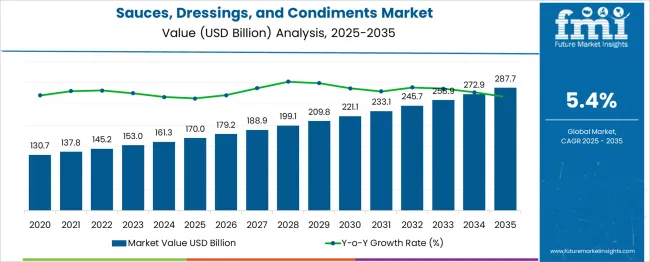

The Sauces, Dressings, And Condiments Market is estimated to be valued at USD 170.0 billion in 2025 and is projected to reach USD 287.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. During the early adoption phase (2020–2024), the market expands from USD 130.7 billion to USD 161.3 billion as innovative product formats, artisanal offerings, and functional ingredients are introduced.

Manufacturers experiment with advanced production technologies, including Hydraulic and Electric Hydraulic processing systems for consistency, efficiency, and small-batch production, while EPS (electric processing systems) begins pilot adoption in smart manufacturing setups. In the scaling phase (2025–2030), growth accelerates from USD 170.0 billion to USD 221.1 billion, supported by increasing consumer acceptance, expanded retail penetration, and optimized supply chains.

Hydraulic and Electric Hydraulic systems reach mainstream implementation, enhancing throughput and quality control, while EPS adoption expands in automated, energy-efficient processing lines. During the consolidation phase (2030 to 2035), the market grows from USD 233.1 billion to USD 287.7 billion, with competition intensifying and major players consolidating distribution and production capabilities. Technology lifecycle mapping positions Hydraulic as mature, Electric Hydraulic moving from scaling to maturity, and EPS emerging in scaling and maturing during consolidation, reflecting a classic S-curve of innovation, adoption, and stabilization.

| Metric | Value |

|---|---|

| Sauces, Dressings, And Condiments Market Estimated Value in (2025 E) | USD 170.0 billion |

| Sauces, Dressings, And Condiments Market Forecast Value in (2035 F) | USD 287.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

Growing awareness of diverse flavor profiles and the willingness to experiment with new cuisines are contributing to higher consumption across households and foodservice establishments.

Manufacturers are responding with product innovations, cleaner ingredient labels, and tailored offerings for regional tastes, which are enhancing brand loyalty and market penetration. Future opportunities are being shaped by rising disposable incomes, the expansion of organized retail, and the premiumization of products.

A shift toward sustainable packaging and an emphasis on supply chain efficiency are also paving the way for greater competitiveness and long-term growth in the market.

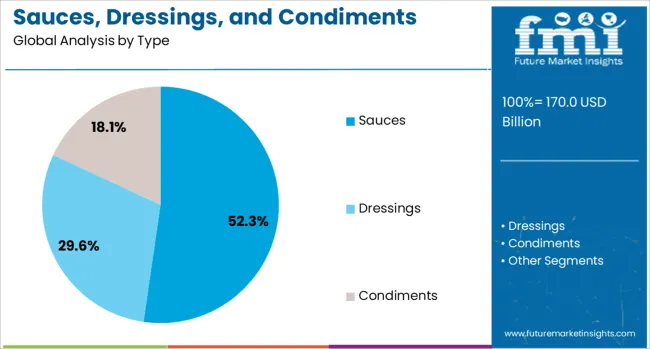

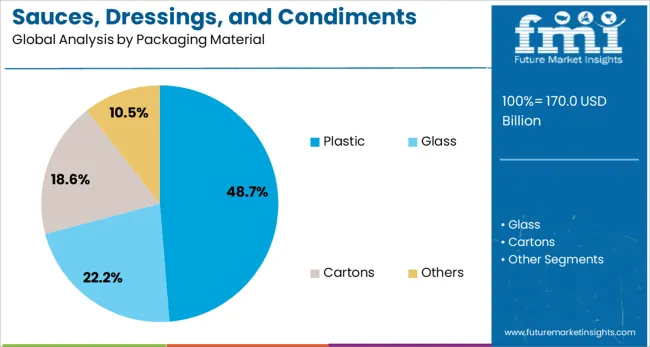

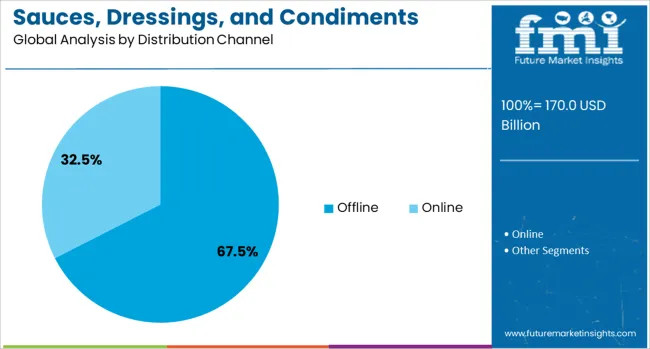

The sauces, dressings, and condiments market is segmented by type, packaging material, distribution channel, and geographic regions. By type, the sauces, dressings, and condiments market is divided into Sauces, Dressings, and Condiments. In terms of packaging material, the sauces, dressings, and condiments market is classified into Plastic, Glass, Cartons, and Others. Based on the distribution channel of the sauces, dressings, and condiments market, it is segmented into Offline and Online. Regionally, the sauces, dressings, and condiments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, sauces are expected to account for 52.3% of the total market revenue in 2025, making it the leading type segment. This position has been reinforced by their versatility across various cuisines and meal occasions, which has elevated their role from a simple complement to a central component of dining experiences.

The convenience of ready-to-use sauces, combined with their ability to enhance both taste and presentation, has strengthened demand in both retail and foodservice channels. Continuous flavor innovation and targeted marketing campaigns have encouraged consumers to incorporate sauces into everyday meals, expanding usage occasions.

Furthermore, their adaptability to healthier formulations and premium variants has attracted a broader consumer base, sustaining the segment’s dominance.

Segmented by packaging material, plastic is projected to hold 48.7% of the market revenue in 2025, maintaining its leadership in the category. This prominence is attributed to plastic’s lightweight, cost-effective, and highly customizable properties, which have made it the preferred choice for both manufacturers and retailers.

Its durability and ability to preserve product freshness have supported its widespread use across diverse distribution environments. Additionally, advancements in recyclable and biodegradable plastics have allowed producers to align with sustainability initiatives without compromising functionality.

The ease of molding plastic into various shapes and sizes suitable for single-serve, family-size, and bulk packaging formats has further reinforced its position as the dominant material in the segment.

When segmented by distribution channel, offline sales are anticipated to capture 67.5% of the market revenue in 2025, establishing it as the leading channel. This leadership is driven by the entrenched shopping habits of consumers who prefer to experience products physically before purchase, particularly in categories involving taste and freshness.

Supermarkets, hypermarkets, and specialty stores have remained effective platforms for product discovery and brand engagement, offering consumers a broad assortment and promotional incentives. The trust and immediacy associated with offline purchases have sustained high foot traffic despite the rise of e-commerce.

Retailers’ focus on attractive in-store displays, sampling activities, and loyalty programs has further enhanced the appeal of the offline channel, cementing its dominant share in the market.

The sauces, dressings, and condiments market is experiencing steady growth as consumers increasingly seek flavorful, convenient, and healthier options. Rising interest in international cuisines, clean-label ingredients, and functional benefits is driving product innovation. Retailers and foodservice providers are expanding their offerings to include organic, low-sodium, and sugar-free varieties. North America and Europe dominate due to high consumer awareness and established retail channels, while Asia-Pacific shows rapid growth driven by rising disposable incomes and urban lifestyle shifts. Manufacturers are focusing on diversified packaging, ready-to-use solutions, and shelf-stable formulations to improve accessibility and convenience. Growing e-commerce channels and home meal preparation trends further support market expansion. Investment in product differentiation, such as unique flavors and ingredient transparency, helps brands attract health-conscious and premium-seeking consumers.

Consumer interest in flavorful, convenient, and healthy condiments is shaping product development. There is increasing demand for organic, low-sodium, low-sugar, and preservative-free options. Ethnic flavors, regional specialties, and fusion blends are gaining popularity among millennials and Gen Z, prompting manufacturers to expand their flavor portfolios. Health-conscious consumers also seek functional benefits, such as digestive or antioxidant properties, incorporated into sauces and dressings. Retailers are responding with smaller, single-serve packaging, multipacks, and easy-to-use containers for on-the-go consumption. Foodservice operators are adding premium and signature sauces to elevate menu offerings. Transparent labeling, clear ingredient lists, and allergen-free options influence purchasing decisions. Brands that adapt to evolving taste preferences and lifestyle trends can capture larger market share and foster stronger consumer loyalty.

Manufacturers are improving processing, preservation, and packaging methods to maintain product quality, freshness, and safety. Advanced thermal processing, high-pressure techniques, and vacuum packaging extend shelf life without compromising taste or nutritional value. Flavor encapsulation and emulsification methods enhance consistency and texture, while automated bottling and labeling systems ensure hygiene and reduce contamination risks. Quality control measures, including microbiological testing and ingredient traceability, are increasingly critical for regulatory compliance and consumer trust. Food-grade packaging solutions help preserve flavor and prevent spoilage, supporting global distribution. Companies investing in these production enhancements can offer differentiated products with consistent taste and safety standards, appealing to premium and health-conscious segments. Efficient production and supply chain management also help reduce waste, maintain margins, and meet growing retail and foodservice demands.

North America and Europe remain dominant due to high retail penetration, diverse consumer tastes, and premium product adoption. Asia-Pacific is rapidly expanding, driven by urbanization, rising disposable incomes, and exposure to Western cuisines. Latin America and the Middle East are experiencing moderate growth as international and local flavors gain popularity. Regional culinary traditions shape flavor profiles and product preferences, influencing marketing and distribution strategies. Local sourcing of ingredients, climate-specific formulations, and packaging adaptations are critical for regional success. Retail chains and online channels are tailoring promotions to suit local tastes and purchasing behaviors. Companies expanding regionally are focusing on partnerships with local distributors, foodservice operators, and e-commerce platforms to enhance reach and brand visibility. Regional understanding allows for effective product customization and competitive positioning in global markets.

Efficient sourcing, processing, and distribution networks are essential for timely product delivery in the sauces and condiments market. Ingredient sourcing depends on crop availability, seasonality, and quality standards. Manufacturers are adopting supplier partnerships, contract farming, and multi-regional sourcing to ensure a consistent supply. Cold chain management, logistics planning, and inventory tracking reduce spoilage and maintain product integrity. Distribution to retail, foodservice, and online channels requires careful coordination to meet demand fluctuations. Reverse logistics for returns or expired stock management ensures operational efficiency. Brands investing in end-to-end supply chain monitoring, demand forecasting, and warehouse automation achieve better delivery performance and cost optimization. A robust supply chain also enables expansion into new regions, supports premium product launches, and strengthens relationships with distributors and retailers, driving overall market growth.

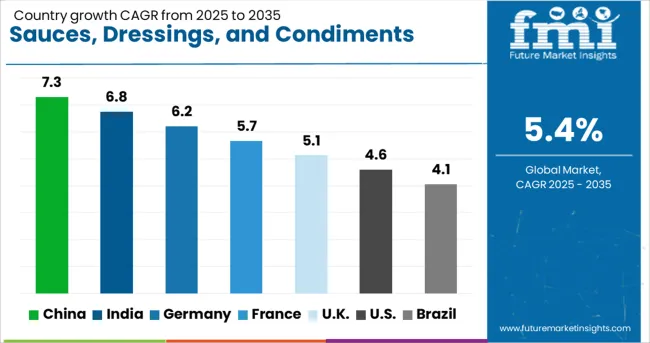

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The sauces, dressings, and condiments market is projected to grow at a CAGR of 5.4%, reflecting rising consumer demand for diverse and convenient flavor options. China leads with 7.3% growth, fueled by increasing urban consumption and expanding retail channels. India follows at 6.8%, supported by a growing middle-class population and greater interest in packaged food products. Germany records 6.2% growth, driven by strong food processing industries and consumer preference for ready-to-use condiments. The UK shows 5.1% growth, reflecting steady demand for packaged sauces in retail and foodservice sectors. The USA demonstrates 4.6% growth, supported by innovations in flavors and convenience-focused product offerings. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the sauces, dressings, and condiments market at 7.3% growth. Urbanization and rising disposable income drive demand for convenient, ready-to-eat meals. Compared to India, China benefits from a large-scale food processing industry and modern retail networks. Consumers increasingly prefer international and fusion flavors, creating opportunities for product innovation. Supermarkets, hypermarkets, and e-commerce platforms improve product accessibility nationwide. Strict food safety regulations ensure high-quality and compliant products. Growth in the quick-service restaurant sector also boosts consumption. Investments in cold chain infrastructure extend shelf life and maintain product freshness. Overall, China combines industrial scale, retail modernization, and culinary trends to lead the market in sauces, dressings, and condiments.

India’s market grows at 6.8%, driven by changing food habits and urban lifestyles. Compared to Germany, India focuses on affordable yet flavorful products for price-conscious consumers. Expansion of modern retail stores and e-commerce channels improves distribution. Rising popularity of international cuisines and packaged foods fuels demand. Food safety and labeling regulations encourage high-quality manufacturing standards. Investments in processing technologies and cold chain systems improve shelf life. Marketing campaigns and introduction of regional flavors strengthen brand recognition. Growth of quick-service restaurants and convenience-focused consumers further supports market expansion. Overall, India leverages affordability, flavor diversity, and retail penetration to sustain sauces, dressings, and condiments market growth.

Germany records 6.2% growth, emphasizing high-quality and organic products. Compared to the United Kingdom, Germany prioritizes clean labeling and sustainable ingredient sourcing. Consumers demand premium, healthy, and functional products, especially in sauces and condiments. Supermarkets and online stores provide wide product accessibility. Culinary experimentation and international food trends increase market consumption. Manufacturers focus on flavor innovation, premium packaging, and sustainability practices. Export opportunities within Europe support revenue growth. Compliance with strict food safety standards strengthens consumer trust. Overall, Germany combines quality focus, innovation, and sustainability to maintain resilience in the sauces, dressings, and condiments market.

The United Kingdom market grows at 5.1%, supported by convenience and health trends. Compared to the United States, the UK emphasizes natural ingredients and clean-label products. Supermarkets, convenience stores, and online channels increase product accessibility. Consumers seek low-fat, organic, and premium sauces and condiments. Marketing campaigns highlighting regional flavors and health benefits drive purchases. Growth in takeaway, home cooking, and food delivery fuels market expansion. Cold chain infrastructure ensures product freshness and longevity. Overall, the UK blends convenience, health-conscious products, and retail modernization to grow the sauces, dressings, and condiments market.

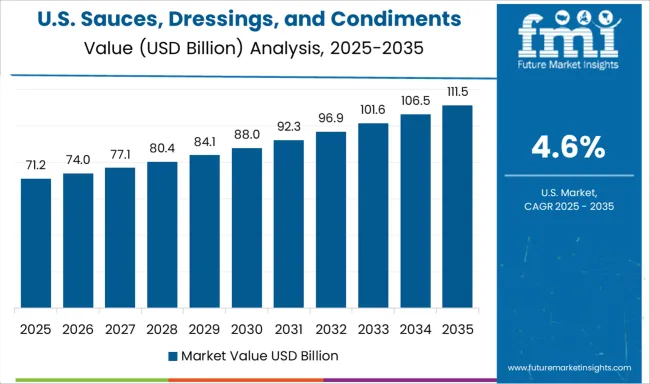

The United States advances at 4.6%, driven by processed and ready-to-eat meals. Compared to China, the US emphasizes flavor innovation, health-conscious options, and convenient packaging. Expansion of supermarkets, e-commerce platforms, and food delivery services enhances product reach. Consumers increasingly prefer organic, low-sodium, and non-GMO options. Marketing campaigns targeting health-focused lifestyles improve brand loyalty. Cold chain and packaging innovations extend shelf life and maintain quality. Overall, the United States combines flavor variety, health-oriented products, and modern retail channels to sustain sauces, dressings, and condiments market growth.

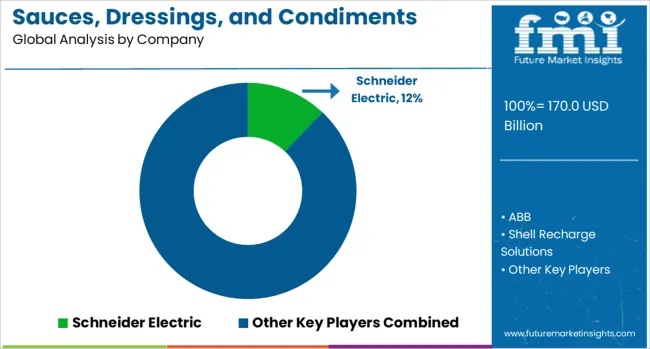

The global sauces, dressings, and condiments market is highly competitive and fragmented, driven by consumer demand for diverse flavors, convenience, and health-oriented products. Prominent multinational food companies dominate the market, leveraging strong brand recognition, extensive distribution networks, and product innovation. Nestlé S.A. and Unilever PLC are major players, offering a wide range of sauces, mayonnaise, and dressings under globally recognized brands.

Kraft Heinz Company is another leader, renowned for its ketchup, mustard, and condiments portfolio with significant presence in retail and foodservice channels. ConAgra Brands, Inc. and McCormick & Company, Inc. focus on flavor innovation and premium offerings, particularly in spices, seasonings, and specialty sauces. Ajinomoto Co., Inc. and General Mills, Inc. cater to regional tastes and ethnic cuisine trends, expanding their product lines in response to evolving consumer preferences.

Smaller regional and private-label brands also play a crucial role, especially in emerging markets where local tastes dominate. The competitive dynamics of this market are shaped by product differentiation, packaging innovation, and health-conscious formulations such as low-sodium, organic, and preservative-free options. Strategic mergers, acquisitions, and partnerships further strengthen market positions, enabling key players to expand geographic reach and portfolio diversity while responding to rising demand for convenient and globally inspired condiments.

In August 2025, Jeremy Clarkson launched a 100% British tomato ketchup at his pub, The Farmer’s Dog, and Diddly Squat Farm Shop. Made with Isle of Wight tomatoes, Hampshire apple cider vinegar, and other local ingredients by Condimaniac, the £7.95 ketchup sold out quickly, highlighting demand for local products.

| Item | Value |

|---|---|

| Quantitative Units | USD 170.0 Billion |

| Type | Sauces, Dressings, and Condiments |

| Packaging Material | Plastic, Glass, Cartons, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Shell Recharge Solutions, Robert Bosch GmbH, Siemens, KEM Power Oyj, Tesla, ChargePoint, BP Pulse, and Blink Charging Co. |

| Additional Attributes | Dollar sales in the Sauces, Dressings, and Condiments Market vary by product type including sauces, dressings, and condiments, form such as liquid, paste, and powder, application across home cooking, foodservice, and packaged foods, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for convenient foods, flavor innovation, and expanding retail channels. |

The global sauces, dressings, and condiments market is estimated to be valued at USD 170.0 billion in 2025.

The market size for the sauces, dressings, and condiments market is projected to reach USD 287.7 billion by 2035.

The sauces, dressings, and condiments market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in sauces, dressings, and condiments market are sauces, _tomato-based, _soy-based, _chili-based, _cream-based, _others, dressings, _mayonnaise and creamy dressings, _yogurt-based dressings, _oil-based dressings, _others, condiments, _relishes, _pickles and _others.

In terms of packaging material, plastic segment to command 48.7% share in the sauces, dressings, and condiments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

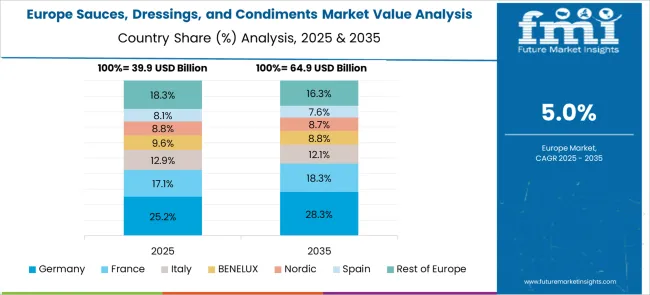

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Sauces and Condiments Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA