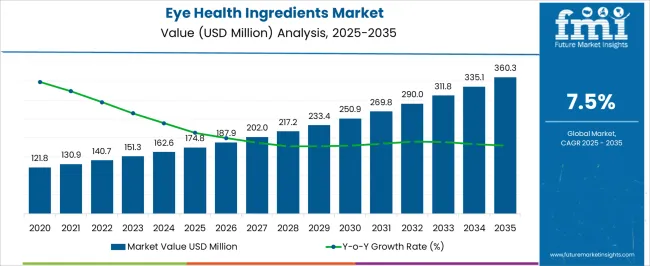

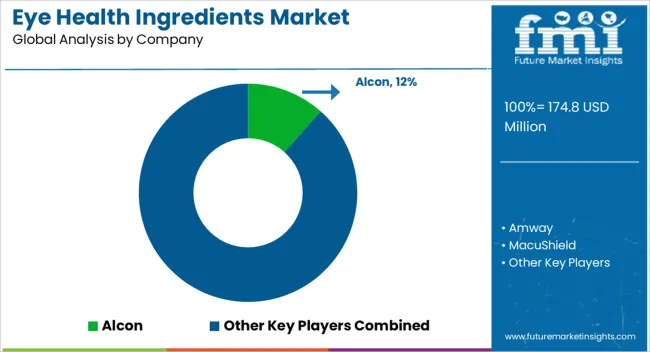

The eye health ingredients industry is projected to grow from USD 174.8 million in 2025 to USD 360.3 million in 2035 at a CAGR of 7.5%, creating a sizeable absolute dollar opportunity across the decade. This value expansion reflects rising usage of carotenoids, antioxidants, and omega-based compounds in dietary supplements, functional foods, and ophthalmic formulations. Analysts suggest that the absolute dollar gain demonstrates the increasing priority consumers place on preventive health and vision support.

The growth is being shaped by consistent product launches and deeper penetration of nutraceuticals into everyday consumption, reinforcing the commercial relevance of eye health ingredients globally. Over the forecast period, the market is expected to witness nearly USD 185.5 million in new revenue potential, showing a significant absolute dollar opportunity for both established and emerging participants. Industry observers believe this trajectory underscores the appeal of specialized formulations targeting conditions such as age-related macular degeneration and digital eye strain. Expansion is also being driven by the greater availability of fortified products in mass retail channels and e-commerce. The absolute dollar opportunity is thus seen as a clear indicator of future profitability, where investments in ingredient development and tailored formulations are expected to define competitive advantage.

| Metric | Value |

|---|---|

| Eye Health Ingredients Market Estimated Value in (2025 E) | USD 174.8 million |

| Eye Health Ingredients Market Forecast Value in (2035 F) | USD 360.3 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The eye health ingredients segment is estimated to contribute nearly 9% of the nutraceutical ingredients market, about 11% of the dietary supplements market, close to 7% of the functional food and beverages market, nearly 10% of the preventive healthcare ingredients market, and around 6% of the specialty ingredients market. Combined, this equates to an aggregated share of approximately 43% across its parent categories. Such a proportion demonstrates how eye health ingredients are recognized as a vital pillar in the broader nutrition and wellness ecosystem, with strong relevance in both preventive care and lifestyle-driven supplementation.

Their value has been reinforced by rising consumption of carotenoids, lutein, zeaxanthin, and omega-3 fatty acids, ingredients that have been linked with maintaining vision and reducing risks of age-related eye conditions. Industry specialists consider this segment not just a niche but a decisive factor shaping consumer choice in supplements and fortified foods. Demand has been propelled by the prevalence of digital device usage and a growing awareness of proactive eye care solutions, ensuring that these ingredients hold strategic importance for formulators and brand owners alike. The market’s role extends beyond consumer health, influencing sourcing, formulation innovation, and product positioning strategies across the global dietary supplement and functional food landscape, cementing its position as an indispensable subset within its parent markets.

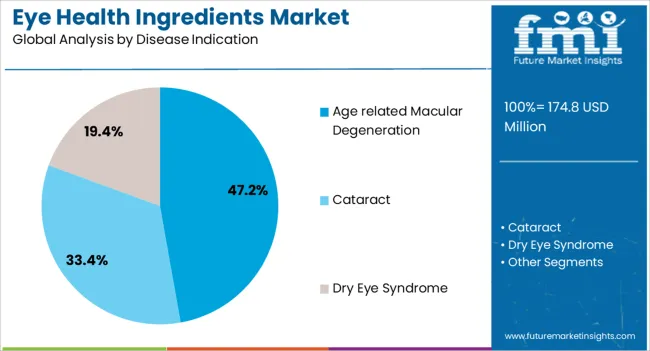

The eye health ingredients market is experiencing steady expansion, supported by growing consumer awareness of preventive eye care and the rising prevalence of vision-related disorders linked to aging, digital device use, and lifestyle factors. Nutraceutical industry reports and health organization publications have emphasized the increasing role of dietary supplementation in maintaining ocular health, particularly in reducing the risk of age-related macular degeneration, cataracts, and digital eye strain.

The market has benefited from strong consumer interest in scientifically supported ingredients, alongside expanding distribution through online and specialty health channels. Product innovation has centered on targeted formulations, combining antioxidants, carotenoids, and essential fatty acids for enhanced efficacy.

Additionally, clean-label trends and demand for naturally sourced compounds have shaped product development strategies. With regulatory bodies approving health claims for certain eye health nutrients, and manufacturers investing in clinical studies to substantiate efficacy, the market is poised for sustained growth. Segmental momentum is expected to be led by natural sources, lutein as the primary active ingredient, and soft gel delivery formats due to their bioavailability advantages.

The eye health ingredients market is segmented by source, ingredient, form, end use, disease indication, and geographic regions. By source, eye health ingredients market is divided into Natural and Synthetic. In terms of ingredient, eye health ingredients market is classified into Lutein, Zeaxanthin, Beta Carotene, Vitamin A, and Bilberry Extracts. Based on form, eye health ingredients market is segmented into Soft Gel, Capsule & Tablets, Liquid, and Powder. By end use, eye health ingredients market is segmented into Human and Animal. By disease indication, eye health ingredients market is segmented into Age related Macular Degeneration, Cataract, and Dry Eye Syndrome. Regionally, the eye health ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

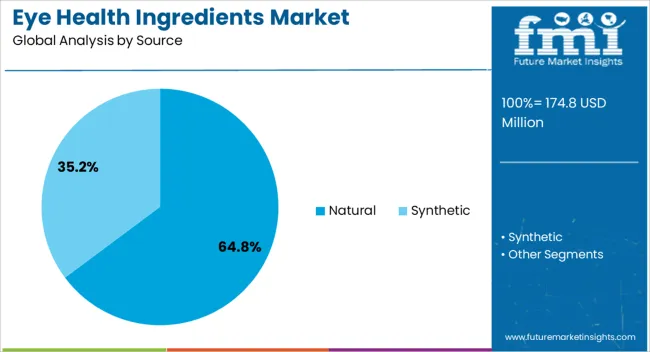

The natural segment is projected to contribute 64.80% of the eye health ingredients market revenue in 2025, maintaining its dominant position due to strong consumer preference for plant-based and minimally processed ingredients. The demand for naturally derived carotenoids, vitamins, and antioxidants has been driven by the perception of superior safety, better absorption, and alignment with clean-label product positioning.

Ingredient suppliers have increased sourcing of marigold flowers, bilberry, and other botanical raw materials to cater to this demand. Health-conscious consumers, particularly in developed markets, have shown willingness to pay a premium for natural-origin products, further strengthening this segment.

Moreover, regulatory support for natural health products in key markets has facilitated broader acceptance and commercialization. As sustainability considerations and traceability standards continue to gain importance, the natural segment is expected to sustain its leadership through transparent sourcing practices and eco-friendly production methods.

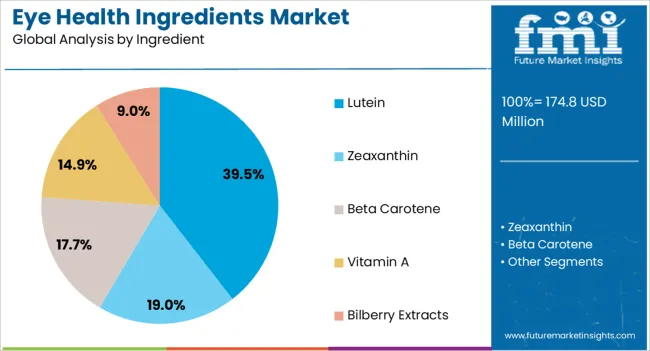

The lutein segment is projected to hold 39.50% of the eye health ingredients market revenue in 2025, leading the ingredient category due to its well-documented benefits in supporting retinal health and visual performance. Clinical studies published in ophthalmology and nutrition journals have consistently linked lutein supplementation to reduced progression of age-related macular degeneration and protection against blue light-induced oxidative stress.

The ingredient’s strong clinical backing has encouraged its inclusion in a wide range of dietary supplements, fortified foods, and functional beverages. Increased awareness campaigns by healthcare professionals and vision care associations have further elevated lutein’s profile among consumers seeking proactive eye health solutions.

Additionally, advancements in extraction and purification technologies have improved lutein’s stability and potency, enabling manufacturers to develop high-quality formulations. The ingredient’s market share is expected to remain robust as ongoing research expands its applications across diverse consumer demographics.

The soft gel segment is projected to account for 41.70% of the eye health ingredients market revenue in 2025, leading the form category due to its superior bioavailability and consumer convenience. Soft gels enable the encapsulation of lipid-soluble compounds such as lutein, zeaxanthin, and omega-3 fatty acids, enhancing their absorption in the body.

Manufacturers have favored this form for its ability to deliver precise dosages, protect sensitive ingredients from oxidation, and ensure extended shelf life. Consumer preference for easy-to-swallow, tasteless formats has also contributed to the segment’s dominance.

Additionally, contract manufacturing advancements have facilitated customization of soft gel formulations to include multiple active ingredients in a single dose, improving compliance for long-term supplementation. As premium nutraceutical brands continue to prioritize product efficacy and user experience, the soft gel format is expected to retain its market leadership in eye health supplements.

The eye health ingredients market is projected to witness strong momentum, influenced by rising awareness of preventive healthcare and growing cases of vision-related disorders. Demand is being fueled by nutraceuticals, fortified foods, and dietary supplements targeting ocular wellness. Opportunities lie in formulations with lutein, zeaxanthin, and omega-3 fatty acids across functional foods and pharmaceuticals. Trends highlight clean-label preferences, plant-derived carotenoids, and personalized nutrition. Challenges such as fluctuating raw material supply, high production costs, and complex regulatory approvals continue to restrict faster adoption across global health and wellness industries.

Demand for eye health ingredients has been reinforced by heightened awareness of preventive healthcare and the prevalence of disorders such as macular degeneration, glaucoma, and cataracts. Nutraceuticals, fortified foods, and supplements have been favored as convenient solutions for maintaining ocular wellness. Carotenoids such as lutein and zeaxanthin, along with omega-3 fatty acids, are being adopted widely due to their proven benefits in improving retinal health. Opinions suggest that consumers are increasingly turning toward dietary supplements to reduce dependency on corrective procedures. Growth in aging populations and prolonged screen exposure has intensified the need for regular intake of vision-supporting compounds. This consistent demand demonstrates the strategic importance of eye health ingredients in functional food and supplement portfolios, placing them as a non-negotiable segment for companies targeting wellness-focused consumers worldwide.

Opportunities in the eye health ingredients market have been shaped by rising integration into functional foods, beverages, and pharmaceutical formulations. Fortification of everyday consumables such as dairy, cereals, and juices with lutein, zeaxanthin, and bilberry extract has created a wider consumer base. Companies are increasingly developing specialized supplement blends tailored for children, elderly consumers, and high-screen-time users. Opinions indicate that the greatest opportunities lie in expanding plant-based sources of carotenoids and omega-3s to cater to shifting consumer preferences. Pharmaceutical-grade eye health formulations are also opening avenues, particularly in prescription-strength products targeting age-related vision impairment. With consumer interest moving toward holistic wellness and preventive care, these opportunities place eye health ingredients at the intersection of nutrition and clinical solutions, offering suppliers diverse pathways for growth across global markets.

Trends in the eye health ingredients market emphasize clean-label formulations, plant-derived carotenoids, and personalized nutrition. Lutein and zeaxanthin sourced from marigold and algae have gained traction as natural alternatives preferred in supplements and fortified products. Omega-3 fatty acids from algae are also trending due to growing interest in plant-based nutrition. Opinions highlight the increasing trend toward personalized health solutions, with companies offering tailored eye health packs based on lifestyle and age profiles. Digital health platforms have begun incorporating supplement recommendations for ocular wellness, further driving ingredient visibility. The trend of blending multiple bioactives in a single formulation is also gaining strength, as consumers seek comprehensive solutions rather than single-ingredient products. Collectively, these trends demonstrate a decisive move toward natural, tailored, and integrative approaches in the global eye health ingredients space.

Challenges in the eye health ingredients market arise from raw material volatility, production costs, and regulatory hurdles. Carotenoids such as lutein and zeaxanthin face supply limitations due to agricultural dependencies, creating instability in pricing. High production and extraction costs for omega-3 fatty acids and plant-derived bioactives restrict affordability for mass-market products. Opinions suggest that complex regulatory frameworks governing health claims and labeling standards delay product launches, especially in international markets. Intense competition among supplement brands also creates challenges for differentiation. Smaller firms struggle with compliance costs and limited sourcing capabilities, reducing their competitiveness. These structural challenges highlight why only suppliers with strong sourcing networks, advanced extraction capabilities, and compliance expertise are well positioned to succeed in this fragmented yet fast-evolving market.

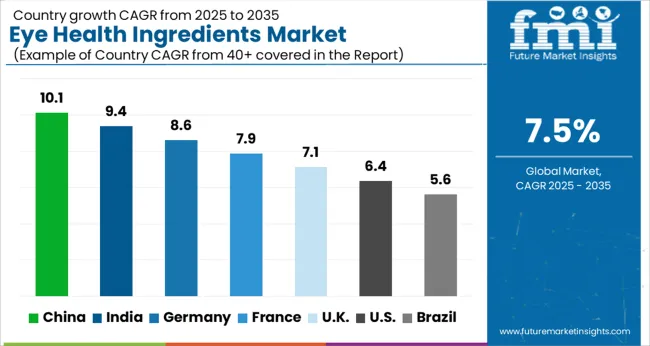

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| U.K. | 7.1% |

| U.S. | 6.4% |

| Brazil | 5.6% |

The global eye health ingredients market is projected to grow at a CAGR of 7.5% between 2025 and 2035. China leads with 10.1%, followed by India at 9.4% and France at 7.9%. The United Kingdom is expected to grow at 7.1%, while the United States records the slowest pace at 6.4%. Growth is influenced by rising prevalence of vision disorders, increased awareness of preventive nutrition, and demand for supplements featuring lutein, zeaxanthin, beta carotene, and omega 3 fatty acids. Asia registers faster growth due to large populations, strong nutraceutical manufacturing, and consumer adoption of fortified products. European markets emphasize regulatory compliance and premium formulations, while the U.S. reflects maturity with steady growth in targeted supplement segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

The eye health ingredients market in China is projected to grow at a CAGR of 10.1%. Rising cases of digital eye strain, myopia, and aging related vision issues drive demand for fortified foods, beverages, and supplements. Domestic producers expand manufacturing of lutein and zeaxanthin, leveraging local agricultural resources. Nutraceutical brands actively market prevention focused formulations, boosting consumer adoption. Government efforts to promote public health awareness further expand the market. China’s strong position in nutraceutical exports also contributes to the acceleration of eye health ingredient applications, consolidating its leadership role across Asia.

The eye health ingredients market in India is forecast to grow at a CAGR of 9.4%. Growth is supported by a rising middle class, dietary supplement adoption, and higher prevalence of myopia among younger demographics. Functional foods and beverages featuring eye health ingredients gain traction across urban centers. Government backed health campaigns highlight preventive nutrition, encouraging wider usage. Domestic nutraceutical firms focus on expanding portfolios that include beta carotene, omega 3 fatty acids, and plant based antioxidants. With strong demand across both preventive healthcare and therapeutic applications, India is emerging as a major consumer market for these formulations.

The eye health ingredients market in France is projected to grow at a CAGR of 7.9%. Expansion is anchored by regulatory compliance, high consumer awareness, and preference for premium quality supplements. French consumers prioritize clinically validated formulations, often featuring lutein, zeaxanthin, and omega 3 fatty acids sourced from marine and botanical origins. Strong demand is observed in the aging population segment, where vision maintenance products are widely adopted. Nutraceutical firms in France also emphasize innovation in delivery formats such as gummies, capsules, and fortified foods, enhancing consumer appeal and expanding usage.

The eye health ingredients market in the UK is expected to grow at a CAGR of 7.1%. Adoption is shaped by rising consumer interest in preventive nutrition and strong distribution networks across pharmacies, supermarkets, and online retail. Supplements targeting macular degeneration and eye fatigue from digital device usage gain traction. Nutraceutical firms emphasize high quality formulations and compliance with EFSA guidelines, ensuring consumer trust. Growth is supported by lifestyle trends favoring health oriented diets and functional products. The UK’s steady trajectory reflects a balanced mix of preventive healthcare demand and strong regulatory oversight.

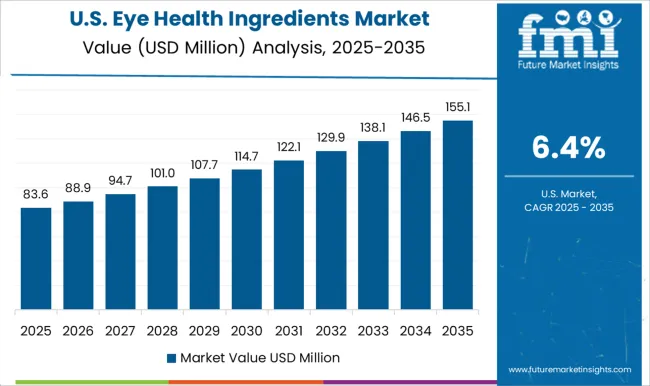

The eye health ingredients market in the US is projected to grow at a CAGR of 6.4%. Growth is moderate due to a mature supplement industry, but increasing cases of age related macular degeneration and dry eye syndrome support ongoing demand. Consumer preference leans toward clinically proven and premium formulations, often marketed through specialty health channels. Nutraceutical firms emphasize innovation in formulations that combine multiple eye health ingredients for synergistic effects. Although expansion is slower than in Asia, the US remains a significant market due to high healthcare spending and steady adoption of condition specific supplements.

Competition in eye health ingredients has been defined by how effectively companies transform clinical science into compelling brochure content. Alcon and Bausch & Lomb distribute brochures highlighting formulations built around lutein, zeaxanthin, and omega-3s, with claims tied to macular health and visual acuity. Amway and Solgar present catalogs that emphasize premium supplement formats, stressing purity, standardized extracts, and convenient dosage forms. Swanson positions its brochures around affordability and broad product range, offering eye health blends across e-commerce channels. MacuShield stands out by concentrating brochures on its patented MZ, L, and Z carotenoids combination, marketed as a targeted formula for age related macular support. Efamol differentiates by publishing brochures highlighting gamma linolenic acid (GLA) rich evening primrose oil, stressing moisture retention and ocular surface comfort. BASF and DSM frame their brochures around ingredient science, showcasing lutein beadlets, beta carotene, and custom premixes backed by clinical trial references. Allied Biotech and FMC emphasize beta carotene and natural pigments, positioning their brochures on colorants with functional roles in ocular supplements. Strategies converge on clarity of benefits, dosage credibility, and scientific backing within brochures. Each brochure is designed as both a marketing tool and an evidence sheet, balancing consumer friendly graphics with technical charts. Clinical references, dosage equivalence, and stability data are routinely printed, making selection a side by side comparison exercise for formulators and brand owners. Competitive differentiation rests less on brand logos and more on how thoroughly brochures outline ingredient provenance, bioavailability, and finished product applications. Players with brochures that combine regulatory compliance notes, formulation flexibility, and validated efficacy create stronger buyer confidence. In this market, the product brochure becomes the decisive ground where complex nutritional science is simplified into persuasive evidence that eye health ingredients deliver measurable vision support.

| Item | Value |

|---|---|

| Quantitative Units | USD 174.8 Million |

| Source | Natural and Synthetic |

| Ingredient | Lutein, Zeaxanthin, Beta Carotene, Vitamin A, and Bilberry Extracts |

| Form | Soft Gel, Capsule & Tablets, Liquid, and Powder |

| End Use | Human and Animal |

| Disease Indication | Age related Macular Degeneration, Cataract, and Dry Eye Syndrome |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alcon, Amway, MacuShield, Efamol, Swanson Bausch & Lomb, Solgar, BASF, FMC Corporation, Allied Biotech Corporation, and DSM |

| Additional Attributes | Dollar sales by ingredient type (lutein, zeaxanthin, beta-carotene, bilberry extract, omega-3 fatty acids), Dollar sales by form (capsules, tablets, powders, softgels, liquids), Trends in preventive eye care and functional nutrition, Role of supplements in reducing risk of age-related macular degeneration and digital eye strain, Growth in fortified foods and nutraceutical formulations targeting vision health, Regional consumption trends across North America, Europe, and Asia Pacific. |

The global eye health ingredients market is estimated to be valued at USD 174.8 million in 2025.

The market size for the eye health ingredients market is projected to reach USD 360.3 million by 2035.

The eye health ingredients market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in eye health ingredients market are natural and synthetic.

In terms of ingredient, lutein segment to command 39.5% share in the eye health ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eye and Face Protection Market Growth - 2025 to 2035

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Eye Shadow Market Insights – Size, Trends & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Key Companies & Market Share in the Eye Shadow Stick Sector

Competitive Overview of Eyewear Packaging Companies

Market Share Insights of Eye Cosmetic Packaging Providers

Eyewear Packaging Market by Material Type from 2024 to 2034

Eyeliner Pen Market

Eye Tracking Solutions Market

Eye Wash Stations Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA