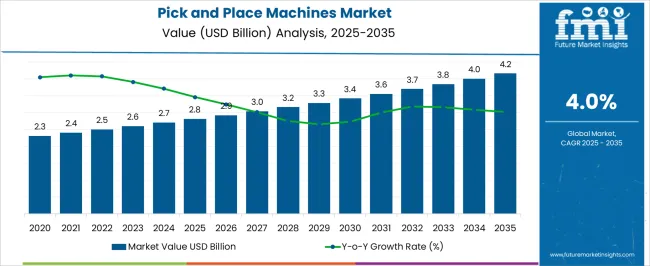

The pick and place machines market is projected to grow from USD 2.8 billion in 2025 to USD 4.2 billion in 2035, reflecting a CAGR of 4.0%. This represents an absolute dollar opportunity of USD 1.4 billion over the decade. The market is expected to expand steadily, reaching USD 2.9 billion in 2026, USD 3.2 billion in 2029, USD 3.4 billion in 2031, and USD 4.0 billion in 2034. The consistent growth trajectory highlights rising adoption across manufacturing and electronics industries, providing equipment manufacturers and investors with clear opportunities to capture incremental revenue and strengthen their market presence.

From an absolute dollar perspective, annual incremental growth begins at approximately USD 0.1 billion in the early years and rises to around USD 0.2 billion in the later stages, culminating in USD 1.4 billion by 2035. Intermediate values such as USD 2.7 billion in 2025, USD 3.3 billion in 2030, and USD 3.8 billion in 2033 illustrate a predictable expansion path. This enables stakeholders to plan production, capacity expansion, and distribution strategies efficiently. Capturing both steady annual growth and the cumulative USD 1.4 billion opportunity ensures maximizing revenue potential in the pick and place machines market over the forecast period.

| Metric | Value |

|---|---|

| Pick and Place Machines Market Estimated Value in (2025 E) | USD 2.8 billion |

| Pick and Place Machines Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

Between 2025 and 2027, the market rises from USD 2.8 billion to USD 2.9 billion, marking the early adoption phase where steady demand drives moderate incremental gains. Another notable breakpoint occurs around 2029–2031, as the market grows from USD 3.2 billion to USD 3.4 billion, reflecting a period of faster expansion and higher absolute dollar growth. These stages are critical for manufacturers and investors to optimize production, align distribution, and capture revenue during periods of rising market demand.

A major breakpoint is observed between 2033 and 2035, when the market increases from USD 4.0 billion to USD 4.2 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 3.3 billion to USD 3.7 billion, acting as bridging periods that maintain growth momentum.

Current growth is driven by the increasing adoption of automated solutions that improve assembly speed, accuracy, and operational efficiency.

The shift towards Industry 4.0 and smart factories is facilitating higher demand for machines capable of precise component handling and integration with vision and robotics technologies. Investments in semiconductor, electronics, and automotive sectors are pushing the market forward, while ongoing technological improvements are enhancing machine flexibility and throughput.

The future outlook remains promising as manufacturers seek to optimize production lines and reduce labor dependency, particularly in high-volume applications. With expanding capabilities in AI and machine vision, the market is expected to experience continued innovation, leading to more intelligent and adaptable pick and place solutions that address diverse production needs.

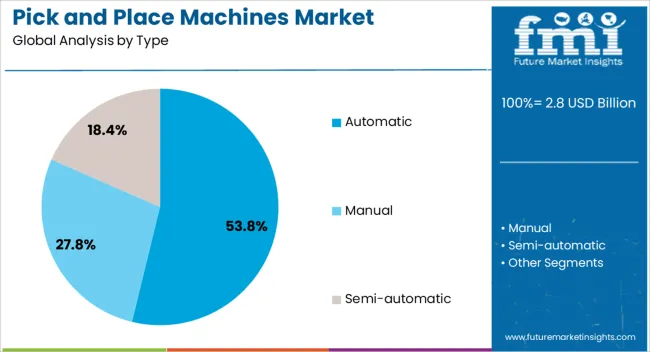

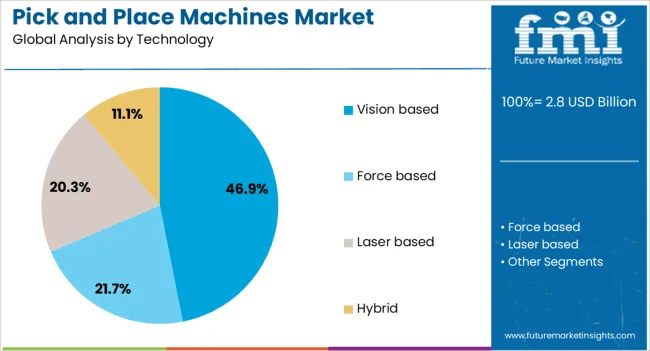

The pick and place machines market is segmented by type, technology, capacity, application, distribution channel, and geographic regions. By type, pick and place machines market is divided into Automatic, Manual, and Semi-automatic. In terms of technology, pick and place machines market is classified into Vision based, Force based, Laser based, and Hybrid.

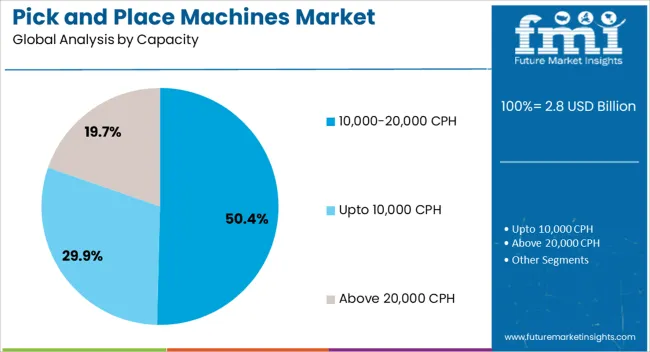

Based on capacity, the pick and place machines market is segmented into 10,000-20,000 CPH, Up to 10,000 CPH, and Above 20,000 CPH. By application, pick and place machines market is segmented into Consumer electronics, Automotive, Packaging industry, Pharmaceutical, Logistics, and Others. By distribution channel, pick and place machines market is segmented into Indirect and Direct. Regionally, the pick and place machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Automatic type segment is forecasted to hold 53.8% of the Pick and Place Machines market revenue share in 2025, establishing itself as the dominant type. This leadership position is being driven by the demand for high-speed and fully automated assembly operations, which reduce human intervention and increase throughput.

Automatic machines are favored for their ability to handle complex components with consistent precision and minimal error rates. The reduction in production downtime due to automation and improved integration with other manufacturing systems has further boosted adoption.

As industries focus on cost efficiency and quality control, automatic pick and place machines provide scalable solutions that meet these requirements. The increasing complexity of electronic components and miniaturization trends are also contributing to the segment’s growth, as automatic machines are better suited to meet stringent assembly specifications.

Vision based technology is anticipated to capture 46.9% of the Pick and Place Machines market revenue share in 2025, leading the technology segment. This prominence is attributed to the enhanced accuracy and adaptability that vision systems bring to automated assembly processes.

Vision-based machines can identify and inspect components in real time, enabling dynamic adjustments and reducing errors. The growing complexity of components and variability in production batches necessitate advanced vision capabilities for quality assurance and alignment.

Additionally, vision technology facilitates better integration with AI and machine learning algorithms, enabling predictive maintenance and process optimization. The expanding use of vision-based solutions is also encouraged by the need for traceability and compliance with stricter quality standards across manufacturing sectors.

The 10,000-20,000 components per hour (CPH) capacity segment is expected to account for 50.4% of the Pick and Place Machines market revenue share in 2025, becoming the leading capacity range. This segment’s growth is being driven by the demand for mid-to-high throughput machines that balance speed and precision for diverse manufacturing environments.

It is particularly preferred by electronics and automotive manufacturers requiring reliable performance for moderate to large production volumes. Machines within this capacity range offer flexibility to handle varying component sizes and complexities while maintaining consistent output.

The demand is supported by manufacturers seeking to scale operations without significant increases in floor space or energy consumption. As production processes evolve to accommodate faster product lifecycles, capacity ranges that provide optimal efficiency and adaptability are gaining prominence in the market.

The pick and place machines market is growing as industries adopt automation to enhance speed, accuracy, and efficiency in electronics assembly, packaging, and manufacturing processes. These machines accurately place components, products, or items on a substrate, PCB, or assembly line with minimal error.

Rising adoption of surface-mount technology (SMT), miniaturized components, and high-volume production drives demand. Manufacturers offering machines with multi-axis motion, high-speed operation, vision systems, and programmable software gain a competitive advantage. Trends toward Industry 4.0, smart factories, and collaborative robotics further accelerate adoption. Integration with IoT and AI-enabled analytics enhances process monitoring, predictive maintenance, and yield optimization, making pick and place machines essential for modern automated manufacturing and assembly applications.

Market growth is restrained by high upfront costs and technical complexities associated with pick and place machines. Advanced systems with multi-head configurations, precision vision systems, and high-speed capabilities require significant capital investment. Programming, calibration, and integration into existing production lines can be complex, necessitating skilled operators and engineers. Maintenance of precision components, sensors, and actuators adds to operational costs. Smaller manufacturers and low-volume producers may find adoption cost-prohibitive. Additionally, adapting machines to handle varying component sizes, weights, and shapes requires customization. Until manufacturers provide more modular, user-friendly, and cost-effective solutions, the market is likely to remain concentrated among large-scale electronics manufacturers, high-volume production facilities, and industries prioritizing precision and automation.

Technological advancements are driving trends in pick and place machines. Machines now feature advanced vision systems, AI-enabled component recognition, high-speed multi-axis motion, and adaptive grippers to handle diverse product types. Integration with real-time monitoring, predictive maintenance, and process optimization platforms improves productivity and reduces downtime. Collaborative robots (cobots) are being used to complement automated pick and place machines in flexible production lines. Modular, scalable designs allow manufacturers to adjust to changing production volumes and component variations. These innovations enhance operational efficiency, reduce human error, and enable manufacturers to meet tight tolerances and increasing production demands in electronics, packaging, and consumer goods industries.

Opportunities in the pick and place machines market are fueled by growing electronics production, miniaturization, and the shift toward automated manufacturing. Increasing demand for smartphones, wearables, automotive electronics, and medical devices drives need for high-precision, high-speed assembly. Industries seeking flexible automation solutions for small- and medium-batch production also present growth potential. Emerging markets in Asia-Pacific, Latin America, and Eastern Europe are investing in electronics manufacturing infrastructure, boosting machine adoption. Manufacturers providing modular, energy-efficient, and intelligent pick and place machines with low changeover times can capture significant market share. Additionally, integration with Industry 4.0 platforms and data analytics offers opportunities to enhance process control, quality assurance, and throughput.

Market growth is restrained by intense competition, maintenance requirements, and lack of standardization. Multiple global and regional suppliers compete on speed, precision, and technology features, affecting margins. Pick and place machines require routine maintenance, calibration, and spare part replacement to ensure reliability and accuracy. Inconsistent component handling standards and differences in software and hardware interfaces can complicate integration across production lines. Small and medium manufacturers may face challenges in adopting advanced systems due to technical complexity and operational costs. Until manufacturers provide cost-effective, standardized, and easily maintainable solutions, market adoption may remain concentrated among high-volume electronics manufacturers and industrial automation leaders.

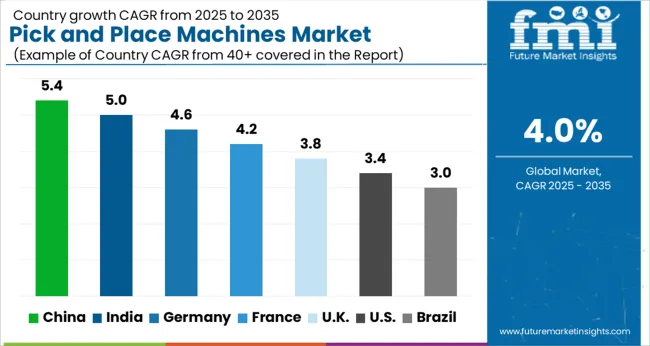

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global automotive communication protocol market was projected to grow at a 7.4% CAGR through 2035, driven by demand in connected vehicles, in-vehicle networks, and automotive electronics. Among BRICS nations, China recorded 10.0% growth as large-scale protocol integration and testing facilities were commissioned and compliance with automotive standards was enforced, while India at 9.3% growth saw expansion of manufacturing units to support rising regional adoption of connected vehicle technologies. In the OECD region, Germany at 8.5% maintained substantial output under strict automotive and electronic regulations, while the United Kingdom at 7.0% relied on moderate-scale operations for passenger and commercial vehicle applications. The USA, expanding at 6.3%, remained a mature market with steady demand in automotive electronics, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The pick and place machines market in China is growing at a CAGR of 5.4% due to increasing automation adoption in electronics manufacturing, automotive assembly, and consumer goods production. These machines are used for precise component placement on printed circuit boards, assembly lines, and industrial equipment, improving production speed and accuracy. Growth is supported by rising electronics production, demand for high precision manufacturing, and industrial modernization initiatives. Suppliers provide machines with advanced vision systems, robotic arms, and programmable features to meet complex production requirements. Distribution through machinery dealers, system integrators, and online platforms enhances market accessibility. Adoption is further driven by manufacturers seeking cost efficient, high throughput, and reliable automation solutions. China remains a leading market due to large-scale electronics and automotive production, technological investment, and demand for efficient manufacturing solutions across multiple industries.

India is witnessing growth at a CAGR of 5.0% in the pick and place machines market due to rising automation in electronics manufacturing, automotive assembly, and industrial production. Companies are adopting these machines to increase production accuracy, reduce labor costs, and improve throughput. Growth is supported by expansion of electronics manufacturing hubs, industrial modernization, and rising demand for consumer electronics and automotive components. Suppliers provide machines with robotic arms, advanced vision systems, and programmable control for precise placement. Distribution through machinery dealers, integrators, and online platforms ensures availability across industrial regions. Adoption is further driven by manufacturers seeking cost effective, high speed, and reliable automation solutions. India’s growing electronics, automotive, and industrial manufacturing sectors make it a key market for pick and place machine adoption.

Germany is growing at a CAGR of 4.6% in the pick and place machines market due to demand from electronics, automotive, and industrial manufacturing sectors. These machines improve production speed, component placement accuracy, and overall efficiency in assembly lines. Suppliers provide high precision, programmable, and reliable machines tailored for various manufacturing requirements. Growth is supported by industrial automation, adoption of Industry 4.0 practices, and expansion of electronics and automotive production. Distribution networks through machinery suppliers, integrators, and engineering service providers enhance market accessibility. Adoption is further influenced by manufacturers seeking to reduce labor dependency and improve operational efficiency. Germany’s focus on high quality and precision in manufacturing makes it a key European market for pick and place machines.

The United Kingdom market is expanding at a CAGR of 3.8% due to increasing adoption of automation in electronics, automotive, and industrial manufacturing. Pick and place machines are used to improve production accuracy, speed, and efficiency while reducing labor costs. Suppliers provide machines with advanced vision systems, robotic arms, and programmable features suitable for diverse production requirements. Growth is supported by industrial modernization, rising demand for high quality manufacturing, and adoption of automated production technologies. Distribution through machinery suppliers, system integrators, and online platforms ensures availability across industrial regions. Manufacturers are focusing on improving throughput, precision, and reliability of operations. Adoption continues to rise as businesses seek cost effective, efficient, and scalable automation solutions in the United Kingdom.

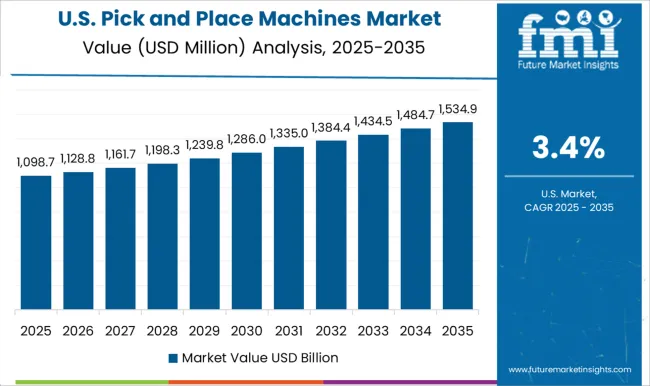

The United States market is growing at a CAGR of 3.4% due to increasing adoption of automation in electronics, automotive, and industrial assembly. Pick and place machines are used to improve accuracy, production speed, and efficiency in component placement. Suppliers provide machines with robotic arms, advanced vision systems, and programmable controls for precise operations. Growth is supported by industrial modernization, expansion of electronics manufacturing, and adoption of smart production technologies. Distribution through machinery dealers, integrators, and online platforms ensures accessibility for industrial users. Adoption is further driven by manufacturers seeking cost effective, reliable, and high throughput solutions. The United States continues to see steady growth in pick and place machine adoption as automation becomes essential for competitive manufacturing operations across multiple sectors.

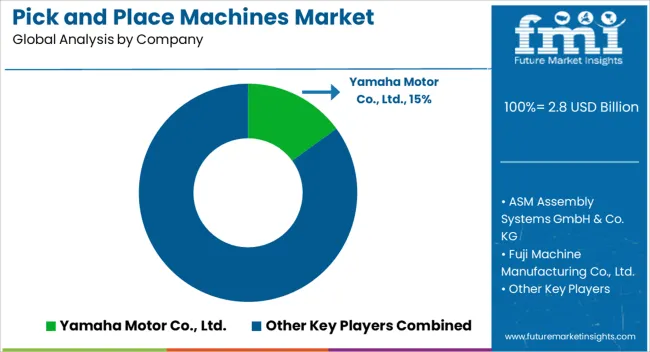

The pick and place machines market is led by Yamaha Motor Co., Ltd., ASM Assembly Systems GmbH & Co. KG, Fuji Machine Manufacturing Co., Ltd., Juki Corporation, Panasonic Corporation, Hanwha Corporation, Mycronic AB, Nordson Corporation, Hanwha Techwin, ASM Pacific Technology Ltd., Universal Instruments Corporation, Europlacer Group, Essemtec AG, Viscom AG, and Speedline Technologies, Inc. Product brochures focus on machine speed, placement accuracy, payload capacity, and flexibility for handling a range of component sizes. Detailed specifications emphasize head types, nozzle counts, vision systems, and feeder compatibility. Images and diagrams highlight layout configurations, multi-lane conveyor integration, and real-time monitoring capabilities for surface-mount technology (SMT) production. Competition is driven by precision, throughput, and automation features. Yamaha and Fuji Machine Manufacturing emphasize high-speed placement for complex PCBs with multiple component types. ASM Assembly Systems and Panasonic highlight modular designs and multi-head systems to handle high-volume production. Juki and Hanwha focus on energy-efficient operations, adaptive software, and compatibility with various component formats. Mycronic and Universal Instruments prioritize microelectronics and fine-pitch component handling, while Speedline Technologies and Essemtec emphasize flexibility and easy integration with assembly lines. Observed industry patterns include continuous improvement of vision systems, feeder automation, and self-optimization algorithms for production efficiency. Strategies revolve around modularity, scalability, and after-sales support. Manufacturers provide turnkey solutions, including installation, training, and software integration to optimize SMT lines. Brochures feature advanced motion control systems, smart diagnostics, and software for predictive maintenance. Partnerships with electronics manufacturers and robotics specialists are highlighted to enhance deployment speed and operational reliability. Product literature emphasizes repeatable accuracy, minimized downtime, and adaptability to evolving component sizes and board layouts. Global expansion, service networks, and compatibility with Industry 4.0 standards are commonly showcased to maintain differentiation and attract high-volume industrial clients.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Type | Automatic, Manual, and Semi-automatic |

| Technology | Vision based, Force based, Laser based, and Hybrid |

| Capacity | 10,000-20,000 CPH, Upto 10,000 CPH, and Above 20,000 CPH |

| Application | Consumer electronics, Automotive, Packaging industry, Pharmaceutical, Logistics, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yamaha Motor Co., Ltd., ASM Assembly Systems GmbH & Co. KG, Fuji Machine Manufacturing Co., Ltd., Juki Corporation, Panasonic Corporation, Hanwha Corporation, Mycronic AB, Nordson Corporation, Hanwha Techwin, ASM Pacific Technology Ltd., Universal Instruments Corporation, Europlacer Group, Essemtec AG, Viscom AG, and Speedline Technologies, Inc. |

| Additional Attributes | Dollar sales vary by machine type, including high-speed, modular, and tabletop pick and place machines; by application, such as electronics assembly, pharmaceuticals, food processing, and packaging; by end-use industry, spanning electronics manufacturing, healthcare, and industrial automation; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising automation adoption, demand for precision assembly, and increasing manufacturing efficiency. |

The global pick and place machines market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the pick and place machines market is projected to reach USD 4.2 billion by 2035.

The pick and place machines market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in pick and place machines market are automatic, manual and semi-automatic.

In terms of technology, vision based segment to command 46.9% share in the pick and place machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pick to Light Market Size and Share Forecast Outlook 2025 to 2035

Pickling Chemicals Market Growth - Trends & Forecast 2025 to 2035

Competitive Landscape of Pickles Providers

Pick Fill Seal Machines Market Size, Share & Forecast 2025 to 2035

Pick and Place Carton Packers Market

Dill Pickles Market Size and Share Forecast Outlook 2025 to 2035

Ball Picking Robot Market Size and Share Forecast Outlook 2025 to 2035

Voice Picking Solution Market Analysis by Component, Industry Vertical, Technology, Deployment Mode and Region from 2025 to 2035

Cherry Picker Crane Market Size and Share Forecast Outlook 2025 to 2035

Cherry Picker Forklift Market Growth - Trends & Forecast 2025 to 2035

Packed Pickles Market Report – Trends, Demand & Industry Outlook 2025-2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Niemann-Pick Disease Type C Therapeutics Market

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Full-size Pickup Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Coal Cutter Pick for Mining Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA