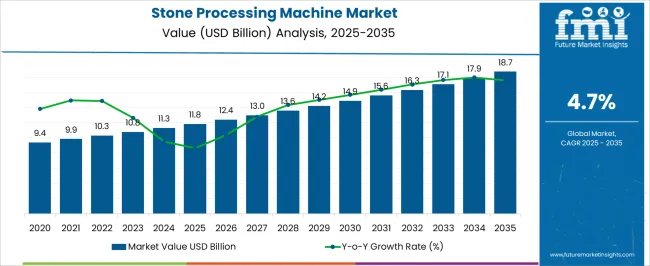

The Stone Processing Machine Market is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 18.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Over this 10-year period, the market follows a consistent upward growth path, adding nearly USD 6.9 billion in value. The year-wise trajectory highlights gradual expansion with compounding growth, supported by rising global demand for automated cutting, polishing, and finishing machinery in construction, architecture, and decorative stone applications. The multiplier effect here shows the market size growing by approximately 1.58 times from the base year to the end year.

The growth trajectory unfolds progressively: 2025–2030 sees the market rising from USD 11.8 billion to USD 14.9 billion, a gain of USD 3.1 billion. This early phase is driven by infrastructure development, urban construction projects, and greater adoption of precision cutting machines in the marble and granite industries. The second half, from 2030 to 2035, accelerates with an increase from USD 14.9 billion to USD 18.7 billion, generating USD 3.8 billion in additional value. This phase reflects intensified industrial-scale demand and more advanced machine adoption. The multiplier values across the timeline demonstrate consistent compounding, underscoring stable long-term growth potential for manufacturers and suppliers in this machinery segment.

| Metric | Value |

|---|---|

| Stone Processing Machine Market Estimated Value in (2025 E) | USD 11.8 billion |

| Stone Processing Machine Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The stone processing machine market is experiencing steady growth driven by increasing demand in construction, architecture, and decorative industries. Rising investments in residential and commercial building projects have led to heightened demand for precision stone cutting and finishing machines.

Innovations in machine technology have improved processing speed, accuracy, and energy efficiency, supporting higher productivity and cost-effectiveness. The expanding use of natural stones, especially marble, in flooring, countertops, and facade applications has created strong demand for specialized processing equipment.

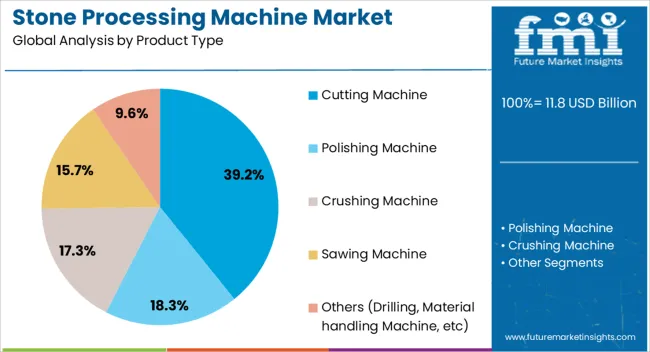

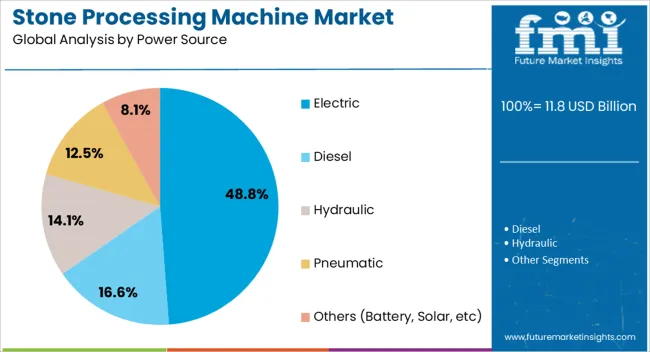

Growing environmental regulations have also encouraged manufacturers to adopt electric power sources to reduce emissions and operational costs. Additionally, the emergence of automated and CNC-enabled stone processing machines has enhanced customization capabilities and reduced manual labor. Market growth is expected to continue as infrastructure development and decorative stone applications expand globally. Segmental growth is anticipated to be led by Cutting Machines, Marble as the primary stone type, and Electric-powered machines.

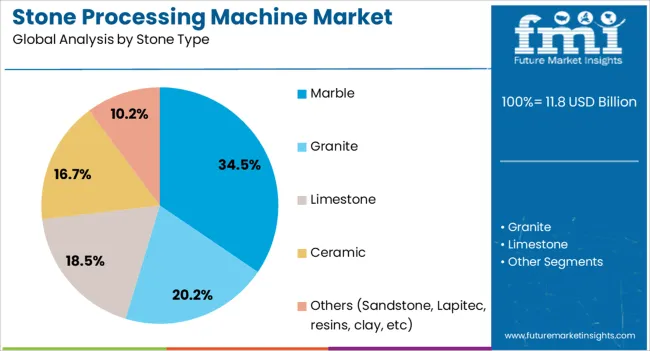

The stone processing machine market is segmented by product type, stone type, power source, end-use, distribution channel, and geographic regions. By product type, the stone processing machine market is divided into Cutting Machine, Polishing Machine, Crushing Machine, Sawing Machine, and Others (Drilling, Material handling Machine, etc). In terms of stone type, the stone processing machine market is classified into Marble, Granite, Limestone, Ceramic, and Others (Sandstone, Lapitec, resins, clay, etc).

Based on the power source, the stone processing machine market is segmented into Electric, Diesel, Hydraulic, Pneumatic, and Others (Battery, Solar, etc). By end-use, the stone processing machine market is segmented into Construction, Mining, Architecture & Decoration, Infrastructure, and Others (Monument & Memorial, Art & Sculpture, etc). By distribution channel, the stone processing machine market is segmented into Direct and Indirect. Regionally, the stone processing machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cutting Machine segment is projected to generate 39.2% of the market revenue in 2025, holding its position as the leading product type. The necessity for precise and efficient cutting operations in stone fabrication supports this segment’s growth.

Cutting machines enable clean and accurate shaping of stones, which is essential for both structural and aesthetic applications. Manufacturers have enhanced cutting machine designs to accommodate diverse stone hardness and thickness, improving versatility.

Additionally, the rise in demand for customized stone designs in the construction and decoration sectors has increased reliance on cutting machines. Faster processing times and lower operational costs have also contributed to this segment’s sustained demand. As construction and decorative stone markets grow, the Cutting Machine segment is expected to maintain its market leadership.

The Marble segment is expected to account for 34.5% of the stone processing machine market revenue in 2025, making it the dominant stone type. Marble’s popularity in premium construction and interior design has driven demand for specialized processing equipment tailored to its properties.

Stone fabricators have focused on machines capable of handling marble’s unique density and brittleness to minimize waste and enhance surface finish quality. The use of marble in flooring, wall cladding, and countertops has remained steady, particularly in luxury residential and commercial projects.

Trends in sustainable sourcing and finishing techniques have further boosted demand for efficient processing methods. As marble continues to be a preferred choice for high-end applications, the Marble segment is expected to sustain its significant market share.

The Electric segment is projected to hold 48.8% of the stone processing machine market revenue in 2025, establishing it as the leading power source category. Electric-powered machines have been favored for their energy efficiency, lower operational noise, and reduced emissions compared to fuel-powered alternatives.

The shift toward electric machinery aligns with growing environmental regulations and industry efforts to reduce carbon footprints. Electric machines offer easier maintenance and compatibility with automation systems, enhancing operational efficiency in stone processing plants.

Furthermore, increasing availability of reliable electricity infrastructure globally has supported the adoption of electric-powered equipment. As demand for cleaner and more sustainable manufacturing solutions grows, the Electric power source segment is expected to maintain its dominant position in the market.

The stone processing machine market is driven by increasing demand for precision, automation, and high-quality stone products. Opportunities in expanding construction and infrastructure sectors are fueling growth, while trends in automation and water recycling are reshaping the market. However, high equipment costs and operational complexity may hinder broader adoption. By 2025, overcoming these challenges through cost-effective, user-friendly machines will be essential for sustaining market expansion.

The stone processing machine market is growing due to the increasing demand for precision and automation in stone cutting, shaping, and finishing. These machines improve efficiency, reduce human error, and allow for more complex designs, making them essential in industries such as construction, monument making, and tile production. By 2025, the need for high-quality stone products, along with advancements in automation, will continue driving growth, especially in emerging markets with expanding infrastructure projects.

Opportunities in the stone processing machine market are growing with the expansion of construction and infrastructure projects globally. As the demand for high-quality stone products for buildings, roads, and monuments increases, the need for efficient processing equipment is also rising. By 2025, the growing construction sector in emerging economies will present substantial growth opportunities, particularly in the demand for machines capable of producing customized stone materials for various applications.

Emerging trends in the stone processing machine market include automation in cutting and finishing processes and the growing focus on water recycling systems. Automated cutting machines equipped with advanced CNC technology are gaining popularity due to their ability to increase productivity and reduce operational costs. Additionally, water recycling systems integrated into machines are becoming more common to reduce environmental impact and conserve water. By 2025, these trends are expected to shape the market as industries demand more efficient and eco-friendly stone processing solutions.

Despite growth, challenges related to high equipment costs and operational complexity remain in the stone processing machine market. Advanced machines with automation features can be expensive, making them inaccessible for small and medium-sized businesses. Additionally, the complexity of operating these machines requires specialized training, leading to higher operational costs. By 2025, addressing these challenges through more affordable and user-friendly machines will be crucial for expanding the market to a broader range of users.

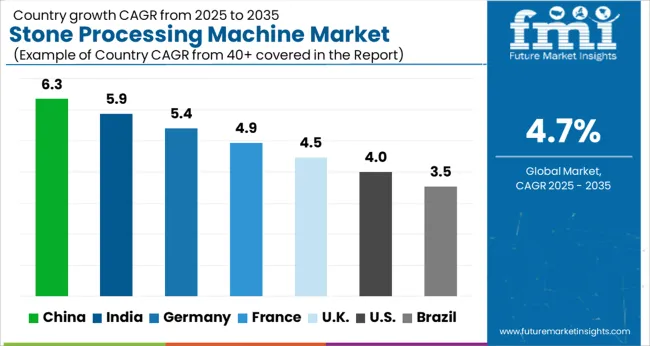

The global stone processing machine market is projected to grow at a 4.7% CAGR from 2025 to 2035. China leads with a growth rate of 6.3%, followed by India at 5.9%, and Germany at 5.4%. The United Kingdom records a growth rate of 4.5%, while the United States shows the slowest growth at 4.0%. These varying growth rates are driven by factors such as increasing demand for stone processing in construction, infrastructure development, and mining industries. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and infrastructure expansion, while more mature markets like the USA and the UK show steady growth driven by technological advancements, high-quality production requirements, and regulatory standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The stone processing machine market in China is growing rapidly, with a projected CAGR of 6.3%. China’s booming construction and infrastructure development sectors, combined with the increasing demand for high-quality processed stone in the building materials industry, are significantly driving the demand for stone processing machines. The country’s focus on enhancing industrial capabilities, advancing machinery technologies, and meeting global standards for construction and architectural applications further accelerates market growth. Additionally, China's growing focus on automation and energy-efficient technologies is expected to continue fueling demand for advanced stone processing machines.

The stone processing machine market in India is projected to grow at a CAGR of 5.9%. India’s growing demand for high-quality processed stone in construction and infrastructure projects is driving the adoption of advanced stone processing machinery. The country’s expanding construction industry, coupled with investments in infrastructure development, is boosting market growth. Additionally, India’s emphasis on technological advancements and the increasing demand for energy-efficient and automated machinery solutions are further accelerating the adoption of stone processing machines across various sectors, including mining, construction, and architecture.

The stone processing machine market in Germany is projected to grow at a CAGR of 5.4%. Germany’s well-established industrial base, particularly in construction and mining sectors, is contributing to steady demand for stone processing machines. The country’s focus on high-quality production, precision engineering, and sustainable manufacturing solutions is driving the adoption of advanced stone processing technologies. Additionally, Germany’s investments in automation and energy-efficient machinery are further contributing to the expansion of the market, particularly in the processing of building materials and decorative stones.

The stone processing machine market in the United Kingdom is projected to grow at a CAGR of 4.5%. The UK’s strong demand for high-quality processed stone in construction, infrastructure, and decorative applications continues to drive market growth. The increasing focus on sustainable building materials and energy-efficient technologies in construction projects is contributing to the adoption of advanced stone processing solutions. Additionally, the UK’s growing interest in automation and smart technologies for manufacturing and construction is further accelerating the demand for stone processing machines in the market.

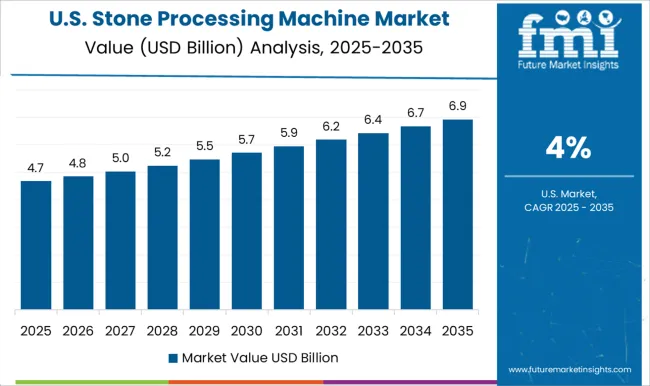

The stone processing machine market in the United States is expected to grow at a CAGR of 4.0%. The USA market remains steady, driven by the demand for high-quality processed stone in various industries, including construction, architecture, and mining. The growing need for precision and high-performance machinery in stone cutting, shaping, and polishing is contributing to the market’s growth. Additionally, the USA focus on automation, energy efficiency, and environmental sustainability in manufacturing processes is driving the adoption of advanced stone processing machines, although at a slower pace compared to emerging markets.

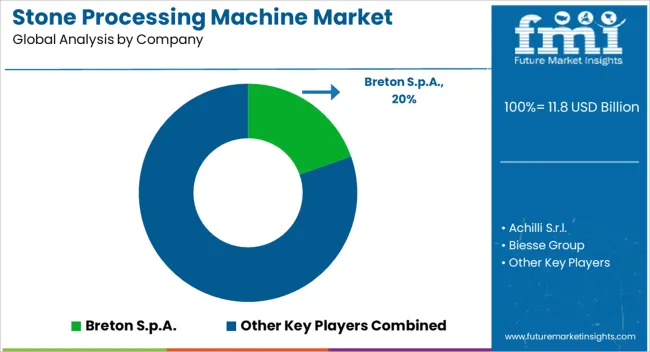

The stone processing machine market is dominated by Breton S.p.A., which leads with its innovative stone cutting, polishing, and shaping solutions used in the granite, marble, and other natural stone industries. Breton’s dominance is reinforced by its advanced technology, strong brand reputation, and comprehensive range of machinery that ensures high precision, efficiency, and durability in stone processing applications.

Key players such as Biesse Group, CMS Stone Technology, and Caterpillar Inc. maintain significant market shares by offering reliable and high-performance machines designed for stone cutting, surface finishing, and shaping. These companies focus on providing efficient, cost-effective solutions for both large-scale and precision stone fabrication. Emerging players like Achilli S.r.l., Donatoni Macchine S.r.l., and Park Industries are expanding their market presence by offering specialized stone processing machines designed for niche applications such as countertop production, stone restoration, and custom stonework. Their strategies include enhancing the speed, precision, and automation of stone machinery while focusing on reducing material waste and energy consumption. Market growth is driven by the increasing demand for natural stone in construction and interior design, the rise of automated stone processing, and advancements in robotic systems for stone cutting. Innovations in digital controls, improved waterjet cutting technology, and energy-efficient machinery are expected to continue shaping competitive dynamics and fuel further growth in the global stone processing machine market.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 Billion |

| Product Type | Cutting Machine, Polishing Machine, Crushing Machine, Sawing Machine, and Others (Drilling, Material handling Machine, etc) |

| Stone Type | Marble, Granite, Limestone, Ceramic, and Others (Sandstone, Lapitec, resins, clay, etc) |

| Power Source | Electric, Diesel, Hydraulic, Pneumatic, and Others (Battery, Solar, etc) |

| End-Use | Construction, Mining, Architecture & Decoration, Infrastructure, and Others (Monument & Memorial, Art & Sculpture, etc) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Breton S.p.A., Achilli S.r.l., Biesse Group, Caterpillar Inc., CMS Stone Technology, Donatoni Macchine S.r.l., GMM S.p.A., Hitachi Construction Machinery Co., Ltd., Intermac, Komatsu Ltd., Marmo Meccanica S.p.A., Park Industries, Pedrini S.p.A., Thibaut S.A.S., and Volvo Group |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across construction, mining, and decorative stone sectors, regional trends in stone processing machine adoption, innovation in automation and energy-efficient cutting technologies, impact of regulatory standards on material safety and emissions, and emerging use cases in sustainable construction and architectural design. |

The global stone processing machine market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the stone processing machine market is projected to reach USD 18.7 billion by 2035.

The stone processing machine market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in stone processing machine market are cutting machine, polishing machine, crushing machine, sawing machine and others (drilling, material handling machine, etc).

In terms of stone type, marble segment to command 34.5% share in the stone processing machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stone Paper Market Size and Share Forecast Outlook 2025 to 2035

Stone Crushing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Examining Stone Paper Market Share & Industry Trends

Destoner Machine Market Trend Analysis Based on Product Type, End-Use, Automation, and Region 2025 to 2035

Gemstone Industry Outlook

Gemstone Cosmetic Powder Market Analysis - Trends, Growth & Forecast 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Pancreatic Stone Protein Testing Market Growth - Trends & Forecast 2024 to 2034

Coloured Gemstone Market Analysis - Size, Share, and Forecast 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA