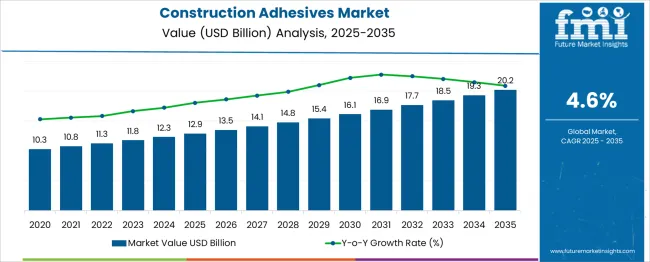

The Construction Adhesives Market is estimated to be valued at USD 12.9 billion in 2025 and is projected to reach USD 20.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Construction Adhesives Market Estimated Value in (2025 E) | USD 12.9 billion |

| Construction Adhesives Market Forecast Value in (2035 F) | USD 20.2 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The construction adhesives market is expanding steadily, supported by rising infrastructure investments, growing urbanization, and increasing demand for high-performance bonding solutions across the construction sector. These adhesives are widely adopted for their ability to replace traditional mechanical fasteners, offering benefits such as improved aesthetics, reduced weight, and enhanced structural integrity.

Demand is further bolstered by evolving architectural designs that require durable, flexible, and weather-resistant adhesives for diverse substrates. As sustainability gains prominence, eco-friendly and low-VOC adhesive formulations are becoming a focus area, especially in markets with stringent environmental regulations.

The future trajectory of the market remains positive, with expanding residential and commercial construction activity, ongoing innovation in adhesive chemistry, and increased use of prefabricated building systems driving long-term demand across developed and emerging regions.

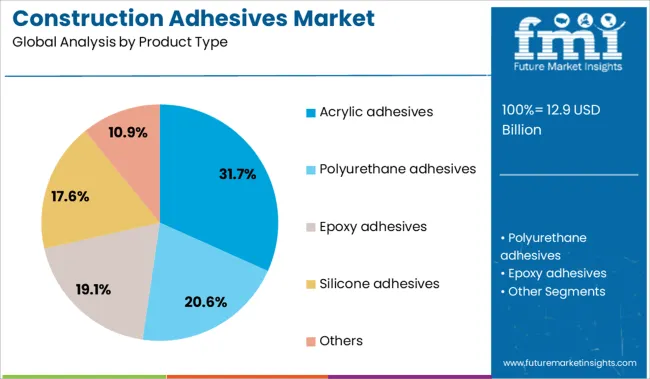

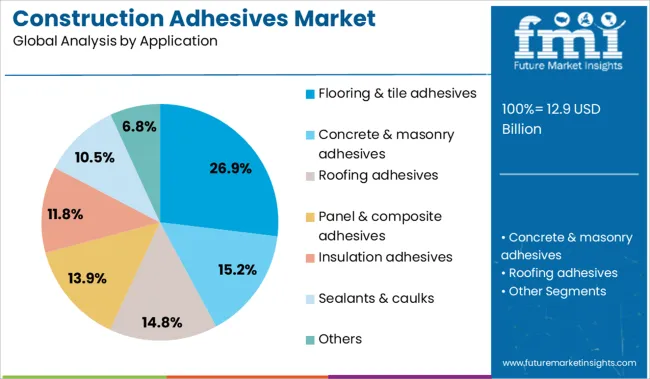

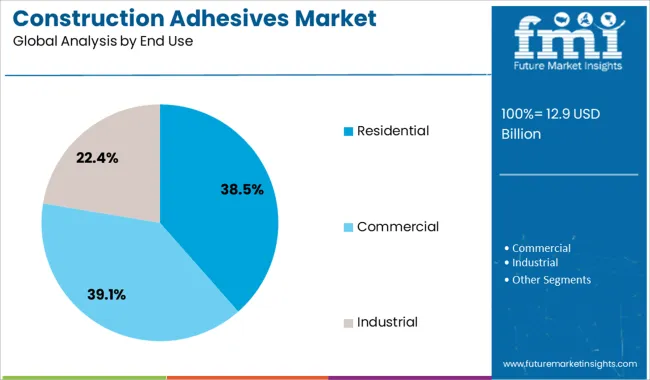

The construction adhesives market is segmented by product type, application, and end use and geographic regions. By product type of the construction adhesives market is divided into Acrylic adhesives, Polyurethane adhesives, Epoxy adhesives, Silicone adhesives, and Others. In terms of application of the construction adhesives market is classified into Flooring & tile adhesives, Concrete & masonry adhesives, Roofing adhesives, Panel & composite adhesives, Insulation adhesives, Sealants & caulks, and Others. Based on end use of the construction adhesives market is segmented into Residential, Commercial, and Industrial. Regionally, the construction adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic adhesives segment leads the product type category with a 31.7% share, driven by its superior bonding strength, fast curing time, and resistance to environmental factors such as moisture, UV, and temperature fluctuations. These adhesives are widely used in both interior and exterior applications due to their versatility in adhering to diverse substrates like concrete, glass, metal, and plastics.

Manufacturers continue to enhance acrylic formulations with improved flexibility and green chemistry attributes, responding to demand from green building projects and regulatory bodies. The popularity of acrylic adhesives is also supported by their low shrinkage, long-lasting performance, and compatibility with automated application methods in industrial settings.

As construction techniques evolve toward lighter and more energy-efficient structures, acrylic adhesives are expected to remain the preferred choice for a wide range of structural and decorative applications, ensuring sustained market leadership.

The flooring and tile adhesives segment holds a significant 26.9% share within the application category, reflecting strong demand from both new construction and renovation activities. These adhesives are essential for ensuring secure and long-lasting tile and flooring installations across residential, commercial, and industrial buildings.

The segment benefits from rising consumer expectations for aesthetic flooring solutions and durable finishes, along with increasing use of large-format tiles and engineered flooring materials that require specialized adhesives. Innovations in product performance, including water resistance, soundproofing, and flexibility, are further enhancing adoption.

With growing emphasis on fast-track construction and low-maintenance surfaces, flooring and tile adhesives are increasingly tailored for quicker setting times and higher bond strengths. Continued urban infrastructure development and the rise in do-it-yourself (DIY) home improvement trends are expected to sustain this segment’s upward momentum.

The residential segment commands the largest 38.5% share of the construction adhesives market by end use, driven by sustained growth in housing construction, remodeling projects, and interior design enhancements. As homeowners increasingly seek personalized and modern living spaces, demand for high-quality adhesives that offer durability, clean application, and compatibility with a variety of surfaces continues to rise.

This segment is further supported by government housing schemes and favorable mortgage policies in several regions, stimulating new homebuilding activities. The push for energy-efficient and sustainable construction materials has also led to the integration of low-emission adhesive solutions in residential projects.

Additionally, rising consumer awareness about indoor air quality and environmental impact is influencing purchasing preferences toward safer and more eco-friendly formulations. With continuous upgrades in residential infrastructure and lifestyle preferences, the segment is well-positioned to maintain its leading role in the market.

The construction adhesives market is driven by growing demand for versatile bonding in residential and commercial projects, supported by compatibility with modern materials and simplified application processes. Infrastructure expansion, renovation activities, and preference for quick-curing, high-performance adhesives further accelerate market

The construction adhesives market is experiencing notable growth due to rising demand for versatile bonding solutions in both residential and commercial projects. Increasing preference for adhesives over mechanical fasteners is being observed in flooring, roofing, and panel installations due to their ability to provide strong adhesion and reduce structural stress. Lightweight construction materials such as composites and engineered wood have created a requirement for advanced adhesive formulations that offer flexibility and durability. The need for energy-efficient building materials and superior sealing performance has further reinforced the adoption of construction adhesives. High compatibility with diverse substrates, along with simplified application processes, continues to influence contractors and builders toward adhesive-based solutions.

Global infrastructure development and refurbishment initiatives have amplified the utilization of construction adhesives in various projects, including transportation, industrial facilities, and residential upgrades. Demand for high-performance adhesives that resist moisture, temperature fluctuations, and chemical exposure has been elevated by stringent building regulations and improved construction standards. Renovation and remodeling trends, particularly in developed economies, have accelerated the use of adhesive products in flooring systems, wall panels, and decorative elements. The focus on efficient labor practices has encouraged adhesive technologies that support quick curing and easy application. Enhanced supply chain networks and product availability through organized retail have also strengthened market accessibility for end users.

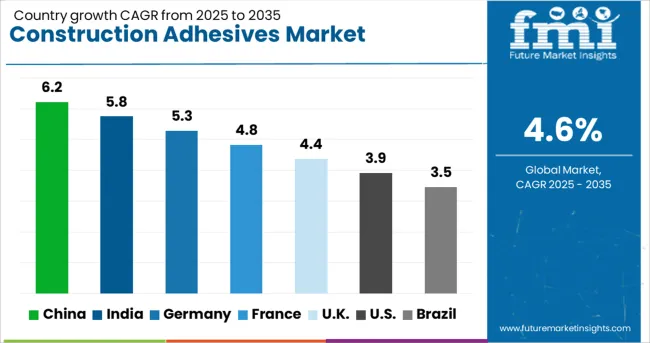

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The construction adhesives market, projected to grow at a global CAGR of 4.9% from 2025 to 2035, displays significant variation across major economies. China, a BRICS member, leads with a CAGR of 6.2%, driven by large-scale infrastructure modernization, rapid residential development, and demand for high-performance adhesives in green building initiatives. India follows at 5.8%, supported by housing projects under national development programs and increased usage of adhesive-based construction materials for cost efficiency.

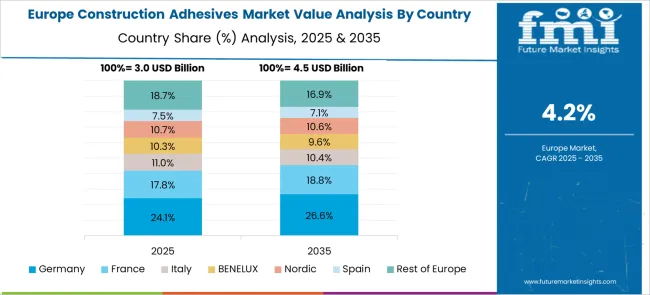

Germany records 5.3%, fueled by advanced construction techniques, adoption of energy-efficient materials, and EU directives promoting sustainable bonding solutions. The UK posts 4.4%, shaped by renovation activities in aging infrastructure and demand for low-VOC adhesives despite regulatory cost pressures. The USA grows at 3.9%, expanding steady uptake in commercial projects and remodeling activity, though competitive pricing pressures influence margins.

BRICS economies are capitalizing on rapid urban development and infrastructure funding, whereas OECD markets focus on compliance-driven innovations and specialized formulations for high-performance applications. The report covers a detailed analysis of 40+ countries, with five leading markets highlighted as a reference.

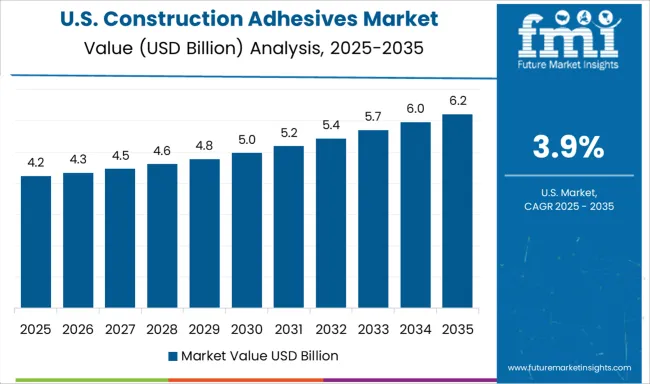

The CAGR for the USA construction adhesives market moved from nearly 3.2% during 2020-2024 to 3.9% in the 2025-2035 phase, driven by strong demand in residential remodeling and commercial retrofitting projects. Growth in private construction investments and government-backed housing initiatives strengthened adhesive use in flooring and wall panel installations. Adhesives with high shear strength and moisture resistance gained adoption due to their suitability for mixed substrates. A transition toward quick-application solutions supported contractor efficiency, while distribution through organized retail and online channels improved accessibility. Product launches featuring low-VOC formulations encouraged preference among developers and compliance with building codes, consolidating market growth in the USA

The CAGR of the UK market increased from 3.6% during 2020-2024 to 4.4% for 2025-2035, as infrastructure upgrades and housing redevelopment programs created new adhesive demand. Early growth was influenced by public investments in school and hospital renovations, favoring adhesives for cost-effective panel bonding and sealing. A sharp rise in modular housing units stimulated consumption of structural adhesives with strong load-bearing properties. Further momentum came from demand for moisture-resistant solutions in flooring and bathroom installations. Import reliance gradually decreased as domestic players improved supply capabilities for specialized adhesive systems, reducing lead times and cost volatility in distribution networks.

Germany’s CAGR moved from around 4.6% in 2020-2024 to 5.3% in 2025-2035, supported by an emphasis on energy-efficient renovation and stringent building codes. Increased focus on commercial retrofitting and refurbishment of aged infrastructure bolstered adhesive utilization in insulation and panel installations. Specialty adhesives that endure thermal stress gained relevance in HVAC ducting and window sealing applications. Automotive-linked industrial construction also spurred growth in epoxy-based adhesive systems for durability. Expansion of adhesive manufacturing clusters in North Rhine-Westphalia and Bavaria ensured a consistent supply, while higher integration with automated application tools enhanced usage efficiency across large-scale projects.

China’s CAGR climbed from 5.1% during 2020-2024 to 6.2% in 2025-2035, expanding growth in urban redevelopment and infrastructure upgrades. Increased adoption of lightweight composites in construction required flexible adhesive systems, prompting domestic brands to expand their portfolio of hybrid formulations. Rising demand for prefabricated and modular building methods further elevated adhesive consumption in panel bonding and structural assemblies. Large-scale public projects such as rail stations and airports boosted consumption of high-strength adhesives for metal and concrete bonding. Strategic partnerships between local producers and multinational chemical companies reinforced innovation and supply resilience in regional markets.

The CAGR for India increased from 4.9% in 2020-2024 to 5.8% during 2025-2035, influenced by expanding residential construction and commercial space developments in urban clusters. Enhanced acceptance of adhesives over mechanical fastening in tiling and roofing applications drove the initial growth phase. Rising investment in highway and metro projects spurred demand for structural adhesives in large-scale construction segments. Supply chain improvements and capacity expansion by domestic manufacturers reduced dependence on imports, enhancing affordability. Rapid e-commerce integration for construction chemicals widened adhesive access for small contractors, while a focus on faster-setting adhesives addressed labor cost challenges.

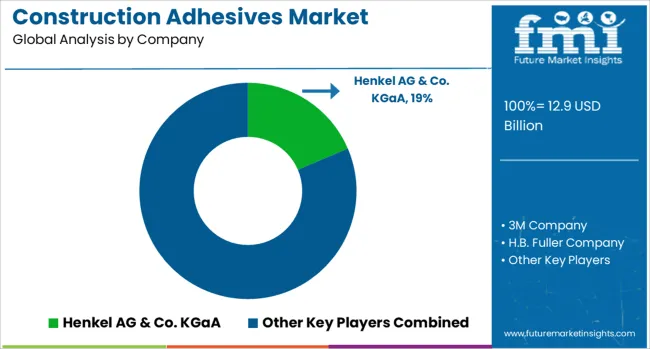

In the construction adhesives industry, leading players are focusing on advanced formulations that deliver strong adhesion, flexibility, and resistance to environmental stress for applications in flooring, paneling, roofing, and structural assemblies. Companies like Henkel AG & Co. KGaA, 3M Company, and H.B. Fuller Company are introducing hybrid polymer adhesives and moisture-curing systems for efficient bonding in residential and commercial projects.

Sika AG and Bostik (Arkema Group) emphasize high-performance sealants and quick-curing solutions that enhance productivity in large-scale construction, while Dow Chemical Company and Huntsman Corporation focus on polyurethane-based adhesives for industrial applications.

Regional specialists such as Mapei Corporation, BASF SE, and Franklin International are scaling innovation in eco-compliant adhesive technologies, targeting markets requiring low-VOC, strong-bond formulations. Strategic initiatives include expanding distribution through e-commerce channels, product customization for modular housing, and integration with automated dispensing systems for greater efficiency.

In March 2025, H.B. Fuller Company launched “Millennium PG 1 EF ECO”, a novel canister-based commercial roofing adhesive.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.9 Billion |

| Product Type | Acrylic adhesives, Polyurethane adhesives, Epoxy adhesives, Silicone adhesives, and Others |

| Application | Flooring & tile adhesives, Concrete & masonry adhesives, Roofing adhesives, Panel & composite adhesives, Insulation adhesives, Sealants & caulks, and Others |

| End Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, Sika AG, Bostik (Arkema Group), Dow Chemical Company, Huntsman Corporation, Mapei Corporation, BASF SE, and Franklin International |

| Additional Attributes | Dollar sales by adhesive type, share by application and region, growth rates across residential and infrastructure projects, competitor market share, pricing trends, regulatory compliance, raw material sourcing, distribution channels, and innovation opportunities in quick-curing and eco-compliant formulations. |

The global construction adhesives market is estimated to be valued at USD 12.9 billion in 2025.

The market size for the construction adhesives market is projected to reach USD 20.2 billion by 2035.

The construction adhesives market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in construction adhesives market are acrylic adhesives, polyurethane adhesives, epoxy adhesives, silicone adhesives and others.

In terms of application, flooring & tile adhesives segment to command 26.9% share in the construction adhesives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA