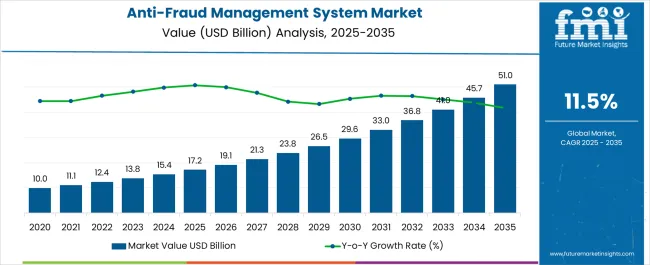

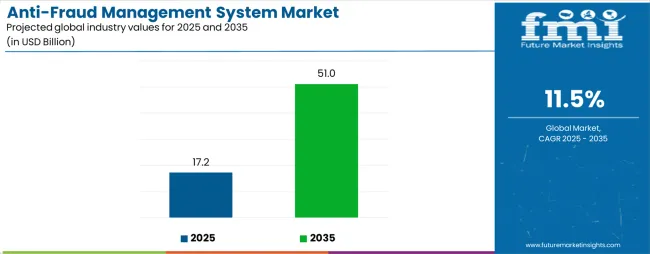

The Anti-Fraud Management System Market is estimated to be valued at USD 17.2 billion in 2025 and is projected to reach USD 51.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

| Metric | Value |

|---|---|

| Anti-Fraud Management System Market Estimated Value in (2025 E) | USD 17.2 billion |

| Anti-Fraud Management System Market Forecast Value in (2035 F) | USD 51.0 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The Anti-Fraud Management System market is expanding steadily, driven by the rising complexity and frequency of fraudulent activities across industries such as banking, financial services, insurance, e-commerce, and healthcare. The digital transformation of business processes and the increasing volume of electronic transactions have created both opportunities and vulnerabilities, making fraud detection and prevention essential. Organizations are adopting advanced anti-fraud solutions that integrate artificial intelligence, machine learning, and real-time analytics to identify suspicious behavior and reduce financial losses.

Stringent regulatory frameworks, combined with growing awareness of cybersecurity risks, are further encouraging businesses to strengthen their fraud management practices. The adoption of cloud-based platforms and integration with enterprise systems such as payment gateways and identity verification solutions are enhancing efficiency and scalability.

Companies are increasingly prioritizing risk management, compliance, and customer trust as competitive differentiators As digital ecosystems continue to evolve, the Anti-Fraud Management System market is expected to witness sustained growth, with ongoing investments in automation, analytics, and security technologies enabling proactive and adaptive protection against emerging fraud schemes.

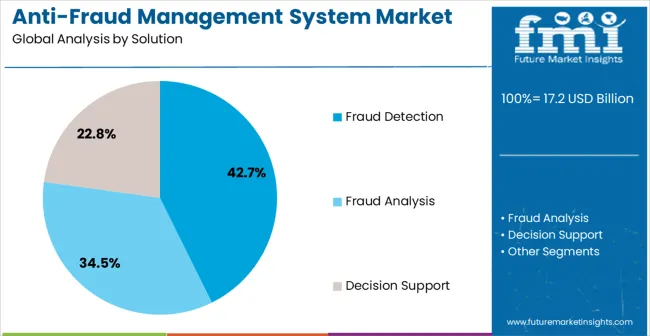

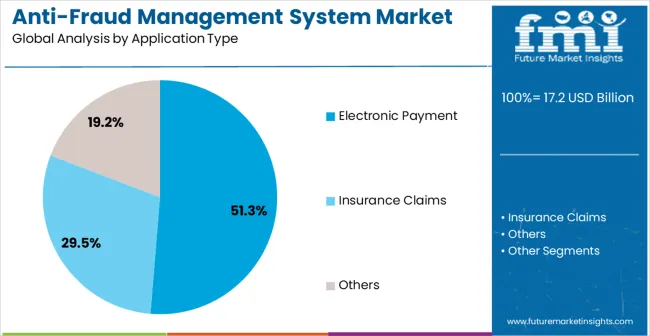

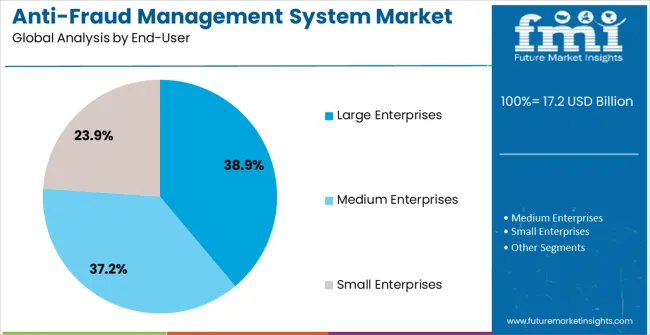

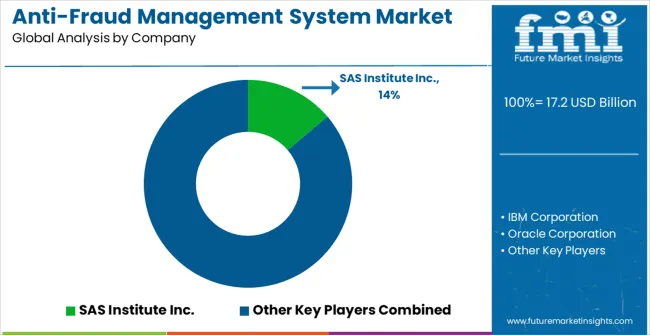

The anti-fraud management system market is segmented by solution, application type, end-user, vertical, and geographic regions. By solution, anti-fraud management system market is divided into Fraud Detection, Fraud Analysis, and Decision Support. In terms of application type, anti-fraud management system market is classified into Electronic Payment, Insurance Claims, and Others. Based on end-user, anti-fraud management system market is segmented into Large Enterprises, Medium Enterprises, and Small Enterprises. By vertical, anti-fraud management system market is segmented into BFSI, Retail, IT & Telecommunication, Government/Public Sector, Healthcare, Real Estate, Energy And Power, Manufacturing, Travel And Transportation, Media And Entertainment, and Others. Regionally, the anti-fraud management system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fraud detection solution segment is projected to account for 42.7% of the market revenue in 2025, positioning it as the leading solution category. Its dominance is being driven by the urgent need to identify fraudulent transactions in real time and prevent financial losses before they escalate. Fraud detection systems leverage advanced machine learning algorithms, behavioral analytics, and predictive modeling to analyze large volumes of transaction data.

The ability to flag unusual patterns and detect anomalies helps organizations respond quickly to potential threats. Integration with enterprise payment systems, banking platforms, and e-commerce gateways has increased adoption, as fraud detection plays a critical role in safeguarding customer trust and ensuring compliance with financial regulations.

Continuous improvement of detection accuracy through AI-driven updates and adaptive models further strengthens the effectiveness of these systems As digital payment volumes grow and fraudsters adopt more sophisticated tactics, fraud detection solutions are expected to remain the cornerstone of anti-fraud strategies, ensuring robust protection across industries and reinforcing their leadership in the market.

The electronic payment application segment is expected to hold 51.3% of the market revenue in 2025, making it the largest application type. The growing volume of digital transactions, fueled by online shopping, mobile wallets, and contactless payments, has increased the risk of fraudulent activities, reinforcing the importance of fraud prevention systems in this segment. Anti-fraud platforms designed for electronic payments provide end-to-end monitoring, encryption, and multi-layered verification to protect both consumers and businesses.

These solutions enable real-time transaction analysis, identity verification, and integration with global payment gateways, ensuring compliance with financial regulations and data protection standards. The ability to continuously update detection algorithms helps organizations address evolving fraud techniques such as phishing, account takeovers, and synthetic identities.

Adoption is further being driven by the rising emphasis on customer security and trust in digital platforms As global payment infrastructures modernize and digital commerce expands, the electronic payment application type segment is anticipated to sustain its leadership, supported by continuous investments in secure, scalable, and adaptive anti-fraud technologies.

The large enterprises segment is anticipated to capture 38.9% of the market revenue in 2025, positioning it as the leading end-user category. This dominance is attributed to the scale and complexity of operations within large organizations, which makes them more susceptible to targeted fraud schemes. Large enterprises manage vast volumes of financial transactions, customer data, and digital interactions, creating a higher risk exposure compared to small and medium-sized businesses.

Anti-fraud management systems in this segment are being deployed to ensure compliance, safeguard brand reputation, and protect shareholder value. Investments in advanced technologies such as AI-driven analytics, real-time monitoring, and multi-layered defense mechanisms are being prioritized to strengthen fraud resilience. Large enterprises also benefit from integrating fraud management platforms with broader risk and compliance systems, improving operational efficiency.

The significant financial resources available to these organizations enable faster adoption of innovative solutions As regulatory scrutiny intensifies and fraud tactics become more sophisticated, large enterprises are expected to remain the primary adopters of anti-fraud management systems, sustaining their leadership in market share.

Digital economy is continuously evolving and this impacts almost every business, seeking some attention at traditional fraud management processes. Enterprises today must have all-rounded understanding of fraud as customers engage with enterprises across multiple channels using a variety of mobile devices.

Fraud detection guards customer and enterprise assets, accounts, information, transactions and deals through the real-time, analysis of activities by customers and other distinct predefined entities. It uses background server-based processes which inspect users’ and other distinct defined entities’ accessibility and conduct patterns, and associates this evidence to a single summary of what’s required for decision making.

Detecting a fraud is not intrusive to a user unless the user’s activity is suspected. Anti-fraud management systems use hybrid models of advanced analytics techniques and rule based complete approach encompassing the wide range of fraud-detection techniques. Anti-fraud management systems effectively fights fraud, by detecting the issue, analyzing it and offering support to make instant decisions.

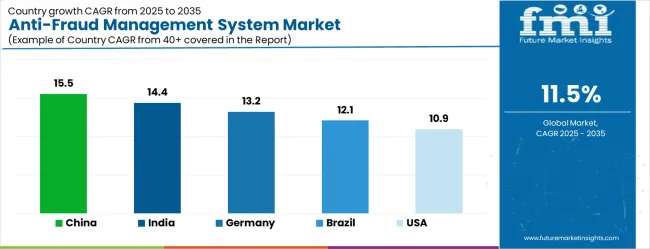

| Country | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| Brazil | 12.1% |

| USA | 10.9% |

| UK | 9.8% |

| Japan | 8.6% |

The Anti-Fraud Management System Market is expected to register a CAGR of 11.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.5%, followed by India at 14.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 8.6%, yet still underscores a broadly positive trajectory for the global Anti-Fraud Management System Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.2%. The USA Anti-Fraud Management System Market is estimated to be valued at USD 5.9 billion in 2025 and is anticipated to reach a valuation of USD 5.9 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 918.0 million and USD 506.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.2 Billion |

| Solution | Fraud Detection, Fraud Analysis, and Decision Support |

| Application Type | Electronic Payment, Insurance Claims, and Others |

| End-User | Large Enterprises, Medium Enterprises, and Small Enterprises |

| Vertical | BFSI, Retail, IT & Telecommunication, Government/Public Sector, Healthcare, Real Estate, Energy And Power, Manufacturing, Travel And Transportation, Media And Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SAS Institute Inc., IBM Corporation, Oracle Corporation, FICO (Fair Isaac Corporation), ACI Worldwide Inc., NICE Actimize, BAE Systems, Experian PLC, LexisNexis Risk Solutions, Fraud.net, Fiserv, Inc., and SAP SE |

The global anti-fraud management system market is estimated to be valued at USD 17.2 billion in 2025.

The market size for the anti-fraud management system market is projected to reach USD 51.0 billion by 2035.

The anti-fraud management system market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in anti-fraud management system market are fraud detection, fraud analysis and decision support.

In terms of application type, electronic payment segment to command 51.3% share in the anti-fraud management system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Crowd Management System Market

Asset Management System Market

Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Visitor Management System Market Analysis – Size, Share & Forecast 2025 to 2035

Traffic Management System Market Analysis – Demand, Growth & Forecast 2025–2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Insulin Management System Market Growth - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Network Management System Market Insights - Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA