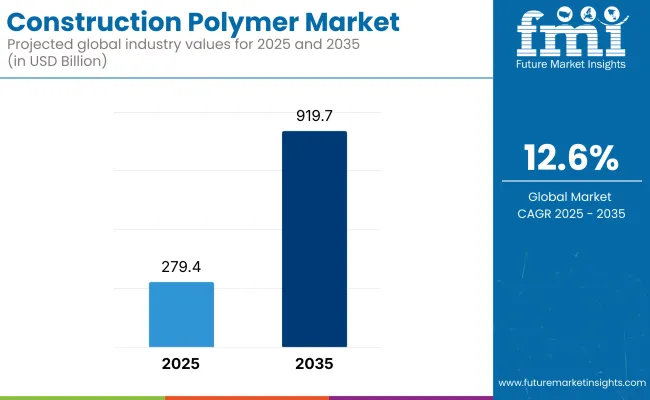

The construction polymer market is going to witness phenomenal growth during the forecast period between 2025 and 2035, and the global market is expected to expand from USD 279.4 billion in 2025 to USD 919.7 billion by 2035 at a CAGR of 12.6%. This growth is fueled by growing demand for superior-performance construction materials with durability, sustainability, and improved functional properties.

Building polymers-like polyvinyl chloride (PVC), polyethylene (PE), polystyrene (PS), polyurethane (PU), and epoxy resins-are used extensively in numerous applications ranging from insulation, flooring, and waterproofing to piping, sealants, adhesives, and protective coatings.

Their resistance to corrosion, chemicals, moisture, and the environment gives them a critical role in modern building technologies. It also allows designers and builders to enjoy a great level of flexibility, leading to faster project completion and lower lifecycle costs. Infrastructure and housing needs are behind accelerated urbanization and population growth, especially among emerging economies in the Middle East, Latin America, and Asia-Pacific regions.

At the same time, growing green building material popularity and worldwide green construction efforts are spurring the use of advanced polymers even more. The lightweight, energy-efficient, and recyclable characteristics of polymers make them suitable for compliance with tough environmental and energy laws of contemporary architecture and engineering.

Advances in polymer science through technology are enabling the production of tailored solutions with improved mechanical strength, fire retardancy, thermal insulation, and long-term stability. Environmentally sensitive intelligent self-healing polymers are surfacing to prominence, with unparalleled potential for building construction applications.

Residential and commercial building construction works are large end-user applications, complemented by public and private investment in infrastructure development, e.g., smart cities, airports, industrial buildings, and transportation systems. In addition, retrofitting and renovation of aging infrastructure in North America and Europe are creating large industry opportunities for construction polymers used in energy-efficient renovation and weather resistance.

The industry is not problem-free. Environmental issues surrounding consumption and disposal of synthetic polymers and volatile raw material prices continue to be major restraints. This has prompted more R&D in recyclable and bio-based polymers with a view to curtailing the environmental impact of construction.

The construction polymer industry is entering a period of high growth between 2025 and 2035, driven by the convergence of innovation, sustainability, and world infrastructure development. With greater focus on durability, energy efficiency, and design flexibility, construction polymers will revolutionize the materials landscape and become building blocks in the buildings of the future.

Market Metrics (2025 to 2035)

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 279.4 billion |

| Industry Value (2035F) | USD 919.7 billion |

| CAGR (2025 to 2035) | 12.6% |

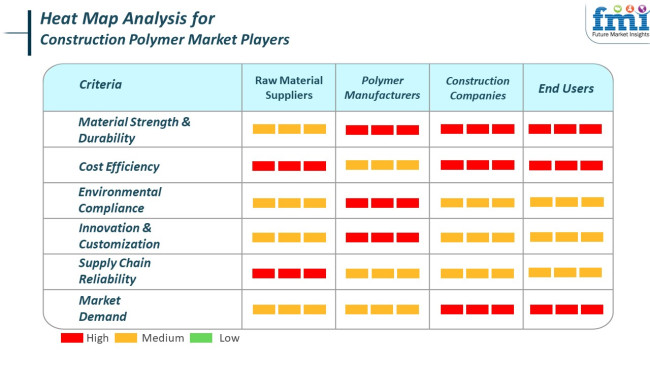

The construction polymer industry is characterized by a system of stakeholders with varied priorities, which mirror the complex needs of the construction sector. Polymer producers and builders highly value material strength, durability, and environmental and regulatory compliance to ensure the sustainability and structural integrity of their offerings.

Raw material suppliers, however, value somewhat moderately material performance, but place high importance on supply chain reliability and economy.End-users and construction companies-such as contractors and property developers-value cost-effectiveness, long-term performance, and flexibility to industry trends to ensure project completion and budgetary constraints.

End-users rank regulation second and turn to upstream partners for provision of standards compliance. Innovation and customization are precious end to end but are most important at the manufacturing level where product creation happens. As light, energy-saving, and sustainable materials gain increased demand, priorities of stakeholders need to be coordinated to maintain pace in the construction polymer industry.

Between 2020 and 2024, the construction polymer sector experienced steady growth, driven by increased usage of high-technology materials in the construction of infrastructure and housing. Flexible, lightweight, and durable polymers such as PVC, HDPE, polypropylene, and epoxy resins found widespread application in piping, insulation, flooring, sealants, and adhesives.

The industry was supported by green building projects, smart building materials trends, and waterproofing systems trends. Microplastic problems, inefficient recycling processes, and unstable petrochemical costs, however, affected supply and sustainability issues. In the subsequent decade, 2025 to 2035, the construction polymers industry will witness a transition towards performance-based, smart, and green polymers.

Bio-based polymers, recyclable thermoplastics, and self-healing polymers will be the highlight with their innovations. Sustainability, lifecycle impact, and conformity to circular economy principles will become the focus. AI-designed polymers, nano-enriched strength and insulation, and sensor-integrated composites will become the standard in high-performance infrastructure.

Regulations by governments will encourage non-toxic, low-VOC, and recyclable materials in public projects. Polymers will also be a vital part of 3D-printed architecture, modular construction, and climate-resilient infrastructures, facilitating durability and energy efficiency targets.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Urbanization, modernization of infrastructure, waterproofing needs, and flexibility in material construction. | Climate requirements, circular economy needs, and the use of intelligent materials in green and resilient infrastructures. |

| PVC, HDPE, epoxy resins, polystyrene, polyurethanes as insulation, pipes, sealants. | Bio-based polymers, recycling-friendly thermoplastics, and intelligent composites with built-in sensors and adaptive properties. |

| Recycling was minimal; high environmental burden of synthetic polymers was an issue. | High emphasis on eco-design, biodegradability, and lower embodied carbon materials. |

| Conventional mixing and application techniques, restricted use of automation. | AI-aided polymer science, robot-guided application, and computer-optimized formulation. |

| Mechanical strength, water resistance, and flexibility were the most popular. | Temperature control, self-healing, fire resistance, and sensitivity to actual real-time environmental change. |

| Constrained to single thermal insulation and sealing use. | Applied in 3D printing, energy-harvesting surfaces, and IoT -based structural health monitoring. |

| Petrochemical price volatility, waste disposal issues, and regulation. | Plastic ban compliance, transition to renewables, and materials lifecycle responsibility. |

| VOC emissions caps, material certification at base level, and code compliance building. | Net-zero building codes required, carbon content labeling, and complete recyclability certifications needed. |

| Roofing, piping, flooring, sealants, adhesives, thermal insulation. | Smart façades, modular building panels, printed structures, and coastal defense. |

| Short-term use with disposal issues; emphasis on upfront cost savings. | Lifecycle value analysis considering reuse, recyclability, and end-of-life design. |

The global construction polymer market is likely to experience massive growth owing to increasing urbanization, infrastructural development, and the demand for ecologically friendly construction products. These increases are due to the flexibility and strength of polymers, which have their use in applications such as pipes, fittings, insulation, and adhesives.

Even with the positive scenario, there are a number of risks that may affect the course of the market. One of the major worries is volatility in raw material prices. Most construction polymers are made from petrochemical products, and crude oil price fluctuations can have a direct bearing on manufacturing costs.

This uncertainty might contribute to higher costs for manufacturers and, consequently, consumers, influencing overall demand. Environmental regulations pose another challenge. With the world moving towards sustainability, there is increasing scrutiny regarding the environmental effect of polymer production and disposal.

Regulatory actions towards minimizing carbon footprints and recycling could require huge investments in research and development of environmentally friendly alternatives. Those companies that do not evolve may face legal action and reduced industry share. There is also competition from alternative materials in the industry.

The traditional construction materials, including metal, wood, and concrete, are still improving with performance and sustainability enhancements. New materials like bio-based composites are also coming into play more and more. These replacements can limit the expansion of construction polymers if they provide the same value at lower expense or with a lower environmental footprint. Supply chain disruption also poses risk.

Globalization of polymer production entails that political tensions, trade restrictions, or unexpected events such as pandemics may interfere with raw material supply and finished products supply. Such interruptions can lead to project delays and cost overruns that affect consumers and suppliers.

To address these threats, players in the industry must diversify sources of raw materials, invest in green product innovation, and build resilient supply chains. Adapting to evolving regulations and innovation will be the secret to competing in the evolving construction polymer industry.

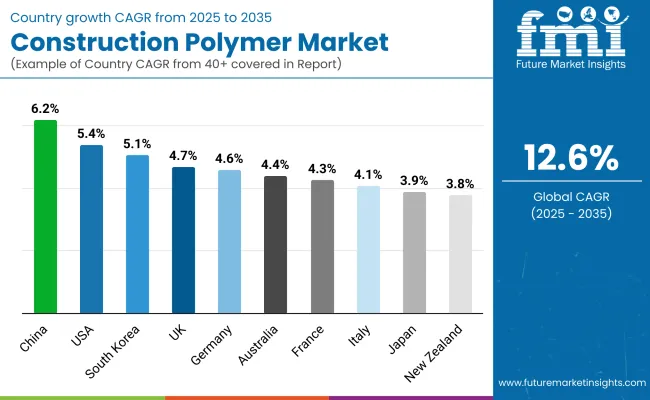

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.7% |

| France | 4.3% |

| Germany | 4.6% |

| Italy | 4.1% |

| South Korea | 5.1% |

| Japan | 3.9% |

| China | 6.2% |

| Australia | 4.4% |

| New Zealand | 3.8% |

The USA polymers industry for construction is anticipated to exhibit a CAGR of 5.4% during 2025 to 2035 on the basis of the growth of infrastructure rebuild projects, green building codes, and tall buildings urbanization. Increased federal and state-level spending in smart cities projects and highways is driving greater application of advanced polymers such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) in structural applications, insulation, waterproofing, and cement additives.

The key industry players in the USA industry are BASF Corporation, DuPont, and Dow Inc., which are continuing to develop growing product lines exclusively for green building construction. Focus on energy conservation and fire-resistant materials is also increasing the demand for higher-end thermoplastic and thermoset polymers. Applications in commercial and industrial buildings are driving a dominant share of overall industry revenue, supported by constant innovation in prefabrication technology and polymer composites.

The UK construction polymers industry is set to grow at a CAGR of 4.7% during the forecast period due to the imposition of strict environmental regulations and a low-carbon infrastructure drive across the nation. The application of high-performance polymers in retrofit and green buildings is gaining prominence, particularly in urban regeneration projects and energy-efficient housing schemes.

Important industry players such as SABIC UK Petrochemicals and Lucite International are developing sustainable options that align with circular economy values. Uses of polymers for insulating panels, sealants, adhesives, and piping systems are also becoming increasingly popular due to evolving construction codes. Ongoing investment in public transport and renewable energy infrastructure also contributes to the demand for resilient and corrosion-resistant polymeric products.

France is also expected to witness a CAGR of 4.3% in the construction polymer industry during 2025 to 2035, with its growth being driven by urban infrastructure development, energy renovation projects, and resilient construction. Government-led initiatives to reduce greenhouse gas emissions are prompting the adoption of recyclable and lightweight polymer-based components in residential and commercial structures.

Dominant players such as Arkema Group and Total Energies are seriously making a move in bio-based and high-performance polymer markets. Increased use of ethylene-vinyl acetate (EVA), acrylics, and elastomers in façades, flooring, and water storage facilities is increasing industry momentum. Prefabrication also contributes to the appeal of polymer composites in terms of speed, flexibility, and cost savings.

The German construction polymer market is expected to achieve a CAGR of 4.6% from 2025 to 2035 with the aid of strong industrial infrastructure, sustainability regulations, and a strong mechanical engineering base. The polymers find widespread applications in thermal insulation, geomembranes, and structural reinforcement in residential as well as commercial construction.

Large players such as BASF SE and Covestro AG are conducting research and development to develop highly resilient polymers with improved heat and sound properties. Polymer-modified concrete and water membrane usage is quickly on the rise, primarily in mass-based infrastructural overhauls and flood protection projects. Smart material integration in buildings is advancing industry complexity as well as innovation.

Italy's construction polymer market is anticipated to grow at a CAGR of 4.1% over the forecast period, led by the revival of residential buildings, seismic rehabilitation, and green urban development. The increasing focus on polymer-based solutions for power saving and free-form architectural construction is fuelling demand for applications within civil engineering.

Firms such as Versalis S.p.A. and RadiciGroup are enhancing product supply in the high-density polyethylene (HDPE) and thermoplastic elastomer industry. The use of construction polymers in roofing, panel systems, and structural glazing is increasing, especially in southern regions where climatic resistance is a key factor. Emphasis on circular economy approaches also influences product composition and recycling operations at the end of life.

South Korea is likely to register a CAGR of 5.1% in the industry for construction polymers during 2025 to 2035, driven by the high-speed redevelopment of cities, smart city initiatives, and cutting-edge construction technology. Strong government initiatives for infrastructure digitization and green performance are driving polymer demand in new-age construction applications.

Large industry players such as LG Chem and Lotte Chemical are offering innovative polymer solutions suitable for application in modular construction and high-performance insulation systems. Polymers are finding more applications in bridge rehabilitation, tunnel lining, and coast defense, particularly due to their strength-to-weight and corrosion characteristics. Emerging building technology such as 3D printing is also finding increasing use of polymers in building construction.

The Japanese construction polymers market will likely record a CAGR of 3.9% over the forecast period due to sustained investments in long-lasting infrastructure and retrofitting existing buildings. Growing seismic activity in the region has further increased applications of polymers in structural damping, sealing joints, and impact-resistant coatings.

Major industry players like Mitsubishi Chemical Group and Sumitomo Chemical are spearheading innovation in specialty polymers for construction. The growing use of high-performance plastics in energy-efficient windows, exterior wall systems, and buried pipes is fueling consistent demand. Emphasis on space-saving, disaster-resistant housing also promotes increased use of polymers in architectural elements.

China is also expected to lead the industry for construction polymers with the fastest growth of 6.2% CAGR from 2025 to 2035. The expansion of urbanization, industrial parks, and smart infrastructure is heavily driving the use of polymer-based construction materials. Green building certification and the adoption of new-generation construction technologies are consolidating the integration of polymers in applications.

Major manufacturers such as Sinopec, China National Petroleum Corporation (CNPC), and Wanhua Chemical are expanding capacities to accommodate surging domestic demand. Applications in thermal insulation, waterproofing, and structural strengthening are increasing rapidly. The expanded application of polymers in prefabricated and modular construction is also set to drive industry value further in the forecast period.

Australia is likely to achieve a CAGR of 4.4% for the construction polymer market between 2025 and 2035 on the back of population growth, commercialization, and climate-resilient infrastructure needs. Polymers are finding more usage in energy-efficient housing and transportation infrastructure, especially in coastal zones and high-risk weather conditions.

Leading producers such as Orica and DuluxGroup are propelling polymer use expansion in external cladding, protective coats, and reinforced concrete. Expansion in the use of PVC and polyurethane systems in plumbing, flooring, and insulation is enhancing construction quality and life. Also, promoting industry innovation and substitution in materials are sustainable construction policies backed by governments.

New Zealand's industry is projected to achieve a growth rate of 3.8% CAGR during the forecast period owing to reconstruction activities, seismic-resistant building codes, and environmental sustainability. The demand for polymeric products in light and flexible construction is driving industry growth.

Companies such as Nuplex Industries and indigenous subsidiaries of international polymer providers are actively providing demand for tough and low-maintenance materials in buildings. The use of polymers is observed to grow in waterproof membranes, structural sealants, and composite panels. Policy incentives for green building approaches and disaster avoidance approaches continue to enhance the strategic value of polymers in infrastructure planning.

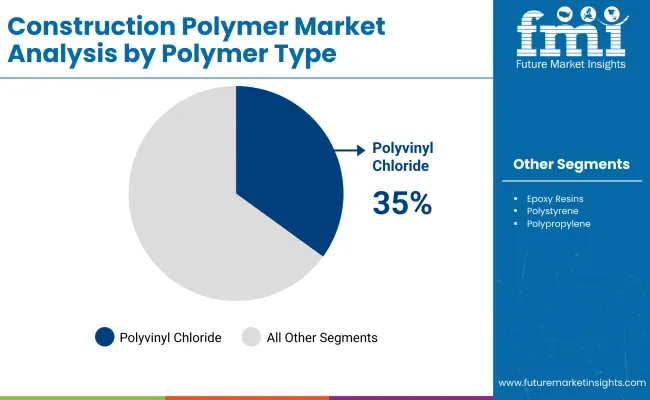

Polyvinyl chloride will dominate the construction polymers market with a share of approximately 35% in 2025. This is owing to its excellent chemical resistance, flame retardancy, low cost, and wide applications in piping systems, window profiles, cable insulation, and waterproof membranes, mainly in the water supply and sewage infrastructures.

Demand for PVC is proving very promising due to new investments being made in water infrastructure by Asian and African governments. For instance, Formosa Plastics Group is a major global supplier that continues to grow PVC production capability to meet international demands for infrastructure projects.

In the United States, Westlake Corporation and OxyVinyls (a division of Occidental Petroleum) are key PVC suppliers that serve both commercial and residential construction markets. Linking production with sustainability goals, these companies are to offer phthalate-free and recyclable PVC alternatives that have already gained ground on green construction projects. About 25% of the entire market is kept by polyethylene (PE).

It is the most extensive application in geomembranes, vapor barriers, roofing membranes, protective sheeting, and cable jacketing. It has high impact resistance, flexibility, and moisture resistance, making it appropriate for both house types and commercial construction. Popularly used in underground piping and radiant heating systems are high-density polyethylene (HDPE) and cross-linked polyethylene (PEX).

Various chemical manufacturers in the world, such as LyondellBasell Industries and Dow Inc., are concentrating their research on advanced PE materials for construction applications. For instance, Dow's ELVALOY™ series features improved weathering resistance for roofing membranes. Similarly, SABIC and Borealis have developed circular PE solutions with recycled content to contribute to low-carbon steps in construction.

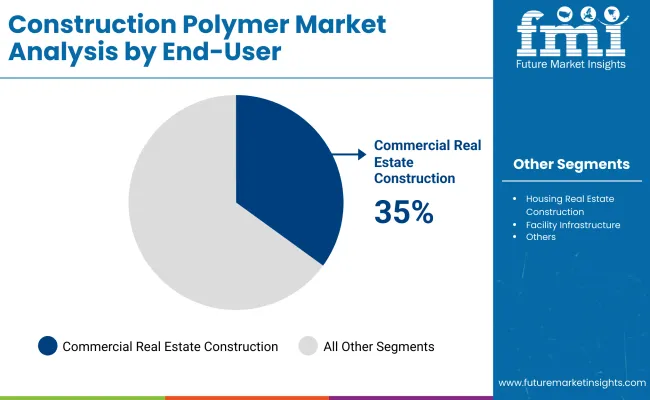

Commercial real estate construction will become the largest end user in 2025, accounting for 35% of the construction polymer market. It comprises office complexes, hotels, shopping malls, and public infrastructure. The product demand is mainly in urban redevelopment and smart cities because of post-pandemic projects.

Polymers are also applied in energy-efficient façades, HVAC insulation, plumbing systems, and flooring. Such polymer-based innovations that help in delivering high-performance construction solutions are, on the other hand, well utilized by companies like BASF, REHAU Group, and others. REHAU's RAUVISIO and RAUTITAN systems are seen mostly in high-rise commercial buildings in Europe and North America for plumbing and heating installations.

Moreover, BASF's Neopor® expanded polystyrene insulation is making its way into increasing number of commercial buildings for thermal regulation and savings on energy. A further 30% comes from housing real estate construction, boosted by ever-growing housing demands, especially in developing countries like India, Indonesia, Nigeria, and Brazil. Affordable housing schemes that will not require time before completion can be scaled easily up or down, and cost less has become a priority for most governments.

Hence, polymer products such as PVC pipes, PE membranes, foam insulation panels, and composite siding are essential to the modern method of construction in housing. Indian players such as Supreme Industries and Astral Poly Technik have scaled their polymer product offerings to support the massive housing efforts under PMAY, the Pradhan MantriAwasYojana of India. Similarly, Mexichem, a subsidiary that now belongs to Orbia, is the biggest player in PVC-based housing solutions across Latin America, including water piping and electrical conduits.

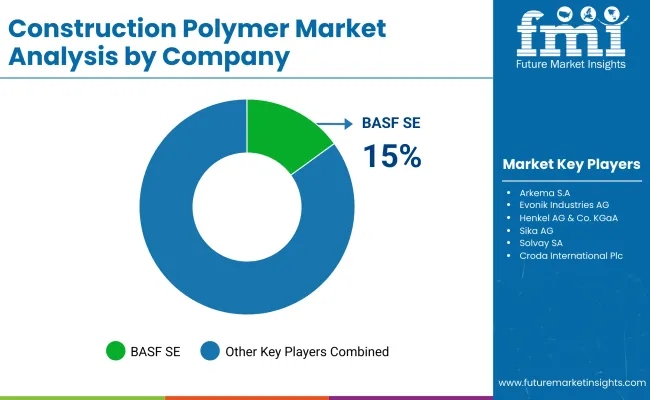

The competitive environment of the construction polymers market includes international chemical firms using advanced formulations of polymer technology with very eminent sustainability and supply chain integration with comparative advantage to maintain their standing in the industry. BASF SE, Arkema S.A., and Evonik Industries AG shall always be the leading figures in the construction polymer market because of their diversified product portfolio, high-performance polymer solutions, and large global distribution networks.

These companies invested huge amounts in R&D and other strategic acquisitions to enhance their competitiveness in high-growth applications such as polymer-modified concrete, waterproofing membranes, and structural adhesives. Thus, the global leaders are matched by the strength heaves of some regional players like SCG Chemicals and Formosa Plastics Corp, which emphasize cost-efficient production and raw material access for regional industry dominance to compete with international leaders.'

Companies have gone further by adopting sustainability and green practice development in polymers as competitive differentiators. Henkel AG & Company, Sika AG and Dupont are taking steps to advance bio-based and recyclable construction polymers, addressing both environmental regulation and the green building materials demanded by customers. Such investments include those in low-VOC adhesives, energy-efficient polymer processing, and carbon-neutral production technologies.

Technological innovations in high-performance polymers, complemented by nanodevices and embedded sensor technology, drive differentiation. 3M Company and Momentive Performance Materials both focus on developing installations such as self-healing polymers, conductive polymer coatings and durably robust sealants that meet next-generation construction needs.

They are coming up with advanced material innovations, such as polymer composites that can have high strength-to-weight ratios, giving very good performance for reinforced concrete, insulation materials, and protective coatings. Firms adopt AI-driven formulation techniques and digitalized production methods for optimizing polymer synthesis and polymer performance testing.

Market Share Analysis by Company

| Company Name | Industry Share (%) |

|---|---|

| BASF SE | 15-19% |

| Arkema S.A. | 12-16% |

| Evonik Industries AG | 10-14% |

| Henkel AG & Co. KGaA | 8-12% |

| Sika AG | 6-10% |

| Combined Others | 35-45% |

| Company Name | Key Offerings and Activities |

|---|---|

| BASF SE | Leading in high-performance construction polymers, focusing on bio-based, sustainable, and durable polymer solutions. |

| Arkema S.A. | Specializes in advanced adhesives, sealants, and lightweight polymer composites for infrastructure and construction applications. |

| Evonik Industries AG | Develops innovative polymer additives, coatings, and insulation materials with superior durability and energy efficiency. |

| Henkel AG & Co. KGaA | Pioneers in eco-friendly adhesives and sealants, integrating digital solutions for performance optimization. |

| Sika AG | Focuses on high-strength construction adhesives and waterproofing polymer technologies for large-scale projects. |

Key Company Insights

BASF SE (15-19%)

Leading in sustainable polymer innovations, advancing bio-based polymers and AI-driven material formulation for next-generation construction applications.

Arkema S.A. (12-16%)

Strengthening high-performance adhesive and polymer composite portfolios, integrating lightweight solutions for energy-efficient building materials.

Evonik Industries AG (10-14%)

Innovating advanced polymer coatings and insulation technologies, leveraging nanomaterials and smart polymer systems for improved durability.

Henkel AG & Co. KGaA (8-12%)

Investing in low-VOC adhesives and AI-powered material analytics, enhancing sustainability and performance in polymer-based construction materials.

Sika AG (6-10%)

Developing high-strength waterproofing and structural polymer solutions, focusing on infrastructure longevity and extreme weather resistance.

Other Key Players

The industry is segmented into epoxy resins, polystyrene, polycarbonate, polyethylene, polyisobutylene, polymethylmethacrylate, polypropylene, polyurethane, polyvinylchloride, and others.

The industry is segmented into walls, floorings, piping, windows, roofs, insulation and sliding, glazing, cladding, plastic wraps, and other applications.

The industry is segmented into commercial real estate construction, housing real estate construction, industrial construction, facility infrastructure, transportation infrastructure, utility infrastructure, and other infrastructure.

The industry is segmented into new construction and renovation.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The market is estimated to be USD 279.4 billion in 2025.

By 2035, the market is projected to reach approximately USD 919.7 billion, driven by increasing demand for durable, lightweight, and sustainable construction materials.

China is expected to experience a 6.2% CAGR, fueled by rapid urbanization, large-scale infrastructure projects, and green building initiatives.

Polyvinyl Chloride (PVC) is the leading product type, widely used in pipes, cables, and fittings due to its cost-efficiency and performance in construction environments.

Key companies include BASF SE, Arkema S.A., Evonik Industries AG, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, Momentive Performance Materials Inc., Solvay SA, DuPont, SCG Chemicals Co., Ltd., Croda International Plc, 3M Company, Polyone Corporation, and Formosa Plastics Corp.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Polymer Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Polymer Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by End-User, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Construction Activity, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 26: Global Market Attractiveness by Polymer Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by End-User, 2023 to 2033

Figure 29: Global Market Attractiveness by Construction Activity, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 56: North America Market Attractiveness by Polymer Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by End-User, 2023 to 2033

Figure 59: North America Market Attractiveness by Construction Activity, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Polymer Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Construction Activity, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Polymer Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Construction Activity, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Polymer Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Construction Activity, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Polymer Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Construction Activity, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Polymer Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Construction Activity, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Polymer Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Polymer Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Polymer Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Polymer Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Polymer Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by End-User, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Construction Activity, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Polymer Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Construction Activity, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-Based Construction Polymer Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA