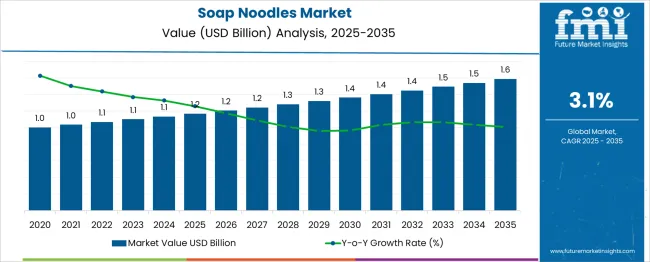

The Soap Noodles Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period. The market exhibits a typical technology and adoption lifecycle for a mature, commodity-driven industry. From 2020 to 2024, the market is in the early adoption phase, growing from USD 1.0 to USD 1.1 billion. During this period, conventional tallow- and palm-based soap noodles dominate, analogous to “hydraulic” technologies established, widely used, and low-risk. Niche specialty variants, such as organic or synthetic blends (comparable to electric, hydraulic and EPS in other sectors), see limited adoption due to higher costs and regulatory constraints.

From 2025 to 2030, the market enters the scaling phase, expanding from USD 1.2–1.4 billion. Adoption broadens as manufacturers increasingly incorporate specialty ingredients, driven by rising demand for premium, eco-friendly, and high-performance soap products. Conventional soap noodles continue to dominate, but electric, hydraulic-like segments and higher-value specialty blends are gaining steady traction in industrial and personal care applications. Between 2030 and 2035, the market transitions to consolidation, reaching a value of USD 1.6 billion. Growth slows as most production and consumption patterns stabilize. Specialty and premium variants achieve wider market penetration, while conventional soap noodles continue to dominate in mass-market applications. The overall market maturity curve is sigmoid-shaped, reflecting early experimentation, steady scaling, and eventual stabilization, with segments mapped according to adoption readiness, cost, and value proposition.

| Metric | Value |

|---|---|

| Soap Noodles Market Estimated Value in (2025 E) | USD 1.2 billion |

| Soap Noodles Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The soap noodles market is experiencing robust growth driven by the increasing demand for personal care products, rising awareness of hygiene, and growing preference for sustainable and plant-based ingredients. Soap noodles serve as the foundational base for a wide range of soaps, and their versatility has enabled manufacturers to tailor formulations according to regional skin types, climate conditions, and consumer preferences.

The use of renewable raw materials such as palm and coconut oil is being promoted in response to environmental concerns, regulatory mandates, and evolving consumer expectations. Additionally, manufacturers are leveraging modern saponification processes to reduce energy consumption, lower carbon emissions, and enhance product consistency.

Expanding middle-class populations and urbanization trends, particularly in Asia-Pacific and Latin America, are creating strong demand for affordable, high-quality hygiene products. As global consumers become more conscious of ingredients and transparency in product sourcing, soap noodles derived from vegetable oil are gaining favor, further boosting innovation in product development and regional supply chain integration.

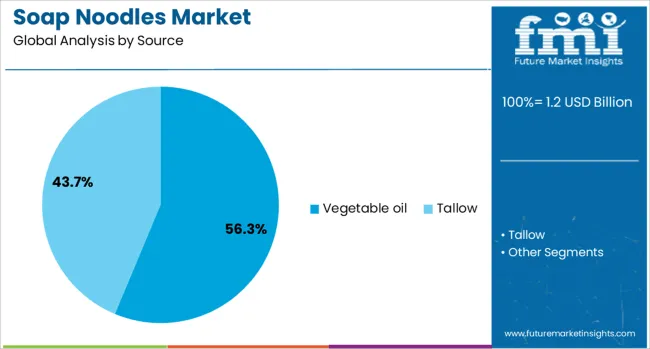

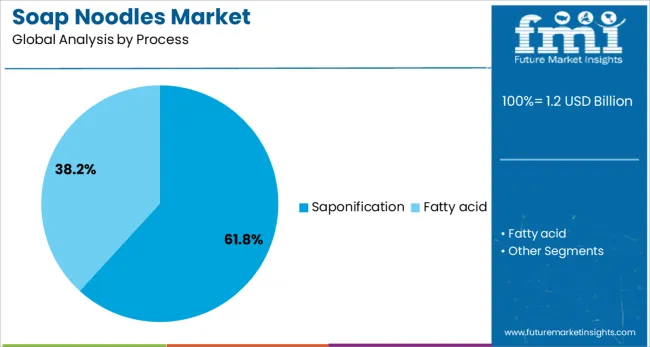

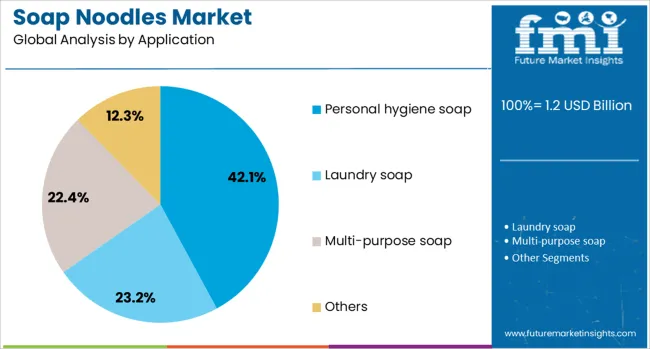

The soap noodles market is segmented by source, process, application, and geographic regions. By source, the soap noodles market is divided into Vegetable oil and Tallow. In terms of the process, the soap noodles market is classified into Saponification and Fatty acid. Based on application, the soap noodles market is segmented into Personal hygiene soap, Laundry soap, Multi-purpose soap, and others. Regionally, the soap noodles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vegetable oil is expected to account for 56.3% of the revenue share in the soap noodles market in 2025, making it the most widely used source. The dominance of this subsegment is being driven by the increasing global shift toward sustainable and plant-based raw materials. Vegetable oil-based soap noodles are perceived as skin-friendly, biodegradable, and ethically sourced, aligning well with consumer demand for environmentally conscious products.

Regulatory encouragement for the use of renewable feedstocks and certification standards such as RSPO have further propelled the use of vegetable oil in soap production. Manufacturers are increasingly adopting palm oil and coconut oil for their high fatty acid content, stable pricing, and abundant availability in tropical regions.

Moreover, the flexibility of vegetable oil in supporting both transparent and opaque soap formulations has reinforced its adoption across personal care and commercial hygiene sectors. These factors collectively position vegetable oil as the leading source segment in the soap noodles market.

Saponification is projected to hold a 61.8% revenue share in the soap noodles market in 2025, emerging as the dominant production process. The continued preference for saponification is being influenced by its ability to produce high-quality, chemically stable soap noodles with consistent properties. This process enables controlled reactions between fats and alkalis, resulting in soap bases that are well-suited for mass-scale manufacturing with predictable performance characteristics.

The scalability and cost-efficiency of saponification have made it the standard method across large manufacturing units, particularly in regions with established soap production clusters. Its compatibility with a wide range of natural oils and its suitability for cold or hot processing have further expanded its adoption.

Additionally, the reduced environmental footprint associated with modern saponification processes, including lower energy usage and waste generation, is supporting its continued use. These technical and economic advantages are contributing to the segment’s dominant role in the market.

Personal hygiene soap is projected to represent 42.1% of the overall revenue share in the soap noodles market by 2025, making it the largest application segment. The growth of this segment is being driven by heightened consumer awareness around health and sanitation, especially in the wake of global health crises and pandemic preparedness. The demand for antibacterial and moisturizing soaps has significantly increased, fueling the consumption of soap noodles in personal hygiene applications.

Public and private initiatives promoting handwashing, hygiene education, and safe sanitation practices have amplified soap usage across urban and rural populations. Additionally, personal hygiene soaps are being reformulated to include herbal extracts, essential oils, and skin-conditioning agents, enhancing their appeal to health-conscious consumers.

Manufacturers are leveraging software-defined production environments to fine-tune batch customization and fragrance profiles. These evolving consumer preferences, combined with a surge in demand from emerging markets, are sustaining the leading position of personal hygiene soap in the soap noodles application landscape.

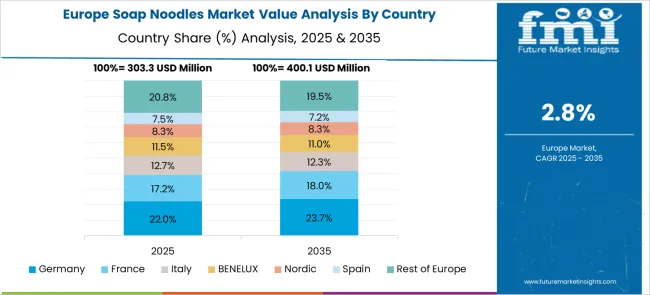

The soap noodles market is expanding steadily due to growing demand for personal care and household cleaning products. Soap noodles, the raw material for soap bars and detergents, are widely used across residential, commercial, and industrial applications. Asia-Pacific leads the market with high consumption and production of soaps, while North America and Europe focus on high-quality, specialty, and fragrance-rich formulations. Increasing preference for mild, skin-friendly, and natural ingredient-based soaps is driving innovation and expanding applications, supporting long-term growth in global soap noodles demand.

Soap noodles are essential in manufacturing bath soaps, laundry soaps, and detergent bars. Increasing awareness of personal hygiene, rising disposable incomes, and growing urban populations are fueling soap consumption. Commercial establishments and hospitality sectors also drive demand for bulk soap products. Manufacturers are focusing on versatile soap noodles suitable for different formulations, including glycerin-rich, fragrance-enhanced, and skin-sensitive variants. The consistent need for soaps in everyday cleaning and hygiene practices ensures stable market growth, with both large-scale soap producers and small businesses relying on high-quality soap noodles for product development.

Producers are developing soap noodles with improved skin compatibility, moisturizing properties, and fragrance retention. Specialty soap noodles incorporate natural oils, herbal extracts, and aesthetic features for premium consumer products. Innovations in saponification techniques and blending methods enhance product consistency and performance. Tailored soap noodles enable manufacturers to differentiate offerings in competitive personal care markets. By improving soap quality, fragrance stability, and foam characteristics, manufacturers meet evolving consumer preferences. These advancements increase consumer trust in end products, encouraging broader adoption and supporting growth in specialty and premium soap segments.

Asia-Pacific dominates due to large-scale soap manufacturing and high population-driven consumption. India, China, and Southeast Asia are major producers and consumers of soap noodles. North America and Europe focus on quality-certified and fragrance-rich variants catering to premium segments. Regional demand is influenced by hygiene awareness campaigns, rising household spending, and industrial consumption in hotels and hospitals. Local production capacities and import-export trends shape the global supply-demand balance. Expanding industrial and household use, coupled with increasing awareness of safe and effective cleaning products, drives consistent growth in soap noodles across all regions.

Soap noodle manufacturers are forming partnerships with suppliers, distributors, and cosmetic companies to expand reach and ensure consistent supply. Collaborations enable co-development of customized formulations for different market segments, including skin-sensitive, organic, and fragrance-enhanced variants. Alliances with distributors and logistics providers ensure timely delivery to bulk consumers, including soap makers and industrial users. Joint ventures also support regional expansion and compliance with local regulations. By leveraging partnerships, companies strengthen their market presence, improve production efficiency, and meet diverse consumer needs, fostering growth in global soap noodle consumption.

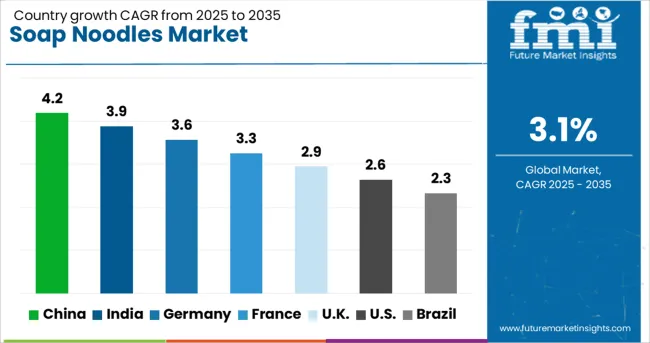

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The soap noodles market is projected to grow at a CAGR of 3.1%, reflecting steady demand from soap manufacturers globally. China leads with a growth rate of 4.2%, driven by large-scale industrial production and extensive raw material availability. India follows at 3.9%, supported by growing personal care consumption and expansion of small and medium-sized soap manufacturers. Germany, at 3.6% growth, emphasizes high-quality production standards and exports to European markets. The UK, with 2.9% growth, leverages efficient manufacturing processes and established distribution channels, while the USA, at 2.6%, relies on consistent domestic demand and supply chain optimization. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the soap noodles market with 4.2% growth, driven by high demand from the personal care and detergent industries. Compared to India, China benefits from a large manufacturing base and established distribution networks. Rising consumer awareness about hygiene and increasing disposable income fuel demand for soaps and detergents. Domestic and export-oriented manufacturers focus on high-quality soap noodles to meet industrial requirements. Innovations in eco-friendly and biodegradable products align with environmental regulations and growing sustainability trends. Investments in modern production facilities and chemical processing technologies enhance efficiency and product quality. Urbanization and rising population densities contribute to increased consumption in both rural and urban markets. Overall, China maintains a competitive edge in the soap noodles market due to industrial capacity, technological advancement, and strong domestic and export demand.

India’s soap noodles market grows at 3.9%, driven by demand from domestic soap manufacturing and growing hygiene awareness. Compared to Germany, India focuses on cost-effective production methods and catering to mass-market brands. Rapid urbanization, rising disposable income, and population growth contribute to increasing soap consumption. Manufacturers invest in modern chemical processing technologies and efficient production lines to maintain competitiveness. Government initiatives promoting sanitation and hygiene, such as Swachh Bharat, boost product adoption across households and institutions. Export opportunities in neighboring regions provide additional growth potential. Product innovations in scented, moisturizing, and eco-friendly soap noodles enhance market appeal. The market steadily grows as domestic manufacturers expand capacity and improve distribution networks to meet rising consumer and industrial demand.

Germany’s soap noodles market grows at 3.6%, supported by demand from high-quality personal care and industrial soap production. Compared to the UK, Germany emphasizes premium product standards, regulatory compliance, and eco-friendly formulations. Consumers prefer biodegradable, sustainable, and dermatologically tested soaps, driving production of specialized soap noodles. Manufacturers focus on precision chemical processing, high-quality raw materials, and compliance with EU environmental standards. The industrial sector, including hotels and hospitality, adds to steady consumption. Innovations in formulations for sensitive skin and organic products increase product differentiation. Germany’s market benefits from technological expertise, quality assurance, and strong export potential to other European countries. Overall, the market remains stable, driven by high standards, sustainability trends, and consistent industrial demand.

The UK soap noodles market grows at 2.9%, driven by demand from both consumer and industrial segments. Compared to the US, the UK emphasizes regulatory compliance, hygiene standards, and sustainable production practices. Urban households and commercial establishments such as hotels and hospitals contribute to steady consumption. Manufacturers focus on high-quality raw materials, efficient production lines, and innovations in eco-friendly formulations. Retail and e-commerce channels facilitate distribution and access to a wide consumer base. Increasing interest in personal care, hygiene awareness, and environmental responsibility drives gradual market growth. Technological improvements in production and packaging support efficient operations. Overall, the UK market remains stable, with sustainability trends and quality standards shaping industry strategies.

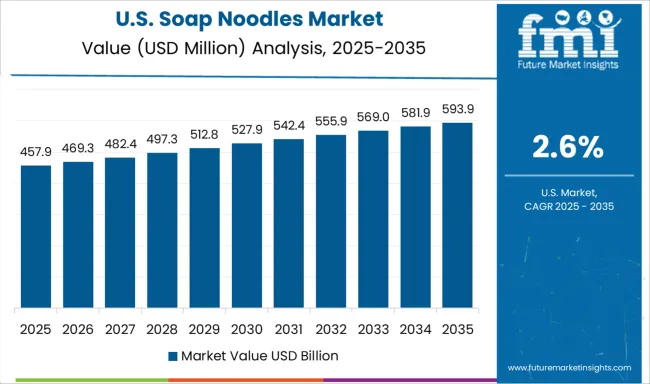

The US market grows at 2.6%, supported by demand from personal care, industrial, and hospitality sectors. Compared to China, the US focuses on premium quality, eco-friendly products, and regulatory compliance. Manufacturers emphasize innovations in moisturizing, scented, and biodegradable soap noodles to meet consumer preferences. Urbanization and lifestyle changes increase household consumption of personal care products. Industrial demand from hotels, healthcare, and cleaning industries contributes to stable growth. Advanced production facilities, quality assurance, and R&D investments improve efficiency and product standards. Distribution through retail, e-commerce, and commercial channels ensures market reach. Overall, the US soap noodles market experiences steady expansion, supported by technological innovation, environmental trends, and rising consumer hygiene awareness.

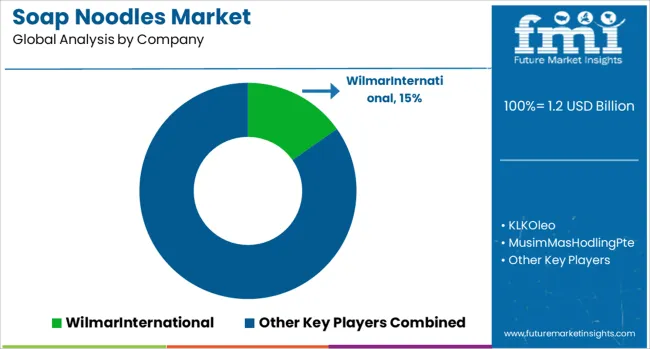

The soap noodles market is a critical segment of the global personal care and household products industry, supplying the primary raw material for soap manufacturing. Soap noodles are mainly produced from vegetable oils, animal fats, and other oleochemical feedstocks, and are used in bar soaps, liquid soaps, and detergent products. Wilmar International is one of the leading global players, known for its large-scale production of oleochemicals and soap noodles, catering to diverse markets worldwide. KLK Oleo and Musim Mas Holding Pte are major Southeast Asian manufacturers with extensive palm oil-based soap noodle production, supplying both domestic and international customers. EVYAP-OLEO and IOI Oleochemicals also play key roles in providing high-quality soap noodles to personal care and industrial soap manufacturers.

Other notable producers include Timur Oleochemicals Malaysia, which specializes in oleo-chemical derivatives for soap and detergent applications, and Jocil Limited, recognized for its diversified oleochemical product portfolio. Companies such as Rubia Industries Limited, John Drury & Co Ltd and M Bedford & Sons, and Olivia Impex Private Limited contribute significantly to regional markets with customized soap noodle solutions. The market is driven by increasing demand for personal hygiene products, rising awareness of eco-friendly and sustainable ingredients, and growing industrial soap production. Key players focus on product quality, consistency, and innovation in sustainable feedstocks to maintain competitiveness in the expanding soap noodles market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Source | Vegetable oil and Tallow |

| Process | Saponification and Fatty acid |

| Application | Personal hygiene soap, Laundry soap, Multi-purpose soap, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | WilmarInternational, KLKOleo, MusimMasHodlingPte, EVYAP-OLEO, IoiOleochemicals, TimurOleochemicalsMalaysia, JocilLimited, RubiaIndustriesLimited, JohnDrury&CoLtdandMBedforth&Sons, and OliviaImpexPrivateLimited |

| Additional Attributes | Dollar sales in the Soap Noodles Market vary by type including vegetable oil-based, animal fat-based, and synthetic-based, application across personal care, household cleaning, and industrial products, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for soap and detergent products, increasing personal hygiene awareness, and expanding manufacturing capacities. |

The global soap noodles market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the soap noodles market is projected to reach USD 1.6 billion by 2035.

The soap noodles market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in soap noodles market are vegetable oil and tallow.

In terms of process, saponification segment to command 61.8% share in the soap noodles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Soap Tablet Market Size and Share Forecast Outlook 2025 to 2035

Soap Dispenser Market Trends - Demand & Forecast 2025 to 2035

Soap Boxes Market Analysis – Growth & Demand 2025 to 2035

The Bar Soap Market is segmented by material type, application, quality, and sub-region from 2025 to 2035.

Vegan Noodles Market Growth - Plant-Based Convenience Trends 2025 to 2035

Liquid Soap Market Trends & Forecast 2025-2035

Organic Soap Market Analysis – Growth & Industry Trends 2024-2034

Electric Soap Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pasta and Noodles Market Analysis by Product Type, Usage, Distribution Channel, and Region Through 2035

Electronic Soap Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Liquid Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Cold Pressed Soap Market Analysis - Trends, Growth & Forecast 2025 to 2035

Powdered Hand Soap Market

Uncooked Pasta and Noodles Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Car Wash Detergents Market Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA