frozen food products, providing consumers with easy access to a wide variety of options under one roof. The growth of modern retail formats, such as hypermarkets and supermarkets, has transformed the shopping experience for consumers, making it more convenient to purchase frozen foods.

Hypermarkets and supermarkets provide not only an enormous amount of frozen food products but also a variety of them to choose from which includes frozen vegetables, ready-to-eat meals, and frozen desserts. The presence of multiple brands and product options allows consumers to compare prices and make informed purchasing decisions. Besides, these retail formats often exhibit promotional offers and discounts that can affect consumers buying decisions.

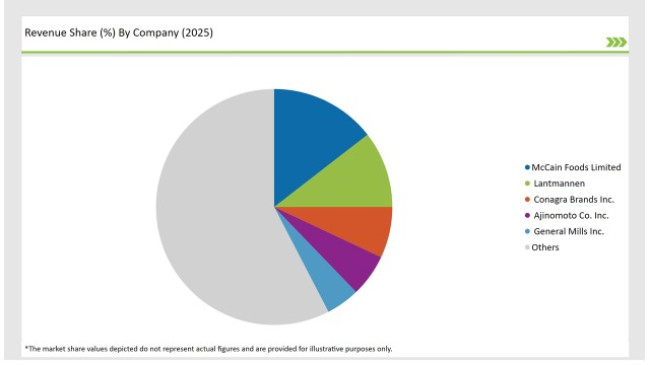

2025 Market Share of ASEAN Frozen Food Manufacturers

Note: The above chart is indicative

The ASEAN frozen food market is extremely competitive, as it is filled with varied participants race to gain the market share. The main manufacturers include long-lasting labels, new businesses, and private labels that all provide a range of frozen foods that meet the needs of different consumers. The market competition is shaped by many factors like the quality of the product, cost, distributional paths, and promotional tactics.

As per Product Type, the industry has been categorized into Frozen Ready Meals, Frozen Seafood & Meat Products, Frozen Snacks & Bakery Products, Frozen Fruits & Vegetables, Others

As Sales Channel, the industry has been categorized into Supermarkets/Hypermarkets, Convenience Stores & Independent Retailers, Online Retail, Food Service/HoReCa, Others

As a Freezing Technique, the industry has been categorized into Individual Quick Freezing (IQF), Belt Freezing, Blast Freezing, Plate Freezing, Cryogenic Freezing

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Frozen Food market is projected to grow at a CAGR of 8.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 27,421.2 million.

India are key Country with high consumption rates in the ASEAN Frozen Food market.

Leading manufacturers include FrieslandCampina, Fonterra Co-operative Group, Lactalis Ingredients, Thai Dairy Industry Co., Ltd., and NutriAsiaare the key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights in the Frozen Food Industry

Market Share Breakdown of Frozen Food Packaging Manufacturers

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Superfood Powder Market Report - Growth, Demand & Forecast 2025 to 2035

UK Frozen Food Market Growth – Size, Share & Forecast 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

USA Frozen Food Market Analysis – Demand, Trends & Forecast 2025–2035

ASEAN Allergen Free Food Market Outlook – Size, Share & Innovations 2025–2035

Europe Frozen Food Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

ASEAN Plant-Based Pet Food Market Insights – Demand, Size & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA