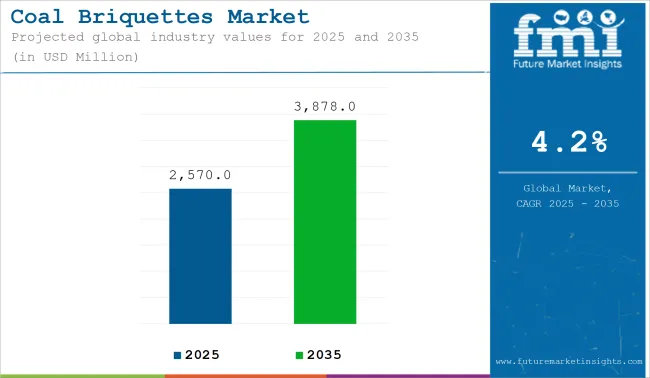

The global coal briquettes market is estimated to be valued at USD 2,569.96 million in 2025 and is projected to reach USD 3,877.96 million by 2035, reflecting a CAGR of 4.2% during the forecast period. Market expansion is being supported by rising energy requirements, increased adoption of smokeless briquettes, and advancements in briquetting technologies.

Coal briquettes are being produced by compressing coal fines with binders to create dense, uniform fuel blocks suited for industrial and residential combustion. The adoption of smokeless briquettes has been observed in urban and semi-urban regions, where air quality regulations are influencing the shift toward cleaner solid fuels. In regions with limited access to piped gas or electricity, coal briquettes are being utilized for space heating and small-scale industrial processes.

Briquetting technologies have undergone mechanization improvements, with automated systems being deployed to enhance output consistency and reduce labor intensity. Combustion efficiency has been improved through innovations in briquette composition, which include moisture regulation and binder optimization.

According to data published by the International Energy Agency, coal continues to represent over 25% of global energy consumption as of 2023, with coal derivatives such as briquettes serving niche but essential roles in decentralized energy supply chains.

Industrial expansion in sectors such as metallurgy, ceramics, and brick kilns has led to increased adoption of briquettes as an alternative to lump coal and firewood. Countries in South Asia and Sub-Saharan Africa are witnessing growing uptake due to the affordability and local availability of raw coal fines. In addition, government programs focused on reducing indoor air pollution have contributed to the dissemination of improved combustion briquettes.

Bio-coal briquettes, produced from agricultural residues blended with coal fines, are being promoted as hybrid fuel solutions. These products are being tested in commercial kitchens, institutional boilers, and community heating systems to reduce carbon emissions. Public-sector energy programs and micro-financing initiatives are being used to encourage the transition from traditional biomass to processed briquette fuels.

Investments in R&D are focused on reducing production costs, increasing energy density, and standardizing product quality for broader adoption across heating and industrial applications. These developments are expected to influence procurement strategies and distribution models between 2025 and 2035.

Pillow-shaped coal briquettes are estimated to account for approximately 38% of the global market share in 2025 and are projected to grow at a CAGR of 4.3% through 2035. Their uniform density, compact structure, and ease of stacking make them highly preferred for applications in domestic heating, industrial boilers, and small-scale power generation units.

These briquettes are commonly manufactured using press molding machines that offer high throughput and dimensional consistency, essential for efficient packaging, transport, and combustion. Manufacturers continue to adopt pillow-shaped formats across developing regions in Asia and Africa due to their low production cost and compatibility with coal dust and mixed biomass blends.

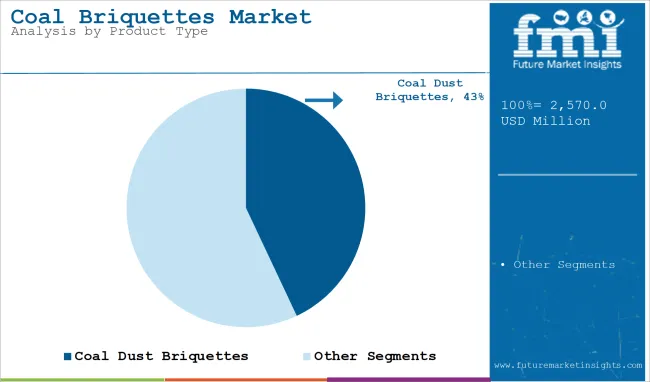

Coal dust briquettes are projected to hold approximately 43% of the global coal briquettes market share in 2025 and are expected to grow at a CAGR of 4.4% through 2035. These briquettes utilize fine coal particles recovered from mining operations, reducing waste while maximizing calorific value.

The high fixed carbon content and longer burn time make them ideal for industrial heating, metallurgical processes, and power production. In emerging economies, coal dust briquettes are gaining traction as an affordable alternative to traditional lump coal, particularly where centralized coal washing and briquetting facilities are being established.

Manufacturers also incorporate binders such as molasses, lime, and starch to improve mechanical strength, reduce smoke emissions, and enhance moisture resistance. As coal briquetting becomes an important aspect of sustainable fuel management, coal dust briquettes remain central to market expansion.

Environmental Concerns and Regulatory Restrictions

There are potential factors that may restrain the growth of the Coal briquettes market such as rising environmental issues and strict regulations imposed to decrease carbon emissions. Governments are currently cracking down on coal based fuels to help control air pollution and facilitate cleaner alternatives.

Moreover, carbon taxes, emissions trading systems, and industrial decarbonization mandates have curtailed the coal briquette adoption across sectors. Even more so, they need to develop new formulas for lower carbon briquettes, invest in cleaner production technologies, and find new approaches for carbon capture and storage (CCS) in order to keep up with increasing regulations around pollution and carbon emissions.

Competition from Renewable and Alternative Energy Sources

Challenge- One of the biggest obstacles for the Coal briquettes market is growing renew sources of energy like wind, solar and biomass. To reduce reliance on fossil fuels, industries and households are increasingly moving towards sustainable energy alternatives.

Furthermore, recent progress in the production of bio-briquettes, hydrogen fuel as well as natural gas are creating competitive alternatives. The coal briquette manufacturers to stay in the analysis would like to boost energies efficiency, alternative gas solutions and mixing renewable additives to produce eco-friendly briquettes according to worldwide durability trends.

Growing Demand in Emerging Economies

Coal briquettes are still in great demand in emerging economies where people do not have access to alternative energy sources despite environmental concerns. Asia, Africa, and Latin America developing states still use coal briquettes for residential heating, industrial applications and electricity generation.

The demand in these regions is further driven by economic growth and urbanization and growing energy needs. Producers who learn to maximize efficient combustion and localized supply chain networks will benefit from continued demand to October 2023.

Advancements in Clean Coal Technologies

On the upside the form of clean coal technologies can all be incorporated into this while on the up-side the Coal briquettes market. Low-sulfur coal briquettes, smokeless briquettes, and bio-coal blends are among some of the innovations helping reduce environmental issues at the same time as reaching energy efficiency.

Moreover, emerging technologies, such as gasification carbon capture utilization and storage (CCUS) and waste-to-energy (WtE) solutions are driving the sustainability credentials of coal briquettes. Companies that make significant investments in research and development to improve briquette performance and reduce emissions will be well-positioned in the market.

Foresight in the Coal briquettes market for 2025 to 2035 between 2020 and 2024, shifts in the Coal briquettes market were propelled by regulatory pressures, technological advancements, and changing consumer preferences. Indeed, in places where environmental policies have diminished demand for unprocessed coal, other areas still use coal briquettes to ensure energy security.

In response, businesses turned to cleaner production processes, better energy efficiency, and hybrid fuel options that could help them remain economically sustainable while being environmentally friendly.

The market will evolve, including further changes as clean energy legislation tightens and alternative fuels continue to gain hold. These may include higher combustion technologies, further investment in carbon offset initiatives, and the incorporation of renewable biomass constituents in briquette recipes.

Digitalization and AI driven optimizing of the supply chain will also enable highly efficient processes and sustainability. The companies that have already adopted the innovation-driven, sustainable, and adaptive business strategy are expected to spearhead the next growth phase of the Coal briquettes market.

The Coal briquettes market in the United States is one of the largest in the world and is driven by high demand for industrial fuel, growing include usage in metallurgical applications, and increase use in power generation. Market growth nevertheless is attributed to the presence of key coal producers and development of clean coal technologies.

Increasing investments in eco-friendly coal briquetting processes, coupled with innovations associated with low-emission combustion technologies, continues to drive market progress. Moreover, automation of briquette production, the adoption of AI-based energy-efficient technology, and the advanced carbon capture methods are increasing the sustainability of the products.

Manufacturers are also innovating in the field of high-density, moisture-proof coal briquettes to improve their combustion efficiency and lower their pollution. The growing demand for oxygen for cost-effective and high-energy fuel sources for industrial and residential heating applications is further propelling the us market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

UK, a significant market for coal briquettes, attributed to growing preference for efficient solid fuels, government measures in encouraging cleaner energy alternatives and energy security. Also, the shift towards sustainable heating solutions is further driving demand.

With growing government regulations promoting carbon reduction policies and increasing usage of smokeless coal briquettes and bio-coal alternatives, the market is anticipated to flourish during the forecast period. In addition, there are advances in ultra-low sulfur coal briquettes, better binding agents, and high-efficiency combustion technology, all of which are now coming into play.

As another fresh alternative, companies are investing in hybrid fuel, where coal is mixed with biomass and pressed into eco-friendly briquettes. In the UK, rising consumer trends toward using high-calorific, low-emission briquettes for heating purpose whether household or industrial is contributing significantly to the growth of the market. The adoption is further fueled by the increasing implementation of waste-to-energy projects and alternative solid fuel developments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Industrial demand from emerging economies along with robust industrial demand, increasing deployment of alternative fuel sources, and carrying out the implementation of clean coal technologies are expected to create lucrative growth opportunity for coal briquettes market across the globe.

Impact of European Union carbon emission reduction through cleaner fuel applications and thriving investments in high-efficiency solid fuel production will promote steady market growth. And the prevalence of low-emission coal briquettes, innovative carbon capture and storage (CCS) technologies and waste-derived solid fuels are increasing sustainability.

Market growth has also been fueled by the increasing popularity of briquettes in steel production, district heating, and power generation. Another factor driving innovation in the coal briquette industry across the EU is the government-supported research into carbon-neutral briquetting methods and the use of renewable binders. Emission tax incentive and regulatory compliance programs; is further accelerating the shift to cleaner briquette fuel.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan coal briquettes market is developing, driven by the country's energy security goal, the need for high-performance industrial fuels and new low-emission coal technologies. In heavy industries, energy-dense solid fuels are being preferred more and more, which is also a reason for the growth of the market.

Innovation is being driven by the country's focus on technological advancements and the integration of AI-driven combustion optimization and carbon capture systems. In addition, stringent government regulations to reduce air pollution along with rising acceptance of alternative binding materials, is prompting companies to manufacture low-sulfur, eco-friendly briquette solutions.

Volatile prices of oil & LPG, along with shifting trends of dependency from these resources, are also some of the factors driving the demand for smokeless coal briquettes in urban heating applications, and industrial steam generation, thereby further boosting the market growth in Japan's energy sector. Japan doctoral research on carbon-neutral fuels and clean energy transition programs have positive influence on future of Coal briquettes demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Rising demand for energy and consumption of industrial fuels along with government trends towards clean coal technology are bolstering the coal briquettes market in South Korea.

Key Drivers: Stringent government regulations for enhancing air quality and increasing use of High-efficiency solid fuels are likely to drive the growth of the market. Furthermore, the country’s emphasis on bettering combustion efficiency by means of high-pressure briquetting, the upgraded binding formulations of coal, and smart monitoring techniques are increasing competitiveness. The rising usage of coal briquettes in steel production, home warming, and industrial furnaces is additionally driving adoption in the market.

Emphasizing energy efficiency and deploying hybrid fuel solutions that use biomass and alternative carbon sources will also help these companies reduce emissions. This trend has also been coupled with increasing energy diversification strategies and the growth of waste-derived fuel technologies in South Korea which in turn has contributed to the growth of the high-performance coal briquettes market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The coal briquettes market is characterized by moderate fragmentation, with numerous regional players alongside large-scale producers. High entry barriers exist due to substantial capital investment in manufacturing plants and strict environmental regulations.

Expertise in coal processing and blending technologies is essential for success, as well as compliance with quality standards required by industries such as metallurgy and power generation. The market is highly competitive, driven by demand for affordable and efficient energy sources. Companies are adopting cleaner technologies, and exploring sustainable alternatives to meet environmental regulations. Forward-looking strategies include the development of low-emission briquettes and partnerships to enhance supply chain efficiencies.

The overall market size for Coal briquettes market was USD 2,569.96 Million in 2025.

The Coal briquettes market expected to reach USD 3,877.96 Million in 2035.

Factors like rising industrial applications, increasing use in residential heating and cooking along with growing need for cost-effective and energy-efficient fuel sources are likely to propel the demand for global coal briquettes market.

The top 5 countries which drives the development of Coal briquettes market are USA, UK, Europe Union, Japan and South Korea.

Pillow-shaped and hexagonal-shaped coal briquettes growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Charcoal Briquettes Market Size and Share Forecast Outlook 2025 to 2035

Coal Mine Ventilation Fans Market Size and Share Forecast Outlook 2025 to 2035

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Coal Cutter Pick for Mining Market Size and Share Forecast Outlook 2025 to 2035

Coal to Ethylene Glycol Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Coal Gasification Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Coal Tar Pitch Market Demand & Growth 2024-2034

Coalingite Market

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Charcoal-Based Detox Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charcoal Bristle Toothbrush Market – Trends, Growth & Forecast 2025 to 2035

Clean Coal Technology Market Growth - Trends & Forecast 2025 to 2035

BBQ Charcoal Market Growth - Trends & Forecast 2025 to 2035

Wood Charcoal Market Trends & Forecast 2024-2034

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Underground Coal Gasification Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Electrostatic Coalescers Market Growth - Trends & Forecast 2025 to 2035

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA