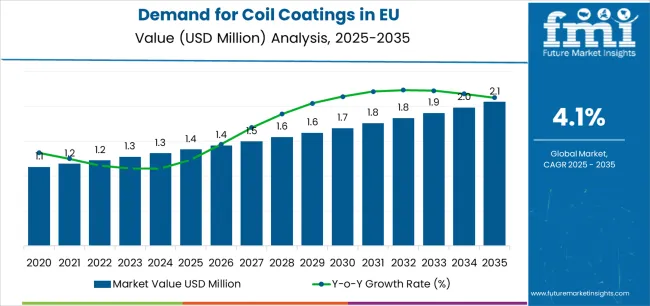

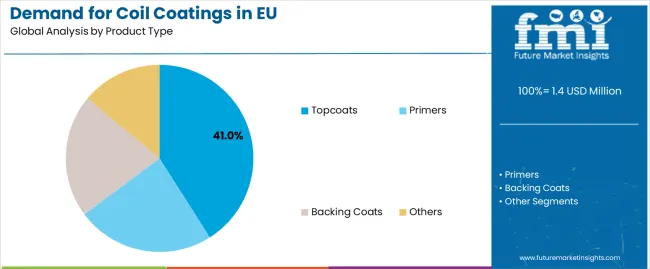

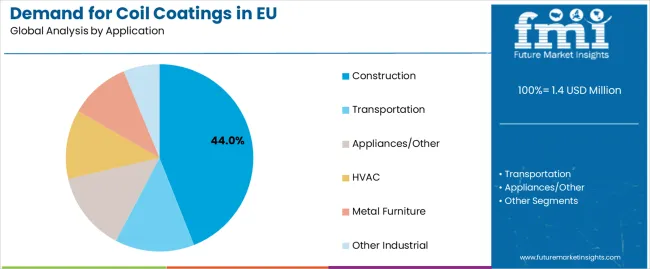

The demand for coil coatings in EU is projected to increase from USD 1.4 million in 2025 to approximately USD 2.1 million by 2035, reflecting a CAGR of 4.1%. Coil coatings, also known as pre-painted metal finishes, remain integral to construction, infrastructure, and industrial manufacturing. Demand for coil coatings is due to their durability, corrosion resistance, and aesthetic appeal, making them a cost-effective solution for long-term metal protection. Among the product categories, the topcoats segment is forecast to lead with a 41% share in 2025, supported by its ability to enhance surface resilience and color retention. On the demand side, the construction sector is projected to account for 44% of the application base, underscoring the central role of coated metal sheets in roofing, cladding, and architectural applications.

EU coil coatings sales are expected to rise from USD 1.4 million in 2025 to nearly USD 2,065 million by 2035, representing an absolute increase of USD 684.6 million. This equates to 49.6% total growth across the forecast period, with the overall industry size set to expand by nearly 1.5X. Market expansion is primarily supported by the demand for durable, pre-finished metal in construction, where energy efficiency and long lifecycle performance are critical. The coatings’ ability to deliver enhanced weather resistance, anti-corrosion properties, and color stability has positioned them as a key element in modern building materials. The adoption of coil-coated metals in façades, roofing systems, and insulated panels is expected to strengthen further, particularly with rising investment in commercial and residential infrastructure.

Beyond construction, other sectors such as transportation, HVAC systems, and household appliances are increasingly relying on coil coatings. Automotive suppliers are turning to pre-coated components to improve corrosion resistance, reduce painting costs, and streamline assembly. Appliance manufacturers are utilizing coil coatings in refrigerators, washing machines, and ovens for both protection and aesthetic customization. In HVAC equipment, coil-coated metals offer improved energy efficiency through reflective surfaces and reduced maintenance requirements. This diversification into new end uses is broadening the market’s long-term growth outlook.

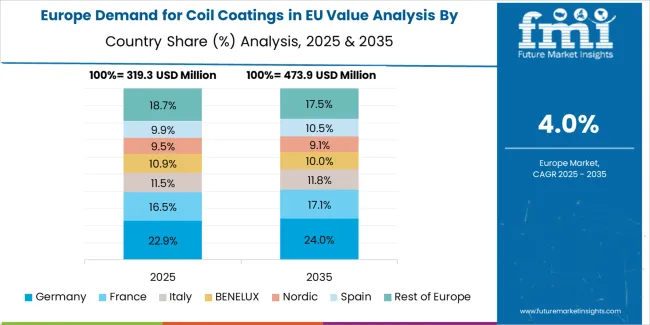

Germany, France, and Italy are positioned as leading adopters, driven by their strong construction bases and established industrial manufacturing capacity. The United Kingdom is also contributing significantly, especially through its appliance industry and commercial building segment. Eastern Europe is emerging as an important growth frontier due to infrastructure modernization and rising investment in durable construction materials.

By 2030, product innovation is expected to focus on advanced topcoat formulations that combine UV stability, anti-microbial properties, and energy-efficient finishes. As manufacturers continue to invest in eco-friendly and high-performance solutions, the EU coil coatings industry is projected to maintain steady growth momentum across both core and emerging applications throughout the forecast horizon.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.4 million |

| Forecast Value in (2035F) | USD 2.1 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Industry expansion is being supported by the construction sector's increasing adoption of pre-finished metal building products and the corresponding demand for factory-applied coating systems delivering superior durability, consistent quality, and environmental advantages compared to post-fabrication painting operations. Modern building product manufacturers and metal panel fabricators rely on coil coatings as essential finishing systems for architectural facades requiring long-term weatherability, metal roofing demanding corrosion protection and aesthetic durability, and wall panels necessitating consistent color and finish quality, driving demand for coating systems that consistently deliver required adhesion properties, flexibility characteristics, and exterior durability necessary for warranty performance and building envelope reliability. Even modest variations in coating quality, including dry film thickness, cure level, or formulation consistency, can significantly impact panel performance and warranty exposure across critical architectural applications.

The growing requirements for sustainable building products and increasing recognition of coil coating's environmental advantages through reduced VOC emissions, minimal waste generation, and energy-efficient application processes are driving demand from building product manufacturers with appropriate environmental certifications and quality management systems. Regulatory authorities are increasingly establishing clear guidelines for building product emissions, construction waste reduction, and life-cycle environmental performance to maintain indoor air quality and ensure sustainable construction practices. Technical research and commercial validation studies are providing evidence supporting advanced coil coating technologies including water-based systems, powder coatings for coil lines, and bio-based resin formulations, requiring specialized application equipment and standardized quality control protocols for optimal film build, appropriate cure characteristics, and consistent appearance properties enabling reliable architectural performance across demanding building envelope applications.

Sales are segmented by product type, application, distribution channel, nature (application substrate), and country. By product type, demand is divided into topcoats, primers, backing coats, and others. Based on application, sales are categorized into construction, transportation, appliances/other, HVAC, metal furniture, and other industrial. In terms of distribution channel, demand is segmented into direct to OEM, specialty distributors, and online channels. By nature (application substrate), sales are classified into steel and aluminum. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The topcoats segment is projected to account for 41% of EU coil coatings sales in 2025, expanding slightly to 42.0% by 2035, establishing itself as the dominant product type across European industry. This commanding position is fundamentally supported by topcoats' essential role providing exterior weatherability for architectural applications, aesthetic appearance defining building facade characteristics, and protective barrier preventing substrate corrosion and coating degradation. The topcoat format delivers exceptional functionality, providing building product manufacturers, appliance producers, and transportation equipment fabricators with high-performance finishing systems that facilitate long-term durability, color retention, and gloss maintenance essential for warranty performance and product differentiation.

This segment benefits from established resin technologies including polyester systems delivering cost-effective performance, silicone-modified polyesters enhancing durability, and PVDF fluoropolymers providing premium weatherability for demanding architectural applications. Additionally, topcoats offer performance advantages across critical applications, including architectural facades requiring decades-long color stability, appliance exteriors demanding scratch resistance and cleanability, and transportation equipment necessitating corrosion protection and appearance retention.

The topcoats segment is expected to expand its share slightly to 42.0% by 2035, demonstrating strengthening positioning as premium architectural applications and high-performance resin systems drive preferential demand growth throughout the forecast period.

Construction applications are positioned to represent 44% of total coil coatings demand across European industry in 2025, expanding to 45% by 2035, reflecting the segment's dominant position as the primary application within the overall industry ecosystem. This substantial share directly demonstrates that building products represent the largest single application sector, with metal panel manufacturers, roofing producers, building envelope fabricators, and architectural cladding suppliers utilizing coil coatings for commercial facades, standing seam roofing, insulated metal panels, and residential siding essential for durable, attractive, and sustainable building construction.

Modern building product manufacturers increasingly rely on coil coatings delivering superior weatherability through proven resin technologies, consistent color and gloss across large panel installations, and warranty-backed performance supporting decades-long architectural service life. The segment benefits from continuous product innovation focused on improving solar reflectance for cool roof applications, enhancing self-cleaning properties through photocatalytic additives, and developing specialty finishes including metallic and textured effects supporting architectural differentiation.

The segment's expanding share reflects growing construction sector investment in energy-efficient building envelopes, increasing adoption of metal building systems for commercial and industrial facilities, and expanding residential metal roofing utilization throughout the forecast period.

EU coil coatings sales are advancing steadily due to ongoing construction sector investment in commercial buildings and infrastructure, increasing adoption of energy-efficient building envelopes, and growing preference for factory-finished metal products offering quality consistency. However, the industry faces challenges, including sensitivity to construction cycle volatility affecting building product demand, PVDF resin supply constraints impacting premium coating availability, and potential competition from alternative facade materials including fiber cement and composite panels. Continued focus on high-performance coating system development, sustainable technology advancement, and architectural aesthetic innovation remains central to industry development.

The gradually accelerating adoption of premium coating systems featuring PVDF (polyvinylidene fluoride) fluoropolymer resins is systematically transforming European architectural coil coating industry from standard polyester systems to high-performance solutions delivering exceptional weatherability, outstanding color retention, and decades-long warranty performance. Advanced PVDF coating systems featuring 70% fluoropolymer resin content, proven multi-decade performance in demanding climates, and resistance to chalking, fading, and chemical attack enable building product manufacturers to offer premium warranties supporting architectural specifications and building owner expectations. These high-performance systems prove particularly valuable for high-rise facades where coating failure creates significant remediation costs, coastal environments where salt exposure accelerates corrosion, and signature architectural projects where appearance retention proves essential for building identity and asset value.

Modern coil coating producers systematically incorporate sustainable technologies including bio-based polyester resins, low-VOC formulations, and water-based primer systems addressing environmental performance requirements and corporate sustainability commitments. Strategic integration of renewable raw materials including bio-based polyols and plant-derived monomers, solvent reduction through high-solids formulations and powder coating adaptations, and energy-efficient curing systems utilizing infrared and LED technologies enable coating suppliers to reduce environmental footprint while maintaining performance characteristics. These sustainability initiatives prove essential for green building certification programs including LEED and BREEAM, where low-emitting materials and bio-based content contribute to certification credits, and for corporate sustainability reporting demonstrating environmental stewardship and circular economy principles.

European building regulations increasingly emphasize roof surface solar reflectance and thermal emittance properties reducing building cooling loads and urban heat island effects, creating demand for coil coatings featuring cool roof technologies through high solar reflectance pigments and infrared-reflective formulations. This energy efficiency focus enables coating suppliers to differentiate offerings through Energy Star qualification, cool roof certification, and solar reflectance index testing demonstrating thermal performance. Cool roof positioning proves particularly important for commercial and industrial buildings where roof surfaces represent significant solar heat gain, and for urban areas where collective roof reflectance affects local climate conditions and energy consumption.

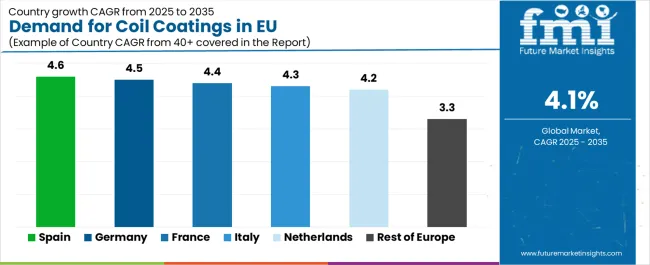

| Country | CAGR % |

|---|---|

| Spain | 4.6% |

| Germany | 4.5% |

| France | 4.4% |

| Italy | 4.3% |

| Netherlands | 4.2% |

| Rest of Europe | 3.3% |

EU coil coatings sales demonstrate robust growth across major European economies, with Spain leading expansion at 4.6% CAGR through 2035, driven by construction sector recovery and metal building product adoption. Germany maintains strong positioning through substantial construction industry and established coating infrastructure. France benefits from commercial construction investment and building product industry strength. Italy leverages ongoing construction activity and architectural metal panel adoption. The Netherlands demonstrates consistent growth reflecting commercial construction and sustainability initiatives. Rest of Europe shows modest advancement across varied construction industry. Overall, sales show strong regional development reflecting sustained construction sector investment and ongoing metal building product adoption across EU industry.

Revenue from coil coatings in Spain is projected to exhibit robust growth with a CAGR of 4.6% through 2035, driven by construction sector recovery from previous economic challenges, expanding metal building product adoption for commercial and industrial facilities, and growing architectural metal panel utilization for residential and commercial applications. Spain's construction sector development and building product industry expansion are creating sustained demand for coil coatings across roofing, siding, and facade applications.

Major building product manufacturers, coil coating service centers, metal panel fabricators, and roofing producers source coil coatings from European suppliers and domestic coating operations ensuring quality specifications. Spanish demand benefits from construction sector investment in commercial buildings and infrastructure, metal roofing adoption for residential applications, and architectural facade development utilizing pre-finished metal panels supporting design flexibility and construction efficiency.

Revenue from coil coatings in Germany is expanding at a CAGR of 4.5%, substantially supported by Europe's largest construction industry, established metal building product industry, and comprehensive coil coating infrastructure serving building, appliance, and transportation sectors. Germany's substantial construction sector and industrial manufacturing base are systematically driving stable coil coating demand across diverse applications.

Major building product manufacturers including metal panel producers and roofing suppliers, appliance manufacturers, and transportation equipment producers source coil coatings from domestic coating operations and European suppliers ensuring quality consistency. German demand particularly benefits from substantial commercial construction activity, established metal building system utilization, and appliance manufacturing sector utilizing coil-coated steel for white goods production.

Revenue from coil coatings in France is growing at a CAGR of 4.4%, fundamentally driven by commercial construction sector investment, building product industry serving architectural industry, and ongoing infrastructure development requiring metal building components. France's diversified construction sector and building product manufacturing capabilities are supporting sustained coil coating demand across multiple application sectors.

Major building product manufacturers, coil coating service centers, construction material distributors, and metal fabricators source coil coatings from European suppliers ensuring architectural specifications. French demand particularly benefits from commercial building construction in urban centers, infrastructure investment requiring metal building components, and architectural project development utilizing metal facades and roofing systems.

Revenue from coil coatings in Italy is growing at a steady CAGR of 4.3%, fundamentally driven by ongoing construction sector activity, metal building system adoption for industrial and commercial facilities, and architectural metal panel utilization supporting design-focused building projects. Italy's construction industry characteristics and design-oriented architecture are supporting sustained coil coating consumption.

Major building product manufacturers, metal panel fabricators, appliance producers, and coil coating service centers source coil coatings from European suppliers ensuring quality specifications and color consistency. Italian demand particularly benefits from construction sector activity supporting building product consumption, design-focused architectural projects utilizing metal facades, and appliance manufacturing requiring coil-coated materials.

Demand for coil coatings in the Netherlands is expanding at a CAGR of 4.2%, fundamentally driven by commercial construction sector activity, sustainable building initiatives favoring factory-finished products reducing on-site waste, and building product distribution serving Benelux industry. Dutch construction sector characteristics and sustainability leadership are creating focused coil coating demand supporting building product manufacturing.

Netherlands demand significantly benefits from commercial construction including office buildings and logistics facilities, sustainable building practices favoring pre-finished metal products reducing construction waste and VOC emissions, and building product distribution infrastructure serving regional industry. The country's sustainability focus creates concentrated demand for environmentally compliant coating systems supporting green building certification.

Revenue from coil coatings in the Rest of Europe region is expanding at a CAGR of 3.3%, supported by varied construction industry conditions across diverse European economies, ongoing building product demand, and established metal building system utilization. Regional construction activity and building product consumption are maintaining steady coil coating demand across varied applications.

Industrial consumers across Rest of Europe industry, including building product manufacturers, coil coating service centers, metal fabricators, and construction material distributors, source coil coatings from European suppliers and regional coating operations. Rest of Europe demand reflects ongoing construction activity across various industry, building product consumption for residential and commercial applications, and established metal building product utilization across diverse construction segments.

EU coil coatings sales are projected to grow from USD 1.4 million in 2025 to USD 2.1 million by 2035, registering a CAGR of 4.1% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 4.6% CAGR, supported by construction sector recovery, expanding metal building product adoption, and growing architectural metal panel utilization. Germany and France follow with 4.5% and 4.4% CAGR, respectively, attributed to substantial construction industry and established building product industries.

Italy demonstrates a 4.3% CAGR, reflecting ongoing construction activity and metal building system adoption. The Netherlands shows a 4.2% CAGR, supported by commercial construction and sustainable building initiatives. The rest of Europe exhibits a 3.3% CAGR, driven by varied construction industry conditions across diverse economies.

EU coil coatings sales are defined by competition among major global coating companies, European specialty coating producers, and regional suppliers serving building products, appliance, and transportation industry. Companies are investing in high-performance resin system development including PVDF technologies, sustainable coating formulation featuring bio-based content and low-VOC systems, architectural color and finish innovation, and technical service programs to deliver reliable, durable, and increasingly sustainable coil coating solutions. Strategic relationships with major building product manufacturers and coil coating service centers, architectural specification support driving project adoption, and warranty programs supporting long-term performance commitments are central to strengthening industry position.

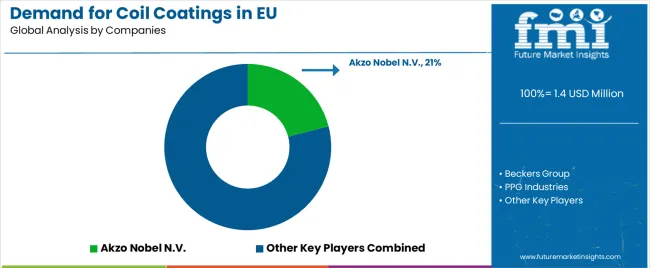

Major participants include Akzo Nobel N.V. with an estimated 21% share, leveraging its strong European coil coating footprint, comprehensive architectural coating portfolio, and established relationships with building product manufacturers. Akzo Nobel benefits from integrated European manufacturing operations, extensive architectural color offerings, and technical service capabilities supporting building product customers and architectural specification development.

Beckers Group holds approximately 15.0% share, emphasizing its European architectural coil coating specialization, focus on building products sector, and technical expertise supporting demanding facade applications. Beckers' success in serving architectural industry through specialized coating systems and technical support creates competitive positioning, supported by European production presence and architectural industry focus.

PPG Industries accounts for roughly 12.0% share through its position as a global coatings leader, offering PVDF coating systems for premium architectural applications and comprehensive product portfolio serving building products and industrial industry. The company benefits from Duranar PVDF technology leadership, global coating expertise, and established relationships with major building product manufacturers.

Sherwin-Williams (Valspar) represents approximately 10.0% share, supporting growth through broad building products industry relationships, comprehensive coating portfolio serving diverse applications, and North American manufacturing translated to European industry participation. Sherwin-Williams leverages coating industry expertise, building product sector relationships, and product portfolio breadth supporting diverse customer requirements.

Axalta Coating Systems accounts for approximately 9.0% share through transportation and appliance coating specialization, industrial coil coating capabilities, and established relationships with appliance manufacturers and commercial vehicle producers. Axalta benefits from transportation coating expertise, appliance sector relationships, and industrial coating capabilities supporting non-architectural applications.

Other companies and regional suppliers collectively hold 33.0% share, reflecting the moderately concentrated nature of European coil coatings sales, where numerous regional coating producers, specialty suppliers, and local manufacturers serve specific geographic industry, application niches, and customer relationships built on technical service, color matching capabilities, and reliable supply. This remaining industry share provides opportunities for differentiation through specialized coating systems for niche applications, regional industry knowledge supporting local customer relationships, custom color development capabilities, and technical service excellence supporting coater optimization and quality consistency.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,065 million |

| Product Type | Topcoats, Primers, Backing Coats, Others |

| Application | Construction, Transportation, Appliances/Other, HVAC, Metal Furniture, Other Industrial |

| Distribution Channel | Direct to OEM, Specialty Distributors, Online |

| Nature (Application Substrate) | Steel, Aluminum |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Akzo Nobel N.V., Beckers Group, PPG Industries, Sherwin-Williams, Axalta, Regional suppliers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type, application, distribution channel, nature (application substrate), and country; regional demand trends across major European industry; competitive landscape analysis with established global coating companies and European specialty producers; building product manufacturer and coater preferences for various coating systems and performance characteristics; integration with architectural construction, appliance manufacturing, and transportation equipment production; innovations in PVDF technologies, sustainable formulations, and cool roof systems; adoption across direct OEM procurement and specialty distributor channels. |

The global demand for coil coatings in eu is estimated to be valued at USD 1.4 million in 2025.

The market size for the demand for coil coatings in eu is projected to reach USD 2.1 million by 2035.

The demand for coil coatings in eu is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for coil coatings in eu are topcoats, primers, backing coats and others.

In terms of application, construction segment to command 44.0% share in the demand for coil coatings in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Functional Coil Coatings Market Analysis – Size, Share & Forecast 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA