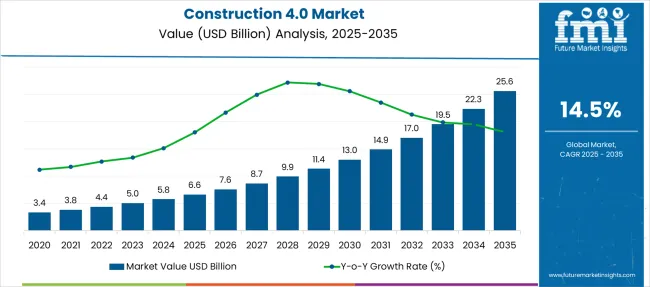

The Construction 4.0 Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 25.6 billion by 2035, registering a compound annual growth rate (CAGR) of 14.5% over the forecast period. This reflects a growth multiple of 3.88 times at a compound annual growth rate of 14.5%. When analyzed through macroeconomic indicators, the market exhibits medium to high sensitivity during the early years, particularly tied to infrastructure investment trends, credit availability, and fluctuations in construction material costs.

Between 2025 and 2030, the market is expected to reach approximately USD 13.1 billion, adding USD 6.5 billion in new value. This phase shows higher elasticity as construction technology adoption is closely linked to public infrastructure budgets and private real estate activity. From 2030 to 2035, an additional USD 12.5 billion is forecasted, supported by growing standardization of data-driven project management and modular building processes, which reduce reliance on cyclical funding patterns. Players such as Trimble, Hexagon, and Topcon are deploying integrated solutions combining machine control, sensor telemetry, and building information modeling. Over time, elasticity is expected to decline as construction 4.0 transitions from optional enhancement to baseline operational strategy, supported by cost savings, improved precision, and safety optimization across project lifecycles.

The construction 4.0 market holds approximately 40% of the digital construction solutions market, driven by the adoption of 3D modeling, simulation, and cloud-based project planning. It contributes nearly 30% to the smart building technologies market, where real-time monitoring and intelligent control systems are used during construction. Around 25% of the industrial robotics and automation market is linked to construction applications, such as robotic arms, autonomous equipment, and modular assembly. It accounts for close to 35% of the IoT and connected devices market, where sensor-based data collection improves on-site decision-making. In the construction management software services market, it comprises around 45%, due to integration of scheduling, cost control, and workflow automation tools.

The sector is evolving rapidly as automation, digitalization, and advanced analytics reshape project execution and infrastructure planning. Robotics and AI-powered machinery are being deployed for tasks such as bricklaying, excavation, and structural assembly, reducing labor dependency and enhancing precision. Digital twin platforms combined with real-time sensor data enable continuous site monitoring, improving safety, scheduling, and cost control. Predictive analytics and machine learning algorithms are streamlining material procurement, maintenance planning, and resource allocation. Additive manufacturing and modular construction techniques are reducing waste and accelerating project timelines. These innovations are driving a shift toward data-centric, intelligent construction ecosystems across global markets.

| Metric | Value |

|---|---|

| Construction 4.0 Market Estimated Value in (2025E) | USD 6.6 billion |

| Construction 4.0 Market Forecast Value in (2035F) | USD 25.6 billion |

| Forecast CAGR (2025 to 2035) | 14.5% |

The Construction 4.0 market is evolving rapidly as the industry embraces digital transformation to enhance productivity, reduce operational costs, and improve project delivery timelines. Integration of smart technologies such as IoT, AI, robotics, and advanced data analytics has accelerated the shift toward connected, automated, and data-driven construction ecosystems.

The global focus on infrastructure development, coupled with labor shortages and the demand for safer, more efficient work environments, is propelling the adoption of Construction 4.0 solutions. Companies are increasingly investing in intelligent machinery, cloud-based platforms, and real-time monitoring systems to optimize resource usage and gain predictive insights.

The future outlook remains strong, driven by government support for smart infrastructure, rising adoption of Building Information Modeling (BIM), and the need for increased transparency and accountability in large-scale construction projects. As stakeholders recognize the long-term value of digital tools in mitigating delays and minimizing rework, Construction 4.0 is expected to become the industry standard.

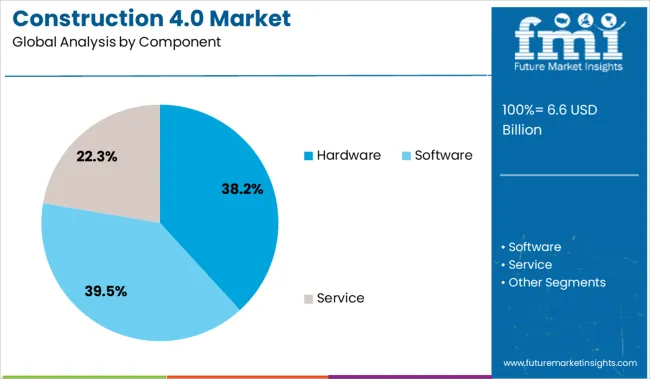

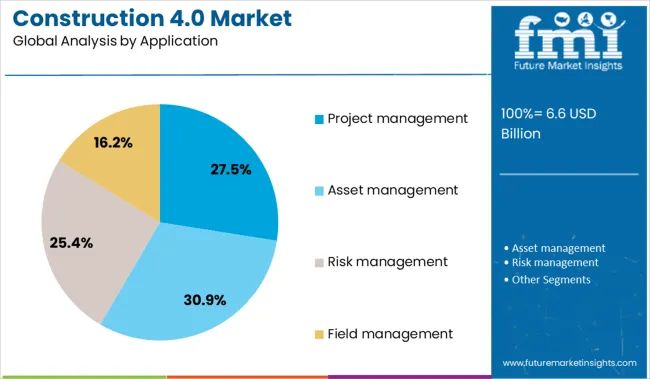

The market is segmented by component, technology, application, end use, and region. By component, it includes hardware, software, and service, covering the core elements of solution delivery. In terms of technology, the segmentation comprises Internet of Things (IoT), Building Information Modeling (BIM), Artificial Intelligence (AI), and other emerging technologies enhancing construction processes. Based on application, the market is classified into project management, asset management, risk management, and field management, supporting comprehensive operational efficiency. By end use, it includes residential, commercial, industrial, and public infrastructure sectors. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The hardware segment dominates the component category with a 38.2% market share, highlighting its foundational role in enabling Construction 4.0 solutions across job sites. This segment encompasses a wide range of physical technologies, including sensors, wearables, drones, RFID devices, and automated machinery that serve as the operational backbone of smart construction environments.

Hardware is crucial for real-time data collection, asset tracking, and on-site automation, allowing for greater control over safety, quality, and workflow efficiency. As companies invest in ruggedized, field-ready devices and sensor-enabled equipment, the demand for interoperable and scalable hardware solutions continues to rise.

Innovations such as autonomous vehicles, robotic arms, and reality capture devices are further accelerating the segment’s growth. With construction firms under pressure to modernize their operations and enhance site intelligence, the hardware segment is expected to retain its leadership position by enabling the physical infrastructure needed to support end-to-end digital transformation.

The Internet of Things (IoT) segment leads the technology category with a 34.9% share, driven by its ability to transform construction sites into connected ecosystems that enhance operational visibility and decision-making. IoT devices are widely used to monitor equipment usage, environmental conditions, worker safety, and structural integrity in real time.

This segment is gaining momentum as firms seek greater efficiency, reduced downtime, and proactive maintenance strategies through continuous data flow from connected assets. IoT integration enables centralized data dashboards and alerts that support faster response to issues, ultimately improving project timelines and cost control.

The scalability and adaptability of IoT systems make them ideal for diverse construction environments, from small-scale residential projects to large infrastructure developments. With ongoing advancements in wireless connectivity and edge computing, the IoT segment is expected to expand further as it becomes a critical enabler of intelligent site management and predictive analytics in the construction industry.

The project management segment holds a leading 27.5% share in the application category, underscoring its importance as a core focus area for Construction 4.0 implementations. Efficient project management is crucial in an industry known for complex workflows, tight deadlines, and significant financial risk.

Digital tools and platforms that support scheduling, budgeting, resource allocation, and documentation are increasingly being adopted to improve collaboration and minimize human error. The integration of real-time data, mobile access, and cloud-based platforms has revolutionized how construction projects are monitored and executed.

The segment is benefiting from the adoption of AI-driven analytics and digital twin technologies that enhance forecasting, risk assessment, and operational transparency. As construction firms seek to optimize performance across the project lifecycle, the demand for integrated project management solutions is expected to grow steadily. Continued digitalization efforts and the pursuit of greater accountability across stakeholders will reinforce the segment’s position in driving value creation through Construction 4.0.

The Construction 4.0 market is being driven by the rapid adoption of automation and connected systems to enhance efficiency, safety, and precision across projects. Simultaneously, opportunities lie in integrating AI-powered predictive analytics and digital twin technology to optimize workflows. Vendors delivering integrated platforms and advanced monitoring tools are set to dominate this evolving sector.

The push toward automated machinery and robotics has been a pivotal force in shaping the adoption of Construction 4.0. In 2024, semi-autonomous earthmoving equipment and concrete pouring systems were introduced to reduce dependence on manual labor. By 2025, automated bricklaying machines and rebar tying robots were deployed on large projects, ensuring consistent quality and faster turnaround times. These changes highlight that construction firms are prioritizing mechanized workflows to mitigate labor shortages and enhance productivity. Providers offering integrated robotic solutions for repetitive, labor-intensive tasks are well-positioned to become essential partners for modern construction projects.

In 2024, digital twin technology began to be implemented for real-time visualization and project simulation, offering contractors the ability to anticipate design and performance issues before execution. By 2025, digital twins linked with IoT sensors and AI algorithms were being deployed to track site progress and forecast delays. These applications reveal that digital twin platforms are shifting from theoretical models to practical tools that drive measurable efficiency gains. Vendors providing customizable, cloud-based digital twin solutions integrated with project management software stand to capture significant opportunities in delivering predictive capabilities for complex construction environments.

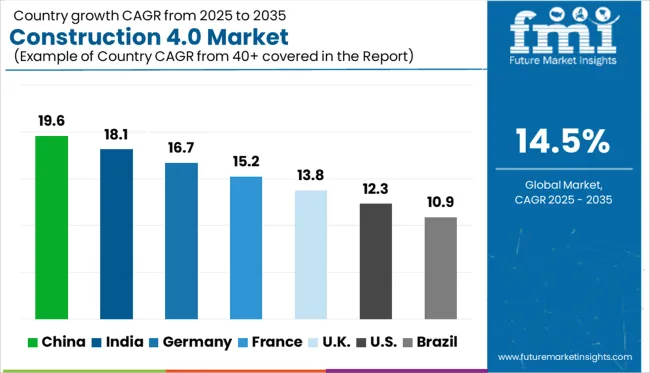

| Country | CAGR |

|---|---|

| China | 19.6% |

| India | 18.1% |

| Germany | 16.7% |

| France | 15.2% |

| UK | 13.8% |

| USA | 12.3% |

| Brazil | 10.9% |

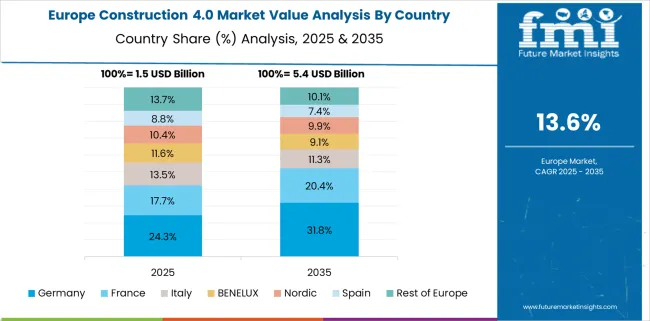

The global Construction 4.0 market is projected to grow at a CAGR of 14.5% between 2025 and 2035. China leads with 19.6%, followed by India at 18.1% and Germany at 16.7%. France records 15.2%, while the United Kingdom posts 13.8%. Growth is driven by robotics, BIM (Building Information Modeling), IoT-enabled equipment, and AI-powered analytics. China and India lead due to large-scale smart city projects and rapid digitalization of construction supply chains. Germany’s demand is shaped by automation for precision engineering, while France focuses on integrated project platforms. The UK emphasizes digital twins and modular construction systems in commercial and infrastructure projects.

China is expected to lead the Construction 4.0 market with a 19.6% CAGR, driven by smart city initiatives, large infrastructure investments, and digital platforms in project lifecycle management. Robotics, 3D printing for structural components, and AI-driven design optimization dominate high-tech construction projects. Domestic firms are building partnerships with tech providers for autonomous machinery integration.

India is forecast to grow at 18.1% CAGR, fueled by government-backed digital initiatives, prefabricated building adoption, and integrated project delivery platforms. Contractors increasingly rely on cloud-based BIM and augmented reality tools for design validation. Partnerships between tech startups and real estate developers accelerate the adoption of digital construction solutions across tier-1 and tier-2 cities.

Germany is expected to grow at a 16.7% CAGR, supported by Industry 4.0 convergence in the construction sector. Digital twins, automated surveying systems, and modular assembly lines are widely used in commercial projects. German firms prioritize data interoperability for supply chain transparency, supported by advanced IoT frameworks.

France is projected to grow at a 15.2% CAGR, driven by government incentives for digitization and the adoption of integrated construction platforms. Energy-efficient building mandates are increasing the use of simulation tools and predictive analytics. Leading construction companies are leveraging robotics for concrete 3D printing and automated rebar placement.

The UK is expected to grow at 13.8% CAGR, driven by modernization in commercial and public infrastructure projects. Digital twins are being deployed for asset lifecycle management, while modular and off-site construction technologies gain prominence. Advanced drones and AI-enabled progress tracking tools support productivity and risk reduction.

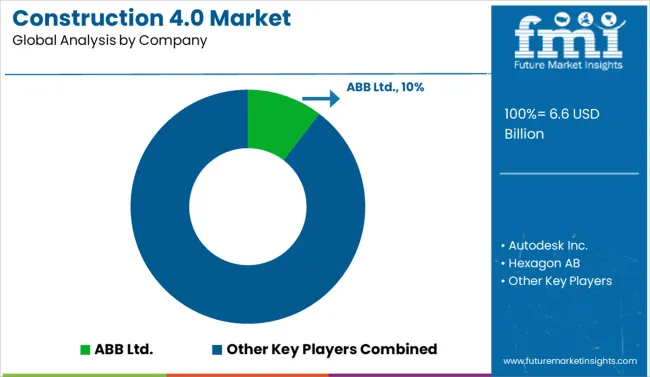

The Construction 4.0 market is moderately consolidated, with ABB Ltd. holding a leadership position through its integrated industrial automation platforms, IoT-enabled monitoring solutions, and robotics deployment for advanced construction operations. ABB’s strategy revolves around creating connected construction ecosystems, integrating predictive maintenance, energy efficiency, and autonomous machine control into existing workflows.

Autodesk Inc. and Bentley Systems dominate software-driven innovation with robust Building Information Modeling (BIM) platforms and digital twin capabilities, enabling real-time collaboration across design and project execution. Trimble, Topcon, and Hilti lead in precision hardware systems and connected tools, providing on-site IoT integration and cloud-linked measurement solutions. Oracle and SAP SE strengthen their competitive positions with cloud-based project lifecycle management and predictive analytics, targeting cost optimization and supply chain resilience.

Tech giants such as Microsoft, IBM, and NVIDIA contribute AI and machine learning frameworks, AR/VR visualization tools, and GPU-based simulations for real-time rendering and predictive planning. Schneider Electric differentiates through energy automation and sustainable construction technologies. Barriers to entry remain steep due to high R&D investments, integration complexity, and compliance with regional safety and quality standards, restricting disruption from smaller firms.

Acquisitions and partnerships have emerged as powerful strategies. Major players are forming strategic alliances with technology firms, such as proptech startups, robotics developers, and software innovators, to accelerate the rollout of integrated, smart construction systems. Significant investments in research and development are being channelled toward developing modular, AI-driven, interoperable platforms. These platforms enable seamless integration across the design, procurement, and construction stages. Companies are continuously introducing new digital tools and technologies, including robotics, AI-powered platforms, IoT-enabled equipment, and modular systems, to stay at the cutting edge of Construction 4.0.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Component | Hardware, Software, and Service |

| Technology | Internet of Things (IoT), Building Information Modeling (BIM), Artificial Intelligence (AI), and Others |

| Application | Project management, Asset management, Risk management, and Field management |

| End Use | Residential, Commercial, Industrial, and Public infrastructure |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Autodesk Inc., Hexagon AB, Hilti Corporation, Oracle Corporation, Topcon Corporation, Trimble, Inc., Microsoft Corporation, Bentley Systems, IBM Corporation, NVIDIA Corporation, SAP SE, and Schneider Electric |

| Additional Attributes | Dollar sales by solution type (BIM, robotics, IoT sensors, AR/VR), regional demand trends, competitive landscape, buyer preference for integrated platforms, integration with digital twins and smart city projects, innovations in AI-driven project management and autonomous machinery. |

The global construction 4.0 market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the construction 4.0 market is projected to reach USD 25.6 billion by 2035.

The construction 4.0 market is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types in construction 4.0 market are hardware, software and service.

In terms of technology, internet of things (iot) segment to command 34.9% share in the construction 4.0 market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA