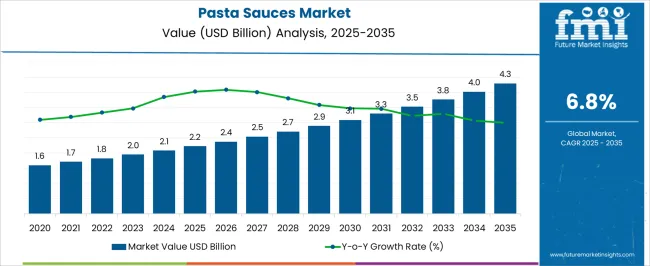

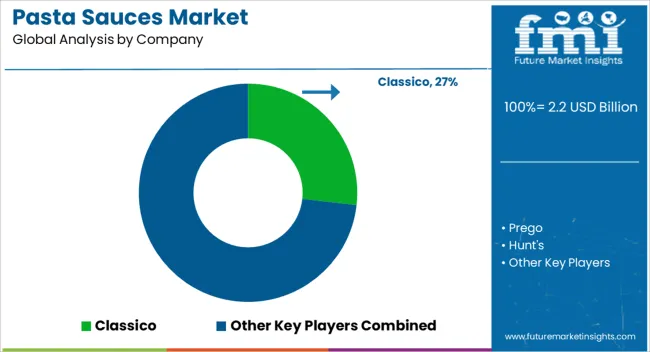

The pasta sauces market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Growth is anticipated to be driven by increasing consumer preference for convenient and ready-to-use meal solutions, coupled with the rising popularity of Italian and Mediterranean cuisine across global markets. Retailers and foodservice providers are expanding their offerings with organic, gluten-free, and low-sodium pasta sauces to cater to health-conscious consumers. The adoption of e-commerce platforms for grocery purchases is further accelerating market penetration, allowing smaller and regional brands to access wider audiences. Product innovation, including unique flavors, artisanal recipes, and premium packaging, is enhancing brand differentiation and consumer engagement.

Emerging markets in Asia-Pacific and Latin America are witnessing faster growth due to rising disposable incomes, urban lifestyles, and evolving eating habits, while mature markets in North America and Europe continue to emphasize quality, authenticity, and premium positioning. Distribution strategies involving partnerships with supermarkets, online grocery platforms, and meal-kit providers are strengthening visibility and availability. In addition, marketing campaigns highlighting sustainability, clean-label ingredients, and convenience are influencing purchase decisions. The overall market trajectory reflects a blend of premiumization, innovation, and accessibility that is expected to sustain strong double-digit growth in select regions over the next few years.

| Metric | Value |

|---|---|

| Pasta Sauces Market Estimated Value in (2025 E) | USD 2.2 billion |

| Pasta Sauces Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The pasta sauces market is influenced by five interrelated parent markets, each contributing a distinct share to overall demand and growth. The retail grocery and supermarket sector holds the largest share at 35%, as consumers increasingly purchase pasta sauces as part of ready-to-cook meal solutions, convenience-focused shopping, and brand loyalty preferences. The foodservice and restaurant market accounts for 25%, driven by Italian, Mediterranean, and fusion cuisine adoption, where chefs and caterers rely on premium, consistent, and diverse pasta sauce offerings to enhance menu appeal and operational efficiency. Online grocery and e-commerce platforms contribute 15%, providing access to niche, regional, and specialty pasta sauce brands, while facilitating promotions, subscriptions, and home delivery options that expand consumer reach.

The industrial and commercial packaged foods sector represents 15%, leveraging pasta sauces as key ingredients in frozen meals, ready-to-eat products, and meal kits for large-scale distribution. Finally, specialty and gourmet retail, including health food stores and delicatessens, holds a 10% share, driven by organic, low-sodium, gluten-free, and artisanal offerings that cater to premium consumer segments. Together, retail grocery and foodservice channels account for 60% of total market demand, highlighting convenience, taste consistency, and product variety as primary drivers, while e-commerce growth, premiumization, and dietary-focused innovations are expected to further accelerate adoption across global markets.

The pasta sauces market is experiencing robust growth driven by evolving consumer preferences for convenient meal solutions, increasing demand for authentic international cuisines, and the rising influence of global food culture on everyday diets. Health-conscious consumers are seeking products with clean labels, reduced additives, and high-quality natural ingredients, prompting manufacturers to innovate with organic and preservative-free options.

Urbanization and busier lifestyles are contributing to the popularity of ready-to-use sauces, while premiumization trends are encouraging the use of exotic ingredients and artisanal recipes. Advancements in packaging that extend shelf life without compromising flavor are further boosting market appeal.

The outlook remains positive as both traditional and modern sauce variants continue to capture attention across diverse consumer segments, supported by retail expansion and digital marketing initiatives.

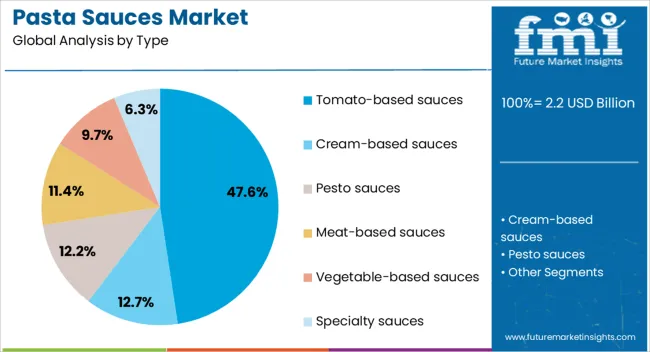

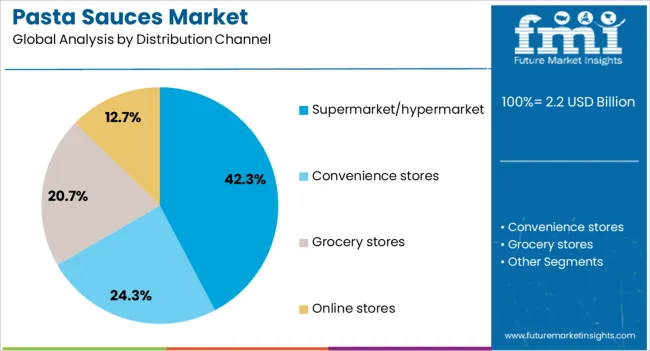

The pasta sauces market is segmented by type, distribution channel, and geographic regions. By type, pasta sauces market is divided into tomato-based sauces, cream-based sauces, pesto sauces, meat-based sauces, vegetable-based sauces, and specialty sauces. In terms of distribution channel, pasta sauces market is classified into supermarket/hypermarket, convenience stores, grocery stores, and online stores. Regionally, the pasta sauces industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tomato-based sauces segment is anticipated to account for 47.60% of the total market revenue by 2025 within the type category, establishing it as the dominant product type. This leadership is attributed to the versatility of tomato-based sauces in a wide range of pasta recipes, their broad consumer acceptance, and the perception of tomatoes as a healthy ingredient rich in antioxidants.

The segment has benefited from product diversification, including low-sodium, organic, and herb-infused varieties, which cater to health and flavor-conscious consumers alike.

Strong cultural associations with traditional pasta dishes and the adaptability of tomato-based sauces to various regional tastes have further strengthened their market position.

The supermarket/hypermarket distribution channel is expected to hold 42.30% of total revenue by 2025 within the distribution category, positioning it as the leading retail format. This dominance is supported by the convenience of one-stop shopping, extensive product variety, and frequent promotional campaigns that attract high foot traffic.

Supermarkets and hypermarkets also provide optimal visibility for pasta sauce brands through strategic shelf placements and in-store sampling, encouraging consumer trial and repeat purchases.

The availability of both premium and value options within these retail formats allows brands to cater to a broad demographic range, thereby sustaining their leadership in pasta sauce distribution.

Retail and foodservice sectors dominate pasta sauce demand, accounting for the majority of sales, while e-commerce and premium flavors continue to expand market reach and consumer adoption.

The pasta sauces market is witnessing strong growth driven by increasing consumer preference for convenient, ready-to-cook meals. Busy lifestyles, dual-income households, and urban consumption patterns are creating consistent demand for sauces that simplify meal preparation without compromising taste. Retailers are expanding shelf space for shelf-stable, refrigerated, and frozen pasta sauces to cater to diverse consumer needs. Flavored sauces, such as tomato basil, arrabbiata, pesto, and Alfredo, are gaining traction among younger consumers seeking variety. Private-label brands are also increasing penetration due to competitive pricing, while promotional campaigns by global and regional players strengthen brand visibility. Ready-to-cook meal kits, meal subscriptions, and e-commerce platforms are expanding accessibility, providing convenient options for at-home cooking.

Premium and gourmet pasta sauces are capturing consumer interest, contributing to higher market value. Organic, low-sodium, gluten-free, and clean-label sauces are increasingly preferred by health-conscious buyers. Exotic flavors, regional Italian recipes, and fusion options are being introduced to enhance culinary experiences at home. Brands are investing in packaging innovations, including glass jars, squeezable bottles, and single-serve portions, to increase appeal and usability. Collaborations with chefs and influencers promote product credibility and culinary expertise. Retailers emphasize sampling programs, recipe pairing suggestions, and cross-category promotions with pasta and bread products. Flavor diversification and premium offerings are driving incremental dollar sales and capturing share from conventional products, especially among millennials and urban households.

The foodservice sector is a significant driver for pasta sauce consumption. Restaurants, cafes, and catering services rely on consistent, high-quality sauces for menu consistency and operational efficiency. Italian, Mediterranean, and international cuisine trends encourage chefs to experiment with authentic and specialty sauces. Bulk packaging, cost-effective portioning, and ready-to-use formats support large-scale adoption. Growth in casual dining, fast-casual, and cloud kitchens accelerates B2B demand. Partnerships between sauce manufacturers and foodservice distributors help improve availability and reduce logistics costs. Training programs for chefs and culinary staff are being leveraged to ensure correct usage and menu optimization. Foodservice adoption complements retail demand, increasing overall market penetration.

E-commerce and online grocery channels are transforming pasta sauce accessibility. Platforms allow consumers to order specialty, organic, and premium sauces not available in local stores. Subscription-based meal kits and home delivery services provide convenience and variety, increasing dollar sales. Digital marketing, influencer endorsements, and recipe content engage younger buyers and encourage brand switching. Retailers integrate online promotions, flash sales, and bundle offers to boost conversion rates. Small and regional brands leverage digital channels to expand geographic reach rapidly. Data analytics enables manufacturers to predict trends, manage inventory, and tailor product portfolios to customer preferences. Direct-to-consumer models and omnichannel distribution strategies are shaping modern pasta sauce consumption.

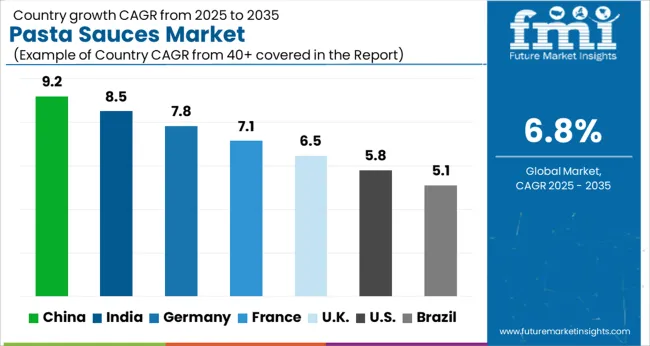

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

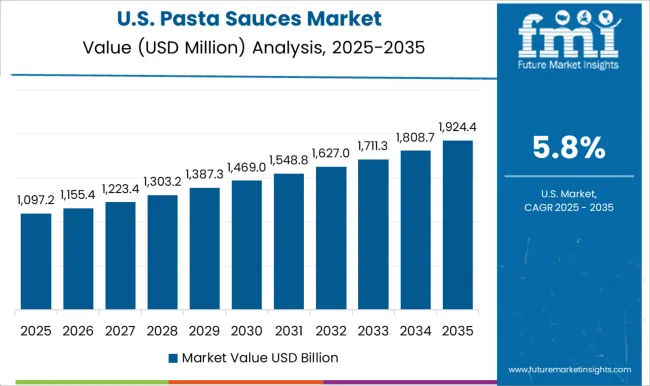

| USA | 5.8% |

| Brazil | 5.1% |

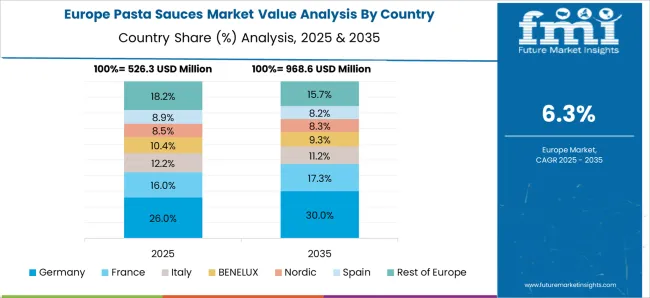

The global pasta sauces market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads with 9.2%, followed by India at 8.5%, Germany at 7.8%, the UK at 6.5%, and the USA at 5.8%. Growth is driven by rising consumer demand for convenient, ready-to-cook meals, premium and gourmet sauces, and the expansion of foodservice channels such as restaurants, cafes, and cloud kitchens. BRICS nations, particularly China and India, are experiencing rapid market expansion due to evolving dietary habits, increasing disposable incomes, and broader retail penetration. OECD countries like Germany, the UK, and the USA focus on quality differentiation, flavor diversification, and e-commerce adoption. Enhanced distribution networks, digital marketing, and promotional campaigns support accessibility and adoption, while private-label offerings strengthen competitive dynamics across regions. The analysis includes over 40+ countries, with the leading markets detailed below.

The pasta sauces market in China is projected to grow at a CAGR of 9.2% from 2025 to 2035, driven by rising demand for convenient meal solutions, international cuisines, and premium gourmet sauces. Rapid growth of supermarkets, hypermarkets, and e-commerce platforms is expanding accessibility to domestic and imported pasta sauce brands. Urban consumers increasingly prefer ready-to-use sauces for quick cooking, while restaurants and cloud kitchens are incorporating diverse flavors to cater to evolving tastes. Manufacturers are scaling production and investing in flavor innovation, packaging variety, and shelf-life optimization. Strategic partnerships with foodservice chains and online grocery platforms are boosting visibility and sales, while marketing campaigns highlight authenticity, quality ingredients, and nutritional benefits.

The pasta sauces market in India is expected to expand at a CAGR of 8.5% from 2025 to 2035, fueled by increasing disposable income, westernized eating habits, and expanding urban retail networks. Supermarkets, modern trade outlets, and online grocery platforms are enabling widespread availability of both local and imported brands. Consumer preference is shifting toward organic, clean-label, and exotic flavor variants, leading manufacturers to diversify product portfolios. Foodservice establishments, including quick-service restaurants and cafes, are adopting premium sauces to enhance menu variety. Production facilities are scaling to meet growing domestic and export demand, while promotional campaigns focus on taste, convenience, and nutritional appeal.

Germany’s pasta sauces market is projected to grow at a CAGR of 7.8% from 2025 to 2035, underpinned by high consumer demand for quality, authentic, and specialty sauces. Retail chains, supermarkets, and online grocery platforms play a central role in distribution, emphasizing private-label and imported Italian brands. Consumers increasingly seek organic, low-sodium, and preservative-free options, prompting manufacturers to expand health-conscious product lines. Demand is also driven by the foodservice sector, including restaurants and catering services, which require consistent quality and diverse flavor offerings. Companies are investing in advanced processing, extended shelf-life solutions, and sustainable packaging to enhance brand perception and market competitiveness.

The UK pasta sauces market is anticipated to grow at a CAGR of 6.5% from 2025 to 2035, driven by demand for convenient cooking solutions and gourmet Italian flavors. Supermarkets, online grocery platforms, and subscription meal kits are key distribution channels enabling broad access to premium and mid-tier products. Consumers show interest in organic, gluten-free, and plant-based sauce options, prompting product diversification. Manufacturers focus on packaging innovation, extended shelf-life, and ready-to-use formats to enhance convenience. Foodservice establishments, including casual dining and delivery services, increasingly adopt pasta sauces for menu enhancement. Marketing campaigns emphasize authenticity, taste, and nutritional benefits to drive household penetration and brand loyalty.

The pasta sauces market in the USA is projected to grow at a CAGR of 5.8% from 2025 to 2035, fueled by rising consumption of Italian cuisine, convenience-focused products, and diverse flavor preferences. Supermarkets, online grocery platforms, and meal kit services provide widespread distribution of premium, organic, and specialty sauces. Health-conscious consumers drive demand for low-sodium, preservative-free, and gluten-free options. Manufacturers are focusing on innovative flavors, packaging convenience, and extended shelf-life to attract households and foodservice operators. Restaurants, cafés, and catering services adopt a wide range of sauces to enhance menu offerings. Promotional campaigns highlighting quality, authenticity, and nutrition further support adoption and market growth.

Competition in the pasta sauces market is shaped by brand heritage, flavor innovation, and distribution capabilities. Classico leads with a strong presence in supermarkets and grocery chains, leveraging a portfolio of classic Italian sauces and consistent quality. Prego competes through diverse flavor offerings, including organic and premium options, emphasizing household convenience and ready-to-use formats. Hunt’s focuses on tomato-based sauces with value-driven pricing and nationwide retail availability, appealing to price-sensitive and family-oriented consumers. Barilla capitalizes on its global pasta brand recognition, cross-promoting pasta and sauces to enhance household adoption and brand loyalty.

Ragù emphasizes traditional recipes and rich flavors, targeting mid-tier consumers seeking authentic Italian culinary experiences. Other players, including regional and private-label brands, differentiate through niche flavors, specialty ingredients, and premium or organic formulations. Retailers, e-commerce platforms, and meal kit services increasingly influence competitive positioning, with shelf visibility, promotions, and online presence being critical for consumer acquisition. Manufacturers invest in flavor diversification, shelf-life extension, and packaging innovation, such as squeezable jars, single-serve portions, and microwavable-ready formats, to cater to convenience-focused households. Strategies across the market emphasize product portfolio depth, taste consistency, and channel reach. Partnerships with foodservice operators, restaurants, and subscription meal kits expand usage occasions beyond home kitchens.

Marketing campaigns highlight authenticity, ingredient quality, and nutritional appeal to differentiate in a crowded landscape. Sales and distribution networks are optimized to ensure nationwide availability and rapid replenishment, supporting both retail and online demand. Product brochures emphasize flavor profiles, preparation ease, organic or preservative-free options, and packaging convenience, reflecting a market focused on consumer preference, convenience, and culinary experience. This competitive landscape demonstrates that heritage brands, flavor innovation, and channel penetration remain key levers for success in the pasta sauces market. Players with strong distribution networks and diversified portfolios are best positioned to capture growing consumer demand across retail and foodservice segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | Tomato-based sauces, Cream-based sauces, Pesto sauces, Meat-based sauces, Vegetable-based sauces, and Specialty sauces |

| Distribution Channel | Supermarket/hypermarket, Convenience stores, Grocery stores, and Online stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Classico, Prego, Hunt's, Barilla, and Ragù |

| Additional Attributes | Dollar sales, market share, category segmentation (tomato, cream, pesto, organic), flavor trends, premium vs value offerings, retail vs foodservice demand, regional consumption patterns, e-commerce growth, packaging formats, and competitive positioning. |

The global pasta sauces market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the pasta sauces market is projected to reach USD 4.3 billion by 2035.

The pasta sauces market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in pasta sauces market are tomato-based sauces, cream-based sauces, pesto sauces, meat-based sauces, vegetable-based sauces and specialty sauces.

In terms of distribution channel, supermarket/hypermarket segment to command 42.3% share in the pasta sauces market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pasta Machine Market Size and Share Forecast Outlook 2025 to 2035

Pasta and Noodles Market Analysis by Product Type, Usage, Distribution Channel, and Region Through 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Sauce Market Expansion - Dairy-Free & Plant-Based Sauces 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Uncooked Pasta and Noodles Market Size and Share Forecast Outlook 2025 to 2035

Gluten-Free Pasta Market Trends - Health-Conscious Eating & Market Growth 2025 to 2035

Sauces and Condiments Market Size and Share Forecast Outlook 2025 to 2035

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA