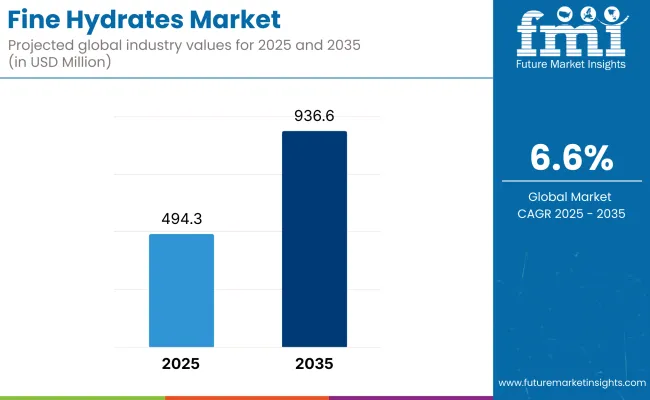

The global fine hydrates market is projected to grow from USD 494.3 million in 2025 to USD 936.6 million by 2035, reflecting a CAGR of 6.6%. This growth is being supported by policy enforcement targeting flame retardancy standards in construction, electrical infrastructure, and electric mobility.

The market is expected to benefit from multi-sector alignment-combining fire safety regulations, ESG compliance, and innovation in flame-retardant formulations. Its penetration across infrastructure, mobility, and electronics is evidence of a sustained industry shift toward safer, sustainable chemical adoption.

Fine hydrates, largely composed of aluminum hydroxide, are being adopted as non-toxic, halogen-free flame retardants. In February 2024, the European Chemicals Agency (ECHA) officially recommended the reduction of brominated compounds in building insulation and cable manufacturing, with aluminum hydroxide identified as a preferred substitute. This regulatory momentum has redirected procurement practices across the EU and influenced global supply chains.

In Q1 2025, Nabaltec AG confirmed a 12.3% year-on-year increase in demand for its eco-refined Apyral 40CD line, which is engineered for low-smoke, high-load electrical applications. CEO Johannes Heckmann stated during the company’s investor briefing, “The push from European regulators and global green standards has made fine hydrates not just an alternative, but a default requirement in sensitive applications.” The firm’s product is now incorporated into wall panels and cable jacketing systems across projects in Germany and Northern Italy.

In the electronics sector, Huber Engineered Materials commissioned a new production facility in Etowah, Tennessee in January 2025 to support fine hydrates with advanced surface treatments. According to VP of Global Operations James D. Jones, “The new Etowah site is optimized for high-consistency hydrate grades designed specifically for fire-resistant enclosures and wire insulations in consumer and industrial electronics.”

The automotive sector has embraced fine hydrates in response to increasing electric vehicle (EV) thermal protection standards. A technical whitepaper released by Hindalco Industries Ltd. in December 2024, titled “Aluminum Hydroxide as a Thermal Barrier in Li-ion Battery Modules”, detailed a 14% reduction in thermal propagation and improved energy retention when ultra-fine hydrates were integrated into battery module separators. Pilot integrations were recorded with EV manufacturers in India and Japan.

Technological enhancements in particle modification have improved the dispersion and performance of fine hydrates in polymer systems. A 2025 study titled “Thermomechanical Behavior of Coated Hydrates in Polyolefin Systems”, published internally by TOR Minerals International, showed that fine hydrates coated with organosilane improved tensile strength by 18% and reduced peak smoke density by 21% when tested in polypropylene matrices under UL-94 V0 conditions.

Despite global bauxite price volatility, companies are mitigating input risks through backward integration. Hindalco’s beneficiation plant expansion in Odisha, India, announced in March 2025, aims to stabilize raw material supply for its hydrate manufacturing line by Q4 2025.

The market is segmented based on particle size, end use, and region. By particle size, the market is divided into coarse, fine, and ultra-fine. Based on end use, the market is categorized into flame retardants, smoke suppressants, filler, adhesives & sealants, and others (paints & coatings, wire & cable insulation, rubbers, thermoplastics). Regionally, the market is classified into North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and the Middle East & Africa.

The ultra-fine segment is projected to grow at the highest CAGR of 6.8% between 2025 and 2035. The surge in demand is driven by the increasing adoption of high-performance flame retardant systems across electronics, automotive, and construction industries. Ultra-fine hydrates offer superior dispersion, transparency, and low viscosity, making them highly suitable for advanced polymer formulations.

In particular, wire & cable insulation and thin-wall applications benefit from the ultra-fine grade’s ability to maintain mechanical properties while delivering enhanced flame resistance. With global safety standards tightening, especially in electrical and transport sectors, manufacturers are investing in ultra-fine grades to meet evolving regulatory demands.

Meanwhile, fine grades continue to hold a substantial market share, favored for balanced performance in general flame retardants and filler applications. Their widespread use across building materials and industrial coatings supports steady demand. Coarse grades, though declining in some segments, maintain relevance in low-cost filler applications and in industries where optical clarity and surface finish are less critical.

In terms of end use, flame retardants remain the dominant application, driven by growing construction activity and stringent fire safety norms. Smoke suppressants and adhesives & sealants segments are witnessing stable growth, while demand in paints & coatings and wire & cable insulation is steadily rising within the others category.

| Particle Size | CAGR (2025 to 2035) |

|---|---|

| Ultra-fine | 6.8% |

The flame retardants segment is projected to remain the largest and fastest-growing end-use category, registering a CAGR of 6.5% between 2025 and 2035. Heightened fire safety regulations across construction, automotive, and electronics industries are driving significant demand for non-halogenated flame retardants where fine hydrates play a critical role.

Ultra-fine grades are increasingly preferred in advanced polymer systems such as polyolefins, PVC, and engineering plastics. The ongoing push for green building materials and sustainable electronics is further propelling demand, particularly in Western Europe and North America, where regulatory frameworks mandate safer, eco-friendly flame retardant solutions.

Meanwhile, the smoke suppressants segment is gaining traction in applications that demand low-smoke, low-toxicity profiles, particularly in public transportation, aerospace, and high-occupancy buildings. The filler segment continues to represent stable demand across plastics, rubbers, and composites, where fine hydrates provide cost-effective mechanical reinforcement and enhanced thermal stability.

The adhesives & sealants segment is witnessing steady growth, fueled by the need for flame-retardant bonding solutions in construction and automotive assembly. Within the others category, paints & coatings, wire & cable insulation, rubbers, and thermoplastics are seeing rising usage of fine hydrates to meet stringent fire safety and durability requirements, making them an important avenue for future market growth.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Flame Retardants | 6.5% |

Processing Limitations and Compatibility with Polymers

One instance of processing and polymer compatibility, though, is that fine hydrates can be subject to challenges despite their benefits, especially in high-load applications. A significant issue with incorporating large volumes of fine hydrates, for instance, concerns the changes in melt flow, surface finish, and mechanical strength of some polymers.

It is a challenge to tailor the right balance between flame retardancy and physical properties, which requires both careful formulation and compounding expertise. Generally, fine hydrates need to be mixed with other favourable additives or plasticizers, which could potentially raise complexity and cost.

In order to deal with aforementioned concerns, continuous research & development must be done on fine hydrates with surface treatments, particle size control, and improved dispersion technologies that can allow for a broader range of polymer systems.

Price Volatility and Energy-Intensive Manufacturing

The process of producing fine hydrate is energy-consuming since it involves high-temperature precipitation and filtration processes. The manufacturing costs and profit margins of small and medium-sized manufacturers are the ones that may get affected by side effects such as the non-uniformity of raw materials (bauxite or alumina) and the changes in the power market (e.g., energy prices).

Supply chain problems stemming from global demand, and changes in mining-related regulatory policies, can also disrupt raw material procurement. As a response to these challenges, companies are emphasizing diversification of supply chains, vertical integration, and energy-efficient manufacturing methods, which is going to help them maintain high standards of quality and cost.

Rising Demand for Halogen-Free Flame Retardant (HFFR) Cables

The switch from traditional halogenated cables to halogen-free cables is picking up speed in the areas of telecommunications, data centers, wind and solar energy, and mass transportation. The non-halogen fine hydrates are mainly used as an additive in HFFR compounds that together provide fire resistance, smoke extinction, and thermal insulation in high-demand environments.

As public buildings, schools, hospitals, and transport systems switch to mandatory use of low-smoke, zero-halogen (LSZH) materials, cable manufacturers are also bringing fine hydrates into polymer sheaths and insulation layers.

This results in a wide range of opportunities in hoodwink-blue smart buildings, energy-efficient housing construction, and electric vehicle charging networks.

Innovation in Surface-Treated and High-Purity Grades

The innovations such as high-performance thermoplastic and elastomeric formulations, the introduction of surface-treated and ultra-fine grade fine hydrates are making way to newer developments. Such specific pregrades deliver better dispersion, higher mechanical strength, and improved electrical insulation and, thus, applications in precision electronics, medical devices, and flame-retardant films.

Companies that focus on nanoparticle engineering, hybrid filler systems, and composite flame-retardant technologies can create additional value through segments where materials are required to meet both fire safety and mechanical performance requirements without the possibility of compromise. Customized polymer demand is increasing as the world moves toward fine hydrate innovation and formulations.

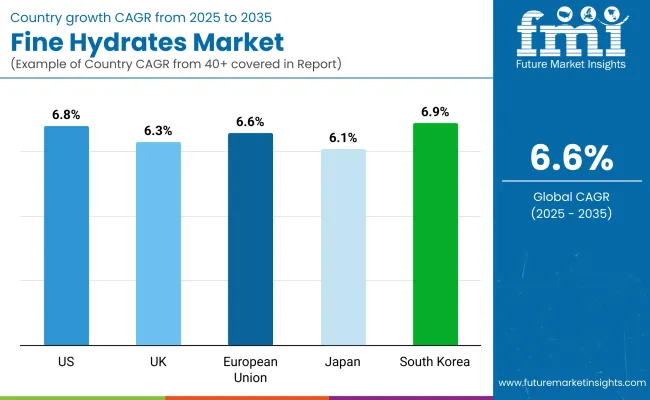

A fine hydrate market in the adversities of the United States is on an upward curve looking at the growth by the increasing consumption of halogen-free flame retardants (HFFRs) in construction, automotive, and wire & cable applications. The increasing convergence on fire prevention standards, and cementing of the path to environmental-friendly flame retardants are the two main factors which are leading producers to the replacement of traditional halogenated additives with fine alumina trihydrate (ATH).

The increasing use of fine hydrate in engineered thermoplastics and rubber-based compounds development is another factor that is helping the market to rise. Construction infrastructure works and tighter building fire code rules are also contributing to the increased demand in the construction industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The United Kingdom's market for the hydrate of fine is slowly growing, thanks to the increase in fire-resistant building materials, low smoke cables, and public infrastructure safety systems. The industries are replacing the halogenated flame retardants with the fine ATH-based additives more and more often, as the environmental authorities set the rules about the fire safety and sustainability.

The added value of both fire retardation and smoke reduction in the product's application for wiring cables makes it the first choice for insulation of advanced performance wire and cable, which in turn, is the main sector of development in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The fine hydrate market in the European Union experiences a constant upward trend as a result of the newly implemented legal bans on halogenated flame retardants, the increasing use of halogen-free fire retardant (HFFR) materials, and a thriving market in the automotive, electronics, and building insulation sectors.

Countries such as Germany, France, and the Netherlands, which are attuning their economies to the paramount principles of energy efficiency and sustainable construction, and simultaneously invigilating the tendentious paradigm shift toward electric mobility, where flame-retardant materials such as fine ATH are indispensable.

Fine hydrate finds the greatest number of applications in polyolefin-based compounds, paintings, sealants, and rubbers, particularly in fire-rated cable jackets and housing parts. The development of micronized grades of ATH is also a driving factor for wider industrial applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.6% |

The Japan fine hydrate market is undergoing slow development, which is as a result of its utilization in fire-resistant polymers in electronics, housing materials, and automotive parts. The focus of Japan is on the production of smaller electronics, electric vehicles (EVs), and the construction of energy-efficient buildings, where the integration of non-halogenated flame retardants like fine hydrate is supported.

The trend of aging infrastructure and building refurbishments has been a boon to the market of fire-proof sealants, coatings, and cables, among which fine hydrate is largely used. The constant innovating of composite-grade ATH, which is given a boost through high-tech OEMs, is also seen as a significant factor.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The market for fine hydrates in South Korea is having a remarkable surge owing to a plethora of other factors such as the rapid industrialization of the country, demand for high-performance polymers as well as the South Korea’s expansion in semiconductors and EV production. Fine ATH is a popular flame resistance agent mainly used in cable sheathing, electrical housings, and thermoplastic elastomers particularly in non-halogenated applications.

The boom in South Korea’s construction sector, improvements in public transportation, and an increase in fire safety awareness are driving new demand in coatings, insulation panels, and sealants. Fine hydrate is also making inroads in battery casings and electronic devices for its thermal stability properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

The fine hydrates sector is showing sustainable growth as a consequence of demand surge from a wide range of sectors for flame retardants, high-performance fillers, and corrosion inhibitors that are not halogenated.

The fine hydrates are, on the other hand, mainly high-purity aluminum hydroxide (ATH) particles of specific size, which are being used mainly in thin cables, rubber & plastics, adhesives & sealants, and coatings. These materials are part of the flame retardant and smoke suppressant family as well as functional fillers, thus they offer both fire safety and mechanical performance advantages.

The more rigid fire safety regulations, especially in construction, automotive, and electrical sectors, are boosting the adoption of ATH-based fine hydrates over the halogenated counterparts thus creating a healthier environment, lower smoke emissions, and financial benefits. The market is somewhat consolidated, with the leading five companies capturing around 46-51% of the overall global market share.

Nabaltec AG

Based in Germany, Nabaltec specializes in the manufacture and sale of high-purity fine hydrates and is the leader in the market particularly in the halogen-free flame retardant segment. The company has a top APYRAL® series that caters to a wide range of industries such as automotive, railways, cables, and E&E thanks to its thermal stability, high whiteness, and particle uniformity. Nabaltec is also making moves to expand in North America and Asia with the introduction of surface-treated and modified ATH grades meant for engineering thermoplastics and unsaturated polyester resins respectively.

Huber Engineered Materials

Huber is a prominent name among flame retardants which are made from aluminum hydroxide, and its product portfolio comprises a large range of Martinal® and Vertex® brands. The company is noted for providing customized solutions with different surface areas, particle sizes, and treatments. Geographically, Huber's strategic expansions in Europe and Asia enable it to further cement its presence in cable compounds, adhesives, roofing materials, and composite manufacturing in conjunction with its customer-centric R&D.

Albemarle Corporation

Even if Albemarle is known for brominated flame retardants, it is still involved in supplying non-halogenated alternatives like fine ATH grades that comply with safety standards worldwide. Its APYRAL® line is (jointly developed with Nabaltec) specifically aimed at wire & cable applications with flame retardant, transport cabins, and low-pressure thermoplastics. To comply with environmental regulations and the demands of halogen-free products Albemarle is improving its ATH manufacturing efficiency and diversification of its product range.

TOR Minerals International

TOR Minerals is specialized in ultrafine aluminum hydroxide and functional fillers being a supplier of flame-retardant polymers, coatings, and engineered compounds. The company's ALUPREM® and TIOPREM® lines concurrently integrate functionalities of ATH and TiO₂, leading to enhanced performance in both brightness and fire retardancy. The company has built solid relationships with the automotive, electronics, and architectural material manufacturing sectors especially in Asia and the Middle East.

Showa Denko K.K.

Showa Denko manufactures a wide range of precipitated aluminum hydroxide grades, which are suitable for dispersion uniformity and compatibility with both thermoplastic and rubber compounds. The company has an advantage in the form of its integrated chemical operations and innovation in surface-treated fillers, which crayonically make it the preferred supplier in Japan, South Korea, and Taiwan. Showa Denko is also consistently increasing its investment in the refinement of fine grades and development of nanoscale ATH.

Coarse, Fine, Ultra-fine

Flame Retardants, Smoke Suppressants, Filler, Adhesives & Sealants, Others

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global market is expected to reach USD 936.6 million by 2035, growing from USD 494.3 million in 2025, at a CAGR of 6.6% during the forecast period.

The flame retardants segment is projected to dominate the market, driven by increasing demand for halogen-free, environmentally safe fire protection materials across construction, automotive, and electronics industries to enhance safety and regulatory compliance.

The construction industry is the leading application segment, supported by stringent fire safety regulations, rising demand for sustainable building materials, and the widespread use of fine hydrates in polymer-based construction products.

Key drivers include growing environmental regulations against halogenated flame retardants, increasing demand for sustainable and non-toxic fire retardant solutions, and advancements in polymer processing that enhance the performance of fine hydrates in various end-use applications.

Top companies include Huber Engineered Materials, Nabaltec AG, Showa Denko K.K., TOR Minerals International, and J.M. Huber Corporation, recognized for their innovative product offerings, high-purity fine hydrates, and strong global distribution networks.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Europe Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 16: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 20: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: MEA Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 24: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Market Attractiveness by Application, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 14: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 20: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 23: North America Market Attractiveness by Application, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 26: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 32: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Europe Market Value (US$ Billion) by Application, 2023 to 2033

Figure 38: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 39: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 40: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 41: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Europe Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 44: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 45: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 46: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 47: Europe Market Attractiveness by Application, 2023 to 2033

Figure 48: Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Asia Pacific Market Value (US$ Billion) by Application, 2023 to 2033

Figure 50: Asia Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 51: Asia Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 52: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 53: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Asia Pacific Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 56: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 57: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 58: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 59: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 61: MEA Market Value (US$ Billion) by Application, 2023 to 2033

Figure 62: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 63: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 64: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 65: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: MEA Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 68: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 69: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: MEA Market Attractiveness by Application, 2023 to 2033

Figure 72: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refined Functional Carbohydrates Market Size and Share Forecast Outlook 2025 to 2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Line Striping Tape Market

Refinery Process Chemical Market Size and Share Forecast Outlook 2025 to 2035

Refinery fuel additives Market Size and Share Forecast Outlook 2025 to 2035

Refined Lactose Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

Demi-fine Jewelry Market Forecast and Outlook 2025 to 2035

UK Refinery Catalyst Market Insights – Growth, Applications & Outlook 2025-2035

Microfined Graphite Powder Market Insights – Size, Trends & Forecast 2025-2035

Ultra-Fine Ath Market Size and Share Forecast Outlook 2025 to 2035

USA Refinery Catalyst Market Report - Trends & Innovations 2025 to 2035

Global Ultra-fine Medical Wire Market Insights – Size, Trends & Forecast 2023-2033

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Europe Fine Chemical Market Analysis - Growth, Applications & Outlook 2025 to 2035

Acrylic Fine Particle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA