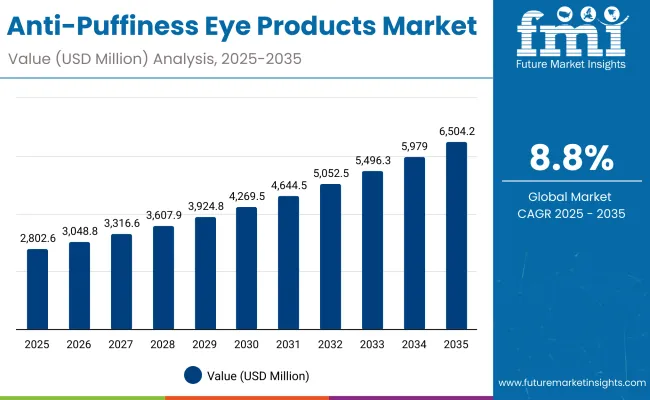

The Global Anti-Puffiness Eye Products Market is expected to record a valuation of USD 2,802.6 million in 2025 and USD 6,504.2 million in 2035, with an increase of USD 3,701.6 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.8% and a more than 2X increase in market size.

Global Anti-Puffiness Eye Products Market Key Takeaways

| Metric | Value |

|---|---|

| Global Anti-Puffiness Eye Products Market Estimated Value in (2025E) | USD 2,802.6 million |

| Global Anti-Puffiness Eye Products Market Forecast Value in (2035F) | USD 6,504.2 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,802.6 million to USD 4,269.5 million, adding USD 1,466.9 million, which accounts for 39.6% of the total decade growth. This phase records steady adoption in daily skincare routines, dermatology recommendations, and consumer-driven preventive care, driven by the rise in dark circles, lifestyle stress, and screen fatigue. Eye serums dominate this period as they cater to over 39–41% of consumer applications requiring lightweight formulations and fast absorption.

The second half from 2030 to 2035 contributes USD 2,234.7 million, equal to 60.4% of total growth, as the market jumps from USD 4,269.5 million to USD 6,504.2 million. This acceleration is powered by widespread deployment of multifunctional anti-aging formulations, natural ingredient integration, and hybrid skincare solutions in premium and mass retail channels.

Overnight repair creams and under-eye patches begin to capture a larger share above 30% by the end of the decade, while ingredients such as peptides and green tea extract expand due to clean-label consumer preferences. E-commerce platforms add recurring revenue, increasing the online sales channel share beyond 40% in total value.

From 2020 to 2024, the Global Anti-Puffiness Eye Products Market grew from under USD 2,300 million to nearly USD 2,700 million, driven by consumer adoption of preventative and corrective eye care formulations. During this period, the competitive landscape was dominated by multinational brands controlling nearly 70% of revenue, with leaders such as Estée Lauder, Shiseido, and L’Oréal Paris focusing on premium serums and creams.

Competitive differentiation relied on clinical efficacy, dermatological endorsements, and brand equity, while e-commerce was gaining ground but still contributed less than 25% of total market value.

Demand for anti-puffiness products is expected to expand to USD 2,802.6 million in 2025, and the revenue mix will shift as e-commerce and specialty beauty retail grow to over 40% share. Traditional beauty leaders face rising competition from digital-first brands offering clean-label, vegan, and dermatologist-approved formulations.

Major global players are pivoting to hybrid portfolios, integrating caffeine, peptides, and hyaluronic acid with advanced delivery systems such as roll-ons and cooling patches to retain relevance. Emerging entrants specializing in green tea and botanical-driven blends are gaining share. The competitive advantage is moving away from heritage brand recognition alone to consumer trust in ingredient transparency, personalization, and omnichannel reach.

Advances in cosmetic formulations have improved efficacy and absorption speed, allowing for more efficient results across diverse skin concerns. Eye serums have gained popularity due to their suitability for lightweight daily use and visible results against puffiness and fine lines.

The rise of caffeine-based products has contributed to enhanced circulation, quick de-puffing effects, and long-lasting consumer adoption. Segments such as aging-related eye bags and dark circles with puffiness are driving demand for solutions that integrate seamlessly into morning and night skincare routines.

Expansion of multifunctional formulations and dermatology-backed products has fueled market growth. Innovations in roll-on applicators, cooling gels, and under-eye patches combined with digital marketing trends are expected to open new consumer bases.

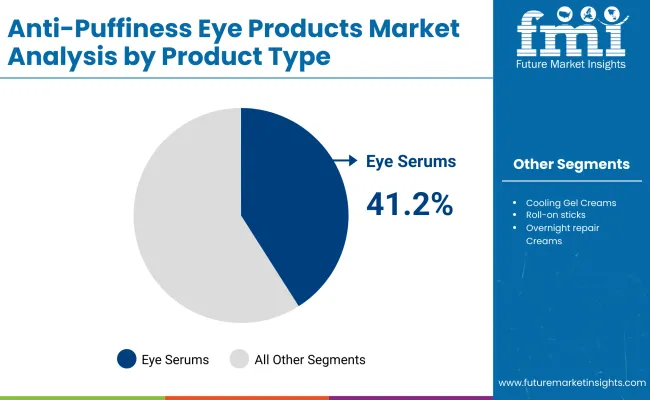

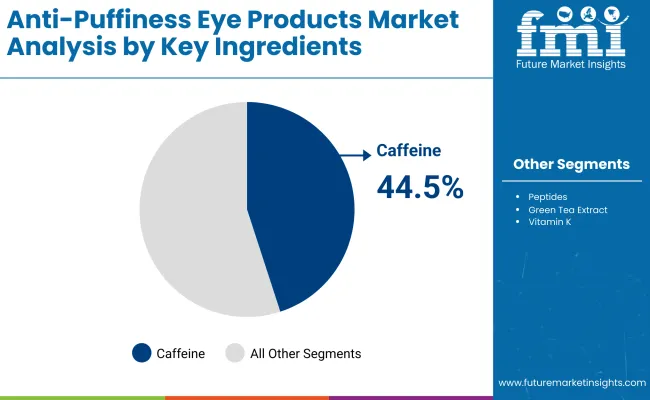

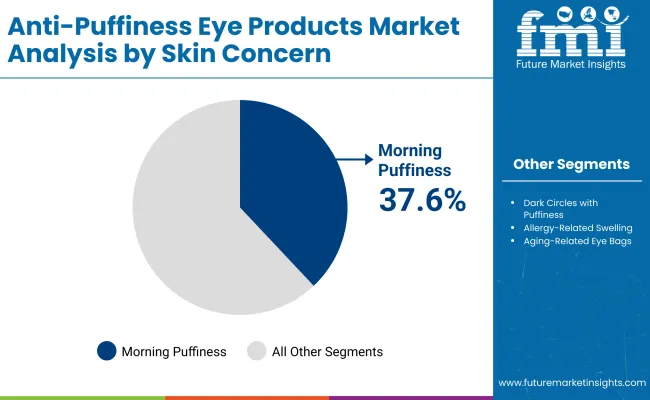

Segment growth is expected to be led by eye serums in product type, caffeine in key ingredients, and morning puffiness in skin concerns due to their precision-driven efficacy and adaptability across consumer groups.

The market is segmented by product type, key ingredients, skin concern, channel, end user, and geography. Product types include eye serums, cooling gel creams, roll-on sticks, under-eye masks/patches, and overnight repair creams, highlighting the core formats driving adoption. Key ingredient classification covers caffeine, peptides, green tea extract, vitamin K, and hyaluronic acid to cater to different skin concerns.

Based on skin concern, the segmentation includes morning puffiness, dark circles with puffiness, allergy-related swelling, and aging-related eye bags. In terms of channel, categories encompass e-commerce, specialty beauty retail, pharmacies & drugstores, department stores, and dermatology clinics. End users include women, men, and unisex. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

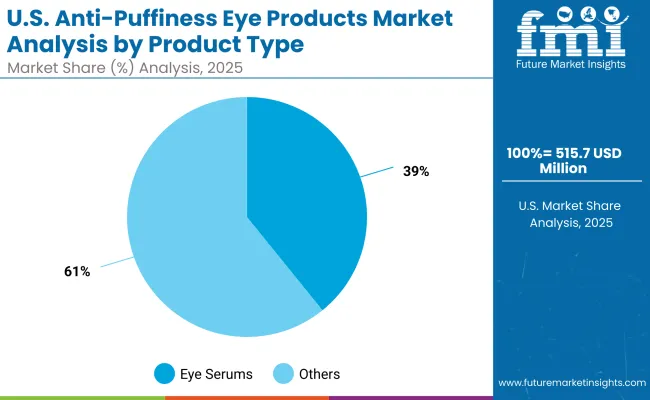

| Product Type | Value Share % 2025 |

|---|---|

| Eye serums | 41.2% |

| Others | 58.8% |

The eye serums segment is projected to contribute 41.2% of the Global Anti-Puffiness Eye Products Market revenue in 2025, maintaining its lead as the dominant product type category. This is driven by consumer preference for lightweight formulations that absorb quickly and deliver immediate results against puffiness and early signs of fatigue. Eye serums are increasingly formulated with caffeine, peptides, and hyaluronic acid, which are recognized for their effectiveness in reducing swelling and restoring firmness.

The segment’s growth is also supported by the increasing adoption of dermatologist-recommended products that fit into both morning and evening skincare routines. Compact packaging formats, precise applicators, and fast-absorbing textures enhance consumer convenience.

As multifunctional skincare becomes more prevalent, eye serums are increasingly positioned as products that address not only puffiness but also dark circles, fine lines, and hydration. The eye serums segment is expected to retain its position as the backbone of anti-puffiness eye care, bridging both premium and mass-market categories.

| Key Ingredients | Value Share % 2025 |

|---|---|

| Caffeine | 44.5% |

| Others | 55.5% |

The caffeine-based products segment is forecasted to hold 44.5% of the market share in 2025, led by its proven application in reducing puffiness through vasoconstrictive and anti-inflammatory properties. Caffeine has gained traction as a hero ingredient due to its ability to improve microcirculation around the delicate eye area, offering visible results in reducing swelling and dark circles.

Its universal appeal across gender groups and age categories has facilitated widespread adoption, particularly in eye serums, roll-on sticks, and cooling gels. The segment’s growth is bolstered by consumer demand for scientifically backed ingredients that deliver measurable results while aligning with clean-label and safe-formulation standards.

As global consumers increasingly associate caffeine with energizing and quick-result benefits, brands are highlighting it in product claims and marketing campaigns. Its compatibility with other active ingredients such as peptides and vitamin K further enhances efficacy, ensuring that caffeine remains the dominant ingredient driving innovation in the Global Anti-Puffiness Eye Products Market.

| Skin Concern | Value Share % 2025 |

|---|---|

| Morning puffiness | 37.6% |

| Others | 62.4% |

The morning puffiness segment is projected to account for 37.6% of the Global Anti-Puffiness Eye Products Market revenue in 2025, establishing it as the leading skin concern addressed by product innovation. Morning puffiness is one of the most common concerns among urban consumers, often linked to sleep cycles, stress, diet, and screen fatigue.

This segment benefits from strong adoption of products offering instant cooling and decongesting effects, including serums, roll-ons, and under-eye patches. Developments in overnight repair creams and hybrid products that address puffiness while delivering hydration and anti-aging benefits further boost this category.

Given the global trend toward early preventive care in skincare, morning puffiness has become a daily priority, particularly among young working professionals and digital-first consumers. The ability of products to show visible improvements within minutes of application makes this segment highly attractive for continued investment.

With rising consumer awareness and targeted product launches, morning puffiness is expected to maintain its leading role in shaping the Global Anti-Puffiness Eye Products Market.

Rising Lifestyle-Induced Eye Fatigue and Screen-Related Puffiness

The proliferation of digital lifestyles, especially among younger demographics, has become a powerful demand driver. Consumers are spending extended hours on laptops, smartphones, and tablets, which directly contribute to eye strain, puffiness, and dark circles. This trend is particularly pronounced in East Asia, India, and the USA, where digital penetration and long working hours are highest.

Products such as eye serums and roll-on sticks are marketed as instant relief solutions, with claims of reducing puffiness within minutes of application. This strong alignment between daily lifestyle habits and product positioning has been one of the major catalysts behind the 41.2% dominance of eye serums in 2025. As work-from-home and hybrid office culture persist, the driver will continue fueling adoption, particularly in e-commerce where digital-first consumers seek easy replenishment cycles.

Ingredient-Led Premiumization and Clinical Validation

Consumers are increasingly attentive to the ingredients listed on labels, and in the anti-puffiness eye segment, caffeine, peptides, and hyaluronic acid have emerged as clinical-grade proof points. Caffeine’s share of 44.5% in 2025 underlines the market’s shift toward scientifically backed actives that consumers trust for visible efficacy.

Dermatologists and influencers are reinforcing caffeine and peptides as safe, reliable solutions for circulation improvement and skin tightening. Furthermore, clinical validation and dermatology endorsements are driving premium price positioning in the USA and Europe, while in China and Japan, demand for green tea extract and vitamin K is rising due to cultural preference for botanical and antioxidant-driven skincare.

This ingredient-led premiumization has created an upselling pathway for brands like Estée Lauder, Shiseido, and L’Oréal Paris, allowing them to capture higher margins and establish stronger consumer loyalty.

Market Saturation in Developed Regions and Overlap with General Skincare

While global demand is expanding, in mature markets such as the USA, Germany, and the UK, there is increasing category overlap between anti-puffiness eye products and broader anti-aging creams or serums. Consumers often use multi-functional moisturizers or general eye creams, reducing the perceived need to purchase specific anti-puffiness solutions.

This overlap results in slower growth (CAGR of 5.8% in the USA compared to 15.7% in India) and limits the market expansion potential in regions where beauty routines are already saturated. Brands face the challenge of differentiating anti-puffiness eye products as indispensable, daily-use essentials, rather than optional add-ons. Without clear value differentiation, category growth risks plateauing in these mature geographies.

High Consumer Sensitivity and Potential for Allergic Reactions

The skin around the eyes is among the most delicate on the human body, which makes consumers highly sensitive to product efficacy and safety. Negative experiences such as irritation, redness, or allergic swelling can immediately lead to distrust and brand switching. This is a significant restraint, particularly in markets like Europe and North America, where regulatory scrutiny and consumer awareness of ingredients like parabens, fragrances, or synthetic stabilizers is very high.

Even ingredients considered safe, such as caffeine or vitamin K, can cause adverse reactions in certain skin types if not formulated correctly. This limits experimentation with stronger actives and pushes companies to invest more heavily in clinical testing and dermatologist-backed marketing, which increases time-to-market and product development costs.

Shift Toward Hybrid Product Formats and Overnight Repair

One of the most notable trends shaping this market is the consumer preference for hybrid products that combine anti-puffiness functionality with anti-aging, hydration, and skin-brightening benefits. This has led to rising popularity of overnight repair creams and under-eye masks/patches, which saw an acceleration in adoption post to 2028 as the market moved beyond simple day-use serums.

Consumers now want multi-action solutions that can address puffiness, dark circles, and fine lines simultaneously. In Asia-Pacific, under-eye patches infused with botanical extracts are trending as part of weekly beauty rituals, while in Western markets, overnight creams dominate because they fit naturally into established nighttime routines. This hybridization trend ensures broader adoption and higher consumer lifetime value, as products are perceived as comprehensive solutions rather than niche treatments.

E-commerce-Led Personalization and Ingredient Transparency

With e-commerce expected to surpass 40% of sales by 2035, digital-first brands are reshaping consumer engagement in this market. Personalized recommendation engines, subscription models, and D2C marketing strategies are now central to how consumers discover and repurchase anti-puffiness eye products.

Platforms such as Amazon, Tmall, and specialty beauty portals are ranking products higher when they emphasize ingredient transparency (caffeine %, peptide concentration), clean-label certifications, and dermatologist endorsements.

This trend is particularly relevant in China and India, where e-commerce-driven growth (CAGRs of 14% and 15.7% respectively) is outpacing offline channels. Transparency and personalization are not only helping smaller players like The Ordinary gain ground but also pushing legacy players to rebrand with detailed ingredient disclosures and digital-first product launches.

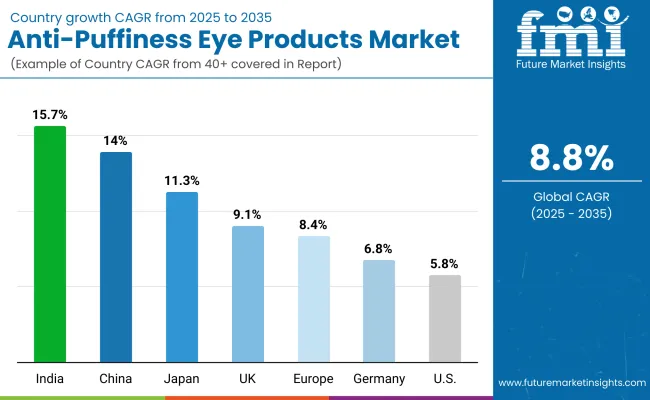

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.0% |

| USA | 5.8% |

| India | 15.7% |

| UK | 9.1% |

| Germany | 6.8% |

| Japan | 11.3% |

| Europe | 8.4% |

China and India are projected to record the fastest growth rates, with CAGRs of 14.0% and 15.7% respectively between 2025 and 2035. This momentum is driven by a combination of rising disposable incomes, growing beauty consciousness among young consumers, and the increasing penetration of e-commerce platforms such as Tmall, Nykaa, and Flipkart that make premium eye care accessible.

In India, the surge of digitally native, affordable clean-label brands is attracting first-time users, while multinational giants are tailoring eye serums and cooling gels to local skincare needs such as puffiness linked with hot climates and lifestyle stress.

In China, the market benefits from both domestic K-beauty and J-beauty influences and the premium positioning of international players like Estée Lauder and Shiseido. The preference for caffeine and green tea extract formulations has reinforced ingredient-led differentiation, driving significant adoption among urban millennials and Gen Z consumers.

In contrast, the USA and Europe are growing at more moderate CAGRs of 5.8% and 8.4% respectively, reflecting market maturity and high penetration of existing skincare routines. While Germany and the UK maintain growth at 6.8% and 9.1%, the challenge lies in differentiating anti-puffiness eye products from broader anti-aging and moisturizing categories, which already dominate consumer habits.

Japan, with a CAGR of 11.3%, reflects the strong overlap between domestic innovation in under-eye patches and consumer loyalty to J-beauty rituals. Across Europe, sustained growth is supported by premium positioning in specialty beauty retail and the expansion of clean-label, vegan-certified products in pharmacies and department stores. Overall, while developed markets provide stability and brand consolidation, Asia-Pacific remains the primary growth engine for the Global Anti-Puffiness Eye Products Market through 2035.

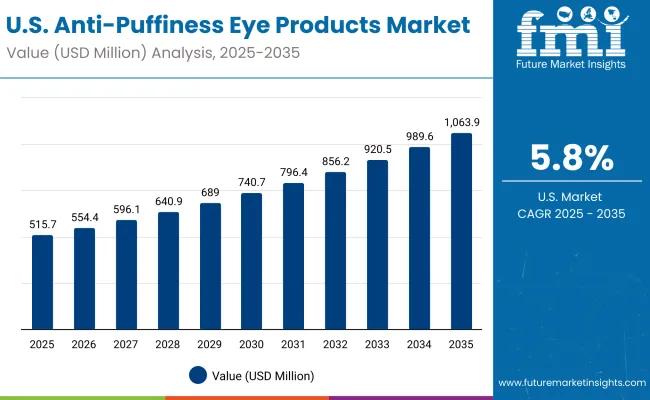

| Year | USA Anti-Puffiness Eye Products Market (USD Million) |

|---|---|

| 2025 | 515.76 |

| 2026 | 554.49 |

| 2027 | 596.13 |

| 2028 | 640.90 |

| 2029 | 689.03 |

| 2030 | 740.78 |

| 2031 | 796.41 |

| 2032 | 856.22 |

| 2033 | 920.52 |

| 2034 | 989.65 |

| 2035 | 1063.97 |

The Global Anti-Puffiness Eye Products Market in the United States is projected to grow at a CAGR of 5.8%, supported by strong consumer spending on premium skincare, rising awareness of preventative eye care, and sustained adoption across women and unisex segments.

Eye serums dominate the market in the USA, contributing 39.2% of sales in 2025 (USD 202.18 million), reflecting demand for lightweight, fast-absorbing solutions that pair well with broader skincare routines. Growth is also being fueled by dermatology clinics and pharmacies, which remain trusted retail channels for products with clinical validation.

The Global Anti-Puffiness Eye Products Market in the United Kingdom is expected to grow at a CAGR of 9.1% through 2035, driven by heightened interest in clean-label, vegan, and cruelty-free formulations. British consumers are highly ingredient-conscious, favoring caffeine and peptide-infused solutions marketed with transparent labeling and dermatologist endorsements.

Specialty beauty retailers and department stores are central to distribution, though e-commerce is quickly catching up as brands leverage influencer-driven marketing on TikTok and Instagram.

India is witnessing the fastest growth in the Global Anti-Puffiness Eye Products Market, forecast to expand at a CAGR of 15.7% through 2035. A surge in demand is coming from tier-2 and tier-3 cities, where affordability and digital accessibility have created new consumer bases.

E-commerce platforms like Nykaa and Flipkart are enabling wider distribution, while MSME-led beauty startups are introducing cost-effective roll-ons and gel creams that appeal to first-time buyers. Premium international brands are also tailoring marketing to address lifestyle-induced puffiness tied to heat, sleep patterns, and rising screen time.

The Global Anti-Puffiness Eye Products Market in China is expected to grow at a CAGR of 14.0%, among the highest globally. Growth is powered by the convergence of K-beauty and J-beauty trends, domestic e-commerce dominance (Tmall, JD.com), and strong urban demand for quick-result formulations.

Caffeine-based products are central, contributing 36.1% of ingredient-led sales in 2025 (USD 95.16 million), but green tea and botanical blends are increasingly gaining attention for their cultural relevance. Affordable local products are enabling rapid adoption among students and young professionals, while premium international players are capturing affluent consumers with advanced overnight creams and patches.

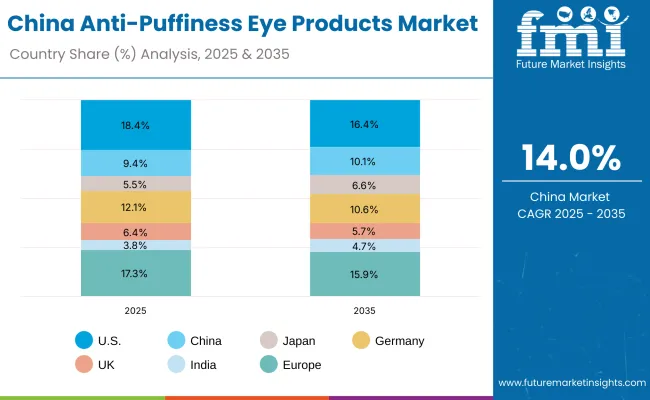

| Country | 2025 Share (%) |

|---|---|

| USA | 18.4% |

| China | 9.4% |

| Japan | 5.5% |

| Germany | 12.1% |

| UK | 6.4% |

| India | 3.8% |

| Europe | 17.3% |

| Country | 2035 Share (%) |

|---|---|

| USA | 16.4% |

| China | 10.1% |

| Japan | 6.6% |

| Germany | 10.6% |

| UK | 5.7% |

| India | 4.7% |

| Europe | 15.9% |

| USA By Product Type | Value Share % 2025 |

|---|---|

| Eye serums | 39.2% |

| Others | 60.8% |

The Global Anti-Puffiness Eye Products Market in the United States is projected at USD 515.76 million in 2025, with eye serums contributing 39.2% (USD 202.18 million), while other formats such as overnight creams, masks, and roll-ons hold 60.8% (USD 313.58 million). The market reflects a clear consumer tilt toward serum-based formulations, which dominate because of their lightweight textures, fast absorption, and clinically validated results. Serums are also highly adaptable for morning and night use, making them essential in daily skincare routines.

Growth is supported by strong clinical positioning, with pharmacies, dermatology clinics, and specialty beauty retailers acting as the most trusted sales channels. USA consumers value transparency and dermatologist backing, which reinforces the adoption of serums formulated with caffeine, peptides, and hyaluronic acid.

E-commerce continues to rise but is often tied to subscription-based services and influencer-led marketing. Over the forecast period, the competitive edge in the USA will be defined by ingredient transparency, multifunctional positioning, and premium packaging.

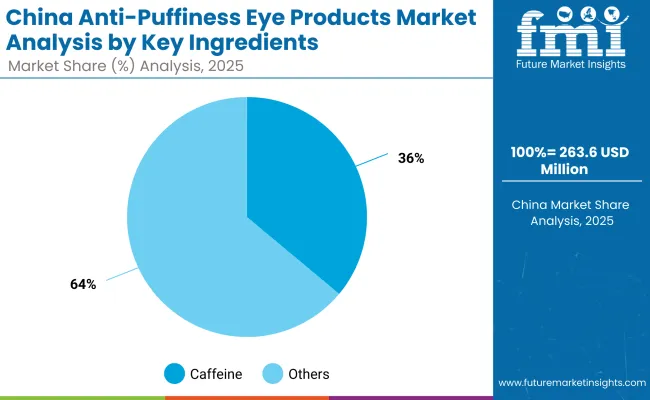

| China By Key Ingredients | Value Share % 2025 |

|---|---|

| Caffeine | 36.1% |

| Others | 63.9% |

The Global Anti-Puffiness Eye Products Market in China is valued at USD 263.61 million in 2025, with caffeine-based formulations leading at 36.1% (USD 95.16 million), while other ingredients such as peptides, green tea extract, and vitamin K account for 63.9% (USD 168.45 million). The dominance of caffeine stems from its wide acceptance as a fast-acting, visible de-puffing agent that appeals to younger demographics.

This advantage positions caffeine as the hero ingredient across serums, cooling gels, and roll-on sticks, often marketed with K-beauty and J-beauty inspired formulations. Growth is further bolstered by the integration of botanical extracts, especially green tea, which resonates with cultural preferences for antioxidant-rich skincare.

Affordable local products are expanding adoption among students and working professionals, while international players capture premium segments with overnight repair creams and under-eye patches. With a CAGR of 14.0%, China will remain one of the most dynamic growth hubs in the next decade, especially through e-commerce platforms like Tmall and JD.com.

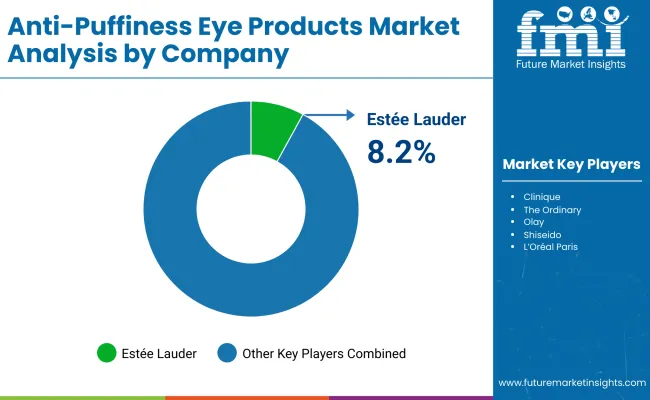

| Company | Global Value Share 2025 |

|---|---|

| Estée Lauder | 8.2% |

| Others | 91.8% |

The Global Anti-Puffiness Eye Products Market is moderately consolidated, with multinational beauty giants leading the segment and mid-sized specialist brands gaining visibility. Estée Lauder commands 8.2% of the global market in 2025, driven by its premium positioning, clinical claims, and dominance in eye serums. Other leading players such as Clinique, Shiseido, and L’Oréal Paris emphasize hybrid products that combine puffiness reduction with anti-aging and hydration benefits.

Mid-tier and digital-first brands such as The Ordinary and Dr. Dennis Gross are disrupting the competitive landscape by offering clean-label, ingredient-transparent formulations that appeal to millennials and Gen Z. Regional powerhouses like Laneige and Kiehl’s are capitalizing on e-commerce growth and loyalty-building campaigns in Asia-Pacific.

The shift in competitive differentiation is moving from heritage branding and packaging to ingredient efficacy, personalization, and omnichannel accessibility. Subscription models, influencer-driven launches, and AR/VR trial experiences are redefining consumer engagement, ensuring that both global leaders and agile niche players find room to compete.

Key Developments in Global Anti-Puffiness Eye Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Eye serums, Cooling gel creams, Roll-on sticks, Under-eye masks/patches, Overnight repair creams |

| Key Ingredients | Caffeine, Peptides, Green tea extract, Vitamin K, Hyaluronic acid |

| Skin Concern | Morning puffiness, Dark circles with puffiness, Allergy-related swelling, Aging-related eye bags |

| Channel | E-commerce, Specialty beauty retail, Pharmacies & drugstores, Department stores, Dermatology clinics |

| End User | Women, Men, Unisex |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, Clinique, The Ordinary, Olay, Shiseido, L’Oréal Paris, Kiehl’s , Laneige , Dr. Dennis Gross, Origins |

| Additional Attributes | Dollar sales by product type and channel, adoption trends in ingredient-led premiumization , rising demand for lightweight eye serums and roll-ons, sector-specific growth in dermatology clinics and e-commerce, revenue segmentation by caffeine, peptides, and botanical actives, integration with digital retail platforms and subscription models, regional trends influenced by lifestyle stress and screen fatigue, and innovations in hybrid overnight repair creams, under-eye patches, and multifunctional eye care formats. |

The Global Anti-Puffiness Eye Products Market is estimated to be valued at USD 2,802.6 million in 2025.

The market size for the Global Anti-Puffiness Eye Products Market is projected to reach USD 6,504.2 million by 2035.

The Global Anti-Puffiness Eye Products Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Global Anti-Puffiness Eye Products Market are eye serums, cooling gel creams, roll-on sticks, under-eye masks/patches, and overnight repair creams.

In terms of product type, the eye serums segment is expected to command 41.2% share in the Global Anti-Puffiness Eye Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Health Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eye and Face Protection Market Growth - 2025 to 2035

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Eye Shadow Market Insights – Size, Trends & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Key Companies & Market Share in the Eye Shadow Stick Sector

Competitive Overview of Eyewear Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA