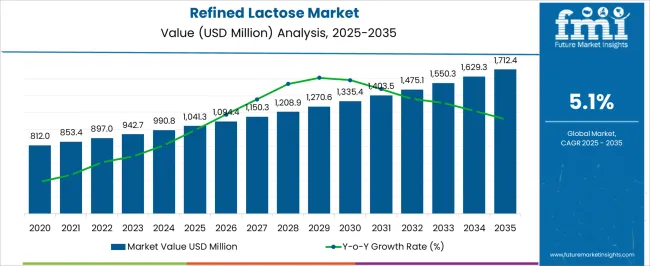

The Refined Lactose Market is estimated to be valued at USD 1041.3 million in 2025 and is projected to reach USD 1712.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The refined lactose market is expected to expand from USD 1,041.3 million in 2025 to USD 1,712.4 million in 2035, achieving a CAGR of 5.1%, offering a significant absolute dollar opportunity. In 2025, with a market size of USD 1,041.3 million, there is substantial potential for revenue generation across applications such as pharmaceuticals, infant nutrition, and food processing. Over the decade, the market is projected to grow by approximately USD 671.1 million, enabling manufacturers and distributors to strengthen supply chains, secure long-term contracts, and increase production capacities to meet steadily rising demand. Early engagement can establish a strong presence in key segments and lay the foundation for sustained growth. By 2035, the refined lactose market is projected to reach USD 1,712.4 million, reflecting an absolute dollar increase of USD 671.1 million from 2025, driven by a consistent 5.1% CAGR. Year-on-year growth from USD 1,041.3 million to USD 1,712.4 million highlights a continuous upward trajectory in demand. Stakeholders who position themselves early can capitalize on incremental revenue across high-demand applications, optimize production and distribution strategies, and convert market expansion into tangible financial gains over the ten-year period. The market’s steady growth ensures ongoing opportunities for investment and expansion throughout the decade.

| Metric | Value |

|---|---|

| Refined Lactose Market Estimated Value in (2025 E) | USD 1041.3 million |

| Refined Lactose Market Forecast Value in (2035 F) | USD 1712.4 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

A breakpoint analysis of the refined lactose market highlights key phases of growth from 2025 to 2035, emphasizing periods with significant revenue expansion. The market, starting at USD 1,041.3 million in 2025, reaches around USD 1,270.6 million by 2030, marking the first breakpoint where the market surpasses the USD 1.2 billion mark. During this phase, absolute dollar growth is approximately USD 229.3 million over five years, reflecting steady adoption across pharmaceutical formulations, infant nutrition, and food processing applications. Companies entering at this stage can establish early supply agreements and secure market share while demand begins to scale consistently. The second breakpoint occurs between 2030 and 2035, when the market grows from USD 1,270.6 million to USD 1,712.4 million. This period represents the largest absolute dollar increase of roughly USD 441.8 million, highlighting an accelerated growth phase driven by cumulative market penetration and increasing global consumption. Stakeholders focusing on this window can maximize revenue by scaling production, expanding distribution, and targeting high-demand sectors. Overall, the breakpoint analysis shows two distinct stages: moderate growth from 2025–2030 and accelerated expansion from 2030–2035, providing clear guidance on when to invest, expand operations, and capture the highest absolute dollar opportunity.

The Refined Lactose market is experiencing sustained expansion, supported by rising applications across pharmaceuticals, food and beverage, and infant nutrition industries. The demand is being reinforced by the product’s functional versatility, high purity levels, and suitability for use in formulations requiring strict quality compliance. Increasing investments in advanced processing technologies have enabled manufacturers to produce refined lactose with enhanced solubility and consistent particle size, improving its performance in end-use applications.

The market is also benefiting from growing global health awareness, which is driving consumption of lactose-based nutritional products. Pharmaceutical and nutraceutical sectors are generating significant demand due to lactose’s role as an excipient in solid dosage forms.

Additionally, the availability of refined lactose derived from sustainable production methods is aligning with industry trends toward environmental responsibility As emerging economies expand their manufacturing capacities and regulatory standards become more stringent, refined lactose is expected to maintain strong market growth, driven by both established and developing consumer bases.

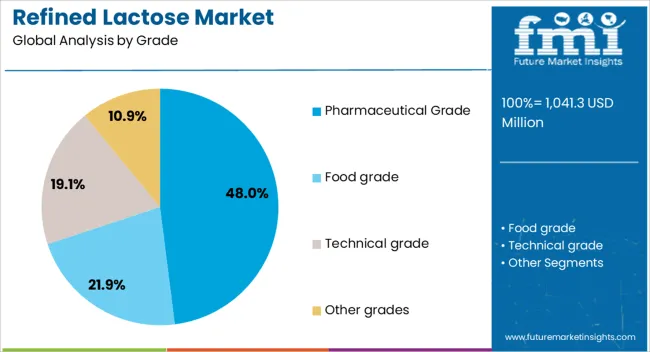

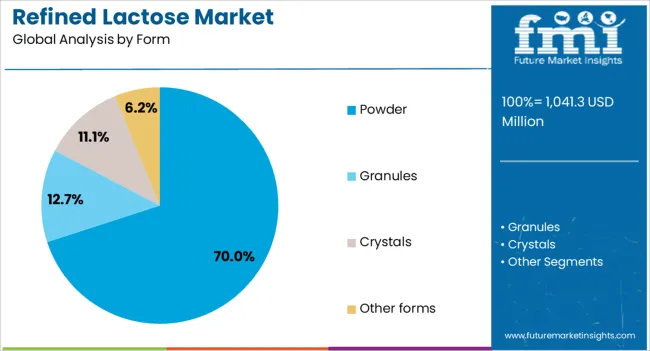

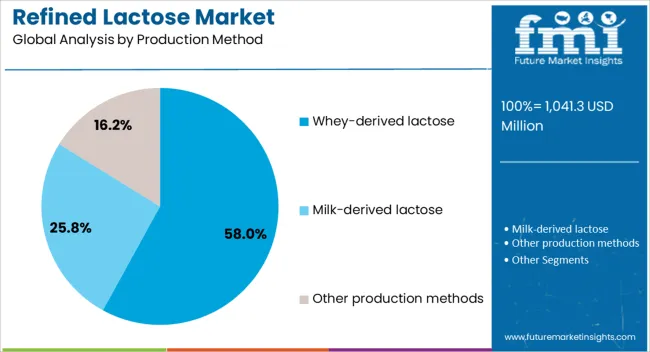

The refined lactose market is segmented by grade, form, production method, application, end use industry, distribution channel, and geographic regions. By grade, refined lactose market is divided into Pharmaceutical Grade, Food grade, Technical grade, and Other grades. In terms of form, refined lactose market is classified into Powder, Granules, Crystals, and Other forms. Based on production method, refined lactose market is segmented into Whey-derived lactose, Milk-derived lactose, and Other production methods. By application, refined lactose market is segmented into Pharmaceuticals, Food & beverage, Infant formula, Animal feed, Cosmetics & personal care, and Other applications. By end use industry, refined lactose market is segmented into Food & beverage industry, Pharmaceutical industry, and Infant formula manufacturers. By distribution channel, refined lactose market is segmented into Distributors & wholesalers, Direct sales/B2B, Online channels, and Other distribution channels. Regionally, the refined lactose industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical grade segment is projected to account for 48% of the Refined Lactose market revenue share in 2025, making it the dominant grade category. This leadership has been driven by its widespread use as an excipient in the formulation of tablets, capsules, and other oral dosage forms. Its high purity, low moisture content, and excellent compressibility make it a preferred choice for pharmaceutical manufacturers seeking consistent product quality.

The growth of this segment has also been supported by strict adherence to pharmacopeial standards, ensuring compliance with international regulatory requirements. Rising global demand for over-the-counter and prescription drugs has reinforced the use of pharmaceutical grade lactose in large-scale production.

Furthermore, the segment benefits from its compatibility with a wide range of active pharmaceutical ingredients, enabling efficient formulation processes The increasing adoption of advanced manufacturing technologies in the pharmaceutical sector has further solidified the segment’s position as the leading grade in the refined lactose market.

The powder form segment is anticipated to hold 70% of the Refined Lactose market revenue share in 2025, making it the leading form category. The dominance of this segment has been attributed to its ease of handling, storage stability, and ability to blend uniformly with other ingredients. Powdered refined lactose is widely used across pharmaceuticals, food processing, and infant formula production due to its high solubility and consistent particle size distribution.

Its adaptability to high-speed manufacturing processes has further driven its adoption, particularly in large-scale production environments. The segment has also benefited from its longer shelf life compared to liquid forms, making it a cost-efficient choice for manufacturers and distributors.

Growing demand in the nutraceutical sector and the expanding global pharmaceutical supply chain have reinforced its strong market position The combination of functional performance, scalability, and cost-effectiveness continues to sustain the powder form segment’s leadership in the refined lactose market.

The whey-derived lactose segment is expected to capture 58% of the Refined Lactose market revenue share in 2025, establishing itself as the leading production method. The segment’s growth has been supported by the abundant availability of whey as a by-product of cheese manufacturing, ensuring a cost-effective and sustainable raw material supply.

Technological advancements in filtration and purification processes have enhanced the ability to produce high-purity lactose from whey, meeting the quality demands of pharmaceutical and food-grade applications. Environmental benefits associated with utilizing whey, which would otherwise be considered waste, have also contributed to the segment’s expansion.

Additionally, the nutritional profile and functional properties of whey-derived lactose make it suitable for a wide range of applications, from infant nutrition to confectionery The scalability of production and alignment with sustainability trends have further strengthened its dominance, positioning whey-derived lactose as a preferred choice in the global refined lactose market.

The refined lactose market is expanding as demand grows in food and beverage, pharmaceutical, and infant nutrition sectors. Refined lactose serves as a functional ingredient, providing sweetness, bulk, and solubility benefits. Its use in dairy products, bakery items, confectionery, and specialized medical formulations is increasing due to its compatibility with diverse applications. The growing global population, rising disposable income, and focus on nutritional and fortified products are driving adoption. Companies investing in high-purity lactose, standardized production, and innovative formulations are well-positioned to capitalize on rising demand across functional foods, infant formulas, and pharmaceutical excipients.

Refined lactose production faces challenges in ensuring consistency, high purity, and supply reliability. Quality variations in raw milk or whey impact the final lactose content and solubility. Manufacturing processes such as crystallization and filtration require precise control to meet stringent pharmaceutical and food-grade standards. Seasonal fluctuations in milk supply can affect production volumes, leading to pricing instability. Regulatory compliance for food and pharmaceutical applications requires strict adherence to hygiene, labeling, and testing standards. Additionally, storage and handling must prevent contamination or moisture absorption, which can compromise product quality. Manufacturers must implement robust quality assurance protocols, validated processing methods, and traceable supply chains to maintain consistent purity and reliability.

The refined lactose market is trending toward specialized applications in functional foods, infant nutrition, and pharmaceuticals. Lactose is increasingly used in probiotic formulations, prebiotics, and protein powders to enhance taste, texture, and solubility. Infant formulas rely heavily on high-purity lactose for digestibility and nutritional equivalence to human milk. Pharmaceutical applications use lactose as a carrier, binder, or filler in tablets, capsules, and dry powders. Technological advancements in lactose purification, microencapsulation, and spray drying are improving product performance. Collaborations between ingredient suppliers, food manufacturers, and pharmaceutical companies are enabling innovation and broader adoption. Consumer demand for fortified, nutritionally balanced, and functional products continues to drive refined lactose use across multiple segments.

Refined lactose offers opportunities in the growing food, beverage, and pharmaceutical industries. Rising demand for dairy-based and functional foods supports expansion in bakery, confectionery, and dairy applications. The pharmaceutical sector increasingly relies on lactose as a safe excipient in oral formulations, while infant formula demand continues to grow in emerging and developed markets. Expansion of nutraceuticals, protein supplements, and fortified beverages presents additional opportunities for lactose-based ingredients. Strategic partnerships with food and pharmaceutical manufacturers can enhance market penetration and create application-specific solutions. Companies that focus on high-purity, traceable lactose and scalable production capabilities can capitalize on increasing demand across diverse end-use sectors.

Market growth for refined lactose is restrained by competition from alternative sweeteners, lactose intolerance concerns, and regulatory constraints. Non-dairy and plant-based sweeteners are increasingly preferred in bakery, confectionery, and beverage applications, limiting lactose adoption. Lactose intolerance and awareness of digestive sensitivity affect consumer acceptance in certain regions. Regulatory requirements for food safety, labeling, and pharmaceutical use vary across markets, adding complexity to global distribution. High-quality production and certification standards increase operational costs, which may be a barrier for smaller manufacturers. Until alternative solutions are harmonized with regulatory compliance and consumer awareness of lactose benefits improves, adoption may remain focused on high-value applications in infant nutrition, pharmaceuticals, and specialized functional foods.

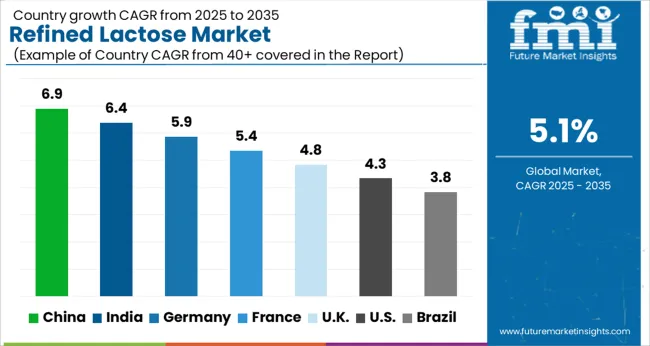

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

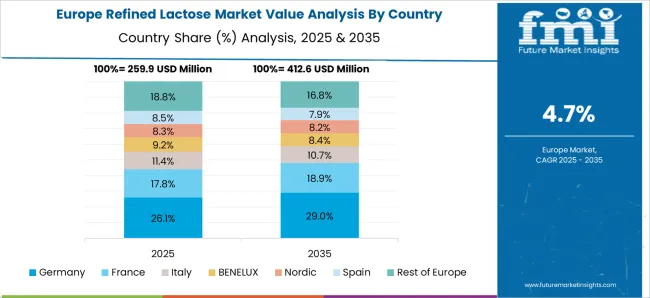

The global refined lactose market is projected to grow at a CAGR of 5.1% through 2035, supported by increasing demand across dairy products, infant nutrition, and pharmaceutical applications. Among BRICS nations, China has been recorded with 6.9% growth, driven by large-scale production and deployment in food and pharmaceutical sectors, while India has been observed at 6.4%, supported by rising utilization in dairy and infant nutrition products. In the OECD region, Germany has been measured at 5.9%, where production and adoption for pharmaceutical, food, and industrial applications have been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in dairy and infant nutrition, while the USA has been recorded at 4.3%, with production and utilization across pharmaceutical, food, and nutritional sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The refined lactose market in China is growing at a CAGR of 6.9%, driven by increasing demand from the food, pharmaceutical, and infant nutrition sectors. Lactose is widely used as a sweetener, stabilizer, and excipient in dairy products, baked goods, and pharmaceuticals. Manufacturers are investing in high purity lactose production, improved solubility, and functional properties to meet industry standards. Government initiatives supporting dairy modernization, infant nutrition programs, and pharmaceutical quality standards are accelerating adoption. Pilot projects in infant formula, pharmaceutical formulations, and functional foods demonstrate operational benefits and compliance with safety regulations. Collaborations between research institutes and industrial manufacturers are advancing production technologies, refining methods, and reducing production costs. Growing consumer awareness of high quality dairy products and increasing demand for processed foods continue to support steady growth in China’s refined lactose market.

Refined lactose market India is expanding at a CAGR of 6.4%, fueled by increasing demand in infant nutrition, dairy processing, and pharmaceutical applications. Lactose is used as a sweetener, excipient, and stabilizer in infant formula, nutritional supplements, and processed foods. Manufacturers are focusing on high purity production, enhanced solubility, and functional versatility. Government programs supporting infant nutrition, dairy modernization, and food quality standards are boosting adoption. Pilot projects in infant formula production, nutraceuticals, and food processing validate practical benefits. Collaborations between research institutes and manufacturers are advancing refining technologies, cost reduction, and production scalability. Rising demand for high quality dairy ingredients and functional foods is expected to drive steady growth across India’s refined lactose market.

Refined lactose market in Germany is recording a CAGR of 5.9%, supported by strong demand from pharmaceutical, infant nutrition, and functional food sectors. Lactose is widely used as a sweetener, excipient, and stabilizer in tablets, infant formula, and dairy products. Manufacturers are investing in high purity production, improved solubility, and functional performance to meet stringent European standards. Government regulations promoting food safety, infant nutrition, and pharmaceutical quality are encouraging adoption. Pilot projects in pharmaceutical formulations, processed foods, and infant formula demonstrate operational benefits. Collaborations between universities, research institutes, and manufacturers are enhancing refining technologies and cost efficiency. Germany’s strong focus on quality, safety, and innovation continues to drive growth in the refined lactose market.

The United Kingdom is experiencing a CAGR of 4.8% in the refined lactose market, driven by adoption in infant nutrition, pharmaceuticals, and food processing industries. Refined lactose is used as a stabilizer, sweetener, and excipient in infant formula, tablets, and dairy products. Manufacturers are focusing on high purity production, improved solubility, and functional versatility. Government regulations and guidelines promoting food safety, infant nutrition, and pharmaceutical quality standards are supporting market growth. Pilot projects in infant formula, functional foods, and pharmaceutical formulations demonstrate operational benefits. Collaborations between research organizations and manufacturers are enhancing refining methods, product performance, and cost efficiency. Growing consumer awareness and demand for high quality dairy and functional ingredients continue to support adoption across the UK market.

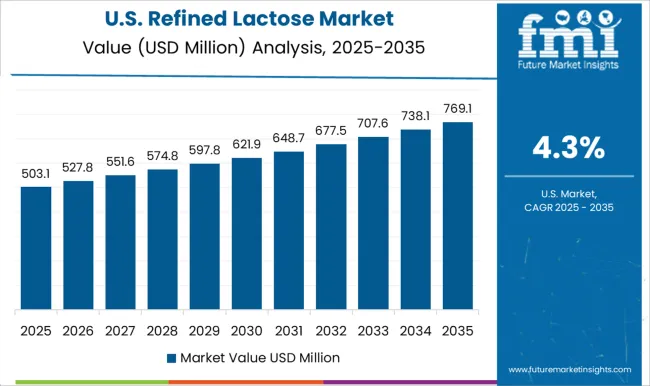

The United States refined lactose market is growing at a CAGR of 4.3%, driven by demand from infant nutrition, pharmaceuticals, and processed food sectors. Lactose is widely used as a sweetener, stabilizer, and excipient in infant formula, tablets, and dairy products. Manufacturers are focusing on high purity, improved solubility, and functional properties to meet regulatory standards. Government programs promoting infant nutrition, food safety, and pharmaceutical quality standards are supporting adoption. Pilot projects in infant formula production, functional foods, and pharmaceutical formulations demonstrate operational efficiency. Collaborations between research institutes and manufacturers are advancing production technologies, cost reduction, and product performance. Rising demand for high quality dairy and functional ingredients is expected to drive steady growth in the USA refined lactose market.

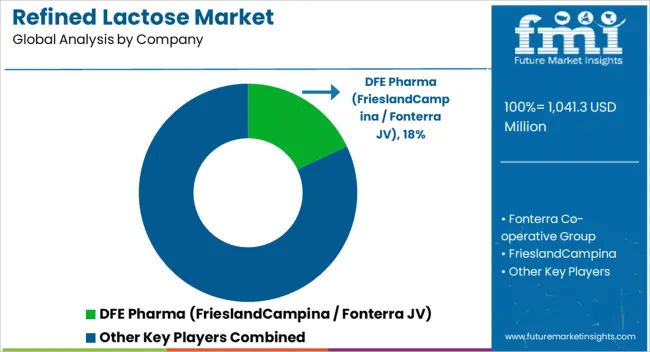

The refined lactose market is characterized by intense competition among global dairy ingredient suppliers and specialized manufacturers. DFE Pharma, a joint venture of FrieslandCampina and Fonterra, is positioned as a leading provider of pharmaceutical- and food-grade lactose, with product brochures emphasizing high purity, low moisture content, and suitability for oral solid dosage forms, infant nutrition, and confectionery applications. Fonterra Co-operative Group competes with a wide range of lactose derivatives and functional dairy ingredients, with brochures highlighting consistent quality, solubility, and compliance with international food safety standards. FrieslandCampina promotes refined lactose and lactose-based ingredients for infant formula, bakery, and nutritional products, with technical literature detailing particle size distribution, functional properties, and application guidelines. Ingredion Inc. focuses on specialty lactose for food, beverage, and pharmaceutical applications, with brochures emphasizing functional benefits, controlled crystallization, and processing recommendations. Lactose (India) Limited provides industrial-scale lactose for both local and export markets, with product literature highlighting purity, moisture content, and GMP-compliant production. MEGGLE GmbH & Co. KG emphasizes lactose powders and derivatives with applications in infant nutrition and dairy processing, with brochures detailing solubility, thermal stability, and particle characteristics. Other regional and emerging players compete with niche lactose products, emphasizing localized supply chains and tailored specifications for specific industry needs. Strategies in the market are centered on product quality, regulatory compliance, and application versatility. R&D investment is directed toward improving crystallization processes, functional properties, and solubility profiles. Partnerships with pharmaceutical and food manufacturers are leveraged to increase adoption of specialty lactose products. Observed industry patterns indicate a focus on infant nutrition, functional foods, and oral pharmaceuticals as high-growth segments. Companies aim to expand production capacity while maintaining consistent quality and meeting increasingly stringent international standards. Innovation is guided by demand for low-lactose, high-purity, and specialty functional lactose variants. Product brochures serve as primary communication tools, presenting technical specifications, functional properties, and application guidelines in concise formats. Detailed charts provide solubility, particle size, moisture content, and lactose composition data. DFE Pharma literature emphasizes pharmaceutical applications and regulatory compliance. Fonterra and FrieslandCampina brochures highlight functional properties for food applications. Ingredion literature presents technical guidance for processing and functional benefits. MEGGLE brochures focus on solubility, thermal stability, and infant nutrition suitability. Brochures are increasingly digital and interactive, enabling customers to assess suitability for specific formulations. Adoption and competitive positioning are determined not only by product performance but also by the clarity and technical depth of brochures and datasheets, making them essential for informed decision-making.

| Item | Value |

|---|---|

| Quantitative Units | USD 1041.3 Million |

| Grade | Pharmaceutical Grade, Food grade, Technical grade, and Other grades |

| Form | Powder, Granules, Crystals, and Other forms |

| Production Method | Whey-derived lactose, Milk-derived lactose, and Other production methods |

| Application | Pharmaceuticals, Food & beverage, Infant formula, Animal feed, Cosmetics & personal care, and Other applications |

| End Use Industry | Food & beverage industry, Pharmaceutical industry, and Infant formula manufacturers |

| Distribution Channel | Distributors & wholesalers, Direct sales/B2B, Online channels, and Other distribution channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DFE Pharma (FrieslandCampina / Fonterra JV), Fonterra Co-operative Group, FrieslandCampina, Ingredion Inc., Lactose (India) Limited, MEGGLE GmbH & Co. KG, and Others |

| Additional Attributes | Dollar sales vary by product type, including lactose monohydrate, lactose anhydrous, and spray-dried lactose; by application, such as pharmaceuticals, infant formula, confectionery, bakery, and dairy products; by end-use industry, spanning food & beverage, pharmaceuticals, and nutraceuticals; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for functional foods, infant nutrition, and pharmaceutical excipients. |

The global refined lactose market is estimated to be valued at USD 1,041.3 million in 2025.

The market size for the refined lactose market is projected to reach USD 1,712.4 million by 2035.

The refined lactose market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in refined lactose market are pharmaceutical grade, _usp/ep/jp grade, _anhydrous lactose, _spray-dried lactose, _monohydrate lactose, _other pharmaceutical grades, food grade, _standard food grade, _high purity food grade, _other food grades, technical grade and other grades.

In terms of form, powder segment to command 70.0% share in the refined lactose market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refined Functional Carbohydrates Market Size and Share Forecast Outlook 2025 to 2035

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Lactose-Free Butter Market Size and Share Forecast Outlook 2025 to 2035

Lactose Market Report – Size, Growth & Forecast 2025 to 2035

Lactose Assay Kit Market Size and Share Forecast Outlook 2025 to 2035

Lactose-Free Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactose-free Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Lactose and Derivative Business

Lactose Free Dairy Product Market Outlook – Share, Growth & Forecast 2025 to 2035

Competitive Breakdown of Lactose Providers

Lactose-free Cheese Market Growth - Consumer Trends & Industry Analysis 2025 to 2035

Lactose-Free Probiotic Yogurt Market Trends - Product Type & Sales Insights

Lactose-free Infant Formula Market

Lactose-free Sour Cream Market

Galactose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A2 Lactose-Free Milk Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

UK Lactose Market Report – Demand, Trends & Outlook 2025-2035

USA Lactose Market Insights – Growth & Demand 2025-2035

Low-Lactose Dairy Foods Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA