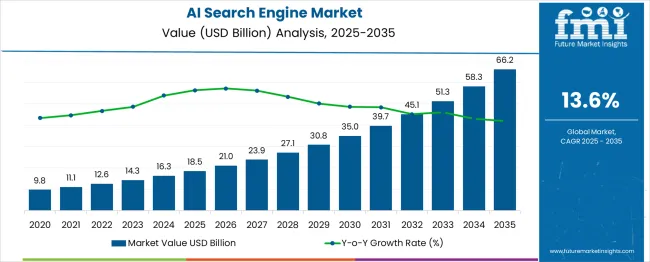

The AI search engine market was valued at USD 18.5 billion in 2025 and is forecasted to reach USD 66.2 billion by 2035, charting a CAGR of 14%. Year-on-year growth patterns show the market advancing from USD 21.0 billion in 2026 to USD 35.0 billion in 2030, followed by a strong acceleration toward USD 58.3 billion in 2034. This steady rise demonstrates the expanding reliance on AI-driven algorithms for more accurate, intuitive, and context-aware search experiences.

The YoY growth reflects not only a rising appetite for intelligent platforms but also the willingness of enterprises to reimagine how users interact with digital content. Such consistent expansion reinforces the view that AI-driven search capabilities are evolving from optional tools into critical business assets.

Year-on-year evaluation indicates robust incremental growth, with values moving from USD 27.1 billion in 2028 to USD 51.3 billion in 2033. This trajectory suggests that decision-making processes and content delivery methods are being reshaped by AI-powered search platforms that prioritize personalization and relevance. The YoY momentum reveals that enterprises that fail to incorporate AI-driven search will likely lose competitive ground, as user expectations continue to shift toward smarter, faster, and more contextualized search solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 18.5 billion |

| Forecast Value in (2035F) | USD 66.2 billion |

| Forecast CAGR (2025 to 2035) | 14% |

The AI search engine market has been emerging as a pivotal subset of broader technology-driven industries, with its influence spreading across multiple parent sectors. Within the artificial intelligence market, AI-driven search platforms represent close to 6.8%, as natural language processing, machine learning algorithms, and contextual understanding are being adopted to deliver more accurate and personalized query results.

In the enterprise software market, the segment holds nearly 5.9%, supported by the integration of AI search into corporate knowledge management, customer support, and productivity tools. Within the digital marketing solutions market, AI search contributes around 6.2%, reflecting its role in optimizing customer journeys, intent-driven targeting, and content discovery. The cloud computing market accounts for 5.6% penetration of AI search, as enterprises deploy scalable search systems within hybrid and multi-cloud environments to manage distributed data efficiently. Meanwhile, in the data analytics market, the share is about 5.3%, highlighting the reliance on AI-enabled search to analyze structured and unstructured datasets in real time.

The AI search engine market represents approximately 29.8% across these parent industries, showing its expanding footprint in shaping digital interactions, corporate decision-making, and consumer engagement. Adoption has been driven by the demand for precision, speed, and contextual intelligence in data exploration, positioning AI-powered search as more than just an auxiliary tool but as a strategic enabler, reshaping user expectations and competitive strategies within these broader parent markets.

Market expansion is being supported by the exponential growth of digital data and the corresponding demand for intelligent search technologies that can understand context, intent, and semantic relationships in information retrieval. Modern organizations are increasingly focused on extracting valuable insights from vast amounts of structured and unstructured data to support decision-making and improve operational efficiency. AI search engines' proven ability to deliver relevant, personalized, and contextually appropriate search results makes them essential technology infrastructure for digital transformation and knowledge management initiatives.

The growing emphasis on conversational interfaces and natural language interaction is driving demand for AI search engines that can understand and respond to complex queries in human-like ways. Enterprise preference for search solutions that combine accuracy with user experience optimization is creating opportunities for innovative AI search implementations. The rising influence of generative AI and large language models is also contributing to increased adoption of AI search engines that can provide comprehensive answers and generate insights from search queries.

The market is segmented by organization size, technology, deployment, end use, and region. By organization size, the market is divided into large enterprises and SMEs. Based on technology, the market is categorized into natural language processing (NLP), machine learning, generative AI, computer vision, and other areas. In terms of deployment, the market is segmented into cloud and on-premises. By end use, the market is classified into retail & e-commerce, media & entertainment, healthcare, IT & telecom, BFSI, travel & hospitality, manufacturing, education, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The large enterprises segment is projected to account for 63% of the AI search engine market in 2025, reaffirming its position as the dominant customer category. Large organizations increasingly deploy AI search engines for their ability to handle massive data volumes, complex search requirements, and enterprise-scale performance demands. Large enterprises' substantial technology budgets and sophisticated IT infrastructure directly address the investment and implementation requirements for advanced AI search solutions.

This organization segment forms the foundation of AI search engine adoption, as it represents the customer base with the greatest need for sophisticated search capabilities and the resources to implement comprehensive AI search solutions. Vendor investments in enterprise-grade features and scalability continue to strengthen adoption among large organizations. With enterprises prioritizing digital transformation and data-driven decision making, AI search engines align with both technological requirements and strategic objectives, making them the central component of enterprise information management strategies.

Natural language processing is projected to represent 38% of AI search engine technology demand in 2025, underscoring its critical role in enabling human-like search interactions and query understanding. Organizations prefer NLP-powered search engines for their ability to understand natural language queries, extract meaning from unstructured text, and provide contextually relevant search results. Positioned as essential technology for intelligent search applications, NLP offers both query processing advantages and result relevance benefits.

The segment is supported by continuous advancement in language models and the growing availability of pre-trained NLP capabilities that enable sophisticated search applications. Additionally, organizations are investing in NLP-powered search to support conversational interfaces and voice-enabled search experiences. As search interactions become more conversational and context-aware, NLP will continue to dominate AI search technology while supporting advanced query understanding and response generation.

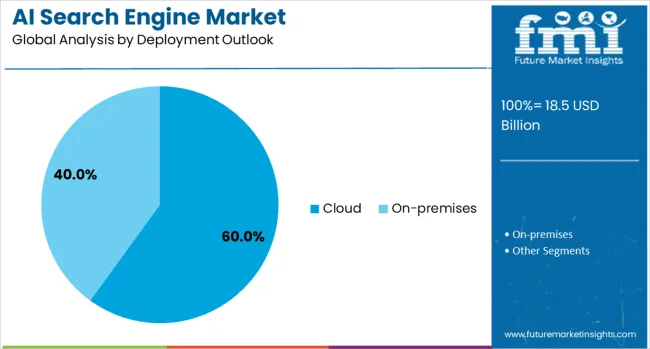

The cloud deployment segment is forecasted to contribute 60% of the AI search engine market in 2025, reflecting the growing preference for scalable and accessible search solutions. Organizations increasingly prefer cloud-based AI search engines for their scalability, cost-effectiveness, and ability to leverage advanced AI capabilities without significant infrastructure investment. This aligns with digital transformation trends that emphasize cloud-first approaches for technology deployment and data management.

The segment benefits from continuous cloud platform improvement and growing enterprise confidence in cloud security and performance capabilities. With established cloud service ecosystems and flexible consumption models, cloud-based AI search serves as the preferred deployment approach for organizations seeking advanced search capabilities, making it a critical foundation for market accessibility and widespread adoption.

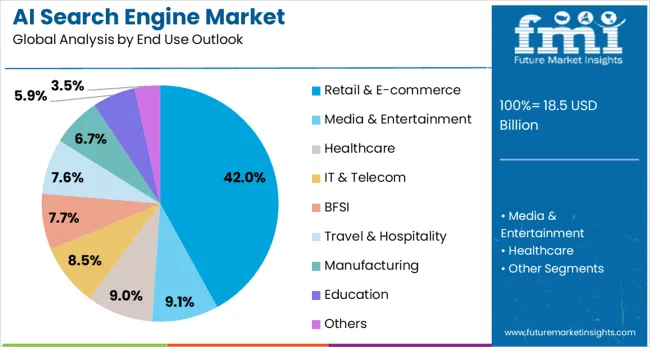

The retail & e-commerce end-use segment is forecasted to contribute 42% of the AI search engine market in 2025, reflecting the critical importance of intelligent search in digital commerce and customer experience optimization. Retail organizations increasingly utilize AI search engines to enhance product discovery, personalize shopping experiences, and improve conversion rates through relevant search results and recommendations. This aligns with e-commerce trends that emphasize search-driven customer engagement and personalized shopping experiences.

The segment benefits from high customer expectations for search relevance and growing competitive pressure requiring superior search capabilities. With significant revenue impact from search quality and established ROI metrics, retail & e-commerce serves as the primary market for AI search engines, making it a critical driver of market growth and technology innovation.

The AI search engine market has been defined by rising demand for context-aware results, natural language queries, and personalized search experiences across multiple industries. Opportunities are being created by enterprise adoption, e-commerce growth, and customer support automation. Trends highlight the shift toward multimodal search, conversational interfaces, and deep semantic indexing. Challenges, however, remain in algorithmic bias, integration complexities, and compliance with data privacy standards. The market’s evolution reflects a dynamic environment where precision, adaptability, and reliability are becoming non-negotiable requirements for global adoption.

The demand for AI search engines has been shaped by industries prioritizing accuracy, relevance, and personalized responses for both professional and consumer applications. Businesses have been relying on AI-powered search platforms to streamline knowledge retrieval, enhance customer interactions, and improve workforce efficiency. This demand has been reinforced by the rapid growth of e-commerce, where precise product discovery and personalized suggestions are vital for conversions. Healthcare organizations are also relying on AI search for medical data accuracy, while financial institutions utilize it for compliance-related searches. Natural language processing, contextual recognition, and real-time adaptability are seen as defining features distinguishing AI search from conventional keyword-based systems. Overall, the growing reliance on AI search engines has been recognized as a crucial enabler for efficiency, decision-making, and competitive positioning across industries.

Opportunities in the AI search engine market have been strengthened by enterprise adoption, retail expansion, and integration into customer support systems. Enterprises have been observed applying AI-driven search to manage unstructured data, improve collaboration, and reduce inefficiencies in information access. eCommerce players are increasingly embracing AI search for recommendation engines, product indexing, and cross-selling strategies. Chatbots and virtual assistants powered by AI search have provided scalable opportunities for automation in customer service and engagement. Healthcare, logistics, and education sectors are beginning to recognize the operational benefits of AI-powered search, which supports domain-specific solutions. Partnerships between software developers and industry operators are likely to accelerate these opportunities further.

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.4% |

| India | 17% |

| Germany | 15.6% |

| France | 14.3% |

| United Kingdom | 12.9% |

| United States | 11.6% |

| Brazil | 10.2% |

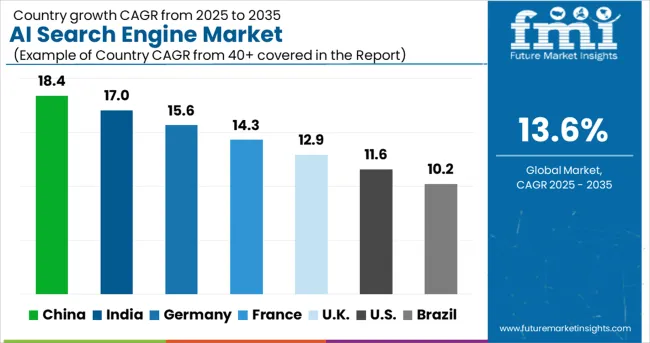

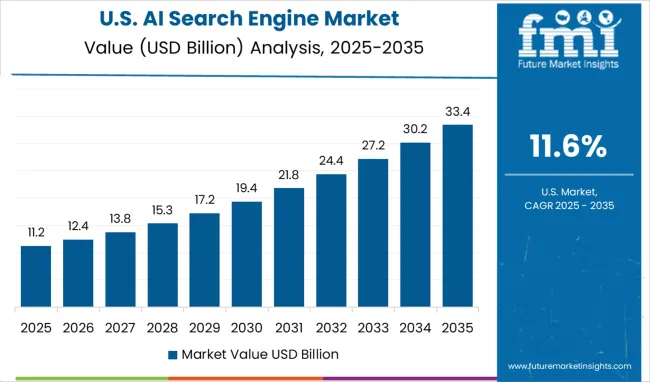

The global AI search engine market is projected to expand strongly from 2025 to 2035, with countries showing varied growth trajectories. China leads with a CAGR of 18.4%, followed by India at 17% and Germany at 15.6%. France records 14.3%, while the United Kingdom grows at 12.9%. The United States shows 11.6%, and Brazil trails with 10.2%. Growth is being driven by rising adoption of AI-powered search platforms across industries, increasing demand for natural language processing, and the integration of intelligent algorithms into enterprise workflows. Emerging markets such as China and India witness stronger growth due to rapid digital adoption, expanding e-commerce, and government-backed AI initiatives, while developed markets focus on advanced applications such as enterprise intelligence, healthcare, and finance.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The AI search engine market in China is projected to grow at a CAGR of 18.4%, fueled by rapid adoption across e-commerce, digital platforms, and enterprise sectors. Chinese companies are deploying AI-driven search tools to enhance user personalization, improve contextual understanding, and deliver more accurate search results. Government-backed initiatives supporting AI research and funding further strengthen market expansion. The country benefits from its vast digital population, increasing demand for intelligent data-driven solutions, and the dominance of local tech giants investing in AI capabilities. China’s market growth is also reinforced by rising adoption of AI search engines in healthcare, education, and financial services.

The AI search engine market in India is expanding at a CAGR of 17%, supported by the growth of digital commerce, fintech services, and online education platforms. Indian enterprises are investing in AI-powered search to improve customer experiences, drive personalization, and enable efficient content discovery. Government programs promoting AI adoption and digital transformation contribute to the acceleration of this market. Rising mobile internet penetration, coupled with the proliferation of regional language content, further enhances demand for intelligent search engines. India’s growing startup ecosystem and collaborations with global technology firms also support innovation and widespread adoption.

The AI search engine market in Germany is growing at a CAGR of 15.6%, driven by adoption in industrial, healthcare, and financial sectors. German enterprises are integrating AI-based search systems into enterprise applications to improve operational efficiency, streamline data access, and enhance decision-making. Market growth is reinforced by strong regulatory frameworks supporting digital adoption and AI research initiatives backed by government funding. Demand for precision, data-driven solutions, and multilingual capabilities further accelerates adoption. Germany’s emphasis on industry-specific AI applications, particularly in manufacturing and engineering, creates new opportunities for AI search engine providers.

The AI search engine market in France is projected to grow at a CAGR of 14.3%, supported by increasing adoption in public services, retail, and healthcare. French organizations are integrating AI-powered search systems to improve information retrieval, automate workflows, and deliver enhanced customer engagement. Growth is reinforced by government strategies for AI adoption, funding for digital infrastructure, and rising demand for AI-driven insights across enterprises. The country also benefits from its strong academic and research ecosystem, which contributes to innovation in natural language processing and semantic search capabilities.

The AI search engine market in the United Kingdom is expanding at a CAGR of 12.9%, driven by demand from e-commerce, financial services, and media sectors. United Kingdom enterprises are adopting AI-based search platforms to improve personalization, enhance customer experience, and streamline data management. Growth is reinforced by government-backed AI initiatives, investments in digital infrastructure, and a strong presence of global AI technology providers. The market also benefits from increasing adoption of AI-driven search in healthcare and academic institutions, where intelligent data retrieval enhances productivity and efficiency.

The AI search engine market in the United States is growing at a CAGR of 11.6%, driven by adoption across enterprise, healthcare, and retail sectors. USA organizations are integrating AI search engines to improve customer engagement, automate workflows, and deliver advanced analytics for business decisions. Growth is reinforced by significant investment in AI research, a robust ecosystem of AI startups, and collaborations with global technology leaders. While growth is slower compared to emerging markets, the USA remains a leading hub for innovation in deep learning, NLP, and voice-enabled search technologies.

The AI search engine market in Brazil is projected to grow at a CAGR of 10.2%, supported by the expansion of digital commerce, banking, and media platforms. Brazilian companies are adopting AI-driven search to provide personalized customer experiences, improve content delivery, and optimize data-driven workflows. Market growth is further enhanced by increasing internet penetration, the rise of mobile-first consumers, and government support for AI initiatives. Adoption is also driven by local enterprises collaborating with global AI providers to deploy advanced search solutions across multiple industries, from e-commerce to healthcare.

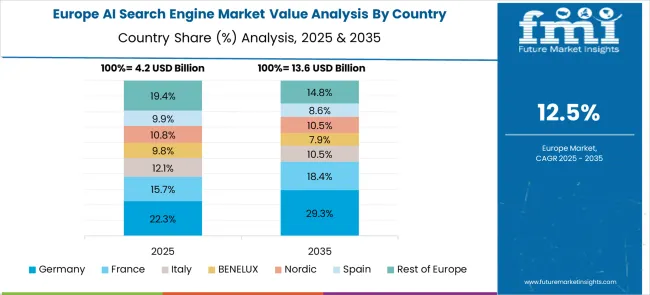

The AI search engine market in Europe demonstrates advanced development across major economies, with Germany showing a strong presence through its technology sector leadership and emphasis on industrial digitization and enterprise AI adoption, supported by companies leveraging engineering excellence to implement sophisticated AI search solutions that emphasize performance, integration capabilities, and regulatory compliance across manufacturing and enterprise applications. France represents a significant market driven by its technology innovation focus and sophisticated understanding of AI applications in business and consumer contexts. Companies are focusing on advanced AI search solutions that combine French technology expertise with cutting-edge artificial intelligence for enhanced information discovery and knowledge management in enterprise and consumer applications.

The UK exhibits considerable growth through its emphasis on financial technology and digital innovation, with strong adoption of AI search engines across financial services, media companies, and technology organizations. Germany and France show expanding interest in enterprise AI search applications, particularly in manufacturing, automotive, and industrial sectors requiring advanced knowledge management. BENELUX countries contribute through their focus on technology innovation and digital transformation initiatives. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing AI adoption and expanding technology sector development.

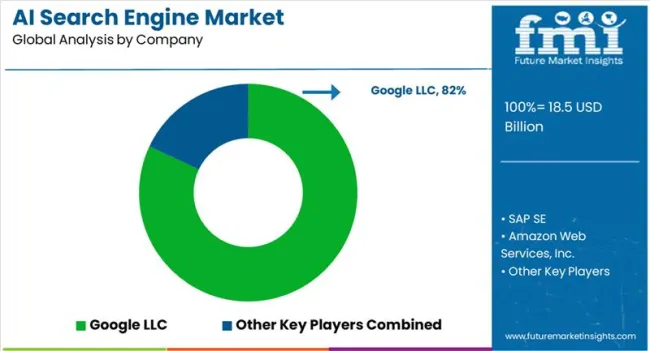

The AI search engine market is shaped by global technology giants, specialized AI startups, and cloud platform providers, driving innovation in semantic search, natural language processing, and contextual data retrieval. Leading players such as Google, Microsoft (Bing AI), OpenAI, IBM Watson, Amazon Web Services, and Baidu hold strong positions by offering advanced AI-powered search solutions that integrate machine learning, conversational AI, and real-time analytics. Competitive differentiation is primarily driven by the accuracy of search results, speed, relevance ranking, integration with enterprise systems, and support for multiple languages and data formats.

Regional and niche players focus on domain-specific search engines, customized AI models, and localized content optimization, providing cost-effective and flexible solutions for small to mid-sized enterprises. Strategic partnerships with cloud providers, data analytics firms, and enterprise software vendors enhance adoption and expand service capabilities. Continuous innovation in transformer-based models, AI indexing techniques, and context-aware retrieval strengthens competitive positioning. Companies prioritizing data security, privacy compliance, and scalable cloud deployment are well-positioned to capture significant market share in this rapidly evolving AI search ecosystem.

| Items | Values |

| Quantitative Units (2025) | USD 18.5 billion |

| Organization Size | Large Enterprises, SMEs |

| Technology | Natural Language Processing (NLP), Machine Learning, Generative AI, Computer Vision, Other |

| Deployment | Cloud, On-premises |

| End Use | Retail & E-commerce, Media & Entertainment, Healthcare, IT & Telecom, BFSI, Travel & Hospitality, Manufacturing, Education, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Google LLC, SAP SE, Amazon Web Services Inc., Salesforce Inc., IBM Corporation, Zeta Global Corp., Adobe, Microsoft, NVIDIA Corporation, and Oracle |

| Additional Attributes | Dollar sales by organization size and end use category, regional demand trends, competitive landscape, buyer preferences for cloud versus on-premises deployment, integration with enterprise systems, innovations in natural language processing, generative AI advancement, and conversational interface development |

Large Enterprises

SMEs

Natural Language Processing (NLP)

Machine Learning

Generative AI

Computer Vision

Other

Cloud

On-premises

Retail & E-commerce

Media & Entertainment

Healthcare

IT & Telecom

BFSI

Travel & Hospitality

Manufacturing

Education

Others

United States

Canada

Mexico

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

China

Japan

South Korea

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Brazil

Chile

Rest of Latin America

Kingdom of Saudi Arabia

Other GCC Countries

Turkiye

South Africa

Other African Union

Rest of Middle East & Africa

The global AI search engine market is estimated to be valued at USD 18.5 billion in 2025.

The size of the AI search engine market is projected to reach USD 66.2 billion by 2035.

The AI search engine market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in AI search engine market are large enterprises and SMEs.

In terms of technology outlook, the natural language processing (NLP) segment is expected to command a 38.0% share in the AI search engine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA