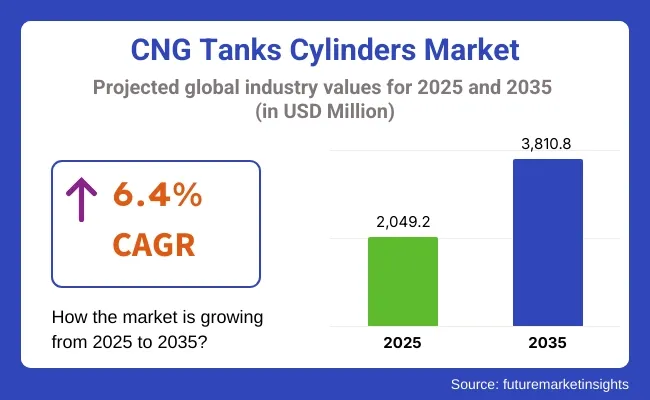

The CNG tank cylinders market is projected to expand from USD 2,049.2 million in 2025 to USD 3,810.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% during the forecast period.

| Metric | Value |

|---|---|

| CNG Tank Cylinders Market Size (2025E) | USD 2,049.2 million |

| CNG Tank Cylinders Market Value (2035F) | USD 3,810.8 million |

| CNG Tank Cylinders Industry CAGR (2025 to 2035) | 6.4% |

Shaping the Future of CNG Tanks Cylinders Market

Type III CNG cylinders share 2025 – highlighting that Type III cylinders are expected to hold a 37 % share in 2025

Hexagon Agility Cummins X15N CNG cylinder integration – users looking for the November 2024 launch of CNG tanks compatible with Cummins X15N engines

CNG tanks market India drivers – to explore demand drivers such as fuel economy, clean transport mandates, and rising CNG vehicle adoption in regions like India

Type IV CNG tanks market growth forecast – for insights into the high-growth segment due to demand for lightweight and durable composite cylinders

Key players in the CNG tanks market – to find information on major manufacturers like Hexagon Agility, Luxfer Gas Cylinders, and Worthington Industries

This growth is being driven by increased adoption of alternative fuel technologies, policy mandates, and advancements in composite pressure vessel manufacturing. In November 2024, the expansion of CNG systems designed for integration with Cummins X15N engines was announced by Hexagon Agility. These systems, intended for Class 8 heavy-duty trucks, were developed with pressure-rated tanks suitable for both compressed natural gas (CNG) and renewable natural gas (RNG) applications. Compliance with the USA EPA and California Air Resources Board (CARB) standards was emphasized in the official press release.

By 2025, full-system integration services, including refueling modules and digital diagnostics, had been offered through the Hexagon FleetCare™ program. Enhanced uptime and regulatory support were delivered to fleet operators managing regional delivery and municipal transport routes.

In a 2024 technical bulletin, HyPerComp Engineering disclosed developments in polymer-lined, carbon-wrapped Type 4 composite tanks. These tanks were designed to reduce overall system weight while maintaining performance under high-pressure conditions. The application was prioritized in vehicle platforms where payload capacity and operational range were directly affected by weight.

American CNG expanded its distribution networks for replacement cylinders and accessories in 2025. Standardized tank kits, developed for cross-platform compatibility, were released to streamline retrofitting and reduce installation time across multiple OEM vehicles.

Advancements in monitoring technologies were also introduced. Fuel pressure and temperature sensors are embedded in modern CNG systems and connected to the vehicle's telematics system, enabling predictive diagnostics and usage analytics.

Steady procurement growth across North American fleet operators has been observed, underpinned by cost-efficiency targets and carbon reduction mandates. Both public and private infrastructure investments have accelerated the deployment of time-fill and fast-fill refueling stations.

Type III CNG cylinders are estimated to account for approximately 37% of the global CNG tanks cylinders market share in 2025 and are projected to grow at a CAGR of 6.8% through 2035. These cylinders feature a full composite wrap over an aluminum liner, offering reduced weight and enhanced gas storage capacity under high pressure. In 2025, OEMs and retrofit system providers will increasingly adopt Type III designs in passenger cars, commercial fleets, and buses to improve vehicle fuel economy and increase driving range.

Their corrosion resistance, longer lifecycle, and recyclability make them well-suited for both OEM integration and aftermarket retrofitting in countries with expanding automotive natural gas vehicle (NGV) infrastructure. Demand remains strong in Latin America, India, and Southeast Asia, where CNG is promoted as a cleaner alternative to diesel and gasoline.

CNG cylinders with a 20 to 50-liter capacity range are projected to hold 37% share of the market in 2025 and are forecast to grow at a CAGR of 6.7% through 2035. This segment offers a balance between weight, space efficiency, and fuel storage volume, making it ideal for compact vehicles, hatchbacks, sedans, and small cargo vans. In 2025, vehicle manufacturers and CNG conversion kit providers favor this capacity range for urban mobility solutions and fleet operations where moderate refueling intervals are acceptable.

Adoption is particularly high in markets such as India, Iran, and Argentina, where CNG vehicles comprise a significant portion of the urban transport fleet. Manufacturers focus on enhancing shell strength, burst pressure resistance, and integration with modular fuel storage systems to cater to varying vehicle layouts and safety requirements.

Safety Compliance, Infrastructure Limitations, and Technological Trade-offs

Key hurdles for the CNG tanks & cylinders market are strict safety regulations, on the other hand, a lack of consistent infrastructure at the global level. Gaseous hydrogen must be stored under pressure, ensuring robust compliance. However, as standards evolve, access to refueling sources is limited in many rural regions, which constrains adoption.

Still, the current heavier Type 1 and 2 cylinders degrade vehicle efficiency, while the lighter Type 4 choices are expensive. Risks also abound, including compatibility issues with various vehicle models and durability concerns. However, counterfeit products and inefficient testing add to mistrust. Combined, these issues hinder widespread adoption, particularly in regions aiming to transition their commercial fleets to natural gas-fueled alternatives.

Clean Fuel Push, Composite Cylinder Innovation, and Fleet Conversion

Despite these challenges, some factors are working in the market’s favour: a growing global demand for cleaner fuel solutions. National decarbonization efforts and fuel taxes are encouraging public and commercial fleets to switch to natural gas.

Composite cylinders (Types 3 and 4) can be extended-life and super-efficient cylinders where there is an ever-increasing need in logistics and passenger transport. New-tech features, such as pressure sensors and digital monitoring of cylinder use, are improving cylinder safety and enhancing performance.

Increased investments in networks of CNG stations and regional fleet conversion programs will push adoption. With recyclability and sustainability emerging as key differentiators, manufacturers that innovate now are well-positioned for long-term growth.

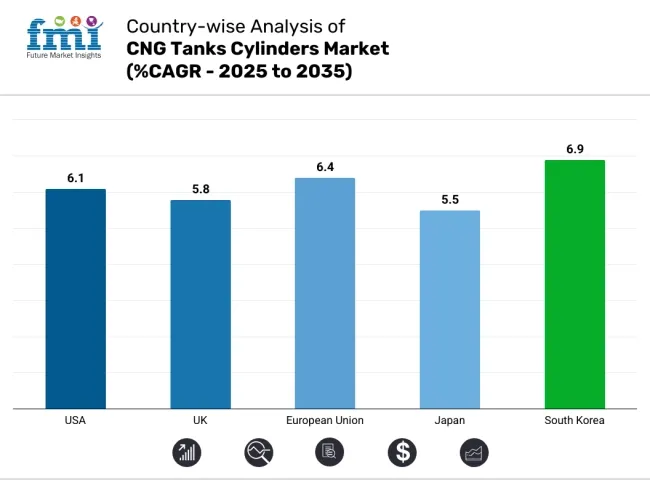

The CNG tank cylinders market in the United States is witnessing steady growth as federal and state-level clean energy mandates promote wider adoption of natural gas vehicles (NGVs). Municipal transit systems and long-haul freight fleets are gravitating to CNG as a means to reduce both their operating emissions and fuel expenditures.

There is a growing demand in the market for lightweight, high-capacity Type IV composite cylinders, particularly among logistics providers seeking ways to enhance efficiency. Additionally, the development of CNG refuelling infrastructure and domestic manufacturing capabilities presents further opportunities for market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

In the United Kingdom, the CNG tank and cylinder industry is emerging and has been envisioned as a precursor to low-carbon transportation. Fleet electrification has garnered the most attention, while natural gas remains an attractive option for some commercial and municipal vehicles.

CNG-fueled buses and waste vehicles are being adopted due to government incentives and urban sustainability objectives. The market is shifting toward a robust, corrosion-resistant composite cylinder designed for densely populated, high-vehicle-traffic cities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The CNG Storage cylinders and tanks market in the EU is gaining momentum, spearheaded by Germany, Italy, and Sweden. In the context of EU clean transport directives, coupled with funds for green mobility, the integration of CNG is accelerating into regional transit and freight networks.

The increasing demand for Type III and IV cylinders is driven by end-users' growing focus on weight savings and safety. A robust regulatory framework maintaining uniform quality standards continues to attract investments from vehicle OEMs and tank manufacturers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan’s CNG tank and cylinder market remains a niche yet steady one, supported by a small yet committed push for alternative fuels. Local governments and public transportation operators are introducing CNG buses in certain areas to reduce emissions and diversify their fuel supply.

Domestic manufacturers are creating ultra-lightweight versions of tanks that are appropriate to the country’s space and safety-maximizing engineering constraints. Japan’s gentler pace of clean mobility evolution means upgrades to the market are incremental yet stable.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The CNG tank cylinders market in South Korea is growing rapidly, driven by aggressive green mobility policies and support for natural gas transit systems. Diesel buses are being replaced with CNG alternatives by the government, and logistics companies are also becoming increasingly interested in NGVs.

Newer composite tanks developed by South Korean tech firms are equipped with sensors to monitor wear and tear, providing for better predictive maintenance. CNG remains a significant alternative for medium- to heavy-duty applications as concerns about pollution in urban areas intensify.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

The worldwide CNG (Compressed Natural Gas) tank cylinder market is an integral part of the alternative fuel vehicle ecosystem, driven by an increased focus on emissions reduction, natural gas infrastructure development, and economical transportation.

These cylinders are designed to contain gas at high pressure safely and are being adopted in increasing numbers among light-duty vehicles, heavy commercial fleets, and public transportation systems. The Type III and Type IV composite cylinders offer a distinct advantage of weight efficiency and larger fuel storage, which is gradually gaining traction in the market.

Technological improvements in liner materials, fiber wrapping, and pressure handling have increased R&D activity. According to the competitive market dynamics, traditional pressure vessel manufacturers, automotive systems suppliers, and specialty composite developers compete based on performance, safety standards, and fuel efficiency.

Numerous additional companies contribute to the global CNG tanks cylinders market by offering regionalized designs, composite integration, and infrastructure-focused systems:

The overall market size for the CNG tanks cylinders market was USD 2,049.2 million in 2025.

The CNG tanks cylinders market is expected to reach USD 3,810.8 million in 2035.

The increasing adoption of alternative fuel vehicles, rising demand for lightweight and high-strength storage solutions, and growing use of carbon fiber cylinders in light duty vehicles fuel the CNG tanks cylinders market during the forecast period.

The top 5 countries driving the development of the CNG tanks cylinders market are the USA, UK, European Union, Japan, and South Korea.

Carbon fiber cylinders and light duty vehicles lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 23: Western Europe Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ million) Forecast by Vehicle Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Material, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Material, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Material, 2023 to 2033

Figure 35: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 56: Western Europe Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 66: Western Europe Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ million) by Material, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 110: East Asia Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 120: East Asia Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Material, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Material, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CNG Powertrain Market Size and Share Forecast Outlook 2025 to 2035

CNG and LPG Vehicles Market Trends - Growth & Forecast 2025 to 2035

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Shrink Tanks Market

Cryogenic Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Global Wine Tanks Market

Flexible Water Tanks Market

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Aboveground Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Underground Storage Tanks Market

Graduated Cylinders Market

Medical Gas Cylinders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA