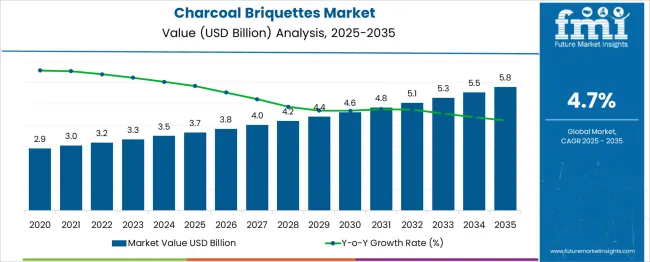

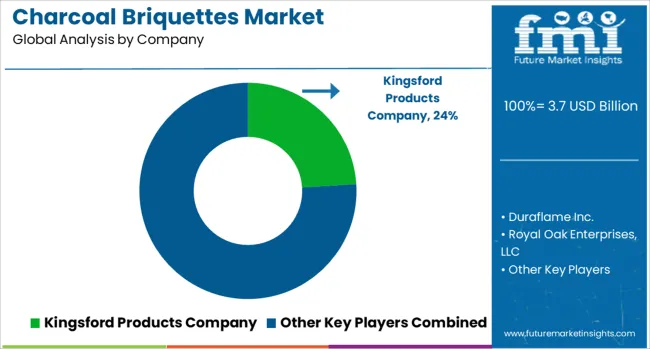

The charcoal briquettes market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Examining the market dynamics in the first half of this period, from 2020 to 2025, the market increases from USD 2.9 billion to USD 3.8 billion. This incremental gain of USD 0.9 billion accounts for roughly 34.6% of the total projected expansion. During these years, growth is supported by rising demand in residential and commercial cooking applications, particularly in regions where traditional cooking methods persist. Charcoal briquettes continue to be preferred for their ease of use, consistent burn time, and cost-effectiveness.

The market also benefits from increased outdoor recreational activities and growing awareness of eco-friendly fuel alternatives. The values show consistent year-on-year growth, with USD 3.0 billion in 2021, rising steadily to USD 4.0 billion by 2024, underscoring a stable upward trend driven by consumer preference and regional cooking practices. In the latter half of the forecast period, from 2026 to 2035, the market is expected to accelerate, adding USD 1.7 billion and representing 65.4% of the total market expansion. This phase benefits from technological advancements in briquette manufacturing processes that improve fuel efficiency and reduce emissions. Enhanced product formulations using sustainable raw materials and binding agents contribute to increased adoption.

Growing environmental concerns and regulatory measures aimed at reducing deforestation and air pollution encourage shifts toward eco-friendly briquettes. Expanding commercial use in foodservice sectors and increasing urbanization in developing countries further drive demand. The charcoal briquettes market is expected to experience sustained growth through 2035, propelled by product innovation, environmental considerations, and evolving consumer habits.

| Metric | Value |

|---|---|

| Charcoal Briquettes Market Estimated Value in (2025 E) | USD 3.7 billion |

| Charcoal Briquettes Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The charcoal briquettes market holds a significant yet specialized share across multiple segments within the global energy and grilling industry. Within the overall solid fuel market, charcoal briquettes account for approximately 12–14%, reflecting their popularity as an efficient and convenient fuel source for cooking and heating. In the outdoor grilling and barbecue category, their presence is dominant, contributing nearly 65–70% share, supported by consistent demand from residential consumers and foodservice operators who prefer standardized heat and extended burn time. In the broader renewable and bio-based fuel segment, charcoal briquettes represent about 8–10%, benefiting from a shift toward low-emission alternatives compared to traditional firewood and coal.

Within the premium barbecue and specialty grilling segment, they hold an estimated 18–20%, driven by innovation in flavor-infused briquettes and eco-friendly formulations using coconut shells and agricultural waste. Their share in commercial hospitality and catering fuel applications is around 10–12%, as briquettes are increasingly adopted for uniform performance and ease of storage. Growth momentum is further strengthened by rising disposable incomes, outdoor cooking culture, and the influence of lifestyle-driven dining experiences in emerging markets. Manufacturers are focusing on product differentiation through smokeless variants, faster ignition technology, and sustainable raw material sourcing to meet evolving consumer expectations. Digital retail platforms and private-label offerings in organized retail have enhanced accessibility, positioning charcoal briquettes as a reliable and cost-effective alternative in global cooking and heating solutions.

Increasing environmental awareness has resulted in a shift toward biomass-based energy sources, with charcoal briquettes offering a cleaner and more sustainable substitute to traditional fossil fuels. Urbanization, growing outdoor leisure activities, and the popularity of barbecuing have further contributed to market expansion.

The ability of charcoal briquettes to produce steady heat output with lower emissions makes them suitable for residential and commercial heating. Technological improvements in briquette production and enhanced product consistency have improved consumer trust and adoption rates.

Additionally, the expanding hospitality sector, especially in developing regions, is supporting bulk demand for high-quality charcoal products. As regulatory emphasis increases on sustainable energy and deforestation control, manufacturers are focusing on renewable raw materials and clean combustion processes, thereby unlocking new growth opportunities across global markets..

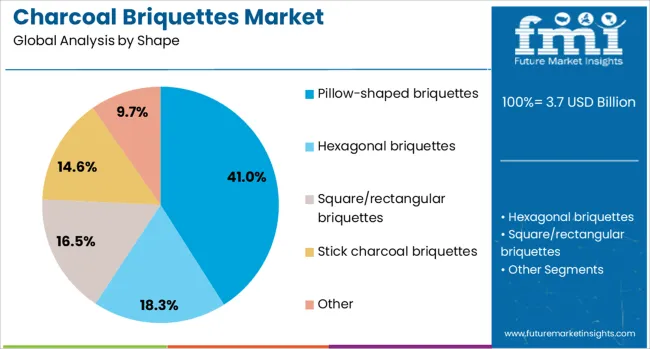

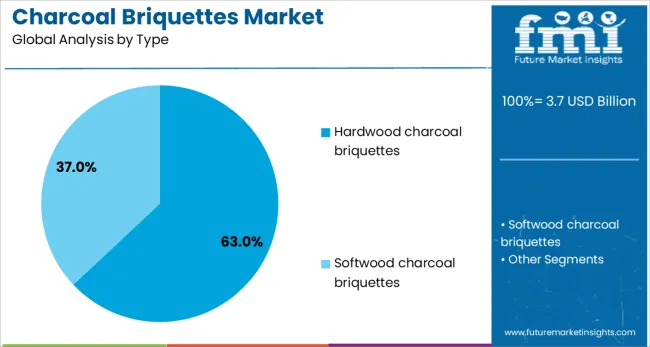

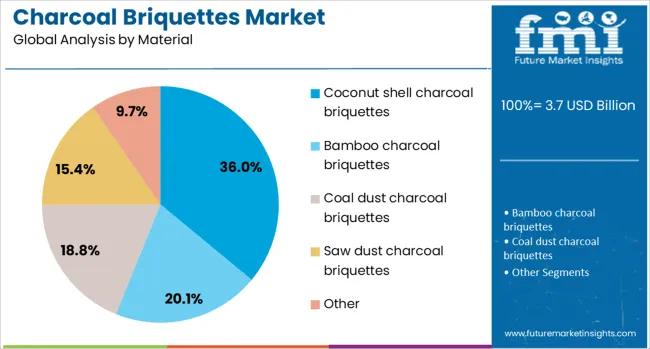

The charcoal briquettes market is segmented by shape, type, material, application, end use, distribution channel, and geographic regions. The charcoal briquettes market is divided by shape into Pillow-shaped briquettes, Hexagonal briquettes, Square/rectangular briquettes, Stick charcoal briquettes, and Other. In terms of the type of charcoal briquettes, the market is classified into Hardwood charcoal briquettes and Softwood charcoal briquettes. The charcoal briquettes market is segmented into Coconut shell charcoal briquettes, Bamboo charcoal briquettes, Coal dust charcoal briquettes, Sawdust charcoal briquettes, and Other. The charcoal briquettes market is segmented into Grilling, Heating, Barbequing, Industrial processes, and Metallurgy. The end use of the charcoal briquettes market is segmented into Residential, Industrial, and Commercial. The charcoal briquettes market is segmented by distribution channel into Offline and Online. Regionally, the charcoal briquettes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pillow-shaped segment is projected to account for 41% of the Charcoal Briquettes market revenue share in 2025, making it the leading shape category. The segment’s leadership has been established by the ease of stacking, uniform combustion properties, and wide consumer acceptance associated with pillow-shaped briquettes. Their design enables better air circulation and consistent burning, which contributes to efficient heat generation during cooking or heating applications.

Pillow-shaped briquettes are often preferred for commercial food services and household barbecues due to their affordability and compatibility with various grill types. The production efficiency and standardized sizing have allowed manufacturers to scale operations while maintaining cost-effectiveness.

Furthermore, their packaging convenience and lower risk of breakage during transportation have reinforced their appeal in retail and bulk markets. As demand continues to rise for user-friendly and efficient charcoal solutions, the pillow-shaped format has sustained its strong position by aligning with both performance expectations and cost-driven preferences of end users..

The hardwood charcoal briquettes segment is anticipated to hold 63% of the Charcoal Briquettes market revenue share in 2025, making it the leading product type. Growth in this segment has been attributed to the superior density and energy efficiency of hardwood-based products, which result in longer burn time and higher heat output. These performance advantages have made hardwood charcoal briquettes a preferred choice for both commercial and residential users seeking consistent grilling or heating results.

The use of sustainably sourced hardwood enhances combustion control and reduces smoke generation, aligning with environmental compliance and clean fuel standards. Their application versatility and proven thermal performance have increased adoption across various cooking and industrial heating scenarios.

As consumers and businesses prioritize quality, consistency, and sustainability in fuel alternatives, hardwood charcoal briquettes have maintained their dominance by delivering tangible value across usage environments. Their long shelf life and steady supply chain availability have also contributed to their enduring preference in the global marketplace..

The coconut shell charcoal briquettes segment is expected to capture 36% of the Charcoal Briquettes market revenue share in 2025, emerging as a major material category. Its growth has been led by increasing focus on renewable and waste-derived energy sources, as coconut shells represent an abundant agricultural byproduct in many tropical regions. The high carbon content and low ash production of coconut shell briquettes enable a clean, odorless, and smokeless combustion experience, making them highly suitable for indoor use and premium grilling applications.

The segment has gained traction among environmentally conscious consumers and export-oriented manufacturers seeking sustainable alternatives to wood-based fuels. Additionally, coconut shell briquettes burn longer and emit less volatile matter, enhancing their appeal for both recreational and commercial users.

With mounting regulatory pressure on deforestation and biomass sourcing, this material type offers a viable solution that aligns with circular economy principles. Its rising adoption reflects a broader shift toward cleaner and more responsible fuel production practices across the industry..

The charcoal briquettes market is expanding through demand for efficient, convenient cooking fuels, e-commerce growth, and product differentiation, but faces challenges from raw material volatility, counterfeit products, and competition from alternative fuels.

The demand for charcoal briquettes has been shaped by the growing preference for efficient and cleaner-burning fuels in domestic and commercial cooking applications. Consumers favor briquettes for their consistent heat output and extended burning time compared to traditional lump charcoal or firewood. This trend is particularly evident in outdoor grilling, barbecue culture, and hospitality services where uniform cooking performance is crucial. The rising popularity of recreational cooking, backyard gatherings, and premium dining experiences has accelerated adoption. Retail penetration through supermarkets and digital marketplaces has widened product reach, making briquettes accessible to a broader audience. The shift toward convenient and ready-to-use fuel products continues to drive interest among both residential users and professional kitchens.

The digital commerce landscape has provided a significant boost to the distribution of charcoal briquettes, offering buyers convenience and competitive pricing options. Online platforms enable manufacturers to bypass traditional retail channels and connect directly with consumers, thereby improving margins. Subscription-based delivery models and bulk purchase discounts are gaining attention among frequent buyers, particularly in urban and peri-urban areas. Retail giants and specialty online stores have introduced private-label charcoal briquettes to capitalize on brand loyalty and seasonal demand spikes. Customer reviews and influencer-driven promotions have further increased consumer confidence in online purchases. These developments highlight how e-commerce is reshaping supply chain strategies and accelerating market penetration for leading players and new entrants.

Charcoal briquette manufacturers are focusing on differentiation to capture competitive advantage in an evolving market. Product innovation revolves around smokeless burning, quick-lighting formulations, and eco-conscious raw material utilization such as coconut shells or agricultural residues. Flavor-infused briquettes have carved a niche within the premium barbecue segment, appealing to consumers seeking unique grilling experiences. Packaging innovations, including moisture-resistant and resealable bags, enhance shelf life and consumer convenience. The adoption of certifications for quality and safety standards has become a key factor for market credibility. These measures are reinforcing brand loyalty and enabling premium pricing strategies while responding to growing consumer interest in health-conscious and performance-oriented grilling solutions.

Despite favorable growth prospects, the charcoal briquettes market faces several constraints that impact scalability and profitability. Raw material availability, influenced by seasonal fluctuations and regulatory constraints on wood-based carbonization, presents supply chain challenges for manufacturers. Price volatility in biomass sources and transportation costs also affects operational margins. Competitive pressures from alternative fuel sources, including propane and electric grills, pose additional hurdles. Counterfeit and low-quality briquettes in unorganized retail channels undermine consumer trust and hinder premium brand positioning. To overcome these obstacles, established brands are investing in quality assurance, efficient sourcing networks, and localized manufacturing facilities. Strategic collaborations with retail partners and targeted marketing campaigns remain essential to maintaining long-term growth momentum.

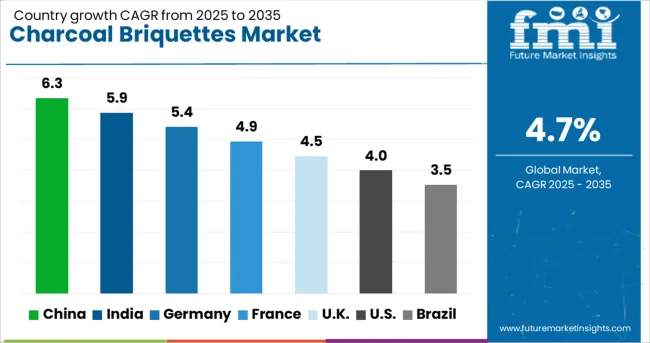

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The charcoal briquettes market is projected to grow at a global CAGR of 4.7% from 2025 to 2035, driven by rising outdoor grilling trends, demand for convenient fuel options, and the growing appeal of premium barbecue experiences. China leads with a CAGR of 6.3%, supported by strong domestic consumption, expanding e-commerce channels, and increased preference for standardized grilling products. India follows closely at 5.9%, fueled by a surge in hospitality sector demand, home-cooking trends, and the introduction of cost-effective briquette variants. France achieves 4.9% growth, benefiting from seasonal outdoor dining patterns and demand for compact packaging formats. The United Kingdom grows at 4.5%, reflecting its transition toward eco-conscious fuels and digital-first retail distribution, while the United States records 4.0%, shaped by competitive dynamics with alternative fuel sources and steady adoption across premium barbecue segments.

The CAGR for the charcoal briquettes market in the United Kingdom was estimated at around 3.6% during 2020–2024 and rose to 4.5% between 2025 and 2035, signaling a shift toward structured growth. The earlier phase saw moderate adoption due to limited consumer focus on outdoor grilling culture and competition from propane-based alternatives. However, growth accelerated in the next decade, driven by increased preference for premium barbecue experiences, seasonal outdoor dining, and greater digital availability of specialty fuels. E-commerce penetration and influencer-driven barbecue trends also contributed to enhanced visibility for eco-conscious, quick-lighting briquettes. Hospitality and catering services further embraced standardized briquettes for consistent performance, improving their share in commercial applications.

China registered a CAGR of nearly 5.2% during 2020–2024, which surged to 6.3% for 2025–2035, supported by strong consumer inclination toward home-based grilling and increased disposable incomes in urban areas. The rise of social dining trends and live-fire cooking experiences in metropolitan regions stimulated interest in standardized fuel solutions. Domestic manufacturers capitalized on these trends with cost-effective and flavor-infused briquettes tailored for barbecue enthusiasts. Enhanced supply chain efficiency through online platforms and integrated logistics accelerated category penetration. Premium variants with faster ignition properties gained attention, while domestic tourism further boosted seasonal consumption.

The CAGR for India’s charcoal briquettes market stood at 4.8% from 2020–2024 and increased to 5.9% between 2025 and 2035, indicating rising momentum in both residential and commercial segments. During the earlier period, the category relied heavily on unorganized retail and local charcoal options, restricting premium product adoption. Growth in the later years is attributed to enhanced awareness of smokeless, standardized briquettes and their compatibility with modern grilling equipment. Hospitality-driven demand and the emergence of organized retail channels further accelerated expansion. E-commerce platforms enabled greater accessibility for branded briquettes, with value packs and combo deals attracting bulk buyers.

France recorded a CAGR of 4.1% during 2020–2024, which moved up to 4.9% for 2025–2035, driven by the cultural emphasis on outdoor dining and a steady rise in summer grilling traditions. The earlier years witnessed slow growth due to a lack of differentiation in product offerings and dominance of traditional charcoal formats. Subsequent years saw premiumization with flavor-infused and eco-friendly briquettes designed for gourmet barbecue applications. Retail promotions and e-commerce bundles encouraged trial purchases, while convenience-driven innovations such as easy-lighting packs found favor among younger consumers. Regional catering services incorporated briquettes for event-based setups, increasing commercial demand.

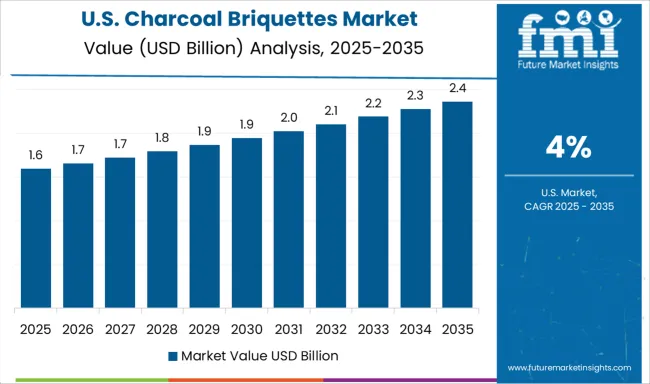

The CAGR for the USA charcoal briquettes market was close to 3.2% during 2020–2024 and improved to 4.0% in the 2025–2035 period, supported by renewed interest in authentic grilling and high-heat cooking methods. Early growth faced headwinds due to consumer reliance on gas grills and rising propane promotions. The shift occurred as influencer-driven cooking content and seasonal holiday grilling revived interest in charcoal-based solutions. Premium low-smoke briquettes targeting health-conscious users gained traction, while supermarket chains expanded private-label offerings to compete on price. E-commerce platforms, supported by subscription-based models, facilitated recurring purchases.

The charcoal briquettes market is highly competitive, featuring prominent manufacturers such as Kingsford Products Company, Duraflame Inc., Royal Oak Enterprises, LLC, The Clorox Company, Gryfskand Sp. z o.o., and Timber Charcoal Company. The market structure combines global giants with regional specialists, creating a competitive environment where differentiation centers on fuel efficiency, ignition speed, burn time, and smoke control. Kingsford Products Company dominates the North American segment with extensive retail presence and premium barbecue offerings, while Royal Oak Enterprises focuses on innovation in eco-conscious formulations. Duraflame Inc. leverages strong brand equity in household heating and grilling fuels, expanding into ready-to-light briquettes. Gryfskand Sp. z o.o. strengthens its position in European markets through sustainable raw material sourcing and private-label collaborations, while Timber Charcoal Company emphasizes high-quality, natural hardwood-based briquettes for niche grilling enthusiasts.

Differentiation strategies include flavored briquettes for gourmet grilling, low-smoke variants targeting urban consumers, and eco-friendly packaging to appeal to environmentally conscious buyers. Companies are increasingly investing in e-commerce platforms and seasonal promotional campaigns, aligning with peak grilling demand during holidays and outdoor events. Strategic initiatives focus on expanding production capacity, securing raw material supply chains, and forming partnerships with major retail and online distributors to ensure consistent availability. Future growth will rely on innovations such as quick-lighting technology, integration of renewable biomass inputs, and value-added products catering to premium barbecue experiences, while maintaining competitive pricing to capture both mainstream and niche consumer segments.

In July 2025, Duraflame announced that a fire destroyed the W.W. Wood Inc. production plant in Pleasanton, Texas (a key supplier of cooking wood fuel).

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Shape | Pillow-shaped briquettes, Hexagonal briquettes, Square/rectangular briquettes, Stick charcoal briquettes, and Other |

| Type | Hardwood charcoal briquettes and Softwood charcoal briquettes |

| Material | Coconut shell charcoal briquettes, Bamboo charcoal briquettes, Coal dust charcoal briquettes, Saw dust charcoal briquettes, and Other |

| Application | Grilling, Heating, Barbequing, Industrial processes, and Metallurgy |

| End Use | Residential, Industrial, and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kingsford Products Company, Duraflame Inc., Royal Oak Enterprises, LLC, The Clorox Company, Gryfskand Sp. z o.o., and Timber Charcoal Company |

| Additional Attributes |

The global charcoal briquettes market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the charcoal briquettes market is projected to reach USD 5.8 billion by 2035.

The charcoal briquettes market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in charcoal briquettes market are pillow-shaped briquettes, hexagonal briquettes, square/rectangular briquettes, stick charcoal briquettes and other.

In terms of type, hardwood charcoal briquettes segment to command 63.0% share in the charcoal briquettes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Charcoal-Based Detox Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charcoal Bristle Toothbrush Market – Trends, Growth & Forecast 2025 to 2035

BBQ Charcoal Market Growth - Trends & Forecast 2025 to 2035

Wood Charcoal Market Trends & Forecast 2024-2034

White Charcoal Powder Market Size, Growth, and Forecast for 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Activated Charcoal Supplements Market Trends - Sales & Industry Insights

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Coal Briquettes Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA