The electro-pneumatic train brakes market is witnessing steady growth due to the rising demand for enhanced train safety, improved braking efficiency, and reduced stopping distances. Rail operators globally are increasingly adopting electro-pneumatic braking systems to replace conventional pneumatic brakes, ensuring faster and more reliable train operations.

These systems enable better synchronization between train cars, offering a significant boost to overall performance. The integration of smart technologies, such as real-time brake monitoring and predictive maintenance solutions, is further revolutionizing the market, creating new opportunities for innovation and advancement.

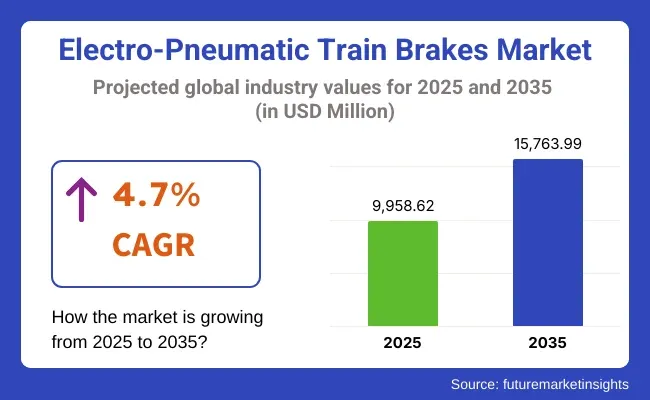

In 2025, the market size for electro-pneumatic train brakes is estimated to be approximately USD 9,958.62 million. By 2035, it is projected to reach USD 15,763.99 million, expanding at a compound annual growth rate (CAGR) of 4.7%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 9,958.62 Million |

| Projected Market Size in 2035 | USD 15,763.99 Million |

| CAGR (2025 to 2035) | 4.7% |

Growth is driven by increasing investments in railway infrastructure modernization, the rise of high-speed rail projects, and growing concerns regarding passenger and cargo safety. Market participants are emphasizing the development of lightweight, energy-efficient braking systems to align with the global push for sustainable and energy-saving transportation solutions.

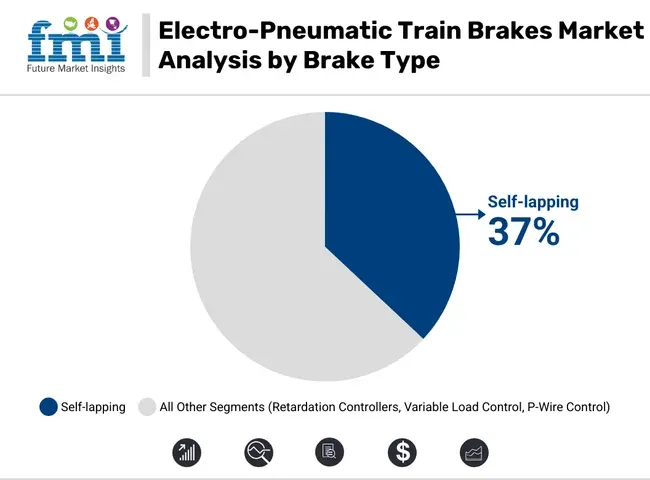

| Brake Type | Market Share (2025) |

|---|---|

| Self-lapping | 37% |

The self-lapping brakes segment is projected to account for the dominant market share owing to their ease of operation, automatic adjustment of brake force and good performance with various types of trains. These systems automatically adjust the braking force according to the driver's inputs, negating the need for constant manual corrections while maximizing safety and operational efficiency.

These systems are being increasingly adopted for both passenger and freight rail applications because they provide consistent braking performance under a wide variety of load and track conditions, while also significantly relieving driver fatigue and improving the overall train handling.

The self-lapping brakes that are essential for maintaining a constant rate of deceleration are highly prized, particularly on high-speed rail, commuter trains and heavy freight operations. The growing modernization of rail infrastructure along with the increasing demand for automated and semi-automated train systems is also contributing to the increasing preference for self-lapping brakes. As part of advanced train control systems, they also contribute towards improved energy efficiency and predictive maintenance, making them one of the key technologies in the future of rail transport.

The global self-lapping brake market is witnessing consistent expansion due to rising focus on safety compliance and performance optimization, with expanding rail networks in regions like Asia-Pacific, Europe, and North America set to hone in on this trend.

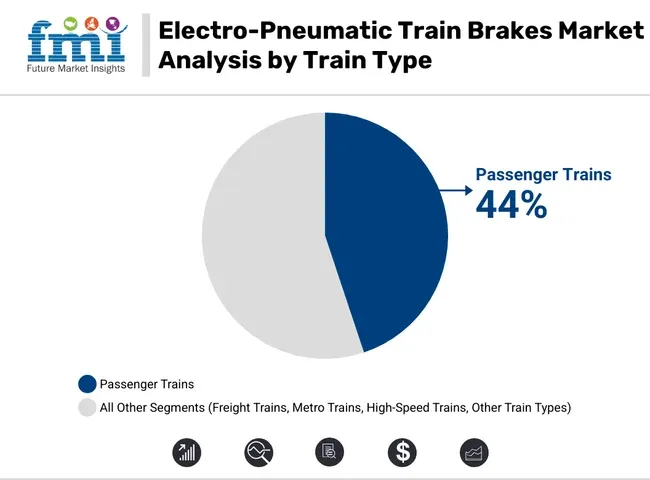

| Train Type | Market Share (2025) |

|---|---|

| Passenger Trains | 44% |

Electro-pneumatic brakes are primarily in use on passenger trains. There is high demand for advanced braking solutions due to increased emphasis on the improvement of commuter safety, comfort, and punctuality for urban, regional, and intercity rail networks. The electro-pneumatic (ECP) brake gives you almost instant reaction times, better braking control, and more effective handling of the train, which is really important to keep trains accelerating and decelerating smoothly, especially in high-density passenger corridors.

This joint braking capability safeguards against derailment and minimizes mechanical tension on couplings, thus protecting cargo during transportation and maximizing operational safety in long-haul trains. High-speed rail projects are growing in number, as are upgrades and modernization of metro and light rail systems, especially in regions of the Asia-Pacific and Europe, thus driving the uptake of electro-pneumatic brakes.

Electro-pneumatic brakes are increasingly preferred as governments and transit authorities invest heavily in rail technologies which require efficient, reliable, and automated braking systems. Moreover, increasing focus on energy-efficient operations as well as integration with real-time train control are all reinforcing the position of electro-pneumatic brakes as an enabler of next-generation rail transportation.

Challenges

High Installation and Maintenance Costs

The market for electro-pneumatic train brakes faces challenges surrounding the high costs associated with the installation of the system, retrofitting the old trains with the newer technology, and advanced braking components requiring strict maintenance measures.

The requirements of significant upfront investments, adaptation of infrastructure, and need of a highly skilled workforce make operators reluctant to replace these pneumatic braking systems. Manufacturers need to tailor cost-optimized solutions, develop modular retrofitting kits, and provide training programs for comprehensive maintenance to overcome these roadblocks.

Regulatory Complexity and Standardization Issues

Stringent safety standards and differing regional specifications have made the transition to electro-pneumatic brakes extremely challenging. Strict test, certification, and operational requirements from regulatory bodies like the FRA (Federal Railroad Administration) and ERA (European Union Agency for Railways) Widespread implementation is also hampered by differences between countries about interoperability and compliance. Companies need to work with authorities, contribute to efforts to harmonize regulatory protocols, and build systems that can be readily standardized to match evolving safety guidelines.

Opportunities

Rising Demand for High-Speed and Urban Transit Systems

The increasing global demand for high-speed railways and urban metros is creating a strong demand for various braking systems such as electro-pneumatic brakes which are used for efficient, precise braking. Its advantages shorter braking distances, coordinated braking responses, and improved passenger safety make them perfect for the new transportation infrastructure. The growth potential for brake system manufacturers is also significantly large with expanding high-speed rail networks in Asia, Europe and the Middle East.

Integration of Smart and Predictive Maintenance Technologies

IoT, sensor technology, and AI-based predictive analytics are beginning to transform train brake maintenance. Braking components are monitored in real time for health faults can be detected earlier, so downtime is reduced, and safety is maximized. Implementing smart diagnostic features in electro-pneumatic brake systems could help companies stand out, paving the way for more value-added services like a predictive maintenance platform and remote system checking capabilities.

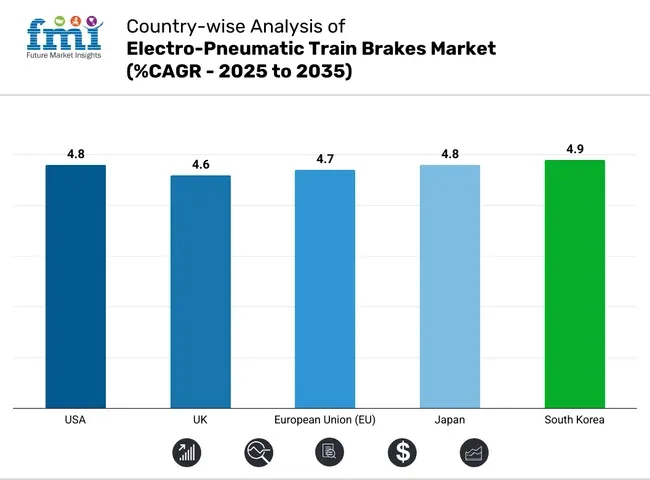

The United States electro-pneumatic train brakes market is projected to record steady growth, owing to government investments towards modernization of railway infrastructure, improved train safety measures and operational efficiency. Advanced braking systems upgrades are helping the freight and passenger rail sectors comply with stringent safety regulations while improving performance across high-speed rail networks.

Government initiatives including things like the Bipartisan Infrastructure Law which encourage infrastructure upgrades are also hastening the transition from normal to electro-pneumatic systems. Additionally, growing focus toward maintaining the minimum maintenance costs along with enhancing braking response times is encouraging their swift adoption across both urban metro and long-distance railway services.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

In the United Kingdom, the electro-pneumatic train brakes market is being propelled by the renovation of the national railway network and improvements in passenger safety standards. The electrification of railways at an unprecedented speed as well as growing investments in high-speed rail projects like HS2 are creating a high demand for reliable and responsive braking technologies.

Furthermore, regulatory pressure to improve performance and sustainability of rail safety is driving operators to implement next-generation braking systems. Rail operators and technology providers are teaming up to deliver smarter and more energy-efficient brake control solutions that match the changing requirements of the UK rail network.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

The electro-pneumatic train brakes market in the European Union is growing steadily, driven by significant investments in railway modernization, sustainability mandates, and increased safety regulation under programs such as Shift2Rail. Advances in braking technologies are being adopted to improve the efficiency of freight and passenger rail services, with countries such as Germany, France and Italy leading the way.

EU regulations encouraging emission reductions in the transport sector and modal shift from road to rail will also stimulate the market. Emerging technologies like predictive maintenance systems, and digitalized brake examination, are on the rise, increasing reliability and extending asset lifecycles, nationally and in cross-border rail networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan is also a leader in the adoption of electro-pneumatic train brakes, thanks to its widely acclaimed world-famous high-speed rails, the Shinkansen. Its focus on rail safety, punctuality and tech innovation is encouraging impactful investments into advanced braking systems.

With advanced train control and signaling systems, Japanese rail operators are implementing electro-pneumatic brakes to maximize braking efficiency and ensure passenger safety at all times. Furthermore, rising efforts for improving energy efficiency across transport modes and readiness for High Speed future projects is also driving demand for modernized and responsive braking technologies in urban and intercity networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

In South Korea, the electro-pneumatic train brakes market is advancing at a positive step, driven by favorable investments in high-speed rail, urban metro expansion, and smart rail technology. In South Korea, increased adoption of advanced braking systems on both new and existing rail networks is being driven by a commitment to transportation safety, energy efficiency, and automation.

They include smart rail projects, many of which are tied to the Korean New Deal, that are combining electro-pneumatic brake technologies with AI-based monitoring and predictive maintenance platforms. With a strong commitment toward innovation and infrastructure resiliency, South Korea has positioned itself as one of the growth hotspots for advanced rail technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The electro-pneumatic train brakes market is gaining strong momentum due to increasing investments in railway modernization, safety regulations, and the global focus on efficient urban transportation systems. Electro-pneumatic brakes offer faster response times, improved control, and better train handling compared to conventional pneumatic brakes. Their adoption is especially accelerating across high-speed rail networks and metropolitan transit systems where reliability and passenger safety are paramount.

Moreover, the integration of IoT-based monitoring and predictive maintenance technologies is enhancing system performance and extending brake lifecycle, thus driving market growth. Additionally, increasing investments in rail electrification projects across Europe, Asia-Pacific, and parts of Africa are significantly contributing to the sustained adoption of electro-pneumatic braking technologies.

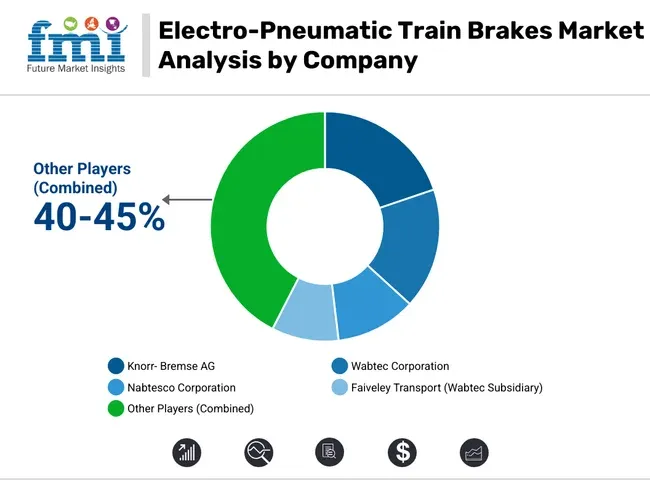

Knorr-Bremse AG (19-21%)

Knorr-Bremse, a global leader in rail vehicle systems, has innovative solutions to offer in the field of electro-pneumatic brakes. Their EP2002 4.0 technology is equipped for better train handling, faster braking response and higher levels of redundancy that are essential for safety in 21st-century urban transit.

Knorr-Bremse’s proactive collaborations with OEMs and urban metro authorities in Germany, Japan, and South Korea further confirm their prowess. Moreover, the company's focus on incorporating sustainability in their product lifecycle such as incorporating energy-efficient brake designs and using of eco-friendly materials are enhancing their attractiveness in light of global green transportation initiatives.

Wabtec Corporation (16-18%)

Wabtec Corporation's next-generation electro-pneumatic brakes are raising the bar across the industry when coupled with AI-based monitoring and fault detection technologies. Their focus on commercial scaling of manufacturing capacity in new markets such as India and Latin America will help them seize the opportunity created by strong global demand for the renaissance of rail.

Furthermore, Wabtec's focus on future connectivity with early investments in smart train systems that connect braking and live data communication technologies show their intent to serve the future of full connectivity and autonomous railway.

Nabtesco Corporation (10-12%)

Nabtesco Corporation develops compact, lightweight brake systems mainly for urban mass transit. Sleek brake calipers may not seem like a high-tech solution to something as straightforward as stopping right now, but knowing when to slow down or stop entirely is becoming increasingly complex in crowded city environments.

Nabtesco is emerging as a powerful contributor to the rapid expansion of urban rail in Asia-Pacific through its increasing investments in low-noise technology and eco-conscious designs. Their alliances with Chinese metro operators and Southeast Asian infrastructure developers are laying the groundwork for a steady increase in their market share internationally.

Faiveley Transport (Wabtec Subsidiary) (8-10%)

As part of the Wabtec family, Faiveley Transport is at the forefront of helping advance electro-pneumatic brake technologies, both for traditional and autonomous rail systems. The Microprocessor-Controlled Brake System (MCBS) offers real-time diagnostics of the entire system for better maintenance predictability and improved compliance with repair standards.

Faiveley has also recently been awarded contracts on large-scale metro projects for KSA, Egypt, and UAE, reflecting a strategic expansion into fast-developing rail markets with governments investing heavily in next-gen urban transport solutions. Finally, their increasing proficiency in smart braking for autonomous trains sets them apart in this dynamically emerging market space.

Other Key Players (40-45% Combined)

This has opened the market for regional manufacturers and niche technology firms providing customized electro-pneumatic brake systems for smaller rail infrastructure and light rail networks who contribute significantly to the market diversity.

There is a growing interest in modular upgrades of legacy trains by companies, especially in Eastern Europe, Southeast Asia, and Africa. Moreover, the increasing emergence of startups integrating AI, IoT, and wireless communications into brake management systems is slowly changing the competitive landscape, thereby paving way for new collaborations and innovation-led expansions.

The overall market size for electro-pneumatic train brakes market was USD 9,958.62 million in 2025.

The electro-pneumatic train brakes market expected to reach USD 15,763.99 million in 2035.

Growing demand for high-speed rail networks, focus on railway safety, advancements in braking technology, and expansion of metro systems will drive the electro-pneumatic train brakes market during the forecast period.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Passenger trains segment driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: East Asia Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 28: East Asia Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 29: East Asia Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 30: East Asia Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 31: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: South Asia & Pacific Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 34: South Asia & Pacific Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 35: South Asia & Pacific Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 36: South Asia & Pacific Market Volume (Units) Forecast by Train Type, 2017 to 2032

Table 37: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: MEA Market Volume (Units) Forecast by Country, 2017 to 2032

Table 39: MEA Market Value (US$ Million) Forecast by Brake Type, 2017 to 2032

Table 40: MEA Market Volume (Units) Forecast by Brake Type, 2017 to 2032

Table 41: MEA Market Value (US$ Million) Forecast by Train Type, 2017 to 2032

Table 42: MEA Market Volume (Units) Forecast by Train Type, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 16: Global Market Attractiveness by Brake Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Train Type, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 34: North America Market Attractiveness by Brake Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Train Type, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Brake Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Train Type, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 70: Europe Market Attractiveness by Brake Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Train Type, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 74: East Asia Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 75: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 81: East Asia Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 84: East Asia Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 85: East Asia Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Brake Type, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Train Type, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: South Asia & Pacific Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 92: South Asia & Pacific Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 93: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia & Pacific Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 99: South Asia & Pacific Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 100: South Asia & Pacific Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 101: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 102: South Asia & Pacific Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 103: South Asia & Pacific Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 104: South Asia & Pacific Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 105: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 106: South Asia & Pacific Market Attractiveness by Brake Type, 2022 to 2032

Figure 107: South Asia & Pacific Market Attractiveness by Train Type, 2022 to 2032

Figure 108: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ Million) by Brake Type, 2022 to 2032

Figure 110: MEA Market Value (US$ Million) by Train Type, 2022 to 2032

Figure 111: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 113: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 114: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: MEA Market Value (US$ Million) Analysis by Brake Type, 2017 to 2032

Figure 117: MEA Market Volume (Units) Analysis by Brake Type, 2017 to 2032

Figure 118: MEA Market Value Share (%) and BPS Analysis by Brake Type, 2022 to 2032

Figure 119: MEA Market Y-o-Y Growth (%) Projections by Brake Type, 2022 to 2032

Figure 120: MEA Market Value (US$ Million) Analysis by Train Type, 2017 to 2032

Figure 121: MEA Market Volume (Units) Analysis by Train Type, 2017 to 2032

Figure 122: MEA Market Value Share (%) and BPS Analysis by Train Type, 2022 to 2032

Figure 123: MEA Market Y-o-Y Growth (%) Projections by Train Type, 2022 to 2032

Figure 124: MEA Market Attractiveness by Brake Type, 2022 to 2032

Figure 125: MEA Market Attractiveness by Train Type, 2022 to 2032

Figure 126: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Train Loaders Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Train Seat Market Growth – Trends & Forecast 2025 to 2035

Train Battery Market Growth - Trends & Forecast 2024 to 2034

Train Auxiliary Rectifier Market

Train Transformer Market

Train Ceiling Modules Market

Train Bogie Market

Strain Type Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

Strain Clamp Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Belt Trainers Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Gait Trainer Market Growth - Trends, Demand & Forecast 2025 to 2035

Air Entrainment Meters for Mortar Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA