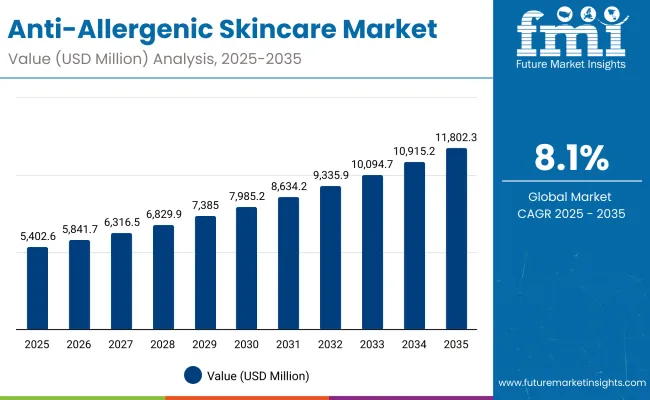

The Anti-Allergenic Skincare Market is expected to record a valuation of USD 5,402.6 million in 2025 and USD 11,802.3 million in 2035, with an increase of USD 6,399.7 million, which equals a growth of nearly 118% over the decade. The overall expansion represents a CAGR of 8.1% and more than a 2X increase in market size.

Anti-Allergenic Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Allergenic Skincare Market Estimated Value (2025E) | USD 5,402.6 million |

| Anti-Allergenic Skincare Market Forecast Value (2035F) | USD 11,802.3 million |

| Forecast CAGR (2025 to 2035) | 8.10% |

During the first five-year period from 2025 to 2030, the market increases from USD 5,402.6 million to USD 7,985.2 million, adding USD 2,582.6 million, which accounts for around 40% of the total decade growth. This phase records steady adoption across eczema-prone and rosacea-prone skincare driven by rising cases of sensitive skin conditions, increasing dermatological consultations, and growth in infant and child-specific hypoallergenic formulations. Pharmacies and dermatology clinics dominate this period as they cater to over 46% of end-users who trust medically guided skincare purchases. Hypoallergenic moisturizers and barrier-repair creams capture the highest attention due to their proven efficacy in managing allergic contact dermatitis and general sensitive-skin users.

The second half from 2030 to 2035 contributes USD 3,817.1 million, equal to 60% of total growth, as the market jumps from USD 7,985.2 million to USD 11,802.3 million. This acceleration is powered by widespread deployment of AI-personalized skincare regimens, e-commerce dominance, and the expansion of soothing serums and gentle cleansers into global markets. East Asia and South Asia & Pacific emerge as the fastest-growing regions, led by China (14.4% CAGR) and India (16.2% CAGR), where dermatology-led skincare demand surges.

E-commerce platforms and specialty beauty retailers begin to capture larger market shares above 55% by the end of the decade, while pharmacies remain a stronghold in North America and Europe. Subscription-based sensitive-skin kits, refillable hypoallergenic formulations, and digital dermatology consultations increase recurring revenue, pushing the software-equivalent services share beyond traditional product sales.

From 2020 to 2024, the Anti-Allergenic Skincare Market grew steadily from USD ~4,200 million to USD 5,000+ million, driven by hardware-centric adoption equivalents such as hypoallergenic moisturizers and barrier-repair creams. During this period, the competitive landscape was dominated by pharmaceutical-linked brands controlling nearly 70% of revenue, with leaders such as Cetaphil, La Roche-Posay, and Eucerin focusing on dermatologist-recommended sensitive-skin solutions for eczema-prone and rosacea-prone users. Competitive differentiation relied on efficacy, tolerance validation, and medical endorsement, while e-commerce and direct-to-consumer channels were often bundled as auxiliary offerings rather than primary revenue streams. Service-based subscription models had minimal traction, contributing less than 10% of the total market value.

Demand for anti-allergenic skincare expanded to USD 5,402.6 million in 2025, and the revenue mix began shifting as e-commerce and specialty retailers grew to over 53% share by channel. Traditional pharmacy leaders faced rising competition from digital-first players offering AI-based skin diagnostics, clean-label vegan formulations, and subscription-based sensitive-skin boxes. Major skincare vendors are pivoting to hybrid models, integrating eco-friendly packaging, refill stations, and online dermatology consultations to retain relevance. Emerging entrants specializing in vegan-certified, fragrance-free, and sustainable sourcing are gaining share. The competitive advantage is moving away from traditional moisturizing innovation alone to ecosystem strength, cross-channel presence, sustainability credentials, and recurring revenue streams.

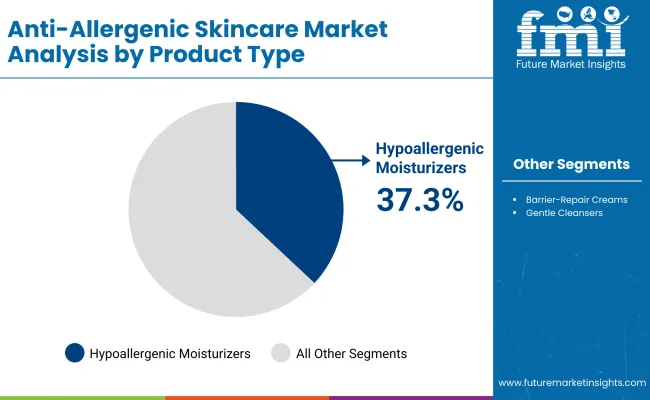

Advances in formulation technology have improved tolerance and efficacy, allowing for safer application across infants, adults, and senior skin types. Hypoallergenic moisturizers have gained popularity due to their suitability for eczema-prone and general sensitive skin, representing 37.3% of total market value in 2025. The rise of barrier-repair creams and soothing serums has contributed to enhanced skin protection and calming effects, while gentle cleansers are replacing harsher surfactants in mass retail.

Expansion of dermatology-led recommendations, clean-label preferences, and e-commerce penetration has fueled market growth. Innovations in fragrance-free and dermatologist-tested claims and subscription-based sensitive-skin kits are expected to open new application areas. Segment growth is expected to be led by hypoallergenic moisturizers, pharmacies & dermatology clinics, and sensitive-skin formulations, due to their proven trust, medical validation, and adaptability across diverse geographies.

The market is segmented by product type, skin concern, channel, end user, and region. Product types include hypoallergenic moisturizers, barrier-repair creams, soothing serums, and gentle cleansers, highlighting the core categories driving adoption across different consumer groups. Skin concern classification covers eczema-prone skin, allergic contact dermatitis, rosacea-prone skin, and general sensitive skin, addressing both clinical conditions and broader consumer sensitivity needs. Based on channel, the segmentation includes pharmacies & dermatology clinics, e-commerce platforms, specialty beauty retail, and mass retail, which together define the diverse distribution pathways shaping consumer access and trust.

In terms of end user, categories encompass infants & children, adults, senior skin, and unisex sensitive-skin users, reflecting demographic-specific demand and formulation targeting. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with country-level emphasis on major markets such as the United States, Canada, Germany, France, the United Kingdom, China, Japan, India, and Brazil, as well as emerging economies driving future growth.

| Product Type | Value Share% 2025 |

|---|---|

| Hypoallergenic moisturizers | 37.3% |

| Others | 62.7% |

The hypoallergenic moisturizers segment is projected to contribute 37.3% of the Anti-Allergenic Skincare Market revenue in 2025, maintaining its lead as the dominant product category. This growth is fueled by rising consumer demand for daily-use moisturizers that provide barrier repair, hydration, and allergen-free protection, making them the first line of defense against sensitive-skin flare-ups. Hypoallergenic moisturizers have gained universal acceptance across infants, adults, and senior skin groups, as they are clinically validated and often dermatologist-recommended.

The segment’s expansion is also supported by increasing awareness campaigns on sensitive skin conditions such as eczema and allergic contact dermatitis, where moisturizers are considered a standard preventive measure. Brands are innovating with fragrance-free, non-comedogenic, and clean-label formulations that improve tolerance and skin compliance. Furthermore, the inclusion of ceramides, hyaluronic acid, and natural soothing agents has reinforced the functional appeal of this category. As personalization and subscription-based skin kits become more common, hypoallergenic moisturizers are expected to retain their position as the backbone of anti-allergenic skincare solutions worldwide.

| Skin Concern | Value Share% 2025 |

|---|---|

| Sensitive skin | 41.2% |

| Others | 58.8% |

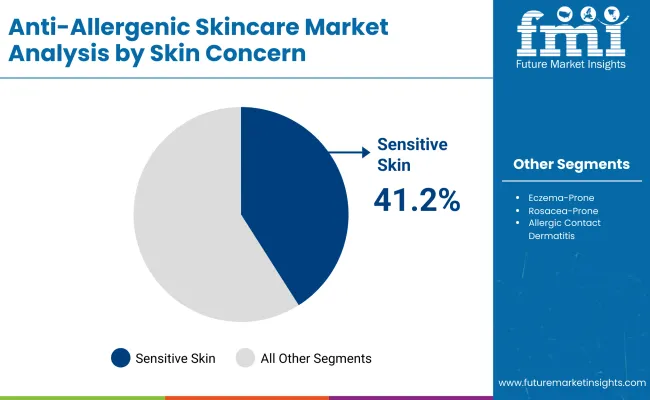

The sensitive skin segment is forecasted to hold 41.2% of the Anti-Allergenic Skincare Market share in 2025, led by the increasing number of consumers identifying themselves as having skin sensitivity. This self-diagnosed segment has grown rapidly, particularly in urban regions where pollution, lifestyle stress, and exposure to allergens heighten the prevalence of sensitivity symptoms such as redness, irritation, and dryness.

Consumers are increasingly seeking all-in-one solutions for general sensitivity rather than targeting specific skin disorders, making the sensitive-skin category the broadest and most inclusive. Its dominance is further reinforced by growing demand among millennials and Gen Z consumers, who are more inclined toward preventive skincare and clean-label products. Dermatologists and skin clinics often recommend sensitive-skin ranges as a precautionary daily care regime, which boosts retail trust and adoption. The segment’s growth is also bolstered by social media advocacy, consumer awareness campaigns, and e-commerce-led education on hypoallergenic routines, all of which position sensitive-skin products as an essential daily skincare category.

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies & dermatology clinics | 46.7% |

| Others | 53.3% |

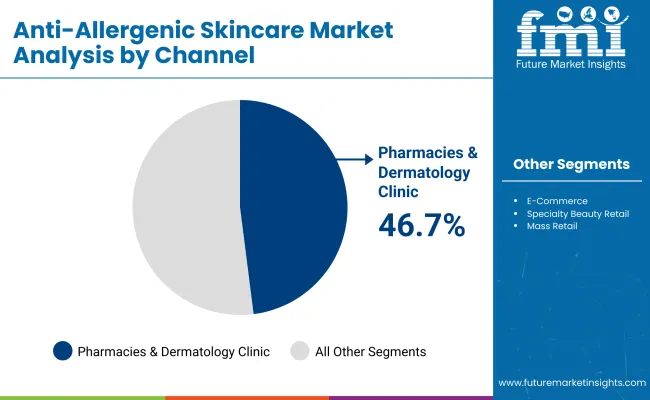

The pharmacies & dermatology clinics segment is projected to account for 46.7% of the Anti-Allergenic Skincare Market revenue in 2025, establishing it as the leading distribution channel. These outlets are preferred by consumers due to the high trust associated with dermatological recommendations, medical-grade product validation, and pharmacist-guided advice. Sensitive-skin users, especially infants, children, and patients with eczema or dermatitis, strongly rely on medical channels for their skincare purchases. This segment is also supported by regulatory frameworks in Europe and North America, where dermatologist-tested and clinically validated claims are mandatory for sensitive-skin positioning. Pharmacies have become the backbone for prescription-led and OTC (over-the-counter) anti-allergenic skincare, reinforcing consumer loyalty.

In addition, dermatology clinics are expanding their role beyond treatment to include retail sales of recommended brands, thereby bridging medical trust with retail convenience. While e-commerce continues to rise, pharmacies & clinics are expected to remain the most dominant channel for at least the first half of the forecast period, given their alignment with medical credibility and consumer trust in safety-first formulations.

Rising Prevalence of Eczema and Allergic Skin Disorders

The Anti-Allergenic Skincare Market is heavily driven by the increasing incidence of eczema, allergic contact dermatitis, and rosacea across both developed and emerging economies. For example, eczema affects over 20% of children in countries like the USA and UK, with flare-ups requiring consistent use of hypoallergenic moisturizers and barrier-repair creams. In Asia-Pacific, urbanization and high exposure to pollutants and allergens are pushing younger consumers to seek daily-use soothing serums and gentle cleansers. This prevalence directly translates to sustained demand for specialized anti-allergenic products that not only treat but also prevent flare-ups. The medical community’s endorsement of hypoallergenic skincare as a first-line, non-invasive management tool further boosts sales through pharmacies and dermatology clinics.

Expansion of Dermatology-Led Skincare and Clinical Endorsements

Another key driver is the strong link between clinical dermatology practices and consumer adoption of anti-allergenic products. Dermatologists are increasingly prescribing and recommending fragrance-free, clean-label, and medically tested brands such as Cetaphil, La Roche-Posay, and Eucerin for sensitive and allergy-prone skin. In many European and North American markets, clinical validation is not just a marketing differentiator but a regulatory requirement for sensitive-skin claims. This medical backing enhances trust among consumers who are wary of mass retail products causing adverse reactions. The integration of anti-allergenic skincare products into dermatology clinic retail shelves has expanded their accessibility, creating a hybrid model of medical credibility and consumer convenience.

High Product Development Costs and Regulatory Barriers

Developing effective anti-allergenic skincare formulations requires rigorous dermatological testing, hypoallergenicity validation, and safety compliance across multiple regions. In the EU, for instance, products must adhere to REACH standards and allergy safety labeling, while in North America, dermatologist-tested claims must be supported by clinical data. This significantly raises R&D costs, making it harder for smaller or emerging brands to compete with established players. In addition, new formulations with advanced barrier-repair ingredients like ceramides and peptides face extended approval cycles before reaching the market, delaying innovation rollout.

Consumer Price Sensitivity in Emerging Markets

While developed economies are witnessing strong adoption of premium anti-allergenic skincare, emerging regions such as South Asia and parts of Latin America remain highly price-sensitive. Premium hypoallergenic moisturizers and barrier-repair creams priced at two to three times higher than standard moisturizers face resistance outside urban upper-middle-class households. This restricts adoption in rural and semi-urban markets, where consumers often turn to basic natural or herbal alternatives perceived as safer but lacking in validated hypoallergenic efficacy. This affordability gap could slow overall market penetration, especially in high-growth regions like India and Brazil.

Surge in AI-Personalized and Subscription-Based Skincare Models

A defining trend in the Anti-Allergenic Skincare Market is the rise of AI-driven skin analysis tools that help consumers identify triggers and customize their sensitive-skin routines. Apps and digital platforms now offer personalized regimens that integrate hypoallergenic moisturizers, serums, and cleansers tailored to each user’s skin profile. Alongside this, subscription-based models are gaining traction, where consumers receive monthly sensitive-skin kits with refillable products. Brands like CeraVe and Aveeno are experimenting with direct-to-consumer platforms offering recurring delivery, trial packs, and digital dermatology consultations. This shift is transforming anti-allergenic skincare from a reactive purchase into a predictive, ongoing wellness routine.

E-commerce Expansion with Clean-Label and Vegan Positioning

E-commerce is becoming the most disruptive growth channel, particularly in Asia-Pacific and Europe, where sensitive-skin products are marketed with clean-label, vegan, and fragrance-free claims. Consumers increasingly prefer online reviews, dermatologist-led tutorials, and influencer-backed education before making purchase decisions. Platforms like Amazon, Tmall, and specialty beauty retailers are curating "sensitive-skin only" sections, giving visibility to brands that emphasize allergen-free and dermatologically tested credentials. This trend is accelerating the shift from pharmacy-dominated distribution to digital-first models, with clean-label certifications (e.g., COSMOS, EWG, Vegan Society) acting as trust signals that drive conversion rates online.

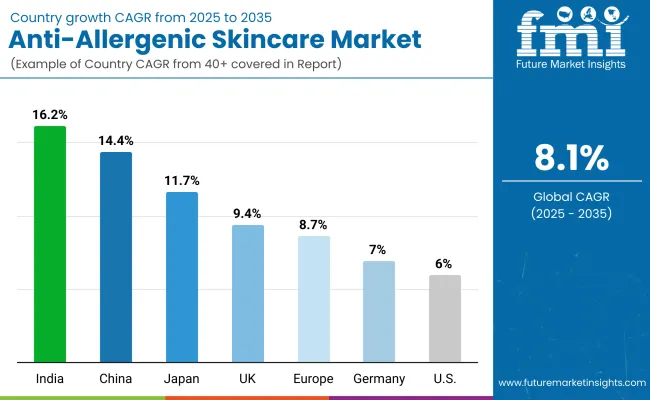

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

| Europe | 8.7% |

The Anti-Allergenic Skincare Market is witnessing highly uneven growth rates across major countries, with India (16.2%) and China (14.4%) emerging as the fastest-growing markets from 2025 to 2035. This acceleration is underpinned by rapid urbanization, increasing dermatological awareness, and rising disposable incomes in Asia. In India, heightened sensitivity to pollution-related skin disorders and the growing pediatric population fuel demand for hypoallergenic moisturizers and barrier-repair creams.

Similarly, China is experiencing a surge in sensitive-skin claims within e-commerce platforms, with online pharmacies and beauty retailers curating specialized product ranges for rosacea-prone and allergy-sensitive consumers. These high-growth Asian markets are further boosted by the integration of tele-dermatology, AI-based skin analysis apps, and digital-first brands, which accelerate consumer education and drive product adoption.

In comparison, mature markets such as the USA (6.0%) and Germany (7.0%) are expanding at steadier rates, reflecting saturation but steady replacement demand. The USA growth is anchored in dermatology-led recommendations and prescription-linked sensitive-skin products, while Europe’s 8.7% CAGR highlights consistent consumer preference for clean-label, fragrance-free skincare that complies with stringent EU cosmetic safety regulations.

The UK (9.4%) is showing stronger momentum than Germany due to higher online penetration and private-label expansion in sensitive-skin categories. Meanwhile, Japan (11.7%) benefits from a culture of high skincare discipline and early adoption of gentle cleansers and soothing serums, particularly among aging consumers managing rosacea and dermatitis. These variations underscore a global landscape where emerging Asia drives volume expansion, while North America and Europe sustain market value through premiumization, regulatory-backed trust, and clinical-grade formulations.

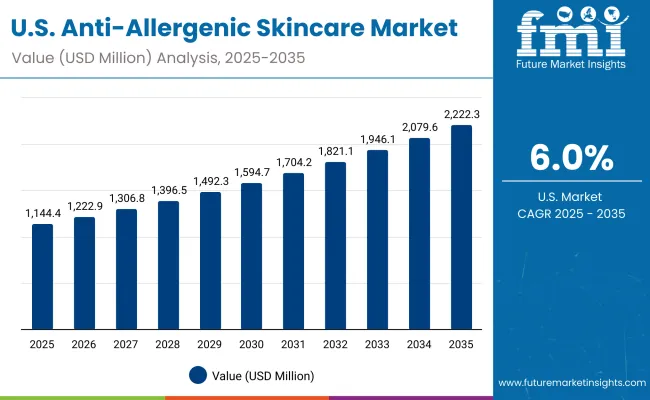

| Year | USA Anti-Allergenic Skincare Market (USD Million) |

|---|---|

| 2025 | 1144.45 |

| 2026 | 1222.98 |

| 2027 | 1306.89 |

| 2028 | 1396.56 |

| 2029 | 1492.39 |

| 2030 | 1594.79 |

| 2031 | 1704.21 |

| 2032 | 1821.14 |

| 2033 | 1946.10 |

| 2034 | 2079.63 |

| 2035 | 2222.33 |

The Anti-Allergenic Skincare Market in the United States is projected to grow at a CAGR of 6.0%, led by increased demand for dermatologist-tested moisturizers and barrier-repair creams. Pharmacies and dermatology clinics dominate distribution, with USA consumers showing strong trust in medical endorsements. Eczema-prone and rosacea-prone skin categories are registering consistent year-on-year growth, supported by rising cases of allergic contact dermatitis in urban regions. The adult segment leads consumption, but growth is also notable in infants and children, where pediatric dermatology is increasingly recommending hypoallergenic skincare. Digital-first adoption is rising in parallel, with Amazon and online pharmacies playing a growing role in product accessibility.

The Anti-Allergenic Skincare Market in the United Kingdom is expected to grow at a CAGR of 9.4%, supported by high adoption of sensitive-skin ranges through online retail channels and specialty beauty outlets. Consumers in the UK are highly responsive to clean-label and vegan-certified products, with demand reinforced by the country’s regulatory emphasis on allergen transparency. Premiumization is evident in soothing serums and gentle cleansers, which are marketed heavily in e-commerce channels. Beyond personal skincare, the UK has seen strong uptake in institutional dermatology clinics and NHS-linked skin programs, highlighting the medicalization of sensitive-skin care.

India is witnessing rapid growth in the Anti-Allergenic Skincare Market, which is forecast to expand at a CAGR of 16.2% through 2035 the highest globally. Rising prevalence of eczema and allergy-related skin sensitivity in urban populations, combined with high pollution exposure, is driving adoption of hypoallergenic moisturizers and barrier-repair creams. Awareness campaigns and dermatologist endorsements in tier-1 and tier-2 cities are fueling market penetration. Pediatric-sensitive skin care is an emerging high-growth category, with parents increasingly prioritizing hypoallergenic solutions for infants and children. Digital adoption is accelerating, with pharmacies, Flipkart, and Nykaa becoming dominant channels for sensitive-skin care access.

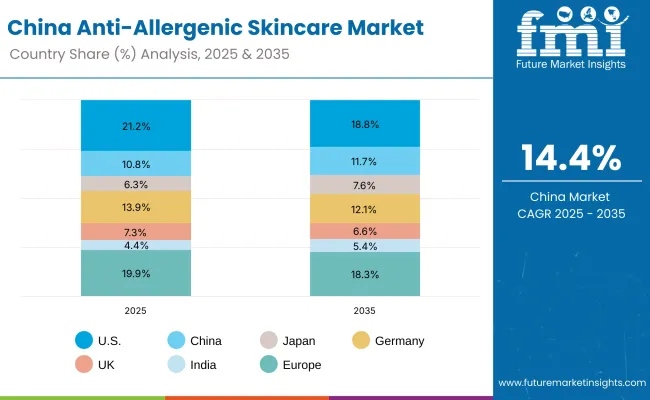

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 10.8% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.3% |

| India | 4.4% |

| Europe | 19.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 7.6% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

| Europe | 18.3% |

The Anti-Allergenic Skincare Market in China is expected to grow at a CAGR of 14.4%, one of the fastest among leading economies. This momentum is driven by digital-first retail ecosystems, tele-dermatology consultations, and sensitive-skin consumer education. Rapid expansion of soothing serums and gentle cleansers is evident across Tmall and JD platforms, where brands emphasize allergen-free and fragrance-free positioning. Municipal hospitals and dermatology clinics are increasingly collaborating with leading skincare brands to promote medically tested ranges. Domestic brands are also competing with multinationals by offering affordable hypoallergenic skincare kits tailored to local skin conditions.

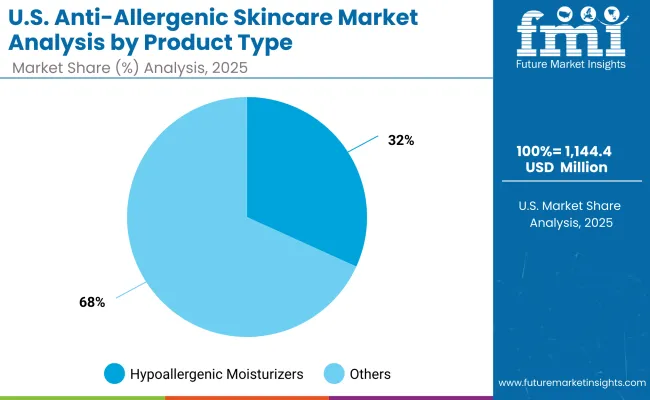

| USA By Product Type | Value Share% 2025 |

|---|---|

| Hypoallergenic moisturizers | 31.8% |

| Others | 68.2% |

The Anti-Allergenic Skincare Market in the United States is projected at USD 1,144.45 million in 2025, with hypoallergenic moisturizers contributing 31.8% of revenue. This leadership reflects the strong consumer reliance on moisturizer-based formulations for eczema-prone and rosacea-prone skin, supported by dermatologist endorsements and clinical trust. Unlike generic skincare categories, hypoallergenic moisturizers in the USA are positioned as medically validated daily essentials, often bundled with prescription-based dermatology regimens.

Growth is supported by the increasing prevalence of allergic contact dermatitis, particularly in urban and pediatric populations. Pharmacies and dermatology clinics dominate the channel structure, reinforcing medical credibility. E-commerce adoption is expanding rapidly, but consumer preference for dermatologist-tested claims remains the defining factor. This segment is further strengthened by innovation in barrier-repair creams with ceramides, soothing serums enriched with niacinamide, and gentle cleansers designed for multi-age groups, providing consistent year-on-year growth.

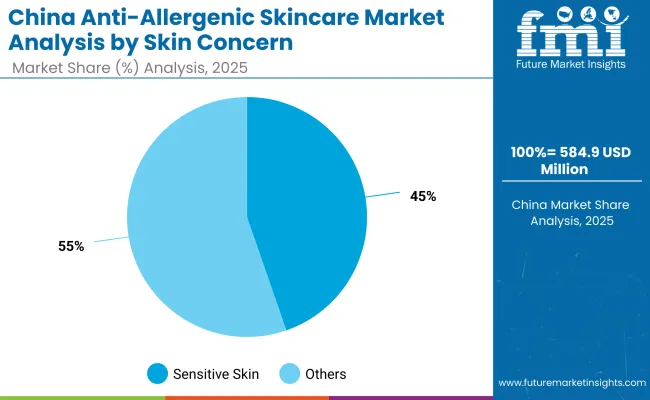

| China By Skin Concern | Value Share% 2025 |

|---|---|

| Sensitive skin | 44.7% |

| Others | 55.3% |

The Anti-Allergenic Skincare Market in China is valued at USD 584.94 million in 2025 (10.8% of global share), with the sensitive skin category leading at 44.7%. This dominance stems from the rapid rise in urban pollution-induced skin sensitivity, coupled with the growing middle-class focus on dermatology-tested skincare. Sensitive skin is no longer perceived as a niche concern in China but rather a mainstream consumer identity, with significant traction among young female demographics.

E-commerce platforms such as Tmall and JD.com have emerged as key growth engines, offering curated "sensitive-skin only" product lines and expanding access beyond tier-1 cities. Affordable dermatologist-backed formulations, particularly soothing serums and gentle cleansers, are accelerating adoption. Pediatric-sensitive ranges are also gaining prominence, especially with parents increasingly aware of child eczema and atopic dermatitis management. This advantage positions the sensitive skin segment as a long-term growth anchor, driving double-digit CAGR through 2035.

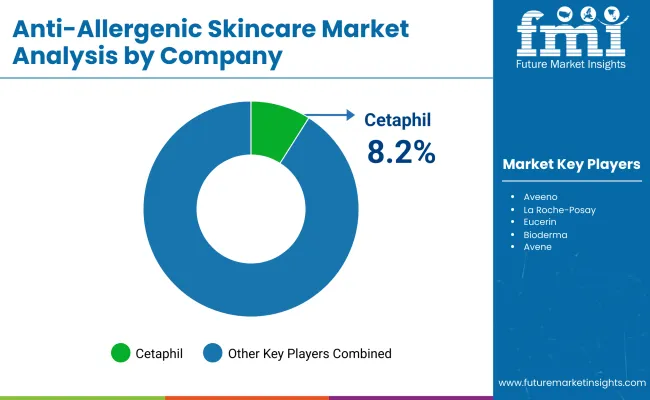

The Anti-Allergenic Skincare Market is moderately fragmented, with multinational dermatology-backed brands, mid-tier clean-label innovators, and niche-focused sensitive-skin specialists competing across diverse geographies. Global leaders such as Cetaphil, La Roche-Posay, and Eucerin hold strong positions, driven by dermatologist-trusted moisturizers, barrier-repair creams, and clinical validation. Their strategies emphasize allergy-tested claims, pediatric-safe formulations, and distribution dominance in pharmacies and dermatology clinics, reinforcing medical trust.

Mid-sized players such as Bioderma, Avene, and Vanicream are gaining momentum through fragrance-free soothing serums and gentle cleansers, tailored for rosacea and eczema-prone users. These companies leverage clean-label positioning and sensitivity-specific branding to expand share in e-commerce and specialty beauty retail.

Niche specialists including Mustela and Aveeno Baby focus on pediatric-sensitive segments, offering hypoallergenic solutions for infants and children, which sets them apart from adult-centric leaders. Their strength lies in customization for early-life skincare and strong endorsements from pediatric dermatologists.

Competitive differentiation is shifting away from generic moisturizing claims toward ecosystem-driven advantages such as subscription-based sensitive-skin kits, AI-enabled skin analysis tools, refillable packaging, and vegan-certified labeling. The winning edge is increasingly defined not only by clinical efficacy but also by digital-first distribution, sustainability credentials, and cross-age adaptability, positioning the market for sustained innovation-led competition.

Key Developments in Anti-Allergenic Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Hypoallergenic moisturizers, Barrier-repair creams, Soothing serums, Gentle cleansers |

| Skin Concern | Eczema-prone, Allergic contact dermatitis, Rosacea-prone, General sensitive skin |

| Channel | Pharmacies & dermatology clinics, E-commerce, Specialty beauty retail, Mass retail |

| End User | Infants & children, Adults, Senior skin, Unisex sensitive-skin users |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aveeno, Cetaphil, La Roche-Posay, Eucerin, Bioderma, Avene, Vanicream, CeraVe, Mustela, Neutrogena |

| Additional Attributes | Dollar sales by product type and skin concern, adoption trends in dermatology-led recommendations and pediatric skincare, rising demand for hypoallergenic moisturizers and soothing serums, sector-specific growth in pharmacies, e-commerce, and specialty beauty retail, channel revenue segmentation, integration with AI-powered skin diagnostics and subscription-based models, regional trends influenced by pollution exposure and sensitive-skin prevalence, and innovations in clean-label, fragrance-free, and vegan-certified formulations. |

The Anti-Allergenic Skincare Market is estimated to be valued at USD 5,402.6 million in 2025.

The market size for the Anti-Allergenic Skincare Market is projected to reach USD 11,802.3 million by 2035.

The Anti-Allergenic Skincare Market is expected to grow at a CAGR of 8.1% between 2025 and 2035.

The key product types in the Anti-Allergenic Skincare Market are hypoallergenic moisturizers, barrier-repair creams, soothing serums, and gentle cleansers.

In terms of channel, pharmacies & dermatology clinics are projected to command 46.7% share in the Anti-Allergenic Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA