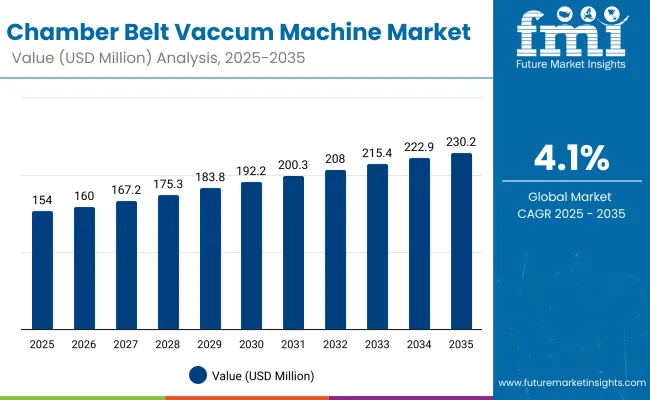

The chamber belt vacuum machine market is expected to grow from USD 154 million in 2025 to USD 230 million by 2035, resulting in a total increase of USD 76 million over the forecast decade. This represents a 49.4% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.1%. Over ten years, the market grows by a 1.5 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 154 million |

| Industry Value (2035F) | USD 230 million |

| CAGR (2025 to 2035) | 4.1% |

In the first five years (2025-2030), the market progresses from USD 154 million to USD 187 million, contributing USD 33 million, or 43.4% of total decade growth. This phase is shaped by strong demand from food processors for hygienic, high-volume sealing solutions. Increasing need for extended shelf life in meat, seafood, and dairy products drives adoption in developed markets.

In the second half (2030-2035), the market grows from USD 187 million to USD 230 million, adding USD 43 million, or 56.6% of the total growth. This acceleration is supported by automation upgrades, energy-efficient pumps, and integration with smart monitoring systems. Expanding applications in pharmaceuticals and ready-to-eat meal packaging further strengthen demand, positioning chamber belt vacuum machines as an essential packaging line investment.

From 2020 to 2024, the chamber belt vacuum machine market expanded from USD 125 million to USD 145 million, driven by demand in meat, seafood, and dairy packaging where hygienic sealing and extended shelf life are essential. Nearly 70% of revenue came from OEMs offering heavy-duty industrial systems. Leading firms such as MULTIVAC, ULMA Packaging, and Proseal focused on belt automation, double-chamber efficiency, and stainless-steel hygienic designs. Differentiation centered on vacuum consistency, throughput speed, and reduced downtime, while IoT-enabled monitoring remained secondary. Service models such as maintenance audits and calibration checks contributed under 15% of total value, with processors favoring upfront equipment investments.

By 2035, the chamber belt vacuum machine market will reach USD 230 million, growing at a CAGR of 4.10%, with smart vacuum monitoring and predictive maintenance solutions accounting for over 40% of revenues. Competition will intensify as integrated solution providers offer AI-enabled seal validation, cloud-linked production traceability, and hygienic automation upgrades. Established leaders are adapting with hybrid models combining hardware innovation with service-led digital platforms. Emerging companies such as Henkelman, WEBOMATIC, and Promarks are gaining traction by introducing energy-efficient pumps, modular chamber designs, and eco-aligned sealing systems to meet sustainability standards and evolving food safety regulations.

The rising need for efficient food preservation, extended shelf life, and hygienic packaging is driving growth in the chamber belt vacuum machine market. These machines are widely adopted in meat, seafood, and dairy processing for their ability to reduce oxidation and contamination. Expanding demand from ready-to-eat and frozen food sectors further supports adoption.

Machines equipped with automated sealing, continuous belt operation, and high-capacity vacuum pumps are gaining popularity for their ability to improve productivity. Their compatibility with diverse packaging materials and ability to handle bulk products enhance versatility. Energy-efficient designs and integration with HACCP compliance systems align with industry sustainability and safety requirements.

The market is segmented by automation level, machine size, pack format, application, and region. Automation level segmentation includes semi-automatic belt, fully automatic belt, and integrated line solutions, supporting varying operational capacities and efficiency demands. Machine size covers compact (<400 mm belt width), mid-range (401-600 mm), and large industrial (>600 mm), enabling flexible use across small to high-volume processing units. Pack format segmentation includes standard vacuum pouches, shrink bags, bone-guard bags, MAP pouches, and specialty films, ensuring extended shelf life and food safety. Applications span meat & poultry, seafood & fish, cheese & dairy, ready meals & prepared foods, and non-food industrial products. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

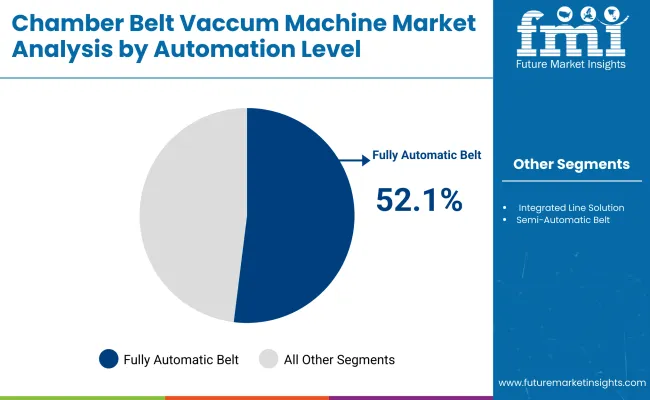

Fully automatic belt machines are projected to hold a 52.1% share in 2025, driven by demand for continuous, high-speed packaging with minimal operator intervention. These systems integrate advanced sealing technology, precision controls, and automated feeding, ensuring uniform vacuum sealing for large-scale operations. Their adoption reduces labor dependency and enhances production consistency in food processing.

Growing use in meat, dairy, and ready-meal packaging highlights their ability to handle diverse pack formats. Manufacturers prefer fully automatic systems for their scalability, integration with upstream conveyors, and compatibility with shrink or MAP processes. Their role in boosting efficiency and compliance with hygiene standards cements their leadership.

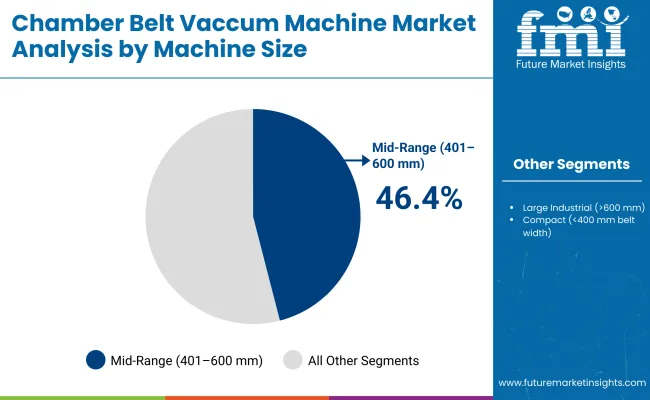

Mid-range belt machines with 401-600 mm width are forecast to account for 46.4% of the market in 2025, offering an optimal balance between compact footprint and industrial throughput. They are widely used in medium-scale food processing plants requiring versatility across multiple product categories.

These machines deliver faster changeovers and can accommodate varied pack sizes without complex adjustments. Adoption is supported by growing demand from regional processors aiming to scale production efficiently. Their ability to combine performance with cost-effectiveness positions mid-range systems as a preferred choice for mid-tier players.

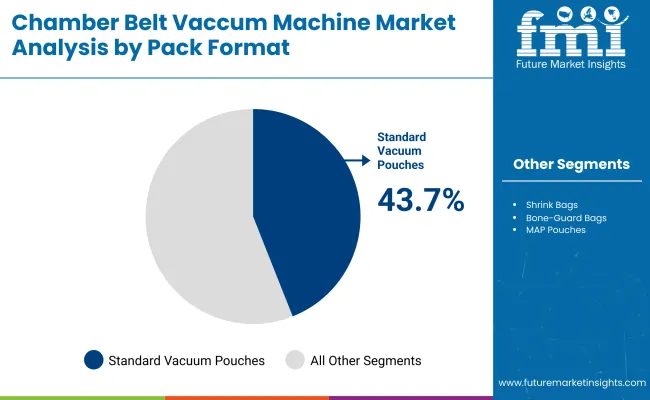

Standard vacuum pouches are expected to represent 43.7% of the market in 2025, owing to their widespread use across meat, seafood, dairy, and ready meal packaging. Their affordability, availability, and compatibility with chamber belt systems make them the most common choice in vacuum sealing.

These pouches extend shelf life by minimizing oxygen exposure, while offering flexibility in thickness and barrier properties. Food processors favor them for bulk and retail-ready packaging. Continued advancements in recyclable and high-barrier pouches are further enhancing their value proposition.

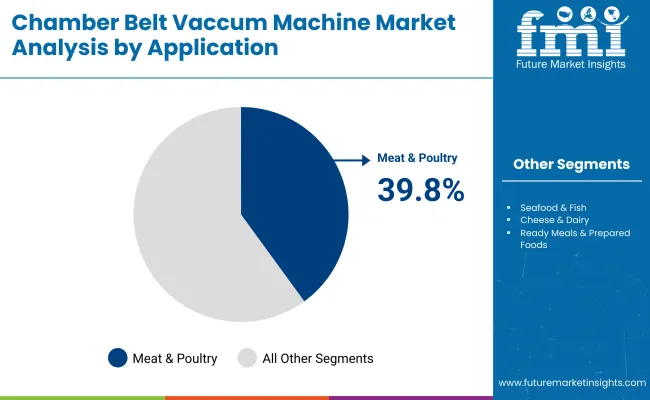

Meat and poultry packaging is projected to hold 39.8% of the market in 2025, driven by the need to extend shelf life while maintaining product quality and safety. Vacuum packaging prevents oxidation, reduces microbial growth, and preserves natural colour, making it critical for fresh and processed meats.

Chamber belt systems are increasingly adopted by large meat processors for continuous high-volume packaging. Integration with shrink and bone-guard packaging further enhances protection and consumer appeal. As global demand for protein-rich diets grows, meat and poultry remain the anchor segment for chamber belt vacuum machine adoption.

The chamber belt vacuum machine market is expanding as demand for efficient, hygienic, and high-capacity vacuum packaging solutions grows across food, pharmaceutical, and industrial sectors. Rising consumption of packaged meat, dairy, and ready-to-eat products is fuelling adoption. However, high machine costs and operational complexity challenge smaller businesses. Automation, energy efficiency, and digital integration are emerging as defining trends in the sector.

High-capacity Packaging, Food Safety, and Shelf-life Extension Driving Adoption

Chamber belt vacuum machines are widely used for their ability to deliver continuous, automated packaging of large product volumes. In food industries, they enhance safety and extend shelf life by creating airtight seals that prevent microbial growth and oxidation. Their application extends to pharmaceuticals, where sterile packaging is crucial, and to industrial goods needing moisture-free storage. Features such as automatic sealing, variable speed controls, and adaptability to different bag sizes make these machines a preferred choice for high-throughput operations.

High Capital Investment, Training Needs, and Maintenance Requirements Restraining Growth

Despite strong demand, widespread adoption is limited by significant upfront investment, making these machines less accessible to small and medium enterprises. Operational complexity requires trained personnel to ensure proper handling, while routine maintenance adds to overall costs. Integration into existing lines may also involve redesign or modification of production layouts. Additionally, power consumption and space requirements can limit feasibility in resource-constrained environments. These challenges slow market penetration despite evident operational advantages.

Automation, Energy Efficiency, and Smart Monitoring Trends Emerging

Key trends include the integration of Industry 4.0 technologies, with sensors and IoT modules enabling real-time machine monitoring and predictive maintenance. Energy-efficient vacuum pumps and sealing technologies are being developed to reduce power usage while maintaining performance. Automated cleaning systems and user-friendly interfaces are improving ease of use. Demand for customizable belt widths and machine sizes is also rising to suit varied production needs. These innovations are transforming chamber belt vacuum machines into intelligent, efficient, and sustainability-oriented packaging assets.

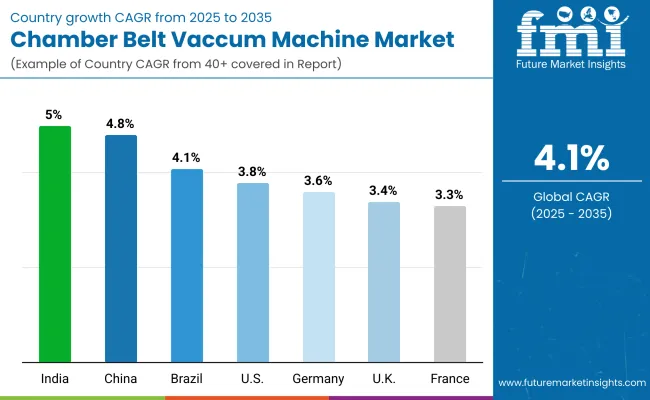

The global chamber belt vacuum machine market is growing consistently, driven by demand for efficient food preservation, extended shelf life, and automation in packaging. Asia-Pacific is emerging as the fastest-growing region, with India and China expanding rapidly due to strong growth in meat, seafood, and dairy processing sectors. Developed markets like the USA, Germany, and Japan remain focused on advanced automation, hygienic machine design, and compliance with international food safety standards, ensuring high adoption across large-scale food industries and exports.

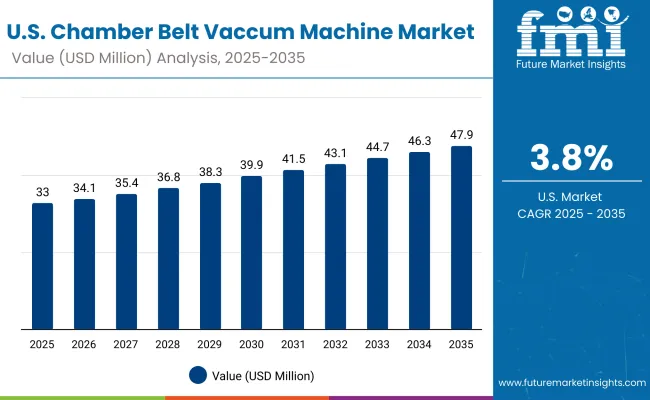

The USA market is projected to grow at a CAGR of 3.8% from 2025 to 2035, driven by demand for high-capacity vacuum systems in meat, poultry, and cheese packaging. Food processors are adopting automation-ready machines with CIP features for hygiene and efficiency. Premium brands emphasize vacuum packaging for freshness, portion control, and reduced food waste, aligning with consumer preferences. Manufacturers are integrating smart monitoring systems for quality assurance in compliance with FDA safety benchmarks.

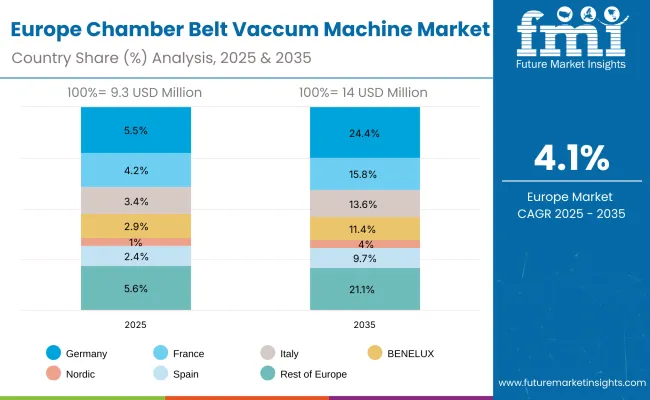

Germany’s market is expected to grow at a CAGR of 3.6%, supported by strong demand from meat, processed food, and cheese industries. The country’s focus on engineering innovation drives adoption of modular, automated vacuum machines. EU food safety standards are prompting manufacturers to upgrade to fully enclosed, contamination-resistant systems. German OEMs are also leading in predictive maintenance and energy-efficient technologies, enabling long-term reliability and lower operational costs for food packaging plants.

The UK market is forecast to grow at a CAGR of 3.4%, driven by adoption in meat, seafood, and ready-to-eat food segments. Rising consumer preference for fresh and preservative-free products is fuelling demand for vacuum machines that extend shelf life. SMEs are increasingly adopting pre-assembled, compact systems for efficiency. Compliance with FSMA and sustainability regulations is supporting innovation in recyclable packaging films and automation-integrated vacuum technologies for flexible production.

China’s market is projected to grow at a CAGR of 4.8%, fuelled by rising protein consumption, seafood exports, and government-backed food safety initiatives. Large-scale processing facilities are deploying advanced vacuum systems to meet domestic and export requirements. OEMs are localizing production with affordable, automation-compatible models. Strong demand from poultry, beef, and aquaculture segments is pushing adoption of chamber belt vacuum machines across inland and coastal manufacturing hubs, supported by rapid cold chain infrastructure expansion.

India is forecast to record the fastest growth at a CAGR of 5.0%, supported by dairy, meat, and frozen food exports. Food processors are investing in high-capacity vacuum machines to ensure compliance with FSSAI and global standards. SMEs are adopting cost-effective vacuum packaging systems to reduce spoilage. Growing cold chain infrastructure and rising consumer preference for frozen, ready-to-cook meals are fuelling adoption of chamber belt vacuum machines, particularly in urban and export-focused processing plants.

Japan’s market is projected to grow at a CAGR of 3.5%, led by demand in seafood, premium meat, and ready-to-eat foods. The focus is on compact, precision-engineered vacuum machines ensuring hygiene and portion control. Manufacturers are innovating with automation-ready, space-efficient models to meet the needs of small processing facilities. Premium food brands emphasize vacuum packaging to enhance product presentation and freshness, aligning with Japan’s strong consumer demand for quality and convenience.

South Korea’s market is expected to grow at a CAGR of 3.2%, driven by seafood, ginseng-based food, and meat processing industries. Demand is rising for hygienic, energy-efficient vacuum systems to support both domestic consumption and exports. Local firms are adopting modular chamber belt machines with automation features to optimize production efficiency. Export-driven demand for K-food products is further driving the integration of vacuum packaging systems aligned with international safety and quality standards.

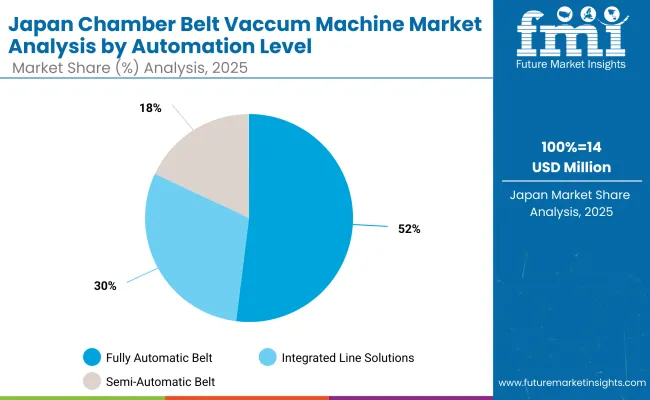

Japan’s chamber belt vacuum machine market in 2025 is valued at USD 14 million, dominated by fully automatic belt systems, which account for 49.7% of the market. Integrated line solutions hold 30.4%, while semi-automatic belts capture 19.8%. The leadership of fully automatic systems reflects increasing adoption in food and industrial packaging, driven by higher productivity, consistency, and minimal manual intervention. Integrated line solutions are also gaining traction due to operational flexibility, while semi-automatic options retain importance in cost-sensitive settings. Together, these categories highlight Japan’s balanced demand across automation levels tailored to diverse industrial requirements.

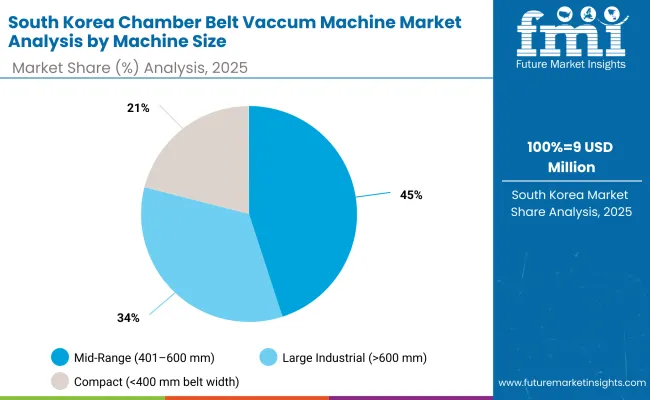

South Korea’s chamber belt vacuum machine market, valued at USD 9 million in 2025, is led by mid-range machines (401-600 mm), which command 47.1% of market share. Large industrial machines above 600 mm follow with 33.7%, while compact models below 400 mm represent 19.2%. Mid-range machines dominate due to their adaptability, efficiency, and wide use in small to medium enterprises seeking cost-effective production. Large machines cater to heavy-duty industrial packaging, while compact systems remain relevant for limited-scale applications. This distribution indicates South Korea’s strong reliance on versatile mid-sized systems while maintaining niche demand across other size segments.

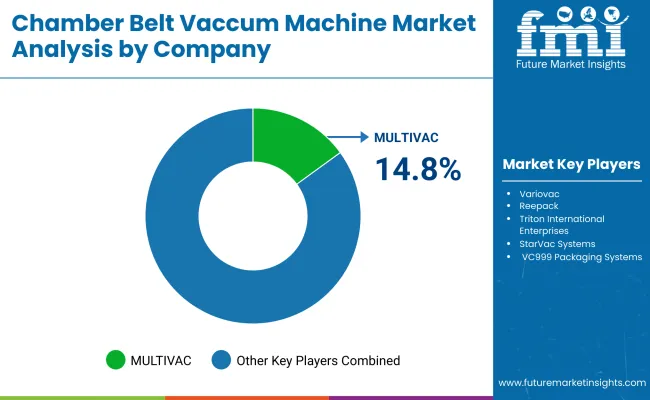

The chamber belt vacuum machine market is moderately fragmented, with packaging machinery leaders, regional engineering firms, and automation solution providers competing across meat, seafood, cheese, and ready-meal processing industries. Global leaders such as MULTIVAC, Variovac, and Reepack hold notable market share, driven by robust hygienic designs, advanced vacuum technology, and compliance with HACCP and ISO food safety standards. Their strategies increasingly emphasize energy efficiency, flexible belt configurations, and high-throughput automation.

Established mid-sized players including Triton International Enterprises, StarVac Systems, and VC999 Packaging Systems are supporting adoption of modular chamber belt machines featuring integrated sealing systems, precision vacuum control, and easy-clean stainless-steel construction. These companies are especially active in medium-scale food production, offering equipment that balances performance with cost efficiency while ensuring consistent packaging quality and extended shelf life.

Specialized providers such as Pack3000 focus on tailored vacuum machine solutions for regional processors and niche markets. Their strengths lie in customization capabilities, compact yet efficient layouts, and integration with downstream packaging lines such as labeling, weighing, and boxing systems, helping clients streamline operations and meet evolving consumer demand for securely packaged, fresh products.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 154 Million |

| By Automation Level | Semi-Automatic Belt, Fully Automatic Belt, Integrated Line Solutions |

| By Machine Size | Compact (<400 mm belt width), Mid-Range (401-600 mm), Large Industrial (>600 mm) |

| By Pack Format / Material | Standard Vacuum Pouches, Shrink Bags, Bone-Guard Bags, MAP Pouches, Specialty Films |

| By Application | Meat & Poultry, Seafood & Fish, Cheese & Dairy, Ready Meals & Prepared Foods, Non-Food Industrial |

| Key Companies Profiled | MULTIVAC, Variovac, Reepack, Triton International Enterprises, StarVac Systems, VC999 Packaging Systems, Pack3000 |

| Additional Attributes | Increasing demand for fully automated belt systems to enhance throughput and efficiency, rising adoption of integrated line solutions for end-to-end packaging automation, growing use of shrink bags and bone-guard films in meat packaging, strong demand from cheese and seafood sectors for consistent vacuum sealing, and emerging applications in non-food industries leveraging vacuum technology for industrial product preservation. |

The global chamber belt vacuum machine market is estimated to be valued at USD 154 million in 2025.

The market size for the chamber belt vacuum machine market is projected to reach USD 230 million by 2035.

The chamber belt vacuum machine market is expected to grow at a CAGR of 4.1% between 2025 and 2035.

The key automation levels in the chamber belt vacuum machine market include semi-automatic belt, fully automatic belt, and integrated line solutions.

The fully automatic belt machines segment is expected to account for the highest share of 52.1% in the chamber belt vacuum machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Dual Chamber Dispensing Bottles Market Size and Share Forecast Outlook 2025 to 2035

Dual-Chamber Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Dual Chamber Bottle Market Insights – Size, Trends & Forecast 2024-2034

Vacuum Chamber Pouches Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Chamber Packaging Machines Market

Anechoic Chamber Market Growth - Trends & Forecast 2025 to 2035

Posterior Chamber Lens Market

Photostability Chamber Market Size and Share Forecast Outlook 2025 to 2035

Stability Test Chamber Market Growth – Trends & Forecast 2019 to 2027

Flammability Test Chamber Market

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Cross-Belt Sorters Market

Packing Belt Market Insights - Growth & Forecast 2025 to 2035

Modular Belt Drive Market

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Belt Materials Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA