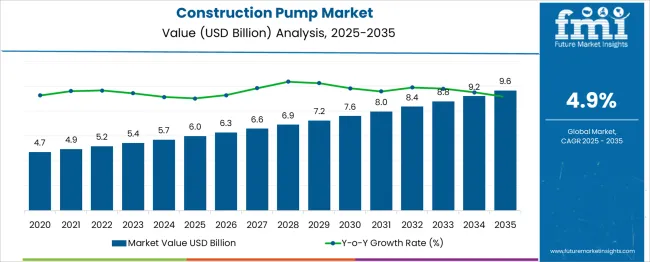

The Construction Pump Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Construction Pump Market Estimated Value in (2025 E) | USD 6.0 billion |

| Construction Pump Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The construction pump market is advancing steadily, driven by the global expansion of infrastructure projects, rapid urbanization, and the rising need for efficient water handling solutions at construction sites. Pumps play a vital role in dewatering, concrete transfer, and wastewater management, making them indispensable in residential, commercial, and industrial construction.

The increased frequency of extreme weather events and the growing emphasis on flood control and drainage systems further contribute to sustained demand. The market is witnessing technological evolution in pump efficiency, energy consumption, and remote monitoring capabilities.

Future growth is expected to be supported by smart pump technologies and increased government investments in housing and civil engineering projects. As environmental regulations tighten and operational reliability becomes paramount, demand for compact, high-performance, and low-maintenance pump systems is projected to continue climbing across key regions.

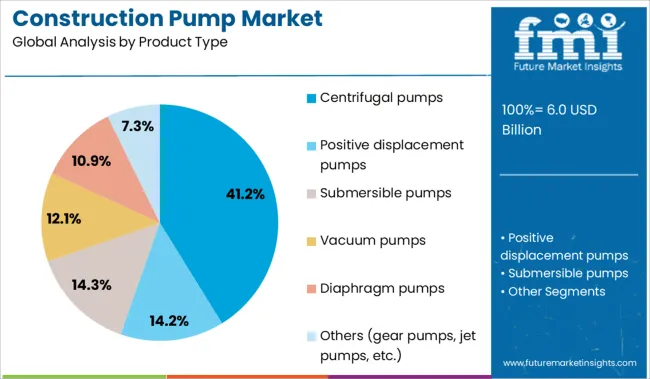

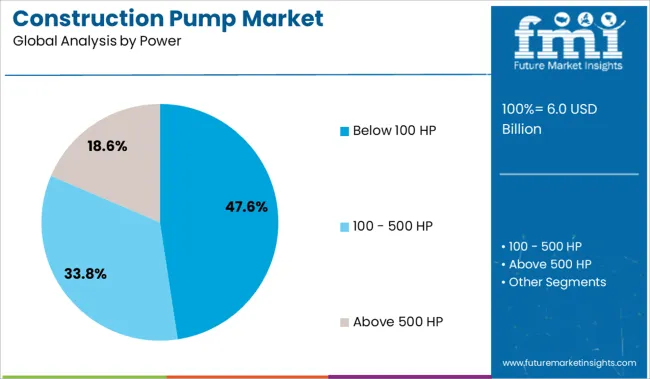

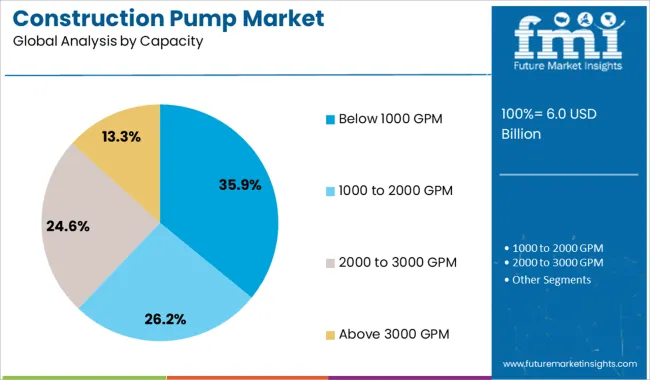

The construction pump market is segmented by product type, power, capacity, and distribution channel and geographic regions. The construction pump market is divided by product type into Centrifugal pumps, Positive displacement pumps, Submersible pumps, Vacuum pumps, Diaphragm pumps, and Others (gear pumps, jet pumps, etc.). In terms of power, the construction pump market is classified into below 100 HP, 100 - 500 HP, and above 500 HP. The construction pump market is segmented based on capacity into below 1000 GPM, 1000 to 2000 GPM, 2000 to 3000 GPM, and above 3000 GPM. The distribution channel of the construction pump market is segmented into Direct, Indirect, and Indirect sales. Regionally, the construction pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The centrifugal pumps segment dominates the product type category with a 41.2% market share, owing to its widespread use in handling water, slurries, and other construction-related fluids. Their relatively simple design, ease of installation, and cost-effectiveness make them ideal for construction applications requiring continuous fluid movement.

These pumps are favored for their adaptability across varying site conditions and project sizes, which enhances their appeal to contractors and civil engineers. Manufacturers are increasingly offering corrosion-resistant and wear-resistant models to extend product life in demanding environments.

The centrifugal pumps segment continues to grow as construction companies prioritize equipment that delivers high throughput, minimal downtime, and operational reliability. With a strong balance of performance and affordability, centrifugal pumps are expected to maintain their dominant presence in the market.

The below 100 HP segment leads the market in terms of power, holding a 47.6% share, due to its suitability for small to medium-scale construction activities and temporary site installations. These pumps are known for their compact size, lower energy requirements, and ease of transport, which make them particularly effective for short-term and remote construction applications.

This segment benefits from the rising number of residential and municipal construction projects that do not require large-scale pumping systems. Technological enhancements have further increased the efficiency and durability of low-power pumps, making them more viable for varied construction tasks.

As sustainability and cost control remain key considerations, the below 100 HP segment is expected to witness continued preference across developing and developed markets alike.

The below 1000 GPM capacity segment captures a 35.9% share of the construction pump market, driven by the broad applicability of mid-range flow capacity in common construction tasks such as dewatering, site drainage, and concrete pumping. These pumps strike a balance between portability and performance, making them ideal for projects where space and energy constraints are prevalent.

The segment has seen growing adoption in both temporary and permanent installations across residential and commercial construction sites. The demand is further boosted by rising infrastructure development in flood-prone and waterlogged regions, where moderate flow rates are sufficient.

With ongoing efforts to reduce operational costs and simplify maintenance, this segment is poised to maintain steady growth driven by its practicality and efficiency across a wide range of construction scenarios.

Construction pumps are being selected for concrete placement, dewatering, grout injection, and slurry movement across building, mining, and infrastructure applications. Diesel-driven, electric, and hydraulic models with remote-control capabilities are being used on-site to improve safety and reduce manual handling. Flexible hose and boom-mounted configurations are being integrated into pumped concrete workflows and water removal systems. Manufacturers are offering modular pump units, rapid changeover kits, and telemetry-enabled controls to support high-efficiency and versatile operation across varied construction environments.

The construction pump market has been influenced by rapid infrastructure development and rising demand for efficient fluid handling in large-scale projects. Increased use of dewatering systems in commercial and residential construction has been considered essential for maintaining site stability and safety. Strong demand for pumps capable of handling abrasive materials and high-pressure requirements has been noted across mining and tunneling operations. Project timelines in the construction sector have become shorter, which has increased the requirement for durable and reliable pumping systems. Manufacturers have been investing in enhancing energy efficiency and operational performance, as buyers increasingly seek cost-effective equipment that supports heavy-duty usage without frequent downtime or high maintenance costs.

Significant opportunities have been observed in specialized pumping solutions for high-rise building projects and mega infrastructure developments. Contractors have been showing a preference for pumps that ensure minimal water accumulation and efficient material transfer on congested sites. Market growth has been supported by rental models, which have lowered capital expenditure barriers for small and mid-scale construction firms. Expansion of public infrastructure, including highways, bridges, and metro systems, has been creating consistent demand for advanced pumping systems. Demand has also increased for pumps suitable for harsh environments where corrosion resistance and high pumping efficiency are prioritized to reduce operational disruptions and maintain continuous workflow during construction activities.

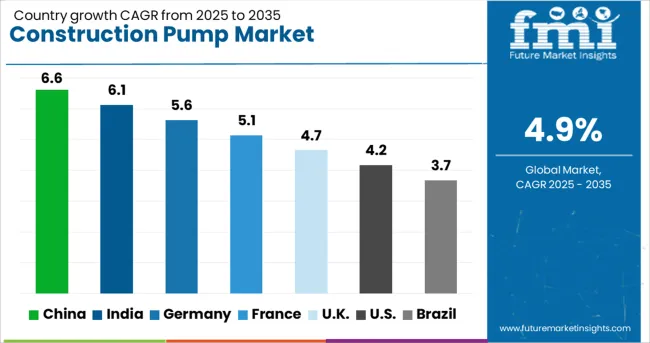

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The construction pump market, projected to grow at a global CAGR of 4.9% from 2025 to 2035, is witnessing diverse growth across major regions. A 6.6% CAGR is being recorded in China, a BRICS member, driven by large-scale infrastructure and high-rise construction activities. A 6.1% CAGR is being seen in India, another BRICS economy, supported by the rapid development of highways, metro systems, and smart housing projects. Germany, part of the OECD, is registering a 5.6% CAGR, supported by demand for energy-efficient pumping systems in modern infrastructure initiatives. The United Kingdom, an OECD member, is showing moderate growth at 4.7%, with emphasis on refurbishment and water management in urban projects. The United States, also in the OECD group, is posting a 4.2% CAGR as construction activity remains stable with growing adoption of rental-based pumping equipment. Higher growth momentum is being observed in BRICS nations, while OECD markets present steady demand focused on operational efficiency and advanced system integration. The report covers in-depth analysis for 40+ countries, with the top five highlighted here as a reference.

The construction pump market in China is forecasted to grow at a CAGR of 6.6% through 2035, driven by ongoing infrastructure expansion and mega construction projects under national development programs. Large-scale investments in high-speed rail, metro systems, and smart city clusters elevated demand for high-capacity dewatering pumps and concrete pumping systems. Manufacturers focused on delivering pumps designed for harsh operating conditions with improved energy performance. Local rental service providers expanded fleets to cater to medium and small contractors, reducing capital cost barriers. Government initiatives to enhance water management at construction sites further strengthened market momentum.

The construction pump market in india is exapected to exapand at a CAGR of 6.1% through 2035, supported by rising public infrastructure spending and affordable housing programs. Nationwide investments in expressways, airports, and industrial corridors drove consistent demand for dewatering and material-handling pumps. Contractors increasingly relied on rental services for high-pressure pumps, particularly in large-scale civil engineering projects. Stringent site safety guidelines encouraged the adoption of advanced pumping systems with operational monitoring capabilities. Market performance was further influenced by the rise of domestic manufacturers supplying competitively priced, robust pumps for long-duration projects.

Germany climbed from 4.9% CAGR during 2020–2024 to 5.6% across 2025-2035, driven by the modernization of transport infrastructure and increased preference for energy-efficient pumping solutions. Large-scale investments in rail networks and greenfield industrial projects encouraged the adoption of high-performance pumps designed for operational reliability. The market saw a notable shift toward automated pumping systems integrated with digital control features for reduced downtime and improved monitoring. Rental services gained traction among SMEs to optimize cash flows and avoid upfront investments in premium pump models. Additionally, construction companies preferred corrosion-resistant pumps for utility infrastructure projects in flood-prone regions.

The CAGR for the United Kingdom rose from 3.9% during 2020-2024 to 4.7% for 2025-2035, supported by increasing refurbishment projects and stricter compliance for site water management. Public funding for housing development and municipal infrastructure boosted demand for portable pumping units and submersible pumps. Rising contractor preference for energy-optimized pumps reflected efforts to lower operating expenses and meet environmental guidelines. The rental segment continued to dominate procurement strategies for mid-tier firms, offering flexibility and reducing maintenance burdens. Urban redevelopment programs across London and other metropolitan areas further contributed to sustained pump usage in foundation and drainage applications.

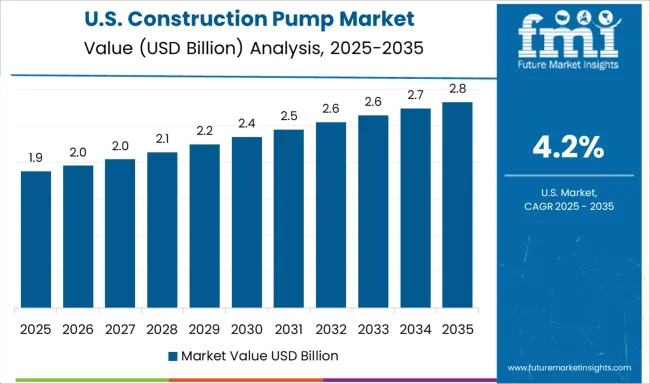

The United States increased from 3.6% CAGR during 2020-2024 to 4.2% in 2025-2035, driven by steady growth in residential and commercial construction, coupled with resilience in infrastructure investments. Pump rentals continued to dominate procurement for large-scale projects, particularly in regions with stringent environmental compliance. Market performance benefited from the integration of high-pressure pumping systems in energy and utility infrastructure development. Adoption of digital-enabled monitoring in pumps became a priority for contractors aiming to reduce operational risk and improve project timelines. Ongoing replacement demand for outdated pumping systems also supported moderate market growth in the region.

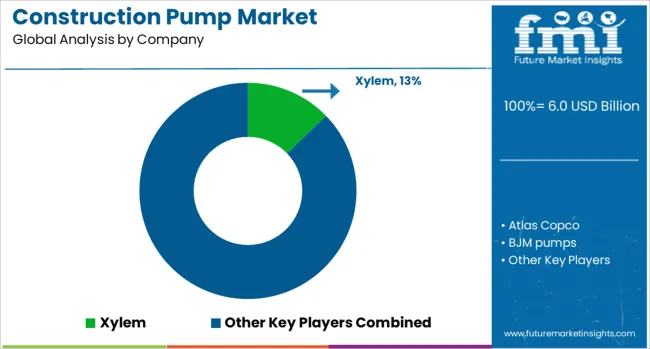

In the construction pump market, major players have been focusing on durable, high-capacity, and energy-efficient pumping systems to meet increasing demand from infrastructure and industrial projects. Companies such as Xylem, Atlas Copco, and Grundfos are developing advanced dewatering pumps designed for heavy-duty applications, with a strong emphasis on performance reliability in challenging environments. Flowserve and KSB SE have expanded offerings in submersible and high-pressure pumps, targeting large-scale civil and mining operations. ITT and Pentair are enhancing rental service availability to meet growing demand for flexible procurement models among contractors. Specialized manufacturers like Tsurumi Manufacturing, BJM Pumps, and Seepex are focusing on corrosion-resistant and abrasive-handling pumps for tunneling and coastal construction projects. SPX Flow and Sulzer have been strengthening portfolios with digitally enabled solutions for real-time monitoring and reduced downtime. Weir Group and Ebara continue to prioritize efficient fluid management systems for critical applications, while MDM is supplying niche pumping technologies for customized site requirements.

In May 2025, Atlas Copco launched the DZS 600 and 1200 VSD+ vacuum pump series, offering significant energy savings and lower operating costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Product Type | Centrifugal pumps, Positive displacement pumps, Submersible pumps, Vacuum pumps, Diaphragm pumps, and Others (gear pumps, jet pumps, etc.) |

| Power | Below 100 HP, 100 - 500 HP, and Above 500 HP |

| Capacity | Below 1000 GPM, 1000 to 2000 GPM, 2000 to 3000 GPM, and Above 3000 GPM |

| Distribution channel | Direct, Indirect, and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem, Atlas Copco, BJM pumps, Ebara, Flowserve, Grundfos, ITT, KSB SE, MDM, Pentair, Seepex, SPX Flow, Sulzer, Tsurumi Manufacturing, and Weir Group |

| Additional Attributes | Dollar sales by pump type, share by region and application, competitive positioning, rental vs purchase trends, regulatory impact, upcoming infrastructure projects, raw material cost outlook, and growth drivers for high-pressure and dewatering pumps. |

The global construction pump market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the construction pump market is projected to reach USD 9.6 billion by 2035.

The construction pump market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in construction pump market are centrifugal pumps, positive displacement pumps, submersible pumps, vacuum pumps, diaphragm pumps and others (gear pumps, jet pumps, etc.).

In terms of power, below 100 hp segment to command 47.6% share in the construction pump market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA