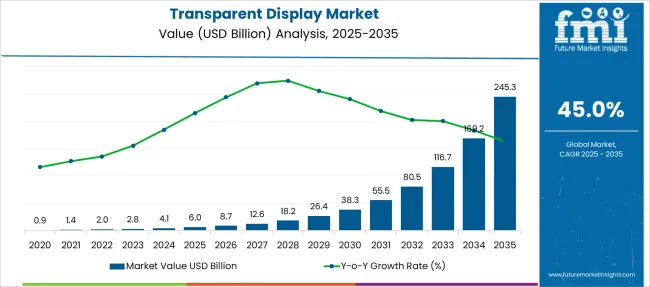

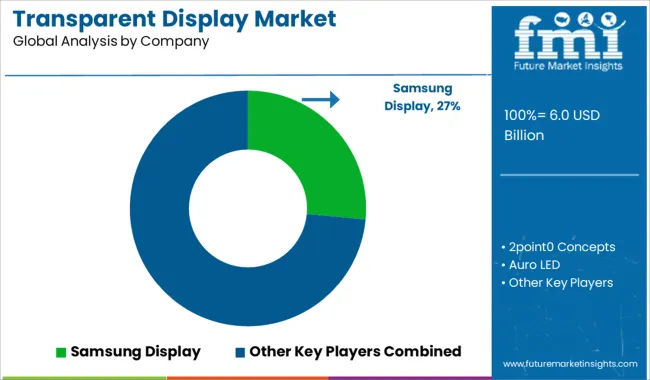

The Transparent Display Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 245.3 billion by 2035, registering a compound annual growth rate (CAGR) of 45.0% over the forecast period.

| Metric | Value |

|---|---|

| Transparent Display Market Estimated Value in (2025 E) | USD 6.0 billion |

| Transparent Display Market Forecast Value in (2035 F) | USD 245.3 billion |

| Forecast CAGR (2025 to 2035) | 45.0% |

The transparent display market is advancing rapidly due to the growing demand for innovative display technologies that enable new user experiences in retail, automotive, and consumer electronics. Developments in organic light-emitting diode (OLED) technology have enhanced display transparency, color accuracy, and energy efficiency, driving adoption in various applications.

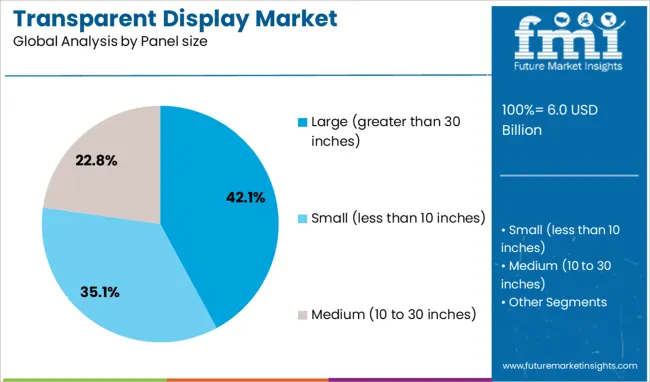

Increasing consumer preference for sleek and futuristic interfaces has expanded opportunities for transparent displays in smart windows, heads-up displays, and augmented reality devices. The expansion of large-format displays greater than 30 inches is supporting market growth by enabling immersive visual experiences in commercial and public environments.

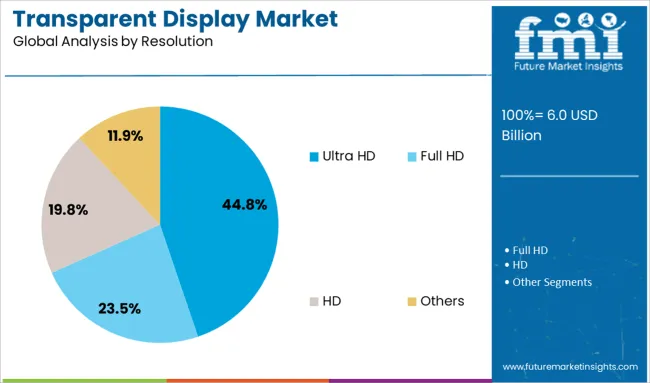

Ultra HD resolution panels are gaining traction as they offer superior image clarity and detail, which is critical for high-end applications. The integration of transparent displays with IoT and smart technologies is expected to accelerate market adoption further. Growth in the transparent display market is expected to be led by OLED technology, large panel sizes, and ultra HD resolution as key driving factors.

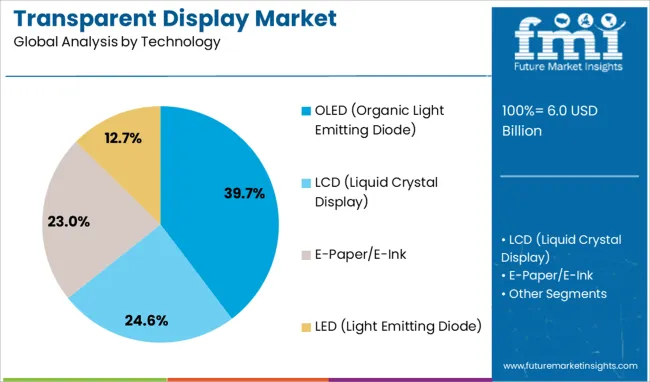

The transparent display market is segmented by technology, panel size, resolution, application, and vertical and geographic regions. By technology of the transparent display market is divided into OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), E-Paper/E-Ink, and LED (Light Emitting Diode). In terms of panel size of the transparent display market is classified into Large (greater than 30 inches), Small (less than 10 inches), and Medium (10 to 30 inches). Based on resolution of the transparent display market is segmented into Ultra HD, Full HD, HD, and Others. By application of the transparent display market is segmented into Digital Signage, HMD, HUD, and Smart Appliance. By vertical of the transparent display market is segmented into Retail & Hospitality, Consumer, Sports & Entertainment, Aerospace & Defense, Healthcare, Automotive & Transportation, Industrial, and Others. Regionally, the transparent display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The OLED technology segment is projected to hold 39.7% of the transparent display market revenue in 2025, maintaining its position as the leading technology. Its growth is attributed to OLED’s superior ability to deliver vibrant colors and deep contrast while maintaining high transparency. OLED displays are lightweight and flexible which makes them ideal for integration into various form factors including curved and transparent surfaces.

Manufacturers have favored OLED due to its low power consumption and fast response times which are critical for dynamic display applications. These characteristics have driven OLED adoption in premium display segments where visual quality and design flexibility are prioritized.

As demand for more interactive and visually appealing transparent displays increases, the OLED segment is expected to continue its leadership.

The large panel size segment greater than 30 inches is anticipated to contribute 42.1% of the market revenue in 2025, positioning it as the dominant size category. This growth is driven by demand for large transparent displays in retail environments, public spaces, and automotive dashboards. Larger panels provide expansive visual areas that improve user engagement and enable more complex display content.

The ability to produce bigger transparent screens with uniform brightness and color consistency has improved significantly. These panels are preferred for installations where visibility and aesthetics are critical such as storefronts, exhibitions, and interactive signage.

As commercial applications expand the preference for larger transparent display panels is expected to remain strong.

The Ultra HD resolution segment is expected to hold 44.8% of the transparent display market revenue in 2025, establishing itself as the leading resolution category. The increasing need for high clarity and detail in transparent displays has driven the adoption of Ultra HD panels especially in sectors such as automotive and retail.

Ultra HD resolution ensures sharper images and a better visual experience, which is critical for augmented reality and heads-up display applications. Consumer demand for immersive and high-quality visual content has accelerated the shift toward Ultra HD displays.

Manufacturers are investing in technologies that support higher pixel densities on transparent substrates while maintaining transparency. With continued advances in display manufacturing and increasing application scope, Ultra HD transparent displays are poised for sustained market growth.

Transparent displays are screens that enable visual content to be viewed through a see‑through panel, often based on OLED, LCD, or electroluminescent technologies. They are integrated into applications such as retail showcases, augmented reality exhibits, digital signage, and head‑up automotive interfaces.

Demand is influenced by the need for immersive visual experiences and innovative presentation formats. Providers offering crisp image quality, high transparency levels, and reliable touch or gesture interactivity have been well positioned. Displays that combine environmental durability and ease of installation continue to shape adoption decisions across consumer, commercial, and automotive sectors.

Adoption of transparent displays has been supported by the desire to create interactive experiences in retail, museums, and hospitality venues. Transparent screens provide brand visibility while displaying dynamic content and enhancing customer engagement. Interest has been seen in vehicle dashboards and head‑up interfaces that present navigational or safety information without obstructing driver view.

Marketing use cases in store fronts and exhibition booths have leveraged transparent panels to generate attention. Technological enhancements improving display brightness, color fidelity, and transparency levels have reinforced uptake. Demand is being raised as experiential displays offer differentiation and memorable interaction in crowded environments.

Growth has been constrained by the premium price of transparent display panels, especially for large‑format or high‑resolution versions. Installation complexity in retrofit scenarios and the need for specialized mounting or housing have increased deployment overhead. Energy consumption for backlighting or ambient lighting conditioning has added operational cost. Ambient light conditions in real‑world settings have impacted readability and perceived contrast.

Maintenance and cleaning requirements for front and rear surfaces have posed practical challenges in high‑traffic installations. Compatibility with existing content systems and media players has required additional configuration effort. Content development for transparent medium has demanded evolved design skills, limiting rapid adoption in some settings.

Opportunities are emerging in automotive head‑up display implementation for navigation, safety alerts, and vehicle information visualization. Retail environments such as high‑end stores, showrooms, and pop‑up experiences offer potential for transparent display use in product demonstrations and interactive windows.

Sector-specific solutions for hospitality, entertainment, and exhibition design are gaining interest. Partnerships with system integrators, digital content providers, and design agencies are enabling the bundled offering of hardware and custom visualization services. Joint development of transparent display‑enabled kiosks or point‑of‑sale modules has broadened deployment prospects. Expansion into smart appliance interfaces and interactive signage solutions continues to open up demand for this display format.

Transparent displays with integrated touch or gesture responsiveness are being adopted to improve user interaction in retail and information kiosks. Layered display design combining transparent screens with ambient sensors or integrated lighting is becoming more prevalent. Dual‑mode display formats that switch between transparent and opaque content presentation are gaining attention. Remote content management systems for scheduling and updating visual content are being used to simplify field operation. Development of flexible or curved transparent panels enables seamless integration into vehicle interiors, architectural glass, and selective enclosure surfaces. Modular display components that can be tiled or joined for large installations are increasingly used in experiential and commercial display projects.

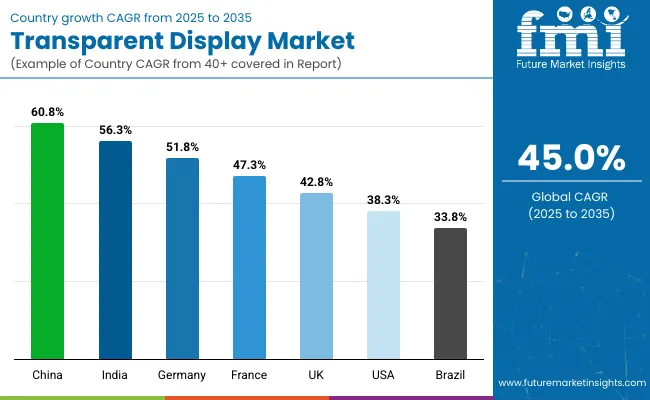

| Country | CAGR |

|---|---|

| China | 60.8% |

| India | 56.3% |

| Germany | 51.8% |

| France | 47.3% |

| UK | 42.8% |

| USA | 38.3% |

| Brazil | 33.8% |

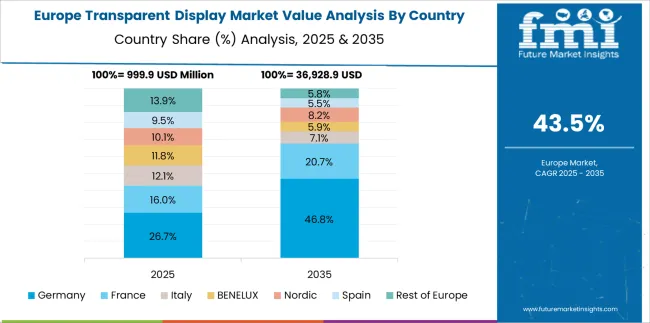

The transparent display market is projected to grow at an exceptional CAGR of 45% between 2025 and 2035, fueled by rising demand for immersive digital signage, automotive head-up displays, and next-generation consumer electronics. China leads at 60.8% CAGR, supported by large-scale integration in retail, transportation hubs, and advanced automotive systems. India follows with 56.3%, driven by AR-enabled displays and expansion of smart retail. Among OECD markets, Germany posts 51.8%, focusing on industrial applications and premium automotive use cases, while France records 47.3%, highlighting luxury retail and museum installations.

The United Kingdom grows at 42.8%, with investments in interactive environments for airports, exhibitions, and commercial spaces. Collectively, BRICS nations (China and India) dominate growth, while European economies (Germany, France, UK) maintain strong adoption through innovation in high-value applications. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to register an impressive 60.8% CAGR, driven by the large-scale integration of transparent displays in retail and transportation hubs. Smart retail stores are utilizing transparent OLED panels for interactive product showcases, while metro systems and airports are adopting these displays for real-time information. Automotive manufacturers are embedding transparent HUDs in electric vehicles to enhance the user experience.

Domestic technology firms are introducing high-resolution, energy-efficient panels to meet the growing demand of consumers. Collaborations with global display manufacturers are strengthening China’s dominance in advanced display production and export. AR-enhanced panels for gaming and entertainment sectors are also driving incremental revenue streams in the country.

India is projected to grow at a 56.3% CAGR, supported by expanding demand in the retail and real estate sectors. Shopping malls and showrooms are integrating transparent OLED and LCD panels for immersive digital signage. Automotive brands are exploring transparent HUD technology for premium vehicles to improve driver safety and convenience.

Startups in the consumer electronics space are experimenting with transparent screens for wearable devices and home automation systems. Investments in digital infrastructure for airports and metro stations are creating opportunities for large-format installations. Collaborations between domestic electronics firms and international display manufacturers aim to reduce costs and expand adoption across mid-segment markets.

Germany is expected to post a 51.8% CAGR, fueled by advanced applications in automotive manufacturing, industrial visualization, and retail spaces. Leading automobile OEMs are integrating transparent HUDs in electric and luxury vehicles to enhance the in-cabin experience. Manufacturing facilities use transparent displays for process monitoring and digital control panels, improving operational efficiency. Retail brands in Germany deploy transparent display walls for interactive product engagement in premium outlets.

Technology companies are investing in high-brightness panels suitable for outdoor advertising and smart public information systems. Strong partnerships between display innovators and automotive giants solidify Germany’s position as a high-value application hub for transparent display technology.

France is forecast to grow at a 47.3% CAGR, driven by transparent display integration in luxury retail, museums, and cultural spaces. Leading fashion brands deploy transparent OLED screens in storefronts for immersive brand storytelling and real-time content projection. Museums and art galleries use transparent display walls to provide digital layers over physical exhibits, enhancing visitor engagement.

Transportation hubs adopt transparent displays for navigation and digital information systems. Manufacturers are introducing energy-efficient panels with ultra-slim designs to meet the aesthetic needs of premium environments. Strategic collaborations with luxury retail chains ensure widespread implementation of transparent display solutions across flagship stores in France.

The United Kingdom is projected to expand at a 42.8% CAGR, supported by the increasing demand for interactive installations across commercial and public spaces. Airports, railway stations, and shopping centers are leading the deployment with transparent digital signage for dynamic passenger communication. Enterprises are adopting transparent panels for corporate presentations and experience zones.

The entertainment sector integrates transparent screens into stage setups and interactive museum exhibits, creating immersive environments. Display manufacturers in the UK are focusing on developing lightweight, durable panels for easy installation in modular systems. Growing interest in AR-compatible transparent screens further amplifies demand across commercial applications.

The transparent display market is highly competitive, with major players such as Samsung Display, LG Electronics, BOE Technology Group, Panasonic, and Universal Display Corporation leading through advanced OLED and LCD technologies for commercial, retail, and automotive applications. Samsung and LG dominate premium segments with large-format transparent OLED panels, leveraging strong R&D capabilities and integration with AR/VR ecosystems.

BOE Technology Group focuses on scaling production for high-resolution transparent displays, targeting consumer electronics and smart signage markets. Panasonic and Planar Systems deliver high-clarity transparent LCD solutions optimized for digital retail displays and interactive kiosks. Companies like Leyard, Nexnovo, and ClearLED specialize in LED-based transparent screens for outdoor advertising and large-scale digital installations, while Crystal Display Systems and Pro Display offer modular solutions for architectural and exhibition applications.

Niche innovators such as Kent Optronics and HOX LED Technology emphasize customized display systems for defense and automotive HUD (Head-Up Display) markets, integrating durability with optical performance. Market rivalry is intensifying as transparent display adoption expands across smart retail, automotive displays, and next-generation consumer electronics. Competitive differentiation relies on transparency ratio, brightness, energy efficiency, and seamless integration with IoT and AR platforms. Entry barriers remain high due to complex manufacturing processes, high production costs, and the need for specialized supply chains.

Future competitiveness will be shaped by the commercialization of flexible OLED panels, transparent micro-LED technologies, and AR-enabled smart glass solutions. Companies investing in high-transparency materials, enhanced color reproduction, and scalability for large-format applications are expected to lead in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Technology | OLED (Organic Light Emitting Diode), LCD (Liquid Crystal Display), E-Paper/E-Ink, and LED (Light Emitting Diode) |

| Panel size | Large (greater than 30 inches), Small (less than 10 inches), and Medium (10 to 30 inches) |

| Resolution | Ultra HD, Full HD, HD, and Others |

| Application | Digital Signage, HMD, HUD, and Smart Appliance |

| Vertical | Retail & Hospitality, Consumer, Sports & Entertainment, Aerospace & Defense, Healthcare, Automotive & Transportation, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Display, 2point0 Concepts, Auro LED, BenQ Display, BOE Technology Group, Clearled, Crystal Display Systems, Glimm Display, HOX LED Technology, Huake Light Electronics, Japan Display, Kent Optronics, Leyard, LG Electronics, Nexnovo, Panasonic, Planar Systems, Pro Display, Unit LED, and Universal Display Corporation |

| Additional Attributes | Dollar sales by display type (OLED, LCD, micro-LED) and application (retail signage, automotive HUD, consumer electronics, industrial displays), with demand driven by immersive advertising experiences, smart city initiatives, and automotive integration. Regional trends indicate strong adoption in Asia-Pacific due to consumer electronics manufacturing hubs, while North America and Europe focus on retail digitization and automotive innovation. Innovation trends center on ultra-thin transparent panels, flexible substrates, and integration with augmented reality for interactive and dynamic content delivery. |

The global transparent display market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the transparent display market is projected to reach USD 245.3 billion by 2035.

The transparent display market is expected to grow at a 45.0% CAGR between 2025 and 2035.

The key product types in transparent display market are oled (organic light emitting diode), lcd (liquid crystal display), e-paper/e-ink and led (light emitting diode).

In terms of panel size, large (greater than 30 inches) segment to command 42.1% share in the transparent display market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transparent Barrier Laminators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Paper Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Coating Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Digital Signage Market Analysis by Type, End Users and Region Through 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA