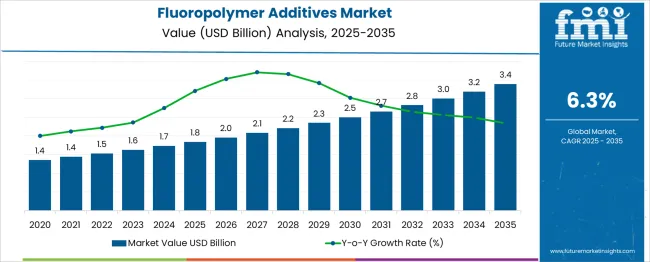

The Fluoropolymer Additives Market is expected to grow from an estimated USD 1.8 billion in 2025 to USD 3.4 billion by 2035. This translates to an absolute dollar opportunity of USD 1.6 billion over the forecast period. The steady increase in market value highlights a growing demand for fluoropolymer additives across various end-use industries such as automotive, electronics, and chemical manufacturing. Annual market values reveal a gradual expansion from USD 1.8 billion in 2025 to approximately USD 2.3 billion by 2029. This early growth phase indicates initial adoption and market penetration, supported by rising awareness of the performance benefits of fluoropolymer additives, including enhanced chemical resistance and thermal stability. The market continues to gain momentum from 2030 onward, reaching USD 3.0 billion by 2033 and culminating at USD 3.4 billion in 2035. This phase reflects intensified application in high-growth sectors, driven by innovation and regulatory support for advanced materials. The incremental growth from year to year suggests a consistent market expansion without abrupt fluctuations, indicating a stable growth environment. The absolute dollar opportunity of USD 1.6 billion underscores the significant potential for players focusing on product development, geographic expansion, and diversification to capitalize on this market’s steady upward trajectory through 2035.

| Metric | Value |

|---|---|

| Fluoropolymer Additives Market Estimated Value in (2025 E) | USD 1.8 billion |

| Fluoropolymer Additives Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The fluoropolymer additives market is witnessing consistent expansion fueled by increasing demand across automotive, electronics, industrial coatings, and construction sectors. The market is being shaped by the unique chemical and thermal resistance properties these additives bring to host materials, particularly in high-performance applications.

As sustainability and durability take precedence in product formulations, fluoropolymer additives are being increasingly incorporated into plastics, lubricants, paints, and coatings to improve wear resistance, reduce friction, and ensure longevity. Industry reports and manufacturer updates indicate rising adoption in high-temperature applications, where traditional materials fail to meet performance standards.

Additionally, innovations in micropowder processing and surface treatment technologies are enhancing additive dispersion and functional efficiency. With stricter regulatory standards for efficiency and emissions across industries, the demand for additives that improve performance without compromising environmental compliance is expected to rise, positioning the market for steady growth in both established and emerging economies.

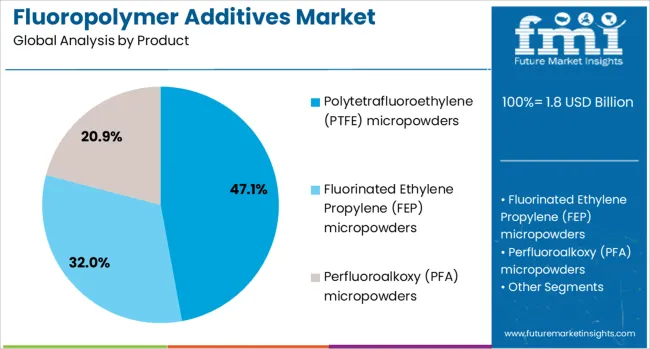

The fluoropolymer additives market is segmented by product, and geographic regions. By product, the market is divided into Polytetrafluoroethylene (PTFE) micropowders, Fluorinated Ethylene Propylene (FEP) micropowders Perfluoroalkoxy (PFA) micropowders. Regionally, the fluoropolymer additives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polytetrafluoroethylene micropowders subsegment is anticipated to contribute 47.1% of the product category’s revenue share in 2025, making it the dominant product type in the fluoropolymer additives market. This leading position is attributed to the unique ability of PTFE micropowders to impart superior lubricity, abrasion resistance, and thermal stability to a wide range of host materials.

Their compatibility with thermoplastics, elastomers, and coatings has supported widespread industrial use, particularly in automotive components, electronic connectors, and high-performance architectural coatings. PTFE micropowders have also been preferred for their ability to reduce friction and wear in mechanical applications, enhancing the lifecycle of finished products.

Their ultra-fine particle structure ensures even dispersion during processing, which has improved formulation consistency in advanced manufacturing setups. Moreover, regulatory trends favoring long-lasting, low-maintenance materials in end-use sectors such as transportation and industrial manufacturing have further cemented the segment’s share in the global market.

The market has been expanding steadily as industries seek materials that enhance product performance through improved chemical resistance, thermal stability, and low friction properties. These additives have been widely incorporated into plastics, coatings, rubbers, and composites to impart non-stick, anti-corrosive, and weather-resistant characteristics. The market growth has been supported by increasing demand from automotive, electronics, aerospace, and chemical processing sectors, where durable and high-performance materials are critical. Innovations in additive formulations have improved compatibility with various polymer matrices, enabling enhanced processing and final product properties.

Significant demand for fluoropolymer additives has been observed in the automotive and electronics sectors due to their ability to improve durability, chemical resistance, and electrical insulation. In automotive manufacturing, these additives have been used to enhance fuel system components, wiring insulation, and exterior parts, contributing to lighter and more efficient vehicles. The electronics industry has utilized fluoropolymer additives to protect sensitive devices from moisture, heat, and chemical exposure, improving product lifespan and reliability. The growing production of electric vehicles and portable electronic devices has further driven market growth. Additive innovations have enabled better dispersion and compatibility within polymer blends, facilitating improved mechanical and thermal properties. These factors have led to increased adoption of fluoropolymer additives as essential functional enhancers in advanced automotive and electronics manufacturing.

Advances in fluoropolymer additive technology have focused on improving processability, compatibility, and performance attributes in end-use applications. Developments such as nano-scale fluoropolymer dispersions and grafted copolymers have enhanced additive dispersion in diverse polymer matrices, resulting in uniform property enhancement. Surface modification techniques have improved adhesion and anti-fouling capabilities in coated products. Additives have been engineered to reduce friction, improve thermal stability, and resist chemical degradation under harsh operating conditions. Additionally, formulations have been optimized to minimize environmental impact by reducing volatile organic compound emissions during processing. These technological improvements have broadened the range of polymers and applications suitable for fluoropolymer additives, increasing their versatility and market reach. Continuous research is expected to yield next-generation additives that meet evolving industrial and environmental requirements.

The market has been shaped by increasing regulatory scrutiny aimed at reducing the use of hazardous substances and minimizing environmental impact. Regulations targeting persistent organic pollutants and fluorinated chemicals have prompted reformulation efforts to eliminate or reduce perfluorinated compounds in additive production. Manufacturers have been adopting safer chemistries and green synthesis methods to comply with global standards and certifications. Restrictions on volatile organic compound emissions and waste management practices have also influenced manufacturing processes. These regulatory pressures have encouraged the development of eco-friendly fluoropolymer additives that maintain performance while adhering to sustainability goals. Market players have been investing in research to innovate alternatives that balance safety, efficacy, and cost-effectiveness. Compliance with evolving environmental laws is expected to remain a key factor driving innovation and shaping market dynamics.

Fluoropolymer additives have been increasingly applied across various industries beyond automotive and electronics, including chemical processing, packaging, textiles, and medical devices. In chemical processing, additives enhance resistance to aggressive chemicals and high temperatures, protecting equipment and extending service life. Packaging materials benefit from additives that provide non-stick and barrier properties, improving product preservation and processing efficiency. In textiles, fluoropolymer additives impart water repellency and stain resistance, meeting consumer demand for durable, easy-care fabrics. The medical device industry has utilized these additives to improve biocompatibility and sterilization resistance. The broadening range of applications reflects the additives’ functional versatility and critical role in enhancing product performance across sectors. This diverse adoption is expected to sustain steady growth in the fluoropolymer additives market globally.

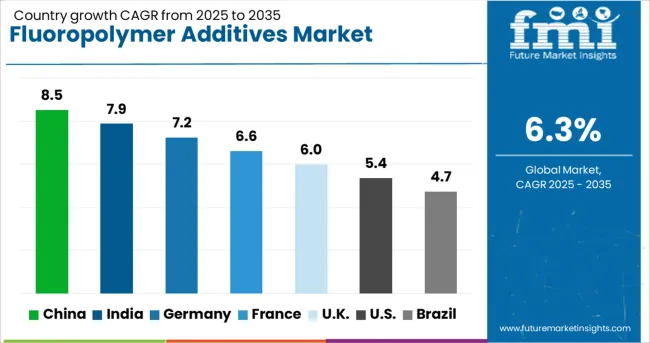

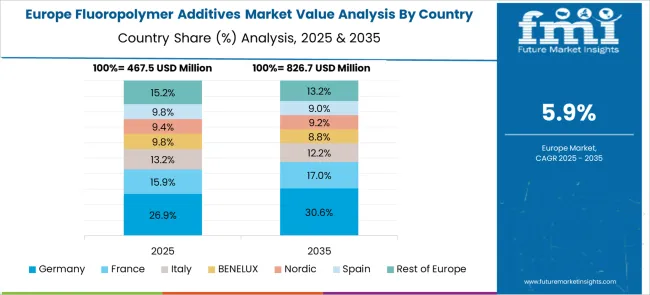

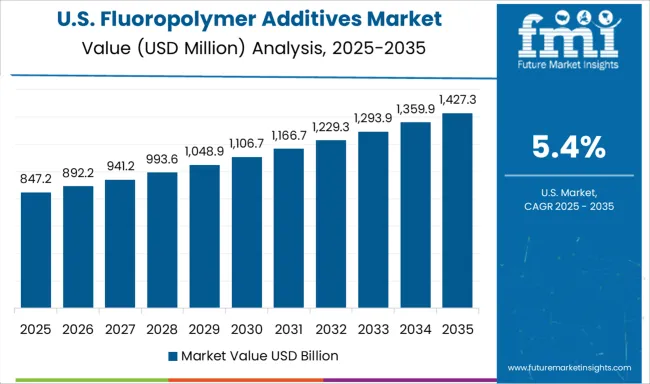

The market is anticipated to grow at a CAGR of 6.3% between 2025 and 2035, driven by demand for enhanced chemical resistance, thermal stability, and performance in automotive, electronics, and industrial sectors. China leads with an 8.5% CAGR, supported by strong manufacturing capabilities and rapid adoption of advanced materials. India follows at 7.9%, fueled by growing industrial production and technological upgrades. Germany, at 7.2%, benefits from extensive R&D activities and stringent quality standards. The UK, growing at 6.0%, experiences steady demand due to innovation in specialty additives. The USA, with a 5.4% CAGR, sees growth driven by industrial applications and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market is anticipated to grow at a CAGR of 6.3% between 2025 and 2035, driven by demand for enhanced chemical resistance, thermal stability, and performance in automotive, electronics, and industrial sectors. China leads with an 8.5% CAGR, supported by strong manufacturing capabilities and rapid adoption of advanced materials. India follows at 7.9%, fueled by growing industrial production and technological upgrades. Germany, at 7.2%, benefits from extensive R&D activities and stringent quality standards. The UK, growing at 6.0%, experiences steady demand due to innovation in specialty additives. The USA, with a 5.4% CAGR, sees growth driven by industrial applications and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is expected to expand at a CAGR of 8.5% between 2025 and 2035. Growth is driven by increased applications in plastics, coatings, and electronics where enhanced chemical resistance and lubricity are required. Domestic manufacturers such as Shanghai 3F New Materials and Zhejiang Meilun have ramped up production capacities and focused on developing additives with improved thermal stability and processability. Demand is also boosted by rising exports to Asia Pacific and Europe. Government support for advanced materials manufacturing strengthens the competitive landscape, encouraging innovation and cost-effective solutions tailored to local industries.

India is forecast to grow at a CAGR of 7.9% from 2025 to 2035, supported by expanding polymer manufacturing and coating industries. Companies including Uflex and Chemours focus on additives that improve surface properties and chemical resistance for packaging and automotive applications. The growing electronics manufacturing sector drives demand for specialty additives in circuit board coatings. Local R&D efforts emphasize sustainability and compliance with evolving environmental regulations. Export opportunities to Middle East and Africa also contribute to market expansion.

Sales of fluoropolymer additives in Germany are expected to advance at a CAGR of 7.2% through 2035. The market benefits from strong demand in automotive, electrical, and chemical sectors requiring high-performance additives. Leading players such as Wacker Chemie and Chemours invest heavily in R&D to enhance additive performance in terms of heat resistance and durability. Regulatory emphasis on eco-friendly additives accelerates innovation. Application in renewable energy components and industrial coatings supports steady growth, while collaborations with research institutes enhance product development.

The market in the United Kingdom is projected to grow at a CAGR of 6.0% during 2025 to 2035. Market expansion is driven by rising demand in coatings, packaging, and electrical industries. Key manufacturers including Chemours and 3M focus on developing additives with enhanced performance for surface protection and process efficiency. The construction industry’s adoption of weather-resistant coatings contributes to growth. Increasing regulatory focus on reducing volatile organic compounds supports development of sustainable additives.

Sales of fluoropolymer additives in the United States are expected to increase at a CAGR of 5.4% from 2025 to 2035. Growth is supported by demand in aerospace, automotive, and electronics manufacturing sectors requiring high-performance additives. Leading companies such as Chemours and Daikin focus on innovation to improve additive heat stability and environmental compliance. Expanding industrial coating applications and retrofitting projects contribute to market volume. Regulatory trends favor low-emission and eco-friendly additive products, driving research and product development.

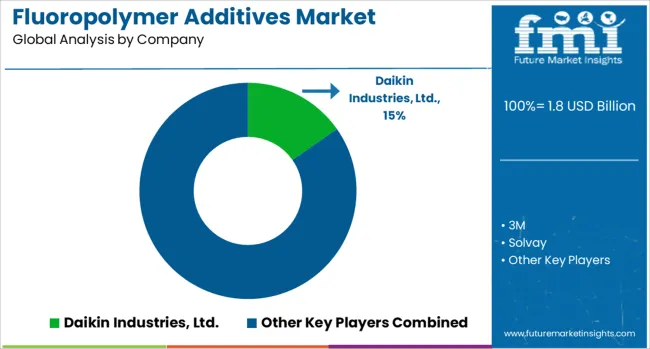

The market is dominated by well-established companies offering specialty additives that enhance product performance in industries like automotive, electronics, and coatings. Daikin Industries, Ltd. stands out by providing a broad portfolio of fluoropolymer additives known for thermal stability and chemical resistance. Similarly, 3M delivers innovative fluorinated additives that improve durability and reduce friction in various applications. Solvay and DuPont are major contributors, focusing on high-quality additives that optimize processing and end-product properties. Gujarat Fluorochemicals plays a significant role as a regional supplier with growing international presence, supported by robust research initiatives. AGC Inc. “Reprolon, Texas” contributes with advanced fluoropolymer additives tailored for specialized industrial uses. Shamrock Technologies and Micro Powders, Inc. are recognized for their micronized additives, which provide enhanced dispersion and improved physical characteristics. Chenguang Research Institute of Chemical Industry and Fluorogistx bring research-driven products that meet stringent quality and environmental standards. Maflon SpA and Reprolon, Texas deliver niche fluoropolymer additive solutions targeting unique industry requirements, while KITAMURA LIMITED and Laurel Products, LLC cater to regional markets with tailored formulations. Entry barriers in this market include the need for advanced chemical synthesis capabilities, strict regulatory compliance, and significant capital investment. Companies that continuously invest in R&D, maintain high product quality, and develop strategic partnerships remain well-positioned in this competitive landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product | Polytetrafluoroethylene (PTFE) micropowders, Fluorinated Ethylene Propylene (FEP) micropowders, and Perfluoroalkoxy (PFA) micropowders |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin Industries, Ltd., 3M, Solvay, DuPont, Gujarat Fluorochemicals, Asahi Glass Co., Ltd., Shamrock Technologies, Micro Powders, Inc., Chenguang Research Institute of Chemical Industry, Fluorogistx, Maflon SpA, Reprolon, Texas, KITAMURA LIMITED, and Laurel Products, LLC |

| Additional Attributes | Dollar sales by additive type and application sector, demand dynamics across plastics processing, coatings, automotive, and electronics industries, regional trends in consumption across North America, Europe, and Asia-Pacific, innovation in slip and anti-block additives, thermal stabilizers, and environmentally friendly formulations, environmental impact of fluorochemical production, waste management, and recycling challenges, and emerging use cases in lightweight automotive components, flexible electronics, and high-performance packaging materials. |

The global fluoropolymer additives market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the fluoropolymer additives market is projected to reach USD 3.4 billion by 2035.

The fluoropolymer additives market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in fluoropolymer additives market are polytetrafluoroethylene (ptfe) micropowders, fluorinated ethylene propylene (fep) micropowders and perfluoroalkoxy (pfa) micropowders.

In terms of , segment to command 0.0% share in the fluoropolymer additives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Coating Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Fluoropolymer Film Market Trends 2024-2034

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Growth – Trends & Forecast 2024-2034

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Amine Additives in Paints and Coatings Market

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Ceramic Additives Market

Foundry Additives Market

Refining Additives Market Size and Share Forecast Outlook 2025 to 2035

Silicone Additives Market Size and Share Forecast Outlook 2025 to 2035

Butyrate Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA