The global uncoated fine papers market is valued at USD 1,317.8 million in 2025 and is projected to reach USD 1,988.4 million by 2035, expanding by nearly 1.5X at a CAGR of 4.2% over the period. This absolute increase of USD 670.6 million highlights the resilience of fine paper demand in a period where digitalization is reshaping document and printing practices. Growth is primarily supported by the rising need for premium-quality printing solutions, professional-grade documentation, and the expansion of specialty publishing and educational materials. Even as routine printing volumes decline, the role of uncoated fine paper in professional and high-value applications ensures steady momentum.

One of the major drivers of this market is the adoption of uncoated fine papers for high-quality printing and official documentation. These papers provide superior opacity, texture, and printability, making them indispensable for commercial printers, corporate offices, and educational institutions. While digital platforms reduce basic paper usage, the requirement for reliable, durable, and aesthetically appealing paper in contracts, certificates, publishing, and branding material remains strong. Premium paper grades, particularly those with enhanced brightness and improved surface uniformity, are witnessing higher demand in sectors where quality presentation is linked to brand reputation and customer perception.

The commercial printing industry remains a significant contributor to overall consumption. Brochures, marketing materials, annual reports, and personalized communication rely on uncoated fine papers, especially in businesses that emphasize quality and design. Specialty publishing, including art books, literature, and niche educational content, also sustains steady demand due to consumer preference for tactile and high-quality paper-based reading experiences. Office administration contributes another significant stream, as uncoated fine papers are still widely used for correspondence, record-keeping, and internal documentation across industries that require physical archives and compliance-ready materials.

Regional patterns of growth add another dimension. North America and Europe remain mature but stable markets, supported by sustained demand for high-grade documentation, publishing, and legal uses. These regions emphasize sustainable forestry and eco-certified paper production, creating opportunities for suppliers who can meet stringent environmental standards. Asia Pacific, however, is projected to be the fastest-growing market, with expanding corporate sectors, rising literacy levels, and growing educational publishing driving large-scale consumption. Countries such as China, India, and those in Southeast Asia are expected to generate significant new demand. Latin America and the Middle East will remain smaller contributors but provide niche growth tied to educational printing and localized publishing.

Competitive differentiation in this market revolves around quality consistency, eco-friendly production, and supply chain efficiency. Leading players are investing in upgraded paper mills, enhanced pulping technologies, and recyclable paper grades to meet evolving expectations of sustainability and durability. Partnerships with printing firms and large institutions ensure long-term supply contracts, while product innovation in brightness, smoothness, and bulk adds further value to end-users.

Between 2025 and 2030, the uncoated fine papers market is projected to expand from USD 1,317.8 million to USD 1,618.7 million, resulting in a value increase of USD 300.9 million, which represents 44.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing demand for premium printing solutions, rising commercial documentation patterns enabling professional presentation formats, and growing availability of advanced paper manufacturing technologies across commercial printing operations and specialty publishing facilities.

Between 2030 and 2035, the market is forecast to grow from USD 1,618.7 million to USD 1,988.4 million, adding another USD 369.7 million, which constitutes 55.1% of the ten-year expansion. This period is expected to be characterized by the advancement of high-brightness formulations, the integration of enhanced opacity technologies for print optimization, and the development of premium surface treatments across diverse paper categories. The growing emphasis on digital printing compatibility and advanced coating applications will drive demand for specialized paper varieties with enhanced printability characteristics, improved color reproduction properties, and superior performance attributes.

Between 2020 and 2024, the uncoated fine papers market experienced moderate growth, driven by increasing demand for professional printing formats and growing recognition of uncoated papers' effectiveness in supporting high-quality reproduction across commercial and office sectors. The market developed as businesses recognized the potential for uncoated fine papers to deliver printing excellence while meeting modern requirements for opacity characteristics and cost-effective production patterns. Technological advancement in pulping processes and fiber treatment practices began emphasizing the critical importance of maintaining paper quality while enhancing manufacturing efficiency and improving material consistency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,317.8 million |

| Forecast Value in (2035F) | USD 1,988.4 million |

| Forecast CAGR (2025 to 2035) | 4.20% |

The printing and publishing market is the largest contributor, accounting for approximately 40-45%. Uncoated fine papers are widely used in high-quality printing applications such as books, magazines, brochures, and corporate stationery. Their superior texture, printability, and ability to convey a premium feel make them the preferred choice for applications requiring a tactile experience, particularly in the luxury goods and high-end publications sectors. The packaging materials market holds around 20-25%, as uncoated fine papers are increasingly used for premium packaging, such as gift wraps, luxury product packaging, and retail packaging. Their aesthetic appeal and tactile quality enhance the consumer experience, making them popular in premium product packaging.

The office supplies and stationery market contributes approximately 15-18%, as uncoated fine papers are commonly used for high-quality writing and printing paper in office settings, including business correspondence, reports, and presentations. The e-commerce and retail market holds around 10-12%, where uncoated fine papers are used in branded packaging, custom notes, and promotional materials to create a more personalized and premium feel for customers. The advertising and marketing market represents about 8-10%, as uncoated fine papers are utilized in direct mail campaigns, flyers, and other marketing materials aimed at delivering a tactile and memorable brand experience.

Market expansion is being supported by the increasing global demand for high-quality printing solutions and the corresponding shift toward premium paper grades that can provide superior print characteristics while meeting user requirements for professional presentation and cost-efficient production processes. Modern businesses are increasingly focused on incorporating paper formats that can enhance document quality while satisfying demands for consistent, reliably performing sheets and optimized printing practices. Uncoated fine papers' proven ability to deliver excellent printability, opacity enhancement, and diverse application possibilities makes them essential materials for commercial printers and quality-conscious brand owners.

The growing emphasis on professional documentation and print quality excellence is driving demand for high-performance uncoated fine paper systems that can support distinctive document positioning and comprehensive brand presentation across commercial printing, office communications, and publishing categories. User preference for papers that combine functional excellence with manufacturing consistency is creating opportunities for innovative implementations in both traditional and emerging printing applications. The rising influence of digital printing technologies and modern commercial infrastructure is also contributing to increased adoption of uncoated fine papers that can provide authentic performance benefits and reliable supply characteristics.

The market is segmented by type of paper, application, and region. By type of paper, the market is divided into wood pulp uncoated fine papers, cotton fiber uncoated fine papers, recycled uncoated fine papers, and others. Based on application, the market is categorized into commercial printing, office, and packaging. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

The wood pulp uncoated fine papers segment is projected to account for 46% of the uncoated fine papers market in 2025, reaffirming its position as the leading paper category. Businesses and printing facilities increasingly utilize wood pulp uncoated fine papers for their superior fiber strength characteristics, established manufacturing efficiency, and essential functionality in diverse printing applications across multiple document categories. Wood pulp uncoated fine papers' standardized production characteristics and proven cost-effectiveness directly address user requirements for reliable paper manufacturing and optimal printing value in commercial applications.

This paper segment forms the foundation of modern uncoated fine paper production patterns, as it represents the format with the greatest commercial scalability potential and established compatibility across multiple printing systems. Business investments in pulping automation and quality standardization continue to strengthen adoption among efficiency-conscious manufacturers. With users prioritizing print quality and material optimization, wood pulp uncoated fine papers align with both economic objectives and performance requirements, making them the central component of comprehensive printing strategies.

Commercial printing is projected to represent 55% of the uncoated fine papers market in 2025, underscoring its critical role as the primary application for quality-focused businesses seeking superior print reproduction benefits and enhanced document presentation credentials. Commercial users and printing companies prefer commercial printing applications for their established market patterns, proven print acceptance, and ability to maintain exceptional quality profiles while supporting versatile document offerings during diverse client experiences. Positioned as essential applications for discerning printers, commercial printing offerings provide both market penetration excellence and brand positioning advantages.

The segment is supported by continuous improvement in print enhancement technology and the widespread availability of established quality frameworks that enable professional printing compliance and premium positioning at the commercial level. Printing companies are optimizing paper specifications to support market differentiation and competitive pricing strategies. As printing technology continues to advance and businesses seek professional document formats, commercial printing applications will continue to drive market growth while supporting brand recognition and client satisfaction strategies.

The uncoated fine papers market is advancing moderately due to increasing printing quality consciousness and growing need for premium paper choices that emphasize superior print performance outcomes across commercial segments and office applications. However, the market faces challenges, including competition from digital alternatives, environmental pressures on paper usage, and raw material price volatility affecting production economics. Innovation in recycled content integration and advanced manufacturing systems continues to influence market development and expansion patterns.

The growing adoption of uncoated fine papers in commercial printing and office documentation is enabling businesses to develop presentation patterns that provide distinctive print quality benefits while commanding professional acceptance positioning and enhanced document characteristics. Commercial applications provide superior opacity properties while allowing more sophisticated print density features across various document categories. Users are increasingly recognizing the functional advantages of uncoated fine paper positioning for premium document protection and efficiency-conscious printing integration.

Modern uncoated fine paper manufacturers are incorporating advanced recycling technologies, post-consumer fiber utilization, and closed-loop material recovery systems to enhance environmental credentials, improve circular economy outcomes, and meet commercial demands for responsible paper solutions. These systems improve resource effectiveness while enabling new applications, including recycled content certification and fiber traceability programs. Advanced recycling integration also allows manufacturers to support environmental leadership positioning and regulatory compliance beyond traditional papermaking operations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

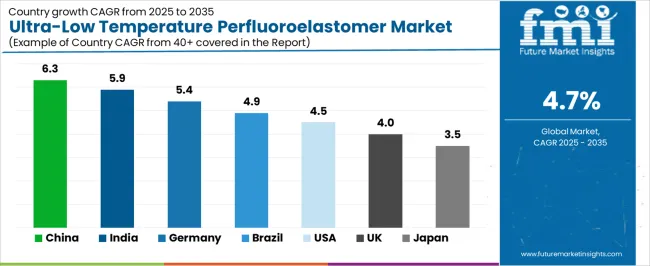

The uncoated fine papers market is experiencing steady growth globally, with China leading at a 5.7% CAGR through 2035, driven by the expanding commercial printing industry, growing office documentation, and increasing adoption of professional paper products. India follows at 5.3%, supported by rising commercial printing trends, expanding educational infrastructure, and growing acceptance of premium paper solutions. Germany shows growth at 4.8%, emphasizing established printing capabilities and comprehensive paper development. Brazil records 4.4%, focusing on commercial documentation and printing expansion. The USA demonstrates 4.0% growth, prioritizing quality printing solutions and technological advancement.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from uncoated fine papers consumption and sales in China is projected to exhibit exceptional growth with a CAGR of 5.7% through 2035, driven by the country's rapidly expanding commercial printing sector, favorable business attitudes toward professional documentation, and initiatives promoting quality paper optimization across major production regions. China's position as a leading manufacturing market and increasing focus on premium printing development are creating substantial demand for high-quality uncoated fine papers in both commercial and specialty markets. Major printing companies and paper producers are establishing comprehensive manufacturing capabilities to serve growing demand and emerging market opportunities.

Demand for uncoated fine papers products in India is expanding at a CAGR of 5.3%, supported by rising educational sophistication, growing commercial printing requirements, and expanding documentation infrastructure. The country's developing printing capabilities and increasing commercial investment in advanced manufacturing are driving demand for uncoated fine papers across both imported and domestically produced applications. International paper companies and domestic manufacturers are establishing comprehensive operational networks to address growing market demand for quality uncoated fine papers and efficient printing solutions.

Revenue from uncoated fine papers products in Germany is projected to grow at a CAGR of 4.8% through 2035, supported by the country's mature printing market, established manufacturing culture, and leadership in paper standards. Germany's sophisticated production infrastructure and strong support for quality are creating steady demand for both traditional and innovative uncoated fine paper varieties. Leading paper manufacturers and specialty producers are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Demand for uncoated fine papers products in Brazil is projected to grow at a CAGR of 4.4% through 2035, driven by the country's emphasis on commercial expansion, manufacturing leadership, and advanced production capabilities for papers requiring specialized fiber varieties. Brazilian manufacturers and distributors consistently seek commercial-grade papers that enhance document differentiation and support printing operations for both traditional and innovative commercial applications. The country's position as a Latin American manufacturing leader continues to drive innovation in specialty uncoated fine paper applications and commercial production standards.

Revenue from uncoated fine papers products in the USA is growing at a CAGR of 4.0% through 2035, supported by the country's emphasis on printing innovation, documentation standards, and advanced technology integration requiring efficient paper solutions. American businesses and commercial brands prioritize material performance and printing precision, making uncoated fine papers essential materials for both traditional and modern document applications. The country's comprehensive quality excellence and advancing printing patterns support continued market expansion.

Demand for uncoated fine papers products in the UK is expanding at a CAGR of 3.6%, supported by mature publishing markets, established printing standards, and quality-focused commercial applications. The country's sophisticated printing infrastructure and emphasis on material optimization are creating steady demand for premium uncoated fine papers across traditional and innovative printing sectors. Leading publishing companies and commercial printers are developing comprehensive strategies to serve both domestic requirements and specialized export markets.

Revenue from uncoated fine papers products in Japan is projected to grow at a CAGR of 3.2% through 2035, supported by the country's emphasis on precision manufacturing, paper quality standards, and advanced technology integration requiring efficient material solutions. Japanese businesses and printing companies prioritize material excellence and manufacturing precision, making uncoated fine papers essential materials for both traditional and modern printing applications. The country's comprehensive quality leadership and advancing printing patterns support continued market expansion.

The Europe uncoated fine papers market is projected to grow from USD 448.5 million in 2025 to USD 675.8 million by 2035, recording a CAGR of 4.2% over the forecast period. Germany leads the region with a 35.5% share in 2025, moderating slightly to 35.0% by 2035, supported by its strong manufacturing base and demand for premium, technically advanced paper products. The United Kingdom follows with 20.5% in 2025, easing to 20.0% by 2035, driven by a sophisticated printing market and emphasis on quality and material efficiency standards.

France accounts for 17.0% in 2025, rising to 17.5% by 2035, reflecting steady adoption of professional printing solutions and documentation optimization. Italy holds 12.5% in 2025, expanding to 13.0% by 2035 as commercial printing innovation and specialty paper applications grow. Spain contributes 8.5% in 2025, growing to 9.0% by 2035, supported by expanding commercial sector and documentation handling. The Nordic countries rise from 4.0% in 2025 to 4.2% by 2035 on the back of strong quality adoption and advanced printing technologies. BENELUX remains at 2.0% share across both 2025 and 2035, reflecting mature, efficiency-focused markets.

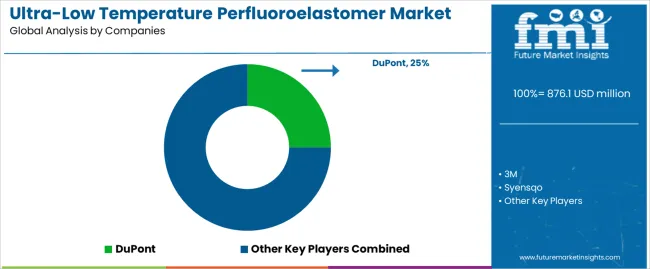

The uncoated fine papers market is characterized by competition among established paper manufacturers, specialized pulp producers, and integrated fiber solution companies. Companies are investing in pulping technologies, advanced fiber treatment systems, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable uncoated fine paper systems. Innovation in brightness enhancement, opacity improvement methods, and application-specific product development is central to strengthening market position and customer satisfaction.

Arctic Paper leads the market with a strong focus on paper innovation and comprehensive uncoated fine paper solutions, offering commercial paper systems with emphasis on manufacturing excellence and technological heritage. UPM provides specialized papermaking capabilities with a focus on global market applications and fiber engineering networks. Mondi Group delivers integrated paper solutions with a focus on commercial positioning and operational efficiency. PaperIndex specializes in comprehensive paper manufacturing with an emphasis on commercial applications. Norske Skog focuses on comprehensive printing and publishing papers with advanced design and premium positioning capabilities.

The success of uncoated fine papers in meeting commercial printing demands, business-driven documentation requirements, and performance integration will not only enhance print quality outcomes but also strengthen global paper manufacturing capabilities. It will consolidate emerging regions' positions as hubs for efficient paper production and align advanced economies with commercial printing systems. This calls for a concerted effort by all stakeholders -- governments, industry bodies, manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,317.8 million |

| Type of Paper | Wood Pulp Uncoated Fine Papers, Cotton Fiber Uncoated Fine Papers, Recycled Uncoated Fine Papers, Others |

| Application | Commercial Printing, Office, Packaging |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Arctic Paper, UPM, Mondi Group, PaperIndex, Norske Skog, and other leading uncoated fine papers companies |

| Additional Attributes | Dollar sales by type of paper, application, and region; regional demand trends, competitive landscape, technological advancements in papermaking engineering, brightness enhancement initiatives, opacity improvement programs, and premium product development strategies |

The global uncoated fine papers market is estimated to be valued at USD 1,317.8 million in 2025.

The market size for the uncoated fine papers market is projected to reach USD 1,988.4 million by 2035.

The uncoated fine papers market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in uncoated fine papers market are wood pulp uncoated fine papers , cotton fiber uncoated fine papers, recycled uncoated fine papers and others.

In terms of application, commercial printing segment to command 55.0% share in the uncoated fine papers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Hydrates Market Analysis & Forecast 2025 to 2035

Fine Line Striping Tape Market

Refinery Process Chemical Market Size and Share Forecast Outlook 2025 to 2035

Refinery fuel additives Market Size and Share Forecast Outlook 2025 to 2035

Refined Functional Carbohydrates Market Size and Share Forecast Outlook 2025 to 2035

Refined Lactose Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

UK Refinery Catalyst Market Insights – Growth, Applications & Outlook 2025-2035

Microfined Graphite Powder Market Insights – Size, Trends & Forecast 2025-2035

Demi-Fine Jewelry Market Insights – Growth & Forecast 2024-2034

Ultra-Fine Ath Market Size and Share Forecast Outlook 2025 to 2035

USA Refinery Catalyst Market Report - Trends & Innovations 2025 to 2035

Global Ultra-fine Medical Wire Market Insights – Size, Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA