The Latin America frozen food market is set to grow from an estimated USD 25,737.3 million in 2025 to USD 47,770.9 million by 2035, with a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 25,737.3 million |

| Projected Latin America Value (2035F) | USD 47,770.9 million |

| Value-based CAGR (2025 to 2035) | 6.4% |

The frozen food market in Latin American countries is continuing to grow steadily, as more urban people accept and adopt the consumption of frozen products. The rise of large retail stores like Carrefour, Walmart, and Cencosud has been the most significant reason for the increase of frozen food accessibility to middle-income people in Latin America.

In addition, the coming up of e-commerce platforms, which are also favored by consumer shopping behaviors after COVID-19, has increased the predicate for very quick and out-of-the-shelf meal solutions all over the region, although the purchases of frozen food have become more convenient. By 2025, the frozen food segment is projected to rise to USD 25,737.3 million and a study based on 10-year observation predicts it will grow at an annual rate of 6.4%.

The increase of dual-income households all over Latin America has resulted in busier day-to-day routines and insufficient time for cooking. The results of this process, in addition to the ready-to-cook options that make the day of the consumer shorter, are the rapidly growing demand for frozen dishes.

Argentina and Chile occupy the chief position in the trade of frozen fruits, vegetables, and seafood in the Latin American region. The frozen export market, meanwhile, has spurred the building of better technology and more precise cold supply chain systems organically, which have improved the production, storage, and distribution processes that result in not only higher quality goods for international markets but also for local consumers.

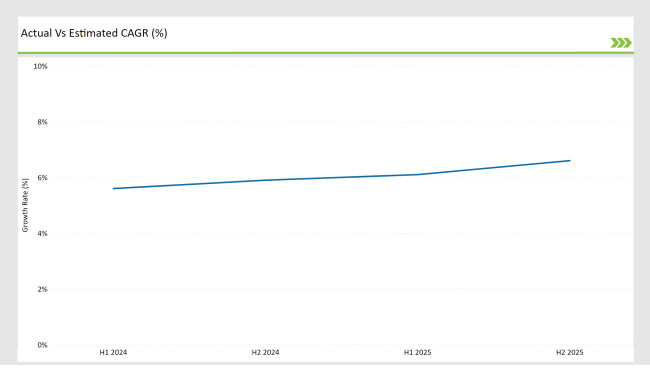

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America frozen food market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America frozen food market, the sector is predicted to grow at a CAGR of 5.6% during the first half of 2024, with an increase to 5.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 6.1% in H1 and is expected to rise to 6.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Rising Popularity of Quick Freezing Technique

The increasing interest in the new refrigeration methods that make products colder, such as Blast Freezing and Individual Quick Freezing (IQF), are rocking the Latin American frozen food market. The technique Blast Freezing involves the rapid freezing of food at very high sub-zero temperatures, thereby, ensuring the texture, taste and nutritional benefits of the foodstuff remain intact.

For instance, this method is the most reliable one for freezing ready-to-eat meals that can serve consumers with high quality yet simple meal options. On the other side, IQF is being paid attention to as a method that can freeze fruits, vegetables, and seafood separately in a way that they do not stick together. This is synonymous with ensuring the quality of fresh and unprocessed raw material, which to a greater extent encourages those who deal with healthy food to choose them.

Both of these methods improve the quality of final products and fulfil the requirements of increasingly picky clients. Furthermore, these methods are opposed to preservatives, since they do not require their use which in turn, helps to prevent diseases and at the same time, the finished products stay fresher for a longer time. All of these aspects have triggered the demand across both retail and food service sectors.

Expansion of Retail Channels Driving Frozen Food Accessibility and Variety

The new retail channels of Latin America markets have been the real engine of the frozen food industry by the way of product accessibility and product variety. Hypermarkets and supermarkets make the top of the list, setting the trend with a full range of frozen food products such as ready meals, meat, seafood, and vegetables, which are designed to meet the increased demand from urban customers.

The improvement in the cold chain and logistics management brought benefits in many ways such as product quality, penetration into small cities and towns, etc. that have frozen road adoption in a wave. The corner shops have equally been excellent players selling open pack sizes and fast-purchase options that target busy shoppers and those who are on-the-go. What is more, the frozen bakery, and gourmet sauces premium product lines are being stocked by specialty shops that have successfully worn the green badge by shaking hands with health-oriented consumers.

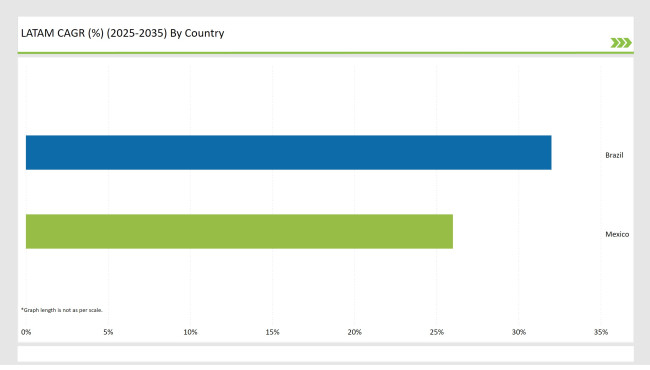

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Brazilian scenario manifests an increasing trend of attachment to worldwide food consumption styles leading to the drive for a cultural transition of eating processed and frozen food items. Available products such as frozen pizzas, meat, and desserts are becoming popular items in the households since they provide convenience and taste that blends with the local preferences.

Adjusting to the situation companies decided to introduce regionally inspired frozen foods such as feijoada or pão de queijo, thus linking them to the traditional Brazilian way of living. This was, of course, sharply aided by the number of coupled households bringing 2 salaries to the line and the urban lifestyle that so many people adore. The eating of frozen food products has gained preference because they are quick to prepare and at the same time are traditional foods that the consumers are used to.

Mexico's organized retail segment has become a powerful conduit in the promotion of frozen foods. Such harvesting fruits as Walmart de México and Soriana - are near the top of the list in terms of proactive expanding of frozen foods, introducing an impressive range of different kinds of frozen products, including both popular Mexican foods like (but certainly not limited to) tamales, sopes, and enchiladas, as well as frozen vegetables and seafood.

A wide variety of foods on the shelves caters to both urban and semi-urban consumers and makes previously hardly accessible places much more reachable. Cold chain storage has never been better with the new retail formats, so product quality and freshness are guaranteed. Addressing the demand for easier and varied shopping options, the retailers have made frozen food a dietary staple through improved product assortment.

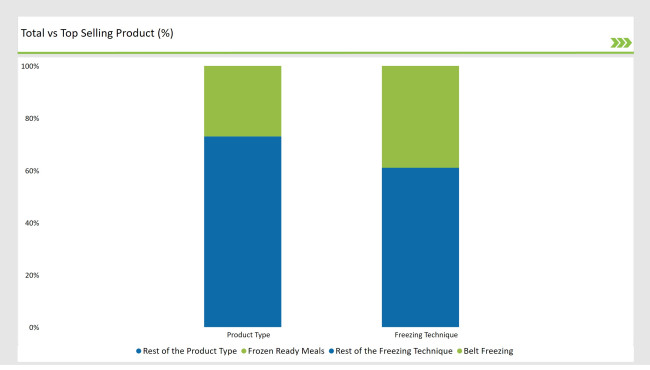

% share of Individual categories by Product Type and Applications in 2025

The Belt Freezing method is becoming preferred among the bulk processing businesses due to its high efficiency and uniform freezing of existing delicate products. It basically provides continuous freezing for large-scale operations that require processing large volumes of items such as frozen fish and seafood products promptly and conveniently.

The positive air circulation provided in the Belt Freezing process helps to guarantee everything is frozen evenly which is a crucial aspect if one has to eat the shrimp and cod fillets like before, in the summer, relaxed and spoiled. Such a combination of outstanding performance and precision control of freezing temperatures makes the machine applicable in both retail and food service industries.

Retail giants and manufacturers in Latin America are taking the lead in the frozen ready meal market via regional culinary preferences and additional products tailored to local tastes. For instance, Brazil's GrupoPão de Açúcar and Mexico's Soriana have both made available their exclusive frozen ready meal lines dubbed as traditional dishes like feijoada, tamales, and empanadas.

Such ready-to-eat meals made for the families and individuals who love to eat but have less time to cook at home are actually the main dish with spicy sauce, and shrimps together with creamy sauce, and chicken with fried rice. The option of family-sized meals is the main reason it is good for parties, thanks or Christmas gatherings.

Aside from that, the frozen ready meals are also pitched as "authentic" meals because the recipes are designed based on spices or other ingredients that are mostly used by the local people. One illustration is frozen tamales in Mexico that are prepared very quickly, aside from that they remain with the traditional flavor, but empanadas in Argentina and feijoada in Brazil are national dishes that make the people think of the countries' gastronomy. The avail of these new innovations in the market is to serve full meals that are somewhat different from traditional ones and only take the customer a shorter time to prepare.

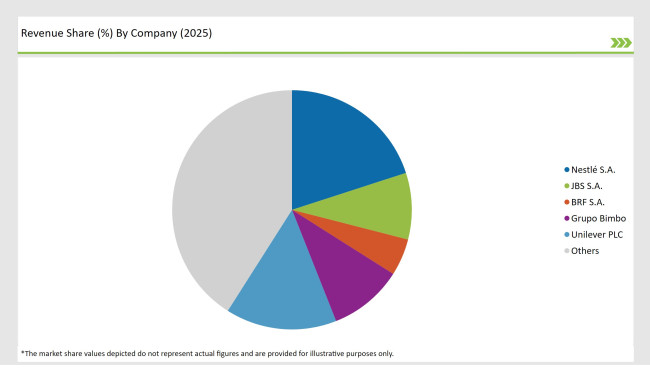

2025 Market share of Latin America Frozen Food Manufacturers

Note: above chart is indicative in nature

In Latin America, the controlled approach within the frozen ready-to-eat meal market has been the main cultivation factor pushed by retailers and manufacturers with respect to local gastronomy and the extension of regional product ranges. The companies that focus on the meal sector responsible for expanding the freezer section are the GrupoPão and Soriana in Brazil and Mexico respectively.

These frozen ready meals are planned for families who have no time for the kitchen and for people who care for the original taste of home-cooked dish without any sacrifices. Family pack sizes for parties, holidays, etc. have made the products even more appealing. To reach this aim the manufacturers are making as much use of the local food products as possible.

For instance, frozen tamales are the time-savers for Mexicans in terms of preparation, on the other hand, empanadas in Argentina and feijoada in Brazil are the symbols of local dishes. Frozen ready meals have been through programming and fixing embedded consumers' time issues while keeping it real with the meal quality and authenticity that consumers usually demand.

As per Freezing Technique, the industry has been categorized into Blast Freezing, Belt Freezing, and Individual Quick Freezing.

As per Product Type, the industry has been categorized into Frozen Ready Meals, Frozen Fish and Seafood, Frozen Meat Products (Poultry, Pork, Beef), Frozen Dairy Products, Frozen Fruits and Vegetables, Frozen Bakery Products, and Frozen Soups and Sauces.

As per Sales Channel, the industry has been categorized into Food Service Industry and Retail/Household (Hypermarket/Supermarket, Convenience Store, Departmental Stores, Wholesale Stores, Mass Grocery Stores, Independent Retailers, and Specialty Stores).

Industry analysis has been carried out in key countries of Brazil, Mexico, and Rest of Latin America.

The Latin America frozen food market is projected to grow at a CAGR of 6.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 47,770.9 million.

The market is driven by the rising demand for frozen foods, offering convenient, ready-to-cook options that save time while meeting modern consumer needs.

Mexico and Brazil are key regions with high consumption rates in the Latin America frozen food market.

Leading manufacturers include Nestlé S.A., JBS S.A., BRF S.A., Grupo Bimbo, and Unilever PLC.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA