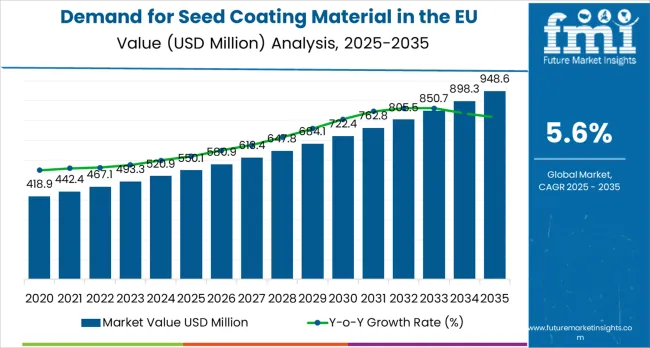

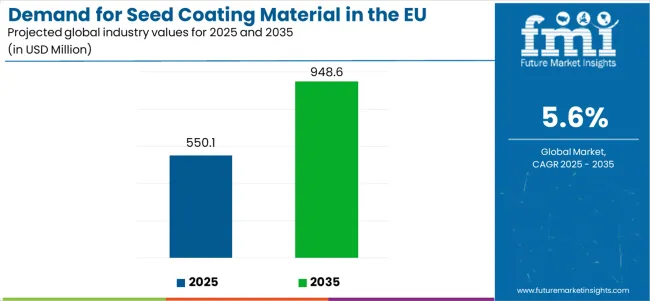

European Union seed coating material sales are projected to grow from USD 550.1 million in 2025 to approximately USD 948.6 million by 2035, recording an absolute increase of USD 397.4 million over the forecast period. This translates to a total growth of 72.3%, with demand forecasted to expand at a compound annual growth rate (CAGR) of 5.6% between 2025 and 2035. As reported in Future Market Insights (FMI)’s authoritative research on specialty and bulk chemicals, the overall industry size is expected to grow by nearly 1.7 times during the same period, supported by the accelerating adoption of precision agriculture, an increasing focus on seed enhancement technologies, and the development of applications across polymers, pellets, colorants, and mineral-based formulations throughout European markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 550.1 million |

| Market Forecast Value (2035) | USD 948.7 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

Between 2025 and 2030, EU seed coating material demand is projected to expand from USD 550.1 million to USD 721.9 million, resulting in a value increase of USD 171.8 million, which represents 43.2% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of bio-based coating technologies, increasing seed treatment sophistication across cereals and oilseeds, and growing integration of controlled-release formulations that optimize nutrient delivery and pest protection. Manufacturers are expanding their product portfolios to address evolving agricultural requirements for enhanced germination rates, improved seedling vigor, and environmentally sustainable coating materials that comply with EU regulatory frameworks for agricultural inputs.

From 2030 to 2035, sales are forecast to grow from USD 721.9 million to USD 948.7 million, adding another USD 225.6 million, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by further development of advanced polymer technologies enabling multifunctional seed coatings, integration of precision agriculture data driving customized formulation requirements, and expansion of bio-based materials addressing sustainability mandates. The growing emphasis on crop yield optimization and increasing regulatory pressure for reduced chemical inputs will drive demand for innovative seed coating materials that deliver enhanced agricultural performance while minimizing environmental impact.

Between 2020 and 2025, EU seed coating material sales experienced steady expansion at a CAGR of 5.6%, growing from USD 419.1 million to USD 550.1 million. This period was driven by increasing mechanization of European agriculture, rising awareness of seed treatment benefits for crop establishment, and growing recognition of coating technologies as cost-effective solutions for crop protection. The industry developed as major agrochemical companies and specialized seed treatment providers recognized the commercial potential of advanced coating materials. Product innovations in polymer chemistry, improved adhesion characteristics, and enhanced compatibility with biological seed treatments began establishing farmer confidence and mainstream acceptance of seed coating technologies.

Industry expansion is being supported by the rapid advancement of precision agriculture technologies across European farming operations and the corresponding demand for seed enhancement solutions that deliver consistent performance, optimize input efficiency, and support sustainable agricultural intensification. Modern seed producers and agricultural retailers rely on seed coating materials as essential components for protecting seeds during handling and planting, delivering nutrients and biologicals directly to germinating seedlings, and ensuring uniform seed size for precision planting equipment compatibility. Even minor improvements in germination uniformity, seedling establishment, or early-season vigor can translate into significant yield advantages and economic returns for farmers, driving comprehensive adoption of seed coating technologies.

The growing awareness of sustainable agriculture practices and increasing regulatory restrictions on conventional pesticide applications are driving demand for seed coating materials from certified manufacturers with appropriate environmental credentials and compliance documentation. Regulatory authorities throughout the European Union are increasingly establishing stringent guidelines for seed treatment product registration, environmental safety assessments, and application rate limitations to protect pollinator health and maintain ecosystem integrity. Scientific research studies and agronomic field trials are providing extensive evidence supporting seed coating materials' effectiveness in enhancing crop establishment while reducing overall pesticide usage, requiring specialized formulation expertise and standardized application protocols for optimal performance across diverse soil conditions, crop varieties, and climatic zones.

Sales are segmented by product type (material), crop type (application), distribution channel, nature, and country. By product type, demand is divided into polymers, pellets, colorants, minerals/pumice, and others including bio-based materials, enzymes, and adhesives. Based on crop type, sales are categorized into cereals & grains, oilseeds & pulses, vegetables, flowers & ornamentals, and other crop types. In terms of distribution channel, demand is segmented into B2B (seed companies) and retail & e-commerce. By nature, sales are classified into conventional and bio-based. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The polymers segment is projected to account for 45% of EU seed coating material sales in 2025, establishing itself as the dominant material category across European markets and expanding to 49% share by 2035. This commanding position is fundamentally supported by polymers' superior film-forming properties, excellent adhesion to seed surfaces, and versatile functionality enabling controlled-release mechanisms for nutrients and biologicals. The polymer-based format delivers exceptional performance across diverse seed types, providing manufacturers with reliable materials that facilitate uniform coating application, enhance seed flowability for mechanical planting systems, and protect seeds from mechanical damage during handling and storage.

This segment benefits from continuous innovation in polymer chemistry, development of environmentally friendly polymer alternatives, and extensive research into biodegradable formulations that address sustainability concerns while maintaining functional performance. Additionally, polymer-based coatings offer versatility across various application methods, including film coating, encrustation, and pelleting technologies, supported by proven manufacturing processes that ensure consistent quality and regulatory compliance.

The polymers segment is expected to increase its share from 45% in 2025 to 49% by 2035, demonstrating strengthening market position as advanced polymer technologies increasingly displace traditional coating materials, supported by superior performance characteristics and growing availability of bio-based polymer alternatives throughout the forecast period.

.webp)

Cereals & grains are positioned to represent 40% of total seed coating material demand across European markets in 2025, maintaining substantial share at 38% through 2035, reflecting the segment's dominance as the primary crop category within the overall industry ecosystem. This considerable share directly demonstrates that cereal and grain seeds, including wheat, corn, barley, and other major field crops, represent the largest single application segment, with seed producers systematically coating these high-volume crops to ensure optimal germination, enhance seedling vigor, and deliver targeted crop protection during critical establishment phases.

Modern agricultural producers increasingly view coated cereal and grain seeds as standard practice rather than premium options, driving demand for coating materials optimized for mechanical planting systems, formulated to protect against soil-borne pathogens, and designed to deliver early-season nutrients supporting rapid establishment. The segment benefits from continuous product innovation focused on fungicide compatibility, insecticide integration for soil pest protection, and development of biological coating formulations incorporating beneficial microorganisms that enhance nutrient uptake and stress tolerance.

The segment maintains substantial share throughout the forecast period, with slight relative decline from 40% to 38% reflecting proportionally faster growth in higher-value crop segments, particularly oilseeds & pulses, which expand from 25% to 27% share as coating adoption accelerates across soybeans, peas, and other pulse crops requiring specialized coating formulations.

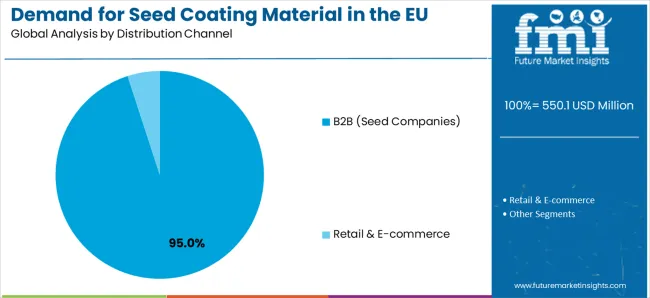

B2B channels, comprising seed production companies and commercial seed processors, are strategically estimated to control 95% of total European seed coating material sales in 2025, maintaining dominant position at 94% through 2035, reflecting the fundamental nature of seed coating as an industrial process conducted by specialized seed treatment facilities rather than individual farmers. European seed companies and commercial seed processors demonstrate consistent demand for seed coating materials that perform reliably in high-throughput coating equipment, deliver consistent quality across production batches, and meet stringent regulatory requirements for seed treatment product registration and environmental compliance.

The segment provides essential market stability through long-term supplier relationships, technical collaboration on formulation optimization, and consistent large-volume purchasing supporting manufacturing efficiency and cost competitiveness. Major European seed companies, including KWS SAAT, Limagrain, and specialized seed processors serving regional markets, systematically integrate advanced coating technologies into production operations, often developing proprietary coating formulations in collaboration with material suppliers to deliver differentiated seed products commanding premium pricing in competitive agricultural markets.

The segment maintains overwhelming dominance throughout the forecast period, with slight relative decline from 95% to 94% reflecting modest expansion of retail and direct-to-farmer channels as precision agriculture technologies enable on-farm seed treatment applications and specialty crop producers explore customized coating solutions for niche market applications.

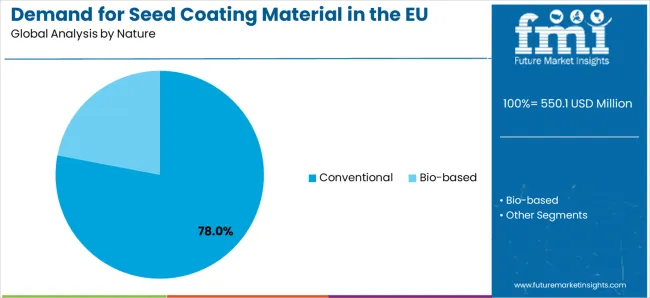

Conventional seed coating materials are strategically positioned to contribute 78% of total European sales in 2025, declining to 65% by 2035 as bio-based alternatives expand from 22% to 35% share, representing materials produced through traditional synthetic polymer chemistry and established manufacturing processes without biodegradability or renewable content requirements. These conventional products successfully deliver proven performance characteristics, cost-competitive pricing, and extensive regulatory approval histories while ensuring broad commercial availability across all major European markets and seed crop applications.

Conventional production serves cost-sensitive seed processors, high-volume cereal and oilseed applications, and established coating processes prioritizing manufacturing efficiency and consistent performance over sustainability differentiation. The segment derives competitive advantages from mature manufacturing infrastructure, economies of scale in polymer production, and comprehensive technical documentation supporting regulatory approvals across multiple European jurisdictions without constraints associated with bio-based certification or biodegradability demonstration requirements.

The segment experiences declining share from 78% to 65% throughout the forecast period as bio-based alternatives accelerate from 22% to 35%, reflecting EU sustainability initiatives, increasing regulatory pressure for environmentally compatible agricultural inputs, and growing availability of competitively priced bio-based polymers derived from renewable feedstocks including starch, cellulose, and protein-based materials.

EU seed coating material sales are advancing steadily due to accelerating precision agriculture adoption, growing seed treatment sophistication, and increasing integration of biological seed treatments requiring compatible coating formulations. However, the industry faces challenges, including regulatory complexity surrounding seed treatment product approvals, price sensitivity among commodity crop producers limiting premium coating adoption, and environmental concerns regarding polymer persistence and potential aquatic toxicity. Continued innovation in bio-based materials and multifunctional coating systems remains central to industry development.

The rapidly accelerating development of bio-based polymer technologies is fundamentally transforming seed coating material production from traditional petroleum-derived synthetic polymers to renewable resource-based alternatives including modified starches, cellulose derivatives, protein-based polymers, and polylactic acid formulations. Advanced bio-based coating materials deliver environmental sustainability advantages through renewable feedstock sourcing, biodegradability in soil environments following seed germination, and reduced carbon footprint compared to conventional synthetic polymers, while maintaining functional performance characteristics essential for commercial seed coating applications.

These sustainable innovations prove particularly important for European markets where regulatory frameworks increasingly prioritize environmental compatibility, agricultural sustainability initiatives encourage reduced synthetic input usage, and consumer preferences for environmentally responsible agriculture drive seed company differentiation through sustainability messaging. Major seed coating material suppliers invest heavily in bio-based polymer development, pilot-scale production optimization, and field performance validation, recognizing that sustainable coating solutions represent critical competitive differentiators and regulatory compliance requirements for future market participation.

Modern seed coating material producers systematically incorporate advanced controlled-release mechanisms enabling precise timing of nutrient and biological delivery to germinating seedlings, optimizing input efficiency while reducing environmental losses through leaching or volatilization. Strategic integration of polymer matrix technologies, microencapsulation systems, and pH-responsive formulations enables manufacturers to position seed coating materials as sophisticated delivery platforms supporting precision agriculture objectives including reduced input usage, enhanced nutrient use efficiency, and minimized environmental impact.

These technological improvements prove essential for high-value crop applications where coating materials deliver integrated solutions combining physical seed protection, chemical crop protection, nutritional supplementation, and biological inoculation in single application processes. Companies implement extensive agronomic testing programs, collaboration with seed treatment equipment manufacturers, and formulation optimization targeting specific performance requirements including germination uniformity, seedling vigor enhancement, and compatibility with diverse seed treatment active ingredients.

European regulatory authorities and agricultural stakeholders increasingly prioritize pollinator safety in seed treatment product evaluations, environmental risk assessments, and coating material approvals, driving demand for formulations that minimize dust-off during planting operations, reduce exposure risks to beneficial insects, and demonstrate environmental compatibility through rigorous ecotoxicology testing. This regulatory evolution enables manufacturers to differentiate premium offerings through low-dust formulations, encapsulation technologies preventing active ingredient migration, and comprehensive safety documentation supporting regulatory approvals across multiple European jurisdictions.

The development of dust-reducing polymer technologies, optimization of coating adhesion properties, and implementation of standardized testing protocols for abrasion resistance expands manufacturers' abilities to create compliant products meeting increasingly stringent regulatory requirements while maintaining commercial viability and competitive pricing. Brands collaborate with regulatory consultants, agricultural extension services, and farmer organizations to develop coating solutions balancing environmental safety requirements with agricultural performance needs, supporting market access and commercial success throughout evolving regulatory landscapes.

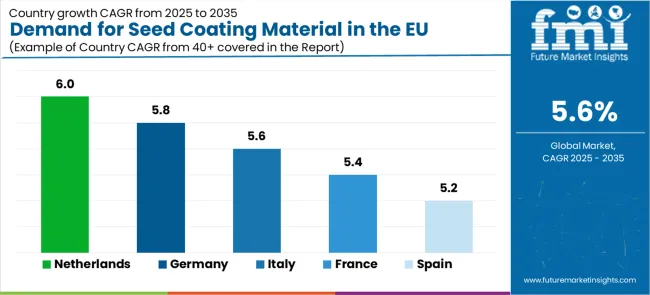

| Country | CAGR % |

|---|---|

| Netherlands | 6% |

| Germany | 5.8% |

| Italy | 5.6% |

| France | 5.4% |

| Spain | 5.2% |

EU seed coating material sales demonstrate consistent growth across major European agricultural economies, with all countries expanding at 5.6% CAGR through 2035, reflecting mature market development and proportional expansion throughout established seed treatment infrastructure. Germany maintains leadership through advanced agricultural technology adoption and sophisticated seed industry presence. France benefits from extensive cereal production and large-scale farming operations. Italy leverages diverse crop portfolios and specialty seed markets. Spain demonstrates steady growth supported by horticultural seed production and expanding field crop mechanization. The Netherlands emphasizes seed industry expertise and serves as European seed trading hub. Overall, sales show stable regional development reflecting consistent agricultural modernization and seed treatment adoption.

Revenue from seed coating material in Germany is projected to exhibit steady growth with a CAGR of 5.8% through 2035, driven by exceptionally well-developed agricultural mechanization, comprehensive seed industry infrastructure including major seed breeding companies and specialized seed processors, and strong farmer adoption of advanced seed treatment technologies throughout the country. Germany's sophisticated agricultural sector and internationally recognized leadership in precision farming technologies are creating substantial demand for high-performance seed coating materials across cereals, oilseeds, and specialty crops.

Major seed companies, including KWS SAAT, Deutschen Saatveredelung (DSV), and specialized regional seed processors, systematically expand coating capabilities, often investing in advanced coating equipment and formulation optimization to deliver differentiated seed products commanding premium pricing. German demand benefits from large-scale farming operations supporting high-volume seed usage, substantial investment in agricultural research and development, and cultural emphasis on agricultural innovation that naturally supports seed coating material adoption across mainstream farming communities.

Revenue from seed coating material in France is expanding at a CAGR of 5.4%, substantially supported by extensive cereal and oilseed production systems, established seed processing infrastructure, and growing adoption of integrated crop management practices incorporating seed treatment technologies. France's position as Europe's largest agricultural producer and major cereal exporter systematically drives demand for seed coating materials across wheat, corn, barley, and sunflower production.

Major seed companies, including Limagrain, MAS Seeds, and regional cooperatives with seed processing operations, progressively invest in coating technologies to enhance seed performance and differentiate product offerings. French sales particularly benefit from large farm sizes supporting mechanical planting equipment adoption, agricultural cooperatives facilitating seed treatment service provision, and government agricultural policies encouraging sustainable farming practices including precision seed treatments that optimize input efficiency.

Revenue from seed coating material in Italy is growing at a CAGR of 5.6%, fundamentally driven by diverse crop production systems spanning cereals, vegetables, specialty crops, and horticultural applications requiring specialized coating formulations. Italy's agricultural diversity and emphasis on high-value specialty crops create opportunities for premium coating materials delivering enhanced performance across diverse germination conditions and crop establishment requirements.

Major seed companies and processors, including local breeding companies and subsidiaries of international seed corporations, strategically invest in coating capabilities supporting diverse crop portfolios. Italian sales particularly benefit from vegetable seed production for domestic and export markets, growing protected agriculture requiring precision seed performance, and premium crop applications where coating material investments deliver measurable returns through enhanced germination uniformity and seedling vigor.

Demand for seed coating material in Spain is projected to grow at a CAGR of 5.2%, substantially supported by extensive horticultural seed production for domestic and export markets, expanding field crop mechanization particularly in northern regions, and growing adoption of precision agriculture technologies. Spanish agricultural sector's emphasis on vegetable production for European markets positions seed coating materials as essential tools for ensuring consistent germination and seedling establishment across diverse planting conditions.

Major vegetable seed companies, field crop cooperatives, and specialized seed processors systematically expand coating capabilities, with particular emphasis on precision vegetable planting systems requiring uniform seed sizing. Spain's substantial horticultural seed production industry, concentrated in southeastern regions, drives demand for specialized coating formulations supporting lettuce, tomato, pepper, and other high-value vegetable crops requiring exceptional germination uniformity and seedling vigor.

Demand for seed coating material in the Netherlands is expanding at a CAGR of 6%, fundamentally driven by the country's strategic position as European seed trading center, concentration of specialized seed companies and processors, and advanced agricultural technology development infrastructure. Dutch seed industry's international orientation and emphasis on innovation create opportunities for advanced coating material applications across diverse crop types and export markets.

Netherlands sales significantly benefit from concentration of seed companies including Bejo Zaden, Enza Zaden, and numerous specialized seed processors serving European markets, combined with sophisticated agricultural research institutions collaborating on seed treatment technology development. The country's position as seed trading hub facilitates coating material demand through re-export activities, with seeds imported for coating and treatment before distribution throughout European markets.

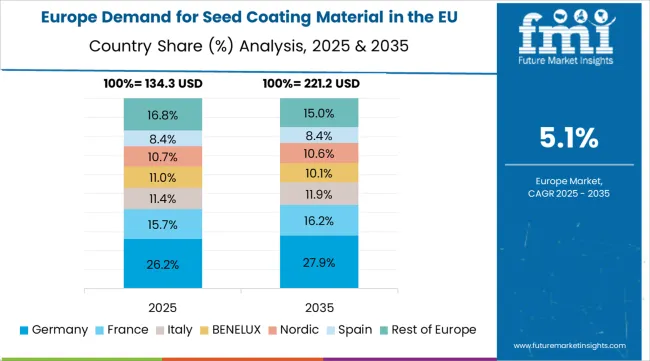

EU seed coating material sales are projected to grow from USD 550.1 million in 2025 to USD 948.7 million by 2035, registering a CAGR of 5.6% over the forecast period. All major European countries demonstrate consistent growth at a 5.6% CAGR, reflecting mature market development and proportional expansion across established agricultural economies.

Germany maintains the largest share at 28.4% in 2025, supported by advanced agricultural mechanization and sophisticated seed industry infrastructure. France follows with 22.1% share, attributed to extensive cereal production and established seed processing capabilities. Italy, Spain, and the Netherlands collectively contribute 28% of European sales, driven by diverse crop portfolios and specialized seed treatment requirements.

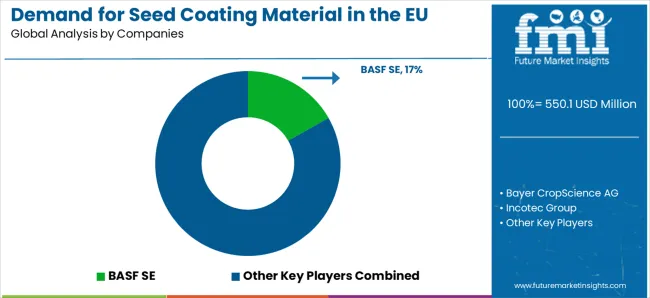

EU seed coating material sales are defined by competition among major agrochemical corporations with seed treatment divisions, specialized coating material suppliers, and regional polymer manufacturers. Companies are investing in bio-based polymer development, controlled-release technology optimization, regulatory compliance expertise, and sustainability communication to deliver high-performance, environmentally compatible, and regulatory-compliant seed coating solutions. Strategic partnerships with seed companies, technical service programs supporting formulation optimization, and collaborative research initiatives are central to strengthening competitive position.

Major participants include BASF SE with an estimated 18% share, leveraging its extensive polymer chemistry expertise, comprehensive seed treatment product portfolio, and established European presence supporting consistent supply to seed companies. BASF benefits from vertical integration spanning polymer production through formulated seed treatment products, technical support services, and the ability to provide integrated solutions including coating materials, fungicides, and insecticides supporting comprehensive seed treatment programs.

Bayer CropScience AG holds approximately 17% share, emphasizing multifunctional coating formulations, integration with proprietary seed treatment products, and strong relationships with major seed companies throughout Europe. Bayer's success in developing coatings optimized for compatibility with biological seed treatments and controlled-release fertilizer delivery creates strong positioning and customer loyalty, supported by extensive technical service capabilities and regulatory expertise.

Incotec Group accounts for roughly 9% share through its specialized focus on seed enhancement technologies, proprietary coating equipment systems, and comprehensive technical service supporting seed companies' coating operations. The company benefits from Netherlands-based seed industry expertise, long-standing relationships with vegetable seed producers, and reputation for innovation in pelleting and encrustation technologies serving high-value specialty crops.

Clariant International represents approximately 6% share, supporting growth through sustainable colorant solutions, eco-friendly polymer formulations, and technical expertise in specialty coating applications. Clariant leverages chemical industry expertise, global manufacturing capabilities, and commitment to sustainable chemistry principles, attracting environmentally conscious seed companies seeking differentiated coating solutions.

Croda International holds roughly 5% share, emphasizing bio-based ingredient supply, specialty polymer additives, and sustainable chemistry expertise. Croda's focus on renewable raw materials, biodegradable formulation components, and performance-enhancing additives positions the company strategically as regulatory frameworks increasingly prioritize environmental sustainability.

Other companies and regional suppliers collectively hold 45% share, reflecting moderate fragmentation within European seed coating material sales, where numerous polymer suppliers, regional coating material manufacturers, and specialized formulation companies serve local markets, specific crop applications, and niche requirements. This competitive structure provides opportunities for differentiation through specialized materials (biodegradable polymers, controlled-release systems), regional manufacturing presence, technical service capabilities, and customized formulations addressing specific seed company requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 948.7 million |

| Product Type (Material) | Polymers, Pellets, Colorants, Minerals/Pumice, Others (Bio-based/Enzymes/Adhesives) |

| Crop Type (Application) | Cereals & Grains, Oilseeds & Pulses, Vegetables, Flowers & Ornamentals, Other Crop Types |

| Distribution Channel | B2B (Seed Companies), Retail & E-commerce |

| Nature | Conventional, Bio-based |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | BASF SE, Bayer CropScience AG, Incotec Group, Clariant International, Croda International, Regional suppliers |

| Additional Attributes | Dollar sales by product type, crop type, distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established agrochemical corporations and specialized coating material suppliers; seed company preferences for various coating materials and formulations; integration with biological seed treatments and controlled-release technologies; innovations in bio-based polymer development and environmental compliance; adoption across diverse crop applications; regulatory framework analysis for seed treatment product registration and environmental safety; supply chain strategies; and penetration analysis for conventional and precision agriculture applications throughout European farming systems. |

The global demand for seed coating material in the EU is estimated to be valued at USD 550.1 million in 2025.

The market size for the demand for seed coating material in the EU is projected to reach USD 948.6 million by 2035.

The demand for seed coating material in the EU is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in demand for seed coating material in the EU are polymers, pellets, colorants, minerals/pumice and others (bio-based/enzymes/adhesives).

In terms of crop type (application), cereals & grains segment to command 40.0% share in the demand for seed coating material in the EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Demand for Thermal Insulation Materials in EU Size and Share Forecast Outlook 2025 to 2035

Therapeutic Drug Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Robots Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Apheresis Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Therapeutic Diet for Pet Market Analysis by Age Group, Health Condition, Distribution Channel and Others Through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Therapeutic Nuclear Medicine Market Analysis – Size, Share & Forecast 2024-2034

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA