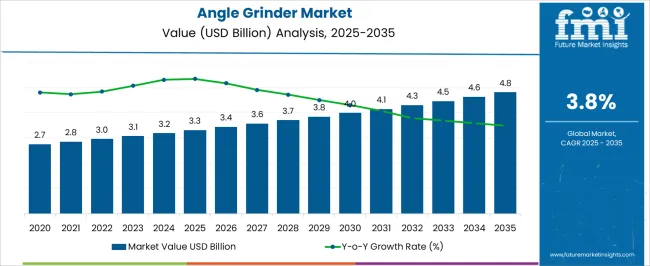

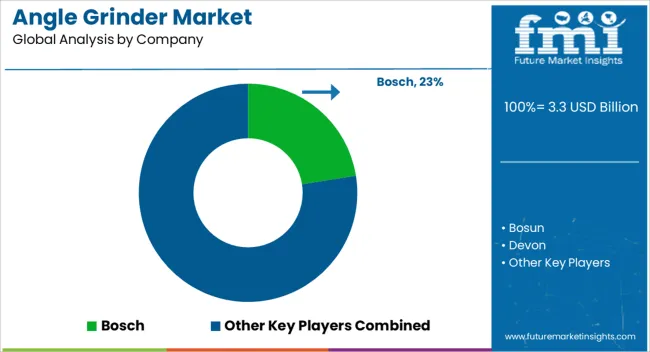

The angle grinder market is projected to grow at a CAGR of 3.8% from 2025 to 2035, with the market anticipated at USD 3.3 billion in 2025 and forecast to reach USD 4.8 billion by 2035. Contribution of volume versus price growth reveals that much of the early expansion is expected to come from incremental unit sales across construction, automotive repair, and small-scale fabrication sectors, where demand for portable and affordable tools is steady.

Between 2025 and 2030, the rise from USD 3.3 billion to USD 3.7 billion is primarily volume-driven, supported by DIY adoption, contractor purchases, and broader accessibility through e-commerce platforms. From 2030 onward, as the market matures, price-driven growth takes a larger role, lifting the market from USD 3.8 billion to USD 4.8 billion by 2035. This is anticipated due to premiumization trends, where brushless motors, ergonomic designs, and smart safety features push average selling prices higher. Suppliers are also focusing on battery-powered and cordless models, contributing to stronger pricing power. In my assessment, the overall curve illustrates a shift where early expansion is quantity-led, but long-term momentum depends on innovation-driven value addition, higher dollar sales per unit, and replacement cycles that encourage professional users to invest in premium models.

| Metric | Value |

|---|---|

| Angle Grinder Market Estimated Value in (2025 E) | USD 3.3 billion |

| Angle Grinder Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The angle grinder market is strongly shaped by five interconnected parent markets, each contributing uniquely to its growth and deployment. The construction and infrastructure sector holds the largest share at 34%, fueled by the need for cutting, grinding, and finishing tasks in large-scale building projects, road construction, and renovation activities where durable handheld tools are indispensable. The metal fabrication and manufacturing segment contributes 28%, as workshops and industrial plants use angle grinders extensively for welding preparation, surface finishing, and steel cutting, ensuring high efficiency in production lines. The automotive repair and maintenance market accounts for 16%, driven by bodywork, welding cleanup, and component repair tasks requiring precise grinding and polishing.

The DIY and consumer segment represents 12%, with rising adoption among hobbyists and small contractors who increasingly purchase compact, cordless models through retail and e-commerce channels. Finally, the mining and heavy engineering sector holds a 10% share, where robust grinders are needed for equipment maintenance and on-site fabrication tasks in demanding conditions. Collectively, construction, metal fabrication, and automotive sectors account for nearly 78% of overall demand, underlining the dominance of industrial applications. The angle grinder market will maintain steady growth as professional-grade adoption is supplemented by expanding consumer and aftermarket demand, ensuring consistent dollar sales and market share globally.

The current market environment reflects a growing preference for versatile and efficient grinding solutions capable of meeting diverse industrial needs. Increasing infrastructure development, urbanization, and demand for metal processing are key factors shaping the market's trajectory.

The integration of technological advancements such as improved motor efficiency, safety features, and ergonomic designs is enhancing product appeal. The shift towards automated and precision grinding operations is further accelerating adoption across end-use industries.

Rising investments in manufacturing automation and the expansion of the construction sector globally are expected to propel the market forward. The future outlook remains positive as manufacturers continue to innovate and respond to evolving customer demands, particularly emphasizing durability and performance in challenging working environments.

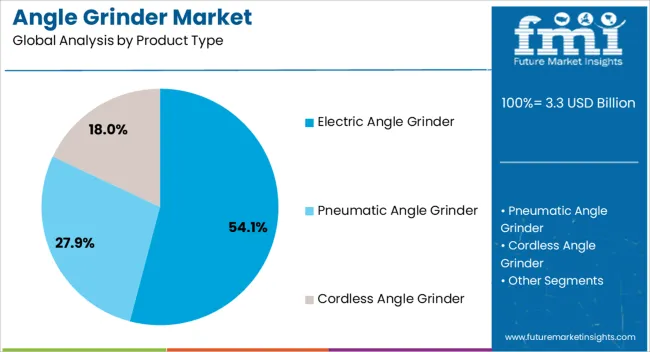

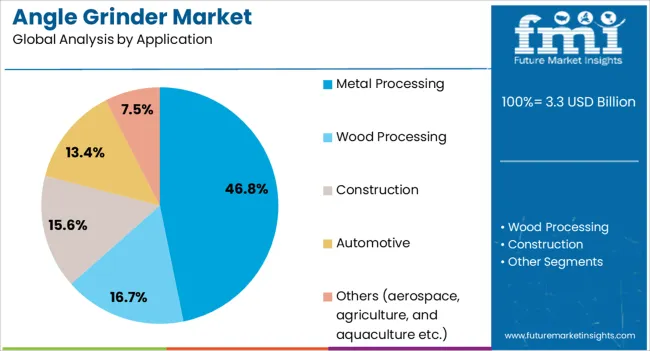

The angle grinder market is segmented by product type, application, distribution channel, and geographic regions. By product type, the angle grinder market is divided into Electric Angle Grinder, Pneumatic Angle Grinder, and Cordless Angle Grinder. In terms of application, angle grinder market is classified into Metal Processing, Wood Processing, Construction, Automotive, and Others (aerospace, agriculture, and aquaculture etc.).

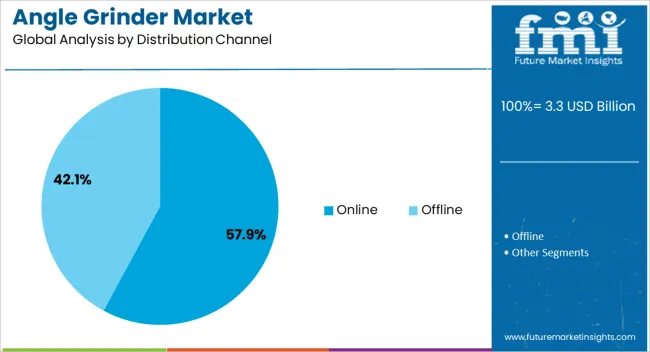

Based on the distribution channel, the angle grinder market is segmented into Online and Offline. Regionally, the angle grinder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Electric Angle Grinder segment is anticipated to hold 54.1% of the overall market revenue share in 2025, establishing it as the dominant product type. This leading position is attributed to the segment's operational efficiency, ease of use, and adaptability to various grinding and cutting tasks.

Electric angle grinders offer advantages such as consistent power output, low maintenance requirements, and compatibility with a broad range of accessories, which contribute to their widespread acceptance. The growing emphasis on energy-efficient and lightweight power tools has further supported this segment's expansion.

Additionally, the availability of portable and corded electric models caters to both professional users and DIY enthusiasts, driving market penetration Enhanced safety features and ergonomic designs have also boosted user confidence, making electric angle grinders the preferred choice across multiple applications.

The Metal Processing application segment is projected to account for 46.8% of the Angle Grinder market revenue in 2025, marking it as the leading application area. This growth is driven by the high demand for surface finishing, cutting, and grinding in metal fabrication industries, including automotive, shipbuilding, and heavy machinery manufacturing.

The segment’s expansion is supported by increasing industrialization and infrastructure development that necessitate precise and efficient metalworking solutions. The versatility of angle grinders in handling diverse metal types and thicknesses has made them indispensable tools in workshops and manufacturing plants.

Furthermore, advancements in abrasive technologies and tool durability have enhanced performance in metal processing tasks, thereby driving greater adoption The rising focus on improving productivity and reducing operational costs has further cemented the segment’s prominence.

The Online distribution channel is expected to capture 57.9% of the market revenue share in 2025, becoming the preferred route for angle grinder sales. The dominance of this channel is driven by the increasing trend of digital procurement and the convenience of online shopping.

Customers benefit from a wider product selection, competitive pricing, and access to detailed product information and reviews, which influence purchasing decisions. The growth of e-commerce platforms and improved logistics networks has facilitated timely delivery and enhanced customer experience.

Moreover, manufacturers and retailers have expanded their online presence and marketing efforts to tap into global and regional demand more effectively. The shift towards online purchasing is also supported by the rising adoption of smartphones and internet penetration, enabling both end-users and businesses to conveniently source angle grinders through digital channels.

The angle grinder market is shaped by construction demand, metal fabrication, automotive maintenance, and consumer adoption. Growth stems from both professional applications and expanding DIY use, ensuring balanced long-term development.

The angle grinder market is increasingly driven by the construction and infrastructure sectors where the tools are essential for cutting concrete, steel reinforcement, and tiles. Contractors value their ability to handle diverse applications with precision and speed. The rise of large-scale infrastructure projects worldwide is boosting procurement of heavy-duty grinders with higher power ratings. Compact cordless variants are also gaining importance for onsite flexibility. Suppliers are targeting professional users with durable designs and advanced safety features to reduce workplace accidents. In my view, the construction sector remains the strongest growth pillar for angle grinders as contractors prioritize performance, long service life, and reduced downtime on demanding projects.

Metal fabrication and industrial workshops represent a vital segment for angle grinders, where the tools are used in grinding weld seams, cutting metal sheets, and surface preparation. Manufacturers require grinders with consistent torque, adjustable speed, and compatibility with a wide range of discs. This sector has shifted toward higher adoption of cordless grinders to improve mobility in production environments. Extended runtimes and ergonomic designs are helping fabricators boost productivity while ensuring operator safety. My assessment is that angle grinders are no longer seen as just accessory tools but as key enablers of precision and efficiency in fabrication, making this segment a stable contributor to long-term market growth.

Automotive repair shops and aftermarket service providers are increasingly turning to angle grinders for cutting, polishing, and rust removal tasks. Their compact design, coupled with versatile attachments, makes them indispensable in tight spaces and for precision repair jobs. The adoption of cordless and lightweight grinders is growing in workshops where maneuverability is a priority. Professionals also prefer models with dust protection and quick-change systems to minimize downtime. I believe the automotive sector contributes significantly to steady market expansion as replacement cycles, repair requirements, and aftermarket service trends create consistent demand for durable, easy-to-use angle grinders with tailored features.

The DIY and consumer segment is playing an increasingly important role in the angle grinder market. Hobbyists, small contractors, and household users are purchasing compact, cost-efficient grinders for small-scale projects such as tile cutting, woodworking, or home repairs. E-commerce platforms have widened product accessibility, encouraging impulse and replacement purchases. Manufacturers are responding by developing models with user-friendly features like vibration reduction, overload protection, and simplified controls. In my opinion, the consumer and DIY market provides a steady secondary growth channel, ensuring volume expansion even as professional-grade markets focus more on price and performance.

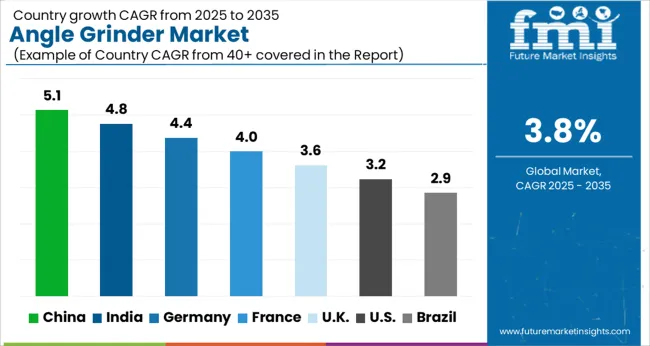

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

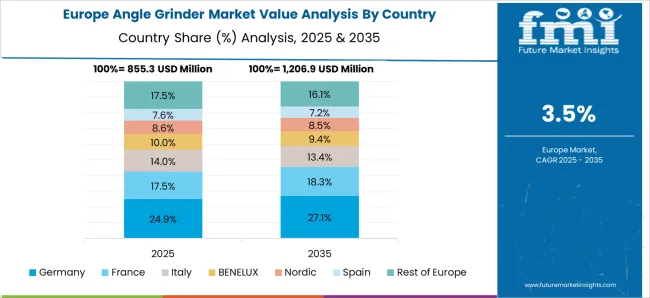

The global angle grinder market is projected to grow at a CAGR of 3.8% from 2025 to 2035. China leads at 5.1%, followed by India at 4.8%, Germany at 4.4%, France at 4.0%, the UK at 3.6%, and the USA at 3.2%. Growth is driven by expanding construction activities, infrastructure upgrades, and rising demand for handheld power tools in metal fabrication and automotive repair. Asia-Pacific, particularly China and India, shows strong adoption fueled by large-scale industrialization, local manufacturing, and increasing consumer-level purchases for DIY use. European countries, including Germany and France, emphasize quality-driven adoption in automotive, precision engineering, and industrial workshops, while the UK records steady growth through small contractors and construction refurbishments. The USA demonstrates moderate adoption, driven by demand from automotive, shipbuilding, and aerospace maintenance sectors, alongside growing e-commerce retail distribution. Product differentiation, cordless innovations, aftermarket services, and ergonomic designs further strengthen dollar sales and market share globally. The analysis spans over 40+ countries, with the leading markets detailed above.

The angle grinder market in China is projected to grow at a CAGR of 5.1% from 2025 to 2035, supported by rapid infrastructure expansion, construction activity, and demand from automotive and metal fabrication industries. Domestic manufacturers are scaling up production to meet growing needs for both professional and consumer-grade tools. Cordless and brushless models are becoming popular, especially in urban projects where mobility and efficiency are vital. The DIY segment is also contributing to demand growth as retail and e-commerce platforms increase accessibility. In my view, China will continue leading the global angle grinder market due to its strong manufacturing base, consumer acceptance, and continuous infrastructure-driven investments.

The angle grinder market in India is expected to grow at a CAGR of 4.8% from 2025 to 2035, driven by infrastructure development, housing projects, and rising industrial activity. Domestic toolmakers are expanding product ranges, focusing on affordable, durable grinders for small contractors and workshops. Cordless variants are being introduced at competitive prices, supported by collaborations with battery suppliers. E-commerce is enabling rural and semi-urban penetration, while construction projects in smart cities create steady professional demand. From my perspective, India’s market trajectory highlights strong growth potential, backed by policy-driven infrastructure investment and consumer demand diversification.

The angle grinder market in Germany is projected to expand at a CAGR of 4.4% from 2025 to 2035, anchored in industrial fabrication, automotive workshops, and precision engineering sectors. German manufacturers emphasize high-quality, ergonomic, and safety-compliant grinders suited for demanding applications. Industrial automation trends and strict workplace standards drive adoption of advanced grinders with vibration reduction and dust management features. Replacement cycles are shorter, as professional users prefer reliability and efficiency over cost savings. In my opinion, Germany’s market reflects a preference for premium, high-performance grinders, making it one of the most quality-driven regions globally.

The angle grinder market in the UK is anticipated to grow at a CAGR of 3.6% from 2025 to 2035, supported by construction refurbishment, small-scale metal workshops, and growing DIY trends. Demand is strongest in urban construction projects where compact, cordless grinders are highly valued. The consumer market is also significant, with online retail platforms enabling higher penetration in residential repair and hobbyist use. Professional-grade models are being adopted for commercial and infrastructure projects, although growth is steadier compared to emerging regions. I believe the UK market will remain balanced between consumer and professional adoption, with a gradual tilt towards cordless technology.

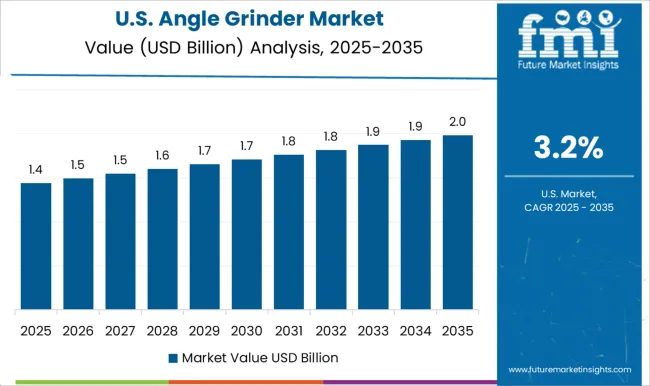

The angle grinder market in the USA is projected to grow at a CAGR of 3.2% from 2025 to 2035, influenced by demand from automotive repair, aerospace maintenance, and construction contractors. Professional workshops seek grinders with long service life, dust protection, and efficient motors for heavy-duty use. The consumer segment is growing due to rising DIY culture and the popularity of cordless tools. North American manufacturers emphasize innovation in safety features and energy-efficient brushless motors. In my assessment, the USA market shows steady yet moderate growth, with emphasis on aftermarket sales, premium models, and cordless adoption as main contributors.

Competition in the angle grinder market is defined by motor efficiency, safety features, cordless performance, and industrial-grade durability. Bosch leads with a diverse range of professional and DIY grinders, focusing on ergonomic design, high torque, and advanced dust protection systems. Makita competes strongly with its lithium-ion cordless platforms, prioritizing lightweight builds, long battery life, and wide distribution reach across construction and metalworking sectors. Stanley Black & Decker differentiates with its DeWalt line, offering rugged grinders tailored for professionals, with enhanced safety guards, vibration control, and widespread retail availability. Hilti commands premium positioning in construction applications with grinders engineered for heavy-duty tasks, backed by on-site service contracts and precision engineering. Milwaukee Tool (TTI) emphasizes cordless power tools with its M18 platform, providing long runtime, interchangeable batteries, and smart tool connectivity for contractors. Hitachi (Hikoki) combines affordability with advanced features, catering to both professionals and hobbyists across Asia and Europe.

Fein positions itself in the industrial niche, highlighting reliability, precision, and low-vibration designs for metalworking specialists. Dongcheng Tools, Bosun, Guoqiang Tools, Devon, and Ken Tools hold significant share in China, competing with cost-effective grinders and extensive distribution in domestic and regional markets. Positec Machinery leverages its WORX brand to capture DIY consumers, focusing on compact cordless designs with user-friendly features. Wurth integrates its grinders into broader tool and consumables supply chains, strengthening customer loyalty through bundled solutions and strong B2B networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Product Type | Electric Angle Grinder, Pneumatic Angle Grinder, and Cordless Angle Grinder |

| Application | Metal Processing, Wood Processing, Construction, Automotive, and Others (aerospace, agriculture, and aquaculture etc.) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Bosun, Devon, Dongcheng Tools, Fein, Guoqiang Tools, Hilti, Hitachi, Ken Tools, Makita, Milwaukee Tool (TTI), Positec Machinery, Stanley Black & Decker, TTI, and Wurth |

| Additional Attributes | Dollar sales, share, regional demand segmentation, cordless vs corded adoption, industrial vs DIY usage trends, pricing benchmarks, regulatory compliance, raw material cost impacts, and competitor strategies. |

The global angle grinder market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the angle grinder market is projected to reach USD 4.8 billion by 2035.

The angle grinder market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in angle grinder market are electric angle grinder, pneumatic angle grinder and cordless angle grinder.

In terms of application, metal processing segment to command 46.8% share in the angle grinder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Angle-Resolved Photoemission Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Weld Angle Brackets Market Size and Share Forecast Outlook 2025 to 2035

Right Angle Fastener Market Analysis - Size, Share, and Forecast 2025 to 2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Grain Mill Grinder Market Size and Share Forecast Outlook 2025 to 2035

Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cylindrical Grinders Market Growth - Trends & Forecast 2025 to 2035

Plastic Scrap Grinder Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cordless Fillet Weld Grinder in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA