The Full-size Pickup Trucks Market is forecasted to grow from USD 94.3 billion in 2025 to USD 139.6 billion by 2035, reflecting a CAGR of 4.0%. This moderate growth path highlights a cost structure strongly influenced by raw materials, manufacturing complexity, distribution, and after-sales value capture. Steel and aluminum account for a considerable share of material costs, particularly with rising emphasis on lightweight frames that balance durability and fuel efficiency. Battery components also introduce higher input costs as electrified variants begin expanding in the product mix.

The value chain starts with component suppliers, ranging from chassis and drivetrain manufacturers to electronics and safety system providers. OEMs hold significant control in design, integration, and final assembly, where labor, automation, and compliance costs influence margins. Downstream, dealer networks and distribution channels play a pivotal role, though digital sales platforms are gradually altering traditional cost layers.

Aftersales services, spare parts, and accessories contribute additional revenue, reinforcing lifecycle profitability. Rising investments in electrification, digital connectivity, and safety features elevate R&D and capital expenditures within the value chain. The scale efficiencies from high-volume production partly offset these costs. By 2035, while conventional models remain cost-efficient anchors, the value chain will increasingly integrate advanced technologies, reshaping cost allocation and enhancing long-term competitive positioning.

| Metric | Value |

|---|---|

| Full-size Pickup Trucks Market Estimated Value in (2025 E) | USD 94.3 billion |

| Full-size Pickup Trucks Market Forecast Value in (2035 F) | USD 139.6 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The full size pickup trucks market is experiencing consistent growth driven by rising demand for utility focused vehicles across both personal and commercial domains. Increasing investments in infrastructure, logistics, and rural development have accelerated fleet expansions, particularly in developing regions.

Advancements in powertrain technology, vehicle durability, and payload capacity are further enhancing the appeal of full size pickups. Automakers are focusing on integrating premium interior features, safety enhancements, and advanced connectivity options, expanding the customer base beyond traditional utility buyers.

The market is also benefiting from government incentives and policy support for local manufacturing and commercial vehicle financing. As the demand for versatile, high performance vehicles continues to grow across industries, full size pickup trucks are expected to remain vital assets in work and lifestyle transportation needs.

The full-size pickup trucks market is segmented by cab, fuelapplication, and geographic regions. By cab of the full-size pickup trucks market is divided into Regular, Extended, and Crew. In terms of fuel of the full-size pickup trucks market is classified into Gasoline, Diesel, and Electric. Based on application of the full-size pickup trucks market is segmented into Commercial and Industrial. Regionally, the full-size pickup trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular cab configuration is expected to contribute 47.30% of the total market revenue by 2025 within the cab category, making it the leading segment. This dominance is driven by its straightforward design, lower manufacturing costs, and higher payload efficiency, making it an optimal choice for commercial and heavy duty utility applications.

The compact cabin allows for extended cargo space, which is particularly valued in logistics, agriculture, and field services. Fleets requiring functional vehicles without passenger accommodations have increasingly favored regular cabs due to their practicality and ease of maintenance.

As operational efficiency and cost optimization remain top priorities in commercial fleet planning, the regular cab format continues to hold a dominant position in the market.

The gasoline segment is projected to hold 52.60% of the total market revenue by 2025 under the fuel category. This leading position is attributed to the widespread availability of gasoline infrastructure, lower upfront vehicle costs, and improved fuel efficiency in newer engine models.

Gasoline powered pickups also offer smoother operation, reduced engine noise, and better adaptability for urban and mixed terrain driving. With lower maintenance requirements compared to diesel and a broader range of model availability, gasoline variants are preferred by both individual and small commercial operators.

The segment has further benefited from emissions regulations that favor gasoline engines over older diesel counterparts, reinforcing its market dominance.

The commercial application segment is expected to account for 58.10% of total market revenue by 2025, positioning it as the largest end use segment. This growth is being driven by expanding usage of pickup trucks across sectors such as construction, agriculture, mining, and delivery services.

The versatility of full size pickups in handling both cargo and towing duties makes them indispensable for operational logistics. In addition, fleet procurement in both public and private sectors has contributed to rising demand, especially for durable and easily serviceable vehicle configurations.

As infrastructure projects scale up and industries rely more on mobile utility solutions, the commercial segment continues to anchor the full size pickup trucks market with sustained and growing demand.

The market has been shaped by a combination of consumer preference for versatile vehicles and the need for utility in commercial and personal applications. These trucks have been widely used for towing, hauling, and recreational purposes while offering comfort and advanced features comparable to passenger cars. Demand has been reinforced by the rising popularity of off-road vehicles, expansion of construction activities, and lifestyle-oriented purchases. The segment has also seen strong competition among automakers, with emphasis placed on durability, engine efficiency, and technology integration.

The market for full-size pickup trucks has been influenced by the growing consumer need for vehicles that serve both work and lifestyle functions. These trucks have been preferred not only by businesses for hauling and towing heavy loads but also by individuals for personal transport and recreational use. The dual-purpose appeal has made them popular across urban and rural settings. Automakers have introduced customizable trims, ranging from basic work-oriented versions to luxury variants with advanced infotainment and safety features. This variety has broadened their customer base, strengthening overall adoption. Increased interest in outdoor activities such as camping and off-roading has further boosted demand. Their versatility in combining rugged capability with passenger comfort has positioned full-size pickup trucks as one of the most resilient and consistently performing automotive segments globally.

The adoption of electric and hybrid powertrains has been steadily influencing the full-size pickup trucks market. Leading manufacturers have invested in electric pickup models to address rising environmental regulations and consumer demand for sustainable mobility. Electric pickups have been designed with high torque for towing and payload capacity, offering comparable performance to traditional internal combustion models. Government incentives and charging infrastructure expansion have supported this transition, although challenges remain regarding battery range for long-haul usage. Hybrid powertrains have also gained traction as a middle ground between fuel efficiency and capability. Automakers have responded by integrating modular architectures that allow both conventional and electric variants within the same model line. This shift has redefined competition in the market, making electrification a central theme for long-term growth in the full-size pickup trucks industry.

The full-size pickup trucks market has been shaped by continuous improvements in safety, telematics, and driver assistance technologies. Automakers have incorporated features such as adaptive cruise control, collision avoidance, blind spot detection, and advanced braking systems to enhance driver confidence in heavy-duty usage. Connectivity solutions have further allowed real-time navigation, vehicle diagnostics, and integration with mobile applications for remote monitoring. Infotainment systems have been upgraded to match passenger car standards, appealing to consumers seeking comfort along with utility. Telematics adoption has enabled fleet managers to monitor vehicle performance and driver behavior more efficiently. These advancements have elevated full-size pickups from purely utility vehicles to technologically advanced mobility solutions. As regulatory frameworks emphasize safety compliance, and consumers demand premium features, technology integration has become a key factor strengthening the competitive landscape of the market.

Economic activity across construction, agriculture, and related industries has had a major impact on the demand for full-size pickup trucks. These vehicles have been indispensable in transporting equipment, raw materials, and personnel across rugged terrains and project sites. Infrastructure development initiatives, particularly in emerging economies, have expanded usage within construction and mining operations. Agricultural producers have also adopted these trucks for efficient movement of goods and machinery across farms and rural areas. Industrial enterprises have prioritized full-size pickups for their durability and ability to handle heavy payloads while maintaining road efficiency. Seasonal demand surges during planting and harvest cycles have further contributed to steady adoption. The resilience of the agricultural and construction sectors has ensured consistent market demand, demonstrating how macroeconomic activities directly shape the growth trajectory of the full-size pickup trucks market.

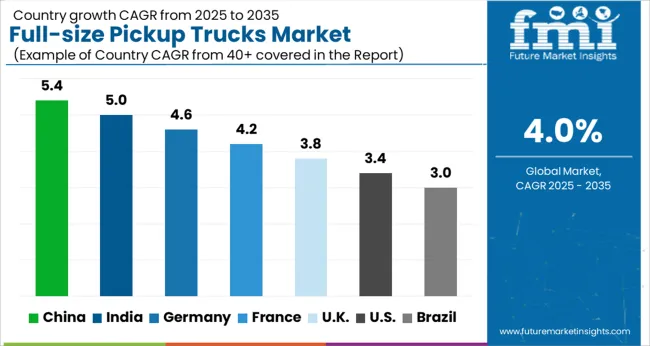

The market is expected to expand at a CAGR of 4.0% between 2025 and 2035, shaped by commercial applications, lifestyle utility demand, and technological upgrades. China, with a 5.4% CAGR, expands strongly due to growing domestic production and adoption in construction and logistics. India follows at 5.0%, reinforcing its market through infrastructure projects and rising utility vehicle preference. Germany advances at 4.6%, progressing with engineering excellence and integration of hybrid pickup models. The UK, at 3.8%, witnesses’ momentum supported by niche adoption for utility fleets and rural transport needs. The USA, at 3.4%, maintains steady demand through entrenched pickup culture and gradual electric pickup introductions. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to register a CAGR of 5.4% in the market between 2025 and 2035. Rising demand from construction, agriculture, and logistics sectors is driving adoption. Domestic automakers are investing in advanced designs and fuel-efficient models to compete with international brands. Supportive policies for new energy vehicles are pushing electric and hybrid pickup developments. Urban and rural infrastructure growth is strengthening demand for multipurpose utility vehicles across diverse sectors.

India is forecast to grow at a CAGR of 5.0%, supported by increasing utilization in logistics, construction, and agricultural transport. The demand is further reinforced by the expansion of industrial activity and infrastructure projects. Pickup trucks are gaining traction as cost-efficient transport solutions for small and medium businesses. Global automakers are entering the Indian market with upgraded models, while domestic manufacturers are focusing on rugged, fuel-efficient designs.

Germany is set to expand at a CAGR of 4.6% during the forecast period. The market is supported by demand from industrial sectors, agriculture, and logistics companies. Rising consumer interest in lifestyle pickup models is adding to growth. Manufacturers are investing in electrified powertrains and connected vehicle technologies to comply with EU emission norms. Strong aftermarket support and advanced dealer networks are reinforcing adoption across the country.

The United Kingdom is projected to witness a CAGR of 3.8%, driven by logistics expansion, construction activities, and growing rural transport needs. Pickup trucks are also finding increasing acceptance in lifestyle and leisure applications. Manufacturers are focusing on lightweight materials and hybrid technologies to meet tightening emission standards. Advancements in fleet management and connected technologies are expected to accelerate adoption further.

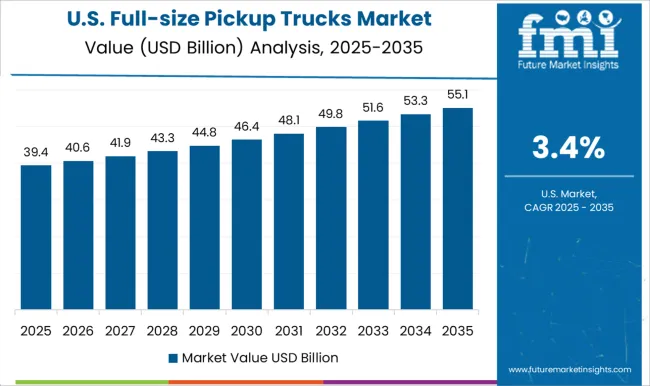

The United States is expected to grow at a CAGR of 3.4%, with demand led by construction, oil and gas, and logistics sectors. Pickup trucks continue to dominate the light truck segment due to their versatility and durability. The transition toward electric full-size pickups are gaining momentum as major automakers invest heavily in new models. Rising demand for advanced safety and telematics systems is also reshaping market competitiveness.

The market has been shaped by leading global automakers that consistently innovate to meet rising consumer and commercial demands. Ford Motor Company has secured a dominant position through its iconic F-series, which remains one of the best-selling vehicle lines worldwide due to strength, versatility, and advanced technology integration. General Motors, through its Chevrolet Silverado and GMC Sierra models, has maintained a strong presence by offering a balance of durability, performance, and comfort.

Ram Trucks has captured a significant share with vehicles known for luxury interiors, high towing capacity, and modern driver-assist features. Toyota Motor Corporation and Nissan have also established solid reputations for reliable and long-lasting pickup models that are widely trusted for both professional and lifestyle use. Alongside these leaders, other companies are expanding influence across markets. Honda and Mitsubishi Motors have invested in offering practical and adaptable trucks for regional demand. Isuzu continues to focus on producing pickups recognized for ruggedness and commercial utility. Great Wall Motors has gained visibility in Asian markets by launching cost-effective trucks with expanding export strategies. Volkswagen has also entered this competitive segment, introducing vehicles with advanced connectivity and design flexibility to attract a new customer base. With ongoing investments in electrification, autonomous driving features, and enhanced safety, these companies are driving the evolution of full-size pickup trucks, ensuring their relevance in both developed and emerging economies.

| Item | Value |

|---|---|

| Quantitative Units | USD 94.3 Billion |

| Cab | Regular, Extended, and Crew |

| Fuel | Gasoline, Diesel, and Electric |

| Application | Commercial and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford Motor Company, General Motors, Great Wall Motors, Honda, Isuzu, Mitsubishi Motors, Nissan, Ram Trucks, Toyota Motor Corporation, and Volkswagen |

| Additional Attributes | Dollar sales by truck segment and customer base, penetration across retail consumers, commercial fleets, and government procurement, effect of electrification with battery-powered and hybrid pickups, integration of connected infotainment, telematics, and driver assistance features, regional consumption trends across North America, Latin America, Europe, and Asia-Pacific, role of lifestyle demand versus work utility applications, competitive strategies of OEMs including platform sharing and modular designs, pricing influence from raw material and supply chain factors, impact of emission regulations and fuel efficiency mandates, aftermarket opportunities in accessories and performance upgrades, and lifecycle factors such as resale value, durability, and long-term maintenance economics. |

The global full-size pickup trucks market is estimated to be valued at USD 94.3 billion in 2025.

The market size for the full-size pickup trucks market is projected to reach USD 139.6 billion by 2035.

The full-size pickup trucks market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in full-size pickup trucks market are regular, extended and crew.

In terms of fuel, gasoline segment to command 52.6% share in the full-size pickup trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Wireline Trucks Market

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Rear Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Side Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA