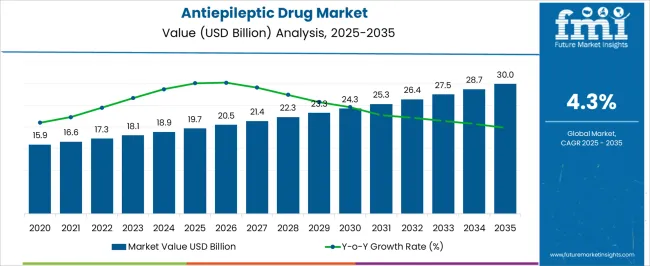

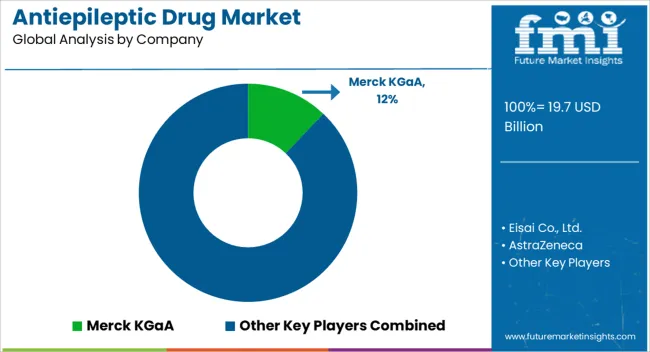

The Antiepileptic Drug Market is estimated to be valued at USD 19.7 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Antiepileptic Drug Market Estimated Value in (2025 E) | USD 19.7 billion |

| Antiepileptic Drug Market Forecast Value in (2035 F) | USD 30.0 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The antiepileptic drug (AED) market is expanding steadily, driven by the growing prevalence of epilepsy and neurological disorders globally. Clinical journals and public health reports have underscored an increasing diagnosis rate due to improved screening programs and greater awareness of seizure disorders. Pharmaceutical companies have intensified their focus on developing advanced formulations with better tolerability and fewer side effects, which has significantly reshaped treatment preferences.

Investor presentations have highlighted consistent research into next-generation molecules and reformulations that address unmet therapeutic needs while enhancing patient compliance. Additionally, supportive regulatory pathways and patent extensions for key products have provided growth momentum. Digital health solutions, including seizure monitoring devices and telemedicine, have improved patient adherence to AED regimens, further bolstering market expansion.

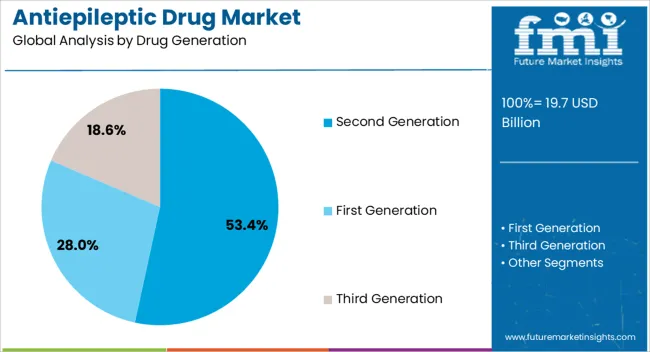

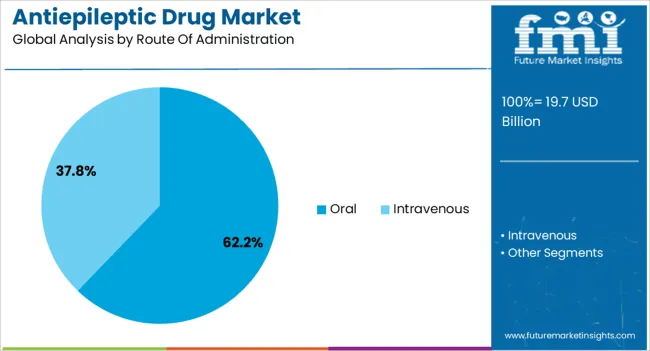

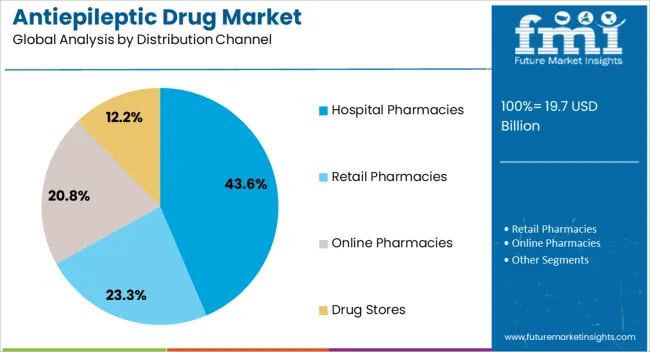

Looking ahead, rising demand for safer and more effective drugs, expansion of healthcare access in emerging economies, and integration of personalized medicine are expected to strengthen the market outlook. Segmental growth is projected to be dominated by second-generation drugs, oral administration routes, and hospital pharmacies, reflecting clinical preference and treatment accessibility.

The second generation segment is projected to contribute 53.4% of the antiepileptic drug market revenue in 2025, establishing its leadership in the therapeutic landscape. Growth of this segment has been supported by clinical preference for improved safety profiles, reduced drug-drug interactions, and better patient tolerability compared to first-generation AEDs.

Medical literature has documented that second-generation agents provide broader spectrum efficacy, making them suitable for multiple seizure types. Pharmaceutical innovations have further enhanced this segment through extended-release formulations and targeted therapies designed to reduce dosing frequency and improve adherence.

Healthcare providers have increasingly prescribed these drugs due to their lower incidence of cognitive and systemic side effects, which has contributed to improved patient quality of life. As healthcare systems prioritize individualized treatment approaches and expanded therapeutic choices, the second-generation segment is expected to maintain its leading role in the market.

The oral segment is projected to account for 62.2% of the antiepileptic drug market revenue in 2025, underscoring its dominance as the preferred route of administration. Growth of this segment has been driven by patient convenience, ease of dosing, and widespread availability of oral formulations across generic and branded options.

Oral administration has been favored by clinicians for its suitability in chronic therapy, allowing patients to manage treatment in outpatient and home settings. Pharmaceutical pipelines have consistently focused on developing oral extended-release and once-daily formulations that improve adherence and reduce seizure frequency.

Patient compliance studies have reinforced the effectiveness of oral administration, showing reduced treatment discontinuation rates compared to alternative routes. With healthcare systems emphasizing long-term management strategies and affordability, the oral segment is anticipated to retain its strong market position, supported by innovation in drug delivery technologies and consistent patient acceptance.

The hospital pharmacies segment is projected to contribute 43.6% of the antiepileptic drug market revenue in 2025, maintaining its leadership in distribution. This segment’s prominence has been influenced by the high proportion of epilepsy patients initiating treatment within hospital settings, where accurate diagnosis and specialist consultation are readily available.

Hospital pharmacies have played a critical role in ensuring timely access to both branded and generic AEDs, particularly for acute seizure management and complex epilepsy cases. Healthcare policy frameworks and institutional purchasing agreements have strengthened the role of hospital pharmacies as primary distribution points for advanced therapies.

Additionally, hospitals have established comprehensive patient support systems, including counseling and monitoring programs, which enhance medication adherence. The concentration of neurologists and epilepsy specialists within hospital networks has further driven prescription volumes through this channel. As healthcare infrastructure continues to evolve and demand for integrated patient management grows, hospital pharmacies are expected to remain a key driver of AED distribution.

Chronic epilepsy is a neurological condition causing recurrent seizures, treated with genetically influenced antiepileptic drugs, brain damage, and pregnancy-related factors. Antiepileptic medications (AEDs) are essential in treating epilepsy by regulating brain electrical activity, improving quality of life, and seizure control. They also contribute to the psychological well-being of individuals with epilepsy.

With individualized medicine selection based on seizure type and unique patient features, epilepsy medications are essential in reducing consequences, including injury and accidents. The epilepsy incidence is rising owing to accidents, injuries, and infectious diseases, affecting the central nervous system and propelling the growth of the epilepsy drug sector.

The increasing prevalence of age-related neurological illnesses, such as epilepsy, in the geriatric population, necessitates the development of specific AEDs and management techniques for industry expansion. Epilepsy prevalence and improved neurological disorders diagnosis controls industry growth due to the plurality and demand for epilepsy drugs for the treatment of brain injuries.

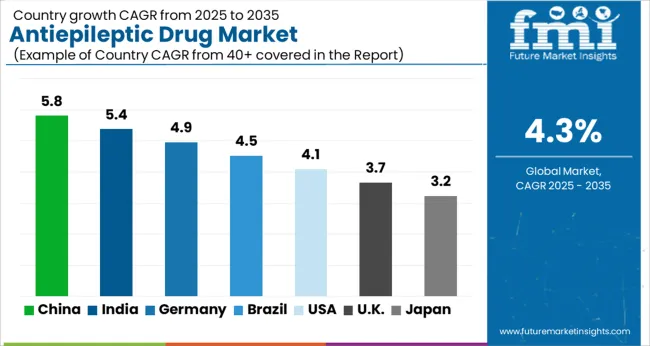

The global demand has historically developed at a CAGR of 4.6%. However, sales have hampered at a trifling pace, displaying a CAGR of 4.3% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 4.6% |

Cognitive adverse effects, disease, and pharmacodynamics of antiepileptic drugs increasing the likelihood of drug therapy complications, hinder the demand for epilepsy patients’ management. Epileptic seizures can be controlled with current AEDs, but one-third remain uncontrolled due to complex AED and epilepsy-related drug therapy complications.

The global public health emergency declared in 2024 has significantly impacted the economy through drug production, distribution disruptions, and financial impacts on firms and industries. AED users may face increased drug interactions and toxicity due to their complex medical conditions and prescriptions, affecting their ability to control seizures.

Drug therapy problems in epilepsy patients significantly impact treatment effectiveness and medical care reliability, hindering AED demand growth and affecting the development of the medical care industry.

Substitute antiepileptic drugs (AEDs) have enhanced treatment outcomes in epilepsy, reducing side effects and expanding therapeutic options, indicating positive strides in epilepsy drug development. For instance, The International League Against Epilepsy (ILAE) identifies over 30% of epilepsy patients who do not respond to the combination of two prescribed anti-seizure medications as "drug-resistant."

The research and development of novel therapies are crucial for improving patient symptoms and quality of life, as well as caregivers. A large clinical pipeline and investigational studies for pediatric and geriatric antiepileptic drugs is projected to lead to opportunistic industry expansion.

Introduction of Effective Third Generation Drugs

To encounter unmet therapeutic needs, new approaches to traditional antiepileptic drug (AED) research and development are required. The pharmaceutical industry has an opening to create novel and generic medications as the patents on second-generation drugs are about to run out.

The introduction of third-generation drugs, encouraging market expansion, and funding clinical studies are the actions of major businesses. Eisai Co., Ltd., for instance, introduced Fycompa, an AED it discovered in-house, in Japan in July 2024 with a new fine granule formulation. These ongoing research and development investments are predicted to fuel industry expansion in the upcoming decade.

Sports Injuries Emerges the Demand for Emergency Drug Care

Head injuries are prevalent in the sports sector, leading to demand for emergency AEDs in sports rehabilitation centers. Pharmaceutical companies are developing epileptic drugs for rapid relief in emergencies. For instance, Angelini Pharma has been approved by the European Commission for the adjunctive treatment of focal-onset seizures in adults, aiming to augment its consumer base for sports rehabilitation.

Even though several types of research show that sports-related injuries aren't more common in epilepsy patients compared to the general population, raising questions about whether these patients avoid sports due to unreliable reasons.

Demand for Generic Biomedicines Augments the Research

The demand for biological neuro therapies, which are harnessed from natural sources and rooted in traditional approaches scribbled in the ancient scriptures such as Ayurveda, is a key aspect of the growth of generic medication.

The use of generic biomedicines in the treatment of neurological disorders, such as epilepsy, is a testament to the positive impact of your research and development efforts. These biomedicines are an important component of neurotherapies. The growth of natural medication is fueled by increased awareness of its benefits, with patients increasingly seeking organic AED treatments.

In the section that follows, detailed analyses of the industry segments for antiepileptic medications are given. Nevertheless, in 2025, there is going to be ample demand for drugs of the second generation. Among patients with epilepsy, oral medications are much preferred.

| Attributes | Details |

|---|---|

| Top Drug Generation | Second Generation |

| Revenue share in 2025 | 53.4% |

In 2025, second-generation antiepileptic medication demand is projected to account for 53.4% of the industry share. Given its efficacy in lowering hospital stays linked to epilepsy, particularly for individuals with numerous comorbidities, this offers various options.

Due to their great tolerance, safety, and novel modes of action, second-generation antiepileptics are anticipated to become popular and have higher approval rates. Examples include Lamotrigine, Levetiracetam, Brivaracetam, and Perampanel.

More doctors and neurologists who practice close to epilepsy facilities are writing prescriptions for these medications, which is encouraging the expansion of these drugs.

| Attributes | Details |

|---|---|

| Top Route of Administration | Oral |

| Revenue share in 2025 | 62.2% |

The oral route of administration is anticipated to hold a notable share of the epilepsy treatment drugs sector, accounting for around 62.2% in 2025. The oral segment is projected to grow gradually over the forthcoming decade, signaling a promising future for epilepsy treatment and fostering optimism among stakeholders.

The oral route is favored for its convenience, patient compliance, and the assurance of well-established formulations. With the ability to allow patients to self-administer and adhere to prescribed regimens consistently, oral medications are a reliable and stable choice for epilepsy treatment.

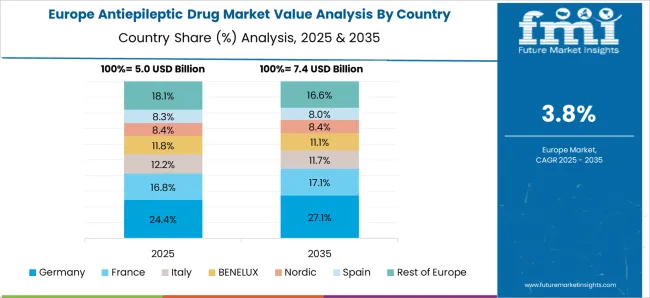

As episodes of epilepsy are becoming common around the globe, the demand for antiepileptic drugs is augmented from different regions. The medical sector of the United States is making significant demand for AEDs, whereas the demand from Germany’s healthcare sector is supposed to follow that market.

Asia Pacific is emerging as a prominent player in the development of epilepsy medication owing to the medical and pharmaceutical industries of China and India. The United Kingdom is anticipated to develop a sophisticated consumer base for AED medications in the upcoming decade.

The Epilepsy foundations and healthcare professionals are working together to enhance education, facilitate early diagnosis, and raise awareness; with such development, the United States antiepileptic drug market is projected to experience a 4.7% CAGR from 2025 to 2035.

The United States FDA regulates and approves epilepsy drugs, ensuring safety and efficacy, catering to innovation, and supporting industry growth in the United States.

Lipocine Inc. presented "LPCN 2101: An Endogenous Neuroactive Steroid for Epilepsy" at the Epilepsy Foundation Pipeline Conference in 2025, displaying recent breakthroughs in epileptic treatment.

The antiepileptic drug market in Germany is projected to report a CAGR of 4.1%. This is compelled by the high national acceptance rate of these medications, which significantly influences its development.

The German Society for Epileptology states that most adult patients with focal epilepsies in a real-world clinical setting in Germany get antiepileptic drugs as monotherapy.

In Germany, there are often insufficient or restricted reimbursement rules for epilepsy medications. This leads to patients paying more out-of-pocket, potentially impacting the affordability and use of certain drugs, especially for those with low incomes.

Antiepileptic medicine sales in China are predicted to register a 5.3% CAGR through 2035 because of a sizable "epilepsy treatment gap" brought on by societal prejudice and subpar healthcare delivery. Key pharmaceutical firms in the industry currently have a chance to evolve.

Since customers prefer purchasing medication online over traditional ways, internet pharmacies have become an essential tool for businesses, helping to propel industry growth. It is anticipated that the number of around 10 million epileptics in China is going to keep increasing. The multitude of these patients prefer online pharmacies for the safe distribution of medications.

As one of the earliest pioneers of epilepsy medication research and development, the United Kingdom antiepileptic drug market to hold a beacon of hope with a CAGR of 5.9% from 2025 to 2035.

The United Kingdom's pharmaceutical industry creates both brand-name and generic drugs to treat epilepsy. In addition, businesses are creating cutting-edge technical solutions to reduce epileptic episodes.

The mjn-SERAS, for instance, was introduced by the medical technology start-up mjn-NEURO in May 2025. In the United Kingdom, this helps in seizure detection. With the use of artificial intelligence, this revolutionary device can anticipate seizures up to three minutes in advance.

India has made great strides in the treatment of epilepsy; research has mostly concentrated on genetic and epidemiological issues. The antiepileptic drug market is anticipated to reach a peak at a CAGR of 5.4% between 2025 and 2035.

The Indian Epilepsy Society has set the recommendations for managing epilepsy in India. These guidelines are subject to periodic adjustments in light of developing knowledge and treatment trends.

The launch of generic Topiramate extended-release capsules by Zydus Lifesciences in January 2025 is proof that Indian companies are actively engaged in the research and development of AED drugs.

In the medical industry, prominent firms use a competitive price strategy. Businesses are forming alliances with the public sector and end-use industries, while competitors increase product ranges in response to growing demand.

Various establishments, including pharmaceutical manufacturers, research institutions, and healthcare providers, all striving to increase share, dominate the antiepileptic drug market. They either collaborate with other businesses or obtain government authorization to distribute new therapies.

Good manufacturing practices are vital for pharmaceutical players in the epilepsy drug market, as they reduce residue risk and ensure safety. Pharmacies across the globe are preferred for obtaining epilepsy drugs. Industry participants use strategies like product launches, approvals, strategic acquisition, and innovations to maintain and grow their global reach.

Recent Developments in the Antiepileptic Drug Market

The industry is diverged into first-generation, second-generation, and third-generation based on drug generation.

Depending on the route of administration, the industry is bifurcated into oral and intravenous.

Antiepileptic medications are distributed through various distribution channels, including hospital pharmacies, retail pharmacies, online pharmacies, and drug stores.

The industry is examined across key regions including North America, Latin America, Europe, East Asia, South Asia, Oceania, as well as Middle East and Africa.

The global antiepileptic drug market is estimated to be valued at USD 19.7 billion in 2025.

The market size for the antiepileptic drug market is projected to reach USD 30.0 billion by 2035.

The antiepileptic drug market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in antiepileptic drug market are second generation, first generation and third generation.

In terms of route of administration, oral segment to command 62.2% share in the antiepileptic drug market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA