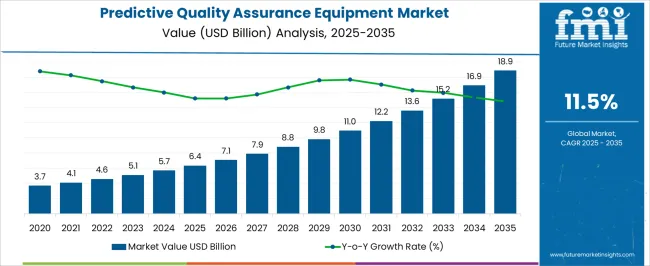

The predictive quality assurance equipment market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 18.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

This steady increase is reflective of the growing need for advanced predictive tools in ensuring product quality and consistency across various industries. With increasing global demand for precision and efficiency, particularly in sectors such as manufacturing, pharmaceuticals, and automotive, the market will benefit from the rising implementation of predictive analytics for quality control. As a result, businesses will increasingly prioritize high-accuracy solutions to minimize defects and improve production processes.

In the long-term, market expansion is driven by the increasing reliance on real-time data analytics to foresee potential quality issues before they occur. The year-on-year growth trajectory indicates a consistent upward movement, with values progressing from USD 7.1 billion in 2026 to USD 18.9 billion by 2035. This growth is expected to be fueled by a heightened focus on data-driven decision-making, enabling companies to enhance production lines with more reliable, quality-assured outputs. Demand for predictive quality assurance equipment will intensify as industries look to optimize their operational efficiency, reduce costs, and enhance customer satisfaction by maintaining superior product standards.

| Metric | Value |

|---|---|

| Predictive Quality Assurance Equipment Market Estimated Value in (2025 E) | USD 6.4 billion |

| Predictive Quality Assurance Equipment Market Forecast Value in (2035 F) | USD 18.9 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The predictive quality assurance equipment market holds a niche but growing share across several key parent markets. In the quality assurance market, it represents approximately 4-5%, as organizations increasingly adopt predictive technologies to enhance product quality and optimize production processes. Within the manufacturing equipment market, the share is around 2-3%, reflecting the rising demand for advanced machinery that integrates predictive analytics to ensure the consistency and reliability of manufactured goods. In the industrial automation market, predictive quality assurance equipment accounts for about 3-4%, driven by the broader trend of automation in production lines that rely on predictive maintenance and real-time monitoring to reduce errors and inefficiencies.

In the machine learning and AI market, the share of predictive quality assurance equipment is around 1-2%, as AI-driven tools are leveraged to forecast potential defects and improve product design and manufacturing processes. In the process control market, predictive quality assurance equipment holds an estimated 2-3%, as industries use these systems to monitor and control critical process variables, ensuring high-quality outputs in sectors such as chemicals, food, and pharmaceuticals. This market’s growing presence across these sectors highlights the increasing reliance on data-driven tools and predictive models to improve efficiency, minimize defects, and maintain high-quality standards in manufacturing processes.

The market is experiencing strong growth, driven by the increasing need for proactive maintenance and quality control in industrial operations. The integration of advanced analytics and real-time monitoring technologies is enabling organizations to detect and address potential equipment failures before they occur, thereby reducing downtime and operational costs.

Growing adoption across manufacturing, energy, and process industries is being supported by the rising emphasis on efficiency, safety, and compliance with stringent quality standards. The shift toward Industry 4.0 practices is accelerating the deployment of predictive quality solutions that leverage artificial intelligence, machine learning, and IoT-enabled sensors.

Organizations are prioritizing investments in systems that provide actionable insights, optimize performance, and extend equipment life cycles As industries face heightened global competition, predictive quality assurance equipment is being recognized as a strategic tool for ensuring product integrity and operational excellence, positioning the market for sustained growth in the coming years.

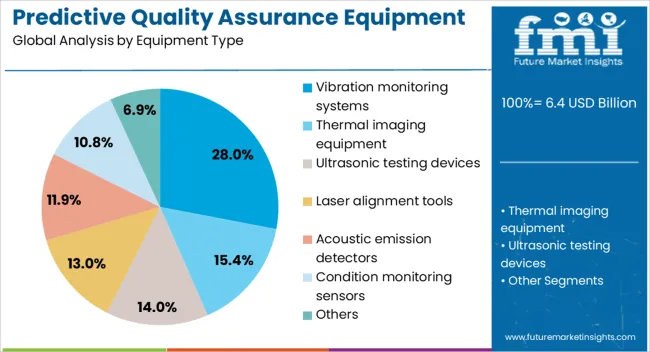

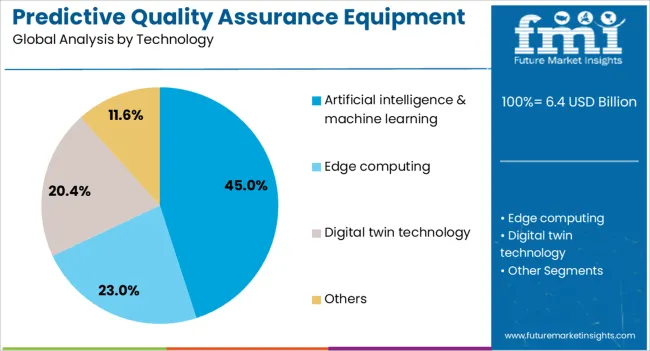

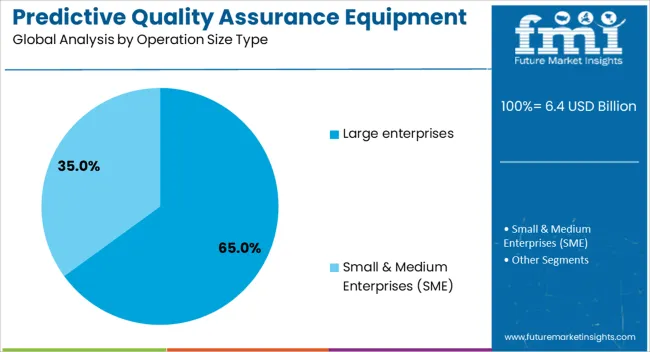

The predictive quality assurance equipment market is segmented by equipment type, technology, operation size type, application, end use, distribution channel, and geographic regions. By equipment type, predictive quality assurance equipment market is divided into vibration monitoring systems, thermal imaging equipment, ultrasonic testing devices, laser alignment tools, acoustic emission detectors, condition monitoring sensors, and others. In terms of technology, predictive quality assurance equipment market is classified into artificial intelligence & machine learning, edge computing, digital twin technology, and others. Based on operation size type, predictive quality assurance equipment market is segmented into large enterprises and small & medium enterprises (SME). By application, predictive quality assurance equipment market is segmented into rotating equipment monitoring, gearbox & bearing fault detection, tool wear and failure prediction, production line quality control, heat and pressure anomaly detection, and others. By end use, predictive quality assurance equipment market is segmented into automotive, heavy engineering & construction equipment, oil & gas machinery, aerospace & defense equipment manufacturing, metal & mining equipment, power generation equipment, and food & beverage processing machinery. By distribution channel, predictive quality assurance equipment market is segmented into direct and indirect. Regionally, the predictive quality assurance equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vibration monitoring systems segment is projected to hold 28% of the market revenue share in 2025, making it the leading equipment type. Growth in this segment has been supported by the increasing demand for early fault detection in rotating machinery and critical assets. Vibration monitoring has been widely adopted as it enables the identification of mechanical issues such as misalignment, imbalance, and bearing faults before they lead to costly failures.

The integration of predictive analytics into these systems has enhanced their accuracy and responsiveness, allowing for timely maintenance interventions. Industrial sectors with heavy reliance on continuous operations have favored vibration monitoring systems for their proven ability to extend equipment life and improve safety standards.

Additionally, advancements in sensor technology and wireless communication have made these systems easier to deploy and maintain The cost savings and operational reliability provided by vibration monitoring have been key factors driving its dominant position in the equipment type segment.

The artificial intelligence and machine learning segment is anticipated to command 45% of the market revenue share in 2025, establishing it as the leading technology. The growth of this segment has been driven by the ability of AI and ML algorithms to analyze large volumes of operational data and identify patterns that may indicate potential failures or quality deviations. The application of these technologies has enabled more accurate and dynamic decision-making, reducing reliance on manual inspections and reactive maintenance.

Real-time data processing capabilities have allowed for predictive insights that enhance product consistency and operational efficiency. Industries are increasingly deploying AI and ML-powered systems to reduce production downtime, improve throughput, and meet stringent quality benchmarks.

Continuous learning from historical and live data streams has further strengthened the precision of these solutions As organizations seek to optimize their quality assurance processes, AI and ML are expected to remain central to technological advancements in this market.

The large enterprises segment is expected to account for 65% of the market revenue share in 2025, making it the dominant operational size category. This leadership has been reinforced by the substantial financial and technological resources that large enterprises can allocate toward advanced predictive maintenance and quality assurance systems. These organizations typically operate complex production lines and maintain extensive asset portfolios, making predictive equipment essential for minimizing downtime and safeguarding productivity.

Large enterprises have prioritized solutions that integrate seamlessly with existing enterprise systems, enabling centralized monitoring and streamlined decision-making. The adoption of scalable platforms with AI-driven analytics has allowed for comprehensive oversight across multiple facilities.

Regulatory compliance requirements and the need to maintain high product standards have further motivated large enterprises to invest heavily in predictive quality technologies The proven return on investment and competitive advantage gained from enhanced operational reliability have solidified this segment’s leadership in the market.

The predictive quality assurance equipment market is expanding, driven by the growing need for improved product quality and operational efficiency across various industries. As opportunities arise from the adoption of AI and machine learning technologies, trends such as remote monitoring and data-driven optimization are reshaping the landscape. However, challenges like high costs and integration complexities remain, posing barriers to widespread adoption. The market is set to continue growing as businesses seek innovative solutions to enhance product quality and meet ever-stricter quality standards.

The demand for predictive quality assurance (QA) equipment is rising as industries seek to improve product quality, reduce defects, and streamline manufacturing processes. As consumer expectations for high-quality products increase, businesses across sectors like automotive, electronics, and food production are turning to predictive QA systems to anticipate and resolve quality issues before they occur. This demand is being further amplified by the growing complexity of manufacturing processes and the need to maintain consistency in product quality. Predictive QA equipment offers a proactive approach to problem-solving, thus enabling companies to maintain competitive advantage.

Opportunities in the predictive quality assurance equipment market are expanding as businesses strive to achieve operational efficiency and reduce waste. As global competition increases, companies are leveraging predictive analytics to drive process optimization and ensure compliance with stringent quality standards. In industries such as pharmaceuticals and automotive, the use of predictive QA systems enables earlier detection of potential failures, reducing costly recalls and improving overall production cycles. The increasing adoption of AI and machine learning is poised to further enhance the capabilities of predictive QA equipment, opening new growth opportunities for the market.

One of the dominant trends in the predictive quality assurance market is the integration of AI and machine learning algorithms into equipment systems. These systems can analyze real-time production data, predict defects, and recommend corrective actions before problems affect product quality. Another trend is the shift towards cloud-based predictive QA platforms, enabling remote monitoring and faster decision-making. The focus on data-driven insights to optimize production processes is growing rapidly, offering companies a way to improve product consistency, reduce downtime, and enhance overall manufacturing productivity.

Despite the promising growth of predictive QA equipment, several challenges remain that could hinder widespread adoption. The high initial investment costs associated with implementing predictive systems can be a deterrent for small and medium-sized enterprises. Furthermore, integrating predictive QA equipment into existing manufacturing setups can be complex and time-consuming. There is also the challenge of ensuring the accuracy and reliability of data inputs, as poor data quality can lead to incorrect predictions and unreliable results. Overcoming these challenges will be key to unlocking the full potential of predictive QA systems.

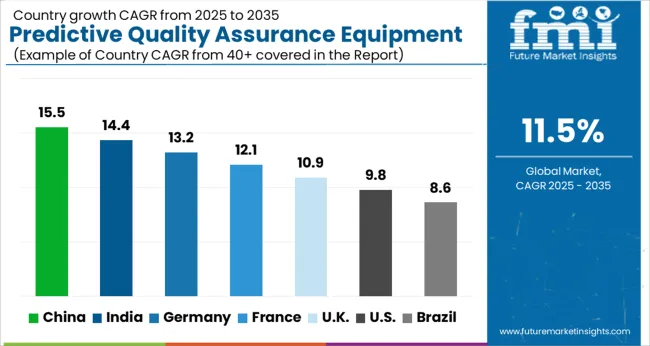

| Country | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| France | 12.1% |

| UK | 10.9% |

| USA | 9.8% |

| Brazil | 8.6% |

The global predictive quality assurance equipment market is projected to grow at an 11.5% CAGR from 2025 to 2035. China leads with a growth rate of 15.5%, followed by India at 14.4%. France records a growth rate of 12.1%, while the United Kingdom shows a 10.9% growth rate, and the United States has the slowest growth at 9.8%. This growth is driven by the increasing adoption of automation and data analytics in manufacturing and production processes, with predictive quality assurance (QA) systems playing a pivotal role in ensuring product quality. The demand for predictive QA solutions is expanding rapidly in emerging markets like China and India, fueled by industrialization and technological advancements, while mature markets like the USA and the UK experience steady growth due to greater focus on operational efficiency and quality improvement. This report includes insights on 40+ countries; the top markets are shown here for reference.

The predictive quality assurance equipment market in China is expected to grow at a CAGR of 15.5%. China’s rapid industrialization, coupled with a strong focus on improving manufacturing processes and product quality, is driving the demand for predictive QA solutions. The country’s emphasis on smart manufacturing and the integration of Industry 4.0 technologies further accelerates the adoption of predictive equipment in production lines. Moreover, China’s investment in automation, AI, and machine learning to improve manufacturing efficiency and product quality is significantly boosting market growth. The growing demand for high-quality products across industries such as automotive, electronics, and pharmaceuticals is also contributing to this upward trend.

The predictive quality assurance equipment market in India is projected to grow at a CAGR of 14.4%. India’s expanding manufacturing sector, along with the government’s initiatives to promote automation and digitalization in industries, is fueling demand for predictive QA solutions. The rise of smart factories, coupled with increased adoption of data analytics and AI in production processes, is further contributing to market growth. India’s growing focus on improving product quality, reducing waste, and enhancing operational efficiency is driving the adoption of predictive QA systems in various sectors, including automotive, food processing, and textiles. These factors, along with rising investments in industrial automation, are expected to continue supporting market growth.

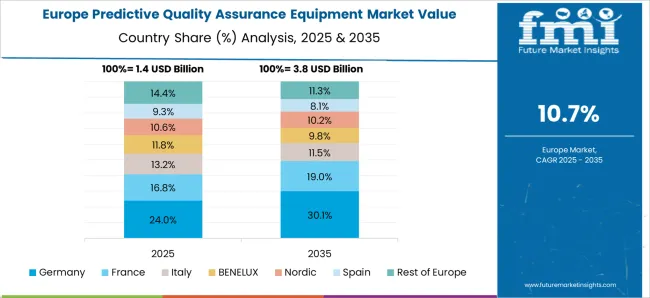

The predictive quality assurance equipment market in France is expected to grow at a CAGR of 12.1%. France’s strong industrial base and commitment to improving manufacturing efficiency through automation are key drivers of this market. The country’s focus on incorporating predictive quality assurance systems across its manufacturing sectors, including aerospace, automotive, and pharmaceuticals, is fostering steady growth. Additionally, the increasing need for high-quality products, alongside the growing trend of sustainability in production, is accelerating the demand for predictive QA equipment. France’s emphasis on digital transformation and adoption of smart technologies further supports the market’s expansion, as industries strive to enhance productivity while reducing waste.

The predictive quality assurance equipment market in the United Kingdom is projected to grow at a CAGR of 10.9%. The UK’s emphasis on enhancing manufacturing efficiency and ensuring product quality through automation and data analytics is fueling the adoption of predictive QA solutions. The increasing integration of AI and machine learning technologies in production processes is helping industries improve product quality while reducing costs and waste. The growing demand for predictive QA systems in industries such as automotive, food, and electronics further drives market growth. Additionally, the UK government’s initiatives to promote the adoption of Industry 4.0 technologies and digitalization in manufacturing contribute to the continued expansion of the market.

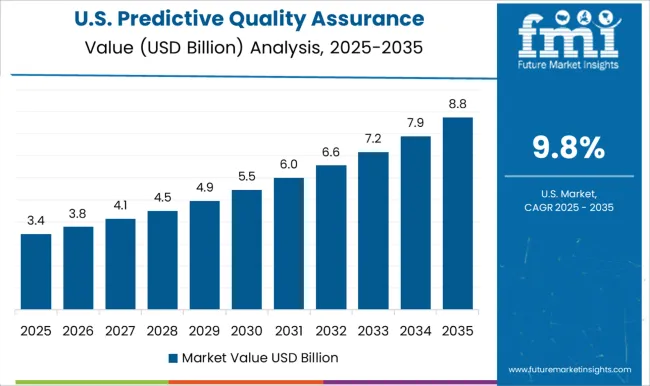

The predictive quality assurance equipment market in the United States is projected to grow at a CAGR of 9.8%. The demand for predictive QA systems is being driven by the increasing need for high-quality products in manufacturing sectors such as automotive, electronics, and pharmaceuticals. The USA market benefits from advanced manufacturing technologies, including AI, machine learning, and automation, which improve production efficiency and quality control. Moreover, the focus on reducing operational costs, enhancing sustainability, and meeting strict regulatory standards is accelerating the adoption of predictive QA solutions. Although the growth rate is slower compared to emerging markets, the continued focus on quality improvement and efficiency ensures steady market expansion in the USA

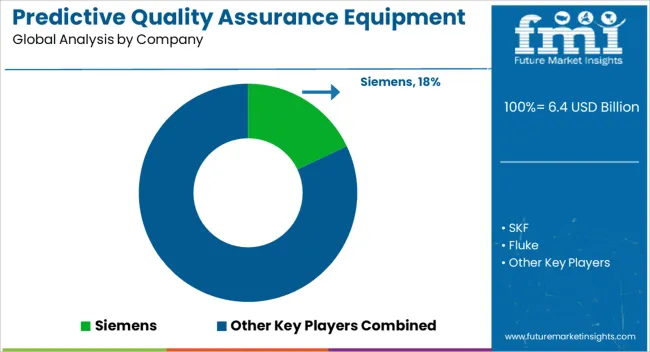

The predictive quality assurance equipment market is highly competitive, with major players such as Siemens, SKF, Fluke, Emerson, Honeywell, GE Digital, Rockwell Automation, National Instruments, and ABB leading the way. Siemens, with its extensive industrial automation portfolio, offers predictive maintenance and quality assurance solutions that help manufacturers optimize production and reduce downtime. SKF, known for its expertise in bearings and seals, has expanded its offerings to include predictive maintenance equipment, enabling real-time monitoring of equipment health. Fluke is a key player in industrial testing and measurement solutions, providing tools for predictive diagnostics to enhance product quality and reliability. Emerson and Honeywell offer integrated solutions that combine predictive quality assurance with process control, focusing on minimizing risks and improving operational efficiency.

Their solutions are widely adopted in industries such as oil and gas, automotive, and manufacturing. GE Digital leverages its advanced industrial internet of things (IIoT) capabilities to offer predictive analytics platforms that improve product quality through data-driven insights. Rockwell Automation provides automation solutions that integrate predictive quality assurance with manufacturing operations, offering tools for real-time monitoring and quality control. National Instruments and ABB further strengthen the market with their state-of-the-art equipment and software platforms, designed to monitor and improve product quality through predictive analysis. The competitive landscape is shaped by innovation, advanced analytics, and a strong focus on delivering reliable, real-time quality assurance solutions across diverse industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.4 Billion |

| Equipment Type | Vibration monitoring systems, Thermal imaging equipment, Ultrasonic testing devices, Laser alignment tools, Acoustic emission detectors, Condition monitoring sensors, and Others |

| Technology | Artificial intelligence & machine learning, Edge computing, Digital twin technology, and Others |

| Operation Size Type | Large enterprises and Small & Medium Enterprises (SME) |

| Application | Rotating equipment monitoring, Gearbox & bearing fault detection, Tool wear and failure prediction, Production line quality control, Heat and pressure anomaly detection, and Others |

| End Use | Automotive, Heavy engineering & construction equipment, Oil & gas machinery, Aerospace & defense equipment manufacturing, Metal & mining equipment, Power generation equipment, and Food & beverage processing machinery |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, SKF, Fluke, Emerson, Honeywell, GE Digital, Rockwell Automation, National Instruments, ABB, and Others |

| Additional Attributes | Dollar sales by product type (hardware, software), dollar sales by form (sensors, monitoring systems, software solutions), trends in automation and real-time data analytics, use in manufacturing and production quality control, growth in demand for predictive maintenance and process optimization, and regional patterns of adoption across industries such as automotive, electronics, and pharmaceuticals. |

The global predictive quality assurance equipment market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the predictive quality assurance equipment market is projected to reach USD 18.9 billion by 2035.

The predictive quality assurance equipment market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in predictive quality assurance equipment market are vibration monitoring systems, thermal imaging equipment, ultrasonic testing devices, laser alignment tools, acoustic emission detectors, condition monitoring sensors and others.

In terms of technology, artificial intelligence & machine learning segment to command 45.0% share in the predictive quality assurance equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Touch Market Size and Share Forecast Outlook 2025 to 2035

Predictive Analytics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Predictive Automobile Technology Market

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

Quality and Compliance Management Solution Market Forecast and Outlook 2025 to 2035

Quality Process Management Application Market Size and Share Forecast Outlook 2025 to 2035

Quality Warranty Management Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring Software Market

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Power Quality Meter Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Quality Testing Equipment Market Growth – Trends & Forecast 2018-2027

Inline Quality Control Sensors Market

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Supplier Quality Management Applications Market Share

Supplier Quality Management Applications Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA