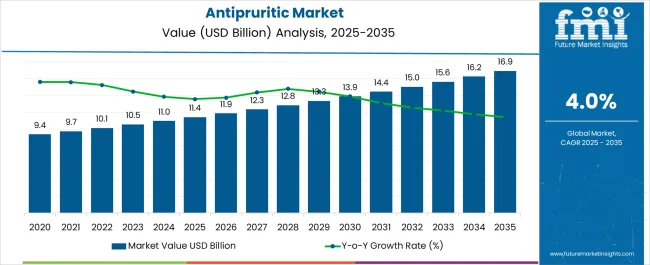

The Antipruritic Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 16.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Antipruritic Market Estimated Value in (2025 E) | USD 11.4 billion |

| Antipruritic Market Forecast Value in (2035 F) | USD 16.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The antipruritic market is advancing steadily, driven by the rising prevalence of dermatological conditions, increasing patient awareness, and the availability of diverse treatment options. Current market dynamics are being shaped by demand for effective therapies that provide rapid relief from itching and inflammation, as well as regulatory approval for novel formulations with improved safety profiles.

The market is also benefiting from ongoing research in immunology and dermatology, which has expanded understanding of pruritus pathophysiology and supported the development of targeted drugs. Pricing pressures and side-effect concerns are being addressed by manufacturers through innovation in drug delivery systems and investment in topical and systemic therapies with fewer adverse effects.

The future outlook is marked by continued adoption of advanced therapies, wider access to treatment in emerging economies, and the expansion of over-the-counter options, all of which are expected to enhance availability and affordability Growth rationale is underpinned by strong clinical demand, technological advancements in formulation, and healthcare infrastructure expansion, ensuring the market maintains its upward trajectory.

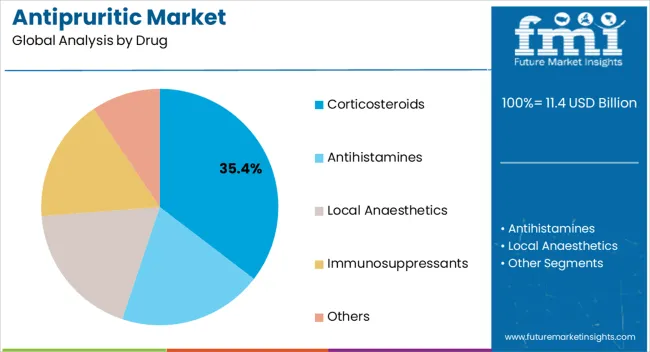

The corticosteroids segment, accounting for 35.40% of the drug category, has been leading due to its established effectiveness in reducing inflammation and providing rapid relief from itching. Its widespread adoption has been reinforced by strong clinician preference, particularly in managing both acute and chronic dermatological conditions.

Regulatory approval for multiple formulations, including creams, ointments, and sprays, has expanded accessibility across different patient groups. The segment’s growth has been supported by manufacturing consistency, affordability, and integration into treatment guidelines worldwide.

Recent innovations in low-potency and combination corticosteroids have further improved safety and tolerability, reducing long-term side effects while maintaining efficacy These developments are ensuring that corticosteroids continue to dominate the antipruritic market.

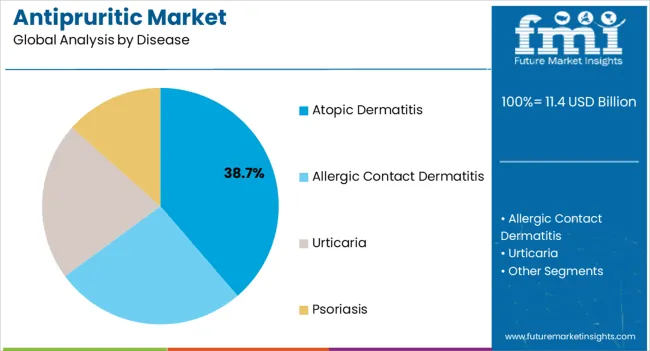

The atopic dermatitis segment, representing 38.70% of the disease category, has retained its leadership due to the high incidence of the condition across both pediatric and adult populations. Its prominence is supported by the chronic and recurrent nature of the disease, which requires sustained therapeutic intervention.

Increased awareness, early diagnosis, and expanded availability of advanced therapies have further strengthened this segment. Integration of antipruritic drugs into standard care protocols has ensured consistent demand, while ongoing research into disease mechanisms has led to improved targeted therapies.

Rising healthcare expenditure and the expansion of dermatology clinics have also contributed to segment stability Over the forecast horizon, strong pipeline developments and the introduction of biologics are expected to sustain the segment’s market share.

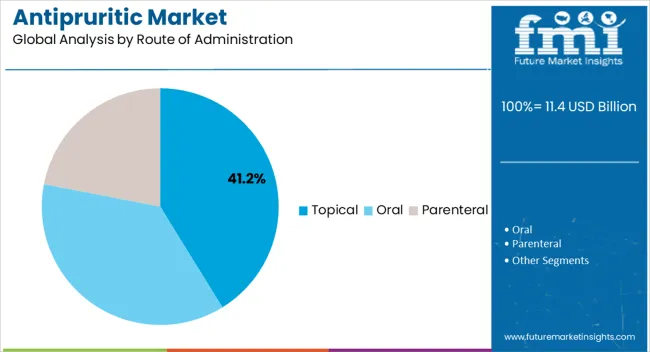

The topical route, holding 41.20% of the administration category, has emerged as the leading mode due to its ease of use, rapid onset of action, and minimal systemic absorption. Adoption has been strengthened by patient preference for non-invasive application and clinician confidence in its effectiveness for localized pruritus management.

Widespread availability of creams, gels, and ointments has ensured accessibility across retail and hospital pharmacies. The segment has also benefited from innovations in formulation technology, including sustained-release and barrier-enhancing products that improve skin penetration and therapeutic outcomes.

Lower risk of systemic side effects has reinforced the appeal of topical administration, particularly for long-term management of chronic dermatological conditions Continued product innovation and expansion into over-the-counter categories are expected to maintain the topical route’s dominance in the market.

| Attributes | Details |

|---|---|

| Antipruritic Market Size (2020) | USD 9.1 billion |

| Antipruritic Market Size (2025) | USD 10.5 billion |

| Antipruritic Market CAGR (2020 to 2025) | 4.1% |

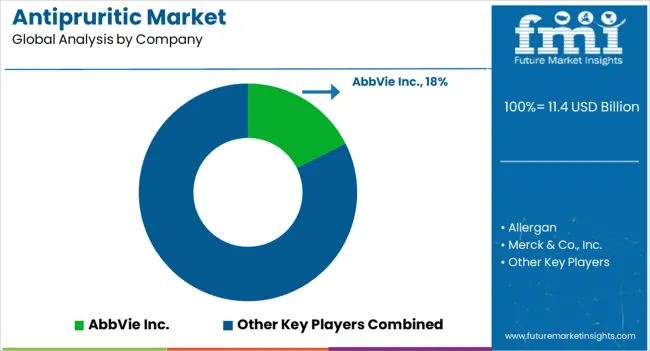

The market observed a growth of 4.1% during 2020 and 2025. The global market for antipruritic held nearly 64.6% of the overall USD 11.4 billion skin treatment market shares in 2025.

The most frequent dermatologic symptom reported by patients is pruritus. It is associated with a variety of skin conditions, the majority of which are characterized by primary lesions such as vesicles, plaques, and papules.

The underlying causes of pruritus are still unknown, making it difficult for healthcare practitioners to control itching in individuals with severe pruritus adequately. There are typically discrepancies between causative and symptomatic approaches to pruritus therapy. A common strategy for navigating the broad terrain of pruritus therapy is to categorize these alternatives according to their underlying causes.

Causative therapy aims to identify and treat the underlying illness causing the itching. Symptomatic treatment hides the itch through treatments such as cooling, heating, or counter-irritation (e.g., scratching). To provide relief sooner, symptomatic treatment and addressing the underlying disease process may be used. The popular therapeutic options are classified as symptomatic therapy and management.

Disruptive technical advancements, increasing healthcare investments, and health system optimization are driving the swift development of the medical and drug industries. Modern medical institutions, ambulatory care centers, and clinics throughout the world are deliberately adopting cutting-edge technological technologies and equipment into their operations to improve efficiency and competitiveness.

The global market's revenue growth is fuelled by factors such as rising chronic illness incidence, rapid improvements in the healthcare and medical sectors, widespread use of new instruments and techniques, and increased funding from various public and private sectors.

Furthermore, rising emphasis on drug discovery, rising need for precision medicine, widespread deployment of home care services and point-of-care diagnostics, and increased investments in R&D activities are likely to boost global market revenue and profit during the projected timeframe.

These factors are projected to impact the growth of the industry worldwide positively. With a CAGR of 4.2%, the industry is predicted to develop significantly during the following decade.

Chronic pruritus, a growing health problem, significantly impacts quality of life. Ongoing research has revealed new pathways and itch receptors, which has improved our understanding of these aspects. Expectations are strong that these latest insights are going to encourage the development of ground-breaking treatments for this frequently ignored and inconvenient ailment.

The administration of medications that reduce neural sensitization to pain, such as gabapentin, pregabalin, SSRIs, and norepinephrine antidepressants, either singly or in combination, is now required for the therapeutic management of chronic pruritus.

In the future, adopting a variety of topical and systemic medicines that focus on the different receptors and neurological pathways mediating distinct forms of itch would improve the quality of life for millions of pruritic patients.

Because of the condition's complex etiology and various contributing factors, treating chronic pruritus (CP) remains challenging. Despite the well-known antipruritic properties of traditional pharmacotherapy, such as topical therapy, light therapy, and systemic therapy, these strategies typically fail to provide significant relief for affected individuals.

Despite the wide range of therapy options, chronic pruritus is still challenging to treat. Several antipruritic treatments are still used off-label as of right now. There are currently just a few effective topical treatments for itching, and existing itch management techniques do not cover most unmet needs.

Furthermore, few published works employ general health metrics to evaluate CP, and there are very few economic statistics on the cost of chronic pruritus. According to the American Academy of Dermatology's (AAD) National Burden of Skin Disease report, pruritus-related disorders in the United States incur a yearly treatment expense of USD 9.4 million and an opportunity cost of USD 107 million (2020).

According to Luk et al. (2024), people with CP have an annual financial burden of USD 1,067 because of both direct and secondary medical costs. The impact of stress, anxiety, depression, and functional incapacity on the patient and their loved ones as a result of the condition are examples of what are known as intangible costs that are not taken into account by current techniques of cost assessment.

During the forecast period, the market is expected to experience barriers in its growth trajectory due to a significant financial burden, limited evidence-based data, and parameters associated with existing treatment alternatives.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 37.4% |

| China | 8.9% |

| Germany | 4.70% |

| United Kingdom | 5.10% |

| Japan | 3.20% |

The United States dominated the antipruritic market with 37.4% of market shares in 2025. The antipruritic market size in the United States is estimated to rise at a 4.30% CAGR through 2035. The country has a vast healthcare system includes comprehensive patient care and reimbursement provisions. Moreover, with greater patient awareness regarding various treatment modalities and options for pruritus treatments, the country holds a leading stance within the global market.

China captured a value share of 8.9% in the global market in 2025. The demand for antipruritic treatments is projected to surge at a 6.90% CAGR through 2035. It has been observed in several population-based studies that in Chinese patients, the frequency and severity of pruritus vary with skin conditions, skin type, age, and gender.

According to GBD 2020, young and middle-aged demographics have a higher illness burden from acne. Nearly 9.4% of the world’s population suffers from acne, making it the 8th most widespread condition globally. The market for antipruritics is driven by the increased prevalence of skin diseases in China, providing key producers with opportunities to expand within the country.

Germany held around 5.7% of the antipruritic market in 2025. The market for antipruritic in Germany is predicted to thrive at a 4.70% CAGR through 2035. In Germany, a surprisingly high number of pruritus sufferers, particularly those with specific localizations on the body, have unmet medical needs. This factor promotes opportunities for established manufacturers within the country to promote and develop novel therapeutics, addressing these unmet needs, hence propelling growth throughout the forecast period.

The United Kingdom held nearly 3.50% of the market shares in 2025. The demand for antipruritic in the United Kingdom is estimated to rise at a 5.10% CAGR through 2035. The introduction of telemedicine services in the United Kingdom has unlocked the door to online consultations and prescriptions for antipruritic drugs, increasing access to healthcare services. Government subsidies or incentives for research and development could appeal to pharmaceutical businesses to invest in producing new and improved antipruritic remedies.

Japan held nearly 5.20% of the market shares in 2025. The antipruritic market size in Japan is projected to surge at a 3.20% CAGR through 2035. Skincare and appearance are highly valued in Japanese society. A robust cultural preference for preserving good skin increases demand for antipruritic treatments, particularly those with aesthetic advantages. Japan is famous for its technological advances. Integration of cutting-edge technology, such as smart skincare devices or AI-driven diagnostic tools for dermatological diseases, could represent a differentiating element in market growth.

| Segment | Immunosuppressants (Drug Type) |

|---|---|

| Value Share (2025) | 31.3% |

Immunosuppressants held a share of around 31.3% in the global market in 2025. This is due to the effectiveness of oral immunosuppressants such as cyclosporine, mycophenolate mofetil, and azathioprine in treating itching caused by inflammatory disorders like atopic dermatitis. Furthermore, systemic corticosteroids can also be administered to reduce inflammation in extreme situations of chronic pruritus.

The most effective way to reduce itching in atopic dermatitis is to manage the inflammation with topical or systemic immunosuppressive medications effectively.

| Segment | Psoriasis (Disease Type) |

|---|---|

| Value Share (2025) | 33.2% |

Psoriasis held around 33.2% of the global market in 2025. Psoriasis is a prevalent, chronic illness that has no cure. According to the 2020 report on the worldwide disease burden, there have been 4,622,594 reported cases of psoriasis globally in that year. The age range of 60 to 69 years has the maximum prevalence of psoriasis overall, with a roughly equal frequency between men and women.

The burden is substantially heavier in North American and European countries with high incomes and high SDI indices. To help reduce the disease burden of psoriasis globally, this factor fuels the interest of manufacturers in the market in the development of novel therapies.

| Segment | Oral (Route of Administration) |

|---|---|

| Value Share (2025) | 39.8% |

The oral route of administration held a share of around 39.8% in the global market in 2025. This is due to the usage of oral antihistamines for the symptomatic alleviation of pruritus. Oral antihistamines of the first or second generations, such as cetirizine and loratadine, are widely recommended. First-generation oral antihistamines include diphenhydramine and hydroxyzine.

Moreover, due to the ease of administration of oral medication dosages, the oral route of administration gains a more significant share within the global market.

| Segment | Hospital Pharmacies (Distribution Channel) |

|---|---|

| Value Share (2025) | 30.4% |

Hospital pharmacies held around 30.4% of the global market in 2025. Several institutional pharmacies provide commonly prescribed medications for pruritus at subsidized rates, thus propelling sales of antipruritics within these settings. Moreover, with the ease of dispensing, presence of branded and generic drug options, as well as greater accessibility to patients, this segment holds a dominant share within the global market.

Key players are enhancing their research and development activities to launch novel products. The expansion of their product range and efforts to improve their pipelined products are two other strategic acquisitions and partnerships with key businesses.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, the Middle East and Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, Spain, United Kingdom, Russia, BENELUX, China, Japan, South Korea, India, Indonesia, Thailand, Malaysia, Australia, New Zealand, GCC Countries, Turkey, North Africa, South Africa |

| Key Companies Covered | AbbVie Inc.; Allergan, Merck & Co., Inc.; Amgen Inc.; Pfizer Inc.; Cara Therapeutics; Enteris BioPharma; NeRRe Therapeutics; Menlo Therapeutics; XBiotech Inc.; Ipsen Pharma; Eledon Pharmaceuticals, Inc.; Amorepacific; RDD Pharma, Ltd; Novartis AG; AstraZeneca; Sanofi; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Takeda Pharmaceutical Company Limited; Cipla Ltd. |

| Key Market Segments Covered | Drug, Disease, Route of Administration, Distribution Channel, and Region |

| Pricing | Available upon Request |

The global antipruritic market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the antipruritic market is projected to reach USD 16.9 billion by 2035.

The antipruritic market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in antipruritic market are corticosteroids, antihistamines, local anaesthetics, immunosuppressants and others.

In terms of disease, atopic dermatitis segment to command 38.7% share in the antipruritic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA