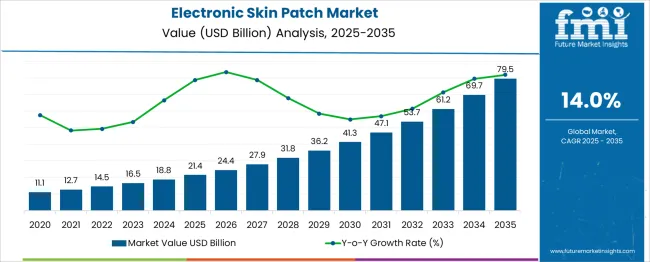

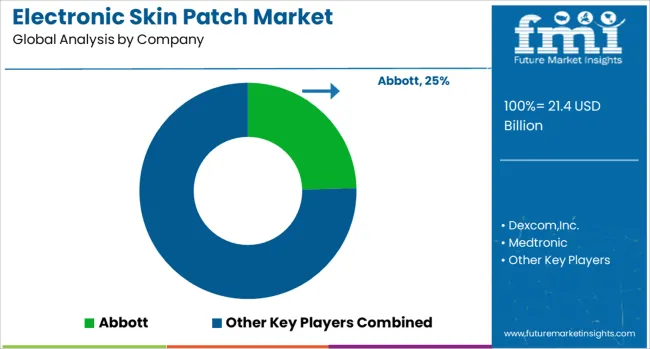

The Electronic Skin Patch Market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 79.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

Between 2025 and 2030, the market grows from USD 11.1 billion to USD 24.4 billion. Annual YoY gains during this period are: USD 1.6 billion in 2026 (+14.4%), USD 1.8 billion in 2027 (+14.2%), USD 2.0 billion in 2028 (+13.8%), USD 2.3 billion in 2029 (+13.9%), and USD 2.6 billion in 2030 (+13.8%). These gains are underpinned by widespread clinical adoption of patches for real-time glucose monitoring, ECG, and continuous temperature tracking. FDA-cleared devices such as Abbott’s FreeStyle Libre and wearable ECG patches are expanding reimbursement frameworks, reducing barriers to physician prescription. From 2030 to 2035, growth accelerates sharply from USD 24.4 billion to USD 79.5 billion with YoY gains exceeding USD 5 billion by 2033. This jump reflects integration with AI platforms and closed-loop drug delivery systems. Studies published in Nature Biomedical Engineering indicate enhanced patient adherence and clinical accuracy over traditional wearables. Enterprise adoption in pharma trials, remote care protocols, and outpatient rehabilitation drives B2B growth, while aging populations and rising chronic illness prevalence sustain long-term demand. The market’s structure is shifting from optional monitoring to foundational infrastructure in digital medicine.

| Metric | Value |

|---|---|

| Electronic Skin Patch Market Estimated Value in (2025 E) | USD 21.4 billion |

| Electronic Skin Patch Market Forecast Value in (2035 F) | USD 79.5 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

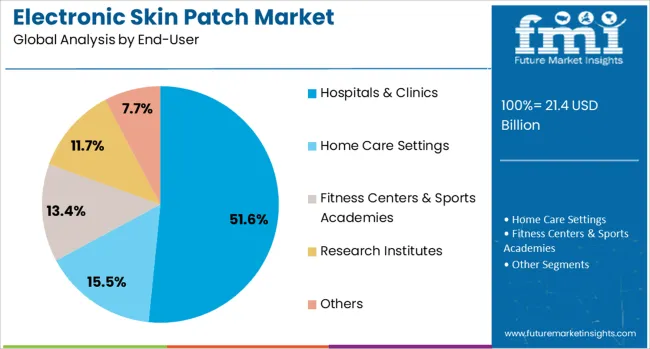

The Electronic Skin Patch Market is primarily driven by healthcare monitoring and diagnostic applications, which account for approximately 38–46% of the total market. These patches are widely used for continuous glucose monitoring, ECG, heart rate, temperature, and SpO₂ tracking. Their non-invasive design and real-time data transmission capabilities make them essential in chronic disease management and remote patient monitoring. Drug delivery and therapeutic applications contribute about 20–25%, with patches being used for transdermal delivery of medications such as insulin, nicotine, pain relief drugs, and hormones. Hospitals and clinics represent the largest end-user base, holding around 42–43% of the market, due to their widespread adoption of skin patches in both inpatient and outpatient care settings. Home healthcare follows with an estimated 20–25% market share, reflecting the growing demand for self-managed health monitoring, especially among elderly and chronic care patients.

Fitness and sports monitoring comprise 5–8%, where athletes use skin patches for real-time data on hydration, lactate levels, and performance optimization. The military and defense segment, though smaller at 2–4%, utilizes patches for monitoring soldiers' physical conditions in field operations. Lastly, consumer wellness and lifestyle applications contribute around 5–7%, driven by rising interest in wearable health tech for everyday use, particularly through online and retail channels.

The electronic skin patch market is gaining substantial traction as advancements in wearable biosensors, flexible electronics, and personalized healthcare converge to reshape traditional health monitoring systems. These skin-adherent devices are increasingly being used for continuous physiological data tracking, offering a non-invasive alternative to conventional diagnostic tools.

Growth in chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders has accelerated the adoption of patches capable of delivering real-time insights to healthcare providers and patients. Miniaturized components and improved sensor-skin interface technologies have contributed to better signal fidelity and long-term wearability.

Integration with mobile health platforms and cloud-based analytics is further enabling remote diagnostics and digital health interventions, which align well with the ongoing global shift toward telemedicine and outpatient care. Regulatory support for remote patient monitoring and the demand for preventive care solutions are anticipated to expand the market's footprint, particularly in regions investing in digital health infrastructure and aging population care systems.

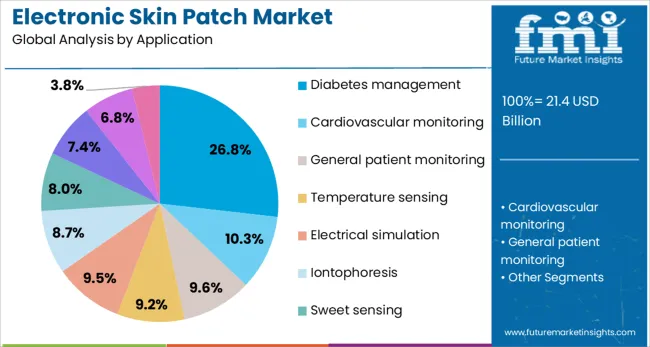

The electronic skin patch market is segmented by product type, application, end-user, distribution channel, and wireless connectivity, as well as geographic regions. The electronic skin patch market is divided by product type into Monitoring & Diagnostic and Therapeutic Patches. In terms of application, the electronic skin patch market is classified into Diabetes management, Cardiovascular monitoring, General patient monitoring, Temperature sensing, Electrical stimulation, Iontophoresis, Sweet sensing, Wound monitoring & treatment, Motion sensing, and Others.

The end-user market for the electronic skin patch is segmented into Hospitals & Clinics, Home Care Settings, Fitness Centers & Sports Academies, Research Institutes, and Others. The distribution channel of the electronic skin patch market is segmented into Offline and Online. The wireless connectivity of the electronic skin patch market is segmented into Connected and Non-connected. Regionally, the electronic skin patch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monitoring and diagnostic segment is projected to contribute 57.4% of the overall revenue share in the electronic skin patch market in 2025, reflecting its dominant role in current and emerging use cases. Growth in this segment has been influenced by rising demand for real-time health data capture, which allows early detection of physiological abnormalities and enhances treatment personalization.

Advances in printed electronics and microfluidic sensor design have enabled patches to monitor parameters such as glucose levels, heart rate variability, and temperature without the need for invasive procedures. Clinical acceptance has increased due to the high reliability and accuracy of diagnostic patches, particularly in cardiac telemetry and ambulatory care.

These solutions have become essential in decentralized trials and outpatient monitoring scenarios, supported by policy shifts promoting remote diagnostics. The capability to integrate with electronic health records and mobile health applications has improved decision-making in clinical workflows, reinforcing the preference for monitoring and diagnostic skin patches across a wide range of healthcare settings.

The diabetes management segment is expected to account for 26.8% of the electronic skin patch market revenue in 2025, indicating its critical importance in chronic care strategies. Continuous glucose monitoring patches have been increasingly adopted due to their ability to provide real-time blood sugar trends without requiring frequent finger pricks. Technological improvements in interstitial fluid sensing and Bluetooth-enabled data transmission have enhanced usability and patient compliance.

The growing prevalence of diabetes, particularly type 2 diabetes in aging populations and high-risk demographics, has led to strong demand for wearable glucose monitoring solutions that are less intrusive and more comfortable. The integration of these devices with insulin pumps and mobile health dashboards supports personalized diabetes management and better glycemic control.

Health insurance providers and government health programs are also recognizing the clinical and economic value of continuous monitoring, further supporting the uptake of skin patches in diabetes care. As digital therapeutics evolve, electronic patches are playing an increasingly central role in disease self-management ecosystems.

Hospitals and clinics are projected to hold 51.6% of the total electronic skin patch market revenue in 2025, signifying their role as primary deployment centers for diagnostic and therapeutic applications. The preference for these end-users is driven by the increasing integration of skin patch-based monitoring solutions into acute care, emergency, and outpatient workflows. These devices offer rapid deployment and continuous monitoring without interfering with patient mobility, making them valuable in both short-stay and chronic care settings.

Clinical validation of patch-based ECG, temperature, and respiratory monitors has supported their inclusion in hospital-grade diagnostic protocols. Moreover, skin patches are being used in post-operative monitoring, neonatal care, and during inpatient recovery to reduce risks and improve patient outcomes.

Their compatibility with electronic medical records and centralized monitoring dashboards supports real-time data access and alerts, enhancing operational efficiency. As healthcare facilities continue adopting remote patient management systems and seek to reduce the burden on hospital infrastructure, electronic skin patches are emerging as vital tools in clinical practice.

Rising chronic disease prevalence and demand for non invasive health tracking are accelerating use of electronic skin patches. Expansion opportunities lie in AI powered analytics platforms and wearable device ecosystem partnerships.

Healthcare providers, home care services, and fitness companies are deploying electronic skin patches to monitor vital signs such as glucose levels, heart rhythm, temperature, and hydration continuously. Wearable patches offer patient friendly and non invasive data collection that reduces hospital visits. Diabetic care is a leading use case while cardiovascular condition management and respiratory monitoring are expanding. Self adhesive sensors with wireless connectivity enable telehealth programs to track patient status in real time. As chronic illnesses rise globally care systems increasingly rely on remote monitoring tools. These devices reduce clinical workload, enhance early intervention capabilities, and support preventive medicine strategies in both chronic and post operative care.

Growth is being enabled through smart patch systems integrated with AI powered analytics that detect anomalies and offer predictive insights. Energy harvesting patches that eliminate need for batteries are gaining ground aided by wearable friendly sensor design. Partnerships with telehealth platforms, wellness app developers, and medical device makers help embed patches into broader care ecosystems. Subscription models for data dashboards and alerts assist healthcare providers and insurers manage patient compliance and health outcomes. Collaborations with textile companies and patch adhesive suppliers ensure skin compatibility and long wear comfort. Co branded pilots with sports clinics and senior care networks provide visibility and validation of patch technology across both clinical and consumer health applications.

Miniaturized electronic skin patches face a core challenge in balancing compact form factors with real-time data processing demands. On-device computational power remains constrained by size and energy limits. Continuous sensing of metrics such as glucose, ECG, perspiration or hydration generates high volumes of raw data that must be transmitted wirelessly or stored for later analysis. Frequent transmission increases power drain and shortens operational longevity. Engineers must optimize signal fidelity while reducing noise and latency, especially in applications requiring real-time intervention. Without efficient algorithms and low-power wireless protocols, patches struggle to deliver actionable insights or meet battery life expectations. Inconsistent performance due to limited onboard processing may hinder adoption in clinical-grade devices. Manufacturers need to balance comfort, connectivity, and analytics capabilities for sustained user compliance and accurate health monitoring.

Electronic skin patches offer compelling value in home-based monitoring of chronic conditions including diabetes, hypertension, and respiratory disorders. Continuous vital sign tracking reduces reliance on clinical visits and enables early detection of warning signs. With increasing telehealth integration, clinicians can remotely review patch-collected data and adjust treatment plans accordingly. This use case shifts patch deployment from acute care into chronic care pathways, positioning patches as preventative health tools rather than reactive diagnostics. Patients using multiparameter patches for hydration, heart rate, ECG or glucose can improve adherence while reducing hospital readmissions. Manufacturers offering long-durability adhesive patches designed for wear over several days perform better in this segment. Integration with portals and clinician dashboards encourages adoption among medical facilities seeking to monitor high-risk patients outside of traditional settings. This expands market potential beyond wearable wellness into medical-grade remote monitoring.

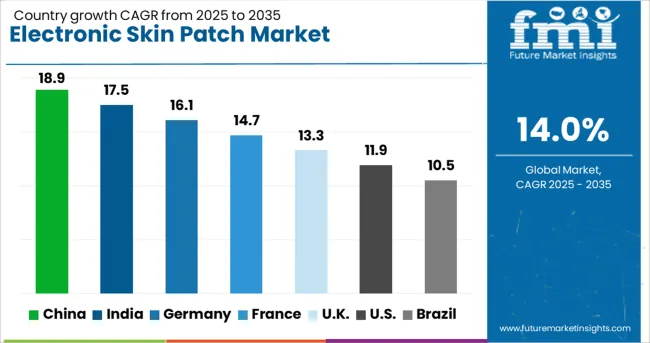

| Country | CAGR |

|---|---|

| China | 18.9% |

| India | 17.5% |

| Germany | 16.1% |

| France | 14.7% |

| UK | 13.3% |

| USA | 11.9% |

| Brazil | 10.5% |

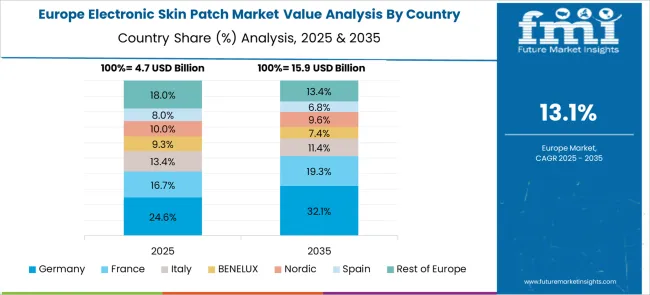

China, a BRICS nation, is projected to grow at 18.9% CAGR from 2025 to 2035, supported by rapid expansion of consumer health monitoring devices and rising demand from hospital-based remote diagnostics. India, also in BRICS, follows at 17.5%, where electronic skin patches are being adopted across home-care settings, especially for glucose tracking and cardiovascular alerts in tier-2 and tier-3 cities. Within the OECD, Germany shows 16.1% growth, backed by consistent procurement from rehabilitation centers and clinical trials using patch-based drug delivery formats. France, at 14.7%, benefits from high acceptance in elderly care, especially in regional health clusters deploying real-time vitals monitoring. The United Kingdom, growing at 13.3%, is seeing increased integration of skin patches in post-operative recovery programs and chronic disease monitoring by NHS-backed pilot programs. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The electronic skin patch market in China is expanding rapidly at a CAGR of 18.9%, driven by the growing healthcare technology ecosystem and increasing demand for wearable medical devices. Advanced sensor systems are being integrated into skin patches for real-time health tracking, including glucose monitoring and cardiovascular functions. Government support for digital health programs is accelerating adoption in both clinical and home care settings. Local manufacturers are investing in flexible, biocompatible materials to improve user comfort and sensor accuracy. Collaborations with research institutes are enabling breakthroughs in non-invasive diagnostics. Rising awareness of chronic disease management and aging population needs is further enhancing growth. Integration of AI and IoT is unlocking opportunities for personalized care delivery.

The electronic skin patch market in India is progressing at a CAGR of 17.5%, supported by rising chronic disease prevalence and growing adoption of digital health tools. Local startups and device manufacturers are prioritizing cost-effective, non-invasive patches for glucose tracking, hydration sensing, and drug delivery. Government initiatives focused on rural healthcare access are expanding the use of wearable diagnostics. Collaborations between hospitals and technology providers are advancing remote patient monitoring and data integration. Innovation in lightweight, hypoallergenic materials is addressing diverse climate and skin conditions. Widespread smartphone use and the growth of telehealth platforms are supporting market penetration in both urban and rural areas.

Germanys electronic skin patch market is advancing at a CAGR of 16.1%, driven by strong healthcare infrastructure and the move toward personalized treatment. Patches are being applied in continuous glucose tracking, wound healing monitoring, and drug delivery systems. Focus on secure data handling and device interoperability is influencing product development. Joint efforts between technology firms and research institutions are resulting in innovations in flexible electronics and skin-safe adhesives. Regulatory support for digital health adoption is facilitating broader clinical use. Demand is increasing due to aging population trends and chronic disease prevalence. Sustainability is being addressed through biodegradable components and eco-conscious production techniques.

The electronic skin patch market in France is experiencing a CAGR of 14.7 percent, supported by healthcare digitization and advancements in flexible bioelectronics. Patches are being utilized for vital sign monitoring, drug delivery, and rehabilitation treatments. National health strategies promoting remote care are increasing usage in homes and hospitals. Companies are integrating multi-sensor technologies with AI-driven analytics for enhanced diagnostics. Research is focused on improving adhesion, breathability, and biocompatibility, especially for sensitive skin. Compliance with strict European medical standards is creating export opportunities for domestic producers.

The electronic skin patch market in the United Kingdom is expanding at a CAGR of 13.3 percent, driven by growing investment in digital health and telemedicine services. Patches are being deployed for real-time monitoring of vital signs, tracking medication adherence, and guiding rehabilitation therapies. Integration with NHS digital health programs is making skin patch technologies more accessible. Research centers and device firms are working together to develop compact sensors with greater sensitivity and long-term wearability. Regulatory alignment and patient-centered design principles are guiding product innovation. Public campaigns are promoting awareness of wearable health devices among senior citizens and chronic disease patients.

The electronic skin patch market comprises a blend of major medical technology firms and specialized device manufacturers, segmented into Tier 1 and Tier 2 suppliers based on scale, innovation, and application focus. Tier 1 suppliers lead in integrated health monitoring solutions, with products designed for large-scale deployment in chronic disease management. These companies offer advanced electronic skin patches that support continuous monitoring of physiological parameters such as glucose levels, heart rate, and body temperature. Their patches are clinically validated, FDA-approved, and often linked to digital health ecosystems that allow real-time data sharing between patients and healthcare providers. These solutions are widely used in diabetes care, cardiac monitoring, and hospital-based remote patient management, benefiting from robust R&D investments and global supply capabilities. Tier 2 suppliers operate at a more specialized level, developing compact, lightweight, and user-friendly skin patches tailored for specific conditions or demographic needs. These firms focus on innovative applications like insulin micro-dosing, wearable ECG tracking, and multi-parameter monitoring for outpatient and telehealth use. While Tier 1 players dominate in terms of volume and infrastructure, Tier 2 companies are gaining traction through rapid innovation cycles, flexible product development, and strong alignment with consumer wellness and preventive healthcare trends. Their skin patches are often designed with comfort and discretion in mind, appealing to users seeking seamless integration into daily routines.

On November 11, 2024, Henkel and Linxens announced a collaboration to showcase a proof-of-concept electronic skin patch with self-regulating heating elements, printed via roll-to-roll technology, at the MEDICA trade show in Düsseldorf. The innovation aims to improve patient comfort in medical wearables.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.4 Billion |

| Product Type | Monitoring & Diagnostic and Therapeutic Patches |

| Application | Diabetes management, Cardiovascular monitoring, General patient monitoring, Temperature sensing, Electrical simulation, Iontophoresis, Sweet sensing, Wound monitoring & treatment, Motion sensing, and Others |

| End-User | Hospitals & Clinics, Home Care Settings, Fitness Centers & Sports Academies, Research Institutes, and Others |

| Distribution Channel | Offline and Online |

| Wireless Connectivity | Connected and Non-connected |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abbott, Dexcom,Inc., Medtronic, InsuletCorporation, iRhythmTechnologies,Inc.(Zio), KoninklijkePhilipsN.V., and Vitalconnect |

| Additional Attributes | Dollar sales by patch type including monitoring and diagnostic, therapeutic, and energy-harvesting; by application such as diabetes management, cardiovascular monitoring, and temperature sensing; and by end-user including hospitals, clinics, and home care settings; demand driven by the need for continuous health monitoring, advancements in flexible electronics, and increasing prevalence of chronic diseases; innovation in wireless connectivity and miniaturization; cost influenced by sensor technology and manufacturing processes; and emerging use cases in personalized medicine and remote patient monitoring. |

The global electronic skin patch market is estimated to be valued at USD 21.4 billion in 2025.

The market size for the electronic skin patch market is projected to reach USD 79.5 billion by 2035.

The electronic skin patch market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in electronic skin patch market are monitoring & diagnostic and therapeutic patches.

In terms of application, diabetes management segment to command 26.8% share in the electronic skin patch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA