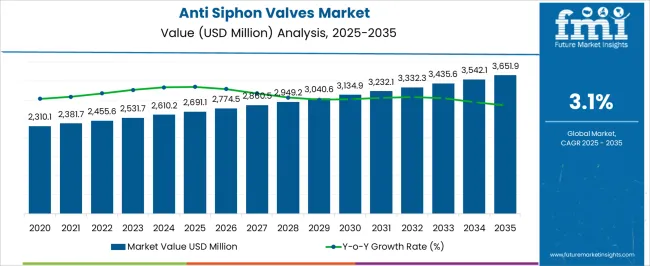

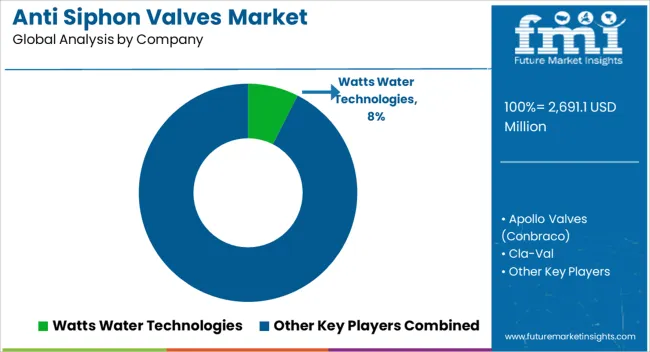

The global anti siphon valves market is projected to grow from USD 2,691.1 million in 2025 to USD 3,651.6 million by 2035, reflecting an absolute increase of USD 960.5 million over the forecast period. This represents a cumulative growth of 35.7% over the decade. The market is expected to expand at a compound annual growth rate (CAGR) of 3.1% between 2025 and 2035, with the overall market size projected to grow by 1.4X during the same period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,691.1 million |

| Industry Size (2035F) | USD 3,651.6 million |

| CAGR (2025 to 2035) | 3.1% |

Between 2025 and 2030, the anti siphon valves market is projected to expand from USD 2,691.1 million to USD 3,134.7 million, adding USD 443.6 million in value during this period. This phase is expected to be driven by increasing demand for fuel theft prevention systems in automotive and marine applications, alongside growing adoption of water conservation measures in commercial plumbing installations. Regulatory requirements for backflow prevention in potable water systems and expanding automotive production in emerging markets are supporting steady growth momentum.

From 2030 to 2035, the market is forecast to grow from USD 3,134.7 million to USD 3,651.6 million, registering an additional value increase of USD 516.9 million. This phase will be characterized by advanced material adoption, including engineering plastics and specialized alloys for harsh operating environments. Integration of smart valve technologies and IoT-enabled monitoring systems in commercial and industrial applications is expected to drive premium product demand across developed markets.Between 2020 and 2025, the anti siphon valves market expanded from USD 2,394.8 million to USD 2,691.1 million, supported by increasing awareness of fuel security issues and regulatory mandates for backflow prevention in water supply systems. Growth during this period was driven by rising automotive production, expansion of marine recreational activities, and modernization of plumbing infrastructure in developing economies. The COVID-19 pandemic temporarily affected supply chains but accelerated adoption of contactless and automated valve solutions in commercial applications.

The anti siphon valves market is experiencing steady growth due to increasing concerns about fuel theft, water contamination prevention, and regulatory compliance across multiple industries. Rising fuel costs have intensified the need for effective anti-siphoning solutions in automotive, marine, and off-road vehicle applications. Commercial and residential plumbing sectors are driving demand through stricter water quality standards and backflow prevention requirements imposed by municipal authorities and health organizations.

Technological advancements in valve materials and design are enhancing product performance while reducing maintenance requirements. Engineering plastics are gaining acceptance for their corrosion resistance and cost-effectiveness compared to traditional metal valves. The marine industry continues to be a significant growth driver as recreational boating activities expand globally, requiring reliable fuel system protection against contamination and theft.

Industrial applications are adopting anti siphon valves for process fluid management and contamination prevention in chemical, food processing, and pharmaceutical facilities. Environmental regulations promoting water conservation and quality protection are creating additional demand for specialized valve solutions across diverse end-use sectors.

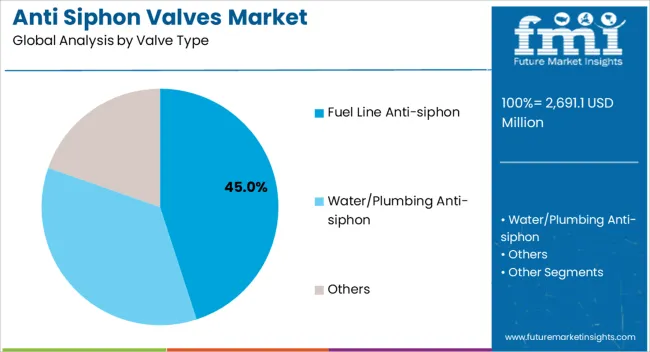

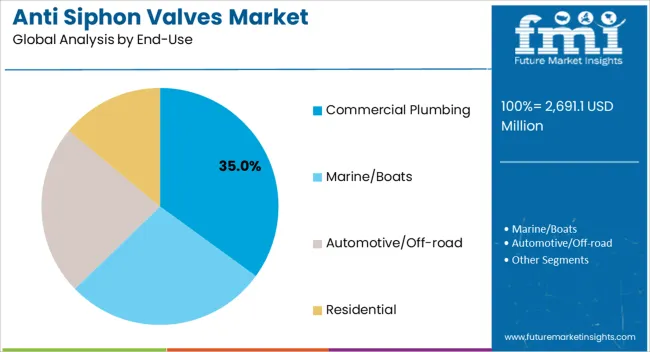

The market is segmented by valve type, material, end-use, size/connection, and region. By valve type, the market is divided into fuel line anti-siphon, water/plumbing anti-siphon, and others. Based on material, the market is categorized into brass/bronze, stainless steel, engineering plastics, and others. In terms of end-use, the market is segmented into marine/boats, automotive/off-road, commercial plumbing, and residential sectors. By size/connection, the market is classified into ≤1/2", 3/4"–1", and >1". Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Fuel line anti-siphon valves are projected to account for 45% of the market share in 2025, driven by escalating fuel theft incidents and rising fuel prices globally. These valves provide critical protection for automotive fleets, construction equipment, and marine vessels by preventing unauthorized fuel extraction while maintaining normal vehicle operation. Commercial transport companies and fleet operators are increasingly investing in anti-siphon solutions to reduce operational costs and improve fuel security.

The segment benefits from continuous product innovation, including tamper-resistant designs and integration with fuel monitoring systems. Demand is particularly strong in regions with high fuel theft rates and inadequate security infrastructure. Off-road vehicle applications in mining, agriculture, and construction are contributing significantly to segment growth as equipment values and fuel consumption increase.

Commercial plumbing applications are expected to represent 35% of market demand in 2025, reflecting mandatory compliance with health and safety regulations governing backflow prevention. Office buildings, hospitals, schools, and industrial facilities require reliable anti-siphon protection to maintain water system integrity and prevent cross-contamination. Building owners and facility managers prioritize valve solutions that offer long-term reliability and minimal maintenance requirements.

The segment benefits from ongoing construction activity in commercial and institutional sectors, particularly in emerging markets where infrastructure development is accelerating. Renovation and modernization projects in developed countries are driving replacement demand for valves that meet updated regulatory standards and performance specifications.

The anti siphon valves market is evolving through technological innovation and regulatory compliance requirements across multiple industries. However, price sensitivity in cost-conscious applications and competition from alternative solutions continue to challenge market expansion. Supply chain disruptions and raw material cost fluctuations are affecting manufacturer margins and pricing strategies.

Material Innovation Driving Performance Enhancement

Engineering plastics are gaining market acceptance as manufacturers develop high-performance polymer compounds that offer corrosion resistance, lightweight construction, and cost advantages over traditional metal valves. These materials enable complex valve geometries that improve flow characteristics while reducing manufacturing costs. Stainless steel maintains strong demand in corrosive environments and high-pressure applications where material reliability is critical.

Brass and bronze alloys continue to dominate traditional applications due to their proven performance and compatibility with existing plumbing systems. Material selection is increasingly driven by total cost of ownership considerations, including installation complexity, maintenance requirements, and service life expectations across different operating environments.

Smart Technology Integration Expanding Market Opportunities

Integration of electronic monitoring and control systems is creating premium market segments for intelligent anti-siphon valves. These advanced products offer real-time status monitoring, automatic operation, and integration with building management systems for optimized performance. IoT connectivity enables predictive maintenance scheduling and remote diagnostics, reducing operational costs and improving system reliability.

Digital valve solutions are particularly attractive to large commercial and industrial users who can justify higher initial costs through improved operational efficiency and reduced maintenance expenses.

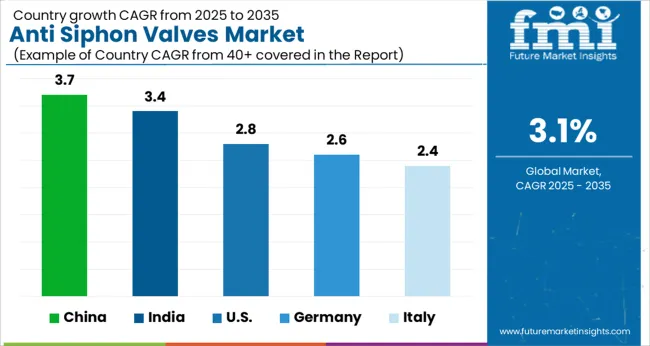

| Countries | CAGR |

|---|---|

| China | 3.7 |

| India | 3.4 |

| USA | 2.8 |

| Germany | 2.6 |

| Italy | 2.4 |

Revenue from anti siphon valves in China is projected to record the highest CAGR of 3.7% during the forecast period, driven by massive infrastructure development and expanding automotive production capacity. The country's rapid urbanization and industrial growth are creating substantial demand for both fuel line and water/plumbing anti-siphon valves across multiple sectors. Government initiatives promoting water conservation and environmental protection are mandating installation of backflow prevention devices in new construction projects. Commercial building expansion in major cities is generating significant demand for plumbing valve solutions that meet international quality standards. Manufacturing localization strategies by global valve companies are improving product availability and reducing costs for domestic customers.

Revenue from anti siphon valves in India is forecast to grow at 3.4% CAGR, supported by industrial development and improving regulatory standards for water quality protection. The country's expanding manufacturing sector requires reliable valve solutions for process applications and utility systems. Government smart city initiatives are driving modernization of water supply infrastructure, creating demand for advanced backflow prevention technologies. Rising fuel costs and theft incidents are prompting fleet operators to invest in comprehensive anti-siphoning solutions. Local manufacturing capabilities are developing to serve growing domestic demand while reducing import dependency.

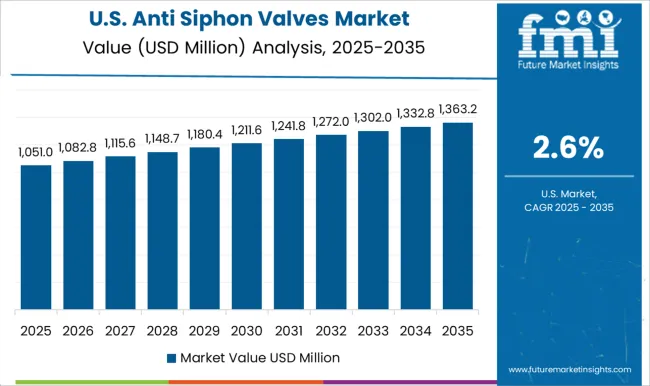

The USA anti siphon valves market is expected to grow at 2.8% CAGR, driven by regulatory compliance requirements and infrastructure modernization projects. Stringent water quality regulations at federal and state levels mandate installation of certified backflow prevention devices in commercial and institutional buildings. The mature automotive market is creating replacement demand for anti-siphon valves in fleet vehicles and recreational boats. Energy sector expansion, particularly in oil and gas applications, is generating demand for specialized valve solutions in harsh operating environments. Green building certification programs promote adoption of water-efficient technologies that include advanced anti-siphon capabilities.

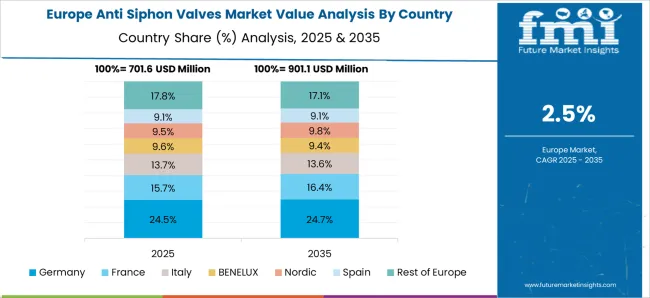

Demand for anti siphon valves in Germany is projected to grow at 2.6% CAGR, emphasizing high-quality valve solutions that meet stringent environmental and safety standards. The country's advanced manufacturing sector requires precision-engineered valves for demanding industrial applications. Building renovation and modernization activities are driving replacement demand for valves that comply with current European Union directives. Automotive industry concentration creates specialized demand for fuel system components including anti-siphon technologies. Environmental regulations promoting water conservation and contamination prevention support adoption of advanced valve technologies across multiple sectors.

Sales of anti siphon valves in Italy are expected to record 2.4% CAGR growth, driven by tourism industry development and marine applications along extensive coastlines. The country's significant recreational boating sector creates sustained demand for marine fuel system protection. Building renovation activities in historic cities require specialized valve solutions that meet preservation requirements while ensuring modern safety standards. Industrial expansion in northern regions generates demand for process valve applications in manufacturing facilities. Water infrastructure modernization projects are upgrading aging systems with contemporary backflow prevention technologies.

The anti siphon valves market is characterized by diverse competitive dynamics across regional and application segments. Established manufacturers focus on product quality, regulatory compliance, and customer service while emerging players compete on cost and specialized solutions. Innovation in materials and smart technologies is creating differentiation opportunities for companies that can invest in research and development capabilities.

Apollo Valves (Conbraco) maintains strong position in North American markets through comprehensive product portfolios and established distribution networks. The company focuses on brass and bronze valve solutions for plumbing applications, emphasizing quality and reliability for commercial customers. Cla-Val specializes in automatic control valves and backflow prevention solutions, serving municipal water authorities and industrial customers with engineered products.

Eaton Aerospace provides specialized fuel valve solutions for aviation and aerospace applications, requiring high-performance materials and precise manufacturing tolerances. Flomatic Valves concentrates on backflow prevention devices for water supply systems, offering extensive product lines that meet various regulatory requirements. Parker Hannifin leverages its instrumentation expertise to provide advanced valve solutions for industrial process applications.

Reliance Valves serves European markets with quality-focused products for plumbing and heating applications. T&S Brass specializes in commercial foodservice and plumbing fixtures, including anti-siphon solutions for restaurant and institutional kitchens. Viega combines traditional valve manufacturing with innovative joining technologies for modern plumbing systems. Watts Water Technologies offers comprehensive water quality and safety solutions, including extensive backflow prevention product lines.

Zurn Elkay (Wilkins) maintains leadership in commercial plumbing applications through its extensive backflow prevention product portfolio and strong relationships with plumbing contractors and engineers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,691.1 Million |

| Valve Type | Fuel Line Anti-siphon, Water/Plumbing Anti-siphon, Others |

| Material | Brass/Bronze, Stainless Steel, Engineering Plastics, Others |

| End-Use | Marine/Boats, Automotive/Off-road, Commercial Plumbing, Residential |

| Size/Connection | ≤1/2", 3/4"–1", >1" |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Apollo Valves (Conbraco), Cla Val, Eaton Aerospace, Flomatic Valves, Parker Hannifin, Reliance Valves, T&S Brass, Viega, Watts Water Technologies, Zurn Elkay (Wilkins) |

| Additional Attributes | Dollar sales by valve type and application, regional infrastructure demand, OEM competition, buyer focus on reliability and compliance, integration with smart irrigation, water-efficiency innovations, and sustainable plumbing practices. |

The global anti siphon valves market is estimated to be valued at USD 2,691.1 million in 2025.

The market size for the anti siphon valves market is projected to reach USD 3,651.9 million by 2035.

The anti siphon valves market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in anti siphon valves market are fuel line anti-siphon, water/plumbing anti-siphon and others.

In terms of material, brass/bronze segment to command 40.0% share in the anti siphon valves market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA