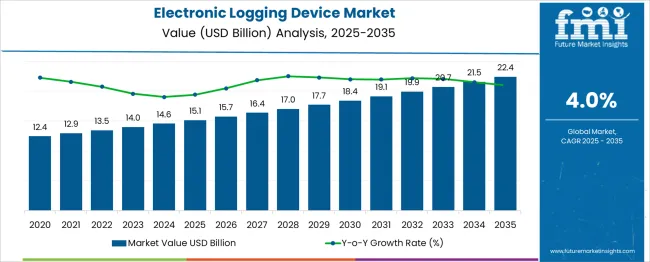

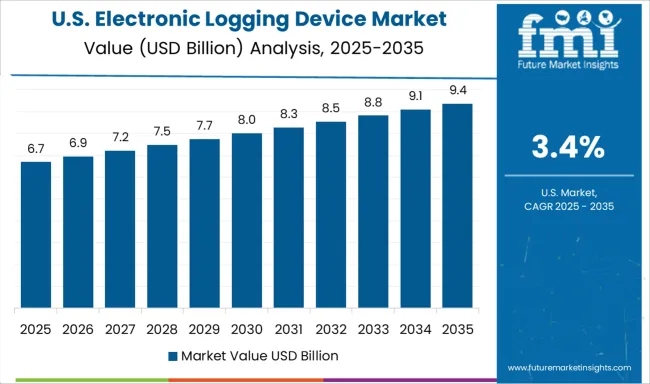

The Electronic Logging Device (ELD) Market is projected to grow from USD 15.1 billion in 2025 to USD 22.4 billion by 2035, reflecting a CAGR of 4.0%. Evaluating the Growth Contribution Index (GCI) helps identify how each year’s incremental growth adds to the total market expansion over the forecast period. The absolute increase across the decade is USD 7.3 billion, with annual contributions gradually rising in magnitude. Early years such as 2025 to 2026 show modest gains of USD 0.6 billion, while mid-period growth, such as 2029 to 2030, contributes approximately USD 0.7 billion. Later years, particularly 2033 to 2035, show larger annual contributions approaching USD 0.9 billion, signaling compounding effects over time.

The GCI distribution reveals that the latter half of the forecast period contributes more significantly to total growth. This pattern indicates that while early adoption continues steadily, regulatory reinforcements, technological enhancements, and wider fleet compliance are likely to amplify market expansion in the later years. The GCI analysis suggests a balanced yet back-loaded growth contribution trend for the ELD market, where incremental adoption in the initial years sets a foundation for stronger absolute gains towards the end of the forecast period, thereby sustaining long-term momentum.

| Metric | Value |

|---|---|

| Electronic Logging Device Market Estimated Value in (2025 E) | USD 15.1 billion |

| Electronic Logging Device Market Forecast Value in (2035 F) | USD 22.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The electronic logging device market is gaining rapid traction as global transportation regulations mandate stricter compliance with driver hours-of-service and vehicle operation standards. This shift is being accelerated by legislative frameworks such as the ELD mandates in the United States, Canada, and Mexico, which have created a foundational push toward digitalizing commercial fleet operations. Adoption is being supported by a rising emphasis on reducing administrative burden, improving driver safety, and enhancing operational efficiency across logistics networks.

Key industry participants are investing in scalable, integrated platforms that combine telematics, GPS tracking, and real-time diagnostics to offer comprehensive fleet visibility. Advancements in IoT, cloud computing, and AI-powered route optimization have made electronic logging systems more intelligent and interoperable.

The transition from paper logs to digital records is being further supported by OEM partnerships and aftermarket solutions that enable seamless hardware-software integration. Looking ahead, as cross-border trade volumes increase and fleet modernization continues, electronic logging devices are expected to become standard infrastructure within global commercial transportation ecosystems.

The electronic logging device market is segmented by component, form factor, vehicle type, fleet size, application, and geographic regions. By component, the market is divided into Hardware, Software, Services. In terms of form factor, the market is classified into Embedded and Integrated. Based on vehicle type, the market is segmented into Heavy Commercial Vehicles (HCVs), Light Commercial Vehicles (LCVs) Buses and Coaches. By fleet size, the market is segmented into Medium Fleets (50–249 vehicles), Large Fleets (250+ vehicles)Small Fleets (1–49 vehicles). By application, the market is segmented into Fleet Management, Compliance Monitoring, Driver Performance & Monitoring, Vehicle Diagnostics, Others (Fuel Management, Route Management, etc.). Regionally, the electronic logging device industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

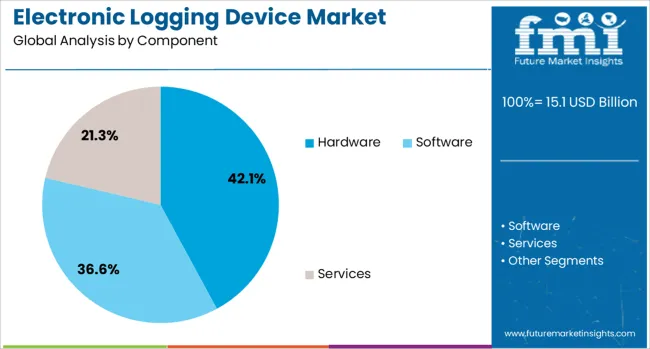

The hardware component segment is projected to account for 42.1% of the electronic logging device market revenue in 2025, making it a critical contributor to the market’s foundation. The dominance of this segment is being influenced by the growing installation of tamper-resistant, compliant, and high-reliability logging units across heavy-duty vehicle fleets. Hardware systems equipped with secure digital memory, wireless connectivity, and onboard diagnostics interfaces have been widely adopted to ensure accurate data capture and transmission.

The rising need for ruggedized devices capable of withstanding extreme operating conditions and vibrations has also contributed to increased hardware demand. Technological upgrades enabling real-time synchronization with vehicle ECMs and cloud platforms have enhanced the accuracy and traceability of logs.

Moreover, hardware solutions have played a pivotal role in regulatory audits and roadside inspections by offering authenticated and retrievable driving records. As fleet operators prioritize performance consistency and regulatory conformity, investments in reliable ELD hardware are expected to sustain long-term market growth.

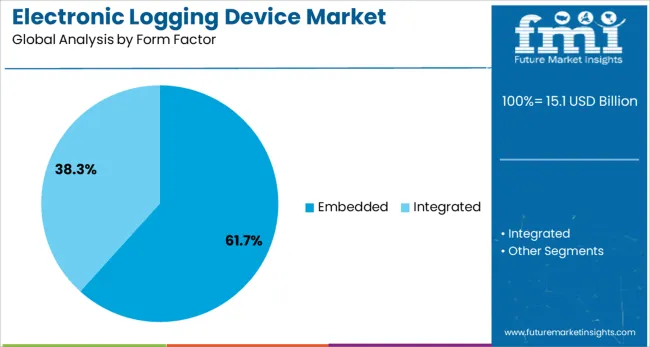

The embedded form factor segment is expected to capture 61.7% of the electronic logging device market share in 2025, reflecting its increasing preference over portable solutions. This dominance is being driven by the integration of ELD functionalities directly into vehicle electronics, allowing for seamless data acquisition, minimal tampering risk, and permanent installation benefits. Embedded solutions have gained strong traction among fleet operators seeking streamlined maintenance, enhanced connectivity, and long-term durability without dependence on external mobile devices.

Their ability to support continuous data logging, remote diagnostics, and over-the-air firmware updates has strengthened their position in the market. Integration with advanced driver-assistance systems and telematics control units has further enhanced the operational intelligence of embedded ELDs.

The reduction in total cost of ownership and alignment with OEM design standards have positioned embedded systems as the preferred choice for both newly manufactured and retrofitted commercial vehicles. As fleet digitalization becomes mission-critical, embedded ELD systems are anticipated to remain the industry benchmark.

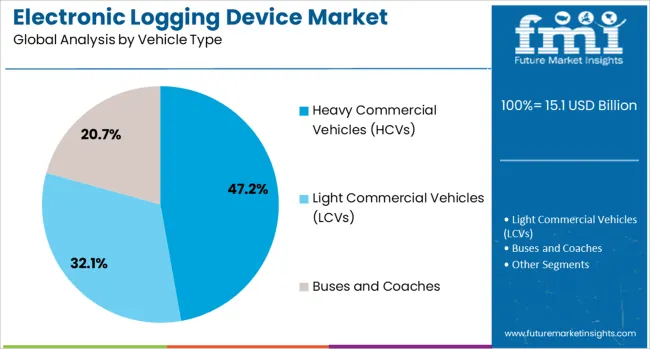

The heavy commercial vehicles segment is anticipated to hold 47.2% of the electronic logging device market revenue in 2025, establishing itself as the leading vehicle category for ELD adoption. This growth is being propelled by stringent compliance requirements targeting long-haul and high-capacity vehicles, particularly in North America and Europe. The scale of operations in heavy-duty freight, combined with long-distance routes and multiple jurisdictional regulations, has increased reliance on precise logging systems to manage driver fatigue, service hours, and vehicle diagnostics.

Embedded ELD units have been widely integrated into these fleets to enhance regulatory visibility, improve safety, and reduce liability during inspections. The high cost of non-compliance, coupled with pressures to optimize route planning and fuel usage, has further driven adoption across logistics and freight transport operators.

Additionally, increased collaboration between fleet management solution providers and commercial vehicle OEMs has enabled native integration of ELD functionalities. As the backbone of cross-border and domestic logistics, heavy commercial vehicles are expected to remain the primary segment driving ELD deployment.

The market is experiencing steady growth as transportation and logistics companies prioritize compliance with regulatory mandates and operational efficiency improvements. These devices automatically record driving time and vehicle operation data, replacing manual logbooks, which reduces errors and enhances transparency. Adoption is driven by stringent government regulations aimed at improving road safety, minimizing driver fatigue, and ensuring adherence to hours-of-service rules. Technological advancements in telematics integration, GPS tracking, and cloud-based analytics are enhancing device functionality. Despite initial investment concerns, the long-term benefits in terms of reduced administrative burden, improved fleet management, and optimized routing are compelling more operators to integrate ELDs into their fleets.

Regulatory bodies in multiple regions have mandated the use of electronic logging devices to enforce hours-of-service compliance among commercial drivers. These mandates aim to prevent fatigue-related accidents and ensure accurate, tamper-proof recording of driving activities. Fleet operators are compelled to adopt ELDs to avoid penalties, maintain safety ratings, and meet insurance requirements. Compliance benefits extend beyond avoiding fines, as ELD-generated data can be leveraged to improve operational transparency, streamline inspections, and reduce disputes over log accuracy. As more countries introduce similar regulatory frameworks, the demand for ELD solutions is expected to rise significantly, particularly among large fleet operators seeking to standardize safety practices.

Modern ELD solutions are increasingly integrated with telematics systems, providing real-time location tracking, driver behavior monitoring, and vehicle diagnostics alongside compliance logging. These features enable fleet managers to optimize routes, reduce idle time, and improve fuel efficiency. Real-time data analytics allow predictive maintenance scheduling, reducing downtime and repair costs. Cloud connectivity ensures that information is accessible remotely, supporting data-driven decision-making and cross-departmental coordination. This technological integration transforms ELDs from a compliance tool into a comprehensive fleet management solution. Enhanced functionality through artificial intelligence and machine learning is further expanding their role in optimizing operational performance.

Beyond regulatory compliance, fleet operators are recognizing the operational benefits of ELD adoption. Automated logging reduces administrative work for drivers and back-office staff, freeing resources for more strategic tasks. Accurate tracking of driving hours and vehicle usage improves payroll accuracy and eliminates inefficiencies in route planning. Data from ELDs helps identify underperforming assets, reduce fuel waste, and improve delivery timelines. These operational efficiencies directly translate into cost savings, making ELD adoption a financially attractive investment. Small and medium-sized fleet operators are increasingly adopting affordable ELD solutions that provide both compliance and measurable operational benefits.

Despite the benefits, ELD adoption faces hurdles such as high initial device costs, subscription fees for data services, and integration expenses with existing fleet systems. Smaller operators with limited budgets may perceive these costs as a significant barrier. Additionally, driver resistance due to concerns over constant monitoring, perceived privacy invasion, and adaptation to new technology can slow adoption rates. Training programs and clear communication about the safety and efficiency benefits of ELDs are critical for overcoming such resistance. As market competition increases, more cost-effective, user-friendly solutions are emerging, which may help address these adoption challenges over time.

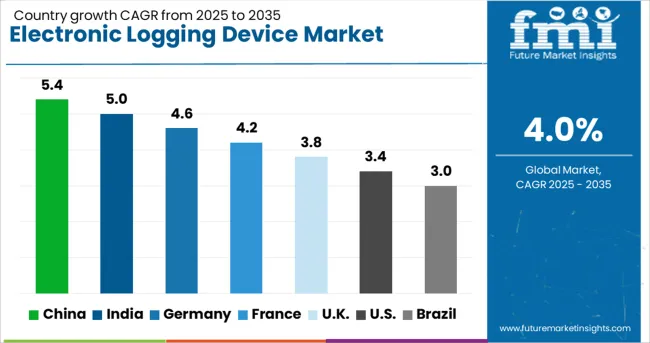

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The market is set to expand at a CAGR of 4.0% between 2025 and 2035, influenced by the enforcement of driver compliance regulations, adoption of fleet management solutions, and integration of telematics in transportation. China is forecast to lead with a 5.4% CAGR, backed by the rapid modernization of logistics fleets and stricter regulatory frameworks. India follows at 5.0%, with growth fueled by rising commercial vehicle adoption and digital tracking systems. Germany, at 4.6%, benefits from established transport infrastructure and consistent compliance enforcement. The UK, with a 3.8% CAGR, shows gradual adoption due to regulatory requirements. The USA, at 3.4%, experiences steady demand linked to mandatory ELD rules for commercial trucking operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electronic logging device market in China is anticipated to expand at a CAGR of 5.4% between 2025 and 2035, driven by regulatory enforcement for driver work-hour compliance and fleet operational efficiency. Major logistics operators are integrating ELD solutions with telematics platforms to monitor driver behavior and vehicle performance in real time. Growing e-commerce and last-mile delivery networks are further boosting the need for accurate data logging. Domestic technology providers are offering cost-effective, GPS-enabled solutions to meet compliance requirements, while large transport companies are upgrading systems to improve safety and reduce operational costs.

India is projected to grow at a CAGR of 5.0%, supported by the government’s focus on improving road safety and logistics efficiency. Large trucking companies and fleet operators are increasingly implementing ELDs to ensure compliance with driver work-hour norms and to optimize route planning. Integration with fleet management software is becoming a standard feature, enabling better fuel monitoring and vehicle utilization. Technology adoption is also being encouraged by rising competition in long-haul transport services, prompting operators to invest in modern tracking and compliance tools.

The market in Germany is forecast to grow at a CAGR of 4.6%, influenced by strict EU driving time regulations and the push for advanced telematics solutions. Logistics and freight companies are investing in connected ELD platforms to improve compliance, enhance driver safety, and reduce downtime. Manufacturers are developing multilingual and cross-border compliant systems to cater to Pan-European transport requirements. Rising demand for real-time performance analytics is encouraging integration of ELDs with cloud-based monitoring tools, enabling predictive maintenance and operational cost savings.

The United Kingdom market is expected to expand at a CAGR of 3.8%, propelled by increasing compliance requirements and efforts to modernize fleet management practices. Operators in freight, passenger transport, and delivery services are transitioning from manual logbooks to automated logging systems. Integration with GPS navigation and route optimization tools is enhancing operational efficiency. Industry players are also introducing ELD solutions with remote data access for better oversight of dispersed fleets, which is critical in long-distance haulage and intercity transport.

The market in the United States is projected to grow at a CAGR of 3.4%, influenced by Federal Motor Carrier Safety Administration mandates and growing adoption of telematics-based compliance solutions. Large fleet operators are focusing on ELD systems with enhanced driver interface, improved accuracy, and integration capabilities with dispatch and maintenance software. Demand for wireless and mobile-compatible devices is increasing, particularly among small and medium fleet operators. Rising emphasis on reducing violations and improving driver productivity continues to support steady adoption across the industry.

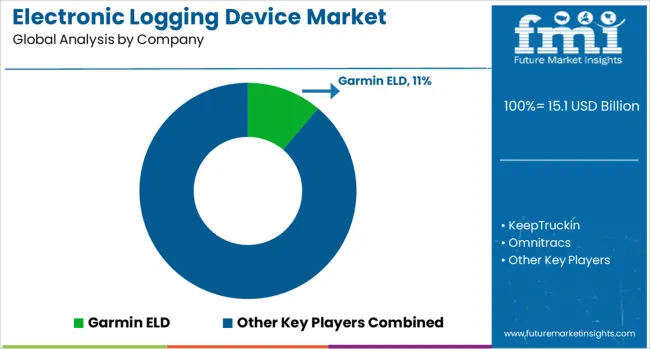

Competition in the electronic logging device market is shaped by firm regulatory mandates. Rivalry is intense. Garmin, Samsara, Omnitracs, KeepTruckin (now Motive), Magellan are engaged. Garmin’s offering is delivered through rugged hardware with fleet-grade software features. Samsara’s system is provided via cellular-connected gateways combined with analytics-rich dashboards.

Omnitracs’ platform is furnished with deep routing and compliance modules intended for legacy large-scale operations. KeepTruckin’s devices were distributed with straightforward plug-and-play installation and intuitive driver apps. Magellan’s solution is marketed with simplified OBD-II connectivity and real-time alerts.

Differentiation is pursued through integration depth, pricing models tied to subscription tiers, OEM partnerships (observed industry pattern). Channels are managed via direct fleet teams, authorized distributors, alliances with truck OEMs (observed industry pattern). Technology is delivered via GPS, LTE cellular, cloud dashboards, mobile driver interfaces, automated violation alerts. A price hierarchy is implied by feature set, analytics scope, service level.

Strategy is structured around compliance alignment, ecosystem expansion, modular scalability. Each vendor is certified to FMCSA technical standard. Firmware updates are issued to sustain compliance. APIs are extended to logistics platforms, dispatch systems, insurance analytics. Subscription plans are offered for compliance-only or add-on operational insights.

Target segments are small fleets, owner-operators, cross-border carriers (observed industry pattern). Scalability is enabled by modular hardware activated via software tiers, reducing deployment complexity. Sustainability is addressed by digital recordkeeping that eliminates paper logs and reduces fuel waste via optimized routing (observed industry pattern). Brochure content is focused on compliance, ease of installation, operational value. Garmin’s materials specify dash-mount configurations, Bluetooth connections, hours-of-service recording.

Samsara’s literature is providing plug-and-play install, automatic log sync, GPS tracking, custom alerts. Omnitracs’ brochures are detailing routing, messaging, multi-jurisdiction compliance reporting. KeepTruckin’s sheets are highlighting simple OBD-II or J-box plug-in, mobile app logging, real-time compliance monitoring.

Magellan’s collateral is describing basic plug-in install, alert generation, USB and cellular data export. Warranty terms, mounting accessories, data retention policies are cited. Messaging remains factual. Devices are presented as compliant, easy to deploy, and extensible into broader fleet management systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.1 Billion |

| Component | Hardware, Software, and Services |

| Form Factor | Embedded and Integrated |

| Vehicle Type | Heavy Commercial Vehicles (HCVs), Light Commercial Vehicles (LCVs), and Buses and Coaches |

| Fleet Size | Medium Fleets (50–249 vehicles), Large Fleets (250+ vehicles), and Small Fleets (1–49 vehicles) |

| Application | Fleet Management, Compliance Monitoring, Driver Performance & Monitoring, Vehicle Diagnostics, and Others (Fuel Management, Route Management, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Garmin ELD, KeepTruckin, Omnitracs, Trimble, Geotab, Samsara, Verizon Connect, AT&T Fleet Complete, Donlen, Stoneridge, TomTom Telematics, Blue Ink Technology, CarrierWeb, ORBCOMM, Pedigree Technologies, Teletrac Navaman, Wheels Inc., and Transflo |

| Additional Attributes | Dollar sales by device type and fleet size, demand dynamics across long-haul trucking, public transportation, and delivery services, regional trends in adoption driven by regulatory mandates in North America, Europe, and Asia-Pacific, innovation in telematics integration, GPS accuracy, and real-time diagnostics, environmental impact of reduced idling and fuel optimization, and emerging use cases in predictive maintenance, driver behavior analytics, and integration with autonomous vehicle systems. |

The global electronic logging device market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the electronic logging device market is projected to reach USD 22.4 billion by 2035.

The electronic logging device market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in electronic logging device market are hardware, software and services.

In terms of form factor, embedded segment to command 61.7% share in the electronic logging device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Devices Market Size and Share Forecast Outlook 2025 to 2035

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA