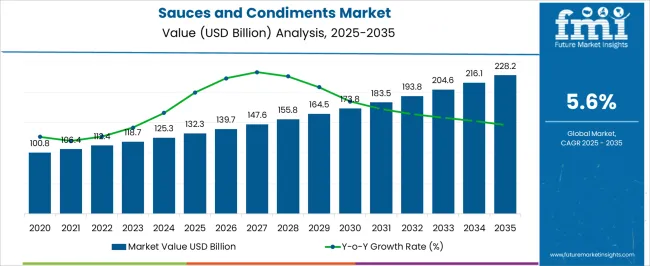

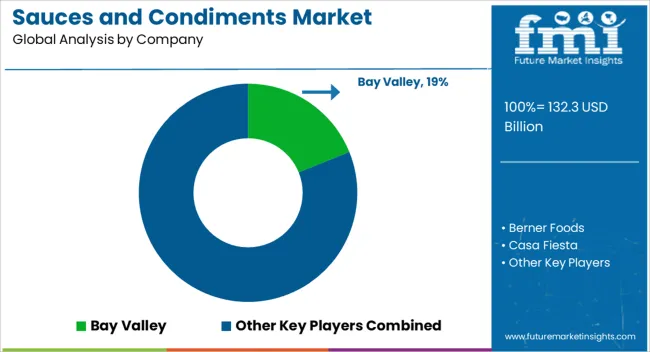

The sauces and condiments market is estimated to be valued at USD 132.3 billion in 2025 and is projected to reach USD 228.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The absolute dollar opportunity in this market is significant, driven by increasing consumer preference for flavor-enhancing products, ready-to-eat meals, and convenience-oriented food solutions. Growth is anticipated across both developed and emerging markets, where rising disposable incomes, evolving culinary tastes, and exposure to international cuisines are fueling demand. Retail expansion, including supermarkets, hypermarkets, and online grocery platforms, is increasing accessibility, while the foodservice sector, from quick-service restaurants to gourmet dining, continues to drive adoption. Product innovation, including low-sodium, organic, and plant-based formulations, is attracting health-conscious consumers and enabling premiumization.

Regional cuisines are encouraging localized product development, with spicy, tangy, and fermented sauces gaining popularity in Asia, Europe, and North America. Private-label offerings by large retailers are expanding market penetration, while global trade and export initiatives are creating cross-border growth opportunities. The integration of sauces and condiments into packaged foods, meal kits, and culinary applications is further boosting volume consumption. Manufacturers are expected to benefit from increased production efficiency, improved supply chain management, and targeted marketing campaigns that align with evolving taste preferences, ensuring the sauces and condiments market remains a lucrative segment within the global food industry.

| Metric | Value |

|---|---|

| Sauces and Condiments Market Estimated Value in (2025 E) | USD 132.3 billion |

| Sauces and Condiments Market Forecast Value in (2035 F) | USD 228.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The sauces and condiments market is shaped by five interrelated parent markets that collectively define its growth trajectory, product adoption, and consumer demand. The retail food and grocery market holds the largest share at 40%, driven by supermarkets, hypermarkets, and online platforms that offer a wide variety of sauces, dressings, and condiments to urban and suburban consumers seeking convenience and flavor enhancement. The packaged and processed foods market contributes 25%, as sauces and condiments are increasingly integrated into ready-to-eat meals, frozen foods, and meal kits, providing consistency, taste, and convenience for households and foodservice providers.

The foodservice and hospitality sector accounts for 20%, with restaurants, quick-service outlets, and catering services driving demand for bulk and premium condiments to diversify menus and enhance culinary experiences. The emerging health and wellness market, with a 10% share, encourages low-sodium, organic, and plant-based condiment variants that cater to health-conscious consumers seeking functional and nutritious options. Finally, the international trade and export market represents 5%, as sauces and condiments see rising cross-border demand, with manufacturers expanding distribution to new geographies. Collectively, retail, packaged foods, and foodservice contribute 85% of demand, highlighting that accessibility, convenience, and culinary versatility remain the primary growth drivers shaping the sauces and condiments market globally.

The sauces and condiments market is experiencing strong demand driven by evolving consumer tastes, increased interest in global cuisines, and the growing influence of convenience-based food solutions. Rising urbanization, busy lifestyles, and the expansion of the foodservice sector are prompting greater consumption of ready-to-use sauces and condiments across both household and commercial applications.

Innovation in flavor profiles, clean-label formulations, and healthier ingredient alternatives is further enhancing market penetration. The shift toward premium, artisanal, and region-specific offerings is also expanding the customer base across different demographics.

Additionally, the growth of online grocery channels and wider retail distribution networks is ensuring easier accessibility for consumers. The market outlook remains positive as manufacturers continue to align product development with health, flavor, and convenience trends while adapting to sustainability initiatives in packaging and sourcing.

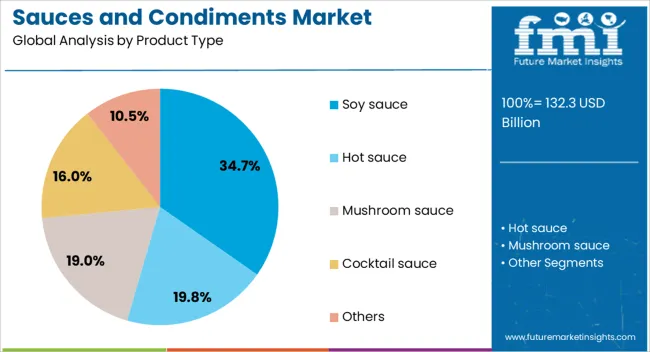

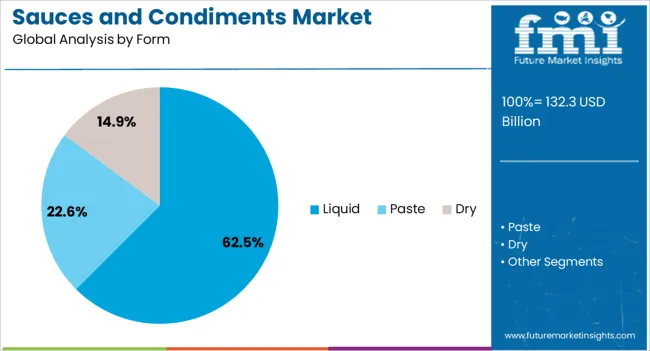

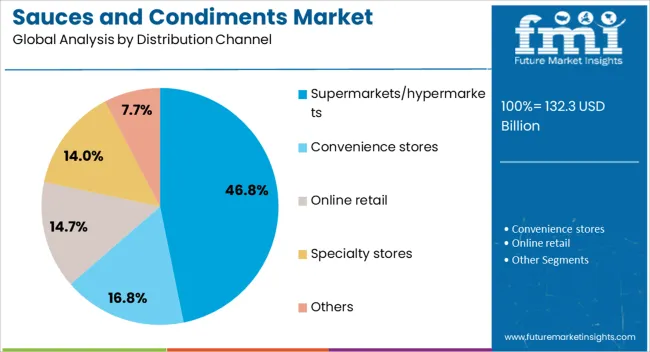

The sauces and condiments market is segmented by product type, form, distribution channel, and geographic regions. By product type, sauces and condiments market is divided into soy sauce, hot sauce, mushroom sauce, cocktail sauce, and others. In terms of form, sauces and condiments market is classified into liquid, paste, and dry. Based on distribution channel, sauces and condiments market is segmented into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and others. Regionally, the sauces and condiments industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy sauce segment is expected to hold 34.70% of total market revenue by 2025, making it the leading product type. This dominance is driven by its versatile use across multiple cuisines, strong consumer preference for umami-rich flavors, and its role as a staple in both home cooking and foodservice.

Rising popularity of Asian cuisine globally has further boosted consumption.

Additionally, innovation in low-sodium and organic variants is broadening its appeal to health-conscious consumers, reinforcing its position as the top segment in the product type category.

The liquid form segment is projected to account for 62.50% of total revenue by 2025 within the form category. This is supported by its ease of use, consistent flavor delivery, and suitability for direct application or cooking purposes.

Liquid sauces and condiments offer convenience and immediate flavor enhancement, aligning with the fast-paced cooking habits of modern households.

Their dominance is also attributed to extensive product variety and availability across both mass-market and premium ranges, ensuring wide consumer adoption.

The supermarkets and hypermarkets segment is expected to contribute 46.80% of total market revenue by 2025, making it the most prominent distribution channel. The segment benefits from high product visibility, extensive brand assortment, and the ability for consumers to compare multiple options in one place.

In-store promotions, sampling activities, and bundled offers further encourage sales through this channel.

As these retail formats continue to expand globally and modernize with digital integration, their role in driving sauces and condiments sales is expected to remain dominant.

The sauces and condiments market is driven by flavor demand, retail accessibility, and foodservice adoption. Health-focused and innovative product offerings continue to expand market reach and consumer engagement.

The sauces and condiments market is experiencing strong growth due to increasing consumer demand for flavorful, ready-to-use, and convenient food products. Busy lifestyles and the desire for quick meal preparation are driving adoption across households and working professionals. Consumers are seeking diverse taste profiles, including spicy, tangy, fermented, and ethnic-inspired sauces that complement global cuisines. This trend has prompted manufacturers to expand product lines, introduce premium variants, and cater to localized tastes in various regions. Health-conscious buyers are also gravitating toward low-sodium, organic, and clean-label options. The emphasis on convenience, taste variety, and functional benefits is pushing both retail and foodservice sectors to innovate while meeting evolving consumer expectations.

Retail expansion is a key driver of sauces and condiments market growth. Supermarkets, hypermarkets, specialty stores, and online grocery platforms are increasing accessibility to a wide range of sauces, dips, dressings, and condiments. E-commerce has enabled smaller brands to reach niche consumers while established players strengthen their omnichannel presence to drive volume sales. Retail promotions, subscription models, and bundled offerings encourage trial and repeat purchases. Improved cold-chain logistics and inventory management are ensuring product quality and availability, even in remote regions. Retailers are also responding to seasonal and festival demand, offering themed or limited-edition products. Collectively, the retail and online ecosystem is expanding market penetration, attracting both price-sensitive and premium-seeking consumers.

The foodservice sector is significantly shaping the sauces and condiments market, with restaurants, catering services, and quick-service outlets incorporating a variety of sauces into their menus. Premium sauces, marinades, and ethnic condiments are being used to enhance customer experience and differentiate offerings. Chain restaurants and hospitality groups are collaborating with suppliers to ensure consistent quality, flavor, and supply for high-volume operations. Culinary professionals are experimenting with fusion flavors and signature blends to cater to evolving taste preferences. Bulk procurement for institutional kitchens and event catering is also driving demand for packaged and ready-to-use condiments. Foodservice adoption ensures wider exposure and encourages consumers to integrate these products into their daily meals at home.

Product innovation continues to drive market expansion, with manufacturers introducing low-sodium, sugar-free, organic, and plant-based condiments to meet health-conscious demand. Functional benefits, such as added probiotics, natural preservatives, and nutrient fortification, are increasingly incorporated into sauces and dressings. Packaging innovation, including portion-controlled sachets, resealable pouches, and eco-friendly containers, enhances convenience and shelf appeal. Limited-edition flavors and collaborations with celebrity chefs or food influencers create marketing buzz and attract new consumer segments. The combination of flavor variety, health-oriented formulations, and modern packaging strategies is reinforcing brand loyalty, boosting repeat purchases, and strengthening the sauces and condiments market across both retail and foodservice channels.

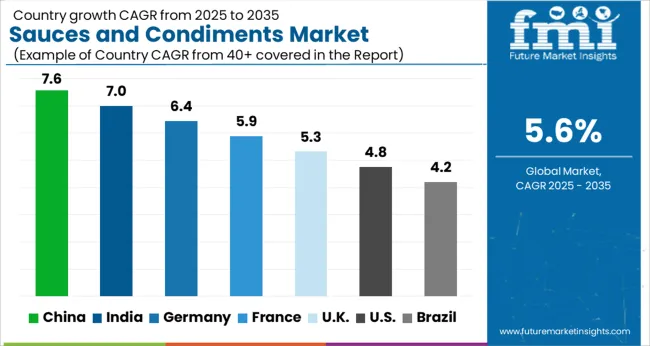

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

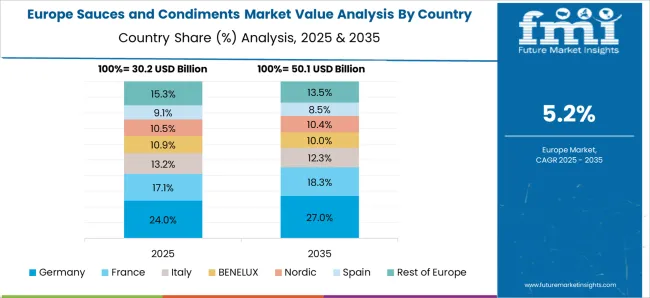

The global sauces and condiments market is projected to grow at a CAGR of 5.6% between 2025 and 2035. China and India, representing leading BRICS economies, are driving expansion through rising disposable incomes, increasing demand for ready-to-eat meals, and growing retail and e-commerce penetration. Germany, the United Kingdom, and the United States, as major OECD members, focus on premium product offerings, health-oriented formulations, and processed food integration, catering to evolving consumer tastes and culinary preferences. Growth is fueled by the popularity of international cuisines, flavor experimentation, and adoption in foodservice and hospitality sectors. Asia continues to dominate production and supply, while Europe and North America emphasize quality, convenience, and innovative product launches. The analysis spans over 40+ countries, highlighting key consumption, production, and market expansion trends.

The sauces and condiments market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by increased urbanization, rising disposable incomes, and growing demand for diverse culinary flavors. With the rapid expansion of the middle class and shifting consumer preferences towards international and fusion cuisines, sauces such as soy, chili, hoisin, and specialty dipping sauces are gaining significant traction. Retailers are increasingly offering premium and organic options to cater to health-conscious consumers, while online grocery platforms are making these products more accessible across urban and suburban areas. The growing demand for packaged food, ready-to-eat meals, and hot-pot consumption are driving growth in this segment. Domestic brands, alongside international players like Heinz and Kikkoman, are focusing on localization and flavor adaptation to meet the evolving taste preferences of Chinese consumers. In the foodservice sector, both traditional restaurants and modern QSR chains are heavily incorporating sauces and condiments into their menu offerings, enhancing flavor profiles and customer experiences.

India's sauces and condiments market is expected to expand at a CAGR of 7.0% from 2025 to 2035, driven by a growing preference for spicy and flavorful foods, rapid urbanization, and the increasing consumption of Western fast food. As India's middle class continues to grow, the demand for sauces like tomato ketchup, mustard, mayonnaise, and chili sauces is expected to rise across both retail and foodservice channels. The popularity of international cuisine, especially in metropolitan areas, is further fueling this trend, with consumers seeking a variety of ready-to-use sauces to complement their meals. Packaged and ready-to-eat meals, which are becoming increasingly popular among working professionals and millennials, are driving demand for easy-to-use condiments. E-commerce platforms and modern retail outlets are expanding the reach of these products, offering consumers an increased variety of local, regional, and international sauces.

Germany's sauces and condiments market is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by consumer demand for both traditional German sauces and a growing interest in international flavors. With a focus on flavor enhancement in both home-cooked meals and foodservice, Germany's market is dominated by mustard, ketchup, and various specialty sauces used in grilling, sausages, and sandwiches. The country is also witnessing an increase in the consumption of ethnic and exotic sauces, such as teriyaki, salsa, and Thai curry, as consumer tastes continue to evolve. Convenience is a key factor driving the market, with a rise in ready-to-use sauces, dressings, and marinades among busy households. The retail sector, including supermarkets and specialty stores, plays a central role in the distribution of these products, while online sales are also growing rapidly. The health-conscious trend is impacting the market, as consumers look for lower-fat, organic, and clean-label sauce options. The German foodservice industry, particularly in fast-casual and fast-food restaurants, is increasing its use of a variety of sauces to enhance meals.

The sauces and condiments market in the United Kingdom is expected to expand at a CAGR of 5.3% from 2025 to 2035, with a growing preference for convenience, flavor innovation, and healthier options. As the UK consumer base continues to diversify, sauces such as hot chili, BBQ, and soy-based condiments are becoming increasingly popular, alongside the established demand for classics like ketchup and mayonnaise. The demand for plant-based, low-sodium, and organic condiments is rising due to increased health consciousness and dietary preferences. Supermarkets and online grocery platforms are the primary distribution channels, offering a broad variety of premium and niche sauces. The growing influence of international cuisines, especially Indian, Middle Eastern, and Asian flavors, is also driving the popularity of specialty sauces like curry sauces, hummus, and tahini.

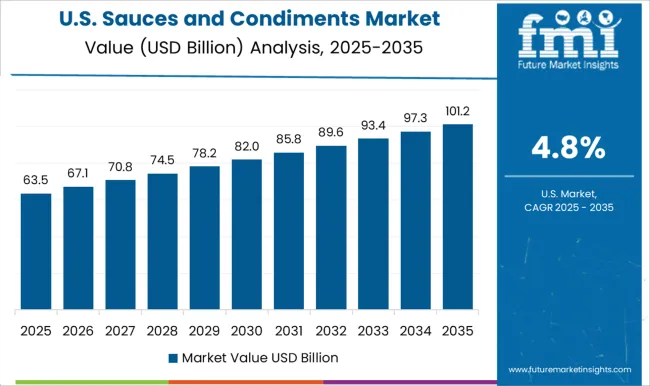

The sauces and condiments market in the United States is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by a wide range of culinary preferences, the popularity of fast food, and a booming demand for healthier condiment options. Ketchup, mustard, mayonnaise, and BBQ sauce continue to dominate the market, but there is also a growing trend toward more adventurous flavors, such as sriracha, buffalo, and specialty hot sauces. In recent years, the demand for organic, low-sugar, and plant-based sauces has increased, with manufacturers responding by offering cleaner and more health-conscious alternatives. The USA market is also witnessing a surge in interest for ethnic sauces, with global cuisines influencing USA food culture. Retail and e-commerce platforms play a crucial role in making these sauces widely accessible, while the foodservice sector, particularly in fast-casual dining, continues to grow as an important outlet for sauce consumption.

Competition in the sauces and condiments market is driven by flavor innovation, production scalability, and global distribution networks. Leading players such as McCormick & Company, The Kraft Heinz Company, and Nestlé leverage strong brand recognition, extensive product portfolios, and established retail presence to maintain market leadership. Kikkoman Corporation and Lee Kum Kee focus on Asian sauces and specialty condiments, combining authentic recipes with global distribution to reach diverse consumer segments. Unilever and Conagra Brands target convenience-driven and value-added products, offering ready-to-use sauces, dressings, and marinades for retail and foodservice markets.

Hormel Foods Corporation, General Mills, and Mars, Incorporated enhance their competitive positioning by investing in functional, low-sodium, and organic options that cater to growing health-conscious consumer demand. Smaller regional players such as Casa Fiesta, Bay Valley, Berner Foods, Fuchs Gewürze GmbH, and Huy Fong Foods maintain niche leadership through ethnic flavors, spicy sauces, and specialty products, often emphasizing artisanal production methods and unique taste profiles. Strategic focus across the industry centers on product differentiation, portfolio expansion, and channel optimization. Innovation in flavor profiles, limited-edition offerings, and ethnic-inspired sauces creates a competitive edge.

Manufacturing efficiency, cold-chain logistics, and co-packing agreements allow large players to scale while maintaining quality. Partnerships with e-commerce platforms, modern trade retailers, and foodservice distributors facilitate penetration into diverse markets. Health-oriented variants, clean-label formulations, and plant-based alternatives are increasingly marketed to capture the wellness-focused consumer segment. Packaging innovation, such as resealable pouches, single-serve sachets, and eco-friendly containers, enhances convenience and brand visibility. Marketing strategies emphasize global reach and cultural adaptability, with campaigns highlighting taste, authenticity, and heritage. Supply chain integration, sustainability-focused sourcing, and technological upgrades in mixing, pasteurization, and bottling processes enhance consistency and efficiency. Continuous product testing, consumer feedback loops, and regional flavor adaptation ensure relevance across local and international markets.

Collectively, these competitive strategies reinforce brand loyalty, expand market share, and sustain long-term growth in the sauces and condiments sector. Product catalogs and brochures highlight flavor profiles, ingredient transparency, and nutritional benefits. Key specifications include spiciness levels, shelf life, allergen-free labeling, and packaging types. Premium lines emphasize artisanal preparation, organic certification, and global culinary authenticity. Ready-to-use sauces, marinades, dips, and dressings are detailed for both retail and foodservice applications. Sampling kits, recipe integrations, and culinary partnerships are promoted to encourage trial and repeat consumption, reflecting a market poised for innovation, diversification, and sustained consumer engagement.

| Item | Value |

|---|---|

| Quantitative Units | USD 132.3 Billion |

| Product Type | Soy sauce, Hot sauce, Mushroom sauce, Cocktail sauce, and Others |

| Form | Liquid, Paste, and Dry |

| Distribution Channel | Supermarkets/hypermarkets, Convenience stores, Online retail, Specialty stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bay Valley, Berner Foods, Casa Fiesta, Conagra Brands, Fuchs Gewürze GmbH, General Mills, Hormel Foods Corporation, Huy Fong Foods, Kikkoman Corporation, Lee Kum Kee, Mars, Incorporated, McCormick & Company, Nestlé, The Kraft Heinz Company, and Unilever |

| Additional Attributes | Dollar sales by product type (ketchup, mayonnaise, hot sauce, dressings), share by region, growth in retail vs. foodservice channels, flavor trends, organic/clean-label adoption, competitive pricing, and emerging distribution opportunities. |

The global sauces and condiments market is estimated to be valued at USD 132.3 billion in 2025.

The market size for the sauces and condiments market is projected to reach USD 228.2 billion by 2035.

The sauces and condiments market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in sauces and condiments market are soy sauce, hot sauce, mushroom sauce, cocktail sauce and others.

In terms of form, liquid segment to command 62.5% share in the sauces and condiments market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Pasta Sauces Market Size and Share Forecast Outlook 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA