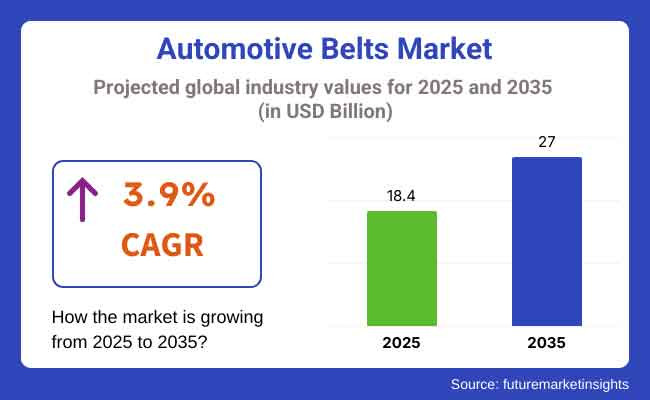

The automotive belts market is set to grow steadily from USD 18.4 billion in 2025 to USD 27.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9%. The market growth is fueled by rising global vehicle production, increasing demand for fuel-efficient and low-maintenance systems, and ongoing adoption of lightweight and durable engine components.

Automotive belts-timing belts, serpentine belts, V-belts, and drive belts being the principal ones-are pivotal in the transmission of power and operation of auxiliary systems like air conditioning compressors, alternators, water pumps, and power steering-gear. They are the driving force behind the correct engine timing and functional efficacy and are found in almost all vehicles, namely, internal combustion engine (ICE) vehicles, hybrids, and mild hybrids.

With OEMs preferring engine egg sizing, desolated emission, and improved mechanical work, the need for durable, high-strength belts that resist wear and tear is on the rise. The extending life of these high tech belts, along with an increasing emphasis on preventive maintenance on fleet and passenger cars, is the main reason for the belt market continuing to grow.

The growing trend of automation, invention of hybrid automotive systems, and use of new materials with engravings of heat, friction, and corrosion resistance are bringing the updates to the vehicular belt sector. The technology boosts the utility and demand for advanced belts by introducing new applications in-start-stop systems, belt-integrated alternator starters (BAS), and turbocharging.

North America is still a leading market, powered by a stable aftermarket for automobiles, the broad use of light commercial vehicles (LCVs), and increased vehicle park. The USA sees a greater preference for premium vehicles where high-performance belts are widely demanded in off-road vehicles, pickup trucks, and hybrid applications.

The aftermarket segment in North America gets a huge boost from the region's focus on preventive measures, which are key additional reasons to lower emissions, thus creating a demand for OE-quality replacement belts. The growth in hybrid and mild-hybrid systems encourages manufacturers to develop belts that are electrically powered and can be used in cars with electric motors.

The European market is influenced by strict CO₂ emission regulations, electric vehicle production, and the major automobile assemblers such as Volkswagen, BMW, and Daimler in the land. The redesigning of the belt systems is with aims to lower energy consumption and ensure better thermal management, especially in turbocharged engines and hybrid drivetrains.

Germany and France are the two main players in the game with the adoption of low-noise serpentine belts with highly durable coatings, while Eastern Europe shows strong aftermarket demand due to the age of vehicle fleets. With the Belt Starter Generator (BSG) systems shifting to 48V hybrids, the area will step into a multi-functional belt design with longer life efficiency.

Asia-Pacific is the number one and fastest-growing geographical zone, with China, India, Japan, and South Korea as its leading nations. The demand from the rising vehicle production, new industrial technologies, and new medium-class consumers preferring fuel-efficient cars are some of the reasons amidst the development of the market.

The edge of production in vehicles supports the belt demand in ICE-based and mild hybrid applications in China while EV production and manufacturing chains in India are driving the market to new heights. The local manufacturing of components in the region will be an additional element driving cost advantage.

The Middle East and Africa (MEA) region are characterized by steady demand from vehicle fleets, commercial transport, and aftermarket services. Toyota LCVs and SUVs are typical examples of models that demand high-performance serpentine and drive belts built for extreme temperature and dusty settings.

While urbanization takes off and import regulations shift, the focus on engine reliability and thermal start up is directing the adoption of advanced belts, manufactured from sole polymer, with extended lifespan and replacement intervals. Besides, the rising number of OEM service networks is helping the market for quality aftermarket belts.

Rise in Battery Electric Vehicle Adoption

The most serious long-term issue is the shift of the industry to battery electric vehicles (BEVs), which do not even need engine belts for functioning due to the lack of internal combustion engines. Since the BEVs' add-ons and components such as timing or serpentine belts do not have any use their demand perspective in the automotive industry is scaring.

This phenomenon is almost neutrally impacted by a robust rise in hybrid vehicles (HEVs, PHEVs, and MHEVs), which are using belts for alternators, compressors, and other engine components. Belt manufacturers must change and will change the focus to products that are compatible with electrified vehicles and they need to set up aftermarket support as well.

Price Sensitivity and Counterfeit Products in Developing Markets

Some developing market regions that are price-sensitive, particularly Asia and Africa, are flooded with cheap, non-branded belts that are often low-quality and fail to meet durability and performance requirements. The spread of counterfeit or substandard goods results in brand erosion and risks safety for not just the OEMs but for the aftermarket suppliers.

In addition, lack of knowledge regarding belt lifespan among the users promotes long usage of belts before they break which poses a risk of sudden breakdowns and damages to engine systems. Manufacturers will have to face it by increasing awareness through dealer training, warranty-backed aftermarket solutions, and lifecycle cost advantages of premium belts.

Expansion of Hybrid Vehicle Segment and Belt Start-Stop Systems

The rise of 48V mild hybrids and full hybrid electric vehicles (HEVs) is a remarkable opportunity. These cars feature Belt Starter Generators (BSGs) that decrease the need for centralized blander and make it easier to reassemble during. These functions, however, require specialized belts that have a high level of elasticity, can withstand more heat, and slip less.

OEMs are turning to belt-driven alternators for cost-effectiveness and serviceability reasons that drive the rising need for stretch-resistant, long-life, and high-load belts. The companies that will create innovative solutions for the performance of the new generation of the belts in hybrid vehicles will gain a significant benefit.

Growth in Global Automotive Aftermarket and Preventive Maintenance

The growth of the global automotive aftermarket is due to the increased vehicle life and a trend toward preventive maintenance. Belts are among the most-affected wear components, which make their replacement cycle-at times 60,000 to 100,000 km-very considerable for an aftermarket category.

Through advances in materials like EPDM and aramid-reinforced belts, aftermarket suppliers are now extending their lifespan products, thus reducing the frequency of replacements. Distributors and retail vendors are employing e-commerce platforms and predictive maintenance software to widen their access.

The popularity of DIY maintenance and fleet managers adopting total cost of ownership strategies will see the demand for premium quality replacement belts and kits rise.

During the period of 2020 to 2024, the market for automotive belts enjoyed substantial growth, thanks to the increase in worldwide vehicle production, the demand for gas-saving vehicles, and the need for replacing old parts. These automotive belts-timing belts, serpentine belts, V-belts-are the elements that efficiently transmit the power from the engine to ensure the vehicle runs smoothly.

Demand was primarily generated through the internal combustion engine (ICE) vehicles which were widespread in the developing regions with a car ownership increase. The automotive aftermarket expansion, innovations in belt durability, and application of noise-reduction technologies were the other reasons that drove the sector forward. However, the tendencies of electrification, the simplification of the EV drivetrain, and the increasing preferences toward direct drive systems began to prove long-term challenges for ICE-belt demand.

In the period of 2025 to 2035, the automotive belts market will undergo a considerable shift as the industry moves from ICE to electric and hybrid vehicles. The future will see AI-powered predictive maintenance, composite material belts, and palm less, long-life options being the precious products.

Smart tensioning systems, belt-integrated sensors, and recyclable materials in both OEMs and aftermarket will take the center stage. Even though there is a drop in ICE production, belts will stay significant in hybrid drivetrains, auxiliary systems, and specialized off-highway applications.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| ICE-Dominant Demand | High utilization of timing belts and serpentine belts in traditional engine configurations. |

| Technical advancements | Count of rubber-reinforced with fiberglass or Kevlar cords along with flexibility and strength. |

| Performance & Durability Focus | Concentration on high-load and low-noise belts in passenger cars. |

| Electrification Impact | Minimal effect on belt use of ICE and mild hybrid vehicles. |

| Predictive Maintenance & Smart Tech | Only wear indicators and scheduled replacement practices. |

| Sustainability & Circularity | The increase in sustainable materials used and the impact of service life are acknowledged. |

| Aftermarket Expansion | The expansion of replacement parts for older ICE vehicles and fleet maintenance is a marked increase. |

| Market Growth Drivers | Vehicle production, engine component wear, and aftermarket sales are the main drivers. |

| Market Shift | 2025 to 2035 |

|---|---|

| ICE-Dominant Demand | Slowly declining as EV popularity incurs, but the hybrid and auxiliary drive systems still need belts. |

| Technical advancements | Carbon fiber and thermoplastic polyurethane (TPU) belts which have a longer life are the mostly used belts. |

| Performance & Durability Focus | AI-optimized belt profiles, smart materials that adapt to thermal and mechanical stress. |

| Electrification Impact | Reduction in the number of belts used in BEVs, but the project of high-efficient belts for auxiliary systems. |

| Predictive Maintenance & Smart Tech | IoT-integrated belts with embedded sensors for tension, temperature, and wear monitoring. |

| Sustainability & Circularity | Belts with a focus on recycling, low-emission production, and carbon-negative supply chains are addressed. |

| Aftermarket Expansion | They(Older ICE vehicles) still have a role in fleet management, agriculture, and commercial off-road applications. |

| Market Growth Drivers | Future growth will be via hybrid adoption, smart diagnostic systems and biocomposite material innovation. |

The automotive belts sector in the United States is undergoing a modest expansion period, propelled by the burgeoning need for commercial vehicles, the increased aftermarket sales, and the slow but steady progress in automotive manufacturing. An important influence in the time-and-serpentine Belt Replacement market is the old vehicle population in the USA, especially in the case of passenger cars and light trucks.

The enhancement in car maintenance knowledge and increase in the applications of belt-integrated alternators, AC compressors, and water pumps are two important factors that lead to the existence of constant aftermarket sales. OEMs are the main drivers for the low-noise and long-lifetime materials combination that initiates belt innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

The automotive belts market in the United Kingdom is experiencing a slow but steady rise, empowered by the demand stability detected in the passenger car segment, and the increasing focus on vehicle efficiency and emissions reduction.

Despite the continuous increase in the adoption of electric vehicles (EVs), the vast majority of the market share is still retained by hybrid vehicles and internal combustion engine (ICE) models, thereby ensuring the ongoing need for timing belts and accessory drive belts.

The aftermarket continues to thrive, with buyers tending to prefer the OEM-grade replacements due to the rising uneasiness regarding engine malfunctioning and fuel economic matters. Along the same line, producers are devoting resources to gaining lightweight materials with abrasion resistance that would enhance performance and decrease vehicle weight.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.6% |

The growth of the European automotive belts market is attributed to automotive OEM force in Germany, France, and Italy, which in turn is boosted by the aftermarket requirement in Eastern Europe. Even though there is a continuous transition from ICE to electric vehicles, ICE and hybrid models still make up a considerable part of the total sales resulting in a positive expression of need for drive belts in engines and HVAC systems.

Noteworthy is the attention OEMs are giving to belt systems that are powerful and heat resistant so as to enhance engineering efficiency and reduce losses by friction. The use of the stop-start belt system and the belt-integrated starter generators (BSG) that are assorted in mild hybrids are demonstrating a new beginning of the life cycle for the belt systems in the electrified powertrains.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

The automotive belts sector in Japan is currently facing slow, though stable growth, chiefly due to the long-lasting vehicle reliability and consequently rationed replacement parts, as well as a slow transition to electric vehicles. Nevertheless, the production of more hybrid models is the lifeline of the country for the conveyor belts, V-belts, and multi-ribbed drive belts.

OEMs in Japan have been the pioneers in engineering ultra-quiet and highly durable belts targeted chiefly for compact and premium hybrid vehicles. There's a small but technically excellent aftermarket in Japan, which concentrates on the high-performance belt substitute.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

The South Korea automotive belts market is expanding at a moderate rate on the back of domestic vehicle production, exports, and the increasing trend of EV-hybrid integration. Although the EV transition could diminish the future demand for automotive belts, hybrids and plug-in hybrids (PHEVs) are still the main belt users.

Now South Korean OEMs are focusing on producing lighter, resonant-free belt systems and the application of belt-driven accessories in vehicle HVAC, alternators, and power steering. The aftermarket has become a new player with the rising number of local component suppliers servicing both domestic and Southeast Asian markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

Timing Belts Lead with Precision Engine Synchronization and Low Maintenance Requirements

In automotive belts, timing belts are the most sold product due to the importance of the precise linkage created on the engine crankshaft and camshaft by the timing belts thus ensuring the valves to function properly. The special feature of these belts is that they are available only on passenger cars and light commercial vehicles. They are the perfect choice for automobiles that aim at the optimization of fuel consumption and exhaust emissions, both of which features are superior to those of the traditional chain systems.

Contrary to the drive belts and V-belts, timing belts are a closed loop, are protected from impurity, and need little lubrication, hence, they are the best choice for modern fuel-saving internal combustion engines. The Original Equipment Manufacturers (OEMs) persist in utilizing timing belts composed of fiber-reinforced rubber and polyurethane, which not only features high-pressure but also has better durability against extreme temperatures.

The introduction of the timing belt to the market as a mechanically reversible and longer replacement interval appliance serves a double purpose, both helping the automotive industry meet the legislative requirements of engine downsizing and low-noise operation.

Multifunctional V-Belts Gain Traction with Compact Design and Enhanced Power Transmission

Multifunctional V-belts have risen winning the market these days, especially in passenger cars and commercial vehicles due to their ability to operate multiple peripheral devices like the alternator, air conditioning compressor, and power steering pump using a single belt system. They have space-saving features as well as high efficiency in comparison to using multiple belts, therefore, auto manufacturers often preferred them for new models.

Multifunctional belts exhibit much more advantages than traditional single ones when it comes to better load distribution, reduced slippage, and extended service life, particularly in the case of EPDM (ethylene propylene diene monomer) or other advanced synthetic materials, which are used for wear and heat resistance. In order to integrate the engine scheme with fewer parts and to maximize the trustworthy, the transition to multifunctional V-belts is foreseen to hasten, particularly in urban vehicle models and hybrid powertrains.

Passenger Vehicles Remain the Largest Market for Automotive Belts with Focus on Fuel Efficiency and Engine Performance

Global vehicle productions, new engine designs, the demand for accessible power transmission components have made the passenger segment the strongest in the automotive belts market. Belts found in this section are the timing, accessory drives, and HVAC belts which the consumers want for the reasons of, they are silent, need no maintenance, and have a long lifecycle.

As car users begin to demand cars that consume less fuel and require less maintenance, the automakers are integrating belts that have a long lifespan, for example, the long-time timing and drive belts, which can stay on for about 150,000 kilometres or more. HEV cars create a necessity for new lightweight technologies used in belts that work of start-stop systems, but also regenerative braking.

The ownership boom of mid-size and compact cars in developing countries like India, Indonesia, and Vietnam alongside the surge in demand for cheap, but high-functioning durable belt systems projected over the next few years is around 42.5%.

Light Commercial Vehicles (LCVs) Expand Belt Demand with Growth in Urban Logistics and Fleet Operations

Due to the fast development of last-mile delivery, ride-sharing services, and small transportation fleets are light commercial vehicles (LCVs) increasingly being demanded driven by this These cars are asked for belts that can function under heavy loading conditions and are then constantly operated in a cycling pattern of starting and stopping, which facts put more stress on the drive and timing belts.

When compared to passenger vehicles, LCVs consume more power because they work for longer hours, and thus the focus is on belts with better wear and tear protection and heat dissipation, as well as, with minimal slippage. Belt manufacturers are working hard to cover this demand and they intend to create additional heavy-duty V-belts and high-torque timing belts along with optimized tensioning systems that maintain their performance during the longer use period.

The economic rise of urban logistics operators in locations such as South Asia, the Middle East, and Eastern Europe has made the demand for strong, low-maintenance automotive belts in the LCV segment increase. Because of the cash flow concerns fleet owners have, they are looking for OEM belts and aftermarket belts, which would come with a longer warranty period.

The global automotive belts market is on a steady upward format due to an increased need for energy-efficient engines, advanced power transmission components, and durable aftermarket parts. Automotive belts including timing, serpentine, and V beld systems are an integral part of ICEs and hybrids. They are mainly used for power transmission, engine synchronization, and for driving auxiliary systems like air conditioning, alternators, and water pumps.

Beside the gradual trend towards EVs, ICEs still hold the majority of the fleet and offer a persistent demand for high-quality automotive belts. Growth is further benefiting from the automotive aftermarket, the rise in the vehicle park, the production increase of passenger and commercial vehicles, as well as the demand for high-performance, heat- and wear-resistant belt materials.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 12-14% |

| Gates Corporation | 10-12% |

| Dayco Products LLC | 7-9% |

| Hutchinson SA (TotalEnergies) | 5-7% |

| Mitsuboshi Belting Ltd. | 4-6% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Provides OE and aftermarket belts, including timing, multi-V, and elastic belts with EPDM and aramid reinforcement. |

| Gates Corporation | Offers Micro-V® and PowerGrip® belts, which are primarily used in light-duty, heavy-duty, or high-performance applications. |

| Dayco Products LLC | Delivers engine timing systems along with serpentine belts that will not drag and have PTFE infusion. |

| Hutchinson SA | Offers belt drive systems and tensioners that are specifically designed to last longer and produce less noise. |

| Mitsuboshi Belting Ltd. | Distributes automotive belts both for OEM producers and aftermarket users including durable timing and V-belts for use in vehicles from Japanese and global brands. |

Key Market Insights

Continental AG

Continental is a leader in the market for automotive power transmission solutions and is part of the industry's elite by offering a full line of high-quality timing belts, serpentine belts, and tensioners for both OE and aftermarket applications.

The company integrates EPDM (ethylene propylene diene monomer) compounds and aramid cords in its products for increased durability and temperature performance. Continental is the original equipment for cars in Germany, the US, and Asia, and the company is currently aiming at reducing parasitic losses and improving efficiency through the development of flexible belt systems for hybrid engines.

Gates Corporation

Gates has emerged as a prominent supplier of top-notch belts and belt drive systems under the name of PowerGrip® (timing belts) and Micro-V® (serpentine belts). Their offering of products contains synchronous, poly chain, and high-torque belts, which are widely adopted in passenger cars, trucks, and performance-based vehicles.

Gates has lined up its priorities by focusing on aspects like noise reduction, wear resistance, and dynamic belt tensioning, thus also contributing to the expansion of its aftermarket portfolio through worldwide distribution channels and state-of-the-art diagnostic tools for belt condition monitoring.

Dayco Products LLC

Dayco is in line for some great changes with a strong focus on timing belts, accessory drive belts, and complete belt-in-oil systems, while the offering still high-durability products for both OEMs and aftermarket channels.

The company's timing belt-in-oil technology has the capacity to reduce friction and enhance NVH performance. Dayco is an important partner of the North American and European car manufacturers with its leadership in the area of automated tensioner systems that increase both the lifetime of belts and the efficiency of engines.

Hutchinson SA

Hutchinson, which is a subsidiary of TotalEnergies, is the designer of multi-ribbed belts, tensioners, and complete drive systems. The company stands out with its long-term value. The key principles of the company which are quiet operation, temperature tolerance, and minimal slippage are the features that made it a competent player in different engine layouts, both transverse and longitudinal systems.

Hutchinson is also expanding its product range with the development of smart belt systems for next-generation mild hybrid (48V) and start-stop engines, incorporating sensors for predictive maintenance.

Mitsuboshi Belting Ltd.

As an original equipment supplier to Japanese car manufacturers, Mitsuboshi is one of the key producers of durable timing and V-belts with a special high resistance to oil, ozone, and heat. The company’s belts are flexible, crack-resistant, and can withstand high temperatures, and they are utilized in OEM assembly lines and in global aftermarket networks. Mitsuboshi aims at technology that is ecologically friendly with the introduction of belt coatings made from low-emission materials and recyclable elastomers.

The market is segmented into Timing Belts, Serpentine Belts, V-Belts, and Ribbed Belts.

The industry is divided into Rubber Belts, Polyurethane Belts, and Hybrid Belts.

The market caters to Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Electric Vehicles (EVs).

The industry includes Original Equipment Manufacturers (OEMs) and Aftermarket.

The market covers Engine Systems, Steering Systems, HVAC Systems, and Alternator & Charging Systems.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The global automotive belts market is projected to reach USD 18.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 3.9% from 2025 to 2035.

By 2035, the automotive belts market is expected to reach USD 27.0 billion.

The drive belts segment is expected to dominate due to their critical role in power transmission for various engine components, along with growing demand in both ICE and hybrid vehicles for performance and efficiency improvements.

Key players in the market include Continental AG, Gates Corporation, Mitsuboshi Belting Ltd., Dayco LLC, and Bando Chemical Industries, Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Seat Belts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA