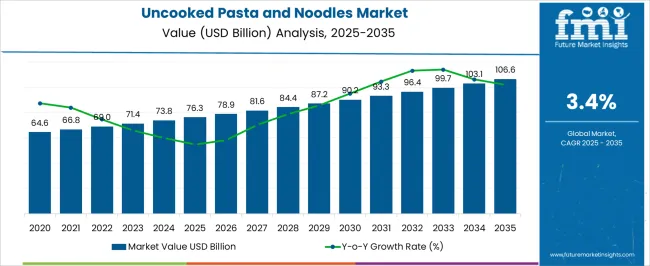

The uncooked pasta and noodles market is set to grow from USD 76.3 billion in 2025 to USD 106.6 billion by 2035, reflecting a CAGR of 3.4%. During the early adoption phase (2020–2024), consumers gradually increased their preference for packaged pasta and noodles due to convenience, longer shelf life, and consistent quality. By 2025, growing demand from households and foodservice channels will drive broader adoption. This phase represents the transition from selective consumption to wider market presence, as manufacturers expand product offerings and distribution networks, laying the groundwork for the scaling phase in the next decade.

From 2025 to 2030, the market enters a scaling phase, characterized by a steady increase in uptake across both retail and institutional segments. Market value rises from USD 76.3 billion in 2025 as expanded production and wider availability boost consumption. By 2030, pasta and noodles are expected to become a staple in households and foodservice menus, paving the way for market consolidation. Between 2030 and 2035, the market reaches USD 106.6 billion, with consistent CAGR-driven growth. Consolidation occurs as leading producers optimize supply chains and strengthen market presence, resulting in a mature and competitive market landscape with stable demand across regions.

| Metric | Value |

|---|---|

| Uncooked Pasta and Noodles Market Estimated Value in (2025 E) | USD 76.3 billion |

| Uncooked Pasta and Noodles Market Forecast Value in (2035 F) | USD 106.6 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The uncooked pasta and noodles market is a significant segment of the global packaged foods market, which includes ready-to-eat meals, snacks, bakery products, and other convenience foods. In 2025, uncooked pasta and noodles account for approximately 12% of the packaged foods market, reflecting steady consumer preference for convenient and shelf-stable meal options. The broader packaged foods market is projected to grow at a CAGR of 2.5–3% during 2025–2035, supported by growing retail penetration, increasing demand from foodservice channels, and evolving consumption patterns. Within the pasta and noodles segment, uncooked variants hold an estimated 65% share in 2025, with the remainder comprising ready-to-eat and instant noodles.

By 2030, scaling up adoption is expected to increase the share of uncooked pasta and noodles to nearly 68%, driven by consistent household consumption and the rising inclusion of these products in institutional foodservice menus. Between 2030 and 2035, consolidation is anticipated as leading producers optimize production efficiency, expand distribution, and strengthen brand presence. By 2035, uncooked pasta and noodles are projected to represent roughly 69–70% of the overall pasta and noodles segment and around 13% of the packaged foods market, solidifying their role as a key revenue contributor within the parent market.

The uncooked pasta and noodles market is witnessing stable expansion, driven by rising global consumption of convenient and shelf-stable staple foods. Demand is being reinforced by urbanization, evolving dietary patterns, and the growth of retail infrastructure in both developed and emerging markets. The current scenario reflects strong consumer preference for versatile carbohydrate sources with long shelf life, aligning with busy lifestyles and home-cooking trends.

Future growth is anticipated as product innovation, fortified variants, and diverse flavor offerings expand market reach across various demographics. Price competitiveness, coupled with widespread acceptance in both traditional and fusion cuisines, strengthens the long-term outlook. Additionally, the market benefits from robust trade flows and regional production hubs that ensure consistent supply and competitive export pricing.

Strategic investments in packaging and distribution efficiency are expected to further enhance market penetration. As the market advances, its resilience is likely to be underpinned by stable raw material supply, effective branding, and expanding availability through modern retail formats.

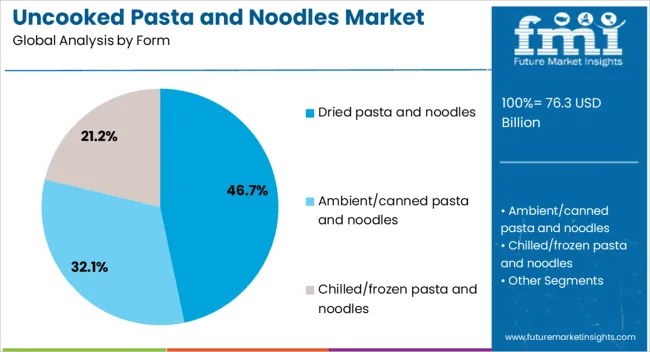

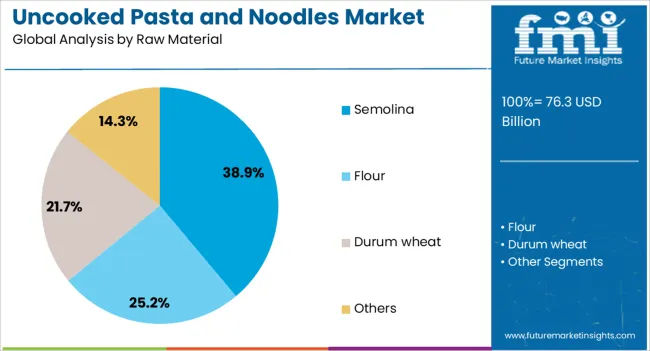

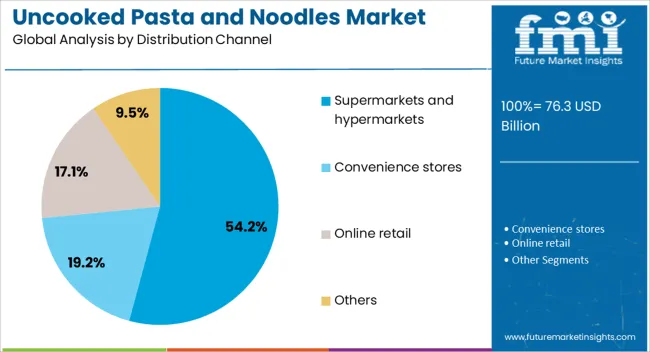

The uncooked pasta and noodles market is segmented by form, raw material, distribution channel, and geographic regions. By form, uncooked pasta and noodles market is divided into Dried pasta and noodles, Ambient/canned pasta and noodles, and Chilled/frozen pasta and noodles. In terms of raw material, uncooked pasta and noodles market is classified into Semolina, Flour, Durum wheat, and Others. Based on distribution channel, uncooked pasta and noodles market is segmented into Supermarkets and hypermarkets, Convenience stores, Online retail, and Others. Regionally, the uncooked pasta and noodles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dried pasta and noodles segment dominates the form category, accounting for approximately 46.7% of the uncooked pasta and noodles market. Its leadership is attributed to extended shelf stability, ease of storage, and minimal transportation constraints, making it a preferred choice for both consumers and distributors. The segment has also benefited from consistent demand in export markets due to its adaptability to varied cooking methods and flavor pairings.

Industrial-scale production efficiencies and packaging innovations have supported widespread availability at competitive prices, reinforcing its position in retail and foodservice sectors. The segment’s resilience during fluctuating economic conditions is strengthened by its cost-effectiveness and versatility across diverse cuisines.

Growing consumer preference for pantry-ready meal components, along with increasing penetration in convenience stores and e-commerce platforms, continues to drive its performance. With ongoing product diversification and marketing strategies targeting health-conscious and gourmet segments, dried pasta and noodles are expected to retain their market leadership.

The semolina segment leads the raw material category, contributing approximately 38.9% of the uncooked pasta and noodles market. Its dominance is supported by its functional properties, including high protein content and optimal gluten structure, which contribute to desirable texture and cooking performance. The segment benefits from established consumer perception of semolina as a premium and authentic ingredient, particularly in traditional pasta production.

Consistent supply from key wheat-growing regions and advanced milling technologies have ensured quality standardization, bolstering its acceptance among both industrial manufacturers and artisanal producers. Market stability is reinforced by its extensive use across mainstream and specialty product lines, with growth further stimulated by the rising demand for fortified and value-added pasta variants.

Strategic sourcing partnerships and vertical integration within major production companies have enhanced cost efficiencies. As consumer preference for quality-driven ingredients persists, the semolina segment is expected to maintain its strong position in the global uncooked pasta and noodles market.

The supermarkets and hypermarkets segment dominates the distribution channel category, holding approximately 54.2% of the uncooked pasta and noodles market. This leadership is driven by the extensive product variety, competitive pricing, and promotional strategies available in large-format retail outlets. The segment benefits from high consumer footfall, enabling frequent replenishment and visibility of products across both premium and value ranges.

Enhanced shelf space allocation for international and specialty pasta products has expanded consumer choices and stimulated trial purchases. Strong supply chain networks and centralized procurement systems ensure consistent availability, even during seasonal demand surges. Additionally, in-store promotional campaigns, sampling programs, and loyalty incentives have contributed to sustained sales momentum.

The segment’s dominance is further reinforced by the integration of offline and online channels, enabling click-and-collect services and home delivery options. With modern trade continuing to expand in urban and semi-urban areas, supermarkets and hypermarkets are expected to remain the primary sales channel for uncooked pasta and noodles in the coming years.

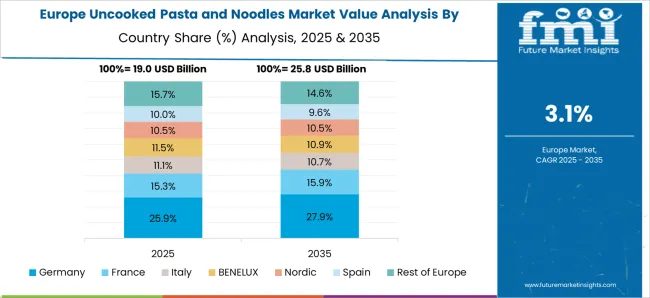

The uncooked pasta and noodles market is growing due to rising global demand for convenient, ready-to-cook, and long-shelf-life products. North America and Europe lead adoption with diverse consumption patterns, premium and specialty pasta, and retail penetration. Asia-Pacific shows rapid growth fueled by rising urbanization, growing middle-class populations, and increasing fast-food consumption. Manufacturers differentiate through product quality, gluten-free and whole-grain options, and innovative flavors. Regional differences in culinary preferences, consumption habits, and distribution channels strongly influence adoption, product development, and market competitiveness.

Rising consumer preference for convenient, ready-to-cook meals is driving adoption of uncooked pasta and noodles. North America and Europe emphasize premium, packaged pasta for home cooking and meal kits, while Asia-Pacific markets adopt noodles and pasta due to fast-paced urban lifestyles, increasing disposable incomes, and ready-to-cook convenience needs.

Differences in consumption habits, meal preparation time, and retail infrastructure influence product type, packaging, and portion size. Leading suppliers provide fortified, pre-portioned, and high-quality products, while regional producers focus on cost-effective, locally preferred flavors. The contrast between convenience-driven Western markets and volume-focused emerging markets shapes product innovation, adoption, and competitive positioning globally.

Health-conscious consumers are driving demand for fortified, gluten-free, whole-grain, and low-carb pasta and noodles. North America and Europe emphasize enriched products targeting wellness, dietary restrictions, and functional benefits. Asia-Pacific markets adopt fortified or protein-enriched noodles to meet nutritional gaps in school and household consumption. Differences in dietary awareness, regulatory labeling, and nutrient fortification standards influence formulation, ingredient sourcing, and marketing strategies. Leading suppliers focus on high-quality, nutrient-dense formulations with consistent texture, while regional producers deliver affordable, locally acceptable options. Nutritional trends contrasts drive product differentiation, adoption, and competitiveness across global uncooked pasta and noodles markets.

Regional taste and culinary preferences strongly influence product adoption. North America and Europe favor Italian-style pasta, specialty shapes, and premium durum wheat products, while Asia-Pacific consumers prefer traditional noodles, rice-based pasta, and locally flavored options. Differences in flavor profile, texture expectations, and cooking practices impact raw material selection, extrusion technology, and packaging formats. Leading suppliers develop versatile products catering to multi-regional tastes, while regional producers focus on locally tailored products with familiar flavors. Culinary preference contrasts affect adoption, brand positioning, and competitive strategies, making region-specific products a critical factor in global market growth.

Distribution channels and retail penetration drive the uncooked pasta and noodles market expansion. North America and Europe leverage supermarkets, online grocery platforms, and foodservice networks to distribute premium and specialty products. Asia-Pacific markets rely on traditional retail, convenience stores, and e-commerce for high-volume distribution, particularly in urban centers. Differences in retail infrastructure, consumer shopping habits, and logistics influence packaging size, product variety, and shelf life. Leading suppliers offer standardized, ready-to-stock products suitable for global distribution, while regional players focus on smaller, locally adapted packaging solutions. Distribution and retail contrasts shape adoption, market coverage, and competitiveness across the global uncooked pasta and noodles market.

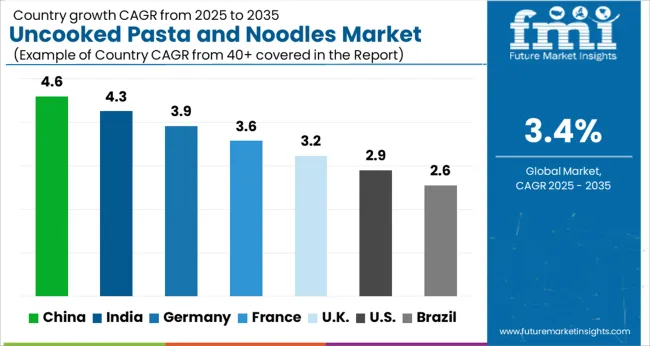

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global uncooked pasta and noodles market is projected to grow at a 3.4% CAGR through 2035, driven by demand in retail, food service, and packaged food sectors. Among BRICS nations, China led with 4.6% growth as large-scale production and distribution networks were established, while India expanded its manufacturing and supply capabilities to meet growing domestic and regional consumption at 4.3%.

In the OECD region, Germany at 3.9% maintained steady output under stringent food safety and quality standards, while the United Kingdom at 3.2% implemented moderate-scale distribution to support commercial and household demand. The USA, growing at 2.9%, sustained consistent adoption in retail and food service applications while complying with federal and state-level food regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The uncooked pasta and noodles market in China is growing at a 4.6% CAGR, driven by changing consumer lifestyles and increased consumption of convenient, ready-to-cook meals. Rising urbanization and higher disposable incomes are encouraging households to adopt international cuisines, including pasta and noodle-based dishes. Retailers and e-commerce platforms are expanding availability, making a variety of pasta products accessible across cities. Domestic manufacturers are producing diverse variants, including whole wheat, fortified, and gluten-free options, catering to health-conscious consumers. Restaurants, cafeterias, and foodservice chains are also contributing to demand by incorporating pasta and noodles into menus. Marketing campaigns emphasize quick preparation, nutritional value, and taste diversity. Overall, the market reflects growing adoption of international food trends, convenience-oriented consumption, and innovation in product offerings.

Uncooked pasta and noodles market in India is registering a 4.3% CAGR, supported by increasing urbanization and changing dietary patterns. Consumers are incorporating pasta and noodles as convenient meal options, particularly in metropolitan and tier-one cities. Domestic manufacturers are introducing innovative products, including multigrain, fortified, and flavored variants, to appeal to children and health-conscious adults. Retail chains, modern trade outlets, and e-commerce platforms are making products widely accessible. Foodservice outlets, quick-service restaurants, and cafeterias continue to drive demand by offering pasta and noodle-based dishes. Awareness campaigns and recipe promotions help educate consumers on quick preparation methods and nutritional benefits. The market growth is influenced by convenience, evolving taste preferences, and product diversification.

Germany’s uncooked pasta and noodles market is growing at a 3.9% CAGR, driven by high adoption of convenient and healthy food options. Consumers prefer whole grain, organic, and gluten-free pasta variants due to increasing health awareness. Retail chains and online grocery stores provide wide availability, improving accessibility for households. Foodservice outlets, restaurants, and cafeterias continue to incorporate pasta and noodle dishes into their menus, increasing market penetration. Manufacturers focus on product innovation, including fortified and specialty pasta varieties, catering to evolving dietary preferences. Marketing emphasizes ease of preparation, nutritional content, and taste. The market is characterized by moderate growth supported by health-conscious consumption, convenience, and diversified product offerings.

The United Kingdom market for uncooked pasta and noodles is expanding at a 3.2% CAGR, driven by convenience-oriented consumption and the popularity of international cuisines. Consumers are increasingly seeking quick-cook meals, leading to higher adoption of pasta and noodle products. Manufacturers offer fortified, multigrain, and specialty variants to meet health-conscious demands. Retailers, supermarkets, and online stores provide widespread product availability, ensuring easy access for households. Foodservice channels, including restaurants and cafes, continue to incorporate pasta dishes into their menus. Marketing efforts highlight nutritional benefits, preparation speed, and taste versatility. Market growth is moderate, reflecting steady adoption of international meal options, innovation in product offerings, and increasing consumer preference for convenient, healthy foods.

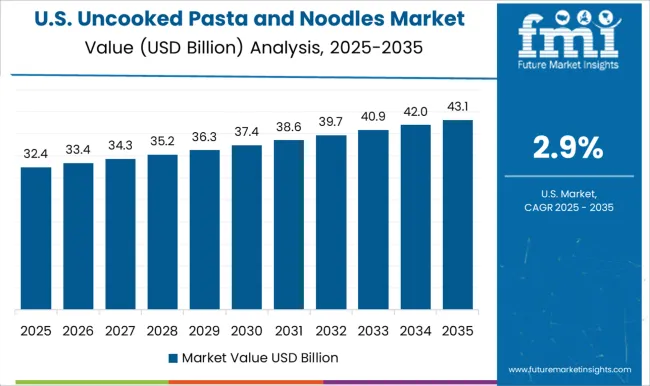

The United States uncooked pasta and noodles market is growing at a 2.9% CAGR, supported by rising adoption of convenient, ready-to-cook meal options. Consumers are increasingly integrating pasta and noodles into daily diets due to quick preparation and versatility. Manufacturers focus on fortified, whole grain, and gluten-free variants to meet health-conscious consumer demands. Retail chains, supermarkets, and online platforms provide widespread access to various products. Foodservice establishments, including quick-service restaurants and cafes, continue to offer pasta-based dishes, driving market demand. Marketing emphasizes taste, convenience, and nutritional value. Market growth is moderate, influenced by steady adoption of international cuisines, health-focused product offerings, and convenience-driven consumer behavior.

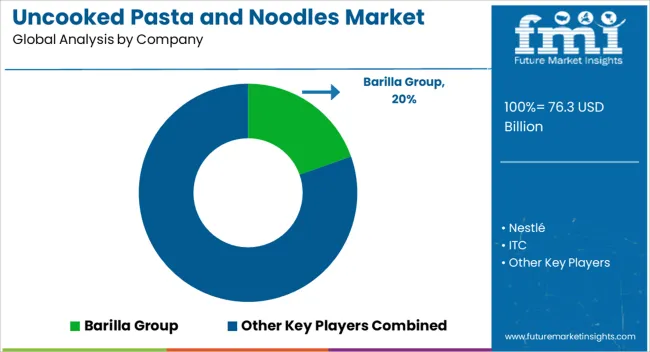

The uncooked pasta and noodles market is dominated by several leading suppliers, including Barilla Group, Nestlé, ITC, Kraft Heinz Company, Unilever, Toyo Suisan Kaisha, Nissin Foods Holdings, Campbell Soup Company, TreeHouse Foods, Ebro Foods, De Cecco, and Jovial Foods. These companies are recognized for their extensive product portfolios, high-quality standards, and global distribution networks, which cater to diverse consumer preferences. Uncooked pasta and noodles are staple foods across numerous regions, and these suppliers play a pivotal role in ensuring consistent availability and variety in shapes, flavors, and ingredients, including whole grain, gluten-free, and fortified options. Market leaders have focused on expanding their production facilities, adopting advanced manufacturing technologies, and enhancing supply chain efficiency to meet the increasing global demand for convenient and nutritious food products. Companies like Barilla Group and Nestlé have emphasized product innovation by introducing specialty pasta and noodle variants to address health-conscious consumer trends.

Similarly, Nissin Foods Holdings and Toyo Suisan Kaisha have strengthened their presence in the instant noodle segment, catering to the rising need for quick and easy meal solutions. Strategic acquisitions and collaborations enable these suppliers to expand their market reach and diversify their product offerings. With the increasing demand for ready-to-cook and nutritionally enriched products, suppliers such as De Cecco and Jovial Foods are leveraging traditional recipes and organic ingredients to appeal to premium consumer segments. Additionally, companies such as Unilever and ITC are integrating sustainable practices into their sourcing and packaging, reflecting the industry’s growing focus on environmental responsibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.3 Billion |

| Form | Dried pasta and noodles, Ambient/canned pasta and noodles, and Chilled/frozen pasta and noodles |

| Raw Material | Semolina, Flour, Durum wheat, and Others |

| Distribution Channel | Supermarkets and hypermarkets, Convenience stores, Online retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Barilla Group, Nestlé, ITC, Kraft Heinz Company, Unilever, Toyo Suisan Kaisha, Nissin Foods Holdings, Campbell Soup Company, TreeHouse Foods, Ebro Foods, De Cecco, and Jovial Foods |

| Additional Attributes | Dollar sales vary by product type, including spaghetti, macaroni, vermicelli, and instant noodles; by ingredient, spanning wheat, rice, and alternative grains; by application, such as retail, foodservice, and ready-to-eat meals; by end-use, covering households, restaurants, and food manufacturers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by convenience food demand, global cuisine popularity, and changing dietary preferences. |

The global uncooked pasta and noodles market is estimated to be valued at USD 76.3 billion in 2025.

The market size for the uncooked pasta and noodles market is projected to reach USD 106.6 billion by 2035.

The uncooked pasta and noodles market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in uncooked pasta and noodles market are dried pasta and noodles, ambient/canned pasta and noodles and chilled/frozen pasta and noodles.

In terms of raw material, semolina segment to command 38.9% share in the uncooked pasta and noodles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pasta and Noodles Market Analysis by Product Type, Usage, Distribution Channel, and Region Through 2035

Pasta Sauces Market Size and Share Forecast Outlook 2025 to 2035

Pasta Machine Market Size and Share Forecast Outlook 2025 to 2035

Soap Noodles Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Sauce Market Expansion - Dairy-Free & Plant-Based Sauces 2025 to 2035

Vegan Noodles Market Growth - Plant-Based Convenience Trends 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Gluten-Free Pasta Market Trends - Health-Conscious Eating & Market Growth 2025 to 2035

Demand for Canned Pasta in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA