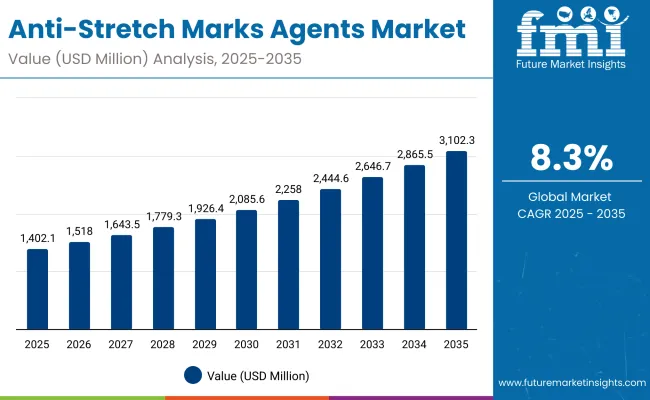

A market valuation of USD 1,402.1 million has been projected for anti-stretch marks agents in 2025, which is anticipated to reach USD 3,102.3 million by 2035. This increase of USD 1,700.2 million reflects more than a two-fold expansion across the decade, supported by an overall CAGR of 8.3%.

Anti-Stretch Marks Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Stretch Marks Agents Market Estimated Value in (2025E) | USD 1,402.1 million |

| Anti-Stretch Marks Agents Market Forecast Value in (2035F) | USD 3,102.3 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

The first half of the forecast period, from 2025 to 2030, is expected to see the market expand from USD 1,402.1 million to USD 2,085.6 million, adding USD 683.5 million. This segment of growth is forecast to contribute around 40% of the total decade increase, led by rising adoption in maternity care formulations and stronger integration into dermocosmetic body care ranges. The emphasis during these years is projected to remain on elasticity and firmness boosters that address preventive care needs, while peptide-based actives will secure a leading share through clinically backed results.

The second phase from 2030 to 2035 is anticipated to deliver an additional USD 1,016.7 million, which equals about 60% of the total market expansion. This acceleration is likely to be driven by expanded application in premium personal care lines, alongside a growing reliance on encapsulation technologies that enhance bioavailability and compatibility. By 2025, peptide-based ingredients are expected to dominate with 61.0% share, while encapsulated delivery systems are projected to hold 65.0% share, confirming their status as formulation standards. Regional leadership is forecast to remain with the USA and Europe in value terms, although China and India are projected to drive the fastest growth momentum.

From 2020 to 2024, the anti-stretch marks agents market was transitioned from a niche skincare ingredient category into a central part of dermocosmetic and maternity care formulations. Ingredient suppliers with encapsulation platforms and GMP-certified peptide production were positioned as leaders, capturing considerable procurement budgets. Competitive positioning was defined by clinical validation, enhanced bioavailability, and reliable claim substantiation.

By 2025, a valuation of USD 1,402.1 million is expected, with encapsulated delivery systems and peptide actives driving the mix. By 2035, the market is projected to more than double to USD 3,102.3 million, fueled by expanding demand in China and India, while the USA and Europe continue to anchor value. Competitive advantage is anticipated to shift decisively toward clinically backed peptides and advanced delivery systems with proven consumer outcomes.

Growth in the anti-stretch marks agents market is being driven by rising consumer demand for preventive and corrective skincare solutions. Increased awareness of skin health during maternity care and body care routines has been creating consistent adoption opportunities. Formulation advancements such as peptide-based actives and biotechnology-derived complexes are being prioritized due to their clinically validated outcomes in collagen remodeling and elasticity improvement. Encapsulation technologies are being widely adopted as they enhance bioavailability, improve stability, and support targeted release within formulations. Regional expansion is being reinforced by accelerated consumption in Asia, particularly in China and India, where higher CAGR growth is projected due to expanding middle-class populations and increasing affordability. Premiumization of personal care products is also stimulating demand, as dermocosmetic brands seek advanced raw materials with proven efficacy. As regulatory focus on safety and clinical substantiation strengthens, suppliers offering transparent dossiers and GMP-certified production are expected to capture greater procurement share.

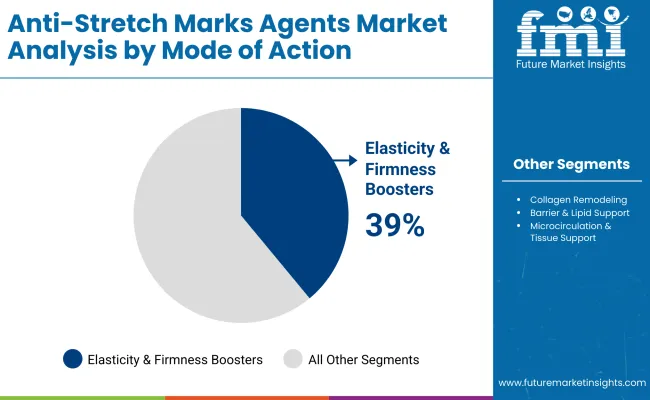

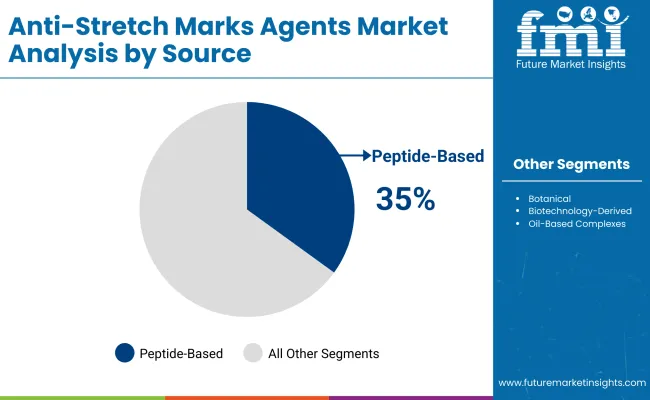

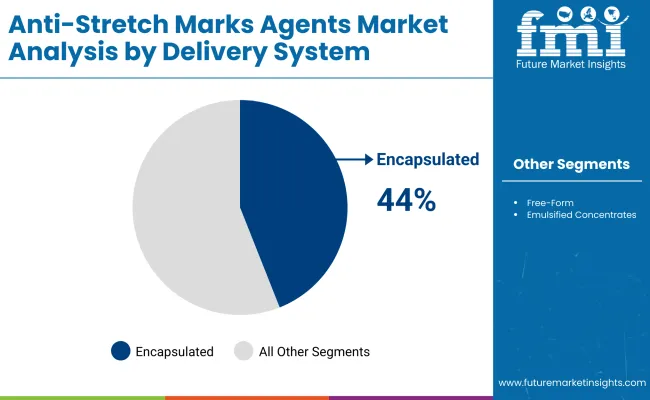

The anti-stretch marks agents market has been segmented across multiple parameters, including mode of action, source, and delivery system. Each segment reflects unique demand drivers that shape ingredient adoption and formulation trends. Mode of action highlights mechanisms addressing elasticity, firmness, and collagen remodeling, which are expected to remain central in preventive care solutions. Source-based classification demonstrates the growing emphasis on peptides, botanical, and biotechnology-derived actives that offer clinically validated efficacy. Delivery systems illustrate the critical role of encapsulation and free-form solutions in enhancing stability and performance. Together, these segments provide clarity on how ingredient-level innovation, coupled with formulation compatibility, is expected to accelerate procurement and strengthen market growth through 2035.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Elasticity & firmness boosters | 39% |

| Others | 61.0% |

Elasticity and firmness boosters are projected to account for 39% of the market in 2025, with an estimated value of USD 546.82 million. Growth is being driven by increasing demand for preventive formulations that strengthen skin resilience and reduce the visibility of stretch marks. Procurement strategies are expected to prioritize clinically substantiated actives that demonstrate elasticity improvements and long-term skin benefits. The segment is also anticipated to benefit from rising integration into maternity care ranges, where demand for proven preventive solutions is highest. While other mechanisms such as collagen remodeling are forecast to gain relevance, elasticity boosters are projected to remain the most adopted mode of action through the forecast horizon.

| Source | Market Value Share, 2025 |

|---|---|

| Peptide-based | 35% |

| Others | 65.0% |

Peptide-based actives are estimated to secure 35% of the global market in 2025, equating to USD 490.74 million. Their adoption is being accelerated by strong clinical evidence demonstrating their ability to stimulate collagen production and support tissue regeneration. Demand is expected to be reinforced by dermocosmetic brands that seek scientifically validated raw materials capable of supporting premium claims. Procurement teams are anticipated to continue favoring peptides for their efficacy, even though their higher cost positions them as specialized inputs. Other sources such as botanical and biotechnology-derived actives are also projected to witness increasing uptake, yet peptide-based ingredients are forecast to remain the leading driver of innovation and differentiation across the next decade.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 44% |

| Others | 56.0% |

Encapsulated delivery systems are forecast to capture 44% of the market in 2025, representing USD 616.92 million in value. Their dominance is being supported by superior bioavailability, enhanced ingredient stability, and controlled release mechanisms that improve performance in final formulations. Adoption is expected to accelerate as dermocosmetic and maternity care brands increasingly prioritize differentiated formulations with verifiable efficacy. Encapsulation is also anticipated to reduce degradation risks during manufacturing and storage, which further strengthens its role in supply chain resilience. While free-form and emulsified formats will continue to serve cost-driven applications, encapsulated actives are projected to emerge as the benchmark standard for next-generation anti-stretch mark formulations through 2035.

Complex formulation requirements and stringent safety validations are shaping the anti-stretch marks agents market, even as ingredient innovation and expanding clinical substantiation are unlocking broader opportunities across dermocosmetic, maternity, and global personal care portfolios.

Clinical Integration into Dermocosmetics

Market expansion is being accelerated by the integration of anti-stretch marks agents into dermocosmetic treatment frameworks. Dermatologists and aesthetic practitioners are increasingly specifying peptide-based and encapsulated actives in professional-grade formulations, supported by assay-backed efficacy and safety data. This clinical integration is reinforcing trust, allowing ingredient suppliers to secure premium positioning within procurement pipelines. Furthermore, the regulatory acceptance of these clinically validated actives is expected to ensure faster inclusion in new product launches, particularly where high evidence thresholds are demanded by regulators and healthcare professionals.

Manufacturing Complexity of Advanced Delivery Systems

Growth is being constrained by the technical complexity associated with producing encapsulated delivery systems at scale. Encapsulation requires precision in particle sizing, stability control, and compatibility testing with multiple excipient bases, which raises costs and lengthens production cycles. Contract manufacturers often face bottlenecks when handling such specialized systems, limiting throughput and increasing dependence on a few specialized suppliers. These constraints can slow down commercialization timelines and reduce flexibility for brands aiming to diversify their product ranges. As procurement shifts toward encapsulated actives, the need for standardized, cost-efficient manufacturing platforms will be critical to overcoming this restraint.

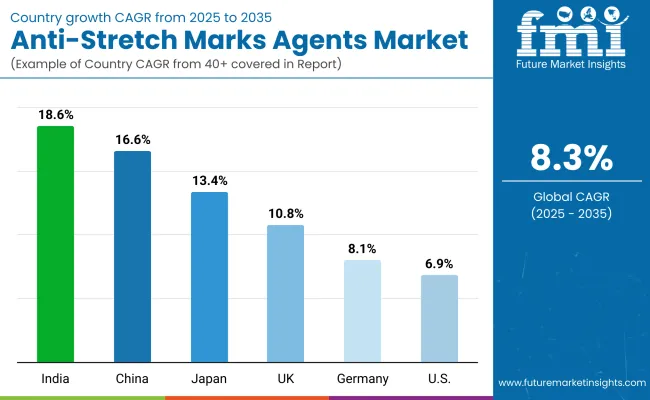

| Country | CAGR |

|---|---|

| China | 16.6% |

| USA | 6.9% |

| India | 18.6% |

| UK | 10.8% |

| Germany | 8.1% |

| Japan | 13.4% |

The anti-stretch marks agents market demonstrates varying adoption dynamics across key countries, shaped by consumer behavior, regulatory standards, and the maturity of dermocosmetic industries. Asia is projected to remain the fastest-expanding region, anchored by India at 18.6% CAGR and China at 16.6%. India’s momentum is being reinforced by rapid urbanization, rising disposable incomes, and growing awareness of maternity care, which is prompting stronger adoption of clinically validated ingredients. China’s trajectory reflects an expanding middle-class population and a surge in premium personal care consumption, supported by government emphasis on innovation within cosmetic formulations.

Japan is anticipated to grow at 13.4% CAGR, sustained by demand for advanced dermocosmetic solutions and consumer trust in clinically proven actives. In Europe, the UK is forecast at 10.8% CAGR, while Germany is expected at 8.1%, reflecting continued reliance on high safety standards and regulatory-driven adoption of quality ingredients. Europe overall is projected at 10.0%, benefiting from a mature consumer base that prioritizes clinically tested and sustainable formulations. The USA market, advancing at 6.9% CAGR, is anticipated to grow steadily, with emphasis on premium brands and dermatology-led innovations. Collectively, these dynamics highlight how regional disparities in consumer expectations and regulatory frameworks are shaping ingredient-level demand worldwide.

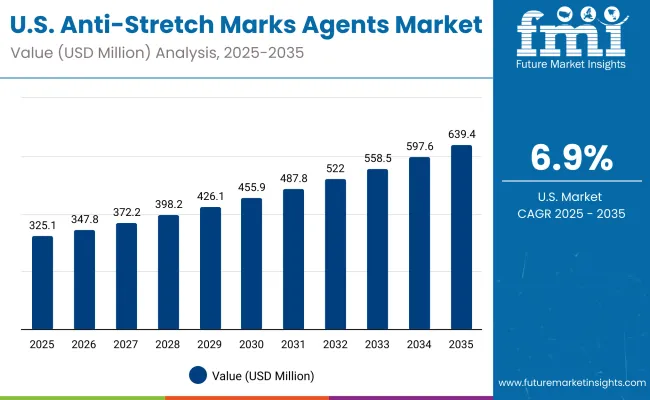

| Year | USA Anti-Stretch Marks Agents Market (USD Million) |

|---|---|

| 2025 | 325.13 |

| 2026 | 347.88 |

| 2027 | 372.23 |

| 2028 | 398.27 |

| 2029 | 426.14 |

| 2030 | 455.97 |

| 2031 | 487.87 |

| 2032 | 522.01 |

| 2033 | 558.54 |

| 2034 | 597.63 |

| 2035 | 639.45 |

The anti-stretch marks agents market in the United States is projected to grow at a CAGR of 6.9% during 2025-2035. The market is expected to expand from USD 325.13 million in 2025 to USD 639.45 million by 2035, supported by consumer awareness of preventive skincare and rising dermocosmetic innovations. Growth is anticipated to be reinforced by the adoption of clinically validated actives such as peptides, as well as encapsulated delivery systems that enhance formulation performance. Regulatory alignment with international safety standards is projected to sustain confidence in advanced ingredients, while dermatology-led endorsements are expected to influence consumer purchasing patterns. Procurement decisions are also likely to shift toward suppliers offering transparent sourcing and sustainability certifications.

The anti-stretch marks agents market in the UK is projected to grow at a CAGR of 10.8% during 2025-2035. Expansion is expected to be supported by retailer-led premiumization, strict cosmetic safety compliance, and rapid uptake of clinically substantiated actives in dermocosmetic body-care lines. Encapsulation platforms are anticipated to gain share as brands seek stability across complex base systems and extended supply chains. E-commerce and pharmacy channels are projected to accelerate trial, while dermatologist advocacy is expected to validate preventive claims for maternity care.

The anti-stretch marks agents market in India is projected to grow at a CAGR of 18.6% during 2025-2035. Growth is expected to be propelled by rapid urbanization, rising maternity-care awareness, and the scale-up of domestic manufacturing under stringent quality systems. Portfolio mixes are anticipated to tilt toward clinically validated peptides paired with cost-effective co-actives, enabling premium mass positioning. Encapsulation is projected to see strong adoption in hot-climate stability programs and D2C launches.

The anti-stretch marks agents market in China is projected to grow at a CAGR of 16.6% during 2025-2035. Expansion is expected to be underpinned by premium personal-care consumption, fast product refresh cycles, and strong KOL-dermatology influence on ingredient credibility. Peptide-based inputs are anticipated to scale alongside local innovation in biotechnology and advanced delivery systems. Cross-border and domestic platforms are projected to amplify brand discovery and rapid formulation iteration.

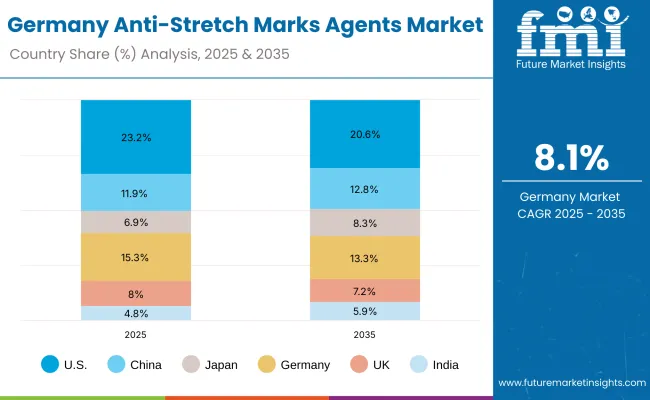

| Country | 2025 |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Country | 2035 |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The anti-stretch marks agents market in Germany is projected to grow at a CAGR of 8.1% during 2025 to 2035. Growth is expected to reflect strong pharmacist-led counseling, rigorous safety expectations, and preference for science-backed formulations. Dermatology-endorsed peptides and controlled-release systems are anticipated to anchor premium offerings, while sustainability credentials are projected to act as tie-breakers in procurement.

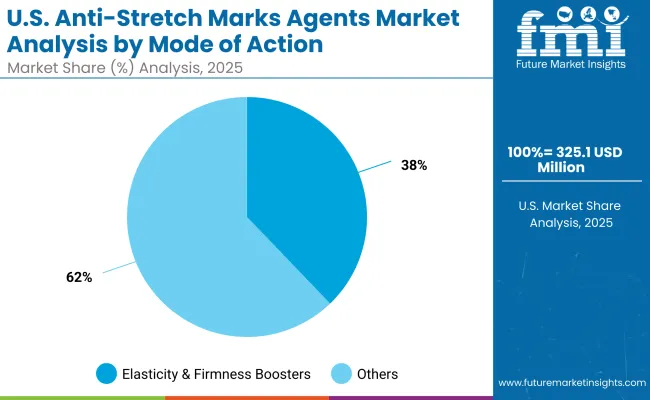

| USA By Mode of Action | Market Value Share, 2025 |

|---|---|

| Elasticity & firmness boosters | 38% |

| Others | 62.4% |

The anti-stretch marks agents market in the USA is projected at USD 325.13 million in 2025. Elasticity and firmness boosters contribute 38%, equivalent to USD 122.25 million, while the remaining 62.4% or USD 202.88 million is generated by other mechanisms, including collagen remodeling and barrier support systems. This distribution reflects a clear orientation toward clinically validated preventive solutions while leaving space for diversified functional pathways. Elasticity boosters are being prioritized due to their role in maintaining skin resilience and delivering measurable improvements, which align with dermatology-led product claims. Meanwhile, broader mechanisms are being retained in formulations as brands seek multi-functional appeal across dermocosmetic and maternity-care categories. As advanced delivery formats enhance the efficacy of elasticity-focused actives, their prominence is anticipated to grow further through the decade. The combination of preventive efficacy and multifunctional innovation is projected to define the USA outlook.

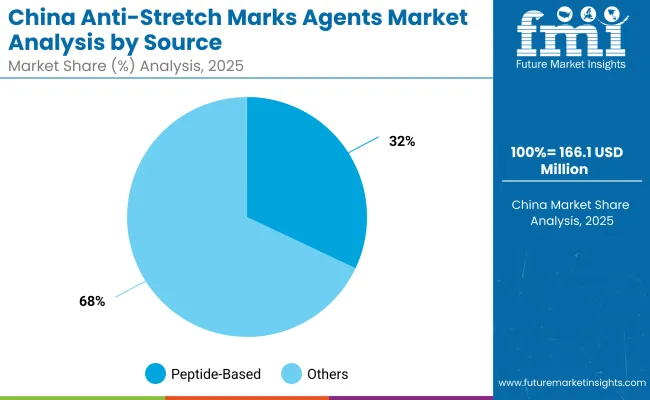

| China By Source | Market Value Share, 2025 |

|---|---|

| Peptide-based | 32% |

| Others | 67.9% |

The anti-stretch marks agents market in China is estimated at USD 166.18 million in 2025. Peptide-based actives are projected to contribute 32%, valued at USD 53.34 million, while other sources represent 67.9%, equal to USD 112.83 million. This distribution illustrates a strong opportunity for peptides, which are being increasingly recognized for their role in stimulating collagen and supporting skin regeneration. Their penetration, however, remains moderated by higher costs and limited large-scale local production capacity. Broader categories, including botanicals and biotechnology-derived actives, are being widely adopted due to affordability, cultural acceptance, and integration into traditional beauty practices. Growth is expected to accelerate as peptides gain traction through premium dermocosmetic launches, clinical substantiation, and cross-border brand strategies. The wider availability of encapsulated formats is anticipated to further strengthen the performance of peptides, ensuring higher adoption in the medium to long term.

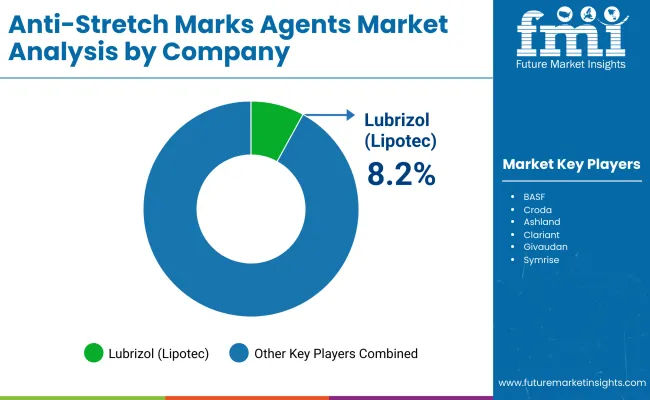

| Company | Global Value Share 2025 |

|---|---|

| Lubrizol (Lipotec) | 8.2% |

| Others | 91.8% |

The anti-stretch marks agents market is moderately consolidated, with global leaders, established raw material suppliers, and specialized innovators competing across dermocosmetic and maternity-care formulations. Multinational suppliers such as BASF, Croda, Clariant, Givaudan, Symrise, Seppic, DSM-Firmenich, and Ashland are positioned as key players, with Lubrizol (Lipotec) emerging as a notable market leader. According to 2025 estimates, Lubrizol (Lipotec) is projected to hold 8.2% of the global market value, while the remaining 91.8% share is fragmented among other ingredient providers.

Strategic emphasis has been placed on the development of peptide-based actives, encapsulation platforms, and clinically substantiated ingredients that align with preventive and corrective skincare trends. Larger suppliers are expected to leverage their scale, regulatory expertise, and global distribution to secure long-term procurement contracts with dermocosmetic majors. Mid-sized companies are anticipated to focus on innovation-driven growth, introducing differentiated formulations through partnerships with contract manufacturers and localized distributors.

Competitive differentiation is being reshaped by demand for clinical validation, sustainability credentials, and supply-chain transparency. The ability to provide assay-linked efficacy data, alongside GMP-certified manufacturing, is projected to act as a key selection criterion for brand owners. The competitive landscape is likely to evolve further as encapsulation technology adoption increases and regional companies strengthen positions through cost-optimized botanicals and biotechnology-derived actives.

Key Developments in Anti-Stretch Marks Agents Market

| Item | Value |

|---|---|

| Market Size (2025E) | USD 1,402.1 million |

| Market Size (2035F) | USD 3,102.3 million |

| Forecast CAGR (2025 to 2035) | 8.30% |

| Quantitative Units | USD million |

| Study Period | 2025 to 2035 |

| Market Definition | Active ingredients and delivery systems used in anti-stretch-mark formulations for dermocosmetic, maternity, and body-care applications |

| Segmentation - Mode of Action | Elasticity & firmness boosters; Collagen remodeling; Barrier & lipid support; Microcirculation & tissue support |

| Segmentation - Source | Peptide-based; Botanical; Biotechnology-derived; Oil-based complexes |

| Segmentation - Delivery System | Encapsulated; Free-form; Emulsified concentrates |

| Segmentation - Physical Form | Emulsion concentrates; Powder; Solution/concentrate |

| Segmentation - Application | Creams & lotions; Oils; Balms & butters; Serums |

| Segmentation - End Use | Maternity care; Body care; Dermocosmetic |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| 2025 Leaders (Select Shares) | Encapsulated delivery 44% (USD 616.92 million); Elasticity & firmness boosters 39% (USD 546.82 million); Peptide-based source 35% (USD 490.74 million) |

| USA Snapshot (2025) | USD 325.13 million |

| China Snapshot (2025) | USD 166.18 million |

| Key Companies Profiled | Lubrizol (Lipotec); BASF; Croda; Ashland; Clariant; Givaudan; Symrise; Seppic; DSM-Firmenich; Rahn |

| Additional Attributes | Dollar sales by segment; dossier-backed efficacy and safety; GMP supply readiness; encapsulation for stability and controlled release; peptide platform scale-up; sustainability and traceability requirements; regional growth led by Asia with strong USA/Europe value leadership |

The global Anti-Stretch Marks Agents Market is estimated to be valued at USD 1,402.1 million in 2025.

The market size for the Anti-Stretch Marks Agents Market is projected to reach USD 3,102.3 million by 2035.

The Anti-Stretch Marks Agents Market is expected to grow at a CAGR of 8.3% between 2025 and 2035.

The key product types in the Anti-Stretch Marks Agents Market include elasticity & firmness boosters, collagen remodeling enhancers, barrier & lipid replenishment systems, and microcirculation & tissue support agents.

In terms of delivery system, the encapsulated segment is expected to command 44% share in the Anti-Stretch Marks Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Stretch Marks Treatment Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA