The global vegan pasta sauce market has been experiencing a rapid growth on account of increasing number of health-conscious consumers and rising demand in the plant-based and dairy-free food alternatives. The new health-conscious consumers want for natural, organic, and clean-label products is fuelling the demand for vegan sauces.

This is, among others, because the flexitarian diet; the environmental movement and meat substitutes; the trend towards plant-based products with the growing demand for innovation and the conflicting promise to the end consumer.

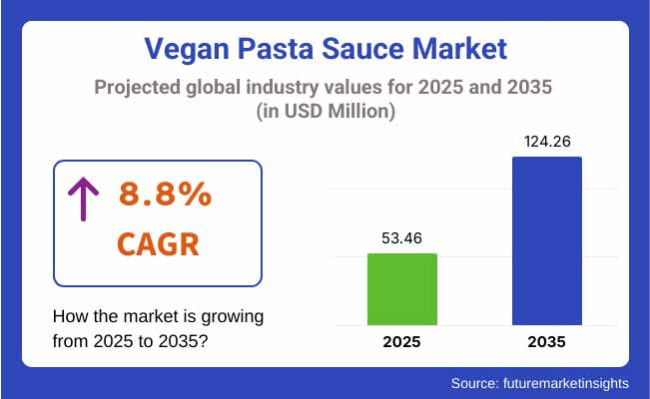

Heightened Interest in Mediterranean and Italian Cuisine, combined with Increasing Home Cooking Trends are Further Accelerating the Market Demand for Vegan Pasta Sauces Made with Pure and Natural ingredients. In 2025, the vegan pasta sauce market was valued at approximately USD 53.46 million. By 2035, it is projected to reach USD 124.26 million, reflecting a compound annual growth rate (CAGR) of 8.8%.

The market expansion is driven by growing consumer awareness about lactose intolerance, demand for minimally processed food, and increasing penetration of vegan products in mainstream retail stores. Additionally, companies are introducing innovative flavors, gluten-free options, and fortified plant-based sauces to attract health-conscious and dietary-restricted consumers.

The market for vegan pasta sauce is led by North America, due to the growing vegan and flexitarian population, and active plant-based food industry along with developed retail infrastructure. There is a growing trend amongst millennials and health consumers (US/Canada) for pasta sauces that are dairy-free (organic/non-GMO certified) in the USA.

There is also increase in Italian cuisine penetrating the market and increase in gains from the meal kit services which include plant-based food variety. Big food companies and start-ups alike are expanding their plant-based sauce lines, which is further driving competition and innovation in the category.

Europe is a key vegan pasta sauces market with a long-established tradition of plant-based consumption alongside a regulatory framework supporting the sustainable consumer as well as a growing health-oriented consumer. Demand for pasta sauces that are clean-label, preservative-free, and organic is being pursued by countries including Germany, the UK, France, and Italy.

The European casest is also benefitting from a growing trend of consumers by visiting restaurants that offer plant based alternatives making it a good time for vegan/plant based food festivals and event to flourish. Moreover, supermarket chains and specialist retailers are introducing vegan sauces to appeal to a growing base of flexitarian and plant-based consumers.

The vegan pasta sauce market in Asia-Pacific is rapidly expanding due to health consciousness, increased disposable income, and higher levels of urbanization. With growing demand for vegan-friendly sauces in countries like China, India, Japan, and Australia, all embracing plant-based diets, the growing middle class in the region and greater penetration of Western cuisine is fueling interest in Italian-inspired vegan sauces.

The inclination of the government to promote the concept of plant-based diet for reductions in carbon footprints and maintaining wellness is further aiding the market growth. Local makers have also gotten in the game by making plays for regional flavors and exploring plant-based inclusions to cater to broader consumers.

The global vegan pasta sauce market will reach new heights as the popularity of plant-based diets soars over the world. Growth is fueled by increasing health consciousness, greater adoption by retailers and restaurants, and innovative product formulations.

As food manufacturers are concentrating to produce organic, clean-label and nutrient-rich vegan sauces, steady demand across various consumer groups is estimated to be evident in the market. Emerging investments in research and development in plant-based food, coupled with a growing perception about sustainability, bodes well for the vegan pasta sauce market in the forthcoming years.

Challenges

High Production Costs and Ingredient Sourcing

The growing costs of high-quality plant-based ingredients are challenging the expansion of the Vegan pasta sauce sector. The need to source organic, non-GMO, and clean-label ingredients like cashew-based creams, nutritional yeast, or plant-based emulsifiers can drive up production costs.

And variability in agricultural yield and inefficiencies in supply chains can affect the price and supply of raw materials. In order to reduce these financial strains, companies must streamline procurement strategies, develop sustainable sourcing partnerships, and invest in cost-effective production methods.

Regulatory Compliance and Shelf Stability

There are strict regulations around food labeling, safety and ingredient transparency in the market. Extensive testing and documentation are necessary, also, in order to ensure that vegan certifications, allergen-free claims, international food safety standards, etc. are met.

This makes it even harder for plant-based sauce makers, who have to rely on natural preservation techniques to achieve an acceptable shelf life without the use of artificial preservatives. To keep most consumers happy and products safe they will have to come up with clean-label ways to preserve food without artificial preservatives while balancing this with standards set by regulators.

Opportunities

Growing Consumer Demand for Plant-Based Diets

As more people are adopting plant-based and flexitarian diets, the demand for vegan pasta sauces continues to increase. Customers are looking for healthier, dairy free as well as meat free options for conventional sauces.

With the increase of plant-based lifestyles and greater attention to sustainability and ethical eating, this is an opportunity for manufacturers to broaden their offerings with a variety of exciting and innovative flavors. Health-conscious and environmentally aware consumers are also attracted to brands that use superfoods, functional ingredients, and unique flavor profiles.

Expansion of E-Commerce and Private Labeling

Increasing online grocery shopping also means that vegan pasta sauces need to be distributed differently than their non-vegan counterparts. E-commerce platforms offer niche brands the chance to expand their audience through offers of subscription models, bundled meal kits, and precision targeting, among other things.

In supermarkets, private-label vegan sauces are also on the rise proving to retailers a competitive advantage. Such investments in digital branding, influencer partnerships and innovative packaging will lead to better market visibility and customer engagement.

The vegan pasta sauce industry expanded significantly from 2020 to 2024, driven by growing awareness of plant-based diets, clean-label products, and allergen-free alternatives. At this time, brands were making strides in organic and gluten-free formulations while also applying focus to sustainability initiatives in their packaging. Supply chain disruptions and inflationary pressures created headwinds, but firms adjusted through local sourcing and sustainable production practices.

Ingredients technology such as food processing and AI consumer insight will continue to expand consumer-oriented trends to gain market share in 2025 to 2035. The next phase of growth will be defined by innovations in fermentation techniques, plant-based protein enhancement, and AI-powered flavor customization.

Companies that help their customers understand how to apply data analytics, sustainable packaging solutions, and functional nutrition benefits will gain a leg up in an increasingly competitive market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with vegan certifications and clean-label standards |

| Technological Advancements | Growth in plant-based ingredient innovation |

| Industry Adoption | Increased demand for gluten-free and organic sauces |

| Supply Chain and Sourcing | Increased reliance on organic ingredient sourcing |

| Market Competition | Dominance of niche plant-based brands |

| Market Growth Drivers | Consumer shift towards plant-based lifestyles |

| Sustainability and Energy Efficiency | Focus on recyclable and eco-friendly packaging |

| Integration of Smart Monitoring | Limited use of digital tracking in ingredient sourcing |

| Advancements in Product Innovation | Development of cashew-based and gluten-free options |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven regulatory monitoring and blockchain -based traceability |

| Technological Advancements | Expansion of fermentation, AI-driven product development |

| Industry Adoption | Personalization of sauces through AI-driven nutrition insights |

| Supply Chain and Sourcing | AI-powered supply chain optimization and sustainable farming |

| Market Competition | Rise of private-label and retail partnerships |

| Market Growth Drivers | Functional ingredients, personalized nutrition, and gut health focus |

| Sustainability and Energy Efficiency | Adoption of biodegradable packaging and carbon-neutral production |

| Integration of Smart Monitoring | Blockchain -enabled ingredient transparency and AI-powered quality control |

| Advancements in Product Innovation | Introduction of adaptive flavor profiles and functional wellness ingredients |

Consumer preferences for plant based food products is a major factor driving growth of the USA vegan pasta sauce market. The rise in awareness of dairy-free & vegan demand is a major factor contributing to the increasing demand for vegan alternatives in the pasta category.

In addition, major market players are introducing organic, non-GMO, and allergen-free variants to meet the desires of health-minded individuals. Market penetration has also been furthered by the growth of supermarket chains, online grocery retailers, and specialty food stores. As more and more people are cooking at home and exploring plant-based meals, the need for creative and flavorful vegan pasta sauces is on the rise as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.0% |

As the number of vegans and vegetarians in the UK soar, so does the market for vegan pasta sauce. Consumers actively desire plant-based meat substitutes for ethical, environmental and health reasons. Supermarkets and food brands are tackling this demand by launching a huge variety of sauces based on cashew, almond or vegetable formulations.

As demand for vegan pasta sauces increases, restaurant and foodservice providers are including pasta sauces into the offering, which is gradually driving the market growth. In fact, sustainable and eco-friendly food packaging is important and influencing consumers purchasing decisions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.5% |

The European Union is shaping up as a vital market for the vegan pasta sauces hand over fist since the rising consumer awareness on the plant-based diets and organic food products. Industries in the region, like Germany, France, and Italy, are also embracing the dairy-free and gluten-free sauces trend as the cases of lactose intolerance increase among youngsters, along with clean eating.

The rising popularity of Mediterranean cuisines and plant-based diets has also contributed to the increase in the consumption of vegan pasta sauces. Additionally, this encourages brands to offer healthier, preservative-free options made from natural ingredients, backed by the strict local EU food regulations that advocate transparency and sustainability.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.7% |

Japan’s vegan pasta sauce market is growing on the back of increasing consumer demand for dairy-free and plant-based food products. The need to secure umami flavors has seen the rise of creative vegan sauces with the likes of miso, mushrooms and seaweed extracts.

Moreover, the proliferation of vegan-friendly restaurants and plant-based food festivals is turning more people on to dairy-free pasta sauce options. The increasing number of flexitarian and health-conscious users is also propelling demand for supplementary nutrients-infused sauces. Increasingly, Japanese consumers can find various vegan pasta sauce brands through expanding e-commerce and specialty food-store options.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.2% |

The Korean vegan pasta sauce market is growing as plant-based diets and Western-inspired cuisines gain popularity in South Korea. Younger consumers looking for healthier food options have also driven the demand for dairy-free and clean-label products.

Moreover, the rise of social media influencers and food bloggers promoting plant-based recipes has also contributed to the growing interest in vegan pasta sauces. The growth of premium grocery stores and online foods delivery platforms are also improving product availability. To satisfy local palate, brands have been rolling out unique blends sauces with Korean-inspired flavors as interest in plant-based meals grows among consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.3% |

| Source | Market Share (2025) |

|---|---|

| Tomato | 48% |

Tomato-based pasta sauces covering vegan segment constitutes the maximum market share owing to their familiar taste, thicker texture and ability to go with different cuisines. Consumers prefer tomato sauces since they are easy to prepare, have natural umami flavors and high antioxidant levels, especially lycopene, with health benefits in heart health and inflammation reductions.

Health-conscious consumers seeking clean-label options are also driving demand, particularly with organic, low-sodium and sugar-free tomato-based sauces. Vegan creamy other sources such as coconut-based and lemon-infused are gaining the attention of past consumers, especially consumers looking for dairy-free creamy textures and citrusy flavor enhancements.

Lemon-based sauces, on the other hand, are more likely to be popular among those who enjoy adding a brighter flavor to their pasta dishes, and coconut-based varieties provide a silky and velvety texture that many have come to prefer over cream-based ones. Advancements in plant-based components from cashew-based and herb-infused sauces are also expanding consumer options and market growth.

Fortified variants with added protein, probiotics and other functional superfoods are being launched by brands to meet the rising consumer demand for nutrient-rich, plant-based convenience foods. With increasing popularity of vegan and flexitarian eating styles, the demand for range of pasta sauces with rich flavors and health benefits is likely to grow even more.

| Distribution Channel | Market Share (2025) |

|---|---|

| Retail Sales | 55% |

Retail sales continue to be the primary distribution channel since supermarkets, grocery stores, and specialty stores provide a great variety of vegan pasta sauces with promotional deals and easy access. The physical store is the most suitable for product comparisons, checking ingredients and immediate purchases, making it a preferred choice regardless of the buying frequency or relationship with the product.

Grocers are adding to their plant-based offerings, putting vegan pasta sauces next to gluten-free pasta, dairy-free cheeses, and other complementary items, a dynamic that only boosts sales. On the other hand, online retail is growing fast, thanks to e-commerce growth, company-focused (DTC) brands and subscription-based vegan food deliveries becoming increasingly popular.

Exclusive discounts and bulk offerings on digital platforms are appealing to consumers who prioritize convenience, and these digital platforms are offering an expanding roster of specialty and international brands. AI driven suggestions, and tailoring the shopping experience are increasing the level of consumer involvement in online retail even more.

Other factors driving the growth of the market include modern trade formats, specialty stores that serve health-conscious and organic consumers, as well as the growing demand for clean-label, allergen-free, and fortified pasta sauces.

The proliferation of vegan pasta sauces in HoReCa (hotels, restaurants and catering) is also driving the penetration of the market as foodservice provides plant-based options in their menus to fulfil the changing consumer behavior. The increasing consumer interest in vegan and flexitarian diets along with the expansion of distribution channels, both physical and online, are anticipated to propel the market’s growth foundation moving forward.

The global vegan pasta sauce market is surging ahead as the vegans in the world are on the rise and more people are inclined towards healthy eating habits. With the increasing demand for organic, clean-label, and dairy-free sauces, companies have been driven to innovate and broaden their product portfolio.

Moreover, the growth of distribution channels such as online retail and specialty grocery stores is enhancing product accessibility. Having a worldwide Compound Annual Growth Rate (CAGR) of 8.8%, the market is projected for continued growth as more consumers embrace plant-based diets and search for convenient yet nutritious meal options.

Additionally, companies are emphasizing premiumization (higher quality or more expensive products), sustainable packaging, and flavor innovations to reach a different segment of consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Primal Kitchen | 20-25% |

| Rao’s Homemade | 15-20% |

| Victoria Fine Foods | 10-15% |

| Muir Glen | 10-14% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Primal Kitchen | In 2025 , Primal Kitchen introduced an expanded range of nut-based vegan pasta sauces, catering to consumers looking for creamy, dairy-free alternatives. The company also strengthened its digital marketing presence and partnered with plant-based meal delivery services to increase brand exposure. These efforts are aimed at increasing customer engagement and expanding its loyal consumer base globally. |

| Rao’s Homemade | In 2024 , Rao’s Homemade launched an organic vegan marinara sauce using sun-ripened tomatoes and natural spices. It also invested in sustainable packaging to appeal to environmentally conscious buyers. By expanding its presence in premium grocery stores and online marketplaces, Rao’s has enhanced its brand visibility among vegan and health-conscious consumers. |

| Victoria Fine Foods | In 2025 , Victoria Fine Foods expanded its retail footprint by entering Asian and European markets, catering to the growing global demand for vegan sauces. Additionally, the company introduced a new line of oil-free pasta sauces, addressing consumer concerns about fat content while maintaining rich, authentic flavors. |

| Muir Glen | In 2024, Muir Glen introduced a new roasted garlic vegan pasta sauce, emphasizing its commitment to organic, pesticide-free ingredients. The brand also implemented eco-friendly initiatives, including sustainable sourcing and recyclable packaging, positioning itself as a leader in environmentally responsible food production. |

Key Company Insights

Primal Kitchen (20-25%)

Primal Kitchen continues to dominate the Vegan pasta sauce market with a focus on clean-label high-quality ingredients with innovative formulations. The company’s emphasis on providing dairy-free, keto-friendly, and Whole30-approved sauces has enabled it to broaden its consumer reach. Moreover, its alliances with leading retail chains and online platforms guarantee that the product reaches customers effectively and is easily accessible.

Rao’s Homemade (15-20%)

Rao's Homemade has created substantial market volume within premium organic vegan sauces. Focusing on traditional cooking techniques and fresh, natural ingredients, the brand offers health-conscious consumers an authentic taste of Italy. Rao's commitment to sustainable sourcing and eco-friendly packaging enhances its competitive advantage in the marketplace.

Victoria Fine Foods (10-15%)

Victoria Fine Foods is known for its artisan-crafted, slow-simmered sauces, vegan variety included. Its emphasis on inspired flavors from around the world and preservative less recipes have led to traction among food-minded shoppers. Expanding to international markets and the launch of some health-conscious ranges should increase its market share.

Muir Glen (10-14%)

Muir Glen is flavorful for its commitment to growing all of its tomatoes and tomato products organically and for sourcing its ingredients sustainably. By using fire-roasted tomatoes and natural herbs, the brand sets itself apart from competitors. As consumers continue to demand organic and pesticide-free products, Muir Glen should be able to maintain steady growth.

Other Key Players (30-40% Combined)

Several companies contribute to the vegan pasta sauce market, offering unique flavors and formulations:

The overall market size for vegan pasta sauce market was USD 53.46 million in 2025.

The vegan pasta sauce market expected to reach USD 124.26 million in 2035.

Growing veganism, lactose intolerance concerns, health-conscious consumers, clean-label trends, and increasing plant-based product innovations will drive the vegan pasta sauce market during the forecast period.

The top 5 countries which drives the development of vegan pasta sauce market are USA, UK, Europe Union, Japan and South Korea.

Retail sales driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Users, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Users, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Users, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by End Users, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by End Users, 2018 to 2033

Table 41: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 45: MEA Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 47: MEA Market Value (US$ million) Forecast by End Users, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ million) by End Users, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End Users, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 27: North America Market Value (US$ million) by End Users, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End Users, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by End Users, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Source, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by End Users, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 93: Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Users, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ million) by Source, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ million) by End Users, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Users, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ million) by Source, 2023 to 2033

Figure 122: MEA Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 123: MEA Market Value (US$ million) by End Users, 2023 to 2033

Figure 124: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: MEA Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: MEA Market Value (US$ million) Analysis by End Users, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by End Users, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 141: MEA Market Attractiveness by Source, 2023 to 2033

Figure 142: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Users, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Vegan Egg Market - Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA