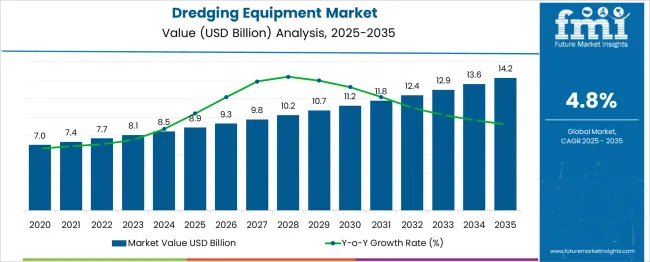

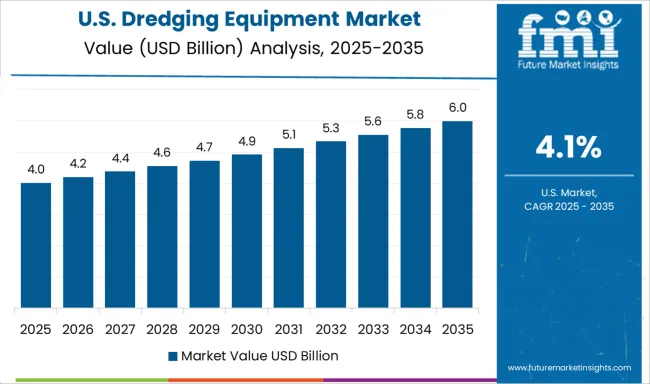

The Dredging Equipment Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 14.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. Year-on-year (YoY) growth analysis indicates consistent incremental gains, driven by increasing investments in maritime infrastructure, port expansion, land reclamation, and environmental restoration projects worldwide. From 2025 to 2026, the market is expected to grow from USD 8.9 billion to 9.3 billion, representing a YoY increase of approximately 4.5%.

This trend continues steadily, with annual growth ranging between 4.4% and 5.0% through 2030, when the market is projected to reach USD 10.7 billion. The demand is primarily fueled by ongoing port upgrades, coastal protection measures, and the deepening of waterways to accommodate larger vessels. Between 2030 and 2035, the market continues its upward trajectory, growing at an average annual rate of 4.9%, ultimately reaching USD 14.2 billion.

Emerging economies in Asia-Pacific, Africa, and the Middle East are expected to drive much of this growth due to infrastructure development and the modernization of trade routes. The stable YoY expansion reflects long-term investment in global shipping, climate resilience, and waterway management strategies.

| Metric | Value |

|---|---|

| Dredging Equipment Market Estimated Value in (2025 E) | USD 8.9 billion |

| Dredging Equipment Market Forecast Value in (2035 F) | USD 14.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Dredging Equipment market is a core segment within the broader marine and offshore infrastructure equipment market, which is itself a part of the global construction and heavy equipment industry, valued at over USD 1.5 trillion as of 2025. Dredging equipment plays a critical role in waterway maintenance, land reclamation, coastal protection, and port construction activities essential for global trade, urban expansion, and climate adaptation. Within the parent market, marine infrastructure equipment accounts for approximately 8–10% of the total construction equipment sector, with dredging equipment representing around 15–20% of that segment. This positions the global dredging equipment market at about USD 8.9 billion in 2025, and it is expected to reach USD 14.2 billion by 2035. Growth in this market is primarily driven by increasing global seaborne trade, expansion of port capacities, and rising investments in climate resilience projects such as flood defenses and shoreline stabilization. Additionally, urban development in coastal regions has led to a surge in land reclamation projects, especially in Asia-Pacific and the Middle East. Key players in the parent market include Royal IHC, Ellicott Dredges, Damen Shipyards, Hyundai Heavy Industries, and DSC Dredge, who design and manufacture a wide range of dredgers, pumps, and excavation systems tailored for both maintenance and capital dredging projects.

The dredging equipment market is undergoing substantial transformation as coastal infrastructure development, port expansions, and inland waterway projects gain momentum globally. Increased government investments in maritime trade facilitation and shoreline protection have elevated the demand for high-efficiency dredging systems. As ports aim to accommodate larger vessels and climate resilience becomes a priority, dredging operations are being scaled up with more advanced, sustainable technologies.

The integration of GPS-based positioning, automation, and environmentally conscious dredging practices has improved operational precision and minimized ecological disruption. Additionally, rising focus on renewable energy projects, including offshore wind farms, is creating new application areas for dredging equipment.

With stronger regulatory frameworks shaping environmental compliance, equipment designs are being optimized to meet both performance and sustainability benchmarks. As developing economies ramp up capital dredging to support trade and flood control infrastructure, the market is expected to experience sustained long-term growth across both mechanical and hydraulic dredging segments..

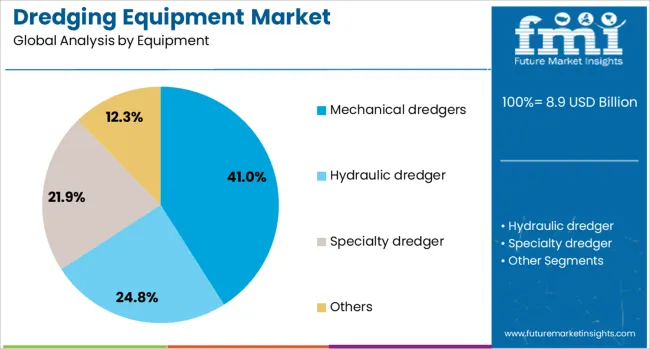

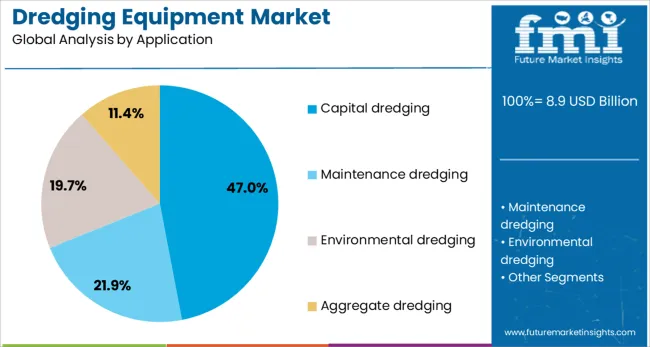

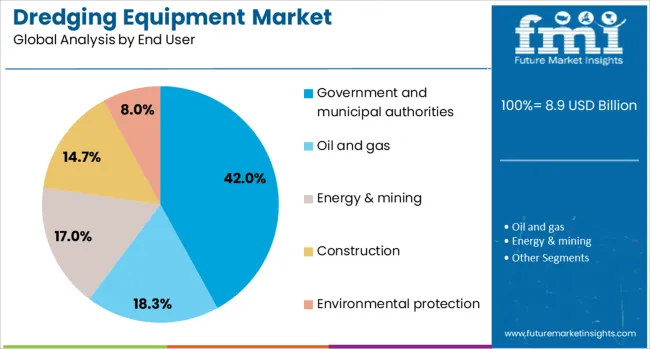

The dredging equipment market is segmented by equipment, application, end user, and geographic regions. The equipment of the dredging equipment market is divided into Mechanical dredgers, Hydraulic dredgers, Specialty dredgers, and Others. The dredging equipment market is classified into Capital dredging, Maintenance dredging, Environmental dredging, and Aggregate dredging. The end users of the dredging equipment market are segmented into Government and municipal authorities, Oil and gas, Energy & mining, Construction, Environmental protection, and Shipping & logistics. Regionally, the dredging equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical dredgers segment is expected to account for 41% of the dredging equipment market revenue share in 2025, making it the leading equipment type. The segment has been propelled by its suitability for removing compacted materials and handling heavy-duty excavation projects with precision. Mechanical dredgers, including grab and bucket types, have been widely utilized in operations where accuracy and depth control are crucial, such as harbor deepening and maintenance.

Their effectiveness in confined or urban environments has enhanced their deployment by port authorities and construction firms. Unlike hydraulic alternatives, mechanical systems have demonstrated superior performance in specific geologies and have required less complex pumping systems.

Additionally, the lower initial investment and flexibility in handling different soil types have further contributed to their preference in capital and maintenance dredging. As the demand for customized, location-specific dredging solutions increases, the mechanical dredgers segment is anticipated to retain its dominant market position..

The capital dredging segment is projected to represent 47% of the dredging equipment market revenue share in 2025, emerging as the foremost application area. This leadership is driven by increasing global investments in port infrastructure, inland navigation channels, and artificial island development. Capital dredging has been essential for creating new harbors, deepening existing ones, and reclaiming land for industrial or residential expansion.

Governments and infrastructure developers have favored this segment due to its long-term value generation and direct impact on trade logistics and coastal resilience. Advanced dredging technologies, capable of efficiently removing large volumes of sediment, have supported extensive capital projects while ensuring compliance with stringent environmental regulations.

The rise in cross-border maritime trade and global container traffic has intensified the need for deeper ports and broader access channels, further anchoring capital dredging as a critical application. This ongoing infrastructure evolution is expected to keep the segment at the forefront of market demand..

The government and municipal authorities segment is anticipated to hold 42% of the dredging equipment market revenue share in 2025, making it the largest end-use sector. The segment has grown substantially due to public sector responsibility for maintaining navigable waterways, flood management systems, and coastal protection infrastructure. Municipalities and port authorities have increasingly adopted dredging equipment to ensure the operational efficiency and safety of urban and regional maritime assets.

This demand has been further supported by public investment programs aimed at climate adaptation, erosion control, and waterway rehabilitation. Budget allocations for long-term infrastructure projects and disaster mitigation efforts have led to steady procurement of both mechanical and hydraulic dredging units.

Additionally, national initiatives to support blue economy development and inland transport infrastructure have elevated the strategic role of dredging in public policy. With growing attention on sustainability and climate resilience, government and municipal authorities are expected to remain the primary drivers of equipment demand in the coming years..

The dredging equipment market is growing steadily as global trade, port expansion and climate resilience investments increase. It serves essential roles in waterway deepening, coastal protection, land reclamation and environmental dredging. Asia‑Pacific leads in technology adoption and infrastructure projects, while North America and Europe support maintenance and remediation demand. Innovation focuses on autonomous systems, eco‑friendly propulsion and smart monitoring. Challenges include high upfront capital and operator shortages. Market evolution hinges on regulatory compliance, sustainability credentials and application‑specific customization to meet diverse regional and project needs.

Major ports and shipping channels worldwide are being upgraded to accommodate larger vessels and higher cargo volumes. Dredging is essential to deepen navigation channels and maintain harbor capacity. Government investments in maritime infrastructure, inland waterways and tourism resorts also support capital dredging activities. Global growth in trade routes drives ongoing demand for both specialized dredging vessels and mobile units. Infrastructure projects in regions such as Southeast Asia, India and the Middle East further boost deployment of cutter suction, trailing suction hopper and water injection dredgers. As trade volumes grow and logistics become more complex operators prioritize equipment that can handle larger scale dredging with reduced downtime while ensuring safe and efficient operations across diverse working environments.

Public and regulatory scrutiny around water quality, aquatic habitat disturbance and sediment disposal has elevated the need for eco‑sensitive dredging methods. Equipment that reduces turbidity, controls emissions, and supports real‑time environmental monitoring is increasingly preferred. Modern dredgers equipped with sediment containment systems, low‑impact diffuser technology, and onboard monitoring sensors address compliance and community concerns. Green dredging solutions are particularly valued in ports with sensitive marine environments or locations subject to strict environmental regulations. Manufacturers that offer vessels with low‑emission engines, energy recovery systems or hybrid power systems are gaining traction. These environmentally calibrated solutions help operators secure permits faster and support sustainability goals while differentiating offerings ahead of policy tightening in ecologically sensitive regions.

The dredging equipment market is embracing digital transformation to enhance performance and reduce operating risks. Integration of telemetry systems, real‑time performance dashboards, and predictive maintenance tools enables operators to monitor key parameters such as engine output, sediment flow rates and wear levels. Autonomous vessel prototypes and remotely controlled dredgers are under trial for reduced crew exposure and improved maneuver precision. These innovations assist deployment in deeper water or restricted zones. Digital twins of equipment allow scenario simulation and actionable insights for fleet planning. Manufacturers partnering with software developers can deliver turnkey smart dredging packages. These technology advances increase uptime, reduce operational disruptions and provide measurable economic efficiency especially for repeat dredging or large-scale maritime works.

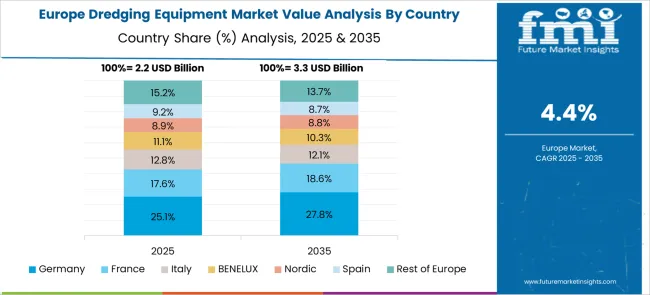

Asia‑Pacific holds the largest share of equipment deployment driven by coastal development, port expansions and flood mitigation programs. India’s coastal initiatives and China’s shipping infrastructure investments are prominent growth drivers. North America and Europe maintain steady demand for maintenance dredging, environmental remediation projects and harbour deepening programs. Middle East and Africa regions are accelerating usage as new economic corridors are developed. Latin America shows rising interest in land reclaiming logistics while local operators seek cost‑efficient dredgers. The industry is consolidated among global equipment manufacturers while regional players specialize in local servicing, customization and rental fleets. Competitive advantage comes from offering flexible financing, rapid deployment, after‑sales support and equipment tailored to specific soil, water and environmental conditions.

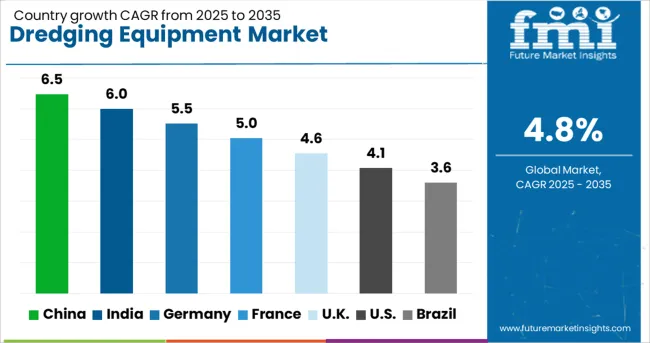

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global dredging equipment market is projected to grow at a CAGR of 4.8% through 2035, driven by expanding maritime infrastructure and coastal development. Among BRICS nations, China leads with 6.5% growth, supported by large-scale port expansion, inland waterway projects, and strong domestic manufacturing capabilities. India follows at 6.0%, backed by increasing investments in river-cleaning programs, harbor modernization, and inland dredging activities. Within the OECD region, Germany shows 5.5% growth, driven by demand for high-performance, precision-engineered dredging systems. The United Kingdom maintains steady momentum at 4.6%, supported by regulatory-driven marine infrastructure upgrades. The United States, a mature market growing at 4.1%, focuses on equipment standardization, environmental compliance, and dredging automation. These countries illustrate a diverse set of infrastructure priorities and regulatory approaches shaping global demand. This report includes insights on 40+ countries; the top markets are shown here for reference.

China has achieved a CAGR of 6.5% in the dredging equipment market, largely fueled by port expansions, river management projects, and land reclamation along coastal regions. Major infrastructure developments in areas such as the Yangtze River Economic Belt and the Guangdong-Hong Kong-Macao Greater Bay Area require continuous dredging to maintain water depth and improve shipping access. The country’s strong shipbuilding industry also supports domestic manufacturing of dredgers, including cutter suction and trailing suction hopper models. Local firms are investing in larger-capacity equipment to handle bulk operations efficiently. Government support for inland waterway development and pollution control further sustains demand. Equipment upgrades focus on fuel efficiency, GPS-guided dredging, and sediment monitoring. Demand from Asia-Pacific neighbors is growing as China increases exports of dredging vessels. Efforts to modernize older fleets and enforce stricter sediment disposal standards are also accelerating purchases across the public and private sectors.

India has recorded a CAGR of 6.0% in the dredging equipment market, propelled by government-backed port development programs and inland waterway initiatives. Projects such as Sagarmala and the Jal Marg Vikas Project are improving connectivity and boosting demand for dredgers and auxiliary equipment. Public sector units like Dredging Corporation of India are modernizing their fleets with medium-sized dredgers suited for rivers and shallow ports. Private shipyards are entering the space by building customized vessels focused on maintenance dredging. The market also benefits from the rising number of beach nourishment and flood control operations across coastal states. Equipment suppliers are offering cost-effective, modular systems designed for ease of deployment in remote areas. Leasing models are becoming popular among regional contractors to manage capex constraints. The trend toward indigenization of components is reducing dependency on imports and ensuring quicker availability of spares and service.

Germany has maintained a CAGR of 5.5% in the dredging equipment market, driven by demand for environmental dredging, harbor maintenance, and riverbed cleaning. Key waterways such as the Elbe and Rhine require periodic sediment removal to support inland shipping. German equipment manufacturers emphasize precision and environmental safety, incorporating real-time monitoring systems and energy-saving engines in dredgers. Projects are increasingly focused on reducing ecological disruption during dredging, using eco-friendly cutter heads and low-turbidity operations. Domestic firms also specialize in custom-built dredgers for use in sensitive zones, including lakes and protected marine areas. Germany exports a significant portion of its equipment to European and African countries through OEM partnerships. Interest in automation and remote-controlled vessels is also growing in the region. Investment in local canal and port refurbishment continues to support market growth, especially in northwestern states.

The United Kingdom has registered a CAGR of 4.6% in the dredging equipment market, supported by coastal protection, river dredging, and harbor maintenance programs. Authorities such as the Environment Agency and port operators rely on dredging to mitigate flooding and ensure navigability of major shipping lanes. The UK has seen a rise in use of hybrid dredgers that combine mechanical and hydraulic systems for flexible operations in both shallow and deep waters.

Smaller contractors are adopting trailer-mounted or modular dredging units for estuarine and inland applications. Technological features such as sonar-based sediment profiling and remote-control systems are gaining popularity to improve accuracy and reduce labor needs. The marine engineering sector’s emphasis on operational safety and emission controls is also driving equipment enhancements. Partnerships with Dutch and German manufacturers help introduce advanced dredging solutions tailored to UK project conditions.

The United States has observed a CAGR of 4.1% in the dredging equipment market, shaped by heavy investment in coastal restoration, port deepening, and inland navigation. Major dredging operations are conducted along the Gulf Coast, Mississippi River, and Great Lakes to maintain commercial shipping access and reduce erosion. USA Army Corps of Engineers plays a central role in awarding dredging contracts, prompting demand for specialized equipment like hopper dredgers and hydraulic pipeline systems. Equipment suppliers are integrating eco-sensitive technologies, including turbidity control and dual-fuel engines, to comply with federal environmental regulations. Leasing and build-operate-transfer models are becoming more common among regional contractors. Interest in dredging automation is increasing, particularly for hazardous or restricted-access environments. Demand is also growing in emergency dredging following hurricanes or extreme weather events, requiring quick mobilization and versatile machinery.

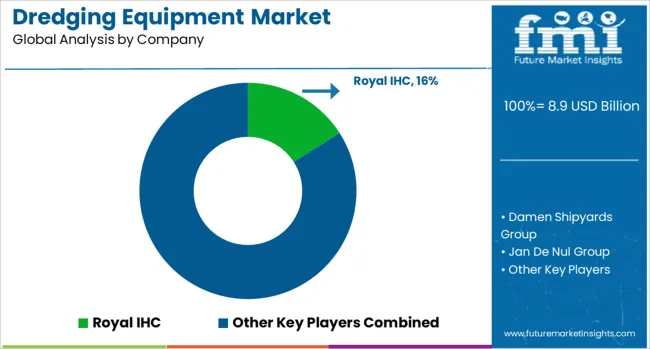

The dredging equipment market plays a key role in supporting port maintenance, land reclamation, inland waterway development, and resource extraction. With growing demand for harbor deepening, flood control, and sand mining, this market relies on robust equipment like cutter suction dredgers, trailing suction hopper dredgers, and excavator-mounted dredge systems. Operators require equipment that ensures continuous operation, high material throughput, and low downtime, especially in marine and riverine environments with varying soil conditions. Royal IHC and Damen Shipyards Group are among the most recognized suppliers globally, offering a wide range of custom-built and modular dredgers. Royal IHC focuses on large-scale cutter suction and hopper dredgers used in offshore and port infrastructure projects, while Damen provides standardized dredging vessels designed for ease of transport and rapid deployment. Jan De Nul Group, though primarily a contractor, also develops and deploys its own advanced fleet, contributing to high standards of dredging automation and productivity. Hyundai Heavy Industries and Liebherr Group bring heavy machinery expertise into the market with adaptable excavator-based dredging platforms and hydraulic systems suited for both land-based and floating operations. Dredge Yard and DSC Dredge focus on mid-sized and customizable dredging systems, catering to contractors seeking reliable solutions for canal maintenance and sediment removal. IHC America, a regional arm of Royal IHC, supports local operators with spare parts, technical training, and equipment service. Across the board, companies delivering durable, easily maintainable, and cost-effective equipment continue to shape competitiveness in this market.

Boskalis builds a 31,000 m³ diesel-electric dredger with Azipods, cutting fuel use by 20% and enabling green methanol fuel. Jan De Nul launched a plug-in hybrid 2,000 m³ dredger, reducing emissions and noise. Royal IHC offers Eco Control, two-speed gearboxes, and a hydrogen-powered H₂-Hopper for near-zero emissions.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Equipment | Mechanical dredgers, Hydraulic dredger, Specialty dredger, and Others |

| Application | Capital dredging, Maintenance dredging, Environmental dredging, and Aggregate dredging |

| End User | Government and municipal authorities, Oil and gas, Energy & mining, Construction, Environmental protection, and Shipping & logistics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Royal IHC, Damen Shipyards Group, Jan De Nul Group, Hyundai Heavy Industries, Dredge Yard, DSC Dredge, Liebherr Group, IHC America, and Others |

| Additional Attributes | Dollar sales by equipment type include mechanical dredgers (cutters, buckets, grabs) and hydraulic dredgers (trailing suction hopper, plain suction, water‑injection), used in capital dredging, maintenance/navigation, land reclamation, environmental cleanup, aggregate extraction, & oil & gas ports across North America, Europe, and Asia‑Pacific. Demand is driven by coastal development, port expansion, and environmental regulations. Innovation focuses on automation, eco‑dredgers, and diesel‑electric hybrids. Costs depend on vessel size, fuel/electric power systems, and project complexity. |

The global dredging equipment market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the dredging equipment market is projected to reach USD 14.2 billion by 2035.

The dredging equipment market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in dredging equipment market are mechanical dredgers, _cutter suction dredger (csd), _bucket dredger, _backhoe dredger, _grab dredger, hydraulic dredger, _trailing suction hopper dredger (tshd), _plain suction dredger, _water injection dredger, specialty dredger, _amphibious dredger, _auger dredger, others, _dredging support vessels, _dredging pumps and _barges and pontoon equipment.

In terms of application, capital dredging segment to command 47.0% share in the dredging equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dredging Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA